Documente Academic

Documente Profesional

Documente Cultură

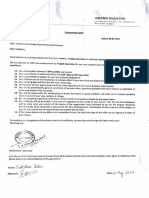

Taxation 2

Încărcat de

Kim BalotDrepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Taxation 2

Încărcat de

Kim BalotDrepturi de autor:

Formate disponibile

There are periodic calls for the government to tax the church.

And the church would reply that the government cant tax it, because their tax-exempt status is guaranteed in the Constitution and the Internal Revenue Code. If we look at the Constitution and actual practice, however, the case is not so simple. The Church is not as tax exempt as they make themselves out to be. They actually pay a lot of taxes: dividends tax, employee contributions, VAT. But at the same time, there is a lot in terms of property and business taxes that the church should pay, but doesnt.

Real Estate Tax Exemption The constitution mentions church tax exemption in Article 6, Section 28(2): Charitable institutions, churches and personages or convents appurtenant thereto, mosques, non-profit cemeteries, and all land, buildings, and improvements, actually, directly, and exclusively used for religious, charitable, or educational purposes shall be exempt for taxation.

Thus, it is clear: church buildings are exempt from real estate tax. Note that this doesnt refer to the church as an institution, or its constituent dioceses, parishes and congregations, which are entities that are much more than mere buildings. If we go by the above provision, other church property should be taxed if they are not exclusively used for religious purposes. Convents, for example, are subject to property tax. School buildings with a dual purpose as residence for priests/nuns and as school, since this is no longer exclusive use should also be taxed.

The presence of a chapel in a convent does not make the convent a religious building; it is just an ordinary residence with a chapel. It is similar to a chapel in a mall the mall remains a commercial building.

Schools and Hospitals There is a constitutional provision covering non-stock, non-profit schools. This is found in Article 14, Section 4. (3) All revenues and assets of non-stock, non-profit educational institutions used actually, directly, or exclusively for educational purposes shall be exempt from tax and duties

(4) Subject to conditions prescribed by laws all grants, endowments, donations or contributions used actually, directly and exclusively for educational purposes shall be exempt from tax.

Under this provision, all income raised by a non-stock, non-profit school should be used for educational purposes. Withdrawals from school funds for use by congregations should be prohibited. If they did this, the school should be stripped of its tax free status; or the congregation should be charged with (technical) theft of the schools assets.

You would then say: the school could simply pay the nuns/religious who have school-related functions, and they could donate this to their congregation. True. Actually, this is what they should do. But the salaries of these nuns/religious should be comparable that of to the other teachers or administrative staff in the school. Paying them higher salaries would constitute a withdrawal of profits by the congregation, which should not be allowed for a non-profit, non-stock educational institution.

Note that non-profit, non-stock covers also schools that are run by private foundations. It would not be right for the head of the foundation running a school to build his residence on school premises, and then get paid a very high salary. So, why should a church congregation be any different?

Then, there is the case of hospitals. Are hospitals included in the term charitable institution?

For me, charitable

institutions would include orphanages, battered women shelters and the like; but hospitals are at best a border line case. There should be clear guidelines made by the Department of Finance to define when a hospital can be classified as a charitable institution. Perhaps it should require that the majority of its patients are poor and that they pay below marketbased hospital fees.

It should not be the case that any religious group could simply put up a hospital, run it in a regular manner, collect high fees from patients, and then claim to be a charitable institution exempt from real estate and income taxes.

Political Clout But in the Philippines today, church run institutions often get away with not paying taxes. Mostly, this is due to the churchs political clout; most politicians are afraid of going after the church for back taxes. And there is also the bias in favor of the church by judges. In a recent case filed by the Cebu City government against Perpetual Succour Hospital (run by religious nuns), the city wanted to collect taxes on the pharmacy and real estate leasing operations done by the hospital, because these are not covered by the tax exempt status of the hospital. But the Regional Trial Court ruled that the accounts for these activities are not separate from that of the hospital, and thus no tax could be collected. Actually, if we were to follow the Constitution, it should be the other way around: since the hospital is no longer exclusively used for charitable purposes, it should be taxed as a whole.

The government, through the Department of Finance, could and should implement the law when it comes to the income and assets of religious institutions. The church should not be allowed a creative interpretation of the tax laws to make themselves tax-exempt. This is especially so when they operate as non-profit and non-stock institutions. There may be some laws that need to be amended, but mostly it is just a question of political will. If the Department of Finance decides to go after the church for back taxes, they will have the Constitution and most of the laws on their side.

