Documente Academic

Documente Profesional

Documente Cultură

Capitalize For Kids: Third Place Winner - Long Chemture Corp.

Încărcat de

ValueWalk0 evaluări0% au considerat acest document util (0 voturi)

1K vizualizări23 paginiCapitalize for Kids: Third Place Winner - Long Chemture Corp.

Titlu original

Capitalize for Kids: Third Place Winner - Long Chemture Corp.

Drepturi de autor

© © All Rights Reserved

Formate disponibile

PDF, TXT sau citiți online pe Scribd

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentCapitalize for Kids: Third Place Winner - Long Chemture Corp.

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca PDF, TXT sau citiți online pe Scribd

0 evaluări0% au considerat acest document util (0 voturi)

1K vizualizări23 paginiCapitalize For Kids: Third Place Winner - Long Chemture Corp.

Încărcat de

ValueWalkCapitalize for Kids: Third Place Winner - Long Chemture Corp.

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca PDF, TXT sau citiți online pe Scribd

Sunteți pe pagina 1din 23

Third Place Winner

Long Chemtura Corp.

By Shaun Currie, Manalapan Oracle Capital Management

Intelligent Investing Challenge

The analyses and conclusions contained within this presentation are based on publicly available information. This presentation is for general

informational purposes only, and does not constitute an agreement, offer, solicitation of an offer, or any recommendation to enter into or

conclude any transaction or confirmation thereof (whether on terms shown herein or otherwise). This presentation should not be construed as

legal, tax, investment, financial, or other advice. It does not have regard to the specific investment objective, financial situation, suitability, or the

particular need of any specific person who may receive this presentation, and should not be taken as advice on the merits of any investment

decision.

The views expressed in this presentation represent opinions of the author, and are based on publicly available information with respect to the

company and other companies referred to herein. Certain information and data herein have been derived or obtained from filings made within

securities regulatory authorities within Canada and the US. No warranty is made that data or information, whether derived or obtained from

filings from regulatory authorities or any third parties, are accurate.

The analysis may include certain statements, estimates, or projections prepared with respect to historic and anticipated operating performance

of the companies. Such statements, estimates, and projections reflect assumptions by the author concerning anticipated results that are subject

to significant economic, competitive, and other uncertainties and have been included strictly for illustrative purposes. Actual results may vary

materially from the estimates and projected results contained herein. No party should purchase or sell securities on the basis of the information

contained in this presentation. The author expressly disclaims liability on account of any partys reliance on the information contained herein

with respect to any such purchases or sales.

The author reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. The author disclaims any

obligation to update the data, information or opinions contained in this presentation.

Disclaimer

Shaun Currie, Manalapan Oracle Capital Management, LLC - Long: Chemtura Corp

I nvestment Thesis See Appendix C for detailed write-up of Investment Thesis

We believe that Chemtura is a misunderstood company whose business today is much different

than it was only a few years ago. Once an over-leveraged, broad-based chemicals company,

Chemtura has been transforming its business through asset divestitures to improve its balance

sheet and become a pure-play on the industrial space. The companys recent announcement to

divest its AgroSolutions business will enable the company to reach a net-cash position for the

first time since returning to the public markets in 2010, and will set up the company to pay down

expensive debt and return cash to shareholders. We project that the company will use the

proceeds of AgroSolutions transaction, along with excess cash on the balance sheet, to pay down

$200MM in debt (which will reduce interest expense by $13.6MM annually) and to initiate a

tender offer to repurchase approximately one-third of the current shares outstanding by year-end

2014. We also project that the tender offer will need to be completed at a premium to the current

stock price, which will enable investors to see sizeable returns over the intermediate-term while

limiting the downside in the stock.

Additionally, we believe that this is still the early innings of the companys goal to unlock

shareholder value CEO Craig Rogerson has a history of monetizing companies and has openly

stated that the rest of the company or its individual pieces could be sold. Our sum-of the-parts

analysis will show that the company is currently valued at a discount to its peers and similar

transactions, which supports the idea that additional value-creating transactions could occur.

These transactions should result in an additional 40-100% upside (after the tender offer is

completed) for shareholders that could be realized over the coming year. Even if these types of

events do not come to fruition, the company has been making big investments its two remaining

industrial segments, and late 2014/early2015 is the time in which these investments should start

to pay off. The growth prospects for these two businesses alone could result in a re-valuation of

the company, which currently trades at a discount to public peers due to an incorrect perception

of the business and its future outlook. Our blended valuation, using a public comps analysis and

a sum-of-the-parts analysis, gives us a $41 price target, representing 60% upside to the current

price. (See Appendix C for detailed write-up)

Catalysts See Appendix B for more detail on Catalysts

1. The companys plan to repurchase 1/3 of the outstanding shares through a tender offer by

year-end 2014.

2. Increased Capex Ends in 2014 and investments begin to be realized, resulting in

increased cash flow and improved metrics going forward.

3. IPP segment capacity expansion comes online in late 2014, with demand already waiting

to be filled, resulting in significant growth going forward.

4. IEP Emerald Innovation, the companys new technology, growth supported by recent

adoption within Dow Chemical and BASF along with European regulation to ban

previous technology, HBCD, by 2015.

5. MATS regulation implementation in 2015 sets up Chemtura for growth out of its bromine

business going forward.

Key Risks - See Appendix B for more detail on Risks

1. The inability to close the AgroSolutions deal

2. The inability to drive sales growth out of its IEP foams business

3. Increased regulatory scrutiny over the use of bromine foams

4. A delay in the opening of the companys China synthetics facility

Valuation

1. Public Comps Analysis (Going Concern) See Appendix A for Comps

Valuation (Based Upon 2016 Estimates)

Low Base High

Chemtura Corp

EPS Estimate $ 1.66 $ 2.56 $ 3.08

P/E Multiple 13.4x 15.8x 18.2x

Value $ 22.24 $ 40.45 $ 56.06

EBITDA Estimate ($ Millions) $ 360.0 $ 441.0 $ 488.0

EBITDA Multiple 9.4x 10.1x 10.9x

Value $ 42.83 $ 61.45 $ 78.43

Average Valuation $ 32.54 $ 50.95 $ 67.24

PV Discounted at 10% $ 26.89 $ 42.11 $ 55.57

Upside/Downside 5.5% 65.1% 117.9%

2. Sum-of-the-Parts Analysis (Company Sale) See Appendix A for Comps

3. Blended Valuation

Sum-of-the-Parts Analysis (Company Sale)

