Documente Academic

Documente Profesional

Documente Cultură

Advertising For CPA Practitioners

Încărcat de

Jim M. MagadanTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Advertising For CPA Practitioners

Încărcat de

Jim M. MagadanDrepturi de autor:

Formate disponibile

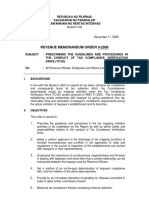

RULES AND REGULATIONS ON ADVERTISING FOR THE PHILIPPINE ACCOUNTANCY PROFESSION

Before, the Professional Accountants are prohibited to advertise beyond their name, address, telephone number and membership in professional organization since it is unethical in the Accountancy Profession. The reasons for that include: a. Advertising can lead to undue competition between and among practitioners, and thus may cause a decline in the quality of service. For example, a practitioner would offer a lower fee to the client compared to other practitioner but his/her quality of services might be affected due to the lowered fee. He/she might not perform test well. b. Advertising would encourage a more commercial approach within the profession thus reducing clients trust in CPAs and also increasing the likelihood of CPAs neglecting their ethical duties. Practitioners might exaggerate themselves to the clients and making themselves more attractive and comparing themselves to other practitioner of the work they have done even though they are incompetent enough to fulfill their duties. c. The cost of advertising would outweigh any savings which might result from competition, and it would be borne ultimately by clients. Due to competition with other practitioners, the cost advertising might also be conveyed to the clients since the clients have to pay for the services rendered by the practitioner. d. Small or new practitioners would be unlikely to have the financial resources to match the advertising of larger or more established practices. Practitioners in the smaller firms might have insufficient funds to advertise themselves to the public since they have smaller and fewer clients compared to the bigger firms who have larger and well known clients.

The rationale behind the prohibition of certain kinds of advertising or advertisements is to lend dignity to the profession which, unlike ordinary services and merchandise, should not be peddled in the market place through touting and self-laudatory means. The expansion of the services provided by the professional accountants(and the inclusion of a provision in the Revised Code of Ethics for Professional Accountants of the International Federation of Accountants (IFAC) which the Board of Accountancy and the Professional Regulation Commission have adopted), they are now allowed to advertise

themselves to the public to provide necessary information about the practitioners or professional partnerships and the services they provide to their clients.

Section 250 on Marketing Professional Services of the Revised Code of Ethics for Professional Accountants in the Philippines provides that: 1. When a professional accountant in public practice solicits new work through advertising or other forms of marketing, there may be potential threats to compliance with the fundamental principles. For example, a self-interest threat to compliance with the principle of professional behavior is created if services, achievements or products are marketed in a way that is consistent with that principle. 2. A professional accountant in public practice should not bring the profession into disrepute when marketing professional services. The professional accountant in public practice should be honest and truthful and should not: Make exaggerated claims for services offered, qualifications possessed or experience gained; or Make disparaging references to unsubstantiated comparisons to the work of another.

If the professional accountant in public practice is in doubt whether a proposed form of advertising or marketing is appropriate, the professional accountant in public practice should consult with the relevant professional body.

To adopt the following rules and regulations on advertising and promotion for the practice of accountancy in the Philippines: 1. Generally, advertising and publicity in any medium are acceptable provided: a. It has as its objective the notification to the public or such sectors of the public as are concerned, of matters of fact (e.g., name, address, contact numbers, services offered) in a manner that is not false, misleading or deceptive; b. It is in good taste; c. It is professionally dignified; and d. It avoids frequent repetition of, and any undue prominence being given to the name of the firm or professional accountant in public practice.

The following however shall not be allowed: a. b. c. d. Self-laudatory statements Discrediting, disparaging, or attacking other firms or CPA practitioners Referring to, using or citing actual or purported testimonials by third parties Publishing and comparing fees with other CPAs or CPA firms or comparing those services with those provided by another firm or CPA practitioner e. Giving too much emphasis on competitive differences f. Using words or phrases which are hard to define and even more difficult to substantiate objectively g. Publishing services in billboard (e.g., tarpaulin, streamers, etc.) advertisements

