Documente Academic

Documente Profesional

Documente Cultură

Market Watch Daily 10.01

Încărcat de

ran2013Descriere originală:

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Market Watch Daily 10.01

Încărcat de

ran2013Drepturi de autor:

Formate disponibile

DNH Financial (Pvt) Ltd.

Daily

10th January 2013

Market Performance

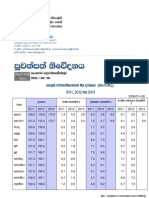

ASPI S&P SL 20 Turnover (mn) Foreign Purchases (mn) Foreign Sales (mn) Traded Companies Market PER (X) Market Cap (LKR bn) Market Cap (US$ bn) Dividend Yield (%) Price to Book (X) 10.01.2013 5,732 3,122 1,013.1 678.9 539.4 214 16.2 2,202 17.1 2.3 2.1 09.01.2013 5,745 3,121 497.2 139.3 170.7 238 16.3 2,207 17.2 2.3 2.1 %Chg. -0.2 0.0 103.8 387.5 216.0 -10.1 -0.6 -0.2 -0.2 0.0 0.0

DNH MARKET WATCH

www.dnhfinancial.com +94115700777

Market Indices

ASI 6,000 5,800 5,600 5,400 5,200 5,000 04/01/2013 07/01/2013 08/01/2013 09/01/2013 10/01/2013 ASI S&P SL20 3,100 3,120 S&P SL20 3,140

Market Outlook

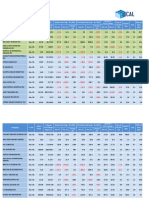

The market traded largely sideways with the ASPI closing a notch down at 5732. Turnover recorded LKR1013 mn with trading in Hatton National Bank and Distilleries accounting for 44% of the days total. Losers modestly offset gainers with Taprobane Holdings, Orient Finance and George Steuart declining by 9.8%, 9.5% and 8.3% and offsetting gains in Infrastructure Developers, Ramboda Falls and Keells Food Products which advancing by 12.0%, 10.3% and 9.5% respectively. In global markets, a positive start to US corporate earnings season and a sharp improvement in Chinas monthly trade helped boost international markets today. Market Trajectory The majority of domestic investors appear to be waiting for either a short term rally to participate in or a strong correction before entering the market. We believe that neither will happen but a gradual re-rating in the market may be the most likely scenario against a solid fundamental backdrop led by a rise in quality stocks. Notwithstanding the current sideways movement, we believe that the market now offers an attractive investment opportunity for those who are willing to look beyond the short term. The bourses appeal at current levels is even more pronounced when considering its relative underperformance against major emerging and developed markets. While net foreign buying in the bourse appears to be increasing, it is likely to rise further as global macro-economic uncertainties could force foreign asset managers to square off global positions and identify new and fundamentally solid emerging markets such as Sri Lanka resulting in a flow of funds into domestic equities. Consequently, we advise investors to pro-actively seek counters that are likely to record healthy and sustainable top line growth (as a result of their strong domestic focus), firm margins and are cash generative, attributes which we believe will lead to strong positive gains and outperformance in the market.

Net Foreign Inflow(YTD)

600 500 400 YTD Net FPI 300 200 100 0 -100 -200

Millions

Source- CSE/ DNH Research

Gainers /Losers (%)

Ceylon Leather(W0013) George Steuart Orient Finance Taprobane Holdings Horana Plantations Keells Food Products Ramboda Falls Infrastructure Developers

-7.7 -8.3 -9.5 -9.8 7.6 9.5 10.3 12.0

Significant Trades (Turnover in LKR Mn)

300 250 200 150 100 50 0 HNB DIST JKH COMB

Global Markets

Sri Lanka - ASPI India - Sensex Pakistan - KSE 100 Taiwan Weighted Singapore - Straits Times Hong Kong - Hang Seng Index 5,732 19,652 16,523 7,812 3,226 23,354 %Chg. -0.22 -0.07 -1.31 0.94 0.18 0.59

Interest Rates & Currencies

Prime Lending Rate (Avg. Weighted) Deposit Rate (Avg. Weighted) Treasury Bill Rate (360 Days) Dollar Denominated Bond Rate LKR/US$ (Selling Rate) LKR/EURO (Selling Rate) 10.01.2013 14.3% 10.1% 11.4% 5.9% 128.7 168.9

