Documente Academic

Documente Profesional

Documente Cultură

Global Air Care The Sweet Smell of Success or Olfactory Fatigue

Încărcat de

Siddharth GautamTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Global Air Care The Sweet Smell of Success or Olfactory Fatigue

Încărcat de

Siddharth GautamDrepturi de autor:

Formate disponibile

Global Air Care: The Sweet Smell of Success or Olfactory Fatigue?

February 2010

Household Care: Global Air Care Euromonitor International

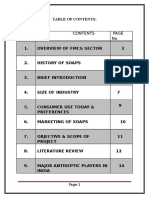

Introduction Global Snapshot Regional Analysis Category Analysis Competitive Environment Future Outlook

Introduction

Household Care: Global Air Care Euromonitor International

Scope

All historic values expressed in this report are in US dollar terms, using a fixed exchange rate (2008). All forecast data are expressed in constant terms; inflationary effects are discounted. Conversely, all historical data

are expressed in current terms; inflationary effects are taken into account.

AIR CARE COVERAGE AIR CARE US$7.9 billion

Spray/aerosol US$2.6 billion

Electric US$1.7 billion

Gel US$0.9 billion

Liquid US$0.5 billion

Candle US$0.7 billion

Car US$1.1 billion

Other US$0.4 billion

Disclaimer Much of the information in this briefing is of a statistical nature and, while every attempt has been made to ensure accuracy and reliability, Euromonitor International cannot be held responsible for omissions or errors Figures in tables and analyses are calculated from unrounded data and may not sum. Analyses found in the briefings may not totally reflect the companies' opinions, reader discretion is advised

Learn More

To find out more about Euromonitor International's complete range of business intelligence on industries, countries and consumers please visit www.euromonitor.com or contact your local Euromonitor International office: London + 44 (0)20 7251 8024 Vilnius +370 5 243 1577 Chicago +1 312 922 1115 Dubai +971 4 372 4363 Singapore +65 6429 0590 Cape Town +27 21 552 0037 Shanghai +86 21 63726288 Santiago +56 2 4332226 3

Introduction

Household Care: Global Air Care Euromonitor International

Key Findings

Market slowing Despite the global economic downturn the air care market has continued to grow albeit more slowly than in previous years. The slowdown originated largely from North America where economic conditions led to a switch from positive growth in years 2003-2007 to decline in 2008. The economic downturn has not been entirely negative in its impact as it has encouraged cocooning, i.e. growth in a home-centred lifestyle which stimulates spending on products to enhance the home environment, such as air care. There are exceptions to the economic gloom as certain markets continue to strive for more affluent lifestyles. Eastern Europe is the most dynamic region in this respect having consistently seen double-digit growth in the air care market. New air care formats abound as innovation has characterised the market. However sprays/aerosols remain the most popular air care format and continue to see major growth across all regions. New fragrances/product improvements still boost sales. Although there are many manufacturers and brands across the globe, Glade/Brise stands out as the number one brand. It is available in multiple formats and plays an important role across all regions. In a market characterised by a few large players the exit of a major manufacturer opens up the opportunity for a shift in the balance of power. As P&G is reported to take over Sara Lee's Ambi-Pur brand, this will significantly strengthen its role in the air care market. It is perhaps ironic that there is a growth towards 'natural' aromas. Consumers want their air care products to deliver fresh and clean smells rather than masking 'artificial' fragrances. Extending this to the use of more natural ingredients may be an obvious trend. The developed regions are showing a growing concern for environmental issues which is reflected in sales. Manufacturers need to take this on board as the importance of sustainability is bound to increase further.

4

Economic benefits Most dynamic region

Category winner

Brand leaders

Manufacturer exit

Natural trends

Green light

Household Care: Global Air Care Euromonitor International

Introduction Global Snapshot Regional Analysis Category Analysis Competitive Environment Future Outlook

Global Snapshot

Household Care: Global Air Care Euromonitor International

Air Care Market Growing, Albeit at Lower Rate

The global air care market was worth just under US$8 billion in 2008 showing growth in value terms of 30% since

2003. However, there has been a general slowdown in growth over the last two years with 2008 being worse than the previous year with the rate of annual growth in value sales slowing from 5% in 2007 to just below 3% during 2008. Despite this, some US$223 million was added to the global market value in 2008.

Global Market for Air Care 2003-2008

9,000 Aircare 8,000 7,000 6,000 5,000 4.0 4,000 3.0 3,000 2,000 1,000 0 2004 2005 2006 2007 2008 6 2.0 1.0 0.0

% value growth

8.0 Growth 7.0 6.0 5.0

US$ million

Global Snapshot

Household Care: Global Air Care Euromonitor International

Spray/Aerosol Driving Growth

The majority of market growth in

Year-on-year Growth by Category 2003-2008

16.0 14.0 12.0 on -year growth % year 10.0 8.0 6.0 4.0 2.0 0.0 -2.0 -4.0 2003-04 2004-05 2005-06 2006-07 2007-08

2008 came from the largest product category, spray/aerosol air fresheners, which grew 9% year-on-year and contributed some 92% of the US$223 million incremental growth, driven by increasing demand in emerging countries.

Not all categories were so

positive with electric and gel air fresheners showing decline and all other categories (except spray /aerosol) registering lower growth rates compared to previous year indicating that the economic climate may be causing some down trading.

The global economic slowdown

has undoubtedly impacted category performance in North America, which suffered a decline from almost 3% growth in 2007 to a marginal fall of 0.2% in 2008. The region's weak performance was a major contributor to the overall global market slowdown.

Spray/aerosol air fresheners Gel air fresheners Candle air fresheners Car air fresheners

Electric air fresheners Liquid air fresheners Other household air care 7

Global Snapshot

Household Care: Global Air Care Euromonitor International

Luxury or Economic (Re)treat?

There is a division between those economies where the

market for air care is still growing (Eastern Europe in particular). Here air care is seen as a more luxurious product associated with an improved standard of living and more affluent lifestyles. Then there are those generally more developed markets where the economic downturn has made consumers question the need for such non-essential products and growth here has slowed substantially. Economic pressures are driving a return in developed economies to a home-centred lifestyle. Since the start of the economic crisis, this cocooning trend has become even more pronounced, as consumers are unable to afford the luxury of going out. There is a positive aspect to this effect in that many consumers want some escape from the doom and gloom and are looking for low-cost ways of boosting their home environment and/or their morale. Air care is ideally placed to capitalise on this by delivering moodenhancing fragrance and odour elimination for those entertaining at home. However, it is notable that consumers are not looking to be extravagant and price is important, so promotional activity has been key for all the leading brands. The home-centred trend is expected to stay beyond recession due to how satisfied consumers have become with the quality of their in-home experience

