Documente Academic

Documente Profesional

Documente Cultură

Attorneys For Ad Hoc Committee of Preferred Shareholders

Încărcat de

Chapter 11 DocketsDescriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Attorneys For Ad Hoc Committee of Preferred Shareholders

Încărcat de

Chapter 11 DocketsDrepturi de autor:

Formate disponibile

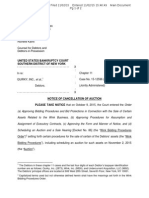

DEWEY & LEBOEUF LLP 1301 Avenue of the Americas New York, New York 10019 Telephone: 212.259.

8000 Facsimile: 212.259.6333 Martin J. Bienenstock, Esq. Irena M. Goldstein, Esq. Timothy Q. Karcher, Esq. Attorneys for Ad Hoc Committee of Preferred Shareholders UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: INNKEEPERS USA TRUST, et al., Debtors. AD HOC COMMITTEE OF PREFERRED SHAREHOLDERS, Movant, -againstINNKEEPERS USA TRUST, et al., Respondents.

x ) ) ) ) ) )

X

Chapter 11 Case No. Case No. 10 13800 (SCC) (Jointly Administered)

) ) ) ) ) ) ) ) ) ) ) x

SUPPLEMENTAL REPLY OF AD HOC COMMITTEE OF PREFERRED SHAREHOLDERS TO OBJECTIONS TO MOTION FOR ORDER DIRECTING APPOINTMENT OF EXAMINER PURSUANT TO SECTION 1104(c)(1)-(2) OF THE BANKRUPTCY CODE TO THE HONORABLE SHELLEY C. CHAPMAN UNITED STATES BANKRUPTCY JUDGE: The Ad Hoc Committee of Preferred Shareholders (the Ad Hoc Committee) in the above-captioned chapter 11 cases of Innkeepers USA Trust (Innkeepers), its parent

NY3 3065514.1

corporation Grand Prix Holdings, LLC (Grand Prix) and their direct and indirect title 11 debtor subsidiaries (collectively, with Innkeepers and Grand Prix, the Debtors), files this supplemental reply in further support of its Motion, dated August 11, 2010, for an Order Directing Appointment of an Examiner Pursuant to Section 1104(c)(1)-(2) of the Bankruptcy Code [Docket No. 179] (the Motion), and in further reply to the limited and other objections and responses thereto filed by Midland Loan Services, Inc. (Midland) [Docket No. 253] (the Midland Response), Wells Fargo Bank, N.A. (Wells Fargo) [Docket No. 282] (the Wells Fargo Joinder), the Official Committee of Unsecured Creditors (the UCC) [Docket No. 263] (the UCC Objection), the United States Trustee (the US Trustee) [Docket No. 268] (the US Trustees Response), Lehman ALI, Inc. (Lehman) [Docket No. 270] (the Lehman Objection), Apollo Investment Corporation (Apollo, and together with the UCC, Lehman, and the Debtors, the Objectors) [Docket No. 277] (the Apollo Objection), and the Debtors [Docket No. 285] (the Debtors Objection, together with the UCC Objection, the Lehman Objection and the Apollo Objection, the Objections), and respectfully represents a follows: Supplemental Reply 1. In the Motion, the Ad Hoc Committee alerted the Court to the Debtors

tricks and shenanigans in connection with their efforts to give the company to Lehman and Apollo Investment Corp. (Apollo) in violation of applicable Supreme Court jurisprudence, and that creditors and preferred shareholders deserve an investigation and a public report of, among other things, such antics. The Objectors opposed the Motion on the grounds that (a) the Debtors and their relationship with Apollo are the subject of other investigations; (b) the Ad Hoc Committees concerns are properly addressed in connection with plan confirmation; and (c) the

