Documente Academic

Documente Profesional

Documente Cultură

Execution

Încărcat de

Chapter 11 DocketsDescriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Execution

Încărcat de

Chapter 11 DocketsDrepturi de autor:

Formate disponibile

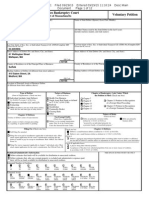

EXECUTION COPY IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: COLLINS &

AIKMAN CORPORATION, et al. 1 Debtors. ) ) ) ) ) ) ) ) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

ORDER APPROVING CROSS-BORDER INSOLVENCY PROTOCOL Upon the motion (the Motion) 2 of the above-captioned debtors (collectively, the Debtors) for an order approving the cross-border insolvency protocol among the Debtors and the Administrators (the Protocol), it appearing that the relief requested is in the best interest of the Debtors estates, their creditors and other parties in interest; it appearing that the Court has jurisdiction over this matter pursuant to 28 U.S.C. 157 and 1334; it appearing that this proceeding is a core proceeding pursuant to 28 U.S.C. 157(b)(2); it appearing that venue of this

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold) , Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968. Capitalized terms used but not otherwise defined herein shall have the meanings set forth in the Motion.

0W[;%+.

0555927051114000000000021

5;

EXECUTION COPY proceeding and this Motion in this District is proper pursuant to 28 U.S.C. 1408 and 1409; it appearing that notice of this Motion and the opportunity for a hearing on this Motion was appropriate under the particular circumstances and that no other or further notice need be given; the Administrators having approved the Protocol; and after due deliberation and sufficient cause appearing therefor, it is hereby ORDERED 1. 2. The Motion is granted in its entirety. The Protocol attached hereto as Attachment 1 and incorporated herein by

reference is approved in all respects. 3. The Debtors are authorized to take all actions necessary to effectuate the

relief granted pursuant to this Order in accordance with the Motion. 4. The terms and conditions of this Order shall be immediately effective and

enforceable upon its entry. 5. The Court retains jurisdiction with respect to all matters arising from or

related to the implementation of this Order.

Entered: November 14, 2005 ___ _/s/ Steven W. Rhodes _ _ Steven W. Rhodes 1. Chief Bankruptcy Judge

S-ar putea să vă placă și

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 paginiAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 paginiAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Wochos V Tesla OpinionDocument13 paginiWochos V Tesla OpinionChapter 11 DocketsÎncă nu există evaluări

- SEC Vs MUSKDocument23 paginiSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 paginiAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 paginiAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsÎncă nu există evaluări

- PopExpert PetitionDocument79 paginiPopExpert PetitionChapter 11 DocketsÎncă nu există evaluări

- Roman Catholic Bishop of Great Falls MTDocument57 paginiRoman Catholic Bishop of Great Falls MTChapter 11 DocketsÎncă nu există evaluări

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 paginiUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsÎncă nu există evaluări

- City Sports GIft Card Claim Priority OpinionDocument25 paginiCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsÎncă nu există evaluări

- Zohar 2017 ComplaintDocument84 paginiZohar 2017 ComplaintChapter 11 DocketsÎncă nu există evaluări

- GT Advanced KEIP Denial OpinionDocument24 paginiGT Advanced KEIP Denial OpinionChapter 11 DocketsÎncă nu există evaluări

- Republic Late Filed Rejection Damages OpinionDocument13 paginiRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- National Bank of Anguilla DeclDocument10 paginiNational Bank of Anguilla DeclChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 paginiUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsÎncă nu există evaluări

- NQ Letter 1Document3 paginiNQ Letter 1Chapter 11 DocketsÎncă nu există evaluări

- Energy Future Interest OpinionDocument38 paginiEnergy Future Interest OpinionChapter 11 DocketsÎncă nu există evaluări

- Zohar AnswerDocument18 paginiZohar AnswerChapter 11 DocketsÎncă nu există evaluări

- Home JoyDocument30 paginiHome JoyChapter 11 DocketsÎncă nu există evaluări

- Kalobios Pharmaceuticals IncDocument81 paginiKalobios Pharmaceuticals IncChapter 11 DocketsÎncă nu există evaluări

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 paginiDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsÎncă nu există evaluări

- APP ResDocument7 paginiAPP ResChapter 11 DocketsÎncă nu există evaluări

- APP CredDocument7 paginiAPP CredChapter 11 DocketsÎncă nu există evaluări

- NQ LetterDocument2 paginiNQ LetterChapter 11 DocketsÎncă nu există evaluări

- Quirky Auction NoticeDocument2 paginiQuirky Auction NoticeChapter 11 DocketsÎncă nu există evaluări

- Farb PetitionDocument12 paginiFarb PetitionChapter 11 DocketsÎncă nu există evaluări

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 paginăSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsÎncă nu există evaluări

- Licking River Mining Employment OpinionDocument22 paginiLicking River Mining Employment OpinionChapter 11 DocketsÎncă nu există evaluări

