Documente Academic

Documente Profesional

Documente Cultură

ResCap Auto Stay Op

Încărcat de

Chapter 11 DocketsDescriere originală:

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

ResCap Auto Stay Op

Încărcat de

Chapter 11 DocketsDrepturi de autor:

Formate disponibile

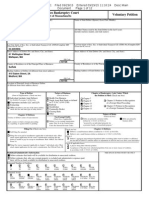

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 1 of 16

Main Document

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re:

NOT FOR PUBLICATION

Case No. 12-12020 (MG) RESIDENTIAL CAPITAL, LLC, et al. Debtors. Jointly Administered

MEMORANDUM OPINION GRANTING IN PART AND DENYING IN PART THE TAGGART MOTION TO LIFT THE AUTOMATIC STAY A P P E A R A N C E S: KENNETH J. TAGGART Pro Se 45 Heron Road Post Office Box 730 Holland, Pennsylvania 18966 By: Kenneth J. Taggart MORRISON & FOERSTER LLP Counsel for the Debtors 1290 Avenue of the Americas New York, New York 10104 By: Norman S. Rosenbaum, Esq.

MARTIN GLENN UNITED STATES BANKRUPTCY JUDGE Kenneth J. Taggart (Taggart) filed a Motion for Leave to File Motion Pursuant to Stay & Relief (and Clarification from Bankruptcy Court) (ECF Doc. # 263) on June 8, 2012 (the Motion). The Debtors opposed the Motion. (ECF Doc. # 682.) The Motion initially came on for hearing on July 10, 2012 (the July 10 Hearing), but after hearing argument, the Court adjourned the hearing, urging the parties to try consensually to resolve the issues. In the event the matter was not resolved, the Court requested supplemental briefing concerning which of Taggarts counterclaims could proceed as defenses to foreclosure under Pennsylvania law. See

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 2 of 16

Main Document

Transcript of Hearing at 44-45, Case No. 12-12020 (MG) (Bankr. S.D.N.Y. July 10, 2012). The parties were unable to resolve the issues and the Motion came back for hearing on August 14, 2012. The Debtors filed a supplemental brief with various attachments (including a memorandum of law by Pennsylvania counsel for debtor GMAC Mortgage, LLC (GMAC Mortgage)) addressing the issues raised by the Court during the July 10 Hearing. For the reasons explained below, the Court grants the Taggart Motion in part and denies it in part. The stay is lifted to permit the state court to determine which of Taggarts counterclaims may be asserted as defenses to foreclosure under applicable Pennsylvania law. Absent further stay relief, however, Taggart may not proceed with his counterclaims to the extent he seeks affirmative damages relief from the Debtors. I. BACKGROUND

Taggart seeks clarification regarding which of the counts contained in his counterclaim pleading (the Taggart Counterclaim Pleading) filed against Debtor GMAC Mortgage can proceed in a state court foreclosure action initiated by GMAC Mortgage and captioned GMAC Mortgage, LLC v. Taggart, Case No. 09-25338 (Mont. Cty. C.C.P. 2009) (the Foreclosure Proceeding). The Taggart Counterclaim Pleading alleges thirty-two counterclaims against GMAC Mortgage including, inter alia, claims for: (i) alleged violations of the Real Estate Settlement and Procedures Act (RESPA), 12 U.S.C. 2601, et. seq., and related regulations, 24 C.F.R. 350; (ii) alleged violations of the Truth-in-Lending Act (TILA), 15 U.S.C. 1601, et. seq.; (iii) alleged violations of the Fair Debt Collection Practices Act (FDCPA), 15 U.S.C. 1692, et. seq.; (iv) alleged violations of the Fair Credit Reporting Act (FCRA), 15 U.S.C. 1681, et. seq.; (v) the Pennsylvania Unfair Trade Practice and Consumer Protection Act, 73 P.S. 201-1, et.