2

NY3 3065514.1

appointment of an examiner is not mandatory because there are not $5 million of uncontingent, liquidated, unsecured claims against the Debtors estates. 2. Those Objections were meritless when lodged, and are even more

disingenuous now in light of what the Court learned during the September 1, 2010 hearing (the September 1 Hearing) on the Debtors motion to assume the Plan Support Agreement, namely, that virtually all of the Ad Hoc Committees assertions in the Motion concerning the Debtors malfeasance were on the mark. Notably: Prior to filing for bankruptcy, the Debtors and their ultimate common equity owner, Apollo, engineered a transaction that would allow Apollo and a single chosen creditor, Lehman, to retain or obtain equity interests in the Debtors while Lehman received more than it could receive if it enforced all of its rights under its loan agreements and the preferred shareholders were being extinguished without any process to maximize value or even to determine of value of the seven assets not subject to a blanket mortgage. The Debtors made no efforts to market test or even value their assets before requesting authority to assume a plan support agreement objected to by every significant secured claimholder as well as the Ad Hoc Committee. The Debtors prevented other parties interested in sponsoring a Plan for the Debtors from conducting due diligence, thereby precluding an alternative proposal. The Debtors did not disclose in their first-day motions and other documents filed with the Court a holding company held a bank account having $7.4 million which company was subject to only de minimis liabilities. The Debtors borrowed money to satisfy obligations to improve certain of the Debtors properties, by saddling other Debtors properties with liens securing the new money while Apollo is separately liable for the improvements pursuant to a written guaranty. 3. This Court held that it could not conclude that the debtors exercised due

care in electing to move forward with the current plan term sheet and the proposed valuation

3

NY3 3065514.1

implied therein. The Court further found that the Debtors were not even handed in their approach and, instead, favored the Lehman/Apollo arrangement over other alternatives.1 4. Notwithstanding the Courts denial of the motion to assume the Plan

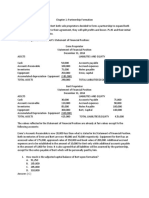

Support Agreement, the Debtors tactics have not changed. For example, in their objection to the Ad Hoc Committees request for a statutory preferred shareholders committee, the Debtors contend there is no value in the seven hotel properties not subject to blanket mortgages because any value above the mortgage liens on such properties would be trapped at Innkeepers USA Limited Partnership (Innkeepers USA LP). See Debtors Objection to Statutory Preferred Shareholders Committee Motion, dated September 24, 2010, at 9-10 [Docket No. 285] (the Debtors Statutory Committee Objection). According to the Debtors, Innkeepers USA LP has secured and unsecured creditors in excess of the $7.4 million of cash it is holding, and even such claims are satisfied in full, the Class C Preferred Limited Partnership Units (Class C Units) in Innkeepers USA LP are entitled to the first $270 million as a liquidation preference. Id.; see also Schedules of Assets and Liabilities for Innkeepers USA Limited Partnership, attached as Exhibit C to the Reply of Ad Hoc Committee of Preferred Shareholders to Objections to Motion for Order Directing Appointment of Statutory Committee of Preferred Shareholders, dated September 28, 2010 [Docket No. 513] (the Statutory Committee Reply). 5. First, according to the Innkeepers USA LP schedules, the liquidated

unsecured claims of Innkeepers USA LP amount to a grand total of $208,795.98. See Schedules of Assets and Liabilities for Innkeepers USA Limited Partnership, attached as Exhibit C to the Statutory Committee Reply. There are unliquidated and contingent claims listed in the schedules, including Innkeepers USA LPs obligation under a guarantee of certain obligations in

See September 1 Transcript at 420, lines 5-7; 428, line 19.

4

NY3 3065514.1

connection with the Genwood Loan. Id. That guarantee, however, as made clear by the Debtors Statutory Committee Objection (at page 10), is not of the entire $32 million obligation but instead of limited obligations.2 Second, and more importantly, according to information provided by the Debtors, the Class C Units are held by Innkeepers Financial Corporation (IFC). See Debtors Statutory Committee Objection, at 9. IFC is wholly owned by Innkeepers (in which the members of the Ad Hoc Committee own preferred shares), and according to its schedules of liabilities has NO liquidated unsecured claims and lists only potential contingent claims under a shared services agreement and franchise agreements. See Schedules of Assets and Liabilities of Innkeepers Financial Corporation, attached as Exhibit D to the Statutory Committee Reply. 6. In other words, the Debtors, in an effort to deprive adequate representation

for preferred shareholders, have once again obfuscated the value of the preferred shares. The Debtors clear attempt to mislead parties as to the true nature of the Debtors assets and liabilities, coupled with the fact that the Debtors made no effort prior to the Ad Hoc Committees requesting appointment of a statutory committee to market test the value of their assets, whether in whole or in part, demonstrate further why appointment of an examiner under Bankruptcy Code section 1104(c)(1) is in the best interests of the estate. 7. There is further evidence that appointment of an examiner is mandatory

under Bankruptcy Code section 1104(c)(2). In this regard, the September 1, 2010 hearing revealed that the Company has in excess of $5 million of fixed, liquidated unsecured debts.

