Documente Academic

Documente Profesional

Documente Cultură

Funa Vs MECO's Partial Case Digest (Discussion of The Main Issue)

Încărcat de

Equi Tin0 evaluări0% au considerat acest document util (0 voturi)

53 vizualizări2 paginiMECO is not a GOCC nor a government instrumentality because it is not owned by the PH government. But it is subject to the auditing of COA only as regards its collection of verification and consular fees. The MECO handles government funds in the form of the "verification fees" it collects.

Descriere originală:

Titlu original

Funa vs MECO's Partial Case Digest (Discussion of the Main Issue)

Drepturi de autor

© © All Rights Reserved

Formate disponibile

DOCX, PDF, TXT sau citiți online pe Scribd

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentMECO is not a GOCC nor a government instrumentality because it is not owned by the PH government. But it is subject to the auditing of COA only as regards its collection of verification and consular fees. The MECO handles government funds in the form of the "verification fees" it collects.

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca DOCX, PDF, TXT sau citiți online pe Scribd

0 evaluări0% au considerat acest document util (0 voturi)

53 vizualizări2 paginiFuna Vs MECO's Partial Case Digest (Discussion of The Main Issue)

Încărcat de

Equi TinMECO is not a GOCC nor a government instrumentality because it is not owned by the PH government. But it is subject to the auditing of COA only as regards its collection of verification and consular fees. The MECO handles government funds in the form of the "verification fees" it collects.

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca DOCX, PDF, TXT sau citiți online pe Scribd

Sunteți pe pagina 1din 2

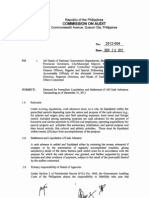

In the case of Funa vs MECO, the Supreme Court held that MECO is not a

GOCC nor a government instrumentality because it is not owned by the PH

government. It is a sui generis private entity - a non-governmental non-stock

corporation. However, it is entrusted by the government to facilitate its

unofficial relations in Taiwan. Thus, not all accounts of MECO are subject to

the auditing power of CoA.

Although MECO is not a government instrumentality, it is nevertheless

subject to the auditing of COA only as regards its collection of verification

and consular fees. Pertinent is the provision of the Administrative Code,

Section 14(1), Book V thereof, which authorizes the COA to audit accounts of

nongovernmental entities required to pay xxx or have government share

but only with respect to funds xxx coming from or through the

government. The said fees collected by MECO are receivables of DOLE.

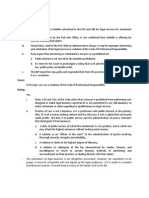

As to the verification fees: Under Section 7 of EO No. 1022, DOLE has the

authority to collect verification fees. But it entered into a series of MoA with

MECO authorizing the latter to collect such fees since the PH does not have

an official post in Taiwan.

As to the consular fees: The authority behind consular fees is Section 2(6)

of EO No. 15, s. 2001. The said section authorizes the MECO to collect

reasonable fees for its performance of consular functions. Evidently, and

just like the peculiarity that attends the DOLE verification fees, there is no

consular office for the collection of the consular fees. Thus, the authority

for the MECO to collect the reasonable fees, vested unto it by the

executive order (EO No. 15, s. 2001)

CONCLUSION

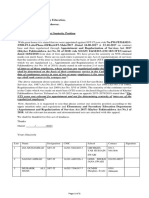

The MECO is not a GOCC or government instrumentality. It is a sui

generis private entity especially entrusted by the government with

the facilitation of unofficial relations with the people in Taiwan

without jeopardizing the countrys faithful commitment to the One

China policy of the PROC. However, despite its nongovernmental character,

the MECO handles government funds in the form of the verification fees it

collects on behalf of the DOLE and the consular fees it collects under

Section 2(6) of EO No. 15, s. 2001. Hence, under existing laws, the

accounts of the MECO pertaining to its collection of such

verification fees and consular fees should be audited by the

COA.

