Documente Academic

Documente Profesional

Documente Cultură

Inflation Affecting NSU Students

Încărcat de

Md.Shahriar HaqueDescriere originală:

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Inflation Affecting NSU Students

Încărcat de

Md.Shahriar HaqueDrepturi de autor:

Formate disponibile

P age |1

Introduction

Inflation is when the prices of most goods and services continue to go upward. When this happens, North South University (NSU) students standard of living falls. That is because each taka buys less, so they have to spend more to get the same goods and services. It usually hurts their buying power. The topic of my research is how inflation is affecting NSU students. Now NSU students are facing the most expensive academic year to date, with an inflation rate monthly around 8.56 percent and average of monthly inflation rate is 10.76%. Consumer price index (CPI) of general index in June is 270.43, food index is 296.74, non food index 236.16. (Bangladesh Bureau of statistics, 2012, June, p. 1). The rising cost of transportation, food prices, stationary prices, and maintaining good health, personal savings, individual welfare, are terrible experience. Also, current inflation does not match with increased jobs. Students are experiencing a mental dissatisfaction overall. I have chosen this topic because I was passionate to know the impact of such experiences on NSU

P age |2

students; whether it is difficult to survive or not for them; how their parents are responding by rising cost. I have found answers to such questions through my research work. There are several reasons why inflation affecting NSU students. Ten years ago, when inflation was still low, students were satisfied with their desired items. But now many students are seriously affected by price hike. Inflation is affecting to student's life about their living, their study, their transportation, their food, their savings, their part time job, their salary, their education loan and their spirit.

First of all, students living become more difficult because of rapidly rising price. With small amount of support money from their parents, students hard to live well. The cost of living is rising and students quality of life is lower. In case of daily meal how students can buy meat or fish with high price? Because of that, they use vegetable or even instant noodle instead of daily food. Besides, rent-house electricity, water fee are all increase. To have a good flat in this time in Bashundhara R/A is rather difficult for some students. Therefore, they have to live in small, old, bad condition flats; sometimes they have a lot of uninvited guests like mosquito. Moreover, monthly student must pay for electricity, water with high prices, depending on the price stipulated by the landlord. Eating not enough nutrients, living in bad condition flats also caused students poor health. Learning requires pretty much work of the mind so if lack of nutrients, students hardly to focus on. The higher the inflation, the lower the living of standard.

In addition to this, inflation also greatly affect to students studying. Because of rising of the cost of living, many families cannot support for their children well. The tuition fee, books, study tools are all increasing. How students can absolutely focus on study if they eat not enough

P age |3

nutrition, lack of money to buy books, study tools. Doing part time job is the best solution for a lot of students. They can both learn and do part time job or do tuition. However, spending a lot of time to earn money that affects a lot to their health as well as their study. After hard study period, they continue to do part time job and come back their rent house in tired. And they may be failed in the final exam.

Finally, inflation not only affect to students living and study, inflation also affect to their spirit. With a lot of students, to support for their study is not easy. Parents have to worry and work rather hard. Especially, in the context of high inflation with the rapidly rising of everything, they have more difficulty. A lot of students are broken heart to receive value money from hard hands of their parents. How can they do not love as well as worry about their parents. Some students even think that they are a burden for their parents. They do their best to study, others do part time job; however, the others cannot focus on study and they fail in the exam.

P age |4

Background

What is Inflation?

The measure of price increases within a set of goods and services over a period of time is known as inflation. According to Butler, Inflation is the percentage of change in price of goods and services (para. 4).

The Economics of Glossary defines inflation as: Inflation is an increase in the price of a basket of goods and services that is representative of the economy as a whole (what is inflation, para.1).

P age |5

A similar definition of inflation can be found in Economics by Parkin and Bade: Inflation is an upward movement in the average level of prices. Its opposite is deflation, a downward movement in the average level of prices. The boundary between inflation and deflation is price stability (para. 2).

Amadeo (2012) reported that, Inflation is when the prices of most goods and services continue to creep upward. When this happens, your standard of living falls. That's because each dollar buys less, so you have to spend more to get the same goods and services (what is inflation, para.1).