Growth in Air Care Sales by Region 2005-2008

20.0 18.0 16.0 14.0

grow % year-on year th

12.0 10.0 8.0 6.0 4.0 2.0 0.0 -2.0 2005-06 Asia Pacific Eastern Europe Middle East and Africa Western Europe 8 2006-07 2007-08

Australasia Latin America North America

Household Care: Global Air Care Euromonitor International

Introduction Global Snapshot Regional Analysis Category Analysis Competitive Environment Future Outlook

Regional Analysis

Household Care: Global Air Care Euromonitor International

Western Europe Still Top but Eastern Europe Most Dynamic

Regional Market Shares 2008

5% 5% 36% 16% 3% 2% Western Europe North America Asia Pacific Eastern Europe Latin America Middle East and Africa Australasia 33%

Although Western Europe and North America

dominate the market overall (combining for over two-thirds) they have reached a point of maturity such that rates of growth have steadied. This trend has been compounded by the effects of the global recession. Nevertheless the introduction of new and innovative products still has the power to boost sales. The fastest-growing region is Eastern Europe which has now overtaken Latin America in terms of size despite the fact that the latter is still growing well ahead of the market overall. Eastern Europe enjoyed value growth of 17% in 2008.

Many nations within Eastern Europe are

Growth by Region 2003-2008

Region Asia Pacific Australasia Eastern Europe Latin America Middle East and Africa North America Western Europe 2003/2004 2.4 7.0 17.4 18.0 5.9 12.6 4.2 2007/2008 4.1 1.2 17.8 10.8 7.8 -0.2 2 2003-2008 CAGR 7.0 10.5 24.6 16.3 8.3 6.8 7.2

experiencing improvements in the standard of living going beyond the air care market. Growth by nation varies and is dependent on how affluent individual countries have become, ranging from those, e.g. Romania, where air care is still perceived as an unnecessary luxury to others, e.g. the Czech Republic, where air care innovation is finding appeal. Growth in Eastern Europe is driven largely through sales in Hungary, Poland and the Czech Republic. A rising standard of living is also driving strong growth in Latin America, particularly in Argentina, which dominates the region, where growth in 2008 was 27%.

10

Regional Analysis

Household Care: Global Air Care Euromonitor International

Regional Differences by Format

Asia Pacific gels

North America all plugged in Sprays top most regions

Electric air fresheners account Spray/aerosol air fresheners

Gel Air Fresheners: % Share of Regional Market 2008

30 25 20 15 10 5 0

for almost a third of the value of the North American market. This exceeds all other regions and it is the only market where the electric format is larger than the spray/aerosol format.

The picture is changing; with

consistently deliver and are the preferred format for around half of all consumers in four of the seven regions as they are considered the most affordable and at the same time easy-to-use format for freshening the air.

more innovation in traditional formats, it is likely that the 10 percentage points lead held by electric in 2003 will be eroded completely by the end of 2009.

Asia Pacific stands alone in its love of gel The market in North America is

Spray/Aerosol Fresheners: % Share of Regional Market 2008

70 60 50 40 30 20 10 0

air fresheners. They dominate the market with arguably three times the appeal of any other region.

The leading brand is Kobayashi

Pharmaceutical Co Ltd's Sawaday which had 22% of sector value sales in 2008 followed by ST Corp's Shoshu with approaching 11%.

The appeal of gel does not extend to

India, and is largely confined to Thailand (the biggest market), Taiwan and China.

spread more widely across all the air care sectors than elsewhere with a greater choice of products and more niche opportunities. Hence although electric carries the largest share at 31% it does not dominate the market, i.e. spray/aerosol had a comparable share of 28% in 2008.

11

Regional Analysis

Household Care: Global Air Care Euromonitor International

Western Europe Presents Mixed Picture

Western Europe is the largest market for air care and was worth US$2,824 million in 2008 up 2% on 2007 or just

over US$56 million. This was despite very challenging economic conditions from which some nations in the region have yet to emerge. These conditions allowed private label to continue to increase its share of the market from 12.6% to 13.5% in 2008, equivalent to being the fourth largest brand in the market.

Performances ranged widely: from winners such as Turkey which grew almost 13% year-on-year; to losers such as

Belgium which shrank by half a percent. In all, six countries witnessed market decline with most of the major players only just holding their own. With the exception of Italy, all remaining top-five markets (which together make up just over 80% of regional sales) including the UK, France, Spain and Germany, grew at a lower rate compared to the previous year and fell below the regional average.

Italy grew by over 4%, which although higher than its near neighbours was considerably lower than growth in 2007

which was over 6%. The market is relatively underdeveloped in Italy and this has helped it to grow faster.

Spain in particular suffered a significant slowdown from 10% growth in 2007 to just 2% in 2008. The economic

downturn has had a big psychological impact on consumers in Spain relegating products such as air care to nonessential status. A reduction in car usage dealt a double blow to sales of car air fresheners.

Western Europe Value Growth by Country 2008

4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 4.4

% value growth

Western Europe average 1.7 1.3 1.0 1.1

United Kingdom

France

Spain

Italy

Germany 12

Regional Analysis

Household Care: Global Air Care Euromonitor International

Turkey Fights Downturn

At first glance it seems that Turkey avoided the global

recession, however the figures are in fact the result of a concerted effort to offset the effects of the downturn.

In 2008, companies launched promotional campaigns

Western Europe Air Care by Country 2007/2008

Turkey Austria Belgium Portugal

to minimise the negative effects of the global economic crisis. Promotions included 'buy-one-get-one-half-price' offers. With Reckitt Benckiser offering its Air Wick FreshMatic electric air fresheners in this manner for a limited period. These promotions accompanied by strong advertising helped to increase their sales in 2008.

Although premium-priced formats such as electric had

been doing well, the economic crisis caused a shift back towards cheaper formats such as spray/aerosol. Standard spray/aerosol air fresheners showed the fastest retail value growth of 15% in Turkey in 2008.

Rising raw material costs have driven the average unit

Netherlands Germany Italy Spain France United Kingdom -5 0 5 10 2008 2007 15 13

price higher which in turn has driven market value up.

Underlying the challenges of the economic downturn in

Turkey is a positive trend towards more Westernised lifestyles and rapid urbanisation that sees consumers seeking to improve their living conditions including having fresh clean aromas in the home.

With an improvement in economic conditions, growth

is expected to continue despite the fact that the market is now reaching a level of maturity.

% value growth 2007/2008

Regional Analysis

Household Care: Global Air Care Euromonitor International

Economy Restraining North America

North America is the second largest region for

air care, however due to a reduction in demand for electric air fresheners it suffered a slowdown in growth in 2008. Year-on-year the air care market in North America fell by 0.2% in 2008 losing US$6 million in actual value.

Electric air fresheners have historically enjoyed

North America Air Care Volume vs Value Category Growth 2008

20 Value 15 10

% value growth

Volume

buoyant sales in North America, however over the last two years sales fell as products were discontinued, with more focus placed on instant-release aerosol sprays (included by Euromonitor International under spray/aerosol air fresheners) and hence being the major reason for growth in this category.