S-ar putea să vă placă și

- Funa Vs MECO's Partial Case Digest (Discussion of The Main Issue)Document2 paginiFuna Vs MECO's Partial Case Digest (Discussion of The Main Issue)Equi Tin50% (2)

- Group 8 - Convention On The Elimination of All Forms of Discrimination Against WomenDocument1 paginăGroup 8 - Convention On The Elimination of All Forms of Discrimination Against WomenVivi KoÎncă nu există evaluări

- Funa V Manila Economic and Cultural OfficeDocument5 paginiFuna V Manila Economic and Cultural OfficeNina CuerpoÎncă nu există evaluări

- Funa Vs MecoDocument3 paginiFuna Vs Mecovermouth6wineÎncă nu există evaluări

- Funa v. MECODocument3 paginiFuna v. MECOJustin Moreto33% (3)

- 4 - Funa V MECODocument3 pagini4 - Funa V MECOSelynn CoÎncă nu există evaluări

- Corpo - Funa V MECO and COADocument8 paginiCorpo - Funa V MECO and COAPrincess DarimbangÎncă nu există evaluări

- FUNA v. MECO-GuanzonDocument2 paginiFUNA v. MECO-GuanzonEnzo OfilanÎncă nu există evaluări

- Funa V Manila Economic and Cultural OfficeDocument2 paginiFuna V Manila Economic and Cultural OfficeRaya Alvarez TestonÎncă nu există evaluări

- Dennis Funa vs. MECODocument1 paginăDennis Funa vs. MECONajeb MatuanÎncă nu există evaluări

- 11 Funa v. MECO and COA (Diaz)Document6 pagini11 Funa v. MECO and COA (Diaz)Carl IlaganÎncă nu există evaluări

- 157 Funa v. MECODocument4 pagini157 Funa v. MECOJuno GeronimoÎncă nu există evaluări

- BPI v. CBP (Now BSP)Document2 paginiBPI v. CBP (Now BSP)Shine Dawn Infante100% (1)

- FUNA v. MECO DigestDocument1 paginăFUNA v. MECO DigestDonn LinÎncă nu există evaluări

- Funa-v-MECO, Consti 1 Case Digest 2. Funa-v-MECO, Consti 1 Case DigestDocument4 paginiFuna-v-MECO, Consti 1 Case Digest 2. Funa-v-MECO, Consti 1 Case DigestRESUELLO DIVINA MAEÎncă nu există evaluări

- Digest BuenoDocument8 paginiDigest Buenomrpowerplus100% (1)

- Funa Vs Manila Economic and Cultural Office G.R. No. 193462 February 4, 2014Document4 paginiFuna Vs Manila Economic and Cultural Office G.R. No. 193462 February 4, 2014PCpl Harvin jay TolentinoÎncă nu există evaluări

- Funa and Manila Economic and Cultural Office and The Commission On AuditDocument6 paginiFuna and Manila Economic and Cultural Office and The Commission On AuditTrick San AntonioÎncă nu există evaluări

- Galita-DBP v. COADocument2 paginiGalita-DBP v. COAKylie GavinneÎncă nu există evaluări

- Virtua1 1aw 1ibrary: Topic: Bank AuditDocument2 paginiVirtua1 1aw 1ibrary: Topic: Bank AuditChloe SyGalitaÎncă nu există evaluări

- V. Commissioner of Internal Revenue, 30 SCRA 968)Document20 paginiV. Commissioner of Internal Revenue, 30 SCRA 968)Bernice RosarioÎncă nu există evaluări

- Case Digest - Funa v. MeacofDocument2 paginiCase Digest - Funa v. MeacofAljanna RNÎncă nu există evaluări

- Case Digest Funa Vs Manila Econ OfficeDocument2 paginiCase Digest Funa Vs Manila Econ OfficeelobeniaÎncă nu există evaluări

- Funa v. MECODocument1 paginăFuna v. MECOJORLAND MARVIN BUCUÎncă nu există evaluări