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 3 of 16

Main Document

seq.; (vi) Regulation Z, 12 C.F.R. 226.18(g), (h); (vii) Quiet Title, (viii) alleged violations of the Fair Credit Extension Uniform Act, 73 P.S. 2270.1, et. seq.; (ix) alleged violations of the Mortgage Property Insurance Coverage Act, 7 P.S. 6701, et. seq. (the Insurance Claim); and (x) alleged violations of Taggarts First and Fourteenth Amendment rights of freedom of expression and due process. On June 6, 2012, the Debtors filed in the Foreclosure Proceeding a Notice of Bankruptcy and Effect of Automatic Stay & Interim Order Granting Limited Relief to Borrowers in Foreclosure Proceedings (Notice of Bankruptcy). In the Notice of Bankruptcy, the Debtors indicated their position that each of Taggarts counterclaims, with the exception of the Insurance Claim, was stayed under this Courts Supplemental Order for Interim Relief Under Bankruptcy Code Sections 105(a), 362, 363, 502, 1107(a), and 1108 and Bankruptcy Rule 9019 (I) Authorizing the Debtors to Continue Implementing Loss Mitigation Programs; (II) Approving Procedures for Compromise and Settlement of Certain Claims, Litigations and Causes of Action; (III) Granting Limited Stay Relief to Permit Foreclosure and Eviction Proceedings, Borrower Bankruptcy Cases, and Title Disputes to Proceed; and (IV) Authorizing and Directing the Debtors to Pay Securitization Trustee Fees and Expenses (the Interim Supplemental Servicing Order). (ECF Doc. # 391.) On June 11, 2012, Taggart filed in the Foreclosure Proceeding his Amended Motion for Stay Pursuant to Bankruptcy of GMAC Mortgage, LLC (the Motion for Stay) seeking to stay the entire Foreclosure Proceeding until this Court clarified the Interim Supplemental Servicing Order. On June 15, 2012, the state court presiding over the Foreclosure Proceeding entered an order summarily denying Taggarts Motion for Stay.

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 4 of 16

Main Document

On July 3, 2012, the Debtors filed their Omnibus Objection to Motions for Relief from the Automatic Stay Scheduled for Hearing on July 10, 2012. (ECF Doc. # 682.) At the July 10 Hearing, Taggart indicated that he believed all of his counterclaims should be permitted to proceed under the Interim Supplemental Servicing Order. On July 13, 2012, the Court entered the Final Supplemental Order Under Bankruptcy Code Sections 105(a), 362, 363, 502, 1107(a), and 1108 and Bankruptcy Rule 9019 (I) Authorizing the Debtors to Continue Implementing Loss Mitigation Programs; (II) Approving Procedures for Compromise and Settlement of Certain Claims, Litigations and Causes of Action; (III) Granting Limited Stay Relief to Permit Foreclosure and Eviction Proceedings, Borrower Bankruptcy Cases, and Title Disputes to Proceed; and (IV) Authorizing and Directing the Debtors to Pay Securitization Trustee Fees and Expenses (the Supplemental Servicing Order). (ECF Doc. # 774.) The Supplemental Servicing Order is primarily designed to allow the Debtors to continue prosecuting numerous state court foreclosure actions around the country. While the automatic stay does not apply to the foreclosure actions that the Debtors commenced prepetition, the Supplemental Servicing Order permits defendants in state court foreclosure actions to assert and prosecute claims and counterclaims that are defenses to foreclosure under applicable state law. The automatic stay was not lifted, however, to permit borrowers to assert and prosecute claims against the Debtors seeking to recover monetary damages.1 The Court has already denied motions to lift the automatic stay in precisely such circumstances. See Memorandum Opinion

1

The Supplemental Servicing Order permits borrowers to continue to prosecute direct claims and counterclaims relating exclusively to the property that is the subject of the loan owned or serviced by a Debtor for the purposes of defending, unwinding, or otherwise enjoining or precluding any foreclosure, but prevents any claims (i) for monetary relief against the Debtors except where a monetary claim must be plead in order for an Interested Party to assert a claim to defend against or otherwise enjoin or preclude a foreclosure (each a Mandatory Monetary Claim) and (ii) for relief that if granted, would not terminate or preclude the prosecution and completion of a foreclosure or eviction . . . .

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 5 of 16

Main Document

Denying the Gilbert Motion to Dismiss or to Vacate the Automatic Stay, In re Residential Capital, LLC, No. 12-12020 (Bankr. S.D.N.Y. Aug. 8, 2012) (ECF Doc. # 1054) (denying Gilbert motion to lift the automatic stay with respect to damages claims against the Debtors). On July 18, 2012, without seeking a modification of the automatic stay, Taggart commenced another action against the debtor GMAC Mortgage in the United States District Court for the Eastern District of Pennsylvania, captioned Taggart v. GMAC Mortgage LLC, Case No. CV-12-4077 (E.D. Pa.) (the Postpetition Federal Action). The Debtors argue that the filing of this action was a violation of the automatic stay, but the Debtors have not yet filed a motion seeking to impose sanctions for violation of the automatic stay. The complaint in the Postpetition Federal Action asserts claims for damages in excess of $46 million and to Quiet Title against GMAC Mortgage, several GMAC Mortgage employees and GMAC Mortgages attorneys in the Foreclosure Proceeding related to the same allegedly wrongful foreclosure at issue in the Foreclosure Proceeding. On July 23, 2012, Taggart filed still another motion, styled a Motion for Leave to File Motion Pursuant Stay & Relief Oral Argument & Hearing Requested. (ECF Doc. # 882.) That motion sought authority to proceed with the Postpetition Federal Action and a separate action pending in the United States District Court for the Eastern District of Pennsylvania, captioned Taggart v. GMAC Mortgage, LLC, Case No. 2:2012-cv-00415 (E.D. Pa.) (the Prepetition Federal Action), which also seeks damages and certain declaratory relief in response to the Debtors allegedly wrongful foreclosure. On August 14, 2012, Taggart withdrew this motion.2

