Documente Academic

Documente Profesional

Documente Cultură

IAS Conversion Document Mar12 Lcci

Încărcat de

StpmTutorialClassDescriere originală:

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

IAS Conversion Document Mar12 Lcci

Încărcat de

StpmTutorialClassDrepturi de autor:

Formate disponibile

internationalenquiries@ediplc.

com

+44 (0) 2476 518951 www.lcci.org.uk

International Accounting Standards

(IAS) Guidance:

Terminology and Presentation

International Accounting Standards (IAS) Guidance: Terminology and Presentation

Contents

1

Introduction

First Level

1.1 Terminology

Format of the Income

1.2 Statement and Statement of

Financial Position

1.3 Treatment of discount

1.4 Summary

Second Level

2.1 Preface

2.2 Partnerships

2.3 Limited liability companies

2.4 Manufacturing Accounts

10

2.5 Non-trading organisations

11

2.6

Statement of Comprehensive

Income

2.7 Summary

11

11

Third Level

3.1 Preface

3.2 Terminology

3.3

Accounting treatment of

goodwill

12

12

12

Format of Consolidated

Income Statement and

3.4

Consolidated Statement of

Financial Position

13

3.5 Cash flows

14

3.6 IAS standards

15

3.7 Summary

15

Fourth Level

4.1 Preface

16

4.2

Components of financial

statements

16

4.3

Format of the Statement of

Financial Position

16

4.4

Statement of Comprehensive

Income

17

4.5

Statement of Changes in

Equity

17

4.6 Financial statements

18

4.7 IAS Standards

20

International Accounting Standards (IAS) Guidance: Terminology and Presentation

Introduction

The International Accounting Standards (IAS) and the International Financial Reporting Standards (FRS)

are widely used throughout the world. Since 2001, almost 120 countries have required or permitted the

use of IFRS. All remaining major economies have established time lines to converge with or adopt IFRS in

the near future.

International Accounting Standards (IAS) Guidance: Terminology and Presentation

1. First Level

1.1 Terminology

UK

IAS

Fixed Assets

Non-current Assets

Stock

Inventory

Trade Debtors

Trade Receivables

Prepayments

Other Receivables

Trade Creditors

Trade Payables

Accruals

Other Payables

Trading Profit and Loss Account

Income Statement

Sales

Revenue

Balance Sheet

Statement Of Financial Position

Provision for Doubtful Debts

Allowance For Doubtful Debts

Net Book Value

Carrying Amount

Creditors amounts falling due within 1 year

Current Liabilities

Creditors amounts falling due after more than 1 year

Non-current Liabilities

Long term Debenture

Loan Note

1.2 Format of the Income Statement and the Statement

of Financial Position

Whilst there are no compulsory requirements for the presentation of the accounts of sole traders, it is

recommended that candidates become familiar with preparing accounts in the IAS format.

International Accounting Standards (IAS) Guidance: Terminology and Presentation

1.2.1 Format of Financial Statements for a sole trader

Peter Piper

Income Statement for the year ended

31 March 20x0

$

Revenue

18,300

Cost of goods sold

Opening inventory

2,200

Add Purchases

13,100

Less Closing inventory

Peter Piper

Statement of Financial Position at

31 March 20x0

Plant and equipment

4,560

Motor vehicles

2,500

7,060

15,300

Current Assets

(2,100) 13,200

Inventories

Gross profit

5,100

Less Expenses:

4,200

Other receivables

150

1,000

Cash

Rent and rates

1,500

Total Assets

Light and heat

1,300

Sundry expenses

Profit for the year

70

6,520

13,580

Capital

50

200

2,100

Trade receivables

Motor expenses

Loan interest

Non-cuurent Assets

(4,050)

1,050

Opening balance

4,150

Add Profit for the year

1,050

5,200

( 400 )

Less Drawings

4,800

Non-current Liabilities

Bank loan

5,000

Current Liabilities

Trade payables

2,400

Other payables

400

Bank overdraft

980

Total equity and liabilities

3,780

13,580

1.3 Treatment of Discount

Discount allowed should be deducted from revenue,

Discount received should be deducted from purchases.

1.4 Summary

The impact of international accounting standards at this level is mainly presentational. Candidates

preparing accounts under recognisable formats will not be penalised as IAS does not apply to sole traders.

However, candidates wishing to progress to higher levels would be encouraged to use these formats.

International Accounting Standards (IAS) Guidance: Terminology and Presentation

2. Second Level

2.1 Preface

Practices and principles raised at the First Level will be relevant at the Second Level, reflecting the

cumulative requirements of the LCCI syllabuses.