I believe it is high time that the government fully collect the taxes due from dioceses, congregations and the like. We should not continue with the myth that the church as a whole is tax exempt. This is effectively tax evasion by the church, and in the present framework of pushing for full tax compliance by everyone, the church should not be an exception. Otherwise, that will be the same as condoning corruption (in this case, tax evasion), and we dont want that to happen. Or do we

"The power to tax is the power to destroy." If churches had to pay taxes, then it is possible and perhaps likely that the government would have to shut down a church for failure to pay taxes. As such, the separation of church and state under the First Amendment requires a tax exemption for churches. It may be true that giving a tax exemption to churches (and other non-profits) provides other societal benefits that

independently justify the exemption, but churches are exempted because of the First Amendment. Congress could start taxing non-profit organizations other than churches tomorrow, but taxing churches would require a constitutional amendment. Even a "bad" church (whatever that means) is entitled to a tax exemption.

S-ar putea să vă placă și

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (344)

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)

- Regional Trial Court JurisdictionDocument4 paginiRegional Trial Court JurisdictionKim BalotÎncă nu există evaluări

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- Activate Adobe Photoshop CS5 Free Using Serial KeyDocument3 paginiActivate Adobe Photoshop CS5 Free Using Serial KeyLukmanto68% (28)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (73)

- AswangDocument8 paginiAswangKim BalotÎncă nu există evaluări

- SQL-Problems Solutions PDFDocument11 paginiSQL-Problems Solutions PDFManpreet Singh100% (1)

- Contemporary World Prelim Exam Test DraftDocument5 paginiContemporary World Prelim Exam Test DraftGian Quiñones93% (45)

- Joint Memorandum Circular (JMC) No. 2021Document49 paginiJoint Memorandum Circular (JMC) No. 2021Nicey RubioÎncă nu există evaluări

- Ra 8491 (Irr)Document15 paginiRa 8491 (Irr)Kim Balot50% (2)

- Storage Reservior and Balancing ReservoirDocument19 paginiStorage Reservior and Balancing ReservoirNeel Kurrey0% (1)

- Implementing Rules and Regulations 10533Document16 paginiImplementing Rules and Regulations 10533Kim BalotÎncă nu există evaluări

- Intermediate Accounting Testbank 2Document419 paginiIntermediate Accounting Testbank 2SOPHIA97% (30)

- MMPX 403 Parametr ListDocument30 paginiMMPX 403 Parametr ListOğuz Kağan ÖkdemÎncă nu există evaluări

- STS Chapter 5Document2 paginiSTS Chapter 5Cristine Laluna92% (38)

- Pope Francis SpeechDocument5 paginiPope Francis SpeechKim BalotÎncă nu există evaluări

- Poverty Situation and DSWD ResponseDocument20 paginiPoverty Situation and DSWD ResponseKim BalotÎncă nu există evaluări

- Background of Natural LawDocument1 paginăBackground of Natural LawKim BalotÎncă nu există evaluări

- Warranties in Sales Agency Loans Pledge Mortgage Antichresis 2015 Pactum Non Alienando Agreement of No AlienationDocument1 paginăWarranties in Sales Agency Loans Pledge Mortgage Antichresis 2015 Pactum Non Alienando Agreement of No AlienationKim BalotÎncă nu există evaluări

- SK Fund, ResoDocument3 paginiSK Fund, ResoKim BalotÎncă nu există evaluări

- The Summer SolsticeDocument7 paginiThe Summer SolsticeleiaglibotÎncă nu există evaluări

- Case DigestDocument2 paginiCase DigestKim BalotÎncă nu există evaluări

- HeadingDocument2 paginiHeadingKim BalotÎncă nu există evaluări

- Improving Sugarcane Farming in Rural PhilippinesDocument2 paginiImproving Sugarcane Farming in Rural PhilippinesKim BalotÎncă nu există evaluări

- Improving Sugarcane Farming in Rural PhilippinesDocument2 paginiImproving Sugarcane Farming in Rural PhilippinesKim BalotÎncă nu există evaluări

- EnglishDocument2 paginiEnglishSarah BaylonÎncă nu există evaluări

- 229 Sklar Criminallaw 0Document102 pagini229 Sklar Criminallaw 0Kim BalotÎncă nu există evaluări

- Public International Law (Williams) - NADocument52 paginiPublic International Law (Williams) - NABulli PabalanÎncă nu există evaluări

- HTTP Vote BuyingDocument1 paginăHTTP Vote BuyingKim BalotÎncă nu există evaluări

- Transportation RouteDocument1 paginăTransportation RouteKim BalotÎncă nu există evaluări

- EnglishDocument2 paginiEnglishSarah BaylonÎncă nu există evaluări

- Civil Service Exam ReviewerDocument103 paginiCivil Service Exam ReviewerPatrick Hel O. Laurito78% (18)