2. The use of the name of an international accounting firm affiliation/correspondence other than a notation that it is a member/correspondent firm of that foreign firm shall not be allowed so as to imply that the foreign firm is practicing in the Philippines. 3. No firm or CPA practitioner shall identify the name of a client or items of a clients business in advertising, public relations or marketing material produced to promote his practice provided that the client gives its written consent. 4. No firm or CPA practitioner shall use the term Accredited or any similar words or phrases calculated to convey the same meaning if the claimed accreditation (BOA, SEC, BSP or IC) has expired. 5. All advertisements must have prior review and approval in writing by the Risk Management Partner and Managing Partner or their equivalents. 6. The following examples are illustrative of circumstances in which publicity is acceptable and the matters to be considered in connection therewith subject always to the overriding requirements mentioned in the preceding rules. a. Awards It is in the interests of the public and the accountancy profession that any appointment or other activity of a professional accountant in a matter of national or local importance, or the award of any distinction to a professional accountant, should receive publicity and that membership of the professional body should be mentioned. However, the professional accountant should not make use of any of the aforementioned appointments or activities for personal professional advantage.

b. Professional Accountants Seeking Employment or Professional Business A professional accountant may inform interested parties through any medium that a partnership or salaried employment of an accountancy nature is being sought. The professional accountant should not, however, publicize for subcontract work in a manner which could be interpreted as seeking to procure professional business. Publicity seeking subcontract work may be acceptable if placed only in the professional press and provided that neither the accountants name, address or telephone number appears in the publicity. A professional accountant may write a letter or make a direct approach to another professional accountant when seeking employment or professional business.

c. Directories A professional accountant may be listed in a directory. Entries may include name, address, telephone number, professional description, services offered and any other information necessary to enable the user of the directory to make contact with the person or organization to which the entry relates. d. Books, Articles, Interviews, Lectures, Radio and Television Appearances Professional accountants who author books or articles on professional subjects, may state their name and professional qualifications and give the name of their organization but shall not give any information as to the services that firm provides. Similar provisions are applicable to participation by a professional accountant in a lecture, interview or a radio or television program on a professional subject. What professional accountants write or say, however, should not be promotional of themselves or their firm but should be an objective professional view of the topic under consideration. Professional accountants are responsible for using their best endeavors to ensure that what ultimately goes before the public complies with these requirements. e. Training Courses, Seminars, etc. A professional accountant may invite clients, staff or other professional accountants to attend training courses or seminars conducted for the assistance of staff. Other persons should not be invited to attend such training courses or seminars except in response to an unsolicited request. The requirement should in no way prevent professional accountants from providing training services to other professional bodies, associations or educational institutions which run courses for their members or the public.

However, undue prominence should not be given to the name of a professional accountant in any booklets or documents issued in connection therewith.

f. Booklets and Documents Containing Technical Information Booklets and other documents bearing the name of a professional accountant and giving technical information for the assistance of staff or clients may be issued to such persons, other professional accountants or other interested parties. g. Staff Recruitment Genuine vacancies for staff may be communicated to the public through any medium in which comparable staff vacancies normally appear. The fact that a job specification necessarily gives some detail as to one or more of the services provided to clients by the professional accountant in public practice is acceptable but it should not contain any promotional element. There should not be any suggestion that the services offered are superior to those offered by other professional accountants in public practice as a consequence of size, associations, or for any other reason. In publications such as those specifically directed to schools and other places of education to inform students and graduates of career opportunities in the profession, services offered to the public may be described in a business likeway. More latitude may also be permissible in a section of a newspaper devoted to staff vacancies than would be allowed if the vacancy appeared in a prominent position elsewhere in a newspaper on the grounds that it would be most unlikely that a potential client would use such media to select a professional adviser. h. Publicity on Behalf of Clients A professional accountant in public practice may publicize on behalf of clients, primarily for staff. However, the professional accountant in public practice should ensure that the emphasis in the publicity is directed towards the objectives to be achieved for the client. i. Brochures and Firm Directories

A professional accountant in public practice may issue to clients or, in response to an unsolicited request, to a non-client:

i. A factual and objectively worded of the services provided; and ii. A directory setting out names of partners, office addresses and names and address of associated firms and correspondents.