2.2 Partnerships

2.2.1 Terminology

UK

IAS

Trading, Profit and Loss and Appropriation Account

Income Statement and Appropriation Account

Balance Sheet

Statement of Financial Position

International Accounting Standards (IAS) Guidance: Terminology and Presentation

2.2.2 Format of Financial Statements for a partnership

Peter and Pope

Income Statement and Appropriation

Account for the year ended

31 March 20x0

$

Peter and Pope

Statement of Financial Position at

31 March 20x0

$

Revenue

18,300

Non-cuurent Assets

Cost of goods sold

Plant and equipment

4,560

Opening inventory

2,200

Motor vehicles

2,500

Add Purchases

13,100

Less Closing inventory

7,060

15,300

Current Assets

(2,100) 13,200

Inventories

Gross profit

5,100

Less Expenses:

Trade receivables

4,200

Other receivables

150

Motor expenses

1,000

Cash

Rent and rates

1,500

Total Assets

Light and heat

1,300

Loan interest

Sundry expenses

Profit for the year

70

6,520

13,580

Capital Accounts

50

200

2,100

(4,050)

Peter

1,550

1,050

Pope

1,550

3,100

Interest on Drawing

Peter

100

Pope

50

150

1,200

( 500 )

Salary-Pope

Current Accounts

Peter

1,000

Pope

700

4,800

Interest on capital

Peter

100

Pope

100

( 200 )

500

Share of Profits

1,700

Non-current Liabilities

Bank loan

5,000

Current Liabilities

Peter (1/2 x 500)

250

Pope (1/2 x 500)

250

( 500 )

Trade payables

2,400

Other payables

400

Bank overdraft

980

Total equity and liabilities

3,780

13,580

International Accounting Standards (IAS) Guidance: Terminology and Presentation

2.3 Limited liability companies

The accounts of limited liability companies are affected much more substantially, and candidates

preparing for examinations under IAS will be expected to comply with the basic layouts to be given in

sections 2.3.2 and 2.6.

UK GAAP

IAS equivalent

Limited Company (Ltd)

Private Company

Public Limited Company

Public Company

Preference share Capital

Preferred share capital

Ordinary shares

Equity shares

Profit & loss/Accumulated profits

Retained earnings

2.3.1 Terminology

2.3.2 Treatment of prefered share capital

UK GAAP

IAS equivalent

Redeemable preferred share capital

Shown in Non Current liability

Irredeemable preferred share capital

Shown in Shareholders equity

International Accounting Standards (IAS) Guidance: Terminology and Presentation

2.3.2 Format of Financial Statements for companies

Hill Traders

Statement of Financial Position at

31 March 20x0

Hill Traders

Income Statement for the year ended

31 March 20x0

$

Revenue

18,300

Non-current Assets

Cost of goods sold

Plant and equipment

17,600

Opening inventory

2,200

Motor vehicles

2,500

Add Purchases

13,100

Less Closing inventory

20,100

15,300

Current Assets

(2,100) 13,200

Inventories

Gross profit

5,100

Less Expenses:

Trade receivables

4,200

Other receivables

150

Motor expenses

1,000

Cash

Rent and rates

1,500

Total Assets

Light and heat

1,300

Loan interest

Less: Sundry expenses

Profit for the year

Equity and Liabilities

50

200

(4,050)

1,050

2,100

70

6,520

26,620

Capital and reserves

Ordinary share capital

10,000

Share premium

5,000

Retained earnings

4,000

Equity

19,000

Non-current Liabilities

Bank loan

3,000

Current Liabilities

Trade payables

2,400

Other payables

400

Bank overdraft

1,820

Total equity and liabilities

4,620

26,620

International Accounting Standards (IAS) Guidance: Terminology and Presentation

2.3.3 Presentation of Dividends

Dividends paid by limited companies are no longer reported in the Income Statement. They are included

in the Statement of Changes in Equity, as shown in 2.5. Only dividends paid before the yearend are

included.

2.3.4 Statement of Changes in Equity

The Statement of Changes in Equity reports information about the increase/decrease in net assets or

wealth of equity shareholders. The items that are likely to appear in the Statement of Changes in Equity at

this level are:

Profit for the year

Additional shares issued during the year

Dividends paid during the year

Transfers between reserves (for example , transfer from retained earnings to general reserve)

2.3.5 Format of the Statement of Changes in Equity of

companies

Trotters

Statement of Changes in Equity

For the year ended 31 March 20x0

10

Balance at 1 April

Share

capital

Share

Premium

Retained

earning

General

reserve

Total

equity

$000

$000

$000

$000

$000

1,000

200

500

100

1,800

Changes in Equity for 20x0

Issue of share capital

200

200

(200)

Transfers

Profit for the period

Dividends

Balance at 31 March

1,200

200

200

600

600

(300)

(300)

600

300

2,300

2.4 Manufacturing accounts

The layout of manufacturing accounts will be unchanged, however, although the terminology will be

consistent with IAS, and for example stock will be referred to as inventory.

International Accounting Standards (IAS) Guidance: Terminology and Presentation

2.5 Non-trading organisations

The layout of the accounts of non-trading organisations will remain unchanged, although the terminology

will be consistent with IAS.