The Debtors schedules also list a secured claim of $25,918,903.29 owing to LNR Partners, Inc. in connection with the $25.6 million Merrill Lynch CMBS Mortgage Loan. See Exhibit C of Statutory Committee Reply. Because the Debtors do not make reference in any other document filed with this Court that Innkeepers USA LP is obligated on the $25.6 million CMBS loan (including the objection to the equity committee motion, the first day declaration, and the cash collateral order), the Ad Hoc Committee believes that there is a mistake in the schedules of liabilities. Someone, like an equity committee or an examiner, obviously needs to get to the bottom of what the Debtors assets and liabilities are. In any event, the Ad Hoc Committees advisors have placed a value of $36.9 million on the Double Tree Guest Suites (Washington, D.C.), the borrower under the $25.6 million CMBS loan.

2

5

NY3 3065514.1

Indeed, the Debtors chief restructuring officer, Mr. Beilinson, testified that the collateral securing Lehmans obligations is absolutely not worth $238 million, which would leave a sizeable deficiency claim. See September 1 Transcript at 172, lines 3-8. Further, Mr. Beilinson testified that Midland was overencumbered by hundreds of millions of dollars. See September 1 Transcript at 177, lines 12-16. 8. The Objectors had previously argued that deficiency claims should not

count because they are contingent until fixed by this Court. See Debtors Examiner Motion Objection, dated August 23, 2010, at 4 [Docket No. 285]; Official Committee of Unsecured Creditors Objection, dated August 23, 2010, at 33 [Docket No. 263]. The Objectors should not be allowed to rely upon that tortured logic now that the Debtors own chief restructuring officer testified under oath that there are likely hundreds of millions of dollars of deficiency claims. Because there are clearly unsecured debts in excess of $5 million, appointment of an examiner is mandatory under Bankruptcy Code section 1104(c)(2). 9. The Ad Hoc Committee therefore reiterates its requests the appointment of

an examiner to conduct an investigation of the Debtors, Apollo, and their respective directors and senior officers, in respect of, among other things, the following issues: The potential avoidance of all direct and indirect transfers from Innkeepers and/or its subsidiaries to Apollo or Apollo affiliates; Prepetition acts and omissions from and after July 1, 2009 in respect of the Debtors officers and directors, and the officers and directors of the Debtors other direct and indirect subsidiaries impacting their respective fiduciary duties of care, loyalty, and good faith to Innkeepers; Postpetition acts and omissions from and after July 19, 2010 in respect of Innkeepers officers and directors, and the officers and directors of Innkeepers other direct and indirect subsidiaries impacting their respective fiduciary duties of care, loyalty, and good faith to Innkeepers;

6

NY3 3065514.1

Whether Apollo, Lehman, or any other party caused the Company to take any steps to advantage Apollo, Lehman, or any other party at the expense of other creditors and preferred shareholders; The communications and negotiations that led to the Debtors failed Plan Support Agreement; Whether and how the Company and Apollo created self-imposed emergencies by causing properties not encumbered by Lehmans mortgage to default unnecessarily; The purpose and necessity of debtor-in-possession financing on all the hotels, especially the DIP collateralized by the equity of the Residence Inn San Diego and the Residence Inn Tysons; Exploration of the Companys franchising relationship with Marriott, and whether the Company entered into any agreements with Marriott merely to fulfill a guarantee by Apollo; Whether Apollos 2007 purchase of the Company constitutes a fraudulent conveyance; The nature and extent of the relationships between and among Lehman, Apollo, and the Debtors; How value can be maximized for preferred shareholders and unsecured claimholders; Valuation of Debtors, including, but not limited to, the March 31, 2010 valuation referenced in Apollos Form 10K filed on May 26, 2010, and any valuation of the Debtors that Lehman may have performed in connection with its own chapter 11 cases; The Debtors failure to timely disclose to the US Trustee and this Court the $7.4 million in cash held at Innkeepers USA LP, while arguing that there was no value for preferred shareholders; and The Debtors failure to market test any of their properties before agreeing to the onerous and harmful terms of the PSA.