So inflation is defined as a sustained increase in the general level of prices for goods and services. It is measured as an annual percentage increase. As inflation rises, every taka you own buys a smaller percentage of a good or service.

The value of a taka does not stay constant when there is inflation. The value of a taka is observed in terms of purchasing power, which is the real, tangible goods that money can buy. When inflation goes up, there is a decline in the purchasing power of money. For example, if the inflation rate is 2% annually, then theoretically a 1 taka pack of chocolate will cost 1.02 taka in a year. After inflation, your taka can't buy the same goods it could beforehand. Inflation affecting following areas: Gas/Transportation Food Employment Housing

P age |6

Entertainment

There are several variations on inflation:

Deflation is when the general level of prices is falling. This is the opposite of inflation. Hyperinflation is unusually rapid inflation. In extreme cases, this can lead to the breakdown of a nation's monetary system. One of the most notable examples of hyperinflation occurred in Germany in 1923, when prices rose 2,500% in one month.

Stagflation is the combination of high unemployment and economic stagnation with inflation. This happened in industrialized countries during the 1970s, when a bad economy was combined with OPEC raising oil prices.

Causes of Inflation

Economists wake up in the morning hoping for a chance to debate the causes of inflation. There is no one cause that's universally agreed upon, but the theories given below are generally accepted:

Demand-Pull Inflation Refers to the idea that the economy actual demands more goods and services than available. This shortage of supply enables sellers to raise prices until equilibrium is put in place between supply and demand. This theory can be summarized as "too much money chasing too few goods". In other words, if demand is growing faster than supply, prices will increase. This usually occurs in growing economies.

P age |7

Cost-Push Inflation Also known as "supply shock inflation", suggests that shortages or shocks to the available supply of a certain good or product will cause a ripple effect through the economy by raising prices through the supply chain from the producer to the consumer. You can readily see this in oil markets. When OPEC reduces oil supply, prices are artificially driven up and result in higher prices at the pump. When companies' costs go up, they need to increase prices to maintain their profit margins. Increased costs can include things such as wages, taxes, or increased costs of imports.

Money supply- Plays a large role in inflationary pressure as well. Monetarist economists believe that if the Bangladesh Bank does not control the money supply adequately, it may actually grow at a rate faster than that of the potential output in the economy, or real GDP. The belief is that this will drive up prices and hence, inflation. Low interest rates correspond with high levels of money supply and allow for more investment in big business and new ideas which eventually leads to unsustainable levels of inflation as cheap money is available.

Inflation can artificially be created through a circular increase in wage earners demands and then the subsequent increase in producer costs which will drive up the prices of their goods and services. This will then translate back into higher prices for the wage earners or consumers. As demands go higher from each side, inflation will continue to rise.

P age |8

The Link between Inflation and Money:

Moffat reported that, because inflation is a rise in the general level of prices, it is intrinsically linked to money, as captured by the often heard refrain "Inflation is too many dollars chasing too few goods" (para. 3).

According to him, inflation is caused by a combination of four factors:

1. The supply of money goes up. 2. The supply of other goods goes down. 3. Demand for money goes down. 4. Demand for other goods goes up.

Amadeo (2012) suggested that, Inflation has another bad side -effect...once people start to expect inflation, they will spend now rather than later. That's because they know things will only cost more lately. This consumer spending heats up the economy even more, leading to more and more inflation. This situation is known as spiraling inflation because it spirals out of control (para. 4).

What is Consumer Price Index:

An inflationary indicator that measures the change in the cost of a fixed basket of products and services, including housing, electricity, food, and transportation. The CPI is published monthly, also called cost-of-living index.

P age |9

CPI is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. The CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them; the goods are weighted according to their importance. Changes in CPI are used to assess price changes associated with the cost of living.