j. Stationery and Nameplates Stationery of professional accountants in public practice should be of an acceptable professional standard and comply with the requirements of the law and of the member body concerned as to names of partners, principals and others who participate in the practice, use of professional descriptions and designatory letters, cities or countries where the practice is represented, logotypes, etc. The designation of any services provided by the practice as being specialist nature should not be permitted. Similar provisions, where applicable, should apply to nameplates.

k. Announcements Appropriate newspapers or magazines may be used to inform the public of the establishment of a new practice, of changes in the composition of a partnership of professional accountants in public practice, or of any alteration in the address of a practice. Such announcements should be limited to a bare statement of facts and consideration given to the appropriateness of the area of distribution of the newspaper or magazine and number of insertions.

l. Inclusion of the Name of the Professional Accountant in Public Practice in a Document Issued by a Client When a client proposes to publish a report by a professional accountant in public practice dealing with the clients existing business affairs or in connection with the establishment of a new business venture, the professional accountant in public practice should take steps to ensure that the context in which the report is published is not such as might result in the public being misled as to the nature and meaning of the report. In these circumstances, the professional accountant in public practice should advise

the client that permission should first be obtained before publication of the document. Similar consideration should be given to other documents proposed to be issued by a client containing the name of a professional accountant in public practice acting in an independent professional capacity. This does not preclude the inclusion of the name of a professional accountant in public practice in the annual report of a client.

When professional accountants in their private capacity are associated with, or hold in, an organization, the organization may use their name and professional status on stationery and other documents. The professional accountant in public practice should ensure that this information is not used in such a way as might lead the public to believe that there is a connection with organization in an independent professional capacity. m. Anniversaries A professional accountants press and other media releases or announcements or newspaper supplements, or other similar publications, or other commemorative media, or the holding of media covered events undertaken only to commemorate their anniversaries in public practice by informing the public of their achievements or accomplishments in contributing towards nation building and in international understanding, goodwill, or relationship or enhancing the image or standards of the accounting profession do not violate the rules on advertising and solicitation provided that such announcements or undertakings contains only factual matters without detailed listing of services. Such undertaking should be done only every five years of celebration.

n. Websites A professional accountant may develop and maintain a website in the Internet in such suitable length and style which may also include announcements, press releases, publications and such other necessary and factual information like firms name, partners/principals name and brief description of their educational attainment, brief listing of services, postal address, telephone, fax and e-mail addresses. Such website should adhere to the rules mentioned above.

7. These rules and regulations shall be effective fifteen (15) days after publication in the Official Gazette or in any newspaper of general circulation.

S-ar putea să vă placă și

- Fundamentals of Assurance EngagementsDocument9 paginiFundamentals of Assurance EngagementsAlfredSantos100% (2)

- Borer (2013) Advanced Exercise Endocrinology PDFDocument272 paginiBorer (2013) Advanced Exercise Endocrinology PDFNicolás Bastarrica100% (1)

- (AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesDocument6 pagini(AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesPolinar Paul MarbenÎncă nu există evaluări

- Audit Engagement Letter & Management Representation Letter (Example)Document6 paginiAudit Engagement Letter & Management Representation Letter (Example)Mich Elle Cab75% (4)

- Rmo No 9-06 TCVD Tax MappingDocument16 paginiRmo No 9-06 TCVD Tax MappingGil PinoÎncă nu există evaluări

- Echeverria Motion For Proof of AuthorityDocument13 paginiEcheverria Motion For Proof of AuthorityIsabel SantamariaÎncă nu există evaluări

- Seminar On DirectingDocument22 paginiSeminar On DirectingChinchu MohanÎncă nu există evaluări

- ATDocument8 paginiATNoemi MacatangayÎncă nu există evaluări

- BOA Resolution On AdvertisingDocument7 paginiBOA Resolution On AdvertisingyellahfellahÎncă nu există evaluări

- Government Accounting Chapter 6Document33 paginiGovernment Accounting Chapter 6Charlagne LacreÎncă nu există evaluări

- Arson - People v. Abayon y AponteDocument7 paginiArson - People v. Abayon y AponteChristia Sandee SuanÎncă nu există evaluări

- PDF Prerev Forex 2019doc DD PDFDocument8 paginiPDF Prerev Forex 2019doc DD PDFJade jade jadeÎncă nu există evaluări