Low Base Bull Low Base Bull Low Base Bull

Industrial Performance Products 160.00 $ 190.00 $ 210.00 $ 7.0x 9.0x 12.8x 1,120.00 $ 1,710.00 $ 2,688.00 $

Industrial Engineered Products 125.00 $ 177.00 $ 185.00 $ 8.5x 9.6x 11.0x 1,062.50 $ 1,699.20 $ 2,035.00 $

Total Segment Value 285.00 $ 367.00 $ 395.00 $ 7.7x 9.0x 11.3x 2,182.50 $ 3,409.20 $ 4,723.00 $

Less: Corporate Expenses (including

$30MM Synergies) (60.00) $ (60.00) $ (60.00) $ 7.7x 9.0x 11.3x (462.00) $ (540.00) $ (678.00) $

Plus: Cash & Equivalents 545.00 $ 395.00 $ 245.00 $

Less: Debt (588.00) $ (588.00) $ (588.00) $

Less: Pension Obligations (239.00) $ (239.00) $ (239.00) $

Total Equity Value 1,438.50 $ 2,437.20 $ 3,463.00 $

Shares Outstanding 74.7MM 67.7MM 64.7MM

Price Per Share 19.26 $ 36.00 $ 53.52 $

Upside/Downside -24.5% 41.2% 109.9%

2015 EBITDA Valuation Multiple Value ($ in Millions)

Probability-Weighted Valuation

Low Base High Weight %

Going-Concern $ 26.89 $ 42.11 $ 55.57 80.0%

Company Sale $ 19.26 $ 36.00 $ 53.52 20.0%

Weighted Valuation $ 25.36 $ 40.89 $ 55.16

Upside/Downside -0.5% 60.3% 116.3%

Appendix A Supplemental Materials

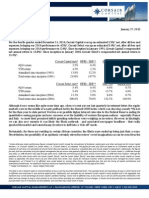

1A Use of Divestiture Proceeds

Capitalization ($ in Millions)

Before

After

AgroSolutions

Divestiture

After Debt

Paydown

Cash $ 400.00 $ 1,250.00 $ 1,046.00

PSP Stock $ - $ 50.00 $ 50.00

Cash & Equivalents $ 400.00 $ 1,300.00 $ 1,096.00

5.75% Notes $ 450.00 $ 450.00 $ 350.00

Term Loan $ 206.00 $ 206.00 $ 206.00

7.875% Notes $ 100.00 $ 100.00 $ -

Other Debt $ 32.00 $ 32.00 $ 32.00

Total Debt $ 788.00 $ 788.00 $ 588.00

Net Debt/(Cash) $ 388.00 $ (512.00) $ (508.00)

Tender Offer Scenarios ($ in Millions)

Low Base Bull

Current Shares Outstanding 96MM 96MM 96MM

Total Repurchase Amount $ 700.00 $ 850.00 $ 1,000.00

Tender Offer Price $ 30.00 $ 30.00 $ 30.00

Shares Repurchased 23.3MM 28.3MM 33.3MM

Remaining Shares Outstanding 74.7MM 67.6MM 64.7MM

2A Pro-Forma I ncome Statement

Pro-Forma Income Statement

2014 2015 2016

Industrial Performance

Products

Sales $ 1,028.0 $ 1,130.7 $ 1,300.4

Operating Income 123.4 158.3 208.1

Depreciation &

Amortization 30.0 32.0 34.0

EBITDA 153.4 190.3 242.1

Industrial Engineered

Products

Sales 851.2 893.7 920.6

Operating Income 102.1 134.1 138.1

Depreciation &

Amortization 43.0 43.0 43.0

EBITDA 145.1 177.1 181.1

Chemtura AgroSolutions 359.2 - -

Operating Income 71.8 - -

Depreciation &

Amortization 12.0 - -

EBITDA 83.8 - -

Total Company EBITDA 400.3 385.4 441.1

Operating Income 202.3 202.4 256.1

Interest Expense 38.0 25.0 25.0

Earnings Before Taxes 164.3 177.4 231.1

Taxes - 17.7 57.8

Net Income 164.3 159.6 173.4

Free Cash Flow $ 169.3 $ 179.6 $ 208.4

Diluted Shares Outstanding 94.0 67.7 67.6

Earnings Per Share $ 1.75 $ 2.36 $ 2.56

3A Public Comps/Valuation

Public Comps

2014 2015 2016

Albemarle Corporation

EPS Estimates $ 4.32 $ 4.91 $ 5.42

P/E Multiple 16.8x 14.8x 13.4x

EBITDA Estimates ($ Millions) $ 594.0 $ 650.0 $ 646.0

EBITDA Multiple 10.6x 9.6x 9.4x

New Market Corporation

EPS Estimates $ 18.29 $ 19.88 $ 21.46

P/E Multiple 21.3x 19.6x 18.2x

EBITDA Estimates $ 397.0 $ 423.0 $ 451.0

EBITDA Multiple 12.8x 11.9x 10.9x

Valuation (Based Upon 2016 Estimates)

Low Base High

Chemtura Corp

EPS Estimate $ 1.66 $ 2.56 $ 3.08

P/E Multiple 13.4x 15.8x 18.2x

Value $ 22.24 $ 40.45 $ 56.06

EBITDA Estimate ($ Millions) $ 360.0 $ 441.0 $ 488.0

EBITDA Multiple 9.4x 10.1x 10.9x

Value $ 42.83 $ 61.45 $ 78.43

Average Valuation $ 32.54 $ 50.95 $ 67.24

PV Discounted at 10% $ 26.89 $ 42.11 $ 55.57

Upside/Downside 5.5% 65.1% 117.9%

4A Sum-of-the-Parts Comps/Valuation

Industrial Performance Products Comparables

Type Date EBITDA Multiple Notes

Lubrizol Acquisition Buyout Mar-11 7x Acquired by

Berkshire Hathaway

New Market Corporation Current

Public

Company

Jul-14 12.8x

Hercules Sale Company

Sale

Nov-08 8.5x Bought by Ashland

Industrial Engineered Products Comparables

Type Date EBITDA Multiple Notes

Albemarle Corporation Current

Public

Company

Jul-14 10.6x

Israel Chemicals Limited Current

Public

Company

Apr-14 11x

Amcol Acquisition Company

Sale

Mar-14 11x Bought by Minerals

Technologies, 8.5x

EBITDA multiple

after synergies

Sum-of-the-Parts Analysis (Company Sale)