However, the Statement of Financial Position will be laid out similarly to Hill Traders, in the Statement of

Financial Position shown in 2.3.2. The Accumulated Fund will be shown above Non Current Liabilities.

2.6 Statement of Comprehensive Income

The Statement of Comprehensive Income will be examined at Level 4.

2.7 Summary

Changes at this level are mainly presentational and specific formats only apply to company accounts.

However, once again, candidates wishing to progress to higher levels would be encouraged to become

used to the formats.

11

International Accounting Standards (IAS) Guidance: Terminology and Presentation

3. Third Level

3.1 Preface

Practices and principles raised at the First and Second Levels will be relevant at the Third Level, reflecting

the cumulative requirements of the LCCI syllabi.

3.2 Terminology

UK

IAS

Minority interest

Non-controlling interest

3.3 Accounting treatment of goodwill

There are two methods of calculating goodwill, the partial and full methods. The partial method is the

method that is currently examined in the syllabus and is therefore currently the only method that is

examined.

12

3.3.1 Accounting treatment of positive goodwill

Goodwill arising from the acquisition of a subsidiary is not amortised. After the initial measurement and

recognition, the group is expected to measure the goodwill at cost less any accumulated impairment

losses since acquisition. The goodwill impairment loss should be charged to the Income Statement.

3.3.2 Accounting treatment of negative goodwill

Negative goodwill should be credited to the Income Statement. It does not appear in the Consolidated

Statement of Financial Position.

International Accounting Standards (IAS) Guidance: Terminology and Presentation

3.4 Format of the Consolidated Income Statement and

Consolidated Statement of Financial Position

Peter Pope Group

Consolidated Statement of Financial Position

at 31 March 20x0

Peter Pope Group

Consolidated Income Statement

for the year ended 31 March 20x0

$

Revenue

18,300

Non-cuurent Assets

Cost of sales

13,200

Goodwill

5,000

Plant and equipment

17,600

Motor vehicles

2,500

Gross profit

5,100

Less: Distibution costs

1,200

Less: Administrative expense

1,000

(2,200 )

2,900

Other operating income

Profit from operations

Interest payable

Profit for the year

1,100

4,000

500

3,500

25,100

Current Assets

Inventories

2,100

Trade receivables

4,200

Other receivables

150

Cash

70

Total Assets

Profit attributable to:

Owners of the Parent

Non-controlling interest

6,520

31,620

$

3,200

300

3,500

Equity and Liabilities

Capital and reserves

Ordinary share capital

$

10,000

Share premium

5,000

Retained earnings

2,000

17,000

Non-controlling Interest

1,000

Equity

18,000

Non-current Liabilities

Redeemable preferred share

capital

Bank loan

5,100

5,000

10,100

Current Liabilities

Trade payables

1,400

Other payables

400

Bank overdraft

1,720

Total equity and liabilities

3,520

31,620

13

International Accounting Standards (IAS) Guidance: Terminology and Presentation

3.5 Cash Flows (IAS 7)

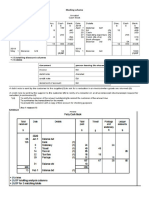

3.5.1 Format of the Statement of Cash Flow

IAS 7 requires reporting of cash flows to be shown under three headings. These are Operating activities;

investing activities and Financing activities.

Whellars

Statement of Cash flows for the year ended 31 March 20x1

$

Cash flows from operating activities

Profit for the year

7,600

Adjustments for:

Depreciation of non-current assets

120

Interest expense

10

Investment income

Operating profit before working capital changes

Decrease in trade receivables

7,718

4,210

Increase in inventories

( 1,100 )

Decrease in trade payables

( 1,800 ) 1,310

cash generated from operations

9,028

Interest paid

14

12

Net cash flow from operating activities

80

8,948

Cash flows form investing activities

Cash paid for non-current assets

Cash received from the sale of non-current assets

(4,000 )

1,400

Interest received

300

Dividends received

200

(2,100 )

Net cash used in investing activities

Cash flows from financing activities

Proceeds from issue of shares

100

Proceeds from long term borrowing

200

Dividends paid

Net cash used in financing activities

( 400 )

( 100 )

Net increase in cash and cash equivalents

6,748

Cash and cash equivalents at 1 April 20x0

1,200

Cash and cash equivalents at 31 March 20x1

7,948

The example is designed to show the possibilities likely in an LCCI examination and contains more figures

than a typical question. However, as in previous sittings, examiners may ask for separate calculations of

the cash flow from operating activities, cash flow from investing activities and cash flow from financing

activities.

International Accounting Standards (IAS) Guidance: Terminology and Presentation

3.6 Relevant international accounting standards

3.6.1 IAS 2 (Inventories)

Inventories are valued at the lower of cost and net realisable value. Costs include purchase cost,

conversion costs and other costs incurred in bringing the inventory to its present location and condition.

No different from the UK standards.