At the hearing on August 14, 2012, Taggart confirmed that he withdrew the motion and the Debtors consented to the withdrawal, leaving open the question of what happens to the Postpetition Federal Action filed in violation of the stay. Taggart stated that he is not prepared to dismiss the action. The Court directed Taggart and Debtors counsel to see if they can consensually resolve the issue; otherwise Debtors counsel stated that they will seek appropriate relief for violation of the stay.

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 6 of 16

Main Document

On August 1, 2012, the Debtors filed Debtors Supplement in Further Opposition to Motion of Kenneth Taggart for Leave to File Motion Pursuant Stay & Relief (and Clarification from Bankruptcy Court. (Debtors Supplement in Further Opposition, ECF Doc. # 968.) II. DISCUSSION

At the heart of the matter in the Taggart Motion is whether any of the 32 counterclaims asserted by Taggart in the GMAC Mortgage Pennsylvania state court foreclosure action may properly be asserted as defenses to foreclosure. To the extent any of the counterclaims are defenses to foreclosure, the Supplemental Servicing Order lifts the automatic stay and permits those defenses to be adjudicated in the state court action. The stay has not been lifted to permit claims for affirmative damages relief to be resolved outside of the bankruptcy court claims allowance process. State law determines what claims or counterclaims may be asserted as defenses to foreclosure. A. Pennsylvania Law Determines What Is a Defense to Foreclosure

GMAC Mortgages Pennsylvania counsel has filed a lengthy memorandum of law addressing each of the counterclaims and whether under Pennsylvania law they can be asserted as defenses to foreclosure. See Debtors Memorandum of Law Regarding Counterclaims Asserted by Kenneth Taggart in State Court Foreclosure Proceedings, dated August 1, 2012. (ECF Doc. # 969.) As GMAC Mortgage argues, it is well established that a foreclosure action in Pennsylvania is an in rem proceeding. An action in mortgage foreclosure is strictly an in rem action and may not include an in personam action to enforce personal liability. Insilco Corp. v. Rayburn, 543 A.2d 120, 123 (Pa. Super. 1988) (citing the definition in Rule 1141 of the Pennsylvania Rules of Civil Procedure of a foreclosure action as one not including an action

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 7 of 16

Main Document

to enforce a personal liability). The very definition of a mortgage foreclosure action under [231 Pa. Code] Rule 1141(a) excludes an action to enforce a personal liability; this restriction is essential to preserve the de terris identity of a mortgage foreclosure action and is equally binding on a mortgagee-plaintiff and a mortgagor-defendant. Signal Consumer Disc. Co. v. Babuscio, 390 A.2d 266, 270 (Pa. Super. 1978); see also N.Y. Guardian Mort. Corp. v. Dietzel, 524 A.2d 951, 953 (Pa. Super. 1987) (recognizing that foreclosure actions in Pennsylvania are in rem only and disallowing pursuit of TILA damages asserted by counterclaim); Birchall v. Countrywide Home Loans, Inc., No. 08-2447, 2009 WL 3822201, a t * 6 (E.D. Pa. Nov. 12, 2009) (stating that a mortgage foreclosure action, as an action in rem, does not allow either party to pursue an action in personam, such as an action for damages); Kondour Capital Corp. v. Marshall L. Williams, Civ. No. 2011-0235, 2011 WL 4352214 (Pa. Com. Pl. Sept. 1, 2011) (concluding that mortgagors counterclaims impermissibly sought monetary damages and indemnification or contribution); Rocco v. J.P. Morgan Chase Bank, 255 Fed. Appx. 638, 643 (3d Cir. 2007) (Claims for money damages, including recoupment claims . . . cannot be brought in a foreclosure action.) (citing N.Y. Guardian, 524 A.2d at 953). Any defense must go to the existence and validity of the mortgage because the viability of a mortgage foreclosure action depends upon the existence of a valid mortgage. See Straker v. Deutsche Bank Natl Trust, No. 3:CV-09-0338, 2010 WL 500412, at *3 (M.D. Pa. Feb. 5, 2010) (quoting In re Madera, 586 F.3d 228, 232 (3d Cir. 2009)); In re Calabria, 418 B.R. 862, 866-867 (W.D. Pa. 2009) (In Pennsylvania, actions in mortgage foreclosure are dependent on the existence of a valid mortgage.). Applying these legal principles, the Debtors argue that most of Taggarts thirty-two counterclaims may not be asserted as defenses to foreclosure; but Debtors acknowledge that one