Low Base Bull Low Base Bull Low Base Bull

Industrial Performance Products 160.00 $ 190.00 $ 210.00 $ 7.0x 9.0x 12.8x 1,120.00 $ 1,710.00 $ 2,688.00 $

Industrial Engineered Products 125.00 $ 177.00 $ 185.00 $ 8.5x 9.6x 11.0x 1,062.50 $ 1,699.20 $ 2,035.00 $

Total Segment Value 285.00 $ 367.00 $ 395.00 $ 7.7x 9.0x 11.3x 2,182.50 $ 3,409.20 $ 4,723.00 $

Less: Corporate Expenses (including

$30MM Synergies) (60.00) $ (60.00) $ (60.00) $ 7.7x 9.0x 11.3x (462.00) $ (540.00) $ (678.00) $

Plus: Cash & Equivalents 545.00 $ 395.00 $ 245.00 $

Less: Debt (588.00) $ (588.00) $ (588.00) $

Less: Pension Obligations (239.00) $ (239.00) $ (239.00) $

Total Equity Value 1,438.50 $ 2,437.20 $ 3,463.00 $

Shares Outstanding 74.7MM 67.7MM 64.7MM

Price Per Share 19.26 $ 36.00 $ 53.52 $

Upside/Downside -24.5% 41.2% 109.9%

2015 EBITDA Valuation Multiple Value ($ in Millions)

Appendix B Catalysts and Risks Defined

1B - Catalysts

1. The companys plan to repurchase 1/3 of the outstanding shares through a tender

offer by year-end 2014 - as a result of the AgroSolutions divestiture, the company plans

to use the proceeds from the transaction, along with excess cash on the balance sheet, to

return capital to shareholders. After speaking with management, we project the company

to repurchase between $700MM and $1B of stock by year-end 2014. Management

recently noted that they are looking at various options to return this cash, which include a

Tender Offer, a special dividend of up to $7 per share (27.5% return), or some

combination of the two. Considering the company has stated it believes its value is about

$40 per share and the fact that our analysis supports this conclusion, we believe that the

company will decide to repurchase about 1/3 of the current outstanding shares through a

tender offer by the end of this year. Chemtura is in essence 100% institutionally owned,

with most of this ownership coming from investors with long-term investment horizons.

Based upon this, combined with our sum-of-the parts valuation and the fact that the

company currently trades at a discount to its peers, we believe that the company will have

to tender the stock at a premium to its current price.

2. Increased Capex Ends in 2014 - After major investments over the past few years, the

companys remaining two businesses, Industrial Performance Products and Industrial

Engineered Products, are poised for growth starting in the back half of 2014. As

performance improves and capital expenditures normalize, we believe that these two

businesses alone will produce over $200MM in free cash flow annually.

3. IPP Segment Capacity Expansion - On the IPP side of the business, Chemtura has

decided to turn its focus to the synthetic lubricants market, and has been making big

investments over the past several years that should now start to pay off. Exxon Mobile is

currently the only other major player in this space, but Exxon has historically not sold its

synthetics out into the market, but instead put it in its own Mobile One product. This

creates a dynamic where Chemtura is the only game in town and therefore can get

better pricing on its product, thus increasing its operating margins. The companys new

synthetic lubricants facility in the Netherlands (which is located close to one of its biggest

customers, BP) recently opened and its synthetic lubricant facility in China will come

online this year. Management has stated that customers are chomping at the bit for this

new capacity to ramp up and expects to utilize it very quickly after it is up and running.

Management expects the IPP business to do about $1.3 billion is sales by 2016, with

margins in the 18-19% range.

4. IEP Emerald Innovation Growth - In the foams business (IEP business), 2013 was a

challenging year due to the fact that ICL aggressively entered the market by offering

reduced prices across the board. This dynamic/weak performance is one of the reasons

for the recent downward pressure on the stock, but we believe that the extent of this

downward pressure is unjustified. Though pricing pressure would normally be a

significant negative event for Chemtura, this risk is offset by the companys push into its

new technology, the Emerald Innovation series, which commands higher prices and is an

area in which Chemtura is clearly ahead of the competition from a technological

standpoint. The Emerald series provides the same flame retardant benefits of other

bromine foam products, but does so in a way that is cleaner for the environment. Both

Dow Chemical and BASF have recently adopted the technology and Europe could ban

the use of the previous technology, HBCD, by 2015.

5. MATS Regulation - The other major piece of Chemturas IEP business is the use of

bromine in trapping mercury emissions. When the companys GeoBrom product is used

to treat coal that is used in power generation, mercury emissions are typically reduced by

98%. Though there is no catalyst for growth in this business during 2014, 2015 should be

a big year for GeoBrom due to the Mercury and Air Toxics Standards (MATS) which

will then go into effect. These standards, which require US coal power generation and oil

fleets to meet certain emission standards or close down by April 2015, were being

contested on the grounds that the EPA did not have the power to enact such a law. On

April 29 of this year, the courts ruled that the EPA does indeed have the power to enact

the law and can proceed with its 2015 implementation. This announcement can be

considered a major win for Chemtura; with the high costs associated with retrofitting a

power plant, Chemturas GeoBrom product provides a strong, value-oriented

alternative. Additionally, this removes the risk that the regulation could be pushed out

into 2016 or beyond.

2B - Key Risks

1. The inability to close the AgroSolutions deal - As a mitigate to this risk, the

AgroSolutions business, which has been growing revenues at 9-10% annually, as a going-

concern piece of Chemtura would add about $120MM in EBITDA to our 2015 forecast

and would result in 2015 EPS of about $2.50 (company would currently be trading at

5x 2015 EBITDA and 9x 2015 EPS, both below peer averages). Platform Specialty

Products has already raised $300MM of the needed cash for this transaction, and is also

backed by a large investment from Bill Ackman, which we believe to be a positive for

Platforms ability to raise the additional funding for the deal.