3.6.2 IAS 7 (Statement of Cash Flows)

Cash flows are reported under three main headings: operating activities, investing activities and financing

activities

3.6.3 IAS 16 (Non-current Assets)

Tangible non-current assets are assets that have a physical substance and are held for use in the

production or supply of goods or services, for rental to others or for administrative purposes and

are expected to be utilised in more than one reporting year. A tangible non-current asset should be

depreciated over its useful economic life. No different from the UK standards.

3.6.4 IAS 27 (Consolidated Financial Statements)

Consolidated financial statements are financial statements of a group (parent and subsidiary) presented

as those of a single entity. Non-controlling interests are reported in equity in the Consolidated Statement

of Financial Position. This standard will be superseded by IFRS 10 from 2013.

3.6.5 IFRS 3 (Business Combinations)

Goodwill arising from consolidation is measured as the difference between the cost (fair value of

the purchase consideration) of an acquired entity and the aggregate of the fair values of the entitys

identifiable assets and liabilities. No different to the UK standards.

3.7 Summary

Changes at this level are once again mainly presentational, most notably with regards to the Statement of

Cash Flow.

15

International Accounting Standards (IAS) Guidance: Terminology and Presentation

4. Fourth Level

4.1 Preface

The issues raised in the First, Second and Third Levels will be relevant at the Fourth Level, reflecting as

such, the cumulative requirements of LCCI syllabi.

4.2 Components of financial statements

IAS 1, states that a complete set of financial statements should include the following:

A Statement of Financial Position at the end of the reporting period.

A Statement of Comprehensive Income for the period.

A Statement of Changes in Equity for the period

A Statement of Cash Flows for the period.

Notes to the accounts, which include accounting policies and relevant explanatory notes.

4.3 Format of the Statement of Financial Position

IAS 1 does not prescribe a format of the statement of financial position. However, it stipulates the

minimum information that has to be disclosed on the face of the statement of financial position.

16

This information is:

Cash and cash equivalents

Intangible assets

Inventories

Issued capital and reserves attributable to the owners of the firm

Non-controlling interest (minority interest) presented within equity

Payables (trade and other)

Provisions

Property, plant and equipment

Receivables (trade and other)

International Accounting Standards (IAS) Guidance: Terminology and Presentation

4.4 Statement of Comprehensive Income

Comprehensive Income for a period includes profit or loss for that period and Other Comprehensive

Income recognised during the period. The only item reported under Other Comprehensive Income that

is examinable at this level is a gain/loss on the revaluation of a non-current asset during the reporting

period.

4.4.1 Minimum Information required on the Statement of

Comprehensive Income

The minimum information on the face of the statement of comprehensive Income required by IAS 1

includes:

Revenue

Finance costs

Profit or loss for the period

Each component of other comprehensive income classified by nature

Total comprehensive income

Profit or loss attributable to non-controlling

Profit or loss attributable to equity holders of the parent company

Total comprehensive income attributable to non-controlling interests

Total comprehensive income attributable to the parent company

4.5 Statement of Changes in equity

The Statement of Changes in Equity reflects information about the increase or decrease in net assets or

wealth of equity shareholders. The minimum information on the face of the statement of changes in equity

includes:

Profit or loss for the period

Each item of other comprehensive income

Additional shares issued during the period

Dividends paid during the year

Purchase of shares during the period

Effects of changes in accounting policy

Effects of correction of errors

17

International Accounting Standards (IAS) Guidance: Terminology and Presentation

4.6 Financial statements

4.6.1 Statement of

Comprehensive Income

classifying expenses by

function

Hayes Metals

Statement of Comprehensive Income

for the year ended 31 March 20x0

$

Revenue

18,300

Cost of sales

13,200

Gross Profit

5,100

Less: Distribution costs

1,200

Less: Administrative expense

1,000

(2,200 )

2,900

Other operating income

1,000

Profit from operations

3,900

Finance costs

( 200 )

Profit for the year

3,700

Other comprehensive income

18

4.6.2 Statement of

Comprehensive Income

classifying expenses by

nature

Gains on revaluation of property

1,000

Total comprehensive income

4,700

Hayes Metals

Statement of Comprehensive Income

for the year ended 31 March 20x0

$

Revenue

$

18,300

Change in inventories of finished

goods and WIP

1,000

Own work capitalised

1,500

Other operating income

1,000

3,500

21,800

Raw materials and consumables

3,000

Staff costs

5,000

Depreciation and amortisation

6,900

Other operating expenses

3,000

Profit from operations

Finance costs

Profit for the year

(17,900 )

3,900

( 200 )

3,700

Other comprehensive income

Gains on revaluation of property

1,000

Total comprehensive income

4,700

International Accounting Standards (IAS) Guidance: Terminology and Presentation

4.6.3 Consolidated Statement of Comprehensive Income

Hayes Metals

Consolidated Statement of

Comprehensive Income

for the year ended 31 March 20x0

$

Revenue

18,300

Cost of sales

13,200

Gross Profit

5,100

Less: Distribution costs

1,200

Less: Administrative expense

1,000

(2,200 )

2,900

Other operating income

Profit from operations

Interest payable

Profit for the year

1,100

4,000

( 600 )

3,400

Other comprehensive income

Gains on revaluation of property

Total comprehensive income

200

3,600

Profit attributale to:

Owners of the Parent

Non-controlling interest

3,100

300

3,400

Total comprehensive income

attributable to:

Owners of the Parent

Non-controlling interest

3,250

350

3,600

Questions at this level would not combine group accounts with the presentation of accounts in

accordance with IAS 1, although candidates would be expected to prepare their answers in a clear and

well-presented way.