The economic downturn has heightened price

5 0 -5 -10 -15 -20

competition bringing with it intense promotional activity such as 'buy-one-get-one-free' and 'buyone-get-one-half-price' offers which in turn are pegging back market values. As a consequence of this and the economic downturn, spending per household fell by 1.4% in 2008.

Gel air fresheners have seen little innovation

other than in fragrance and this has caused the category to contract. Liquid air fresheners have seen a boost to sales due to the growth in popularity of reed diffusers for their decorative appeal.

14

Regional Analysis

Household Care: Global Air Care Euromonitor International

Changing Trends in North America

The North American market is relatively There is a trend towards clean fresh scents such as linen

sophisticated with consumers looking to air care for a number of features and benefits.

They range from those with busy lifestyles who

and laundry arising from those seeking cleanliness.

On the other hand, those wanting to set mood are finding

appeal in more exotic scents such as Hawaiian Breeze.

Fresh scents are now the most popular in the USA taking

want air fresheners to help maintain a pleasant household aroma, without extensive cleaning, to others who are using air fresheners to create ambience and set mood.

In addition, growing rates of pet ownership (and

over from citrus.

Fragrance Ranking in Air Care in the USA 2006-2008

2006 Clean Linen/Fresh Laundry Vanilla Citrus Fruits Apple Aqua/Water Lavender Floral Forest Fruit/Berries Spicy Herbal 9 2 1 7 3 4 6 5 8 10 2007 1 5 2 4 3 7 8 6 9 10 2008 1 2 3 4 5 6 7 8 9 10

15

their accompanying odours) are also driving the desire for increased odour elimination.

The combination of odour elimination and

ambience has boosted the candle sector creating increasing competition from regular candle nonair care products and to a degree the lines for the consumer are becoming somewhat blurred.

Creating ambience is also driving the appeal of

decorative formats such as reed diffusers which resulted in a 7% value gain for liquid air fresheners in North America in 2008.

The market is becoming increasingly segmented

as manufacturers look to target discrete groups for specific reasons. For example, SC Johnson's Glade Plug-Ins Scented Oil Light Show were targeted at tweens (8-12 year-olds) and teenagers.

Regional Analysis

Household Care: Global Air Care

Euromonitor International

Japan Causes Slowdown in Asia Pacific

Asia Pacific is the third largest region for air care but is only about half the size of the market in North America and

Western Europe.

In 2008, it was worth over US$1.3 billion and although it was up 4% on the year before, the pace of growth was a

little slower than the previous three years. The region comprises a mixture of nations at various stages of development so performances necessarily varied.

The most significant players in the region for air care market are Japan, China, South Korea and Thailand, however

they are at different stages of development and therefore demonstrated significantly different growth rates.

Asia Pacific Air Care by Country 2007/2008

1,000 2008 900 800 700 US$ million 600 500 400 300 200 100 0 Japan China South Korea Thailand Malaysia Taiwan Philippines India Vietnam Singapore 16 2007

Regional Analysis

Household Care: Global Air Care Euromonitor International

Japan Favours Gels

Japan is the largest market in Asia

Pacific with around 70% of regional sales but it is the most mature (more similar to the US and European markets) and only grew by 3%. It has consistently had some of the lowest growth levels in the region and therefore accounts for a smaller share of the market than it did five years ago. The popularity of gel air fresheners in the region is almost entirely due to their popularity in Japan. Although they represent only a third of the Japanese market this accounts for 80% of sales in the region. In Japan and hence the region overall, gel air fresheners was the best-performing category in 2008, recording value growth of almost 6%. The rise in sales of gel air fresheners in Japan is due in part to the availability of longer-lasting brands such as Shoshu Pot Jewelia which has a jewel-like appearance and lasts for up to two months. There has been more innovation in this sector, and their compact size and no requirement for electricity aids their popularity.

Japanese Air Care Market: % Share by Category 2008

5%

4%

3% Gel air fresheners 27% Spray/aerosol air fresheners

17%

Car air fresheners Liquid air fresheners Electric air fresheners Other household air care 21% 23% Candle air fresheners

New Product Development in Japan 2008/2009

Product World Fragrance Lasts up to three months Available in three different fragrances: Bulgaria Rose, Hawaii Plumeria, South Spain Sunflower Air Wash for Wardrobe Designed for use within walk-in wardrobes Includes an indicator showing the quantity of deodoriser left Manufacturer Kobayashi Pharmaceutical

ST Corp

17

Regional Analysis

Household Care: Global Air Care Euromonitor International

Eastern Europe Biggest Volume Increase

Eastern Europe was the fastest-growing region for air care in value terms in 2008. The market rose by 18% to

US$435 million, an increase of some US$66 million. While sales in all categories grew it was sales of sprays/aerosols which primarily drove the market with a year-on-year increase of over 17%. In all, since 2003 sales have more than doubled across the region.

The fastest-growing country within the region was the Ukraine which is now the third largest market there. Here the

market is becoming increasingly sophisticated allowing the introduction of more and varied formats. The market is moving faster in urban areas where a more sophisticated lifestyle is enjoyed. Spending per capita rose by 48% in 2008, faster than anywhere else in the world.

Although Russia makes up around a quarter of the market (similar to Poland) this is largely due to its geographical

size and large population, however spend per capita is still relatively low at less than US$1 compared to Poland at over US$3. In Russia, as elsewhere in Eastern Europe improving lifestyles and higher levels of disposable income are driving increased sales.

Eastern Europe Air Care by Country Market Size 2006-2008

140 2006 120 US$ million 100 80 60 40 20 0 Poland Russia Ukraine Romania Hungary Czech Republic Bulgaria

Slovenia

2007

2008

18

Regional Analysis

Household Care: Global Air Care Euromonitor International

Sweet Smell of Success in Poland

Poland is the largest market in Eastern Europe

and continues to grow strongly across all categories. The market grew by 16% in 2008 a rise of US$16 million (greater than sales in most other Eastern European nations). Air care has moved rapidly from being a luxury to a necessity facilitated by higher levels of disposable income. With an improvement in financial status has come a willingness to spend on better quality products from well-known brands. Although sprays/aerosols dominate the market, new and innovative formats and fragrances are growing in appeal. In 2008, electric air fresheners was the fastest-growing category rising in value by 31%. Innovation was a key factor behind growth with major new product launches such as Air Wick Melodia (Reckitt Benckiser) and Ambi-Pur 3volution (from Sara Lee). Although Polish consumers are open to innovative formats they remain somewhat conservative with regard to fragrance tending to prefer traditional aromas such as Pine, Aqua/Water, Floral, Fruity, Lavender, and Jasmine. There is still further growth potential to come from new customers who are being enticed into the market through strong advertising and marketing as well as through continued product innovation.