How does inflation affect students:

Kershaw (2008) pointed out that, Students spend a higher share of their total budget on items which have risen in price fastest over recent years - goods such as food and drink, clothing, tobacco, personal care products, housing and travel, plus tuition fees (para. 3). According to Butler, Inflation mainly affects interest rates and wages. However, in recent years wages have not followed inflatio n rates as they previously did (para. 7).

As students the main affects you will see are:

Rise in prices: the cost of goods will go up and things such as your weekly shop will unfortunately be more expensive

Rise in wages: if you are looking for part time work whilst studying then you may see employers offering higher wages.

Unfortunately your maintenance loan does not follow inflation at its current rate but it may rise next year. Your student debt for both tuition fees and maintenance follows

P a g e | 10

inflation as its base of interest which is unfortunate. Even though a student loan is not meant to have interest the inflation will affect it and when employers are not increasing wages at the rate of inflation it leaves graduates worse off.

Effects of inflation:

1. Hoarding (students will try to get rid of cash before it is devalued, by hoarding food and other commodities creating shortages of the hoarded objects). 2. Distortion of relative prices (usually the prices of goods go higher, especially the prices of commodities). 3. Existing creditors will be hurt (because the value of the money they will receive from their borrowers later will be lower than the money they gave before). 4. Fixed income recipients will be hurt (because while inflation increases, their income doesnt increase, and therefore their income will have less value o ver time).

P a g e | 11

5. Lowers national saving (when there is a high inflation, saving money would mean watching your cash decrease in value day after day, so students tend to spend the cash on something else). 6. Currency debasement (which lowers the value of a currency, and sometimes cause a new currency to be born) 7. Rising prices of imports (if the currency is debased, then its purchasing power in the international market is lower).

How to survive against inflation:

Here are some trivial yet useful ways for students to beat inflation.

Cut spending It may not seem ideal but you will have to cut spending on those things that you would class as a treat

Buy in bulk If you know that you eat a lot of something everyday then why not buy in bulk before prices rise.

Invest in commodities Invest in durable goods or commodities rather than in money. Invest in things that you're going to use anyway and will serve you for a long time. Commodities like gold rise in price all the time and as long as you have a better selling strategy. (but be careful as it is risky)

Saving The saving rates may be lower than inflation but if you put money into a savings account then you will be losing less than if you do not. It has the least risk and a safe return.

Look out for student discounts

P a g e | 12

Be wise when holding cash, whether in your home or in your savings account, if youre earning 5% interest on the money you have in your bank, and inflation rate is 10% then youre in reality losing 5% and not earning anything.

Manage wisely your recurring monthly bills such as (mobile phone bills, cable TV), it would help to reduce them or eliminate some of them.

Same goes with ephemeral items (movies, restaurants, hotel rooms...) theyre not bad if you spend money on them in moderation.

Ask yourself, do I really need these things I am spending my money on? Think how much and how often you will need something before buying it.

Use the money saving tips such as: you need to reduce your consumption of things that are rising rapidly in price (example, gas) without having to reduce your consumption of goods that are rising less rapidly or even falling in price (example, clothes).

Buy only what you need, especially objects that have multi-tasks, and are considered durable goods.

P a g e | 13

Research Questions

I was always trying to know about the effect of inflation on NSU students. I have tried to find the reason behind how they are affected. Actually I tried to look on some specific questions or basic question about the impact of Inflation on NSU students. The questions are:

1. What do you mean by inflation as an NSUers? 2. Which factor is affecting you most? 3. Do you feel that cost of living pay increases have helped rising prices? 4. Are you concern by overall price hike? 5. Which are you doing when inflation is affecting you? 6. Are you mentally dissatisfied by current price hike? 7. If you are a part time job holder or a private tutor, do you face any salary problems? 8. How your family is treating with you with rising cost? 9. What do you think who is responsible for the overall price hike? 10. How do you adjust inflation in your daily life?

P a g e | 14

11. As a student of NSU, do you have any specific policies to survive against inflation? These questions above guided me to design my questionnaire.