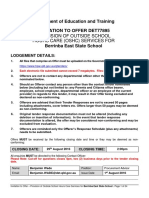

Disclaimer

This Review is prepared and issued by DNH Financial (Pvt.) Ltd. (DNH) based on information in the public domain, internally developed and other sources, believed to be correct. Although all reasonable care has been taken to ensure the contents of the Review are accurate, DNH and/or its Directors, employees, are not responsible for the correctness, usefulness, reliability of same. DNH may act as a Broker in the investments which are the subject of this document or related investments and may have acted on or used the information contained in this document, or the research or analysis on which it is based, before its publication. DNH and/or its principal , their respective Directors, or Employees may also have a position or be otherwise interested in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are inaccurate and unreliable. You hereby waive irrevocably any rights or remedies in law or equity you have or may have against DNH with respect to the Review and agree to indemnify and hold DNH and/or its principal, their respective directors and employees harmless to the fullest extent allowed by law regarding all matters related to your use of this Review. DNH Financial is a fully owned subsidiary of Environmental Resources Investment PLC (ERI).

S-ar putea să vă placă și

- The Index Revolution: Why Investors Should Join It NowDe la EverandThe Index Revolution: Why Investors Should Join It NowÎncă nu există evaluări

- Market Watch Daily 05.07.2013 DNHDocument1 paginăMarket Watch Daily 05.07.2013 DNHRandora LkÎncă nu există evaluări

- DNH Market Watch Daily 13.09Document1 paginăDNH Market Watch Daily 13.09LBTodayÎncă nu există evaluări

- DNH Market Watch Daily 21.09Document1 paginăDNH Market Watch Daily 21.09LBTodayÎncă nu există evaluări

- DNH Market Watch Daily 14.09Document1 paginăDNH Market Watch Daily 14.09LBTodayÎncă nu există evaluări

- Market Watch Daily 28.06.2013Document1 paginăMarket Watch Daily 28.06.2013Randora LkÎncă nu există evaluări

- DNH Market Watch Daily 15.09Document1 paginăDNH Market Watch Daily 15.09LBTodayÎncă nu există evaluări

- DNH Market Watch Daily 05.10Document1 paginăDNH Market Watch Daily 05.10LBTodayÎncă nu există evaluări

- DNH Market Watch Daily 22.09Document1 paginăDNH Market Watch Daily 22.09LBTodayÎncă nu există evaluări

- DNH Market Watch Daily 20.10Document1 paginăDNH Market Watch Daily 20.10LBTodayÎncă nu există evaluări

- Market Watch Daily 05.12.2012Document1 paginăMarket Watch Daily 05.12.2012Randora LkÎncă nu există evaluări

- Market Watch Daily 14.10Document1 paginăMarket Watch Daily 14.10LBTodayÎncă nu există evaluări

- DNH Market Watch Daily 27.10.2011Document1 paginăDNH Market Watch Daily 27.10.2011LBTodayÎncă nu există evaluări

- Market Watch Daily 29-07-2011Document1 paginăMarket Watch Daily 29-07-2011Inde Pendent LkÎncă nu există evaluări

- Market Watch Daily 20.01.2014Document1 paginăMarket Watch Daily 20.01.2014Randora LkÎncă nu există evaluări

- Market Watch Daily 10.09.2013Document1 paginăMarket Watch Daily 10.09.2013Randora LkÎncă nu există evaluări

- Market Outlook 22nd November 2011Document4 paginiMarket Outlook 22nd November 2011Angel BrokingÎncă nu există evaluări

- IDFC AnandRathi 050211Document2 paginiIDFC AnandRathi 050211SarweinÎncă nu există evaluări

- Market Outlook 24th November 2011Document3 paginiMarket Outlook 24th November 2011Angel BrokingÎncă nu există evaluări

- Market Watch Daily 27.09.2013Document1 paginăMarket Watch Daily 27.09.2013Randora LkÎncă nu există evaluări

- Starhill Global REIT Ending 1Q14 On High NoteDocument6 paginiStarhill Global REIT Ending 1Q14 On High NoteventriaÎncă nu există evaluări

- Singtel - : No Myanmar, No ProblemDocument4 paginiSingtel - : No Myanmar, No Problemscrib07Încă nu există evaluări

- Market Outlook 11th January 2012Document4 paginiMarket Outlook 11th January 2012Angel BrokingÎncă nu există evaluări

- Daily Technical Report: Sensex (20666) / Nifty (6141)Document4 paginiDaily Technical Report: Sensex (20666) / Nifty (6141)angelbrokingÎncă nu există evaluări