7

NY3 3065514.1

CONCLUSION WHEREFORE the Ad Hoc Committee respectfully reiterates its request for the appointment of an Examiner to investigate the issues set forth in its Motion and Reply, and granting it such other and further relief as the Court deems just and proper.

Dated: New York, NY September 28, 2010

DEWEY & LEBOEUF LLP

/s/ Martin J. Bienstock Martin J. Bienenstock, Esq. Irena M. Goldstein, Esq. Timothy Q. Karcher, Esq. 1301 Avenue of the Americas New York, New York 10019 Telephone: 212.259.8000 Facsimile: 212.259.6333 Attorneys for Ad Hoc Committee of Preferred Shareholders

8

NY3 3065514.1

S-ar putea să vă placă și

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsDe la EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsEvaluare: 5 din 5 stele5/5 (12)

- 10000003869Document54 pagini10000003869Chapter 11 DocketsÎncă nu există evaluări

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersDe la EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersEvaluare: 3 din 5 stele3/5 (1)

- Attorneys For Ad Hoc Committee of Preferred ShareholdersDocument18 paginiAttorneys For Ad Hoc Committee of Preferred ShareholdersChapter 11 DocketsÎncă nu există evaluări

- Washington Mutual (WMI) - Supplement To Equity Committee's Proposed Letter in Support of Confirmation of The Seventh Amended Joint PlanDocument22 paginiWashington Mutual (WMI) - Supplement To Equity Committee's Proposed Letter in Support of Confirmation of The Seventh Amended Joint PlanmeischerÎncă nu există evaluări

- In ReDocument3 paginiIn ReChapter 11 DocketsÎncă nu există evaluări

- Attorneys For The Official Committee of Unsecured Creditors of Innkeepers USA Trust, Et AlDocument3 paginiAttorneys For The Official Committee of Unsecured Creditors of Innkeepers USA Trust, Et AlChapter 11 DocketsÎncă nu există evaluări

- 10000005545Document49 pagini10000005545Chapter 11 DocketsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCDocument18 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCChapter 11 DocketsÎncă nu există evaluări

- Recent Anomalies and ContradictionsDocument31 paginiRecent Anomalies and ContradictionsCj CrowellÎncă nu există evaluări

- In Re:caribbean Petroleum Corp V., 3rd Cir. (2014)Document11 paginiIn Re:caribbean Petroleum Corp V., 3rd Cir. (2014)Scribd Government DocsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncDocument18 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncChapter 11 DocketsÎncă nu există evaluări

- In Re Residential Capital, LLC, Et Al Debtors Memorandum Opinion and Order 6-20-2012Document17 paginiIn Re Residential Capital, LLC, Et Al Debtors Memorandum Opinion and Order 6-20-2012chunga85Încă nu există evaluări

- States Trustee v. Columbia Gas Sys., Inc. (In Re Columbia Gas Sys., Inc.), 33 F.3d 294, 295-96Document4 paginiStates Trustee v. Columbia Gas Sys., Inc. (In Re Columbia Gas Sys., Inc.), 33 F.3d 294, 295-96Chapter 11 DocketsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncDocument18 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncChapter 11 DocketsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationDocument19 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationChapter 11 DocketsÎncă nu există evaluări

- United States Court of Appeals, Fourth CircuitDocument13 paginiUnited States Court of Appeals, Fourth CircuitScribd Government Docs100% (1)

- Stone Panels Inc Bankruptcy FilingDocument4 paginiStone Panels Inc Bankruptcy FilingespanolalÎncă nu există evaluări

- Joinder TemplateDocument4 paginiJoinder TemplateergodocÎncă nu există evaluări

- Answer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefDocument11 paginiAnswer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefChapter 11 DocketsÎncă nu există evaluări

- Not PrecedentialDocument11 paginiNot PrecedentialScribd Government DocsÎncă nu există evaluări

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADocument21 paginiAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsÎncă nu există evaluări

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADocument5 paginiAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Emhart Teknologies, IncDocument19 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Emhart Teknologies, IncChapter 11 DocketsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedDocument18 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedChapter 11 DocketsÎncă nu există evaluări

- 10000005606Document2 pagini10000005606Chapter 11 DocketsÎncă nu există evaluări