P a g e | 15

Hypothesis

Inflation is always creating an adverse outcome for students. From my research, I will able to find that students from different backgrounds are feeling difficulties to survive and most of them are mentally dissatisfied because their parents are creating pressure on them to not spend on unnecessary things. Since most students in NSU are from affluent families, I will also able to find that they are affected by certain factors such as price hike of food, transportation, living, entertainment etc. Also their salary of part time job and tuition do not fulfill their wants and are not inflation adjusted.

It is expected that most students are mature enough to realize that it is seriously affecting their daily activities. I also believe that students will try to do everything to adjust their lifestyle efficiently and optimally.

P a g e | 16

Methodologies

For my primary research, I have conducted a survey of representative sampling of the North South University student. To that end I designed a questionnaire with different types of questions so as to obtain a range of useful data which helped me to answer my research questions. I made 11 questions for my survey. Every question consisted with minimum four options. I surveyed on twenty people. From them twelve were male and eight were female. They are from CSE, EEE, Finance, Economics, Accounting, and Marketing background respectively. All of them were between 21-23 years of old. First I tried to know if they know the meaning of inflation or not. Because my research was related to those people who know about inflation and seriously affected by it.

For my secondary research, I mainly used archives stored on the internet. I also used the online newspapers to gather information about my research and analysis. However, the internet gave me most of the useful information for my secondary research.

P a g e | 17

Data Presentation and Analysis

1. Meaning of Inflation

14

12 10 Total Number of students 8 6 4 2 0 a. Rising overall price level b.Low purchasing c. Falling of living power standards d.Any other option 5% 5% 25% 65%

Option

Question 1: what do you mean by inflation as an NSUers?

This question was made to answer what NSUers mean by inflation.

This question

yielded some interesting results. The results showed that 65% of the NSU students have opted rising overall price level as a meaning of inflation. That means students are facing price hike in all areas like food, transportation, living cost, personal expenditure and entertainment. So NSUers are worried about this and price level has risen significantly. It matches my hypothesis. 25% of NSUers respond as it is a low purchasing power, it means same amount of money give them less good and 5% have chosen inflation as falling of living standards. That shows that, students of NSU are unable to purchase their necessary item because their purchasing powers have fallen. Only few people said that inflation is falling of living standard.

P a g e | 18

2. Factor affecting most

10 9 8 7 Total number of students 6 5 4 3 2 1 30% 45%

25%

0% a. High b. High food cost c. High stationary d. High living cost transportation cost cost Option

Question 2: Which factor is affecting you most? The analysis to the answers to this question showed that 45% of the students are affected by high living cost. That is because many students are living in the student mess in Bashundhara R/A. When students are feeling other financial strains, expensive housing just adds another level of stress to their lives. As all we know that this area is one of the aristocratic areas in Bangladesh. So rent of the flat is quite high. Another 30% students are seriously affected by high food cost. It may be due to demand-pull inflation. Also 25% of the students are affected by high transportation cost. These students are living outside Bashundhara and affected by high fuel price, bus fare, and auto rickshaw fare. No one respond with high stationary cost. That means prices of education items have not risen significantly.

P a g e | 19

3.Concern by overall price hike

16 14 12 10 Total Number of students 8 75%

6

4 2 0 a. Most of the time. b.But mostly transportation price hike. 10% 0 c. I am pretty much d.Actually it is a affluent so I dont natural process care. 15%

Option

Question 3: Are you concern by overall price hike?

The responses from this question shows that 75% students are seriously concerned by price hike most of the time. So price hike is a daily phenomenon and big problem for students of NSU. As all we know that NSUers belong to affluent family, but only 0% respond that they are affluent, which is quite interesting. However, 15% students respond that it is a natural process. That means these students are not aware of price hike. They dont care inflation in their daily life, and happy about the existing price which go against my hypothesis.