- Market Outlook 13th March 2012Document4 paginiMarket Outlook 13th March 2012Angel BrokingÎncă nu există evaluări

- Market Outlook: Dealer's DiaryDocument4 paginiMarket Outlook: Dealer's DiaryAngel BrokingÎncă nu există evaluări

- Market Outlook 12th October 2011Document4 paginiMarket Outlook 12th October 2011Angel BrokingÎncă nu există evaluări

- Market Outlook 14th September 2011Document4 paginiMarket Outlook 14th September 2011Angel BrokingÎncă nu există evaluări

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 paginiSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069Încă nu există evaluări

- Market Outlook 26th August 2011Document3 paginiMarket Outlook 26th August 2011Angel BrokingÎncă nu există evaluări

- Market Outlook 27th September 2011Document3 paginiMarket Outlook 27th September 2011angelbrokingÎncă nu există evaluări

- Technical Format With Stock 17.09Document4 paginiTechnical Format With Stock 17.09Angel BrokingÎncă nu există evaluări

- 2013-7-9 DBS Lim&TanDocument6 pagini2013-7-9 DBS Lim&TanphuawlÎncă nu există evaluări

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 paginiSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069Încă nu există evaluări

- Market Outlook 5th January 2012Document3 paginiMarket Outlook 5th January 2012Angel BrokingÎncă nu există evaluări

- Technical Format With Stock 14.09Document4 paginiTechnical Format With Stock 14.09Angel BrokingÎncă nu există evaluări

- Daily Technical Report: Sensex (16719) / NIFTY (5068)Document4 paginiDaily Technical Report: Sensex (16719) / NIFTY (5068)Angel BrokingÎncă nu există evaluări

- Market Outlook 29th March 2012Document3 paginiMarket Outlook 29th March 2012Angel BrokingÎncă nu există evaluări

- Market Outlook 30th Decmber 2011Document3 paginiMarket Outlook 30th Decmber 2011Angel BrokingÎncă nu există evaluări

- Market Outlook 17.11.11Document3 paginiMarket Outlook 17.11.11Angel BrokingÎncă nu există evaluări

- Wilmar International: Outperform Price Target: SGD 4.15Document4 paginiWilmar International: Outperform Price Target: SGD 4.15KofikoduahÎncă nu există evaluări

- Market Outlook 28th December 2011Document4 paginiMarket Outlook 28th December 2011Angel BrokingÎncă nu există evaluări

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 paginiGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlÎncă nu există evaluări

- Hindustan Unilever 100610 01Document2 paginiHindustan Unilever 100610 01Kumar AnuragÎncă nu există evaluări

- Head and Shoulders Broken: Punter's CallDocument5 paginiHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluÎncă nu există evaluări

- Technical Report 15th March 2012Document5 paginiTechnical Report 15th March 2012Angel BrokingÎncă nu există evaluări

- Market Outlook 10th January 2012Document4 paginiMarket Outlook 10th January 2012Angel BrokingÎncă nu există evaluări

- JF - India 31 01 07 PDFDocument3 paginiJF - India 31 01 07 PDFstavros7Încă nu există evaluări

- Ongleaf Artners Unds: Emi-Nnual EportDocument48 paginiOngleaf Artners Unds: Emi-Nnual Eporteric695Încă nu există evaluări

- Daily Technical Report: Sensex (16649) / NIFTY (5050)Document4 paginiDaily Technical Report: Sensex (16649) / NIFTY (5050)Angel BrokingÎncă nu există evaluări

- Daily Technical Report: Sensex (17618) / NIFTY (5345)Document4 paginiDaily Technical Report: Sensex (17618) / NIFTY (5345)Angel BrokingÎncă nu există evaluări

- Market Outlook 12th January 2012Document4 paginiMarket Outlook 12th January 2012Angel BrokingÎncă nu există evaluări

- Market Outlook 7th September 2011Document3 paginiMarket Outlook 7th September 2011Angel BrokingÎncă nu există evaluări

- Daily Technical Report, 24.07.2013Document4 paginiDaily Technical Report, 24.07.2013Angel BrokingÎncă nu există evaluări

- Press Release: Contact: Ric Shadforth, State StreetDocument3 paginiPress Release: Contact: Ric Shadforth, State Streetapi-127423253Încă nu există evaluări

- Daily Technical Report, 03.04.2013Document4 paginiDaily Technical Report, 03.04.2013Angel BrokingÎncă nu există evaluări