19

International Accounting Standards (IAS) Guidance: Terminology and Presentation

4.7 Relevant international accounting standards

4.8.1 IAS 8 - Accounting policies

Accounting policies

Accounting policies are specific principles, bases, conventions and practices used by an entity in preparing

and presenting its financial statements. They explain the way a firm treats items within its financial

statements.

Changes in accounting policies

Accounting policies should only be changed where a new accounting standard requires such a change or

where the new policy will result in more relevant and reliable information being presented.

Changes in accounting estimates

An example of a change in accounting estimate is a change in the percentage used to estimate allowance

for doubtful debts. The effect of the change is recognised in the income statement for the year in which

the change takes place. Another example of a change in accounting estimate is a change in the useful

economic life of an asset.

Prior period errors

A prior period error is where an error has occurred even though reliable information was available when

those financial statements were authorised for issue. Examples are mathematical errors, mistakes in

applying accounting policies, misinterpretation of facts and fraud.

20

4.7.2 IAS 10 - Events after the reporting period

IAS 10 with events that occur between the year-end date and the date the financial statements are

authorised for issue by the directors. The events that occur are either adjusting events or non-adjusting

events. Adjusting events are those that provide evidence about conditions that existed at the end of

the reporting date. Non-adjusting events are those that are indicative of conditions that arose after the

reporting date.

4.7.3 IAS 11 Construction contracts

There are minor differences between IAS 11 and SSAP 9, but they will not affect examination questions set

at this level.

4.7.4 IAS 16 Accounting for property, plant and

equipment

IAS 16 deals with the recognition of non-current assets, initial measurement, subsequent measurement

and depreciation. There are no major differences between IAS 16 and FRS 15, the equivalent UK standard.

4.7.5 IAS 20 - Government grants

Grants must not be recognised until conditions have been complied with and there is reasonable

certainty that the grant will be received (prudence). Government grants received must be matched with

expenditure for which the grant is intended (accruals). This standard is not materially different from the

equivalent UK standard.

International Accounting Standards (IAS) Guidance: Terminology and Presentation

4.7.6 IAS 37 - Provisions, contingent liabilities and assets

A liability is an obligation of an entity to transfer economic benefits as a result of past transactions or

events. A provision is a liability of uncertain timing or amount. A provision should be recognised when:

A firm has a present obligation as a result of a past event. The obligation may be legal or constructive

It is probable that an outflow of resources will be required to settle the obligation

A reliable estimate can be made of the amount

If a firm through its future actions can avoid an obligation, a provision cannot be set up

Contingent liability

If one or more of the conditions required for a provision is not met a contingent liability may exist. A

contingent liability should be disclosed unless the possible outflow to meet the obligation is remote. If

outflow of resources is remote do not disclose in the accounts.

Contingent assets

A contingent asset is a possible asset that arises from past events and whose existence will be confirmed

only by the occurrence of one or more uncertain future events not wholly within the entitys control. A

contingent asset should be disclosed when the expected inflow of economic resources is probable.

4.7.7 IAS 38 Intangible assets

Intangible non-current assets are identifiable non-monetary assets that do not have a physical substance.

IAS 38 deals with all intangible non-current assets, including development expenditure. Under SSAP 13

development expenditure may be capitalised after certain conditions have been satisfied. However, under

IAS 38, development expenditure must be capitalised after certain conditions have been satisfied.

21

Tel. +44 (0) 2476 518951

Email. internationalenquiries@ediplc.com

www.lcci.org.uk

S-ar putea să vă placă și

- Statement of Cash Flows - Lecture Questions and AnswersDocument9 paginiStatement of Cash Flows - Lecture Questions and AnswersEynar Mahmudov86% (7)

- Butler Lumber 1Document6 paginiButler Lumber 1Bhavna Singh33% (3)

- Wild24e Chapter04 TB AnswerKeyDocument114 paginiWild24e Chapter04 TB AnswerKeyAbdelkebir Labyad100% (2)

- MU PLC Annual Report 2002 Financial StatementsDocument21 paginiMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyÎncă nu există evaluări

- Chapter 4 AnswersDocument4 paginiChapter 4 Answerscialee100% (2)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 paginiChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarÎncă nu există evaluări