- Solman Man AcctDocument441 paginiSolman Man AcctEster Fetalino Pajuyo100% (7)

- Taxation of Non-Bank Financial Intermediaries PhilippinesDocument12 paginiTaxation of Non-Bank Financial Intermediaries Philippinesjosiah9_5Încă nu există evaluări

- Special Tax Laws PDFDocument34 paginiSpecial Tax Laws PDFJAY AUBREY PINEDAÎncă nu există evaluări

- Article 1872 - 1873Document8 paginiArticle 1872 - 1873Ron VidalÎncă nu există evaluări

- Audit TheoryDocument8 paginiAudit TheoryJekÎncă nu există evaluări

- Key Differences of PFRS For Small Entities and PFRS For SMEsDocument80 paginiKey Differences of PFRS For Small Entities and PFRS For SMEsMarkStephenAsido100% (3)

- Donation Bathan JMMDocument9 paginiDonation Bathan JMMJim M. MagadanÎncă nu există evaluări

- Mas Practice Standards and Ethical ConsiderationsACDocument3 paginiMas Practice Standards and Ethical ConsiderationsACLorenz BaguioÎncă nu există evaluări

- The CPA FirmDocument5 paginiThe CPA Firmemc2_mcv100% (1)

- Management Representation LetterDocument2 paginiManagement Representation LetterMahediÎncă nu există evaluări

- Module 3Document8 paginiModule 3Jim M. MagadanÎncă nu există evaluări

- Module 3Document8 paginiModule 3Jim M. MagadanÎncă nu există evaluări

- PFRS For Small Entities 1 PDFDocument43 paginiPFRS For Small Entities 1 PDFRojohn ValenzuelaÎncă nu există evaluări

- NFJPIA Mockboard 2011 Auditing TheoryDocument6 paginiNFJPIA Mockboard 2011 Auditing TheoryKathleen Ang100% (1)

- Respondents, G.R. No. 187317. April 11, 2013Document3 paginiRespondents, G.R. No. 187317. April 11, 2013Jim M. MagadanÎncă nu există evaluări

- DLP No. 10 - Literary and Academic WritingDocument2 paginiDLP No. 10 - Literary and Academic WritingPam Lordan83% (12)

- Cooperative Development Authority Vs Dolefil Agrarian Reform Beneficiaries Cooperative, Inc., 382 SCRA 552 Case Digest (Administrative Law)Document3 paginiCooperative Development Authority Vs Dolefil Agrarian Reform Beneficiaries Cooperative, Inc., 382 SCRA 552 Case Digest (Administrative Law)AizaFerrerEbina100% (1)

- Rule If The Builder, Planter, Sower, and Owner of The Land Are DifferentDocument7 paginiRule If The Builder, Planter, Sower, and Owner of The Land Are DifferentJim M. MagadanÎncă nu există evaluări

- 78 Warner Barnes V Reyes PDFDocument2 pagini78 Warner Barnes V Reyes PDFJim M. MagadanÎncă nu există evaluări

- AUDIT Journal 6Document17 paginiAUDIT Journal 6Daena NicodemusÎncă nu există evaluări

- Audit Rev. 3Document4 paginiAudit Rev. 3Charles PolidoÎncă nu există evaluări

- Business Partner Master Data - Its Objective Is To Record and Retrieve BusinessDocument2 paginiBusiness Partner Master Data - Its Objective Is To Record and Retrieve BusinessAnjelainePinedaÎncă nu există evaluări

- Threats To Compliance With The Fundamental PrinciplesDocument5 paginiThreats To Compliance With The Fundamental PrinciplesAbigail SubaÎncă nu există evaluări

- Chapter 05Document10 paginiChapter 05Princess LabeÎncă nu există evaluări

- AUDIT Journal 16Document9 paginiAUDIT Journal 16Daena NicodemusÎncă nu există evaluări

- AUDIT Journal 9Document8 paginiAUDIT Journal 9Daena NicodemusÎncă nu există evaluări

- DRAFTLevel 3Document129 paginiDRAFTLevel 3Mark Paul RamosÎncă nu există evaluări