- Mock Tax ExamDocument2 paginiMock Tax ExamRobert Jayson UyÎncă nu există evaluări

- Funa VS MecoDocument2 paginiFuna VS MecoDavid LeeÎncă nu există evaluări

- Cases (2-6-13)Document200 paginiCases (2-6-13)Murli BristolÎncă nu există evaluări

- 4 7 2 Cir Vs Coa LDocument13 pagini4 7 2 Cir Vs Coa LKing BautistaÎncă nu există evaluări

- Commissioner of Internal Revenue Vs CoaDocument4 paginiCommissioner of Internal Revenue Vs CoaAb Castil100% (1)

- II. Inherent Limitations DigestDocument6 paginiII. Inherent Limitations DigestCharmila SiplonÎncă nu există evaluări

- Proton Pilipinas Corp. v. RepublicDocument2 paginiProton Pilipinas Corp. v. RepublicElaine Belle OgayonÎncă nu există evaluări

- 213 DBP V COA (2002)Document23 pagini213 DBP V COA (2002)Ar-Ar BanacoÎncă nu există evaluări

- G.R. No. 193462 - Funa Vs MECO PDFDocument2 paginiG.R. No. 193462 - Funa Vs MECO PDFMarkÎncă nu există evaluări

- Philippine Supreme Court Jurisprudence Year 2014 February 2014 DecisionsDocument20 paginiPhilippine Supreme Court Jurisprudence Year 2014 February 2014 DecisionsPhrexilyn PajarilloÎncă nu există evaluări

- Consti 1Document95 paginiConsti 1Manilyn Beronia PasciolesÎncă nu există evaluări

- 11 Funa V MecoDocument2 pagini11 Funa V MecoAnonymous fnlSh4KHIg100% (1)

- Funa v. Meco (2014)Document13 paginiFuna v. Meco (2014)Alyk Tumayan CalionÎncă nu există evaluări

- DBP Vs COADocument3 paginiDBP Vs COAAnonymous 8SgE990% (1)

- Funa Vs MECO and COA (2014) : Subject: Petition, Even If Rendered Moot and Academic by Supervening Events, May StillDocument17 paginiFuna Vs MECO and COA (2014) : Subject: Petition, Even If Rendered Moot and Academic by Supervening Events, May StillcassieÎncă nu există evaluări

- Domingo Vs RoblesDocument11 paginiDomingo Vs RoblesJFAÎncă nu există evaluări

- Subido v. CADocument3 paginiSubido v. CAKat Dela PazÎncă nu există evaluări

- Funa v. Manila Economic and Cultural OfficeDocument5 paginiFuna v. Manila Economic and Cultural OfficexxxaaxxxÎncă nu există evaluări

- 13 Republic V ParanaqueDocument7 pagini13 Republic V ParanaqueAtty MglrtÎncă nu există evaluări

- Funa vs. Manila Economic and Cultural Office (2014)Document5 paginiFuna vs. Manila Economic and Cultural Office (2014)bellaciao 88Încă nu există evaluări

- Word Work File L - 1330700490Document13 paginiWord Work File L - 1330700490Alyza Montilla BurdeosÎncă nu există evaluări

- Legal Memo DAPDocument4 paginiLegal Memo DAPCo Tam BehÎncă nu există evaluări

- Proton Pilipinas Corporation Vs RepublicDocument3 paginiProton Pilipinas Corporation Vs RepublicMary Anne Guanzon VitugÎncă nu există evaluări

- IntroductionDocument9 paginiIntroductionTonton ReyesÎncă nu există evaluări

- Tetangco Vs COA - Classes of Corporation (Government Corporation)Document2 paginiTetangco Vs COA - Classes of Corporation (Government Corporation)Cece AustriaÎncă nu există evaluări

- Commission On Audit Circular 2012-004Document3 paginiCommission On Audit Circular 2012-004Che Poblete CardenasÎncă nu există evaluări

- Bacani V NACOCO Case DigestDocument1 paginăBacani V NACOCO Case DigestLoren yÎncă nu există evaluări