- Fletcher Appeal of Disgorgement DenialDocument21 paginiFletcher Appeal of Disgorgement DenialChapter 11 DocketsÎncă nu există evaluări

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (120)

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)

- Roads of Enlightenment GuideDocument5 paginiRoads of Enlightenment GuideMicÎncă nu există evaluări

- Acknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyDocument3 paginiAcknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyLanie BatoyÎncă nu există evaluări

- Chapter 1 Basic-Concepts-Of-EconomicsDocument30 paginiChapter 1 Basic-Concepts-Of-EconomicsNAZMULÎncă nu există evaluări

- Module 2. Lesson 2. OverexploitationDocument11 paginiModule 2. Lesson 2. OverexploitationJephthah Faith Adorable-PalicÎncă nu există evaluări

- AI Intelligence (Sam Charrington and Abeba Birhane)Document2 paginiAI Intelligence (Sam Charrington and Abeba Birhane)Ethel Shammah Waoulda Acleta90% (10)

- About ArevaDocument86 paginiAbout ArevaAbhinav TyagiÎncă nu există evaluări

- Cir Vs PagcorDocument3 paginiCir Vs PagcorNivra Lyn Empiales100% (2)

- Page 1 of The Mafia and His Angel Part 2 (Tainted Hearts 2)Document2 paginiPage 1 of The Mafia and His Angel Part 2 (Tainted Hearts 2)adtiiÎncă nu există evaluări

- Final Annexes Evaluation Use Consultants ApwsDocument51 paginiFinal Annexes Evaluation Use Consultants ApwsSure NameÎncă nu există evaluări

- Judgments of Adminstrative LawDocument22 paginiJudgments of Adminstrative Lawpunit gaurÎncă nu există evaluări

- Republic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962Document2 paginiRepublic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962DAblue ReyÎncă nu există evaluări

- NRes1 Work Activity 1 - LEGARTEDocument4 paginiNRes1 Work Activity 1 - LEGARTEJuliana LegarteÎncă nu există evaluări

- Mboce - Enforcement of International Arbitral Awards - Public Policy Limitation in KenyaDocument100 paginiMboce - Enforcement of International Arbitral Awards - Public Policy Limitation in KenyaIbrahim Abdi AdanÎncă nu există evaluări

- Cadila PharmaDocument16 paginiCadila PharmaIntoxicated WombatÎncă nu există evaluări

- Travel Reservation August 18 For FREDI ISWANTODocument2 paginiTravel Reservation August 18 For FREDI ISWANTOKasmi MinukÎncă nu există evaluări

- The District Governess & Other Stories by Miss Regina SnowDocument118 paginiThe District Governess & Other Stories by Miss Regina SnowMarianne MartindaleÎncă nu există evaluări

- 2018-Gray-Life, Death, or Zombie - The Vitality of International OrganizationsDocument13 pagini2018-Gray-Life, Death, or Zombie - The Vitality of International OrganizationsNightWalkerÎncă nu există evaluări

- Colville GenealogyDocument7 paginiColville GenealogyJeff MartinÎncă nu există evaluări

- SUDAN A Country StudyDocument483 paginiSUDAN A Country StudyAlicia Torija López Carmona Verea100% (1)

- Mental Health EssayDocument4 paginiMental Health Essayapi-608901660Încă nu există evaluări

- Webinar2021 Curriculum Alena Frid OECDDocument30 paginiWebinar2021 Curriculum Alena Frid OECDreaderjalvarezÎncă nu există evaluări

- 3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesDocument30 pagini3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesThe Fort PointerÎncă nu există evaluări

- Anderson v. Eighth Judicial District Court - OpinionDocument8 paginiAnderson v. Eighth Judicial District Court - OpinioniX i0Încă nu există evaluări

- The Message of Malachi 4Document7 paginiThe Message of Malachi 4Ayeah GodloveÎncă nu există evaluări

- The Petrosian System Against The QID - Beliavsky, Mikhalchishin - Chess Stars.2008Document170 paginiThe Petrosian System Against The QID - Beliavsky, Mikhalchishin - Chess Stars.2008Marcelo100% (2)

- CH03 - Case1 - GE Becomes A Digital Firm The Emerging Industrial InternetDocument4 paginiCH03 - Case1 - GE Becomes A Digital Firm The Emerging Industrial Internetjas02h10% (1)

- Rainiere Antonio de La Cruz Brito, A060 135 193 (BIA Nov. 26, 2013)Document6 paginiRainiere Antonio de La Cruz Brito, A060 135 193 (BIA Nov. 26, 2013)Immigrant & Refugee Appellate Center, LLCÎncă nu există evaluări

- Strategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All ChapterDocument67 paginiStrategic Management A Competitive Advantage Approach Concepts and Cases 17Th 17Th Edition Fred R David All Chaptertabitha.turner568100% (3)

- RPA Solutions - Step Into The FutureDocument13 paginiRPA Solutions - Step Into The FutureThe Poet Inside youÎncă nu există evaluări

- Voodoo 101Document8 paginiVoodoo 101The Divine Prince Ty Emmecca67% (9)