2. The inability to drive sales growth out of its IEP foams business - This risk would

impair our valuation of the company, but we do note that even under a flat revenue

scenario, operating income will improve in 2014 due to cost cutting initiatives that have

been put into place.

3. Increased regulatory scrutiny - in 2014, California passed legislation requiring tests to

be done with regards to the health and safety risks of materials used in upholstered

furniture. This could directly affect Chemturas bromine foam products used in its flame

retardant upholstery filling line. Management has been open to address this issue, and

sees little possibility of the companys products being affected by the new regulation.

4. A delay in the opening of the companys China synthetics facility this would push

out the ramp-up in revenues of the synthetics business due to capacity constraints.

Appendix C Full Write-up

Long: Chemtura Corp

Executive Summary

Over the past several years, the management team at Chemtura has done a great job of

divesting non-core assets, improving its balance sheet, cutting costs, and streamlining its

business to become a pure-play on industrial specialty chemicals. Yet, these actions seem

to have gone unnoticed as the company still trades at a significant discount to its peers.

The recent announcement of the sale of its AgroSolutions business will allow the

company to both pay off debt, resulting in annual interest expense savings of $13.6MM,

and initiate a stock repurchase tender offer for approximately one-third of the outstanding

shares. We expect this tender offer to be completed at a 20% premium to the current

stock price, which we believe will be finalized by year-end 2014.

After the tender offer is completed, we expect to company to continue to pursue the sale

of the remaining businesses. CEO Craig Rogerson has a history of monetizing companies

and has openly (and recently) stated that he could look to pursue this option with

Chemtura. Our sum-of-the-parts analysis supports 40-100% upside from the current stock

price.

Even without a sale of the business or its remaining pieces, we still believe there is

attractive upside in the stock. The company has made significant investments in its

remaining two industrial businesses, Industrial Performance Products (IPP) and Industrial

Engineered Products (IEP), and each have their own specific catalysts upcoming that will

drive future growth. We believe that as investors take notice of this growth and the value-

creation events the company has recently completed, the company will be valued more

in-line with its peers, which would result in 60% upside to the current stock price.

Investment Thesis

We believe that Chemtura Corp is a misunderstood company whose business today is much

different than it was only a few years ago. Once an over-leveraged, broad-based chemicals

company, Chemtura has been transforming its business through asset divestitures to improve its

balance sheet and become a pure-play on the industrial space. The companys recent

announcement of its divestiture of the AgroSolutions business will enable the company to reach

a net-cash position for the first time since returning to the public markets in 2010, and will set up

the company to pay down expensive debt and return cash to shareholders. We project that the

company will use the proceeds of AgroSolutions transaction, along with excess cash on the

balance sheet, to pay down $200MM in debt (which will reduce interest expense by $13.6MM

annually) and to initiate a tender offer to repurchase approximately one-third of the current

shares outstanding by year-end 2014. We also project that the tender offer will need to be

completed at a premium to the current stock price, which will enable investors to see sizeable

returns (20%) over the intermediate-term while limiting the downside in the stock.

Additionally, we believe that this is still the early innings of the companys goal to unlock

shareholder value CEO Craig Rogerson has a history of monetizing companies and has openly

stated that the rest of the company or its individual pieces could be sold. Our sum-of the-parts

analysis will show that the company is currently valued at a discount to its peers and similar

transactions, which supports the idea that additional value-creating transactions could occur.

These transactions should result in an additional 40-100% upside (after the tender offer is

completed) for shareholders that could be realized over the coming year. Even if these types of

events do not come to fruition, the company has been making big investments its two remaining

industrial segments which should start to pay off in the coming year, and could result in a re-

valuation of the company based solely on its own merits.

Business Overview

Chemtura Corporation traces its roots to its predecessor, Crompton & Knowles, which was

founded in 1900 and entered the specialty chemicals market in 1954. In the mid-1990s, the

company decided to exclusively focus on specialty chemicals, and completed the acquisition of

Witco Corporation in order to grow this business. In 2005, the company merged with Great

Lakes Chemical Corporation and changed its name to Chemtura.

In 2009, with an over-leveraged balance sheet and little liquidity, the company filed for Chapter

11 bankruptcy reorganization. Following the subsequent Chapter 11 filing of its Canadian

subsidiary, the company re-emerged from bankruptcy protection and went public in the latter

half of 2010. At the time of the IPO, the company was still over-leveraged and lacked the focus

necessary to compete effectively.

CEO Craig Rogerson made it a priority to divest non-core assets in order to improve the balance

sheet and re-focus the business going forward. In April of 2013, Chemtura closed on the sale of

its Antioxidant & UV Stabilizers business for $200MM. Later that year, the company closed on

the sale of its Consumer Products segment for $315MM. Proceeds from these transactions were

used to improve the balance sheet and return capital to shareholders (the company has bought

back $110MM of stock to date). In April of this year, the company announced that it had reached

an agreement to sell its AgroSolutions business for $1 billion, with an expected closing in the

second half of 2014.

The ending result of these moves is a company with ample liquidity and an improved focus on

the industrial segment of the market. The company has made major investments over the past

few years in its remaining two businesses, Industrial Performance Products (IPP) and Industrial

Engineered Products (IEP), and the second half of 2014/FY2015 is the time in which these

investments will start to be realized.

CHMTs Industrial Performance Products (IPP) segment focuses on the production of synthetic

lubricants, additives, and urethanes. The lubricant products are used in variety of industrial

applications, but the biggest driver of this business is the automotive industry, where the

company produces petroleum additives and gear/engine lubricants. Growth in this segment will

come from the expansion of its high-end synthetics business (where there is only one other

competitor, who normally does not sell its products into the market) and its investments in

production capacity.

In the Industrial Engineered Products (IEP) business, Chemtura competes in an Oligopoly, with

the other two major players being Albemarle Corporation and Israel Chemicals Limited (ICL).