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 8 of 16

Main Document

or more counterclaims might properly be asserted as a defense to foreclosure to the extent it challenges the existence and validity of the mortgage. Analyzing each claim would require a lengthy analysis by this Court. Recognizing the difficulty of such a claim-by-claim analysis of the thirty-two counterclaims, the Debtors have offered to consent to limited stay relief as follows: [T]he parties may proceed through any dispositive motions practice in the Foreclosure Proceeding, by which the trial court will determine the viability of Mr. Taggarts alleged defenses to foreclosure in the Foreclosure Proceeding. Thereafter, Mr. Taggart would have the opportunity to renew his Motion by filing a notice of hearing fourteen days in advance of the next available omnibus hearing to the extent that any of Mr. Taggarts Counterclaims remain that would otherwise be stayed by the Supplemental Servicing Order. See Debtors Supplement in Further Opposition at 5. This proposal would leave the decision of what is a valid defense to foreclosure under Pennsylvania law to the Pennsylvania court which is in the best position to resolve the issues. The Court agrees with the Debtors that lifting the stay to the extent proposed is the appropriate disposition of the pending Motion. It is possible, of course, that after the state court rules on which counterclaims may be permitted to proceed in state court as defenses to foreclosure that Taggart would be entitled to broader stay relief to the extent that those same counterclaims would support affirmative damages relief and the state court would necessarily have to resolve many of the legal and factual issues necessary to a decision. B. Policies Underlying the Automatic Stay Favor Giving the Debtors a Breathing Spell Section 362(a)(1) of the Bankruptcy Code provides, in pertinent part, that the filing of a bankruptcy petition: operates as a stay, applicable to all entities, of 8

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 9 of 16

Main Document

(1) the commencement or continuation, including the issuance of employment of process, of a judicial, administrative, or other action or proceeding against the debtor that was or could have been commenced before the commencement of the case under this title, or to recover a claim against the debtor that arose before the commencement of the case under this title. 11 U.S.C. 362(a)(1). The automatic stay affords one of the fundamental debtor protections provided by the bankruptcy laws. Midlantic Natl Bank v. N.J. Dept of Envtl. Prot., 474 U.S. 494, 503 (1986). It maintains the status quo and protects the debtors ability to formulate a plan for the sale or other disposition of property of the estate. 3 COLLIER ON BANKRUPTCY 362.03 (Alan N. Resnick & Henry J. Somme reds., 16th ed. 2011). The automatic stay is intended to allow the bankruptcy court to centralize all disputes concerning property of the debtors estate so that reorganization can proceed efficiently, unimpeded by uncoordinated proceedings in other arenas. SEC v. Brennan, 230 F.3d 65, 71 (2d Cir. 2000) (internal quotation omitted). In this regard, the automatic stay promot[es] equal creditor treatment and giv[es] the debtor a breathing spell. In re Pioneer Commercial Funding Corp., 114 B.R. 45, 48 (Bankr. S.D.N.Y. 1990). The automatic stay is critical to debtors because it allows them to focus on their reorganization instead of ligation. Id. at 48. Here, the Debtors have already obtained an order modifying the automatic stay allowing claims asserted as defenses to foreclosure actions being prosecuted by or on behalf of the Debtors to continue outside of the bankruptcy court. In this case, the decision about which counterclaims may be asserted as defenses to foreclosure will be left to the state court that is in the best position to make that determination. The stay remains in place with respect to Taggarts affirmative claims against the Debtors seeking to recover damages. Claims for damages against the Debtors are the usual grist for the bankruptcy claims 9