- CIR v. Bank of Commerce (2005) Case DigestDocument2 paginiCIR v. Bank of Commerce (2005) Case DigestShandrei GuevarraÎncă nu există evaluări

- A Centralising BudgetDocument8 paginiA Centralising BudgetThavam RatnaÎncă nu există evaluări

- Cervantes Vs Auditor General People Vs Jolliffe: Facts: FactsDocument4 paginiCervantes Vs Auditor General People Vs Jolliffe: Facts: FactsWindy Awe MalapitÎncă nu există evaluări

- 11) Tio Vs Videogram Regulatory BoardDocument2 pagini11) Tio Vs Videogram Regulatory BoardJohn AysonÎncă nu există evaluări

- CIR vs. British Overseas Airways Corporation (BOAC)Document7 paginiCIR vs. British Overseas Airways Corporation (BOAC)Kent Alvin GuzmanÎncă nu există evaluări

- Digested 13 18Document13 paginiDigested 13 18Tokie TokiÎncă nu există evaluări

- Presentasi Topik ArtikelDocument30 paginiPresentasi Topik ArtikelputriÎncă nu există evaluări

- Revenue Generation Under The Political and Corporate Nature of Philippine Local GovernmentsDocument13 paginiRevenue Generation Under The Political and Corporate Nature of Philippine Local Governmentsguada40Încă nu există evaluări

- Spouses Salvador Vs Spouses Rabaja (2015) Case Digest in Civil LawDocument3 paginiSpouses Salvador Vs Spouses Rabaja (2015) Case Digest in Civil LawEqui TinÎncă nu există evaluări

- Home Remedies For DiabetesDocument1 paginăHome Remedies For DiabetesEqui TinÎncă nu există evaluări

- FBI Vs FSIDocument2 paginiFBI Vs FSIEqui TinÎncă nu există evaluări

- Tongco Vs Vianzon (1927) Case Digest in EvidenceDocument2 paginiTongco Vs Vianzon (1927) Case Digest in EvidenceEqui TinÎncă nu există evaluări

- FBI Vs FSIDocument2 paginiFBI Vs FSIEqui TinÎncă nu există evaluări

- Res Gestae and Dead Man's Statute Cases (Evidence)Document6 paginiRes Gestae and Dead Man's Statute Cases (Evidence)Equi TinÎncă nu există evaluări

- Cavili Vs Florendo Case Digest (Evidence)Document2 paginiCavili Vs Florendo Case Digest (Evidence)Equi Tin0% (1)

- Ermita Vs Mayor of Manila Case DigestDocument2 paginiErmita Vs Mayor of Manila Case DigestEqui TinÎncă nu există evaluări

- Mejoff Vs Dir of Prisons Case DigestDocument1 paginăMejoff Vs Dir of Prisons Case DigestEqui TinÎncă nu există evaluări

- 1 Albino Co Vs CADocument10 pagini1 Albino Co Vs CAEqui Tin100% (1)

- Case Digest BriefsDocument1 paginăCase Digest BriefsEqui TinÎncă nu există evaluări

- Ermita Vs Mayor of Manila Case DigestDocument2 paginiErmita Vs Mayor of Manila Case DigestEqui TinÎncă nu există evaluări

- North Cotabato Vs GRP Case DigestDocument5 paginiNorth Cotabato Vs GRP Case DigestEqui TinÎncă nu există evaluări

- Tañada Vs Angara Case DigestDocument3 paginiTañada Vs Angara Case DigestEqui Tin100% (2)

- Tañada Vs Angara Case DigestDocument3 paginiTañada Vs Angara Case DigestEqui Tin100% (2)

- Depression Among College StudentsDocument17 paginiDepression Among College StudentsEqui TinÎncă nu există evaluări

- Pascual Vs Sec of Public Works Case DigestDocument4 paginiPascual Vs Sec of Public Works Case DigestEqui TinÎncă nu există evaluări