Poland Air Care by Category 2006-2008

2008 Liquid air fresheners

2007 2006

Candle air fresheners

Other household air care

Gel air fresheners

Car air fresheners

Electric air fresheners

Spray/aerosol air fresheners 0 50 100 150 Local currency, million 19

Regional Analysis

Household Care: Global Air Care Euromonitor International

Argentina Growth Story in Latin America

Latin America has been a strongly growing region and

that growth continued with an increase of 11% in 2008 making the air care market for the region worth US$397 million.

Within this growth not all nations are performing

Latin America Air Care by Category Share 2008

5.4% 4.2%1.6% 8.6% 0.2% 13.2% Spray/aerosol air fresheners Electric air fresheners Car air fresheners Other household air care Gel air fresheners Candle air fresheners 66.7% Liquid air fresheners

strongly. Growth in Brazil, one of the main players in the region, slowed down notably in 2008 and it slipped from being the biggest player to second place behind Argentina.

Argentina has consistently been the most dynamic but

its period of such rapid growth may be over as it reaches maturity, coupled with the economic downturn acting as a brake.

Latin America Market Size by Country 2003-2008

120 100 US$ million 80 60 40 20 0 2003 2004 2005 2006 2007 2008 Argentina Brazil Mexico Colombia Chile Venezuela

The market is dominated by sprays/aerosols and it

continues to see growth, albeit it is no longer the fastestgrowing category.

Growing quickest are gel air fresheners with a CAGR of

36% over 2003-2008, growing by over 49% in 2008 alone.

The category picture is a mixed one; in some nations, e.g.

Chile, sales of anything other than sprays/aerosols are negligible.

Furthermore even though electric air care is the second

biggest category there are relatively few sales in the leading nations of Argentina and Brazil. The popularity of electric air fresheners resides primarily in Mexico which contributes over 50% to total electric air care sales.

20

Regional Analysis

Household Care: Global Air Care Euromonitor International

Clearing the Air in Egypt Boosts the Middle East and Africa

The Middle East and Africa represents only 3% of the world air care market and spending per capita is the lowest in

the world. Nevertheless it has enjoyed a moderate and consistent growth level with a CAGR of 7% over 2003-2008. It grew by 8% in 2008 creating a market worth US$213 million.

All of the leading nations in the region enjoyed around average growth levels in 2008 but Egypt was the strongest,

growing by over 11%. Egypt's high levels of pollution and dust are a key factor driving increasing demand for air care solutions. Car air fresheners is a key category for the region as a whole and wider distribution and greater use by taxi drivers boosted sales in Egypt in particular.

The market in the Middle East/Africa region is less sophisticated than some and is dominated by the sprays/aerosols

category which makes up over half of the market. The second largest category and the fastest growing in 2008 was car air fresheners which grew by 10%.

Gel and electric are the fastest growing of the newer air care formats but sales are only a fifth and a quarter,

respectively, of those for sprays/aerosols. With sprays/aerosols expected to continue to grow faster than other formats with a forecast CAGR of 4% over 2008-2013 the gap will continue to widen.

Middle East and Africa Air Care by Country 2007/2008

60 2007 50 US$ million 40 30 20 10 0 South Africa Egypt Israel Saudi Arabia Morocco Syria Iraq Tunisia

United Arab Emirates

2008

21

Regional Analysis

Household Care: Global Air Care Euromonitor International

Australasia Fading Away

Like other developed regions Australasia felt the effects of the economic downturn and growth in 2008 slowed

significantly to just over 1% such that the market rose by less than US$2 million to US$135 million. The future sees a move to contraction with a forecast negative CAGR of just under 1% over 2008-2013.

The only categories to show positive growth in 2008 and indeed faster growth than 2007 were sprays/aerosols and

car air fresheners. Together these two formats make up around three-quarters of the market. This share will increase as they are the only formats going forward where no decline is expected.

Australasia Air Care Growth by Category 2007/2008

2007-08 2006-07

Car air fresheners Other household air care Candle air fresheners Liquid air fresheners Gel air fresheners Electric air fresheners Spray/aerosol air fresheners -8 -6 -4 -2 0 2 4 6

10

% value growth 22

Household Care: Global Air Care Euromonitor International

Introduction Global Snapshot Regional Analysis Category Analysis Competitive Environment Future Outlook

23

Category Analysis

Household Care: Global Air Care Euromonitor International

More Choice but No Show Stealers

Sprays/aerosols keep growing Global Air Care by Category Share 2003 vs 2008

2003 2008

Variations on a theme

Spray/aerosol air fresheners has grown its share of the

air care market despite much innovation and frequent new product introductions in other formats.

The only other category to have grown share in the last

Other household air care

7.0%

5.7%

five years has been candles which underlines a growing shift away from pure functionality in air care towards added features and benefits such as interior design and style.

The market is becoming increasingly segmented

Liquid air fresheners

6.5%

6.2%

Candle air fresheners

8.0%

8.4%

especially in developed regions where new innovations target specific odours, e.g. pets, areas, e.g. wardrobes, or consumer groups, e.g. teenagers.

This is not to lose sight of the fact that innovation has

Gel air fresheners

12.3%

11.4%

Car air fresheners

14.9%

13.6%

been key to ensuring growth across all sectors. Other household air care has lost most share and this is where least focus has been. Included here are fresheners such as carpet powders where very little advance has been made in recent years.

Lack of growth in the other household care category

Electric air fresheners

23.1%

22.0%

Spray/aerosol air fresheners

28.3%

32.9%

also highlights the fact that there is little sign of any new format making inroads - with new product development focused primarily on variations on existing methods of fragrance delivery.

24

Category Analysis

Household Care: Global Air Care Euromonitor International

Original and Still the Best?

US leads the world

The original air freshener format of

Concentrated has its limits

Argentina and Russia also

Remaining an engine of growth

Spray/aerosol air fresheners is forecast to

spray/aerosol continues to dominate world sales. The USA is the world's largest market for spray/aerosol air fresheners making up around a quarter of value sales. It was also the fastest growing country in 2008 rising by 17%.

Spray/Aerosol Air Fresheners Leading Countries 2007-2008

700 600 500 US$ million 400 300 200 100 0 2007 2008

continue to be the fastest-growing air grew strongly because care category going forward. They are the concentrated sprays/ entry level format for all markets and in aerosols have really taken many ways have the optimum off with their CAGRs over functionality being both portable and 2003-2008 being in the instant. order of 46%. Argentina has the world's largest It is a format that has continued to market for concentrated air evolve in both fragrance and delivery and fresheners in volume is therefore likely to deliver growth in both terms. developed as well as emerging nations. The share of concentrated Spray/Aerosol Air Fresheners to standard air fresheners Forecast % CAGR 2008-2013 is roughly 80:20 and this UK -0.3 has changed little over the Germany 0.2 last few years indicating Argentina 1.3 that perhaps innovation in France 2 this sector must look Japan 2.6 elsewhere than the Spain 2.7 concentrated format.