- Accounting Alert SEC Amended SRC Rule 68Document10 paginiAccounting Alert SEC Amended SRC Rule 68blackphoenix303Încă nu există evaluări

- What Is The Difference Between Attestation Engagement and Direct Reporting Engagement in AuditingDocument13 paginiWhat Is The Difference Between Attestation Engagement and Direct Reporting Engagement in AuditingJennybabe PetaÎncă nu există evaluări

- Chapter 9 - The Verdict On Groupthink Case StudyDocument2 paginiChapter 9 - The Verdict On Groupthink Case StudyAdelson Arado100% (2)

- CombinepdfDocument129 paginiCombinepdfMary Jane G. FACERONDAÎncă nu există evaluări

- Bustamante, Jilian Kate A. (Activity 3)Document4 paginiBustamante, Jilian Kate A. (Activity 3)Jilian Kate Alpapara BustamanteÎncă nu există evaluări

- Reflection Paper Valuation FinalDocument7 paginiReflection Paper Valuation FinalMaureen CortezÎncă nu există evaluări

- OPT QuizDocument5 paginiOPT QuizAngeline VergaraÎncă nu există evaluări

- Regular Output Vat 1Document39 paginiRegular Output Vat 1Samantha Tayone100% (1)

- Isla LipanaDocument11 paginiIsla Lipanachristian boydonÎncă nu există evaluări

- Survey QuestionnaireDocument5 paginiSurvey QuestionnairePrince GueseÎncă nu există evaluări

- Analysis of Notes Receivable and Related AccountsqDocument5 paginiAnalysis of Notes Receivable and Related AccountsqCJ alandyÎncă nu există evaluări

- A. Inbound Logistics B. Outbound Logistics C. Operations D. Marketing Sales E. SalesDocument4 paginiA. Inbound Logistics B. Outbound Logistics C. Operations D. Marketing Sales E. SalesEizzel SamsonÎncă nu există evaluări

- Tax Case in ManagementDocument2 paginiTax Case in ManagementLlerry Darlene Abaco Racuya80% (5)

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 paginiAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseeÎncă nu există evaluări

- Dokumen - Tips - Auditing Problems by Cabrera Solution Key For Auditing 2009 Ed by Cabrera Audit PDFDocument3 paginiDokumen - Tips - Auditing Problems by Cabrera Solution Key For Auditing 2009 Ed by Cabrera Audit PDFJoffrey UrianÎncă nu există evaluări

- Company History FinalDocument10 paginiCompany History FinalElla Andrea Montilla PototÎncă nu există evaluări

- Documents - Tips Cpa Aditional CorlynDocument34 paginiDocuments - Tips Cpa Aditional CorlynCarol Ferreros PanganÎncă nu există evaluări

- QuizzerDocument343 paginiQuizzerAn JoÎncă nu există evaluări

- Current Assets 400,000 Equipment 600,000 Land 200,000 Building 1,200,000 Liabilities (320,000) 2,080,000Document2 paginiCurrent Assets 400,000 Equipment 600,000 Land 200,000 Building 1,200,000 Liabilities (320,000) 2,080,000Amamore PlazaÎncă nu există evaluări

- 118.2 - Illustrative Examples - IFRS15 Part 2Document2 pagini118.2 - Illustrative Examples - IFRS15 Part 2Ian De DiosÎncă nu există evaluări

- 1Document10 pagini1Viannice AcostaÎncă nu există evaluări

- Acctg16a Midterm ExamDocument6 paginiAcctg16a Midterm ExamRannah Raymundo100% (1)

- Chapter 1 Introduction To Consumption TaxesDocument38 paginiChapter 1 Introduction To Consumption TaxesGenie Gonzales DimaanoÎncă nu există evaluări

- 2019 PFRS Pas PicDocument4 pagini2019 PFRS Pas PicAron Vicente100% (1)

- MasterbudgetDocument154 paginiMasterbudgetrochielanciolaÎncă nu există evaluări

- Chapter 04 AnsDocument4 paginiChapter 04 AnsDave Manalo100% (1)

- BOA Resolution 1 Advertising PDFDocument7 paginiBOA Resolution 1 Advertising PDFNorwel Chavez de RoxasÎncă nu există evaluări