- Dill Oil Company, LLC v. Stephens, 10th Cir. (2013)Document15 paginiDill Oil Company, LLC v. Stephens, 10th Cir. (2013)Scribd Government DocsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncDocument18 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncChapter 11 DocketsÎncă nu există evaluări

- International, Inc. For Allowance of Administrative Expense Claim Pursuant To 11 U.S.C. 503Document6 paginiInternational, Inc. For Allowance of Administrative Expense Claim Pursuant To 11 U.S.C. 503Chapter 11 DocketsÎncă nu există evaluări

- U.S. Trustee's Objection To Evercore Partners's G.M. FeesDocument17 paginiU.S. Trustee's Objection To Evercore Partners's G.M. FeesDealBook100% (3)

- Attorneys For Five Mile Capital Partners LLCDocument31 paginiAttorneys For Five Mile Capital Partners LLCChapter 11 DocketsÎncă nu există evaluări

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncDocument16 paginiDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncChapter 11 DocketsÎncă nu există evaluări

- Attorneys For Lehman ALI Inc. and SASCO 2008-C2, LLCDocument119 paginiAttorneys For Lehman ALI Inc. and SASCO 2008-C2, LLCChapter 11 DocketsÎncă nu există evaluări

- Ernst & Young v. Depositors Economic, 45 F.3d 530, 1st Cir. (1995)Document17 paginiErnst & Young v. Depositors Economic, 45 F.3d 530, 1st Cir. (1995)Scribd Government DocsÎncă nu există evaluări

- Collins & Aikman Corporation, Et AlDocument16 paginiCollins & Aikman Corporation, Et AlChapter 11 DocketsÎncă nu există evaluări

- In Re Federal Mogul-Global Inc. T & N Limited Committee of Equity Security Holders of Federal-Mogul Corporation v. Official Committee of Unsecured Creditors, 348 F.3d 390, 3rd Cir. (2003)Document22 paginiIn Re Federal Mogul-Global Inc. T & N Limited Committee of Equity Security Holders of Federal-Mogul Corporation v. Official Committee of Unsecured Creditors, 348 F.3d 390, 3rd Cir. (2003)Scribd Government DocsÎncă nu există evaluări

- Alabama Dept. of Economic & Comm. Affairs v. Ball, 11th Cir. (2011)Document32 paginiAlabama Dept. of Economic & Comm. Affairs v. Ball, 11th Cir. (2011)Scribd Government DocsÎncă nu există evaluări

- Sandra E. Mayerson (SEM-8119) 30 Rockefeller Plaza, 23 Floor New York, New York 10112 Telephone: +1.212.872.9800 Facsimile: +1.212.872.9815Document6 paginiSandra E. Mayerson (SEM-8119) 30 Rockefeller Plaza, 23 Floor New York, New York 10112 Telephone: +1.212.872.9800 Facsimile: +1.212.872.9815Chapter 11 DocketsÎncă nu există evaluări

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 paginiIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsÎncă nu există evaluări

- Defense of Collection Cases Edelman, (2007)Document43 paginiDefense of Collection Cases Edelman, (2007)Jillian Sheridan100% (2)

- Washington Mutual (WMI) - Objection of The Committee of Equity Security Holders To Confirmation of The Modified Sixth Amended Plan of ReorganizationDocument75 paginiWashington Mutual (WMI) - Objection of The Committee of Equity Security Holders To Confirmation of The Modified Sixth Amended Plan of ReorganizationmeischerÎncă nu există evaluări

- Indiana MotionDocument65 paginiIndiana MotionZerohedge100% (1)

- Memorandum of Law of Appaloosa Investment L.P. I, Palomino Fund LTD., Thoroughbred Fund L.P., and Thoroughbred Master Ltd. in Support of Their Status As Parties in Interest Entitled To StandingDocument19 paginiMemorandum of Law of Appaloosa Investment L.P. I, Palomino Fund LTD., Thoroughbred Fund L.P., and Thoroughbred Master Ltd. in Support of Their Status As Parties in Interest Entitled To StandingChapter 11 DocketsÎncă nu există evaluări

- For Publication: Attorneys For The Debtors and Debtors-in-PossessionDocument27 paginiFor Publication: Attorneys For The Debtors and Debtors-in-PossessionChapter 11 DocketsÎncă nu există evaluări