It has been the shift to

instant-release sprays/ aerosols that has boosted growth in the USA.

Italy Russia USA Brazil -2 0 2

2.7 3.9 4.9 5.6

6 25

Category Analysis

Household Care: Global Air Care Euromonitor International

Who's Plugged In?

Electric air care brought a radical new format to the sector when plug-ins first hit the market and their rise in sales

has in some cases been meteoric, although similarly its popularity has been seen to fall equally quickly.

Overall electric represents around 22% of the air care market but its popularity varies widely by region, topping sales

in North America with a 31% share and being least popular in Asia Pacific where it only accounts for 5% of sales.

Although it has had greatest success in developed regions such as North America and Western Europe it is in some of

the countries of these regions where sales are now declining fast. Forecast CAGRs in most of the major Western European nations such as Spain, France and the United Kingdom are likely to be less than 2% from 2008-2013.

There are undoubtedly economic reasons for some of this performance but it is also a sign of maturity where it is

proving harder to excite the consumer to drive new sales.

The prospects for rapid growth are better where the market is less developed and consumers have been ready to

move on to air care that produces prolonged rather than instantaneous freshness and brings with it an element of sophistication.

Growing Markets for Electric Air Fresheners

% year-on-year growth 2007-2008 Ukraine Venezuela Poland Russia Czech Republic 86.2 60.5 30.9 30.5 23.9

Declining Markets for Electric Air Fresheners

% year-on-year growth 2007-2008 Philippines Belgium USA Japan Australia -28.0 -12.0 -10.9 -4.0 -4.0

26

Category Analysis

Household Care: Global Air Care Euromonitor International

Has Electric Lost Its Spark?

Electric formats have had an enormous impact on the market changing air care products from merely functional to

home-enhancing products. Consumers in developed regions such as North America and Western Europe have readily embraced the format, although in North America popularity is waning.

Manufacturers have sought to evolve the product adding new functionality and more added value, e.g. lights and

fans, but there are limitations on how far the product can be taken. This has rapidly moved to being a mature sector and is now more likely to be superseded by other advances in product delivery. Innovation brought the electric air freshener but there is a hunger for further development and a more extensive range of features and benefits.

Furthermore, in some regions electric has not really taken off and other newer formats might prove to have a wider

appeal. Although the premium pricing of electric air care will have caused sales to suffer to a degree during the recession, developed markets already appear to be looking towards the next innovation and this will cause the slowdown in growth to continue. The instant-release sprays/aerosols that are now enjoying popularity in North America may become preferable in developing markets as well.

Electric Air Care % Growth by Region 2003-2008

30.0 25.0 yea %r -on -year growth 20.0 15.0 10.0 5.0 0.0 -5.0 -10.0 -15.0 2003-04 2004-05 2005-06 2006-07 2007-08 27 North America Western Europe Asia Pacific Global

Category Analysis

Household Care: Global Air Care Euromonitor International

A Steady Road for Car Air Fresheners

Car air fresheners make up 14% of the total air care

market with a value of US$1.1 billion in 2008. The contribution varies by region from Asia Pacific where the car category makes up 21% of the market to 9% in Latin America.

This category is characterised generally by steady

Car Air Fresheners by Country: % Growth 2003-2008

100

80

-year growth year% on

growth and is essentially closely linked to affluence and levels of car ownership and usage. Eastern Europe demonstrated the fastest level of growth during in 2008, rising in value by 20%. This was due mainly to growth in Ukraine of 65% and Russia where value increased by 24%.

By contrast in developed regions where the market

60

40

is mature, sales have been declining year on year especially in those nations affected by the economic downturn such as France, Spain and Germany. Increasing fuel costs have caused a fall in car usage and correspondingly in car products.

The market leader is Sara Lee's Ambi-Pur brand

20

which has seen continued product enhancement aimed at individual driver environments such as the development of those fragrances designed to appeal specifically to men and women.

Innovation in the sector has otherwise been fairly

-20

-40 2003-04 2004-05 Japan USA Italy 2005-06 2006-07 2007-08 Russia France Spain Brazil Germany UK 28

limited with efforts concentrated on in-home formats and fragrances but there could still be opportunities potentially in terms of mood enhancement or alertness to enhance the driver experience.

Category Analysis

Household Care: Global Air Care Euromonitor International

More Cars, More Car Air Fresheners

In general nations enjoying an increase in car ownership, greater urbanisation and more affluent lifestyles are seeing

corresponding strong growth in car air fresheners.

Although there is no direct correlation in terms of numbers (indeed data is not available for all countries) the

countries with fastest-growing markets for car air care appear in the top quarter of the list of nations where new car registrations are growing fastest.

Future prospects indicate more of the same to come with steady growth in car air fresheners linked to car ownership

in Eastern Europe and other developing nations and little or no growth in the mature markets of Western Europe.

Top 10 Car Air Fresheners Growth Markets by Country 2007-2008

% growth 2007-2008 Ukraine Venezuela Romania Russia Argentina India Thailand Serbia and Montenegro Indonesia Mexico 64.9 63.6 35.7 24.3 23.8 22.6 22.3 20.0 17.3 16.0

Top 10 Countries for New Car Registrations 2007-2008

% growth 2007-2008 Venezuela Egypt Poland Czech Republic Colombia Russia South Africa China India Chile 10.9 9.5 9.4 8.4 8.0 4.8 4.7 4.6 3.9 3.8

29

Category Analysis

Household Care: Global Air Care Euromonitor International

The Rise and Fall of Gel

Globally the gel format accounts for 11% of the air care Typically sales have been characterised by rapid adoption,

market but is much more significant in Asia Pacific. Here it represents 27% of the market (equal to 39% of global gel sales) making it the best-selling format.

peaking and then growth slowing equally dramatically and in some cases, i.e. the developed regions, the market declining.

Further contraction is expected in Western Europe and

Gel Air Care: % Sales by Region 2008

4% 21%

3% 2% 1%

39% Asia Pacific Western Europe North America Eastern Europe Middle East and Africa Latin America Australasia

North America as other formats deliver perceived improved levels of sophistication and performance. As demonstrated by Western Europe and North America there comes a point when the features and benefits offered by gels may be superseded by other innovations.

Gel Air Care: % Growth by Region 2003-2008

60.0 grow th year% on 40.0 20.0 0.0 -20.0 2003-04 2004-05 2005-06 2006-07 2007-08 Global Australasia Latin America North America Asia Pacific Eastern Europe Middle East/Africa Western Europe 30

30%

Growth in Asia Pacific has been driven by new product

innovations delivering longer-lasting brands and products designed for specific areas of the home, e.g. in Japan the launch of ST Corp's Air Wash for Wardrobe, which is specifically designed for walk-in cupboards and wardrobes.

