Documente Academic

Documente Profesional

Documente Cultură

WSJ Story - Nokia's Supply Chain Shock

Încărcat de

Muhammad BilalDrepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

WSJ Story - Nokia's Supply Chain Shock

Încărcat de

Muhammad BilalDrepturi de autor:

Formate disponibile

Dow Jones Interactive Newsstand

Page 1 of 6

Browse Entire Paper

Return to Front Pages

Trial by Fire: A Blaze in Albuquerque Sets Off Major Crisis For Cell-Phone Giants --Nokia Handles Supply Shock With Aplomb as Ericsson Of Sweden Gets Burned --Was Sisu the Difference? By Almar Latour 01/29/2001 The Wall Street Journal Page A1 (Copyright (c) 2001, Dow Jones & Company, Inc.) Caused by a lightning bolt, the blaze in an Albuquerque, N.M., semiconductor plant burned for just 10 minutes last March. But far away in Scandinavia, the fire touched off a corporate crisis that shifted the balance of power between two of Europe's biggest electronics companies, both major players in the global electronics industry. Nokia Corp. of Finland and Telefon AB L.M. Ericsson of neighboring Sweden both bought computer chips from the factory, which is owned and operated by Philips Electronics NV of the Netherlands. The flow of those chips, crucial components in the mobile phones Nokia and Ericsson sell around the world, suddenly stopped. Philips needed weeks to get the plant back up to capacity. With mobile-phone sales booming around the world, neither Nokia nor Ericsson could afford to wait. But how the two companies responded to the crisis couldn't have been more different. Nokia , which was Europe's largest corporation by market capitalization at the time, met the challenge with a textbook crisis-management effort -- the kind companies of all stripes are finding essential as the pace of global commerce quickens. Nokia officials outside Helsinki noticed a glitch in the flow of chips even before Philips told the company there was a problem. Nokia 's chief supply troubleshooter, an intense 39-year-old Finn who runs marathons and plays rock guitar in his spare time, was on the case within days. Within two weeks, a team of 30 Nokia officials fanned out over Europe, Asia and the U.S. to patch together a solution. They redesigned chips on the fly, sped up a project to boost production, and flexed the company's muscle to squeeze more out of other suppliers in a hurry. "A crisis is the moment when you improvise," says Pertti Korhonen, Nokia 's top troubleshooter, a man whose electric-guitar collection includes two classic Fender Stratocasters. Ericsson, Sweden's largest company, with annual revenue of more than $29 billion, moved far more slowly. And it was less prepared for the problem in the first place. Unlike Nokia , the company didn't have other suppliers of the same chips, known as RFCs, for radio frequency chips. In the end, Ericsson came up millions of chips short of what it needed for a key new product. Company officials say they lost at least $400 million in potential revenue, although an insurance claim against the fire may make up some of it. "We did not have a Plan B," concedes Jan Ahrenbring, Ericsson's marketing director for consumer

http://nrstg1s.djnr.com/cgi-bin/DJInteractive?cgi=WEB_MNS_STORY&GJANum=414777410&page=newsst.../200