- Daily Technical Report: Sensex (17489) / NIFTY (5306)Document4 paginiDaily Technical Report: Sensex (17489) / NIFTY (5306)angelbrokingÎncă nu există evaluări

- Technical Format With Stock 20.09Document4 paginiTechnical Format With Stock 20.09Angel BrokingÎncă nu există evaluări

- Daily Technical Report, 10.07.2013Document4 paginiDaily Technical Report, 10.07.2013Angel BrokingÎncă nu există evaluări

- Market Outlook 9th April 2012Document3 paginiMarket Outlook 9th April 2012Angel BrokingÎncă nu există evaluări

- Daily Trade Journal - 04.03Document7 paginiDaily Trade Journal - 04.03ran2013Încă nu există evaluări

- Daily Trade Journal - 06.03Document7 paginiDaily Trade Journal - 06.03ran2013Încă nu există evaluări

- Daily Exchange Rates-CommiDocument1 paginăDaily Exchange Rates-Commiran2013Încă nu există evaluări

- Daily Exchange Rates-Commi 28Document1 paginăDaily Exchange Rates-Commi 28ran2013Încă nu există evaluări

- Daily Trade Journal - 05.03Document7 paginiDaily Trade Journal - 05.03ran2013Încă nu există evaluări

- Current T Bill Press Release 25-03-2013Document1 paginăCurrent T Bill Press Release 25-03-2013Randora LkÎncă nu există evaluări

- NBF Sector - February 2013Document27 paginiNBF Sector - February 2013ran2013Încă nu există evaluări

- Daily Trade Journal - 01.03Document7 paginiDaily Trade Journal - 01.03ran2013Încă nu există evaluări

- Daily Exchange Rates-Commi 28Document1 paginăDaily Exchange Rates-Commi 28ran2013Încă nu există evaluări

- Daily Trade Journal - 28.02Document13 paginiDaily Trade Journal - 28.02ran2013Încă nu există evaluări

- Daily Exchange Rates-Commi 28Document1 paginăDaily Exchange Rates-Commi 28ran2013Încă nu există evaluări

- Daily Exchange Rates-20092011Document1 paginăDaily Exchange Rates-20092011LBTodayÎncă nu există evaluări

- Legal OpinionDocument63 paginiLegal Opinionran2013Încă nu există evaluări

- CCPI Feb 2013Document2 paginiCCPI Feb 2013ran2013Încă nu există evaluări

- Daily Exchange Rates-20092011Document1 paginăDaily Exchange Rates-20092011LBTodayÎncă nu există evaluări

- Daily Trade Journal - 27.02Document12 paginiDaily Trade Journal - 27.02ran2013Încă nu există evaluări

- Daily Exchange Rates-Commi 28Document1 paginăDaily Exchange Rates-Commi 28ran2013Încă nu există evaluări

- Daily Trade Journal - 21.02Document12 paginiDaily Trade Journal - 21.02ran2013Încă nu există evaluări

- Daily Trade Journal - 22.02Document12 paginiDaily Trade Journal - 22.02ran2013Încă nu există evaluări

- Daily Exchange Rates-20092011Document1 paginăDaily Exchange Rates-20092011LBTodayÎncă nu există evaluări

- DIAL-Earnings Note 2012-Faster and Cheaper Data-BUYDocument6 paginiDIAL-Earnings Note 2012-Faster and Cheaper Data-BUYran2013Încă nu există evaluări

- Daily Trade Journal - 20.02Document12 paginiDaily Trade Journal - 20.02ran2013Încă nu există evaluări

- Current T Bill Press Release 25-03-2013Document1 paginăCurrent T Bill Press Release 25-03-2013Randora LkÎncă nu există evaluări

- Daily Trade Journal - 26.02Document13 paginiDaily Trade Journal - 26.02ran2013Încă nu există evaluări

- CAL UPI Introduction - 20 Feb 2013Document8 paginiCAL UPI Introduction - 20 Feb 2013ran2013Încă nu există evaluări

- Plantations Sector 19.02Document3 paginiPlantations Sector 19.02ran2013Încă nu există evaluări

- Results Update - Dec 2012 20.02Document15 paginiResults Update - Dec 2012 20.02ran2013Încă nu există evaluări

- Daily Exchange Rates-20092011Document1 paginăDaily Exchange Rates-20092011LBTodayÎncă nu există evaluări