Product innovation has been supported by substantial

advertising expenditure, e.g. in Argentina by SC Johnson & Son de Argentina SAIC for its Glade Glass Scents brand. Gel fresheners appeal because they last, are compact and do not require electricity, and have had innovative new brand introductions to drive continued interest.

ye ar

Category Analysis

Household Care: Global Air Care Euromonitor International

Japan Keeps Liquids Afloat

Although globally liquid air fresheners appear to

Liquid Air Care by Region 2008

250 227.8

be making steady progress in the market, having grown at over 2% per annum over the last few years, this hides a more disparate picture.

Liquid air fresheners have a significant role in

Liquids have enjoyed a degree of popularity in

US$ million

Asia Pacific making up 17% of sales which in turn is nearly 47% of the world market valued at US$488 million in 2008. Some 96% of sales in Asia Pacific are in Japan, which on its own sells more liquid air fresheners than any other region in the world. However, Japan is a mature market and future sales growth may be harder to come by. Western Europe but the market appears to be declining and they have lost share of the total Western European air care market.

Liquid air fresheners is the fastest-growing

200 170.1 150

100

58.7 50 20.8 5.0 0 4.7

0.9

category in Eastern Europe with a CAGR of 50% over 2003-2008 with sales in Russia taking off. The liquid category has increased its share from just over 1% to 5% over the period. However, it is anticipated that its share of the market here will remain largely unchanged going forward.

Product launches have delivered bursts of

growth elsewhere but there is little sign of this being improved upon.

31

Category Analysis

Household Care: Global Air Care Euromonitor International

Candles Burning in the West

The market for candles was worth US$659 million in 2008

having grown by a moderate 3% from 2007 demonstrating a significant slowdown over the previous few years. Sales are almost entirely confined to the developed regions of Western Europe, Japan and North America with around 53% of the market being in the USA alone.

Candle air fresheners have proved popular in these regions

Candle Air Fresheners: % Sales by Country 2008

19% 53%

3% 5% 8%

because in addition to air freshening they are also decorative and ambience-enhancing. They do however face competition from other scented candles which often have pleasing aromas without being specifically marketed as air fresheners.

Candle Air Fresheners: % Growth by Region 2003-2008

30 25 % year-on -year growth 20 15 10 5 0 -5 -10 -15 2003-04 2004-05 2005-06 2006-07 2007-08 Eastern Europe Latin America Middle East and Africa North America Western Europe World Asia Pacific

12% USA France Germany United Kingdom Japan Others

Eastern Europe still has some growth

potential in this sector especially as candles have yet to make an impact in Russia the largest market in the sector.

With the exception of Japan, candles have

made little impression in Asia Pacific and even here sales are declining. This decline is in part due to a reluctance to use naked flames in the home but also due to the perception that candles are decorative rather than functional.

32

Household Care: Global Air Care Euromonitor International

Introduction Global Snapshot Regional Analysis Category Analysis Competitive Environment Future Outlook

33

Competitive Environment

Household Care: Global Air Care Euromonitor International

Global Air Care Duopoly?

The market continues to be dominated by two manufacturers, SC Johnson and Reckitt Benckiser, which have

between them just under half of the global air care market. There are more than 40 other manufacturers some of which have particular regional and/or category strengths, however SC Johnson plays a major role in every region of the world. SC Johnson is category leader in five out of the seven categories and Reckitt Benckiser is the number two player in six out of the seven. For both, their main focus has been on in-home air care, however SC Johnson still ranks fourth and Reckitt Benckiser eighth in car air fresheners.

In the sectors where they lead, the share held by these manufacturers is at least twice as large as their nearest rival.

Their strength comes from having the leading brands in the spray/aerosol and electric air fresheners sectors. The latter, however, is a competitive sector and SC Johnson has been gradually losing share due to new entrants and more activity from existing rivals.

Reckitt Benckiser has delivered the stronger performance with share continuing to grow despite difficult trading

conditions by focusing on its most profitable brands and providing them with strong marketing support. Its Air Wick brand has proved to be one of its major strengths in a number of its major markets including Europe and the USA.

Share of Global Air Care Category by Manufacturer 2008

100 80

% value share

60 40 20 0 Spray/aerosolElectric Gel Liquid Candle Other air care Others 34 Car Global SC Johnson & Son Inc Reckitt Benckiser Plc

Competitive Environment

Household Care: Global Air Care Euromonitor International

New Entrants Unfazed

Despite the large share held by the leading two manufacturers this has not prevented new entrants to the market. Procter & Gamble entered the market in 2004 with its Febreze brand and has very rapidly grown share to over 5% of

the global market in 2008 making it the fourth largest player. This positioning arises from a 10% share of electric air fresheners and a 7% share of sprays/aerosols, as well as growth in candles.

It has been reported that Procter & Gamble is looking to strengthen its position through the acquisition of Sara Lee's

air care business in Western Europe (as Sara Lee looks to exit the market). The acquisition would help Procter & Gamble counter the threat from private label in Western Europe and enable it to realistically challenge for the number two slot in the market. The acquisition might poise a serious threat to remaining leading brands: Reckitt's Air Wick and SC Johnson's Brise/Glade.

In 2008, the third-placed manufacturer Sara Lee led sales in car air fresheners with its Ambi-Pur brand holding 13%

of the market. It continues to take share from other manufacturers in this category, however it has failed to make much progress elsewhere. The shift of the brand to Procter & Gamble would therefore strengthen its product portfolio across the board.

Manufacturer Share of Global Air Care Market 2001/2008

Others Private Label ST Corp Kobayashi Pharm. Co Ltd Procter & Gamble Sara Lee Corp Reckitt Benckiser Plc SC Johnson & Son Inc 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 35 2008 2001

% value share

Competitive Environment

Household Care: Global Air Care Euromonitor International

SC Johnson Needs to Keep Working It

SC Johnson is the number one manufacturer in five of the world's seven regions and although it has a portfolio of

brands it is its Glade/Brise brand that plays a major role across the world. Nonetheless this has steadily lost brand share over the past few years and its share of just under 27% in 2008 compared to just over 30% in 2001.

Its position has been threatened by both Reckitt Benckiser's Air Wick and the newer Febreze brand from Procter &

Gamble. SC Johnson introduced its own new brand in 2003 with Oust which now ranks sixth in the market. Although Sara Lee's Ambi-Pur is number three in the market it has also struggled to hold its share, a situation that might change after Ambi-Pur is taken over by Procter & Gamble.

SC Johnson continues to innovate with the Glade brand and it most recent product launches included Glade

PlugIns Scented Oil Light Show, which freshens as well as provides a 'light show' of various colours. Aimed at the teenage girl market, although still attractive for adults, they come in three scents, Berry Burst, Vanilla & Cream and Watermelon Rush.