The companys products in this segment involve the use of bromine, which exists as bromide

salts in crustal rock within the earth. Although Chemtura only controls one-sixth of the bromine

market, it is the clear leader the bromine foams market (flame retardants) and mercury emissions

prevention. When bromine is isolated, it can be combined with other molecules during the

production of polymers to form materials with excellent flame retardant properties (such as

foams). When bromine treated materials burn, they produce hydrobromic acid which interferes

with the oxidation and combustion reactions of fire. Bromine can also be used to treat coal

during power generation, and has been shown to reduce Mercury emissions by up to 98%.

Additionally, bromine intermediaries are used during the manufacturing of numerous industrial,

consumer, and energy products. It can be used to produce very dense fluids used in the oil and

gas industries, as well as organometallics, which are a special group of metals used in

polymerization reactions. Examples of this would be in the production of glass coatings,

semiconductors, LEDs, and pharmaceutical intermediates.

Once a broad-based chemicals company with little direction, Chemtura has become one of the

leaders in the industrial specialty chemical industry. This focus was reinforced earlier this year

when the company announced the sale of its agricultural chemicals segment.

AgroSolutions Transaction a Key Catalyst for Tender Offer

On April 17, 2014, the company announced that it had reached an agreement with Platform

Specialty Products Corporation to sell its AgroSolutions business, the companys agricultural

chemicals segment, for $1 billion ($950MM in cash and $50MM in stock, which will have a 6-

month lock-up period attached to it). Because Chemtura has significant NOLs it can use to offset

taxes on the sale, the company plans to bring in proceeds of about $850MM out of the $950MM

in cash it will receive. Management does not anticipate any regulatory hurdles to the deal and

expects to take $15-20MM of stranded costs out of its business once the sale occurs.

This transaction will return the company to a net-cash position, something that company has not

seen since it re-emergence from bankruptcy in 2010. We believe that part of the reason for the

companys discounted valuation as compared to peers is due to its previously weak balance

sheet. Once the AgroSolutions transaction is complete (second half of 2014), we believe that

investors will re-value the company more in-line with peers due to its improved liquidity

position.

The catalyst of greater significance as a result of the AgroSolutions divestiture is the companys

plan to use the proceeds from the transaction, along with excess cash on the balance sheet, to pay

down expensive debt and return cash to shareholders. On the debt side of the balance sheet, the

company plans to pay off $200MM of debt. The companys 7.875% Notes become callable at

104% of par in September of 2014, and we project that this will be the first piece of the capital

structure which the company pays off. We also project that the company will then use an

additional $100MM to pay off a portion of its 5.75% Notes. Below is the companys pro-forma

balance sheet after debt pay downs:

Capitalization ($ in Millions)

Before After

After Debt

Paydown

Cash $ 400.00 $ 1,250.00 $ 1,046.00

PSP Stock $ - $ 50.00 $ 50.00

Cash & Equivalents $ 400.00 $ 1,300.00 $ 1,096.00

5.75% Notes $ 450.00 $ 450.00 $ 350.00

Term Loan $ 206.00 $ 206.00 $ 206.00

7.875% Notes $ 100.00 $ 100.00 $ -

Other Debt $ 32.00 $ 32.00 $ 32.00

Total Debt $ 788.00 $ 788.00 $ 588.00

Net Debt/(Cash) $ 388.00 $ (512.00) $ (508.00)

After the debt transactions are completed, the company will save $13.6MM in annual interest

expense (96MM shares outstanding, which we believe will be reduced to approximately 67.7MM

shares by the end of this year).

After speaking with management, we also project the company to repurchase between $700MM

and $1B of stock by year-end 2014. The company has already begun to repurchase stock in the

open market, buying $110MM of stock since 2011, but has openly acknowledged that it will

need to look at other options in order to repurchase a significant amount of the float after the

AgroSolutions transaction is completed. Management recently noted that they are looking at

various options to return this cash, which include a Tender Offer, a special dividend of up to $7

per share (27.5% return), or some combination of the two. Considering the company has stated it

believes its value is about $40 per share and the fact that our analysis supports this conclusion,

we believe that the company will decide to repurchase about 1/3 of the current outstanding

shares through a tender offer in order to complete its desired share repurchase activity. Chemtura

is in essence 100% institutionally owned, with most of this ownership coming from investors

with long-term investment horizons. Based upon this, combined with our sum-of-the parts

valuation and the fact that the company currently trades at a discount to its peers, we believe that

the company will have to tender the stock at a premium to its current price, which we forecast to

be in the $30 range, in order to complete a transaction in the $700MM-$1B range. This event

would provide investors a 20% return by years end without any re-valuation of the company.

Tender Offer Scenarios ($ in Millions)

Low Base Bull

Current Shares Outstanding 96MM 96MM 96MM

Total Repurchase Amount $ 700.00 $ 850.00 $ 1,000.00

Tender Offer Price $ 30.00 $ 30.00 $ 30.00

Shares Repurchased 23.3MM 28.3MM 33.3MM

Remaining Shares Outstanding 74.7MM 67.6MM 64.7MM

Though the recent announcement of the AgroSolutions unit sale is an exciting inflection point for

the company, we believe that there is additional upside in the stock after the tender offer is

completed. Once this transaction is finalized, the company will have gone from an over-

leveraged, broad-based chemicals play to a streamlined, niche-focused industrial chemicals

company. Not only have the recent divestitures helped reduce costs and given the company a

better focus going forward, they also make the company a more attractive investment for both

public equity investors as well as other companies as an acquisition target.

Additional Value Remains after AgroSolutions Transaction

Even though the tender offer is an attractive scenario for shareholders in its own right, we

believe that the real value in Chemtura is found in the business that remains after the sale.

After major investments over the past few years, the companys remaining two businesses,

Industrial Performance Products and Industrial Engineered Products, are poised for growth

starting in the back half of 2014. As performance improves and capital expenditures normalize,

we believe that these two businesses alone will produce over $200MM in free cash flow

annually, which gives us confidence in the companys plan to return excess cash to shareholders

this year.

Source: Chemtura Investor Presentation

Both the IPP and IEP segments have their own specific catalysts that should drive future growth.