2/20/2001

Dow Jones Interactive Newsstand

Page 2 of 6

goods. On Friday, the fallout from the New Mexico fire and other component, marketing and design problems reached a climax, as Ericsson announced plans to retreat from the phone handset production market. It said it plans to outsource all its handset manufacturing to Flextronics International Ltd. Ericsson said a slew of component shortages, a wrong product mix and marketing problems sparked a loss of 16.2 billion kronor ($1.68 billion) last year for the company's mobile phone division. Overall, the company reported an operating loss of 1.5 billion kronor. The company will take an additional restructuring charge of eight billion kronor to finance further restructuring of its mobile-phone unit. The news sent Ericsson shares falling 13.5% and shook other high-tech stocks around the world. When the company revealed the damage from the fire for the first time publicly last July, its shares tumbled 14% in just hours. Since then, the shares have continued to fall along with the declining fortunes of many global telecommunications stocks. Ericsson shares are trading around 50% below where they were before the fire. The company has also overhauled the way it procures parts, including an effort to ensure that key components come from more than a single source. "We will never be exposed like this again," says Jan Wareby, who oversees the mobile-phone division as head of the company's consumer-goods unit. At Nokia , the main cost has been frayed nerves on the crisis team. Production stayed on target, despite the fire. And although the company's shares have fallen recently amid concern that demand for the mobile phones that make up its core business could decline, Friday's close of 40.25 euros ($37.21) was only about 18% below where the shares were trading the day before the fire. The company has successfully taken advantage of Ericsson's problems to cement its position as Europe's dominant technology company and boost its share of the world market in mobile-phone handsets. Nokia 's share is now about 30%, up from about 27% a year ago. That's more than double the share of its nearest rival in the handset market, Motorola Corp. And most of that gain came from Ericsson, whose share of the market has fallen to 9% from about 12% last year. Score another victory for the upstart Finns, who have wrangled for centuries with their larger Swedish neighbors. In part, the companies' contrasting responses to the fire reflect the national character of the countries that spawned the two companies. Cautious and comfortable in groups, Swedes often move together. Finns, on the other hand, have a reputation for individualistic derring-do. During the short Nordic summer, for example, both Finns and Swedes entertain themselves with boating expeditions across a 400-mile gulf of water that separates the two countries. Swedes often sail in convoys, while Finns tend to strike out solo. So it was with Nokia and Ericsson. "Ericsson is more passive. Friendlier, too. But not as fast," said one official who dealt with both companies in the fire's aftermath. This also isn't the first time in recent years that Finns, who haven't forgotten they were once under Swedish control, have outdone their neighbors. Swedish fans were so confident they would defeat the Finns in the 1995 world hockey championship that many sang a taunting victory song before the game. When Finland pulled off an upset, Finnish fans stood in the Stockholm arena and sang the song right back -- in Swedish, a language all Finns study in school. Nokia 's esprit de corps -- employees call themselves "Nokians" -- grows out of that same Finnish pluck. Born as a producer of wood pulp in 1865, Nokia has grown to become one of the world's leading electronics concerns with revenue of roughly $19.9 billion for 1999. More than 70% of its revenue comes from the sale of mobile phones, a product for which demand has been exploding from Europe to Japan. Founded 11 years after Nokia , Ericsson has evolved into a more engineering-heavy company. Aside from making mobile phones, which account for about 30% of its revenues, the company is a leader in commercializing complex technologies such as WAP, the software system that most European mobile phones use, and the so-called third-generation, or 3G, networks that may eventually put applications such as video on mobile phones.

http://nrstg1s.djnr.com/cgi-bin/DJInteractive?cgi=WEB_MNS_STORY&GJANum=414777410&page=newsst.../200

2/20/2001

Dow Jones Interactive Newsstand

Page 3 of 6

such as video on mobile phones. Competition between these two national standard-bearers can be intense. Nokia floats hot-air balloons stamped with its name over Stockholm, while Ericsson splashes its name on billboards all over Helsinki. But both companies went global decades ago -- which is why a thunderstorm 4,000 miles away mattered so much. At about 8 p.m. on March 17, the lightning bolt hit an electric line in New Mexico, causing power fluctuations throughout the state. It was either a sudden drop or surge in power -- authorities don't know which -- that started the blaze in Fabricator No. 22. Philips workers quickly smothered the flames, but the damage was done. Plastic ceiling lattices were strewn about the floor. Eight trays of silicon wafers, enough to produce chips for thousands of mobile phones, were stuck in the furnace where the fire was concentrated. All were ruined. Water damage, from sprinklers that went off throughout the plant, was extensive. Smoke particles had spread into the sterile room in the heart of the factory, contaminating the entire stock of millions of chips stored there. These tiny squares of etched silicon, smaller than the nail on a baby's pinkie, allow a mobile phone to do anything from sound amplification to finding radio frequencies, depending on how they're coded. It was immediately clear that repairing the damage would take at least a week, possibly longer. "It's as if the devil was playing with us," said one senior Philips manager who was involved in the clean-up. "Between the sprinklers and the smoke, everything that could go wrong did." Speeding the clean-up was crucial. Desperate executives in Amsterdam joked about showing up in Albuquerque with toothbrushes to help scrub the fabricator themselves. Instead, they assigned customers priority levels. Nokia and Ericsson, which together bought about 40% of the plant's radiofrequency-chip production, would get preferred treatment, the Philips executives decided. About 30 other smaller customers -- including such telecommunications heavyweights as Lucent Technology Inc., which buys chips from Philips for cards used to link computers into wireless networks -- would have to wait. Within days, Nokia officials in Finland already had their first inkling that something was amiss. Order numbers weren't adding up, company officials say. On Monday, March 20, Tapio Markki, Nokia 's chief component-purchasing manager, found out why. In a phone call to his office at Nokia headquarters in the city of Espoo, a Philips account representative informed him of the fire, saying the company had lost "some wafers" but the plant would be back to normal in a week, according to Mr. Markki. Philips officials say they were passing along the best information they had at the time, as quickly as possible. "We thought we would be back up after a week," said Ralph Tuckwell, a spokesman for Philips semiconductors. Mr. Markki wasn't terribly alarmed, but he relayed the news up Nokia 's chain of command to Mr. Korhonen, anyway. "We encourage bad news to travel fast," says Mr. Korhonen, who has worked at Nokia for 15 years. "We don't want to hide problems." Mr. Korhonen didn't anticipate a major problem, either. Still, he offered to send two Nokia engineers based in Dallas to the Philips plant to help. Philips, concerned that visitors might add to the confusion, declined. Mr. Korhonen then placed the five components made at the Philips plant on a "special monitor" list, something the company does dozens of times a year when demand for parts is running red-hot, as it was in March. Nokia officials began checking in with Philips officials daily, and sometimes more often, instead of the weekly monitoring the plant usually received. Nokia officials took advantage of other opportunities to drive their concerns home to Philips officials. At a meeting with Philips officials in Helsinki, Matti Alahuhta, president of Nokia 's mobile-phone division, broke from the scheduled meeting agenda to bring up the fire. "We need strong and determined action right now," he says he told the Philips executives in a conference room overlooking choppy waves in the Baltic Sea. Mr. Alahuhta and his colleagues didn't bang on the table or yell. But Philips executives immediately