P a g e | 20

4. Action after inflation

12 10 8 Total number of students 6 4 2 0 a. I am buying cheaper foods. b. I am driving less or using cheaper transportation. 0 c. I am buying cheaper books. d. I have not done anything yet 15% 35% 50%

Option

Question 4: What are you doing when inflation is affecting you? In response to this question, 50% students respond that they have not done anything yet. It indicates that they belong to the upper class family. It goes against my hypothesis and also totally contradictory to question 3, option c. Another 35% of the students respond that they are buying cheaper foods, which means food cost has risen significantly and students are out of their budget to purchase necessary foods. Only 15% students are driving less due to CNG or petroleum price skyrocketed. Many students are using local bus for cheaper transportation, so their living standard falls. However students are maintaining their regular pattern of purchasing costly books.

P a g e | 21

5. Mental dissatisfaction due to current price hike

14 12 10 Total number of students 8 6 4 2 0 0 a. My expenditures b. My parents are c. Sometime I have d. I am familiar with are out of my budget creating pressure on to borrow money. it. me to spend less. Option 20% 65%

15%

Question 5: Are you mentally dissatisfied by current price hike? The responses from this question strengthened my hypothesis of this research. Here 65% of the students respond that their expenditure is out of their budget. Another 15% respond that their parents are creating pressure on them. So these two options indicate that students are mentally dissatisfied by current price hike and strains on their budget means less for entertainment. In contrast, nobody is interested to borrow money.

P a g e | 22

6.Salary problems

8 7 35% 35%

6

5 Total number of 4 students 3 2 1 0 a. It is not inflation b. It does not fulfill adjusted. my wants. c. My salary is sufficient. 5%

25%

d. My salary has no relation with inflation.

Option

Question 6: If you are a part time job holder or tutor, do you face any salary problem?

The responses from this question are mixed. Exactly 35% of the NSUers respond that it is not inflation adjusted. For maintaining living standards, these students think that their salary is not inflation adjusted. Another 35% of the NSUers respond that it does not fulfill their wants, because most of the NSU students expenditure pattern is high. In both cases it indicates that their salary is insufficient. 25% of the NSUers respond that their salary has no relation with inflation. Indicates that their salary is not affected by inflation. Many students while joining NSU could very well afford high standard of living, thats why their salary matters nothing for increasing rate of inflation.

P a g e | 23

7. Your family responses

10 9 8 7 6 Total number of 5 students 4 3 2 1 0 45%

30% 20%

5%

a. They are giving b. They are c. They have d. They have me more money to influencing me to do ordered me to not completely denied adjust. a job or tuition so spend on me to give extra that I can manage unnecessary things. money. my own expenditure. Option

Question7: How your family is treating with you with rising cost?

The analysis to the answer to this question shows that, 45% of the students respond that their parents have ordered them to not spend on unnecessary things. It indicates that unnecessary spending may lead to budget deficit. Other 20% students respond with doing tuition or part-time job. Only 5% students are not getting extra money from parents. In case of option b, c and d, parents are seriously influencing students to make adjustment to their own. In contrast, 30% of the students respond that their parents are giving them more money to adjusts, which indicate that their parents are not affected by current price hike. It goes against my hypothesis.

P a g e | 24

8. Responsible for price hike

16 14 12 10 Total number of students 8 6 4 2 0 a. Governments, b. Central bank, c. Producers or industry owners 5% 0 d. No one is responsible 25% 70%

Option

Question 8: What do you think who is responsible for overall price hike?

Here, 70% students respond that government is mainly responsible for overall price hike. Government could not restrict the syndicate in hiking the price. They are unable to control demand-pull and cost-push inflation. So everyday price is increasing at an increasing rate, but government is unable to regulate price. Another 25% students think that central bank is mainly responsible due to application of wrong monetary and fiscal policy. Also, if central bank does not control the money supply adequately, it may actually grow at a rate faster than that of the potential output in the economy, or real GDP. The belief is that this will drive up prices and hence, inflation. In contrast, 5% students think that it is the businessman or industry owners who unethically raise prices to maximize their profit even in the month of Ramadan. Nobody choose that it is a natural process, which matches my hypothesis.