- Results Update - Dec 2012 19.02Document14 paginiResults Update - Dec 2012 19.02ran2013Încă nu există evaluări

- Daily Trade Journal - 19.02Document13 paginiDaily Trade Journal - 19.02ran2013Încă nu există evaluări

- Dummies Guide To Writing A SonnetDocument1 paginăDummies Guide To Writing A Sonnetritafstone2387100% (2)

- Deadlands - Dime Novel 02 - Independence Day PDFDocument35 paginiDeadlands - Dime Novel 02 - Independence Day PDFDavid CastelliÎncă nu există evaluări

- Grave MattersDocument19 paginiGrave MattersKeith Armstrong100% (2)

- Test AmeeshDocument7 paginiTest AmeeshUdit DravidÎncă nu există evaluări

- Gamboa Vs Chan 2012 Case DigestDocument2 paginiGamboa Vs Chan 2012 Case DigestKrissa Jennesca Tullo100% (2)

- BirdLife South Africa Checklist of Birds 2023 ExcelDocument96 paginiBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajÎncă nu există evaluări

- Jaimini Astrology and MarriageDocument3 paginiJaimini Astrology and MarriageTushar Kumar Bhowmik100% (1)

- Panera Bread Company: Case AnalysisDocument9 paginiPanera Bread Company: Case AnalysisJaclyn Novak FreemanÎncă nu există evaluări

- Chapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFDocument58 paginiChapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFAbdul Rahman SholehÎncă nu există evaluări

- DLL LayoutDocument4 paginiDLL LayoutMarife GuadalupeÎncă nu există evaluări

- Pre T&C Checklist (3 Language) - Updated - 2022 DavidDocument1 paginăPre T&C Checklist (3 Language) - Updated - 2022 Davidmuhammad farisÎncă nu există evaluări

- Lista Agentiilor de Turism Licentiate Actualizare 16.09.2022Document498 paginiLista Agentiilor de Turism Licentiate Actualizare 16.09.2022LucianÎncă nu există evaluări

- Berrinba East State School OSHC Final ITO For Schools Final 2016Document24 paginiBerrinba East State School OSHC Final ITO For Schools Final 2016hieuntx93Încă nu există evaluări

- Genomics - FAODocument184 paginiGenomics - FAODennis AdjeiÎncă nu există evaluări

- Project TitleDocument15 paginiProject TitleadvikaÎncă nu există evaluări

- Rele A Gas BuchholtsDocument18 paginiRele A Gas BuchholtsMarco GiraldoÎncă nu există evaluări

- Syllabus Biomekanika Kerja 2012 1Document2 paginiSyllabus Biomekanika Kerja 2012 1Lukman HakimÎncă nu există evaluări

- K3VG Spare Parts ListDocument1 paginăK3VG Spare Parts ListMohammed AlryaniÎncă nu există evaluări

- Entrep Bazaar Rating SheetDocument7 paginiEntrep Bazaar Rating SheetJupiter WhitesideÎncă nu există evaluări

- Grafton Business Services 2023Document61 paginiGrafton Business Services 2023Vigh ZsoltÎncă nu există evaluări

- Skype OptionsDocument2 paginiSkype OptionsacidwillÎncă nu există evaluări

- 60617-7 1996Document64 pagini60617-7 1996SuperhypoÎncă nu există evaluări

- Rebecca Young Vs CADocument3 paginiRebecca Young Vs CAJay RibsÎncă nu există evaluări

- Church A Rchitecture Abbey: Throne" Ecclesia Cathedralis (In Latin)Document18 paginiChurch A Rchitecture Abbey: Throne" Ecclesia Cathedralis (In Latin)Pat GeronzÎncă nu există evaluări

- Field Assignment On Feacal Sludge ManagementDocument10 paginiField Assignment On Feacal Sludge ManagementSarah NamyaloÎncă nu există evaluări

- International Covenant On Economic Social and Cultural ReportDocument19 paginiInternational Covenant On Economic Social and Cultural ReportLD MontzÎncă nu există evaluări

- ListeningDocument2 paginiListeningAndresharo23Încă nu există evaluări

- Motion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALDocument157 paginiMotion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALOdzer ChenmaÎncă nu există evaluări

- Narrative ReportDocument6 paginiNarrative ReportAlyssa Marie AsuncionÎncă nu există evaluări

- Grossman 1972 Health CapitalDocument33 paginiGrossman 1972 Health CapitalLeonardo SimonciniÎncă nu există evaluări