On the IPP side, pending capacity expansion and technological innovation should drive both

revenue growth and improved operating margins. Chemtura has decided to turn its focus in this

segment to the synthetic lubricants business, and has been making big investments over the past

several years that should now start to pay off. Synthetic lubricants increase the viscosity of motor

oils, which allow for longer oil change ranges or for use in higher-end vehicles. Exxon Mobile is

currently the only other major player in this space, but Exxon has historically not sold its

synthetics out into the market, but instead put it in its own Mobile One product. This creates a

dynamic where Chemtura is the only game in town and therefore can get better pricing on its

product, thus increasing its operating margins.

On the revenue side, the company will benefit from its investments in added capacity. Its new

synthetic lubricants facility in the Netherlands (which is located close to one of its biggest

customers, BP) opened at the end of 2013 and its synthetic lubricant facility in China will come

online in 2014. Management has stated that customers are chomping at the bit for more

capacity to come online and expects to utilize the new capacity very quickly after it is up and

running. Management expects the IPP business to do about $1.3 billion is sales by 2016, with

margins in the 18-19% range. After reviewing the new capacity and completing a sensitivity

analysis under various scenarios, we believe that it is very plausible that management hits this

goal, and are therefore using it as our base-case assumption.

In the IEP business, Chemtura competes in an Oligopoly, with the other two major players being

Albemarle Corporation and Israel Chemicals Limited (ICL). Although Chemtura only controls

one-sixth of the bromine market, it is the clear leader the foams market (flame retardants) and

mercury emissions prevention market. In the foams business, 2013 was a challenging year due to

the fact that ICL aggressively entered the market by offering reduced prices across the board.

This dynamic/weak performance is one of the reasons for the recent downward pressure on the

stock, but we believe that the extent of this downward pressure is unjustified. Though pricing

pressure would normally be a significant negative event for Chemtura, this risk is offset by the

companys push into its new technology, the Emerald Innovation series, which commands higher

prices and is an area in which Chemtura is clearly ahead of the competition from a technological

standpoint. The Emerald series provides the same flame retardant benefits of other bromine foam

products, but does so in a way that is cleaner for the environment. Both Dow Chemical and

BASF have recently adopted the technology and Europe could ban the use of the previous

technology, HBCD, by 2015. Also, because of the weak results in 2013, the company took steps

to take costs out of the business, including the elimination of many management positions in

which it found redundancies. Even if the adoption of the new technology is not as fast as we

project, the company recently noted that pricing has improved for HBCD this year. This, along

with cost cuts made by management last year will help this business improve results in 2014 over

2013s disappointment.

The other major piece of Chemturas IEP business is the use of bromine in trapping mercury

emissions. When the companys GeoBrom product is used to treat coal that is used in power

generation, mercury emissions are typically reduced by 98%. Though there is no catalyst for

growth in this business during 2014, 2015 should be a big year for GeoBrom due to the Mercury

and Air Toxics Standards (MATS) which will then go into effect. These standards, which require

US coal power generation and oil fleets to meet certain emission standards or close down by

April 2015, were being contested on the grounds that the EPA did not have the power to enact

such a law. On April 29 of this year, the courts ruled that the EPA does indeed have the power to

enact the law and can proceed with its 2015 implementation. This announcement can be

considered a major win for Chemtura; with the high costs associated with retrofitting a power

plant, Chemturas GeoBrom product provides a strong, value-oriented alternative. Additionally,

this removes the risk that the regulation could be pushed out into 2016 or beyond. This new

regulations impact on Chemtura cannot be understated; this is an area in which there has been

very little investment by customers over the last several years, and the new mercury emission

standards should provide a multi-year runway of growth for the GeoBrom business.

The wildcard for the IEP business is the possibility to close on the acquisition of Solaris

ChemTech. In September 2012, Chemtura announce an agreement to purchase from Solaris

certain assets used in the manufacturing and distribution of bromine and bromine chemicals for

cash consideration of $142 million and the assumption of certain liabilities, but the companies

have been unable to gain government approval to close the transaction. If Chemtura is able to

close this deal, it would be an unexpected, major catalyst for the stock as it would increase the

supply of bromine available to the company. Because of the companys inability to close on this

deal, we are assigning no value to a positive outcome in our analysis.

As we stated above, we believe managements assumptions for the IPP business are reasonable

based upon increased capacity and growth in its synthetics business. On the IEP side, we expect

a rebound in both revenues and margins in 2014 based upon the cost savings initiatives, growth

in the companys Emerald Innovation series, and pending Mercury Control Standards taking

shape as we enter 2015. These two remaining units alone will produce between $150MM and

$175MM in free cash flow (6-7% free cash flow yield) through FY2014, at which point free cash

flow generation should improve as the increased investment period ends and the company

realizes the benefits of its recent investments. As these projections come to fruition over the

coming year, along with the share repurchase tender offer, we believe that investors will re-value

Chemtura in-line with its peers. Below, we have provided our outlook for the business along

with comparable company multiples:

Pro-Forma Income Statement

2014 2015 2016

Industrial Performance

Products

Sales $ 1,028.0 $ 1,130.7 $ 1,300.4

Operating Income 123.4 158.3 208.1

Depreciation &

Amortization 30.0 32.0 34.0

EBITDA 153.4 190.3 242.1

Industrial Engineered

Products

Sales 851.2 893.7 920.6

Operating Income 102.1 134.1 138.1

Depreciation &

Amortization 43.0 43.0 43.0

EBITDA 145.1 177.1 181.1

Chemtura AgroSolutions 359.2 - -

Operating Income 71.8 - -

Depreciation &

Amortization 12.0 - -

EBITDA 83.8 - -

Total Company EBITDA 400.3 385.4 441.1

Operating Income 202.3 202.4 256.1

Interest Expense 38.0 25.0 25.0

Earnings Before Taxes 164.3 177.4 231.1

Taxes - 17.7 57.8

Net Income 164.3 159.6 173.4

Free Cash Flow $ 169.3 $ 179.6 $ 208.4

Diluted Shares Outstanding 94.0 67.7 67.6

Earnings Per Share $ 1.75 $ 2.36 $ 2.56

Chemtura is actually a collection of many unique assets that fall under two business segments, so

we will use a blended valuation of Albemarle (to represent IEP) and New Markets Corporation

(to represent IPP) to come up with our valuation of Chemtura.