SC Johnson's strong position is supported heavily by promotional and advertising activity. Advertising campaigns

such as the one in Poland for Brise Sense and Spray raise brand awareness and catch the attention of consumers and are used in synergy with promotional offers to increase sales. For example, SC Johnson has used buy-one-getone-free offers and half-price Brise gel air fresheners when consumers purchase Brise spray/aerosol air fresheners.

SC Johnson % Share of Air Care Market by Region 2008

60.0

% value share

50.0 40.0 30.0 20.0 10.0 0.0 Global Latin America North America Eastern Europe Middle East/Africa Western Europe Australasia Asia Pacific 36

Competitive Environment

Household Care: Global Air Care Euromonitor International

Reckitt Benckiser Wins With Premium Focus

Even though Reckitt Benckiser's key markets of Western Europe and North America have been challenged by the

economic downturn it has continued to perform strongly.

In the half year to June 2009, Reckitt Benckiser's net revenue rose 8%, while the home care category rose 5% year-

on-year with a CAGR of 10% over 2005-2009.

A focus on what the company calls 'power' brands has ensured high margins. Reckitt Benckiser believes that even in

a recession consumers will put product performance before price.

Reckitt Benckiser has generated growth for these brands through continuous investment in product development and

marketing activity. Instead of cutting back it has looked to increase advertising activity. Support for the Air Wick brand has been a crucial driver of revenue in the home care division.

Promotional activity has strong appeal during the economic downturn and has discouraged consumers from

switching to other brands. Although discounting is not sustainable it should help to engender longer-term brand loyalty resulting in continued share growth. In 2009, Air Wick I-Motion was rolled out in a number of new markets.

Reckitt Benckiser Half Year Net Profit 2003-2009

700 600 500 million 400 300 200 100 0 2003 2004 2005 2006 2007 2008 2009 37

Competitive Environment

Household Care: Global Air Care Euromonitor International

Procter & Gamble Takes Over Sara Lee's Air Care Business

Procter & Gamble is a more recent entrant into the global air care market with its Febreze brand, but it has made

rapid progress, and with the acquisition of the Ambi-Pur brand this will give it a massive boost increasing its share from around 5% to just under 13%.

Ambi-Pur brand will give P&G a more balanced air care portfolio enabling it to compete more strongly across more

categories which should in itself offer opportunities for more growth.

Moreover, ownership of the Ambi-Pur brand will give P&G greater manufacturing know-how and more

distribution channels which should benefit further growth of its own Febreze brand.

The acquisition will give the company a particular boost in Western Europe where its Febreze brand is already strong

and where the company is under most pressure with some of its other household brands.

P&G will however have to continue to innovate with the Ambi-Pur brand if it wants to sit happily with the more

innovative Febreze brand.

Sara Lee Presence by Category

Air Care Category Electric Automatic Sprays Car Sprays Toilet Fresheners Brand Ambi-Pur 3volution Ambi-Pur Electrical Plugs Ambi-Pur Instantmatic Ambi-Pur Renov'air Ambi-Pur CAR Ambi-Pur 2Motion Ambi-Pur Sprays Ambi-Pur Mini-sprays Ambi-Pur Toilet Blocks Ambi-Pur Total Fresh Number of Fragrances 11 11 2 2 10 3 10 7 6 4

38

Competitive Environment

Household Care: Global Air Care Euromonitor International

Power Balance Before and After P&G Acquisition of Ambi-Pur

This shift in brand shares (based on 2008 figures) would put the company into contention for second place especially

if it can continue to grow share at the same rate as it has been doing.

Company Ranking Before Acquisition

Company Ranking After Acquisition

Ranking

Company

% market share

Ranking

Company

% market share

SC Johnson & Son

29.2

SC Johnson & Son

29.2

Reckitt Benckiser

19.0

Reckitt Benckiser

19.0

Sara Lee Corp

7.5

Procter & Gamble

12.7

Procter & Gamble

5.2

Kobayashi Pharmaceutical

4.9

Kobayashi Pharmaceutical

4.9

ST Corp

3.3

39

Competitive Environment

Household Care: Global Air Care Euromonitor International

Asian Tigers Keep Multinationals at Bay

While the multinationals excel in other regions of the world, Asia Pacific is dominated by regional manufacturers and

brands. The only multinational with a significant value share within the segment in 2008 was SC Johnson which accounted for 8% of sales.

SC Johnson has no presence in Japan which is the leading country in the region and here the most important

multinational is Procter & Gamble, which accounted for 3% of sales. The company extended its Febreze fabric freshener brand into air care in 2005 and continued to see steady growth in value share.

Kobayashi Pharmaceutical Co Ltd led air care sales in the region during 2008, recording a value share of over 29%.

In Japan, the company's share was an even more impressive 41%, a figure that has risen consistently over the last five years.

The company offers a wide range of different brands and has been proactive in terms of new product development.

Its leading Shoshu brand performed well in 2008, recording a slight increase in value share due to the launch of toilet-specific Shoshugen Shimitsuki-shuu no Shoushuu Mist following the regional trend for area-specific products.

ST Corp is the region's second biggest manufacturer with a market share of approaching 20%. It boosted sales in

2008 with the promotion of its new Air Wash brand for walk-in wardrobes.

Asia Pacific Air Care % Share by Manufacturer 2003

28%

Kobayashi Pharmaceutical Co Ltd SC Johnson & Son Inc Okamoto Industries Co Ltd Daiya Chemical Co Ltd

Asia Pacific Air Care % Share by Manufacturer 2008

Kobayashi Pharmaceutical Co Ltd ST Corp SC Johnson & Son Inc Okamoto Industries Co Ltd Sara Lee Corp

33%

29%

52% 7%

Reckitt Benckiser Plc Sara Lee Corp

2% 3%

3%

5%

Others

3% 3% 4% 9%

Reckitt Benckiser Plc

20%

Others

40

Competitive Environment

Household Care: Global Air Care Euromonitor International

Rising Regional Challengers

New entrant in Latin America

The strong presence of regional producers

Sano Bruno leads rising in Middle East /Africa

Sano Bruno's Enterprises Ltd has gained market share in the Middle

in Asia Pacific is not replicated anywhere else in the world; however that does not mean local producers are entirely absent.

Regional challengers are often confined to

East and Africa over the last three years and now has a 10% share. Its Sano brand is number three in the region. It leads liquid air fresheners with a 55% share and is making inroads into other categories such as gel and electric air fresheners.

a single product category or country but nevertheless make inroads into market share of the larger players.

Bombril SA is a new entrant in the

Share of Middle East and Africa Air Care Market Held by Sano Bruno's Enterprises 2005/2008

60.0 50.0 % share 40.0 30.0 20.0 10.0 0.0

Spray/ aerosol air fresheners 8.8 10.5 Electric air fresheners 0.0 5.2 Gel air fresheners 3.8 5.4 Liquid air fresheners 15.6 54.9 Other household air care 18.8 31.0

Brazilian market. Since 2005, Ceras Johnson's Glade brand has gradually lost value share, mainly as a result of the entry of Bombril into the air care market.