P a g e | 25

9. Adjusting inflation in your daily life

12 10 8 Total number of students 6 4 2 0 a. Spending less and saving more. b. Doing job or tuition. c. Demanding more money from parents. d.Any other 20% 55%

15%

10%

Option

Question 9: How do you adjust inflation in your daily life? The analysis of this question answer is that, 55% students respond with spending less and saving more. Indicate that they are suffering problem in case of their budget. They have stopped spending more and saving for future benefit. So they are going to have to change their lifestyles and find new strategies for meeting their basic needs. Another 20% respond with doing job or tuition. That means to maintain their daily life, they need more money. So they are earning more money to adjust with inflation. Other 15% students respond that they are demanding more money from parents because they are not interested to do a job or do not want to spend less. It also indicates that their parents have enough money to adjust with inflation. In contrast, 10% students respond with other. But they failed to mention how they are adjusting.

P a g e | 26

Summary of Research Findings

Through my research, I had hoped to conclude that the current price hike is seriously affecting NSU students. Over the course of my research I have found that the results show that my hypothesis was correct to a great extent. The primary research that I conducted suggested that though most of the NSU students are affluent but current price hike is affecting all type of students. It is because there is an opportunity cost of spending and holding money. I also found that the recommendations most people are very much concern about the price hike and would like to do job or tuition. Through my secondary research, I observed that inflation is different types and has different reasons. For instance, the government is responsible for demand-pull and cost-pull inflation by not regulating prices regularly and central is responsible for excessive money supply which leads to inflation. Also to survive against inflation, students can adjust inflation by adopting specific polices. Overall, the conclusion that can be drawn is the hypothesis of this research paper is agreed upon by the majority of the respondents whereas negligible group of students are not agreed my hypothesis may be because of their own perception. Consequently, I would have to conclude that the findings of this research paper agree with the hypothesis.

P a g e | 27

Conclusion

In conclusion, price hike is a daily phenomenon and it is seriously affecting NSU students. First of all, the current price of food, transportation, and living has skyrocketed. Secondly, the government is unable to regulate the prices of necessary goods. This would distort the relative price of goods and impede the spending pattern of students. Hence, all this should be taken into consideration on an urgent basis. Through this research, it has shown that the students are very much concern by the current price hike. Economist failed to realize how the economy affects so many university students. Anything that happens to the economy greatly affects students life. When items become more expensive we feel the pinch. Finally, the general consensus is that, if this price rising trend is continued to the future then NSU students will be mentally dissatisfied because their parents will not able to adjust with inflation.

P a g e | 28

List of References

1. Amadeo, K. (2012, April). What is inflation. Retrieved from http://useeconomy.about.com/od/pricing/f/inflation.htm.

2. Kershaw, A. (2008, August). University students hit by inflation. The Independent. Retrieved from http://www.independent.co.uk/student/news/university-students-hit-by-inflation901123.html

3. Big inflation, small inflation affects university students. (2011, February). Retrieved from http://www.marshallparthenon.com/opinion/big-inflation-small-inflation-affects-universitystudents-1.2472026

4. Amadeo, K. (2012,April). How does inflation impact my life. Retrieved from http://useconomy.about.com/od/inflationfaq/f/infl_impact.htm

5. Moffat, M. (2012). What is inflation. Retrieved from http://economics.about.com/od/helpforeconomicsstudents/f/inflation.htm

6. Butler, J. (2012). How to beat against inflation. Retrieved from http://www.savethestudent.org/news/inflation-for-students.html

7. Inflation, Effects and How to Survive it. Retrieved from http://crisistimes.com/inflation.htm

P a g e | 29

S-ar putea să vă placă și

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5794)

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayDocument8 paginiDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayVeeraesh MSÎncă nu există evaluări

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- PESTLE Analysis of ChinaDocument4 paginiPESTLE Analysis of ChinaAmit Pathak67% (3)

- Public Expenditure PFM handbook-WB-2008 PDFDocument354 paginiPublic Expenditure PFM handbook-WB-2008 PDFThơm TrùnÎncă nu există evaluări

- Pub Rethinking Development GeographiesDocument286 paginiPub Rethinking Development Geographiesxochilt mendozaÎncă nu există evaluări