- In Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Cf&i Steel Corporation Colorado & Wyoming Railway Company Unsecured Creditors Committee United Steelworkers of America Afl-Cio-Clc William J. Westmark, Trustee of the Colorado & Wyoming Railway Company, in Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Colorado & Wyoming Railway Company, 150 F.3d 1293, 10th Cir. (1998)Document13 paginiIn Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Cf&i Steel Corporation Colorado & Wyoming Railway Company Unsecured Creditors Committee United Steelworkers of America Afl-Cio-Clc William J. Westmark, Trustee of the Colorado & Wyoming Railway Company, in Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Colorado & Wyoming Railway Company, 150 F.3d 1293, 10th Cir. (1998)Scribd Government DocsÎncă nu există evaluări

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADocument23 paginiAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New YorkDocument4 paginiUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsÎncă nu există evaluări

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument6 paginiIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsÎncă nu există evaluări

- Kunz v. United Security Bank, 489 F.3d 1072, 10th Cir. (2007)Document13 paginiKunz v. United Security Bank, 489 F.3d 1072, 10th Cir. (2007)Scribd Government DocsÎncă nu există evaluări

- In The United States District Court For The Middle District of Tennessee, Nashville DivisionDocument20 paginiIn The United States District Court For The Middle District of Tennessee, Nashville DivisioncharleswaynecoxÎncă nu există evaluări

- Attorneys For The Official Committee of Unsecured Creditors of Innkeepers USA Trust, Et AlDocument14 paginiAttorneys For The Official Committee of Unsecured Creditors of Innkeepers USA Trust, Et AlChapter 11 DocketsÎncă nu există evaluări

- Angela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS ITDocument18 paginiAngela Sacchi V Mers June 24 2011 - HOMEOWNER SURVIVES MOTION TO DISMISS FAC IN CALIFORNIA-THIS JUDGE GETS IT83jjmackÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New YorkDocument2 paginiUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New YorkDocument10 paginiUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsÎncă nu există evaluări

- Edward J. Cheetham, Debtor v. Universal C. I. T. Credit Corp., (In The Matter of Edward J. Cheetham, Debtor), 390 F.2d 234, 1st Cir. (1968)Document7 paginiEdward J. Cheetham, Debtor v. Universal C. I. T. Credit Corp., (In The Matter of Edward J. Cheetham, Debtor), 390 F.2d 234, 1st Cir. (1968)Scribd Government DocsÎncă nu există evaluări

- United States Court of Appeals, Tenth CircuitDocument10 paginiUnited States Court of Appeals, Tenth CircuitScribd Government DocsÎncă nu există evaluări

- Hearing Date: November 10, 2010 at 10:00 A.M. (Prevailing Eastern Time) Objection Deadline: October 27, 2010 at 4:00 P.M. (Prevailing Eastern Time)Document9 paginiHearing Date: November 10, 2010 at 10:00 A.M. (Prevailing Eastern Time) Objection Deadline: October 27, 2010 at 4:00 P.M. (Prevailing Eastern Time)Chapter 11 DocketsÎncă nu există evaluări

- 10000006242Document31 pagini10000006242Chapter 11 DocketsÎncă nu există evaluări

- Et Al.: Hearing Date: August 28, 2012 at 11:00 A.M. Objection Deadline: July 30, 2012 at 4:00 P.MDocument7 paginiEt Al.: Hearing Date: August 28, 2012 at 11:00 A.M. Objection Deadline: July 30, 2012 at 4:00 P.MChapter 11 DocketsÎncă nu există evaluări

- Washington Mutual (WMI) - Objection To The Seventh Amended Joint Plan of Affiliated Debtors by James BergDocument73 paginiWashington Mutual (WMI) - Objection To The Seventh Amended Joint Plan of Affiliated Debtors by James Bergmeischer100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 paginiAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 paginiAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Wochos V Tesla OpinionDocument13 paginiWochos V Tesla OpinionChapter 11 DocketsÎncă nu există evaluări

- SEC Vs MUSKDocument23 paginiSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 paginiAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 paginiAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- PopExpert PetitionDocument79 paginiPopExpert PetitionChapter 11 DocketsÎncă nu există evaluări