- Assign 1 - Sem II 12-13Document8 paginiAssign 1 - Sem II 12-13Anisha ShafikhaÎncă nu există evaluări

- Chapter 3 Short ProlemsDocument9 paginiChapter 3 Short ProlemsRhedeline LugodÎncă nu există evaluări

- The Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersDe la EverandThe Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersEvaluare: 2 din 5 stele2/5 (1)

- TBCH 06Document50 paginiTBCH 06Tornike Jashi50% (2)

- Mas.m-1404. Financial Statements AnalysisDocument22 paginiMas.m-1404. Financial Statements AnalysisCharry Ramos25% (4)

- Analysis of Financial StatementsDocument33 paginiAnalysis of Financial StatementsKushal Lapasia100% (1)

- Financial Statements: BAO6504 Accounting For ManagementDocument20 paginiFinancial Statements: BAO6504 Accounting For ManagementDaud SulaimanÎncă nu există evaluări

- BAO6504 Lecture 2, 2014Document20 paginiBAO6504 Lecture 2, 2014LindaLindyÎncă nu există evaluări

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pagini11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- F1 May 2011 AnswersDocument11 paginiF1 May 2011 AnswersmavkaziÎncă nu există evaluări

- HorngrenIMA14eSM ch16Document53 paginiHorngrenIMA14eSM ch16Piyal HossainÎncă nu există evaluări

- Elpl 2009 10Document43 paginiElpl 2009 10kareem_nÎncă nu există evaluări

- 202 2011 2 eDocument36 pagini202 2011 2 ePrince McBossmanÎncă nu există evaluări

- A Level Recruitment TestDocument9 paginiA Level Recruitment TestFarrukhsgÎncă nu există evaluări

- Fi 410 Chapter 3Document50 paginiFi 410 Chapter 3Austin Hazelrig100% (1)

- CPA IRELAND Accounting Framework April 07Document14 paginiCPA IRELAND Accounting Framework April 07Luke ShawÎncă nu există evaluări

- Financial Statements and Accounting Concepts/PrinciplesDocument27 paginiFinancial Statements and Accounting Concepts/PrinciplesdanterozaÎncă nu există evaluări

- Accounting: Information Sheet Paper II July 2012: Debit R Credit RDocument5 paginiAccounting: Information Sheet Paper II July 2012: Debit R Credit RLynn Nyathogora KareithiÎncă nu există evaluări

- Lecture 1 CHP 1 No SolutionsDocument20 paginiLecture 1 CHP 1 No SolutionsHarry2140Încă nu există evaluări

- Solution Past Paper Higher-Series4-08hkDocument16 paginiSolution Past Paper Higher-Series4-08hkJoyce LimÎncă nu există evaluări

- Division of Corporation Finance: Financial Reporting ManualDocument358 paginiDivision of Corporation Finance: Financial Reporting ManualankushbindwalÎncă nu există evaluări

- FBT - Class Notes - F3Document109 paginiFBT - Class Notes - F3Alberto Wilkins100% (1)

- Corporate Finance AAE 2013Document22 paginiCorporate Finance AAE 2013Oniga AdrianÎncă nu există evaluări

- Answers March2012 f1Document10 paginiAnswers March2012 f1kiransookÎncă nu există evaluări

- Financial Statement AnalysisDocument18 paginiFinancial Statement AnalysisSaema JessyÎncă nu există evaluări

- CH 04Document66 paginiCH 04theresiaaaaaÎncă nu există evaluări

- Aat P7 Hkas 1Document13 paginiAat P7 Hkas 1Edvan HervianÎncă nu există evaluări

- Financial Statements PDFDocument91 paginiFinancial Statements PDFHolmes MusclesFanÎncă nu există evaluări

- Cash FlowDocument25 paginiCash Flowshaheen_khan6787Încă nu există evaluări

- 5 15Document8 pagini5 15Indra PramanaÎncă nu există evaluări

- P1 - Financial Accounting April 07Document23 paginiP1 - Financial Accounting April 07IrfanÎncă nu există evaluări

- ACCT5101Pretest PDFDocument18 paginiACCT5101Pretest PDFArah OpalecÎncă nu există evaluări

- BDP Financial Final PartDocument14 paginiBDP Financial Final PartDeepak G.C.Încă nu există evaluări

- Documents - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFDocument96 paginiDocuments - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFSatyabrataNayak100% (1)

- Financial Statement Analysis FinalDocument49 paginiFinancial Statement Analysis FinalNazirFahimÎncă nu există evaluări

- Sole ProprietorshipDocument12 paginiSole ProprietorshipKamau Gichimu100% (1)

- S7 WEEK8 REI Corporate Finance 15 16Document6 paginiS7 WEEK8 REI Corporate Finance 15 16StefanAndreiÎncă nu există evaluări

- Pyrogenesis Canada Inc.: Financial StatementsDocument43 paginiPyrogenesis Canada Inc.: Financial StatementsJing SunÎncă nu există evaluări