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 10 of 16

Main Document

allowance process and absent unusual circumstances the bankruptcy court remains the appropriate forum to resolve such claims. Permitting courts around the country to adjudicate claims risks diverting the attention of Debtors personnel from pressing issues in the chapter 11 case and increases the risk of inconsistent decisions affecting similarly situated creditors. C. The Automatic Stay Should Not Be Lifted to Permit the Taggart Counterclaims to Proceed Section 362(d)(1) of the Bankruptcy Code provides, in relevant part, that [o]n request of a party in interest and after notice and a hearing, the court shall grant relief from the stay . . . (1) for cause, including the lack of adequate protection of an interest in property of such party in interest . . . . 11 U.S.C. 362(d)(1). The Bankruptcy Code does not, however, define the phrase for cause. In determining whether cause exists to lift the stay for prepetition litigation, courts consider the following factors (the Sonnax Factors): (1) whether relief would result in a partial or complete resolution of the issues, (2) the lack of any connection with or interference with the bankruptcy case, (3) whether the other proceeding involves the debtor as a fiduciary, (4) whether a specialized tribunal with the necessary expertise has been established to hear the cause of action, (5) whether the debtors insurer has assumed full responsibility for defending the action, (6) whether the action primarily involves third parties, (7) whether litigation in another forum would prejudice the interests of other creditors, (8) whether the judgment claim arising from the other action is subject to equitable subordination, (9) whether movants success in the other proceeding would result in a judicial lien avoidable by the debtor, (10) the interests of judicial economy and the expeditious and economical resolution of litigation, (11) whether the parties are ready for trial in the other proceeding, and (12) the impact of the stay on the parties and the balance of harms.

10

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 11 of 16

Main Document

Sonnax Indus., Inc. v. Tri Component Prods. Corp. (In re Sonnax Indus., Inc.), 907 F.2d 1280, 1286 (2d Cir. 1990); In re N.Y. Med. Grp., PC, 265 B.R. 408, 413 (Bankr. S.D.N.Y. 2001). Not all of the Sonnax Factors are relevant in every case, and cause is a broad and flexible concept that must be determined on a case-by-case basis. Spencer v. Bogdanovich (In re Bogdanovich), 292 F.3d 104, 110 (2d Cir. 2002) (citing Mazzeo v. Lenhart (In re Mazzeo), 167 F.3d 139, 143 (2d Cir. 1999)). In a request for stay relief, the moving party bears the initial burden to demonstrate that cause exists to lift the stay. See Sonnax, 907 F.2d at 1285; Capital Comm. Fed. Credit Union v. Boodrow (In re Boodrow), 126 F.3d 43, 48 (2d Cir. 1997) (We have emphasized that a bankruptcy court should deny relief from the stay if the movant fails to make an initial showing of cause.) (internal quotation marks omitted). If the movant is an unsecured creditor, the policies of the automatic stay weigh against granting the relief requested. [T]he general rule is that claims that are not viewed as secured in the context of 362(d)(1) should not be granted relief from the stay unless extraordinary circumstances are established to justify such relief. In re Leibowitz, 147 B.R. 341, 345 (Bankr. S.D.N.Y. 1992); see also Lawrence v. Motors Liquidation Co. (In re Motors Liquidation Co.), No. 10 Civ. 36 (RJH), 2010 WL 4966018, at *4 (S.D.N.Y. Nov. 17, 2010). Under section 362(d)(1), Taggart bears the initial burden of showing cause to lift the stay. In re Mazzeo, 167 F.3d at 142. If the movant fails to make an initial showing of cause, however, the court should deny relief without requiring any showing from the debtor that it is entitled to continued protection. In re Sonnax, 907 F.2d at 1285. Not all of the Sonnax Factors apply in Taggarts case, but the relevant Sonnax Factors weigh strongly in favor of maintaining the automatic stay.

11

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 12 of 16

Main Document

1. Relief Might Not Result in a Partial or Complete Resolution of the Issues (Sonnax Factor No. 1) While relief may eventually result in partial or complete resolution of the issue at hand, the resolution may not be immediate. Prior to the bankruptcy filing, Taggarts litigation was in its early stages. Motion practice addressed to the pleadings, discovery, trial preparation and, absent a settlement, trial all remain to be done. Therefore, the first Sonnax Factor weighs against lifting the stay. 2. Lifting the Automatic Stay Is Connected to and Will Interfere with the Debtors Chapter 11 Cases (Sonnax Factor No. 2) Lifting the stay to the extent requested by Taggart would allow him to proceed with his claims for damages against the Debtors, open the floodgates for other movants seeking stay relief, and force the Debtors to litigate in other courts. Such litigation in non-bankruptcy courts would hinder the Debtors attempts to reorganize by forcing the Debtors to utilize time and resources that would otherwise be spent in resolution of these chapter 11 cases. Accordingly, the second Sonnax factor does not support relief from the stay; lifting the stay will interfere with the Debtors chapter 11 cases. 3. The Other Proceeding Does Not Involve the Debtors as Fiduciaries (Sonnax Factor No. 3) Taggart does not assert that the Debtors are liable as fiduciaries. Even if he did, however, that alone would not be a basis for lifting the stay in this matter. [G]enerally, proceedings in which the debtor is a fiduciary . . . need not be stayed because they bear no relationship to the purpose of the automatic stay, which is debtor protection from his creditors. In re Curtis, 40 B.R. 795, 799 (Bankr. D. Utah 1984) (internal citation omitted). The Motion did not include any evidentiary showing that GMAC Mortgage was acting as a fiduciary. Therefore, the third Sonnax Factor weighs against lifting the stay.