- Board of AccountancyDocument4 paginiBoard of AccountancyLhivanne LamintadÎncă nu există evaluări

- The Philippines?: Individual Assignment 05: Setting Up and Maintaining An Accounting PracticeDocument2 paginiThe Philippines?: Individual Assignment 05: Setting Up and Maintaining An Accounting PracticeNicole Allyson AguantaÎncă nu există evaluări

- Practice Public Accounting in The PhilippinesDocument5 paginiPractice Public Accounting in The PhilippinesTrizia Bermudo TibesÎncă nu există evaluări

- Journal 5Document3 paginiJournal 5not youÎncă nu există evaluări

- 05 JournalDocument4 pagini05 Journalits me keiÎncă nu există evaluări

- Contract of Insurance A. Subject Matter of InsuranceDocument4 paginiContract of Insurance A. Subject Matter of InsuranceJim M. MagadanÎncă nu există evaluări

- Donation: Concept, Nature, and Effect of DonationDocument3 paginiDonation: Concept, Nature, and Effect of DonationJim M. MagadanÎncă nu există evaluări

- Southern Luzon v. Juanita Golpeo. G.R. - Case Digest. FactsDocument2 paginiSouthern Luzon v. Juanita Golpeo. G.R. - Case Digest. FactsJim M. MagadanÎncă nu există evaluări

- First Set of Cases and TopicsDocument1 paginăFirst Set of Cases and TopicsJoesil Dianne SempronÎncă nu există evaluări

- A. The Power of Taxation Is An Essential and Inherent Attribute of Sovereignty, Belonging As ADocument2 paginiA. The Power of Taxation Is An Essential and Inherent Attribute of Sovereignty, Belonging As AJim M. MagadanÎncă nu există evaluări

- Lecture Notes For SuccessionDocument1 paginăLecture Notes For SuccessionJim M. MagadanÎncă nu există evaluări

- Delfin Nario vs. PhilAm Life InsuranceDocument1 paginăDelfin Nario vs. PhilAm Life InsuranceJim M. MagadanÎncă nu există evaluări

- Succession My NotesDocument4 paginiSuccession My NotesJim M. MagadanÎncă nu există evaluări

- 3Document4 pagini3Jim M. MagadanÎncă nu există evaluări

- Tax Activity - 2Document7 paginiTax Activity - 2Jim M. MagadanÎncă nu există evaluări

- Vicente Ong Lim SingDocument1 paginăVicente Ong Lim SingJim M. MagadanÎncă nu există evaluări

- Delfin Nario vs. PhilAm Life InsuranceDocument1 paginăDelfin Nario vs. PhilAm Life InsuranceJim M. MagadanÎncă nu există evaluări

- People v. Baraga y ArcillaDocument6 paginiPeople v. Baraga y ArcillaKaye RodriguezÎncă nu există evaluări

- Vicente Ong Lim SingDocument1 paginăVicente Ong Lim SingJim M. MagadanÎncă nu există evaluări

- Peralta Labrador - v. - Bugarin20180403 1159 lh695wDocument6 paginiPeralta Labrador - v. - Bugarin20180403 1159 lh695wJim M. MagadanÎncă nu există evaluări

- Santos v. Rasalan, G.R. No. 155749Document5 paginiSantos v. Rasalan, G.R. No. 155749Jim M. MagadanÎncă nu există evaluări

- Civpro Prefinals PDFDocument22 paginiCivpro Prefinals PDFJim M. MagadanÎncă nu există evaluări

- Succession My NotesDocument4 paginiSuccession My NotesJim M. MagadanÎncă nu există evaluări

- 3124773-1997-Concrete Aggregates Corp. v. Court of AppealsDocument5 pagini3124773-1997-Concrete Aggregates Corp. v. Court of AppealsChristine Ang CaminadeÎncă nu există evaluări

- 1 Pungutan - v. - AbubakarDocument9 pagini1 Pungutan - v. - AbubakarWednesday AbelgasÎncă nu există evaluări

- Public Corporation Pre-Finals Transcript Reclassification of Agricultural LandsDocument26 paginiPublic Corporation Pre-Finals Transcript Reclassification of Agricultural LandsJim M. MagadanÎncă nu există evaluări