- Co Kim Cham V Tan KehDocument60 paginiCo Kim Cham V Tan KehEqui TinÎncă nu există evaluări

- Vivas Vs Monetary Board Case DigestDocument3 paginiVivas Vs Monetary Board Case DigestEqui TinÎncă nu există evaluări

- Rafol, A Position Paper On Steven Pinker's Why Academics Stink at Writing'Document2 paginiRafol, A Position Paper On Steven Pinker's Why Academics Stink at Writing'Equi TinÎncă nu există evaluări

- Khan V Simbillo Case DigestDocument1 paginăKhan V Simbillo Case DigestEqui Tin0% (1)

- Tax Remedies (Reviewer)Document2 paginiTax Remedies (Reviewer)Equi TinÎncă nu există evaluări

- Dean Coronel Trial Practice TechniquesDocument13 paginiDean Coronel Trial Practice TechniquesEqui Tin100% (3)

- Comm Rev PNB Vs Rodriguez 2008Document1 paginăComm Rev PNB Vs Rodriguez 2008Equi TinÎncă nu există evaluări

- Modes of Acquiring Ownership PartialDocument2 paginiModes of Acquiring Ownership PartialEqui TinÎncă nu există evaluări

- Corporate PowersDocument3 paginiCorporate PowersEqui TinÎncă nu există evaluări

- Phil Lawyers Assoc V Agrava Case DigestDocument2 paginiPhil Lawyers Assoc V Agrava Case DigestEqui Tin100% (2)

- Problem Areas in Legal Ethics Case DigestsDocument30 paginiProblem Areas in Legal Ethics Case DigestsEqui Tin100% (1)

- Outline 2023 Part 1Document2 paginiOutline 2023 Part 1JennicaÎncă nu există evaluări

- 3L00116 PDFDocument1 pagină3L00116 PDFMinal Khedekar DhamanaskarÎncă nu există evaluări

- Ellao vs. Batelec 1Document9 paginiEllao vs. Batelec 1louryÎncă nu există evaluări

- TRV Tutorial in CanadaDocument2 paginiTRV Tutorial in Canadabittu.ayush2845100% (1)

- I-9 Acceptable Documents ListDocument1 paginăI-9 Acceptable Documents Lista6355145Încă nu există evaluări

- Cos and Jo Filing Coc LoDocument11 paginiCos and Jo Filing Coc LoGen S.100% (1)

- Fire InsuranceDocument4 paginiFire InsuranceRoMeoÎncă nu există evaluări

- Registration of UnionDocument3 paginiRegistration of Unionsir_vic2013Încă nu există evaluări

- Spread Law - Criminal Trial in Indian LawDocument4 paginiSpread Law - Criminal Trial in Indian LawDhaval GohelÎncă nu există evaluări

- Bermudez vs. CastilloDocument2 paginiBermudez vs. CastilloTin NavarroÎncă nu există evaluări

- Appeal FOR SST IT SENIORITYDocument1 paginăAppeal FOR SST IT SENIORITYAfraz KhanÎncă nu există evaluări

- Exclude and Protect: A Report On The WWF Case On Wildlife Conservation in The Supreme Court of IndiaDocument144 paginiExclude and Protect: A Report On The WWF Case On Wildlife Conservation in The Supreme Court of IndiaSh KhÎncă nu există evaluări

- Tax Midterms EditedDocument113 paginiTax Midterms EditedJackie CanlasÎncă nu există evaluări

- Or Wcomp 0.72 or Wcomp 0.72Document1 paginăOr Wcomp 0.72 or Wcomp 0.72aaronÎncă nu există evaluări

- Balina-Analysis-Frilou Construction v. Aegis IntegratedDocument2 paginiBalina-Analysis-Frilou Construction v. Aegis IntegratedNamiel Maverick D. BalinaÎncă nu există evaluări

- Oregon House Bill 2208Document3 paginiOregon House Bill 2208Jennevieve FongÎncă nu există evaluări