12

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 13 of 16

Main Document

4. The State Court Hearing the Foreclosure Action Is Best Situated to Address State Law Defenses to Foreclosure (Sonnax Factor No. 4) With respect to the fourth Sonnax Factor, the pendency of the state court foreclosure action in which GMAC Mortgage is seeking relief supports lifting the stay to the extent that Taggarts counterclaims are properly asserted as defenses to foreclosure. In proposing to partially lift the automatic stay, the Debtors essentially agree with this position. While this Court may interpret and apply state law in resolving claims through the bankruptcy process, see, e.g., In re Bally Total Fitness of Greater N.Y., Inc., 402 B.R. 616, 624 (Bankr. S.D.N.Y. 2009) (This Court has significant experience in applying state law . . . .), a defendant in a state court action brought by the Debtors should be able to assert defenses to the relief sought by the Debtors. The state court is in the best position to determine whether a counterclaim is properly asserted as a defense to the foreclosure claim under applicable state law. Accordingly, the fourth Sonnax Factor weighs in favor of granting relief from the automatic stay to the extent provided herein. 5. No Insurer Has Assumed Responsibility for the Action (Sonnax Factor No. 5) No insurer has assumed responsibility for the action here, and the Debtors would therefore need to pay all expenses in litigating the action with out-of-pocket funds from the bankruptcy estate. See Declaration of Jennifer Scoliard 12 (ECF Doc. # 1022, Exhibit 1.) As a result, the fifth Sonnax Factor does not support relief from the stay. 6. The State Court Action does not Primarily Involve Third Parties (Sonnax Factor No. 6) GMAC Mortgage, a Debtor in this Court, is the defendant on Taggarts counterclaims. The foreclosure action and Taggarts counterclaims do not primarily involve third parties. The court should not grant relief from the stay under the sixth Sonnax Factor if the debtor is the main party to the litigation. See City Ins. Co. v. Mego Intl Inc. (In re Mego Intl Inc.), 28 B.R. 324,

13

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 14 of 16

Main Document

326 (Bankr. S.D.N.Y. 1983) (denying motion to lift the automatic stay where the debtor was more than a mere conduit for the flow of proceeds and the action impacted the property and administration of [the debtors] estate, suggesting that continuance of the stay was proper). Thus, the sixth Sonnax Factor does not support granting relief from the stay. 7. Litigation of the Counterclaims to the Extent that Taggart Seeks to Recover Damages in Another Forum Would Prejudice the Interests of Other Creditors (Sonnax Factor No. 7) Requiring the Debtors to defend Taggarts damages claims in other forums would upend the strong bankruptcy code policy that favors centralized and efficient administration of all claims in the bankruptcy court . . . . Public Indus. Inc. v. United States (In re Cuyahoga Equip. Corp.), 980 F.2d 110, 117 (2d Cir. 1992). Allowing Taggart to bring his damages claims now, in a different forum, would be unfair to other creditors who must bring their claims in this Court at a later date. Any litigation costs would diminish the bankruptcy estate. Taggart must be treated as any other unsecured creditor and litigate his claims in this Court along with the Debtors other similarly situated creditors. The seventh Sonnax Factor thus weighs against relief from stay. 8. The Interests of Judicial Economy and Economical Resolution of the Actions Are Best Served by Maintaining the Automatic Stay Except to the Extent Provided Herein (Sonnax Factor No. 10) The Debtors recognize that Taggart should be permitted to proceed with his counterclaims to the extent they may properly be asserted as defenses to the foreclosure action that GMAC Mortgage commenced against Taggart in Pennsylvania state court. After the state court determines which, if any, counterclaims may be adjudicated by the state court as defenses to foreclosure, it is possible that judicial economy will favor permitting that court to fix the amount of the damages claim as well. It is premature to reach that issue however. Accordingly, the tenth Sonnax Factor supports granting relief from the stay to the extent provided herein.