http://nrstg1s.djnr.com/cgi-bin/DJInteractive?cgi=WEB_MNS_STORY&GJANum=414777410&page=newsst.../200

2/20/2001

Dow Jones Interactive Newsstand

Page 4 of 6

Mr. Alahuhta and his colleagues didn't bang on the table or yell. But Philips executives immediately recognized a characteristic Finnish curtness under pressure -- the Finns call it sisu -- that signaled they meant business. There weren't many pleasantries exchanged, according to one Philips executive who was in the room. "It was clear they were angry," he says. "You got the idea this was a matter of life or death for these guys. We respected that." As the number of chips coming from Albuquerque plummeted, Mr. Korhonen started to worry that Nokia had a major problem. On March 31, two weeks after the fire, his fears were confirmed when Mr. Markki interrupted a meeting in Helsinki to report that Philips was now saying weeks more would be needed to repair the plant, and months' worth of chip supplies would be disrupted. Mr. Korhonen grabbed a calculator: Nokia could find itself unable to produce just under four million handsets, the equivalent of more than 5% of the company's total sales at that time. And demand for handsets was booming like never before. "We don't need this," he cried, throwing his hands in the air. The two men started calling other executives they thought could help, and they scrambled to figure out who else made the parts produced in Albuquerque. Of the five components, two were indispensable. One of those was made by various suppliers around the globe. But the other, semiconductors known as Asic chips (for application specific integrated circuits), which regulate the radio frequency mobile phones use, were made only by Philips and one of its subcontractors. "This was a big, big problem," Mr. Korhonen remembers realizing. Nokia officials had learned the hard way that supply disruptions are more the rule than the exception in their business. A few years ago, the company lost out on millions of dollars in potential sales when snags slowed down production. Jorma Ollila, then president and chief executive, vowed it wouldn't happen again. He instituted the practice of aiming executive hit squads at bottlenecks and giving them authority to make on-the-ground decisions. Mr. Korhonen himself once spent months persuading jittery Japanese suppliers to ramp up production to meet Nokia 's aggressive forecasts. "I can't even recall how many karaoke songs I have sung," he says. Within hours of getting the bad news, Messrs. Korhonen and Markki assembled their team of supply engineers, chip designers and top managers in China, Finland and the U.S. to attack the problem. Meanwhile, across the Gulf of Bothnia in Stockholm, top Ericsson officials still hadn't realized what they were up against. Like Nokia , Ericsson officials first heard of the fire three days after it occurred. But that communication was "one technician talking to another," according to Roland Klein, head of investor relations for the company. "There were a few bits and pieces [of information before that], but nothing formal." "The fire was not perceived as a major catastrophe," says Pia Gideon, a spokeswoman for the company. When word came from Philips about how serious the problem really was, more time passed before middle managers at Ericsson fully briefed their bosses. Mr. Wareby, who directly oversees the mobile-phone division as head of consumer products for the company, didn't find out about the snag until early April. "It was hard to assess what was going on," he says. "We found out only slowly." By that time, Messrs. Korhonen and Markki of Nokia were on a plane heading for Philips headquarters in Amsterdam to meet with the company's chief executive. They were joined by Mr. Ollila, currently Nokia 's chairman and chief executive, who rerouted a return trip from the U.S. to attend. Mr. Korhonen says Nokia was "incredibly demanding" with Philips. He says he told Philips' CEO, Cor Boonstra, and the head of the company's semiconductor division, Arthur van der Poel, "We can't accept the current status. It's absolutely essential we turn over every stone looking for a solution." Messrs. Van der Poel and Boonstra declined to be interviewed. Philips spokesman Mr. Tuckwell, who confirmed the meeting took place, said "it was exactly what we expect from a customer." Mr. Korhonen and his team were now racing to restore the chip supply line. To replace more than two