- Roman Catholic Bishop of Great Falls MTDocument57 paginiRoman Catholic Bishop of Great Falls MTChapter 11 DocketsÎncă nu există evaluări

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 paginiUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsÎncă nu există evaluări

- City Sports GIft Card Claim Priority OpinionDocument25 paginiCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsÎncă nu există evaluări

- Zohar 2017 ComplaintDocument84 paginiZohar 2017 ComplaintChapter 11 DocketsÎncă nu există evaluări

- GT Advanced KEIP Denial OpinionDocument24 paginiGT Advanced KEIP Denial OpinionChapter 11 DocketsÎncă nu există evaluări

- Republic Late Filed Rejection Damages OpinionDocument13 paginiRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- National Bank of Anguilla DeclDocument10 paginiNational Bank of Anguilla DeclChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 paginiUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsÎncă nu există evaluări

- NQ Letter 1Document3 paginiNQ Letter 1Chapter 11 DocketsÎncă nu există evaluări

- Energy Future Interest OpinionDocument38 paginiEnergy Future Interest OpinionChapter 11 DocketsÎncă nu există evaluări

- Zohar AnswerDocument18 paginiZohar AnswerChapter 11 DocketsÎncă nu există evaluări

- Home JoyDocument30 paginiHome JoyChapter 11 DocketsÎncă nu există evaluări

- Kalobios Pharmaceuticals IncDocument81 paginiKalobios Pharmaceuticals IncChapter 11 DocketsÎncă nu există evaluări

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 paginiDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsÎncă nu există evaluări

- APP ResDocument7 paginiAPP ResChapter 11 DocketsÎncă nu există evaluări

- APP CredDocument7 paginiAPP CredChapter 11 DocketsÎncă nu există evaluări

- NQ LetterDocument2 paginiNQ LetterChapter 11 DocketsÎncă nu există evaluări

- Quirky Auction NoticeDocument2 paginiQuirky Auction NoticeChapter 11 DocketsÎncă nu există evaluări

- Farb PetitionDocument12 paginiFarb PetitionChapter 11 DocketsÎncă nu există evaluări

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 paginăSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsÎncă nu există evaluări

- Licking River Mining Employment OpinionDocument22 paginiLicking River Mining Employment OpinionChapter 11 DocketsÎncă nu există evaluări

- Fletcher Appeal of Disgorgement DenialDocument21 paginiFletcher Appeal of Disgorgement DenialChapter 11 DocketsÎncă nu există evaluări

- Chapter 6 Exclusions From Gross Income PDFDocument12 paginiChapter 6 Exclusions From Gross Income PDFkimberly tenebroÎncă nu există evaluări

- Case Study Vijay Mallya - Another Big NaDocument10 paginiCase Study Vijay Mallya - Another Big Najai sri ram groupÎncă nu există evaluări

- Transaction Summary - 10 July 2021 To 6 August 2021: Together We Make A DifferenceDocument2 paginiTransaction Summary - 10 July 2021 To 6 August 2021: Together We Make A Differencebertha kiaraÎncă nu există evaluări

- Module 2 - Risk Management ProcessDocument13 paginiModule 2 - Risk Management ProcessLara Camille CelestialÎncă nu există evaluări

- Development Bank of The Philippines v. The Hon. Secretary of Labor, Cresencia Difontorum, Et AlDocument2 paginiDevelopment Bank of The Philippines v. The Hon. Secretary of Labor, Cresencia Difontorum, Et AlKriselÎncă nu există evaluări

- The Bankers Own The EarthDocument51 paginiThe Bankers Own The EarthIanSmith777100% (3)

- Chapter 7Document6 paginiChapter 7Pranshu GuptaÎncă nu există evaluări

- Internal Revenue Manual - 1.33Document13 paginiInternal Revenue Manual - 1.33purpelÎncă nu există evaluări

- Report of Checks Issued 2023Document1 paginăReport of Checks Issued 2023Jahzeel RubioÎncă nu există evaluări

- Goa University International Economics Sem V SyllabusDocument3 paginiGoa University International Economics Sem V SyllabusMyron VazÎncă nu există evaluări

- HLB SME 1form (Original)Document14 paginiHLB SME 1form (Original)Mandy ChanÎncă nu există evaluări

- History of Investment BankingDocument40 paginiHistory of Investment BankingMaritoGuzmanÎncă nu există evaluări