Public Comps

2014 2015 2016

Albemarle Corporation

EPS Estimates $ 4.32 $ 4.91 $ 5.42

P/E Multiple 16.8x 14.8x 13.4x

EBITDA Estimates ($ Millions) $ 594.0 $ 650.0 $ 646.0

EBITDA Multiple 10.6x 9.6x 9.4x

New Market Corporation

EPS Estimates $ 18.29 $ 19.88 $ 21.46

P/E Multiple 21.3x 19.6x 18.2x

EBITDA Estimates $ 397.0 $ 423.0 $ 451.0

EBITDA Multiple 12.8x 11.9x 10.9x

Valuation (Based Upon 2016 Estimates)

Low Base High

Chemtura Corp

EPS Estimate $ 1.66 $ 2.56 $ 3.08

P/E Multiple 13.4x 15.8x 18.2x

Value $ 22.24 $ 40.45 $ 56.06

EBITDA Estimate ($ Millions) $ 360.0 $ 441.0 $ 488.0

EBITDA Multiple 9.4x 10.1x 10.9x

Value $ 42.83 $ 61.45 $ 78.43

Average Valuation $ 32.54 $ 50.95 $ 67.24

PV Discounted at 10% $ 26.89 $ 42.11 $ 55.57

Upside/Downside 5.5% 65.1% 117.9%

We believe that using a blended valuation of Albemarle and New Markets Corporation is the

best way to capture both pieces of Chemturas business. We also believe that the proper way to

value Chemtura is to discount back our 2016 projections because 1) by 2016, the company will

have used their remaining NOLs, so we will be valuing the company based off a normalized tax

rate, 2) valuing the companies like-for-like in 2016 helps us to adjust for different growth rates,

and 3) by the beginning of 2016, all activities related to the sale of AgroSolutions, the tender

offer, and company-specific catalysts will be completed, providing us a full year of realistic

future business results (note: for the next 15+ years, Chemtura will be able to use $60-70MM in

NOLs annually, which equals $1 per share in earnings before taxes after share repurchases are

completed). As you can see, when Chemtura becomes valued in-line with peers, we believe the

stock should be valued 65% higher than its current price at todays fair value, and we also see

little downside in the stock at its current levels.

Further Monetization Could Occur

CEO Craig Rogerson has made no secret to the fact that he may look to further monetize the

business after the AgroSolutions transaction is completed, even hinting at this notion during a

recent conference presentation. This kind of action would make sense considering Mr.

Rogersons background prior to his role at Chemtura, Mr. Rogerson was the CEO of the

specialty chemicals company Hercules, and was the driving force behind the companys sale to

Ashland in 2008. Before his role as CEO, Mr. Rogerson served as the general manager of

BetzDearborn, the industrial water treatment business that Hercules sold to General Electric in

2002. Mr. Rogerson also has a vested interest in this outcome; he currently owns approximately

500,000 shares of the companys stock, an additional 315,000 shares that have not yet vested,

and 400,000 options that are yet to be exercised (with an average strike price around $18).

Because of the potential for further asset divestitures, or even the possible sale of the entire

company, we believe that it is best to value Chemtura by using a sum-of-parts-analysis. Below is

a comparable analysis for each of the companys remaining segments:

Industrial Performance Products Comparables

Type Date EBITDA Multiple Notes

Lubrizol Acquisition Buyout Mar-11 7x Acquired by

Berkshire Hathaway

New Market Corporation Current

Public

Company

Jul-14 12.8x

Hercules Sale Company

Sale

Nov-08 8.5x Bought by Ashland

Based upon comparable transactions, we will use a 7.0-12.8x EBITDA range to value the IPP

unit.

Industrial Engineered Products Comparables

Type Date EBITDA Multiple Notes

Albemarle Corporation Current

Public

Company

Jul-14 10.6x

Israel Chemicals Limited Current

Public

Company

Apr-14 11x

Amcol Acquisition Company

Sale

Mar-14 11x Bought by Minerals

Technologies, 8.5x

EBITDA multiple

after synergies

Based upon comparable transactions, we will use an 8.5-11.0x EBITDA range to value the IEP

unit. As you can see we believe the value of the remaining two businesses are worth about $2.4

billion. When we combine these values with the AgroSolutions sale and adjusting for cash, debt

and pension obligations, we could see the equity value of the business being about $4 billion,

although the current enterprise value is only $2.8 billion.

Based upon the individual values of the remaining segments of Chemtura, we have provided a

sum-of-the-parts valuations based upon the sale of the entire business, in which we include about

$30MM in projected cost synergies in the transaction, which we believe to be conservative as

$15-20MM are the stranded costs from AgroSolutions:

And as you can see from this slide, if the company were to sell the business and if we were to

include $30MM in synergies in the sale, with $15-20MM of this coming from the stranded costs

of AgroSolutions), we get a value of about $36 on the business.

Valuation

Below, we have provided our probability weighted valuation for the company:

Probability-Weighted Valuation

Low Base High Weight %

Going-Concern

$ 26.89 $ 42.11 $ 55.57 80.0%

Company Sale

$ 19.26 $ 36.00 $ 53.52 20.0%

Weighted Valuation $ 25.36 $ 40.89 $ 55.16

Upside/Downside -0.5% 60.3% 116.3%

Overall, we believe that the value of Chemturas business is worth about $41, representing 60%

upside from its current price. We believe that over the next 9 months, investors will realize 20%

Sum-of-the-Parts Analysis (Company Sale)

Low Base Bull Low Base Bull Low Base Bull

Industrial Performance Products 160.00 $ 190.00 $ 210.00 $ 7.0x 9.0x 12.8x 1,120.00 $ 1,710.00 $ 2,688.00 $

Industrial Engineered Products 125.00 $ 177.00 $ 185.00 $ 8.5x 9.6x 11.0x 1,062.50 $ 1,699.20 $ 2,035.00 $

Total Segment Value 285.00 $ 367.00 $ 395.00 $ 7.7x 9.0x 11.3x 2,182.50 $ 3,409.20 $ 4,723.00 $

Less: Corporate Expenses (including

$30MM Synergies) (60.00) $ (60.00) $ (60.00) $ 7.7x 9.0x 11.3x (462.00) $ (540.00) $ (678.00) $

Plus: Cash & Equivalents 545.00 $ 395.00 $ 245.00 $

Less: Debt (588.00) $ (588.00) $ (588.00) $

Less: Pension Obligations (239.00) $ (239.00) $ (239.00) $

Total Equity Value 1,438.50 $ 2,437.20 $ 3,463.00 $

Shares Outstanding 74.7MM 67.7MM 64.7MM

Price Per Share 19.26 $ 36.00 $ 53.52 $

Upside/Downside -24.5% 41.2% 109.9%

2015 EBITDA Valuation Multiple Value ($ in Millions)

of this value through a stock repurchase tender offer, with the rest occurring in 2015 as the

company improves results and possibly looks to monetize the rest of the business.