http://nrstg1s.djnr.com/cgi-bin/DJInteractive?cgi=WEB_MNS_STORY&GJANum=414777410&page=newsst.../200

2/20/2001

Dow Jones Interactive Newsstand

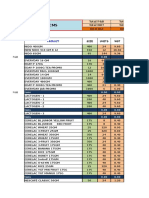

Mr. Korhonen and his team were now racing to restore the chip supply line. To replace more than two million power amplifier chips, they asked one Japanese and one U.S. supplier of the same chip to make millions more each. Largely because Nokia is such an important customer, both took the additional orders with only five days lead time, Mr. Korhonen says. Nokia also demanded details about capacity at other Philips plants. "This was one of the key things we insisted on," says Mr. Korhonen. "We dug into the capacity of all Philips factories and insisted on rerouting the capacity. We asked them, told them, to replan." And he got results. "They didn't go into denial," he says. "The goal was simple: For a little period of time, Philips and Nokia would operate as one company regarding these components." Soon more than 10 million of the Asic chips were replaced by a Philips factory in Eindhoven, the Netherlands. Another Philips plant was freed up for Nokia in Shanghai. The hit team was drumming up solutions within Nokia , as well. The company quickly redesigned some of its chips so they could be produced elsewhere. A project at Nokia to develop new ways of boosting chip production was also fast-tracked. Once Philips got the New Mexico plant operating again, this allowed the plant to make up for two million of the lost chips. At Ericsson, on the other hand, officials were finding themselves increasingly behind the curve. Philips officials told them they couldn't produce enough chips to meet their needs, at least not on time. "We were capacity-bound," said Mr. Tuckwell, the Philips spokesman, who noted that too much time was needed to get production going again to meet all orders from all customers. "We found the best solutions we could." They had nowhere else to turn for several key parts, including Asic chips. In the mid-1990s, the company had tried to save money by simplifying its supply lines, basically by weeding out backup suppliers for many parts. By the time of the fire, many executives were new to their jobs and unaware that the company was vulnerable. Since the fire, Ericsson has reversed course and signed on second suppliers for key parts, including the chips made in Albuquerque. On Friday it left the handset production business only completely. Nokia says it was able to meet its production targets despite the fire. The company projects continued strong growth of handset sales for the next year. Mr. Korhonen even had time recently to pull out one of his guitars, leading a band of colleagues in a version of "Twist and Shout" during an employee outing. --Going Mobile Comparison of two big Scandinavian rivals NOKIA -- Motto: "Connecting people" -- Headquarters: Espoo, Finland -- Employees: 60,000 -- Total sales: $27.7 billion* -- Network sales: $7.0 billion* -- Handset unit sales: 128 million -- Founded as: Wood pulp producer, in 1865 -- Products: Mobile handsets, networks -- Saunas at head office: 6 ERICSSON -- Motto: "Make yourself heard" -- Headquarters: Telefonplan, Sweden -- Employees: 100,000 -- Total sales: $28.5 billion -- Network sales: $20.3 billion -- Handset unit sales: 43.3 million -- Founded as: Telephone manufac-turer, in 1876 -- Products: Networks, mobile handsets -- Saunas at head office: 2 *Analysts forecast Note: Figures are converted from local currency to U.S. dollars at current rate Source: The companies