- Juvenile Delinquency in The PhilippinesDocument2 paginiJuvenile Delinquency in The PhilippinesKim Balot50% (2)

- Attendance Aquinas University of Legazpi Name Year SignatureDocument6 paginiAttendance Aquinas University of Legazpi Name Year SignatureKim BalotÎncă nu există evaluări

- Types of Stills: Edit Source EditDocument3 paginiTypes of Stills: Edit Source EditKim BalotÎncă nu există evaluări

- Cabrera Vs NLRCDocument1 paginăCabrera Vs NLRCKim BalotÎncă nu există evaluări

- 229 Sklar Criminallaw 0Document102 pagini229 Sklar Criminallaw 0Kim BalotÎncă nu există evaluări

- The Power To Tax Is The Power To DestroyDocument2 paginiThe Power To Tax Is The Power To DestroyKim BalotÎncă nu există evaluări

- TaxesaDocument1 paginăTaxesaKim BalotÎncă nu există evaluări

- Criminal Law 123Document3 paginiCriminal Law 123Kim BalotÎncă nu există evaluări

- Types of Stills: Edit Source EditDocument3 paginiTypes of Stills: Edit Source EditKim BalotÎncă nu există evaluări

- Unit 13 AminesDocument3 paginiUnit 13 AminesArinath DeepaÎncă nu există evaluări

- Specialized Government BanksDocument5 paginiSpecialized Government BanksCarazelli AysonÎncă nu există evaluări

- Exam Venue For Monday Sep 25, 2023 - 12-00 To 01-00Document7 paginiExam Venue For Monday Sep 25, 2023 - 12-00 To 01-00naveed hassanÎncă nu există evaluări

- Diagram of Thermal RunawayDocument9 paginiDiagram of Thermal RunawayVeera ManiÎncă nu există evaluări

- ASM Architecture ASM Disk Group AdministrationDocument135 paginiASM Architecture ASM Disk Group AdministrationVamsi ChowdaryÎncă nu există evaluări

- Machine Design - LESSON 4. DESIGN FOR COMBINED LOADING & THEORIES OF FAILUREDocument5 paginiMachine Design - LESSON 4. DESIGN FOR COMBINED LOADING & THEORIES OF FAILURE9965399367Încă nu există evaluări

- Iqvia PDFDocument1 paginăIqvia PDFSaksham DabasÎncă nu există evaluări

- Serras Tilted Arc Art and Non Art Senie in Art Journal 1989Document6 paginiSerras Tilted Arc Art and Non Art Senie in Art Journal 1989api-275667500Încă nu există evaluări

- For-tea Tea Parlour Marketing Strategy Targets 40+ DemographicDocument7 paginiFor-tea Tea Parlour Marketing Strategy Targets 40+ Demographicprynk_cool2702Încă nu există evaluări

- cp2021 Inf03p02Document242 paginicp2021 Inf03p02bahbaguruÎncă nu există evaluări

- PNW 0605Document12 paginiPNW 0605sunf496Încă nu există evaluări

- ApudDocument53 paginiApudlatifahÎncă nu există evaluări

- Case Study Infrastructure ProjectsDocument1 paginăCase Study Infrastructure ProjectsAnton_Young_1962Încă nu există evaluări

- Bolsas Transfer FKDocument7 paginiBolsas Transfer FKBelèn Caridad Nelly Pajuelo YaipènÎncă nu există evaluări

- PaySlip ProjectDocument2 paginiPaySlip Projectharishgogula100% (1)

- FOMRHI Quarterly: Ekna Dal CortivoDocument52 paginiFOMRHI Quarterly: Ekna Dal CortivoGaetano PreviteraÎncă nu există evaluări

- Capran+980 CM en PDFDocument1 paginăCapran+980 CM en PDFtino taufiqul hafizhÎncă nu există evaluări

- A Dream Takes FlightDocument3 paginiA Dream Takes FlightHafiq AmsyarÎncă nu există evaluări

- Namal College Admissions FAQsDocument3 paginiNamal College Admissions FAQsSauban AhmedÎncă nu există evaluări

- CLC Customer Info Update Form v3Document1 paginăCLC Customer Info Update Form v3John Philip Repol LoberianoÎncă nu există evaluări

- Whats The Average 100 M Time For An Olympics - Google SearchDocument1 paginăWhats The Average 100 M Time For An Olympics - Google SearchMalaya KnightonÎncă nu există evaluări

- Road Safety GOs & CircularsDocument39 paginiRoad Safety GOs & CircularsVizag Roads100% (1)