Conclusion

Chemtura is well past its prior issues bankruptcy, an over-leveraged balance sheet, and a lack

of focus. Today, the company is a streamlined, industrial chemicals company with emerging new

technologies. The balance sheet has been cleaned up, now to the point where the AgroSolutions

divestiture gives us the catalyst necessary to make sizable returns over the intermediate term.

Over the next year, we expect more investor to take notice of the improvements at Chemtura,

which should cause the stock to be re-valued in-line with its peers. We also believe that there is a

realistic chance that company puts itself up for sale over the coming year or looks to sell off its

individual assets. In both scenarios, we should see additional upside in the stock over the next 12

months.

S-ar putea să vă placă și

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5794)

- Order GRANTING Defendants' Motion To Dismiss (Docket No. 60)Document14 paginiOrder GRANTING Defendants' Motion To Dismiss (Docket No. 60)theskeptic21Încă nu există evaluări

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (400)

- The Lessons of Oil - Unlocked Howard MarksDocument7 paginiThe Lessons of Oil - Unlocked Howard MarksValueWalkÎncă nu există evaluări

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- Corsair Capital Management 4Q 2014 LetterDocument7 paginiCorsair Capital Management 4Q 2014 LetterValueWalk100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (895)

- Marcato Capital 4Q14 Letter To InvestorsDocument38 paginiMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- Evaluation December 2014Document35 paginiEvaluation December 2014ValueWalkÎncă nu există evaluări

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- Ackman SuitDocument34 paginiAckman SuitValueWalkÎncă nu există evaluări

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- Champouse CRMZCaseDocument22 paginiChampouse CRMZCaseValueWalkÎncă nu există evaluări

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- IPR2015-00720 (Petition)Document70 paginiIPR2015-00720 (Petition)Markman AdvisorsÎncă nu există evaluări

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (588)

- 2014 11 November Monthly Report TPOIDocument1 pagină2014 11 November Monthly Report TPOIValueWalkÎncă nu există evaluări

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (74)

- Why I'm Long SodaStream-Whitney Tilson-10!21!14Document32 paginiWhy I'm Long SodaStream-Whitney Tilson-10!21!14CanadianValueÎncă nu există evaluări

- Jeff Gundlach - This Time It's DifferentDocument73 paginiJeff Gundlach - This Time It's DifferentCanadianValueÎncă nu există evaluări

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- A Google Skeptic Eats Crow-Whitney Tilson-11!21!14Document16 paginiA Google Skeptic Eats Crow-Whitney Tilson-11!21!14ValueWalkÎncă nu există evaluări

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (266)

- Warren Buffet's 1982 Letter To John Dingell Warning About DerivativesDocument4 paginiWarren Buffet's 1982 Letter To John Dingell Warning About DerivativesForbes100% (3)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- 12.02.14 TheStreet LetterDocument3 pagini12.02.14 TheStreet LetterZerohedgeÎncă nu există evaluări

- MW Superb Summit 11202014Document18 paginiMW Superb Summit 11202014ValueWalkÎncă nu există evaluări

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- Denali Investors - Columbia Business School Presentation 2014.11.11 - Final - PublicDocument36 paginiDenali Investors - Columbia Business School Presentation 2014.11.11 - Final - PublicValueWalk83% (6)

- Ackman Pershing Square Holdings Ltd. Q3 Investor Letter Nov 25Document14 paginiAckman Pershing Square Holdings Ltd. Q3 Investor Letter Nov 25ValueWalk100% (1)

- Performance Report November 2014Document1 paginăPerformance Report November 2014ValueWalkÎncă nu există evaluări

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2259)

- Profiles in Investing - Leon Cooperman (Bottom Line 2004)Document1 paginăProfiles in Investing - Leon Cooperman (Bottom Line 2004)tatsrus1Încă nu există evaluări

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- The Malone Complex Presentation - 2014.11.19 VPublicDocument43 paginiThe Malone Complex Presentation - 2014.11.19 VPublicValueWalk100% (7)

- Fpa International Value TranscriptDocument52 paginiFpa International Value TranscriptCanadianValueÎncă nu există evaluări

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (344)

- TPRE Investor Presentation Nov 2014 FINAL v2 v001 M5ih35Document29 paginiTPRE Investor Presentation Nov 2014 FINAL v2 v001 M5ih35ValueWalkÎncă nu există evaluări

- Grey Owl Letter Q 32014Document9 paginiGrey Owl Letter Q 32014ValueWalkÎncă nu există evaluări

- Denali Investors - Columbia Business School Presentation 2008 Fall v3Document28 paginiDenali Investors - Columbia Business School Presentation 2008 Fall v3ValueWalkÎncă nu există evaluări

- Ame Research Thesis 11-13-2014Document890 paginiAme Research Thesis 11-13-2014ValueWalkÎncă nu există evaluări

- 2014 q3 International Value Webcast Final7789C3B7080ADocument14 pagini2014 q3 International Value Webcast Final7789C3B7080AValueWalkÎncă nu există evaluări

- 2014 FPA q3 Crescent Webcast FinalDocument28 pagini2014 FPA q3 Crescent Webcast FinalValueWalkÎncă nu există evaluări

- 2014 q3 Fpa Crescent TranscriptDocument49 pagini2014 q3 Fpa Crescent TranscriptCanadianValueÎncă nu există evaluări

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (121)

- Bruce Greenwald Fall 2015Document24 paginiBruce Greenwald Fall 2015ValueWalk100% (1)

- Simon TBR - Grant's Conference - 2014Document42 paginiSimon TBR - Grant's Conference - 2014ValueWalkÎncă nu există evaluări

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)