Page 5 of 6

http://nrstg1s.djnr.com/cgi-bin/DJInteractive?cgi=WEB_MNS_STORY&GJANum=414777410&page=newsst.../200

2/20/2001

Dow Jones Interactive Newsstand

Page 6 of 6

Copyright 2000 Dow Jones & Company, Inc. All Rights Reserved.

http://nrstg1s.djnr.com/cgi-bin/DJInteractive?cgi=WEB_MNS_STORY&GJANum=414777410&page=newsst.../200

2/20/2001

S-ar putea să vă placă și

- Nokias Supply Chain ManagementDocument12 paginiNokias Supply Chain ManagementFadli RahmanÎncă nu există evaluări

- Nokia HistoryDocument6 paginiNokia HistoryJai JachakÎncă nu există evaluări

- Ericsson Raises Japan Supply Chain ConcernsDocument5 paginiEricsson Raises Japan Supply Chain ConcernsSandipan MondalÎncă nu există evaluări

- NokiaDocument1 paginăNokiaapi-26403048Încă nu există evaluări

- Nokia HistoryDocument2 paginiNokia HistoryParitosh Gupta100% (1)

- Market Segmentation of Nokia: Vivek College CommerceDocument29 paginiMarket Segmentation of Nokia: Vivek College CommerceHemanshu MehtaÎncă nu există evaluări

- The Fire That Changed An IndustryDocument6 paginiThe Fire That Changed An IndustryFadzlli AminÎncă nu există evaluări

- Is Being Bought by Microsoft For 5.44bnDocument11 paginiIs Being Bought by Microsoft For 5.44bnShreyansh JainÎncă nu există evaluări

- Origin of NokiaDocument12 paginiOrigin of NokiaAnkit KapoorÎncă nu există evaluări

- Is Being Bought by Microsoft For 5.44bnDocument11 paginiIs Being Bought by Microsoft For 5.44bnShreyansh JainÎncă nu există evaluări

- NokiaDocument5 paginiNokiaDheeraj WaghÎncă nu există evaluări

- SM NokiaDocument10 paginiSM NokiaArpitAgrawalÎncă nu există evaluări

- History of NokiaDocument5 paginiHistory of Nokiatranquilexplosi98Încă nu există evaluări

- History of NokiaDocument5 paginiHistory of Nokiasherrie8hansen31Încă nu există evaluări

- A Background of The Nokia CompanyDocument5 paginiA Background of The Nokia Companygracefulcadre4940100% (3)

- The Nokia Story...Document35 paginiThe Nokia Story...Nilesh SolankiÎncă nu există evaluări

- Executive Summary: Page - 1Document49 paginiExecutive Summary: Page - 1Saeed KhanÎncă nu există evaluări

- Nokia Corp Project ReportDocument62 paginiNokia Corp Project ReportAmaan SiddiquiÎncă nu există evaluări

- A History of The Nokia CompanyDocument4 paginiA History of The Nokia Companyproudbeach2140% (1)

- Success Story of NokiaDocument12 paginiSuccess Story of Nokiabon2bautista100% (4)

- NokiaDocument17 paginiNokiaMilka PlayzÎncă nu există evaluări

- The Story of NokiaDocument13 paginiThe Story of NokiaHoney SweetÎncă nu există evaluări

- Case Study 1 in Project Management (Nokia)Document12 paginiCase Study 1 in Project Management (Nokia)JOSEFCARLMIKHAIL GEMINIANOÎncă nu există evaluări

- Nokia N 8 Creative BriefDocument14 paginiNokia N 8 Creative BriefSudeep PoudelÎncă nu există evaluări

- History of NokiaDocument8 paginiHistory of NokiaAteeq LaghariÎncă nu există evaluări

- Building a Global Telecommunications BusinessDocument7 paginiBuilding a Global Telecommunications BusinessMd. Liakat HosenÎncă nu există evaluări

- Nokia's Innovation and Differentiation StrategyDocument3 paginiNokia's Innovation and Differentiation Strategyshafiqdoulah1098Încă nu există evaluări

- Building A Global Telecommunications Business A Nokia Case StudyDocument5 paginiBuilding A Global Telecommunications Business A Nokia Case StudyKarem PalmesÎncă nu există evaluări

- Strategies Adopted by Nokia in Order To Achieve Its GoalsDocument14 paginiStrategies Adopted by Nokia in Order To Achieve Its GoalsRaj Paroha50% (2)