- WhenEmpLeave-5cust Philippines-1 PQ PDFDocument37 paginiWhenEmpLeave-5cust Philippines-1 PQ PDFJim M. MagadanÎncă nu există evaluări

- SRDC Vs CADocument2 paginiSRDC Vs CAJim M. MagadanÎncă nu există evaluări

- Lesson 73 Creating Problems Involving The Volume of A Rectangular PrismDocument17 paginiLesson 73 Creating Problems Involving The Volume of A Rectangular PrismJessy James CardinalÎncă nu există evaluări

- Coordination Compounds 1Document30 paginiCoordination Compounds 1elamathiÎncă nu există evaluări

- GE 110HP DC Trolley MotorDocument10 paginiGE 110HP DC Trolley MotorAnthony PetersÎncă nu există evaluări

- Medicidefamilie 2011Document6 paginiMedicidefamilie 2011Mesaros AlexandruÎncă nu există evaluări

- Formal Letter Format Sample To Whom It May ConcernDocument6 paginiFormal Letter Format Sample To Whom It May Concernoyutlormd100% (1)

- Principles of Communication PlanDocument2 paginiPrinciples of Communication PlanRev Richmon De ChavezÎncă nu există evaluări

- CAPE Env. Science 2012 U1 P2Document9 paginiCAPE Env. Science 2012 U1 P2Christina FrancisÎncă nu există evaluări

- International Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Document5 paginiInternational Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Raul CuarteroÎncă nu există evaluări

- DHBVNDocument13 paginiDHBVNnitishÎncă nu există evaluări

- Espn NFL 2k5Document41 paginiEspn NFL 2k5jojojojo231Încă nu există evaluări

- Science Project FOLIO About Density KSSM Form 1Document22 paginiScience Project FOLIO About Density KSSM Form 1SarveesshÎncă nu există evaluări

- Skype OptionsDocument2 paginiSkype OptionsacidwillÎncă nu există evaluări

- Assessment NCM 101Document1 paginăAssessment NCM 101Lorainne Angel U. MolinaÎncă nu există evaluări

- HTTP Parameter PollutionDocument45 paginiHTTP Parameter PollutionSpyDr ByTeÎncă nu există evaluări

- Togaf Open Group Business ScenarioDocument40 paginiTogaf Open Group Business Scenariohmh97Încă nu există evaluări

- De Luyen Thi Vao Lop 10 Mon Tieng Anh Nam Hoc 2019Document106 paginiDe Luyen Thi Vao Lop 10 Mon Tieng Anh Nam Hoc 2019Mai PhanÎncă nu există evaluări

- Alice (Alice's Adventures in Wonderland)Document11 paginiAlice (Alice's Adventures in Wonderland)Oğuz KarayemişÎncă nu există evaluări

- SULTANS OF SWING - Dire Straits (Impresión)Document1 paginăSULTANS OF SWING - Dire Straits (Impresión)fabio.mattos.tkd100% (1)

- Undertaking:-: Prime Membership Application Form (Fill With All Capital Letters)Document3 paginiUndertaking:-: Prime Membership Application Form (Fill With All Capital Letters)Anuj ManglaÎncă nu există evaluări

- Applied Thermodynamics - DraughtDocument22 paginiApplied Thermodynamics - Draughtpiyush palÎncă nu există evaluări

- IBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Document4 paginiIBM Unit 3 - The Entrepreneur by Kulbhushan (Krazy Kaksha & KK World)Sunny VarshneyÎncă nu există evaluări

- K3VG Spare Parts ListDocument1 paginăK3VG Spare Parts ListMohammed AlryaniÎncă nu există evaluări

- Contoh RPH Ts 25 Engish (Ppki)Document1 paginăContoh RPH Ts 25 Engish (Ppki)muhariz78Încă nu există evaluări

- Rebecca Young Vs CADocument3 paginiRebecca Young Vs CAJay RibsÎncă nu există evaluări

- Trần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisDocument2 paginiTrần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisTrần Phương MaiÎncă nu există evaluări

- Conrad John's ResumeDocument1 paginăConrad John's ResumeTraining & OD HRODÎncă nu există evaluări