14

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 15 of 16

Main Document

9. The Movants Case is Not Ready for Trial (Sonnax Factor No. 11) Taggarts counterclaims are clearly not ready for trial. If the Pennsylvania court agrees with the Debtors that the counterclaims may not be asserted as defenses to the state court in rem foreclosure proceeding, Taggart will have to return to this Court to have his claims resolved as part of the claims allowance process. If the state court concludes that any of the counterclaims may properly be asserted as defenses to foreclosure, it is possible that the state court will provide the most appropriate forum to fix the amount of the claims. It is premature at this time to assess the eleventh Sonnax Factor. 10. The Balance of Harms Favors Maintaining the Automatic Stay (Sonnax Factor No. 12) The twelfth Sonnax Factor, the balance of the harms, weighs in favor of lifting the automatic stay only to the extent provided herein, but not to the extent sought by Taggart. **************** Application of the Sonnax factors weigh strongly against the scope of the relief sought by Taggart. Taggart should be able to defend the state court foreclosure action to the extent that Pennsylvania law recognizes any of Taggarts counterclaims as defenses to foreclosure. On the other hand, Taggart, like all other unsecured creditors of the Debtors, should not be permitted to litigate his affirmative claims for damages outside of the bankruptcy court.

15

12-12020-mg

Doc 1148

Filed 08/14/12 Entered 08/14/12 16:39:31 Pg 16 of 16

Main Document

III.

CONCLUSION

For the foregoing reasons, the Taggart Motion to lift the automatic stay is GRANTED to the extent provided herein, but is otherwise DENIED. Debtors counsel is directed to prepare an Order consistent with this Opinion.

Dated:

August 14, 2012 New York, New York

_____

Martin Glenn____________

MARTIN GLENN United States Bankruptcy Judge

16

S-ar putea să vă placă și

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 paginiAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Republic Late Filed Rejection Damages OpinionDocument13 paginiRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 paginiAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- SEC Vs MUSKDocument23 paginiSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 paginiAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- City Sports GIft Card Claim Priority OpinionDocument25 paginiCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsÎncă nu există evaluări

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 paginiUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsÎncă nu există evaluări

- Roman Catholic Bishop of Great Falls MTDocument57 paginiRoman Catholic Bishop of Great Falls MTChapter 11 DocketsÎncă nu există evaluări

- Wochos V Tesla OpinionDocument13 paginiWochos V Tesla OpinionChapter 11 DocketsÎncă nu există evaluări

- PopExpert PetitionDocument79 paginiPopExpert PetitionChapter 11 DocketsÎncă nu există evaluări

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 paginiAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Zohar 2017 ComplaintDocument84 paginiZohar 2017 ComplaintChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 paginiUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsÎncă nu există evaluări

- Energy Future Interest OpinionDocument38 paginiEnergy Future Interest OpinionChapter 11 DocketsÎncă nu există evaluări

- NQ Letter 1Document3 paginiNQ Letter 1Chapter 11 DocketsÎncă nu există evaluări

- Zohar AnswerDocument18 paginiZohar AnswerChapter 11 DocketsÎncă nu există evaluări

- National Bank of Anguilla DeclDocument10 paginiNational Bank of Anguilla DeclChapter 11 DocketsÎncă nu există evaluări

- Home JoyDocument30 paginiHome JoyChapter 11 DocketsÎncă nu există evaluări

- NQ LetterDocument2 paginiNQ LetterChapter 11 DocketsÎncă nu există evaluări

- Kalobios Pharmaceuticals IncDocument81 paginiKalobios Pharmaceuticals IncChapter 11 DocketsÎncă nu există evaluări

- Quirky Auction NoticeDocument2 paginiQuirky Auction NoticeChapter 11 DocketsÎncă nu există evaluări

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 paginiDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsÎncă nu există evaluări

- APP CredDocument7 paginiAPP CredChapter 11 DocketsÎncă nu există evaluări

- APP ResDocument7 paginiAPP ResChapter 11 DocketsÎncă nu există evaluări

- Farb PetitionDocument12 paginiFarb PetitionChapter 11 DocketsÎncă nu există evaluări

- Licking River Mining Employment OpinionDocument22 paginiLicking River Mining Employment OpinionChapter 11 DocketsÎncă nu există evaluări

- GT Advanced KEIP Denial OpinionDocument24 paginiGT Advanced KEIP Denial OpinionChapter 11 DocketsÎncă nu există evaluări