- The Nokia Revolution (Review and Analysis of Steinbock's Book)De la EverandThe Nokia Revolution (Review and Analysis of Steinbock's Book)Încă nu există evaluări

- Idoc.pub International Financial Management 12th Edition Jeff Madura Test BankDocument6 paginiIdoc.pub International Financial Management 12th Edition Jeff Madura Test BankHahahÎncă nu există evaluări

- History of Nokia:: 1. Nokia's First Century (1865-1967)Document16 paginiHistory of Nokia:: 1. Nokia's First Century (1865-1967)Kevin DoshiÎncă nu există evaluări

- Nokia Final AssignmentDocument17 paginiNokia Final Assignmentrandhawa43580% (5)

- History of NokiaDocument7 paginiHistory of NokiaPrasanna RahmaniacÎncă nu există evaluări

- International Business NokiaDocument33 paginiInternational Business NokiaqpwoeirituyÎncă nu există evaluări

- Nokia IntroductionDocument14 paginiNokia IntroductiondanyalÎncă nu există evaluări

- Case Study-NokiaDocument9 paginiCase Study-NokiaMystic MaidenÎncă nu există evaluări

- (BATCH 2018-2020) Term - IiiDocument4 pagini(BATCH 2018-2020) Term - IiiAngshuman PaulÎncă nu există evaluări

- Outsourcing at Ericsson: Firms and Markets Mini-CaseDocument4 paginiOutsourcing at Ericsson: Firms and Markets Mini-CasemarkÎncă nu există evaluări

- 01 NokiaDocument9 pagini01 NokiaRaj Kamal BishtÎncă nu există evaluări

- The Nokia Revolution: The Story of An Extraordinary Company That Transformed An IndustryDocument5 paginiThe Nokia Revolution: The Story of An Extraordinary Company That Transformed An Industrylove angelÎncă nu există evaluări

- Nokia's Rise to Dominance in Mobile PhonesDocument10 paginiNokia's Rise to Dominance in Mobile PhonesprakashÎncă nu există evaluări

- When Were Mobile Phones InventedDocument18 paginiWhen Were Mobile Phones InventedRengeline LucasÎncă nu există evaluări

- Nokia Brand AuditDocument8 paginiNokia Brand AuditJust_denver100% (1)

- NeetuDocument55 paginiNeetuAdigithe ThanthaÎncă nu există evaluări

- Case Study AnalysisDocument6 paginiCase Study AnalysisBitan BanerjeeÎncă nu există evaluări

- Nokia Vs Samsung.Document39 paginiNokia Vs Samsung.sudhirkadam007Încă nu există evaluări

- History: Southern FinlandDocument10 paginiHistory: Southern FinlandInnosent IglEsiasÎncă nu există evaluări

- Nokia First Century: 1865-1967Document4 paginiNokia First Century: 1865-1967Zarna Shingala SÎncă nu există evaluări

- Brand Audit of NokiaDocument8 paginiBrand Audit of NokiaMunmi SharmaÎncă nu există evaluări

- Strategic Formulation of Nokia2Document35 paginiStrategic Formulation of Nokia2Prathna Amin100% (4)

- Nokia Case StudyDocument8 paginiNokia Case StudyKartik JasraiÎncă nu există evaluări

- Nokia's Mobile History and Regional Focus in Asia-PacificDocument4 paginiNokia's Mobile History and Regional Focus in Asia-Pacificpmithesh879Încă nu există evaluări

- EricssonDocument7 paginiEricssonMondalo, Stephanie B.Încă nu există evaluări

- Tarmo LemolaDocument25 paginiTarmo Lemolaharshnvicky123Încă nu există evaluări

- Cell Phones and Smartphones: A Graphic HistoryDe la EverandCell Phones and Smartphones: A Graphic HistoryEvaluare: 3 din 5 stele3/5 (1)

- Honda Case StudyDocument18 paginiHonda Case Studygouatm_infy100% (10)

- Walmart China CaseDocument4 paginiWalmart China CaseMuhammad Bilal100% (4)

- Engro ChemicalsDocument5 paginiEngro ChemicalsMuhammad BilalÎncă nu există evaluări

- TTS WorkingDocument4 paginiTTS WorkingMuhammad BilalÎncă nu există evaluări

- Why Cdos Failed:: Role of Credit Rating AgenciesDocument3 paginiWhy Cdos Failed:: Role of Credit Rating AgenciesMuhammad BilalÎncă nu există evaluări