- 29234rtp May13 Ipcc Atc 1Document50 pagini29234rtp May13 Ipcc Atc 1rahulkingdonÎncă nu există evaluări

- 494.Hk 2011 AnnReportDocument29 pagini494.Hk 2011 AnnReportHenry KwongÎncă nu există evaluări

- CF FRM Nov2020Document370 paginiCF FRM Nov2020KHWAJA MOHAMMAD MASOODÎncă nu există evaluări

- Qfs 1q 2012 - FinalDocument40 paginiQfs 1q 2012 - Finalyandhie57Încă nu există evaluări

- Lecture 7 - Ratio AnalysisDocument39 paginiLecture 7 - Ratio AnalysisMihai Stoica100% (1)

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocument12 pagini2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- Cash Flow ExerciseDocument1 paginăCash Flow ExercisecoeprodpÎncă nu există evaluări

- Advanced Financial Accounting: Professional 2 Examination - April 2007Document12 paginiAdvanced Financial Accounting: Professional 2 Examination - April 2007Muhammad QamarÎncă nu există evaluări

- Division of Corporation Finance - Financial Reporting ManualDocument382 paginiDivision of Corporation Finance - Financial Reporting ManualQueremosabarrabás A Barrabás100% (1)

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Document50 paginiChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888Încă nu există evaluări

- Ch10 Financial Statements of A Limited CompanyDocument21 paginiCh10 Financial Statements of A Limited Companyne002Încă nu există evaluări

- CFA Lecture 4 Examples Suggested SolutionsDocument22 paginiCFA Lecture 4 Examples Suggested SolutionsSharul Islam100% (1)

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 paginiCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Finance for IT Decision Makers: A practical handbookDe la EverandFinance for IT Decision Makers: A practical handbookÎncă nu există evaluări

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersDe la EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersÎncă nu există evaluări

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)De la EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Încă nu există evaluări

- Financial and Accounting Guide for Not-for-Profit OrganizationsDe la EverandFinancial and Accounting Guide for Not-for-Profit OrganizationsÎncă nu există evaluări

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryDe la EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryÎncă nu există evaluări

- Accounting IgcseDocument2 paginiAccounting IgcseStpmTutorialClassÎncă nu există evaluări

- Sad I Amspt32017Document6 paginiSad I Amspt32017StpmTutorialClassÎncă nu există evaluări

- LCCI Level One Final AcctDocument2 paginiLCCI Level One Final AcctStpmTutorialClassÎncă nu există evaluări

- F3 FfaDocument3 paginiF3 FfaStpmTutorialClass100% (1)

- Financial Accounting F3 NotesDocument251 paginiFinancial Accounting F3 Notesarpith raju100% (2)

- Past Paper 2020 PCCBBOEDocument9 paginiPast Paper 2020 PCCBBOEStpmTutorialClassÎncă nu există evaluări

- CASH Flow ArticleDocument39 paginiCASH Flow ArticleStpmTutorialClassÎncă nu există evaluări

- f5 September - December 2015 - Sample AnswersDocument8 paginif5 September - December 2015 - Sample AnswersNeel KostoÎncă nu există evaluări

- Special Journals Transactions Source DocumentsDocument11 paginiSpecial Journals Transactions Source DocumentsStpmTutorialClassÎncă nu există evaluări

- Kelantan Math K1 2016 PDFDocument24 paginiKelantan Math K1 2016 PDFStpmTutorialClassÎncă nu există evaluări

- Ch2 Cash AccountDocument2 paginiCh2 Cash AccountStpmTutorialClassÎncă nu există evaluări

- Kelantan Math K2 2016 PDFDocument24 paginiKelantan Math K2 2016 PDFStpmTutorialClassÎncă nu există evaluări

- Incomplete Records PostingDocument6 paginiIncomplete Records PostingStpmTutorialClassÎncă nu există evaluări

- Management Accounting August 2011Document22 paginiManagement Accounting August 2011StpmTutorialClassÎncă nu există evaluări

- IDIOMS For PEOPLEDocument2 paginiIDIOMS For PEOPLEStpmTutorialClassÎncă nu există evaluări

- F2 Past YearDocument3 paginiF2 Past YearStpmTutorialClassÎncă nu există evaluări

- Financial Accounting May 2014Document25 paginiFinancial Accounting May 2014StpmTutorialClassÎncă nu există evaluări

- Financial Accounting Autumn 2016Document10 paginiFinancial Accounting Autumn 2016StpmTutorialClassÎncă nu există evaluări

- Maths Form 4Document4 paginiMaths Form 4StpmTutorialClassÎncă nu există evaluări

- Financial Accounting Summer 2016Document34 paginiFinancial Accounting Summer 2016StpmTutorialClassÎncă nu există evaluări

- Writing August 2015Document8 paginiWriting August 2015StpmTutorialClassÎncă nu există evaluări