- AmazonFile 0Document2 paginiAmazonFile 0chawllarohitÎncă nu există evaluări

- Teknik AkersonDocument60 paginiTeknik Akerson060098401Încă nu există evaluări

- Chapter 1 Partnership Formation Test BanksDocument46 paginiChapter 1 Partnership Formation Test BanksRaisa Gelera91% (23)

- Tutorial (Merchandising With Answers)Document16 paginiTutorial (Merchandising With Answers)Luize Nathaniele Santos0% (1)

- Stock Tiger RecommendationDocument11 paginiStock Tiger RecommendationRatilal M JadavÎncă nu există evaluări

- What Is A Pitch BookDocument4 paginiWhat Is A Pitch Bookdonjaguar50Încă nu există evaluări

- A B C D: 02 Objective / Objektif 2Document5 paginiA B C D: 02 Objective / Objektif 2foryourhonour wongÎncă nu există evaluări

- Project of Merger Acquisition SANJAYDocument65 paginiProject of Merger Acquisition SANJAYmangundesanju77% (74)

- Quiz 1 - Balance SheetDocument3 paginiQuiz 1 - Balance SheetCindy Craus100% (1)

- P2 07Document3 paginiP2 07rietzhel22Încă nu există evaluări

- Cfas Millan 2020 Answer KeyDocument193 paginiCfas Millan 2020 Answer KeyPEBIDA, DAVERLY N.Încă nu există evaluări

- Chapter 02Document11 paginiChapter 02Saad mubeenÎncă nu există evaluări

- Break Your Bad Money Habits Live Without Financial Stress and Make More MoneyDocument249 paginiBreak Your Bad Money Habits Live Without Financial Stress and Make More MoneyMduduzi Mbhele100% (1)

- Percukaian (Taxation) 2022Document15 paginiPercukaian (Taxation) 2022Faiz IskandarÎncă nu există evaluări

- FM Project HDFCDocument14 paginiFM Project HDFCsameer_kiniÎncă nu există evaluări

- ILAM FAHARI I REIT - Audited Finacncials 2020Document1 paginăILAM FAHARI I REIT - Audited Finacncials 2020An AntonyÎncă nu există evaluări

- LAON Recovery-management-Of Andhra BankDocument87 paginiLAON Recovery-management-Of Andhra Banklakshmikanth100% (1)

- Learn the Essentials of Business Law in 15 DaysDe la EverandLearn the Essentials of Business Law in 15 DaysEvaluare: 4 din 5 stele4/5 (13)

- Profitable Photography in Digital Age: Strategies for SuccessDe la EverandProfitable Photography in Digital Age: Strategies for SuccessÎncă nu există evaluări

- The Certified Master Contract AdministratorDe la EverandThe Certified Master Contract AdministratorEvaluare: 5 din 5 stele5/5 (1)

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseDe la EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseÎncă nu există evaluări

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignDe la EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignEvaluare: 3.5 din 5 stele3.5/5 (3)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetDe la EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetÎncă nu există evaluări

- Contracts: The Essential Business Desk ReferenceDe la EverandContracts: The Essential Business Desk ReferenceEvaluare: 4 din 5 stele4/5 (15)

- How to Win Your Case In Traffic Court Without a LawyerDe la EverandHow to Win Your Case In Traffic Court Without a LawyerEvaluare: 4 din 5 stele4/5 (5)

- Crash Course Business Agreements and ContractsDe la EverandCrash Course Business Agreements and ContractsEvaluare: 3 din 5 stele3/5 (3)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowDe la EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowEvaluare: 1 din 5 stele1/5 (1)

- Law of Contract Made Simple for LaymenDe la EverandLaw of Contract Made Simple for LaymenEvaluare: 4.5 din 5 stele4.5/5 (9)

- Technical Theater for Nontechnical People: Second EditionDe la EverandTechnical Theater for Nontechnical People: Second EditionÎncă nu există evaluări

- How to Win Your Case in Small Claims Court Without a LawyerDe la EverandHow to Win Your Case in Small Claims Court Without a LawyerEvaluare: 5 din 5 stele5/5 (1)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityDe la EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityÎncă nu există evaluări

- Starting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingDe la EverandStarting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingEvaluare: 5 din 5 stele5/5 (1)