- Sony (Regeneration)Document5 paginiSony (Regeneration)Muhammad BilalÎncă nu există evaluări

- Product: Total F&B Total F&B Total NUT Total NUT Total BIZ Total BIZDocument15 paginiProduct: Total F&B Total F&B Total NUT Total NUT Total BIZ Total BIZMuhammad BilalÎncă nu există evaluări

- Corporate Finance Chapter8Document32 paginiCorporate Finance Chapter8AmnyCruzadoTorresÎncă nu există evaluări

- TWS 1Document582 paginiTWS 1Muhammad BilalÎncă nu există evaluări

- 6/20/2015 Brand Mop in Lit/Kg Rs Per Lit/Kg Total Budget Sale Milkpak 100,000 1.4 Nesvita NFV NesfrutaDocument4 pagini6/20/2015 Brand Mop in Lit/Kg Rs Per Lit/Kg Total Budget Sale Milkpak 100,000 1.4 Nesvita NFV NesfrutaMuhammad BilalÎncă nu există evaluări

- Wumart Stores - China's Response To Wal-MartDocument1 paginăWumart Stores - China's Response To Wal-MartMuhammad Bilal0% (1)

- Risk and ContingenciesDocument4 paginiRisk and ContingenciesMuhammad BilalÎncă nu există evaluări

- Financing and valuation of M&A projectDocument4 paginiFinancing and valuation of M&A projectMuhammad BilalÎncă nu există evaluări

- Sampa Video: Project ValuationDocument18 paginiSampa Video: Project Valuationkrissh_87Încă nu există evaluări

- Michelin in The Land of The MaharajasDocument4 paginiMichelin in The Land of The MaharajasMuhammad BilalÎncă nu există evaluări

- 29 Oct SolutionDocument9 pagini29 Oct SolutionMuhammad BilalÎncă nu există evaluări

- Why Cdos Failed:: Role of Credit Rating AgenciesDocument3 paginiWhy Cdos Failed:: Role of Credit Rating AgenciesMuhammad BilalÎncă nu există evaluări

- Critical Chain Project Management Techniques ExplainedDocument33 paginiCritical Chain Project Management Techniques ExplainedMuhammad BilalÎncă nu există evaluări

- OTDDocument7 paginiOTDMuhammad BilalÎncă nu există evaluări

- Critical ChainDocument16 paginiCritical ChainMuhammad BilalÎncă nu există evaluări

- National University of Sciences and Technology NUST Business SchoolDocument1 paginăNational University of Sciences and Technology NUST Business SchoolMuhammad BilalÎncă nu există evaluări

- Compiled - Critical ChainDocument21 paginiCompiled - Critical ChainMuhammad BilalÎncă nu există evaluări

- Sampa Video: Project ValuationDocument18 paginiSampa Video: Project Valuationkrissh_87Încă nu există evaluări

- Lecture 5Document25 paginiLecture 5Muhammad BilalÎncă nu există evaluări

- Assignment 1Document9 paginiAssignment 1Muhammad BilalÎncă nu există evaluări

- Problems CH 2 (B) MuhammadBilalDocument20 paginiProblems CH 2 (B) MuhammadBilalMuhammad BilalÎncă nu există evaluări

- Otd Term ProjectDocument10 paginiOtd Term ProjectMuhammad BilalÎncă nu există evaluări

- Car Loan Analysis Worksheet: Purchase PriceDocument2 paginiCar Loan Analysis Worksheet: Purchase PriceMuhammad BilalÎncă nu există evaluări

- Productivity ExercisesDocument1 paginăProductivity ExercisesMuhammad BilalÎncă nu există evaluări

- Cisco Catalyst 6500 Series Switch: Data SheetDocument29 paginiCisco Catalyst 6500 Series Switch: Data SheetHamed AhmadnejadÎncă nu există evaluări

- 640-802 CCNA Question Review PDFDocument77 pagini640-802 CCNA Question Review PDFkdwillsonÎncă nu există evaluări

- Decoder 2 To 4 With EnableDocument2 paginiDecoder 2 To 4 With EnableKurnia BJÎncă nu există evaluări

- GTA 3 Download & Gameplay GuideDocument11 paginiGTA 3 Download & Gameplay Guidedigital libraryÎncă nu există evaluări