- NSA Docs (EFF FOIA)Document616 paginiNSA Docs (EFF FOIA)LeakSourceInfoÎncă nu există evaluări

- People V HadjiDocument8 paginiPeople V HadjiCMLÎncă nu există evaluări

- Driving Test Application FormDocument4 paginiDriving Test Application FormPaz WinfieldÎncă nu există evaluări

- Motion To Withdraw As CounselDocument4 paginiMotion To Withdraw As CounselJoyce Amara VosotrosÎncă nu există evaluări

- Late Show With David Letterman: Sacha Baron CohenDocument1 paginăLate Show With David Letterman: Sacha Baron CohenEdyta DzikonÎncă nu există evaluări

- In Re Petition For Exemption From Coverage by The Social Security System. Roman Catholic Archbishop of Manila vs. SSCDocument3 paginiIn Re Petition For Exemption From Coverage by The Social Security System. Roman Catholic Archbishop of Manila vs. SSCgraceÎncă nu există evaluări

- Ho HupDocument25 paginiHo Hupcacamarba20036236Încă nu există evaluări

- Nature of Public Law and Its Imortance in GovernanceDocument13 paginiNature of Public Law and Its Imortance in GovernanceAsweta MÎncă nu există evaluări

- Family LawDocument13 paginiFamily Lawshruti mandoraÎncă nu există evaluări

- Aff. of DenialDocument6 paginiAff. of DenialChristian Paul Pinote100% (1)

- Tracing ClothDocument9 paginiTracing ClothMelvin PernezÎncă nu există evaluări

- Aleria Jr. vs. VelezDocument2 paginiAleria Jr. vs. VelezRalph Jarvis Hermosilla AlindoganÎncă nu există evaluări

- For Different Rajasthan ExamsDocument20 paginiFor Different Rajasthan ExamsKriti SinghaniaÎncă nu există evaluări

- Case BriefDocument3 paginiCase BriefLaurenciaÎncă nu există evaluări

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersDe la EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersEvaluare: 5 din 5 stele5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsDe la EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsÎncă nu există evaluări

- Law of Contract Made Simple for LaymenDe la EverandLaw of Contract Made Simple for LaymenEvaluare: 4.5 din 5 stele4.5/5 (9)

- Contracts: The Essential Business Desk ReferenceDe la EverandContracts: The Essential Business Desk ReferenceEvaluare: 4 din 5 stele4/5 (15)

- Sales & Marketing Agreements and ContractsDe la EverandSales & Marketing Agreements and ContractsÎncă nu există evaluări

- How to Win Your Case In Traffic Court Without a LawyerDe la EverandHow to Win Your Case In Traffic Court Without a LawyerEvaluare: 4 din 5 stele4/5 (5)

- Learn the Essentials of Business Law in 15 DaysDe la EverandLearn the Essentials of Business Law in 15 DaysEvaluare: 4 din 5 stele4/5 (13)

- The Certified Master Contract AdministratorDe la EverandThe Certified Master Contract AdministratorEvaluare: 5 din 5 stele5/5 (1)

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseDe la EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseÎncă nu există evaluări

- Technical Theater for Nontechnical People: Second EditionDe la EverandTechnical Theater for Nontechnical People: Second EditionÎncă nu există evaluări

- Crash Course Business Agreements and ContractsDe la EverandCrash Course Business Agreements and ContractsEvaluare: 3 din 5 stele3/5 (3)

- How to Win Your Case in Small Claims Court Without a LawyerDe la EverandHow to Win Your Case in Small Claims Court Without a LawyerEvaluare: 5 din 5 stele5/5 (1)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityDe la EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityÎncă nu există evaluări

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetDe la EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetÎncă nu există evaluări

- Starting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingDe la EverandStarting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingEvaluare: 5 din 5 stele5/5 (1)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowDe la EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowEvaluare: 1 din 5 stele1/5 (1)

- Broadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessDe la EverandBroadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessÎncă nu există evaluări