- Fletcher Appeal of Disgorgement DenialDocument21 paginiFletcher Appeal of Disgorgement DenialChapter 11 DocketsÎncă nu există evaluări

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 paginăSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsÎncă nu există evaluări

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (72)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (119)

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)

- Hospital HistoryDocument25 paginiHospital HistoryTeresita BalgosÎncă nu există evaluări

- GretelMayet’s PortfolioDocument20 paginiGretelMayet’s PortfolioGretel MayetÎncă nu există evaluări

- Hoover v. Keith, 4th Cir. (2005)Document2 paginiHoover v. Keith, 4th Cir. (2005)Scribd Government DocsÎncă nu există evaluări

- Assam's Payment of Gratuity RulesDocument25 paginiAssam's Payment of Gratuity RulesVipin DhakaÎncă nu există evaluări

- Rcpi Vs NLRCDocument5 paginiRcpi Vs NLRCFaith HopeÎncă nu există evaluări

- 09 Rubrico V Macapagal-Arroyo GR No. 183871 Feb 18, 2010Document51 pagini09 Rubrico V Macapagal-Arroyo GR No. 183871 Feb 18, 2010Greta Fe DumallayÎncă nu există evaluări

- Exam Taker Answer ReportDocument3 paginiExam Taker Answer ReportAvelino PagandiyanÎncă nu există evaluări

- UgrammDocument7 paginiUgrammsaikik994Încă nu există evaluări

- Sex Trafficking and Illegal ProstitutionDocument21 paginiSex Trafficking and Illegal ProstitutionJohnÎncă nu există evaluări

- Indemnity BondDocument3 paginiIndemnity BondPoojitha sÎncă nu există evaluări

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 paginiCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsÎncă nu există evaluări

- DajjalDocument10 paginiDajjalKoinÎncă nu există evaluări

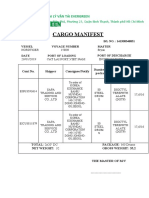

- Cargo Manifest: Công Ty Tnhh Đại Lý Vận Tải EvergreenDocument2 paginiCargo Manifest: Công Ty Tnhh Đại Lý Vận Tải EvergreenFeng KrissÎncă nu există evaluări

- Sanctus Reach The Red WaaaghDocument186 paginiSanctus Reach The Red WaaaghWilbur Whateley100% (3)

- RPH References Per TopicDocument10 paginiRPH References Per TopicNathally Angel EscuadroÎncă nu există evaluări

- Adverse Possession PDFDocument15 paginiAdverse Possession PDFhongman tai100% (1)

- Gladwell's Writing Process and BooksDocument3 paginiGladwell's Writing Process and BooksYounessElkarkouriÎncă nu există evaluări

- InterpretationDocument31 paginiInterpretationricha sethiaÎncă nu există evaluări

- Language On Schools - English Irregular Verbs ListDocument5 paginiLanguage On Schools - English Irregular Verbs ListNicolas FernandezÎncă nu există evaluări

- PD 223Document4 paginiPD 223Catly CapistranoÎncă nu există evaluări

- Workers' Regular Status UpheldDocument9 paginiWorkers' Regular Status UpheldDaley CatugdaÎncă nu există evaluări

- HOLD HARMLESS and INDEMNITY AGREEMENTDocument3 paginiHOLD HARMLESS and INDEMNITY AGREEMENTTRAVIS MISHOE SUDLER I100% (2)

- Form GST REG-06: (Amended)Document3 paginiForm GST REG-06: (Amended)BARMER BARMEÎncă nu există evaluări

- Walt Disney Studios Motion Pictures RELEASE SCHEDULE (Page 1 of 2)Document2 paginiWalt Disney Studios Motion Pictures RELEASE SCHEDULE (Page 1 of 2)Jaime Andrés Bailón MielesÎncă nu există evaluări

- Timeline of Rizal FinalDocument1 paginăTimeline of Rizal FinalannyeongchinguÎncă nu există evaluări

- The Christian Church WorksheetDocument4 paginiThe Christian Church WorksheetAllison Fernandez MatosÎncă nu există evaluări

- Class Presentation Restitution of Conjugal RightsDocument11 paginiClass Presentation Restitution of Conjugal Rightskashish.guptaÎncă nu există evaluări

- Termination Letters1 PDFDocument481 paginiTermination Letters1 PDFyourNEWS MediaÎncă nu există evaluări

- Philippines Supreme Court Upholds Penalty for Illegal Horse Race BettingDocument2 paginiPhilippines Supreme Court Upholds Penalty for Illegal Horse Race BettingRaymondÎncă nu există evaluări