- 3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeDocument4 pagini3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeLab Lee0% (1)

- 2.3 Movie Time: Antonia TasconDocument2 pagini2.3 Movie Time: Antonia TasconAntonia Tascon Z.100% (1)

- Long Tom SluiceDocument6 paginiLong Tom SluiceJovanny HerreraÎncă nu există evaluări

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Document17 paginiGuide To Original Issue Discount (OID) Instruments: Publication 1212Theplaymaker508Încă nu există evaluări

- 3M Knowledge Management-Group 1Document22 pagini3M Knowledge Management-Group 1Siddharth Sourav PadheeÎncă nu există evaluări

- 8 Trdln0610saudiDocument40 pagini8 Trdln0610saudiJad SoaiÎncă nu există evaluări

- SGS Secured in TJ 5601 22084 Electric Original ReportDocument10 paginiSGS Secured in TJ 5601 22084 Electric Original ReportUsman NadeemÎncă nu există evaluări

- 2022 06 15 LT Hyderabad Metro Rail Unveils Metro Bazar ShoppingonthegoDocument2 pagini2022 06 15 LT Hyderabad Metro Rail Unveils Metro Bazar ShoppingonthegoKathir JeÎncă nu există evaluări

- CIVIL Green BuildingDocument17 paginiCIVIL Green Buildingyagna100% (1)

- Effect of Vishal Mega Mart On Traditional RetailingDocument7 paginiEffect of Vishal Mega Mart On Traditional RetailingAnuradha KathaitÎncă nu există evaluări

- TUT. 1 Regional Integration (Essay)Document2 paginiTUT. 1 Regional Integration (Essay)darren downerÎncă nu există evaluări

- An Iot Based Dam Water Management System For AgricultureDocument21 paginiAn Iot Based Dam Water Management System For AgriculturemathewsÎncă nu există evaluări

- Unit 1. Fundamentals of Managerial Economics (Chapter 1)Document50 paginiUnit 1. Fundamentals of Managerial Economics (Chapter 1)Felimar CalaÎncă nu există evaluări

- Construction Cost Analysis in Residential SectorDocument11 paginiConstruction Cost Analysis in Residential SectorRishikesh MishraÎncă nu există evaluări

- Installment Sales - PretestDocument2 paginiInstallment Sales - PretestCattleyaÎncă nu există evaluări

- Contoh Report TextDocument1 paginăContoh Report TextRandi naufÎncă nu există evaluări

- Advantages and Disadvantages of Shares and DebentureDocument9 paginiAdvantages and Disadvantages of Shares and Debenturekomal komal100% (1)

- Rethinking Social Protection Paradigm-1Document22 paginiRethinking Social Protection Paradigm-1herryansharyÎncă nu există evaluări

- Etoro Aus Capital Pty LTD Product Disclosure Statement: Issue Date: 31 July 2018Document26 paginiEtoro Aus Capital Pty LTD Product Disclosure Statement: Issue Date: 31 July 2018robert barbersÎncă nu există evaluări

- 11th 12th Economics Q EM Sample PagesDocument27 pagini11th 12th Economics Q EM Sample PagesKirthika RajaÎncă nu există evaluări

- New Economic Policy of IndiaDocument23 paginiNew Economic Policy of IndiaAbhishek Singh Rathor100% (1)

- Assertive Populism Od Dravidian PartiesDocument21 paginiAssertive Populism Od Dravidian PartiesVeeramani ManiÎncă nu există evaluări

- Mock Meeting Perhentian Kecil IslandDocument3 paginiMock Meeting Perhentian Kecil IslandMezz ShiemaÎncă nu există evaluări

- Internship Project BSLDocument58 paginiInternship Project BSLRajesh Kumar100% (1)

- Bookmakers NightmareDocument50 paginiBookmakers NightmarefabihdroÎncă nu există evaluări

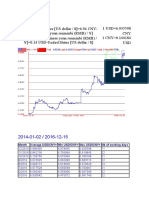

- Month Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysDocument3 paginiMonth Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysZahid RizvyÎncă nu există evaluări