- Practice 1 MADocument2 paginiPractice 1 MAStpmTutorialClassÎncă nu există evaluări

- Prepositions For TIMEDocument1 paginăPrepositions For TIMEStpmTutorialClassÎncă nu există evaluări

- Tahun 1 TestDocument14 paginiTahun 1 TestStpmTutorialClassÎncă nu există evaluări

- Tahun 1 TestDocument14 paginiTahun 1 TestStpmTutorialClassÎncă nu există evaluări

- Sr3 Homework MayDocument7 paginiSr3 Homework MayStpmTutorialClassÎncă nu există evaluări

- Maths TransformationDocument6 paginiMaths TransformationStpmTutorialClassÎncă nu există evaluări

- F4 Maths MidyearDocument5 paginiF4 Maths MidyearStpmTutorialClassÎncă nu există evaluări

- Soalan 2013 Jurnal KhasDocument2 paginiSoalan 2013 Jurnal KhasStpmTutorialClassÎncă nu există evaluări

- Alah Valley Academy of Surala Cotabato, Inc.: Assets Notes Current AssetsDocument15 paginiAlah Valley Academy of Surala Cotabato, Inc.: Assets Notes Current AssetsTERESITAESPARTEROÎncă nu există evaluări

- Accounting For Manager - Accounting Exam SolutionDocument9 paginiAccounting For Manager - Accounting Exam SolutionDinar HassanÎncă nu există evaluări

- Cfas Notes 2Document15 paginiCfas Notes 2Liu GwynÎncă nu există evaluări

- Fund Flow Statement AnalysisDocument16 paginiFund Flow Statement AnalysisgopinathÎncă nu există evaluări

- P2 01v2Document11 paginiP2 01v2Rhegee Irene RosarioÎncă nu există evaluări

- Laporan Keuangan Ace Hardware 2014-Q1 PDFDocument44 paginiLaporan Keuangan Ace Hardware 2014-Q1 PDFBang BegsÎncă nu există evaluări

- PP For Chapter 2 - Analyzing TransactionsDocument49 paginiPP For Chapter 2 - Analyzing TransactionsAncoi Ariff Cyril100% (1)

- FA IV Rewritten070306Document549 paginiFA IV Rewritten070306Collins Abere100% (1)

- ASS Accountingcycleofaservicebusiness FJPDocument59 paginiASS Accountingcycleofaservicebusiness FJPArlyn Ragudos BSA1Încă nu există evaluări

- 1-3 Business Combination 1-3 Business Combination: Summary of IFRS 3 BackgroundDocument11 pagini1-3 Business Combination 1-3 Business Combination: Summary of IFRS 3 BackgroundNiceth JanÎncă nu există evaluări

- Neraca Dan Laba Rugi (Blank Form)Document2 paginiNeraca Dan Laba Rugi (Blank Form)Ugi Dwiki PÎncă nu există evaluări

- Luigi Balucan Inacc3 Week 2Document12 paginiLuigi Balucan Inacc3 Week 2Luigi Enderez BalucanÎncă nu există evaluări

- IAS 7 CashflowDocument14 paginiIAS 7 CashflowChota H MpukuÎncă nu există evaluări

- Rapport Du Seminaire Animé Par DR Tarik BounjemDocument8 paginiRapport Du Seminaire Animé Par DR Tarik BounjemIhssane GartouaÎncă nu există evaluări

- CJ - Credit SuiseDocument24 paginiCJ - Credit Suisebackup tringuyenÎncă nu există evaluări

- About Financial Account V2 PDFDocument465 paginiAbout Financial Account V2 PDFStar69 Stay schemin2100% (1)

- Accounting 2Document157 paginiAccounting 2Christian Terens AblangÎncă nu există evaluări

- Statement of Financial PositionDocument9 paginiStatement of Financial PositionIsye NingrumÎncă nu există evaluări

- Quiz 3Document9 paginiQuiz 3Lê Thanh ThủyÎncă nu există evaluări

- Baitap C3 HVDocument27 paginiBaitap C3 HVThanh ThảoÎncă nu există evaluări

- Module 17 - ReceivablesDocument8 paginiModule 17 - ReceivablesLuiÎncă nu există evaluări

- Tata Consultancy Services Result UpdatedDocument15 paginiTata Consultancy Services Result UpdatedAngel BrokingÎncă nu există evaluări

- Business Combi - AcquisitionDocument6 paginiBusiness Combi - Acquisitionnaser20% (5)

- M3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri RDocument9 paginiM3 - Tugas Akuntansi Keuangan Menengah 1A - 1B - Salma Putri Rrully movizarÎncă nu există evaluări

- Harris Corporation DataDocument16 paginiHarris Corporation DataAbhinav SinghÎncă nu există evaluări

- Plant Assets UTS Ganjil & UTS SA GenapDocument7 paginiPlant Assets UTS Ganjil & UTS SA GenapNicholas AyeÎncă nu există evaluări