- Causes and Effect of Harmonics in Power System IJSETR-VOL-3-IsSUE-2-214-220Document7 paginiCauses and Effect of Harmonics in Power System IJSETR-VOL-3-IsSUE-2-214-220emmanuel akaÎncă nu există evaluări

- Computer Vocabulary Can You Match The Definitions and The Words?Document1 paginăComputer Vocabulary Can You Match The Definitions and The Words?ANGELA ANDREAÎncă nu există evaluări

- zpc2 Users Manual PDFDocument124 paginizpc2 Users Manual PDFrenegarsÎncă nu există evaluări

- User Manual: 11Kw Twin Solar Inverter / ChargerDocument75 paginiUser Manual: 11Kw Twin Solar Inverter / ChargerAzmi EmranÎncă nu există evaluări

- 8051-CH6-ArithLigic InstructnsDocument114 pagini8051-CH6-ArithLigic Instructnsshivaspy100% (1)

- 2010 Subaru Outback and Legacy Navigation HackDocument9 pagini2010 Subaru Outback and Legacy Navigation HackradioalarmÎncă nu există evaluări

- Differnece BW Digitial Differential Analyzer LDA and Bresenhams LDADocument1 paginăDiffernece BW Digitial Differential Analyzer LDA and Bresenhams LDAyudhishtherÎncă nu există evaluări

- A29l160atv 70FDocument42 paginiA29l160atv 70Farond5318Încă nu există evaluări

- A Generic High Bandwidth Data Acquisition Card For Physics ExperimentsDocument9 paginiA Generic High Bandwidth Data Acquisition Card For Physics ExperimentsekaÎncă nu există evaluări

- Running Java Bytecode On The Android - Sun JVM On Top of DalvikVM - Stack OverflowDocument2 paginiRunning Java Bytecode On The Android - Sun JVM On Top of DalvikVM - Stack Overflowfcassia625Încă nu există evaluări

- Engineering Note. Connectivity To Allen-Bradley Controllers: by Eduardo BallinaDocument16 paginiEngineering Note. Connectivity To Allen-Bradley Controllers: by Eduardo BallinaJavier MiramontesÎncă nu există evaluări

- DPS5020 Operating ManualDocument9 paginiDPS5020 Operating ManualRoby JackÎncă nu există evaluări

- SIT202 Assignment1Document3 paginiSIT202 Assignment1Ramana MurugaÎncă nu există evaluări

- For Clean Gases With Optional Integral Display: FMA1700A/1800A SeriesDocument2 paginiFor Clean Gases With Optional Integral Display: FMA1700A/1800A SeriesIvette Desales SotoÎncă nu există evaluări

- 18.314 Practice Final ExamDocument4 pagini18.314 Practice Final ExamLionel CarlosÎncă nu există evaluări

- Data Sheet Nidaq Ni 6008Document5 paginiData Sheet Nidaq Ni 6008Erick Tamayo LoezaÎncă nu există evaluări

- Mock Test 1: JKSSB Account AssistantDocument10 paginiMock Test 1: JKSSB Account AssistantADEENA NOORÎncă nu există evaluări

- Lab 5Document2 paginiLab 5Jan Renn ArleÎncă nu există evaluări

- Design and Fabrication of Low Cost Vccum Cleaner ProjectDocument19 paginiDesign and Fabrication of Low Cost Vccum Cleaner ProjectKARTHICK MÎncă nu există evaluări

- Guide On Access BIOS To Different Brands of PCDocument2 paginiGuide On Access BIOS To Different Brands of PCrez habloÎncă nu există evaluări

- Applications of 8086Document38 paginiApplications of 8086Ajay PeterÎncă nu există evaluări

- Dicas para Agilizar o Seu Atendimento!!: CódigoDocument42 paginiDicas para Agilizar o Seu Atendimento!!: CódigoaidresoaresÎncă nu există evaluări

- Basics of Communication SystemsDocument14 paginiBasics of Communication Systemsmarxx100% (1)

- Cissell Pt594 Pants TopperDocument29 paginiCissell Pt594 Pants TopperDinosaurio1990Încă nu există evaluări

- TRX Vu2hmyDocument10 paginiTRX Vu2hmyokuraokuÎncă nu există evaluări

- Tecumseh Model Ov358ea 206904f Parts ListDocument5 paginiTecumseh Model Ov358ea 206904f Parts Listcamdog1010% (1)