Since its entry Bombril has grown its share

to 3%, and it is the only company with a sufficiently large distribution system to potentially threaten Ceras Johnson and Reckitt Benckiser.

Bombril's No Ar and Mon Bijou brands are

2005 2008

number three and five in Brazil, respectively, and are expected to increase in popularity among Brazil's consumers. The company's year-on-year value sales growth between 2007 and 2008 was 302%.

Also growing fast is the Car-Freshener Corp which has increased

share consistently over the last eight years to a 5% share in the region. Its 1 Extra Strength brand is number five in the region but dominated car air fresheners with a 32% value share in 2008.

41

Competitive Environment

Household Care: Global Air Care Euromonitor International

Brand New or Same Old?

Global Air Care Performance by Brand

Brand Glade/Brise Air Wick Ambi-Pur Private label Febreze Renuzit Oust Ranking 2008 1 2 3 4 5 6 7 Trend over last three years

28% 27%

The market is dominated by SC Johnson's Glade/Brise brand

which has the number one position in all regions apart from Asia Pacific (where ST Corp's Shoshu leads) and Western Europe (where Reckitt Benckiser's Air Wick has overtaken it).

Reckitt Benckiser is in a strong second place globally, thanks in

large part to its Air Wick brand now leading in Western Europe.

Aside from this the market is quite fragmented allowing private

label to take an increasing share.

Brand Share Global Air Care Market 2008

Glade/Brise Air Wick Ambi-Pur Private label Febreze Renuzit 1% 2% 2% 2% Oust 3% 5% 6% 7% 17% Shoshu Shoshu

Auto Expressions

Over the last three years the relative position of the

top brands has remained unchanged. Nevertheless the leading SC Johnson brands Glade/Brise and Oust have both lost some share.

This relative stasis belies a very active marketplace

with continual new introductions of fragrance and product such that the leading brands keep evolving and meeting consumer needs at all price points.

The wide range of consumer choice in brands and

formats makes consumer choice harder and advertising and promotion essential to success, thus the brand leaders maintain their positions in part by extensive and expensive advertising and marketing campaigns.

Others

42

Competitive Environment

Household Care: Global Air Care Euromonitor International

Other Brands With a Presence

The leading two brands have consolidated their position with

a presence across all the air care categories. Glade/Brise and Air Wick are the leading or second-placed brands in most categories. However they do not lead all categories nor are they without serious challengers.

For example, the world's leading brand Glade/Brise occupies

Share of Spray/Aerosol Air Fresheners by Top Four Brands 2004-2008

35

the number three slot in car air fresheners where Sara Lee's Ambi-Pur brand is strengthening its position as number one.

In liquid air fresheners Glade/Brise is only the number five

30

brand with the Kobayashi Pharmaceutical Co Ltd's Oheya no Shoshugen challenging Air Wick as number two.

Henkel's Renuzit has been growing share strongly in candle

25 % value share

air fresheners where it is now competing with Air Wick for the number two spot.

In other household air care Church & Dwight Co Inc's Arm &

20

15

Hammer brand takes a substantial share (8%) with its unique baking soda format of carpet and room odour eliminators.

Febreze is now the number three brand in sprays/aerosols

10

and continues to climb correlating directly with a decline in the share held by Glade/Brise.

Febreze has increased its share of standard sprays/aerosols

from 2% in 2004 to 9% in 2008. In electric air fresheners it has increased share from 0.2% in 2004 to 10% in 2008.

It now needs to consolidate this growth and not slip back as

0 2004 2005 2006 2007 2008

was the case with Oust which had a similarly meteoric entry to the market.

Glade/Brise Air Wick Febreze 43

Competitive Environment

Household Care: Global Air Care Euromonitor International

Western Europe Private Label Opportunity

Private label plays a significant role in Western Europe making up 14% of value sales in 2008 increasing year on

year for the last five years.

Private label is not confined by category as share has increased across the board. Innovations made by the leading

brands have been mirrored by developments in private label.

The economic climate has allowed private label to flourish as consumers have looked to make compromises and

economise. Those nations worst hit by recession, namely the UK, Ireland and Spain, have seen their share of private label rise to 12%,13% and 16%, respectively.

Equally, private label which generally adopts a three-tier approach is also able to offer premium products that

compete with the market leaders without the price premium.

Asda in the UK, for example, has followed latest

% share

premium new product developments from major manufacturers by introducing products such as Asda 3scents electric air freshener which alternates between three different types of fragrances every 45 minutes, or Asda Timed Release air freshener which mirrors Air Wick FreshMatic's latest development from Reckitt Benckiser.

With good quality private label products available it

Western Europe Private Label Share by Category 2001-2008

25

20

15

may prove hard to convert consumers back to brands once the recession fades.

Although the economic crisis has been global and other

10

regions have seen small shifts towards private label it is only in Western Europe where retailers have been able to capitalise on changing spending habits.

The increase in private label in Western Europe may

5 2001 2002 2003 2004 2005 2006 2007 2008

Air care Electric air fresheners Candle air fresheners Car air fresheners Spray/aerosol air fresheners Liquid air fresheners Other household air care

put price pressure on branded operators leading to price cuts or more likely intense promotional activity.

44

Competitive Environment

Household Care: Global Air Care Euromonitor International

Smelling Fresh and Fruity

Fragrance is an integral part of the air care product and There is also a trend towards fragrances that remind

was historically limited to those aromas addressing the functional needs of unpleasant odour masking.

Recently fragrances have been introduced that are

intended to enhance emotional wellbeing by being in some way comforting. These range from uplifting food aromas such as vanilla and fruit scents to clean and fresh smells that allegedly bring the outside in.

Leading fragrances are those that have a sense of being

clean and fresh such as having a clean laundry aroma or are reminiscent of the sea.

The most popular fragrance worldwide is the natural

users of places or occasions so that they can indulge in a little escapism or fantasy. These are usually exotic and tropical fragrances that essentially transport the user away. Increasingly though there are fragrances that are place-specific such as the Febreze Destinations Collection range, e.g. Brazilian Carnival, or the National Geographic range from Ambi-Pur with its Japan Tatami, inspired by the fresh soothing aroma that comes from authentic Japanese Tatami mats.

Developments in product functionality mean that

smell of lavender.

Natural scents have proved especially popular when

used in devices that provide ongoing fragrance rather than occasion-specific products.

products no longer have to deliver a single fragrance but can offer alternatives such as Moonlit Walk & Wandering Stream, available as a 2-in-1 candle from SC Johnson. Interest in a brand can be sustained by the introduction of new fragrances or combinations thereof.

Top Three Fragrances in Leading Nations 2008

Argentina Lavender Cotton Baby/Baby powder Australia Lavender Citrus fruits Rose France Fruity/Floral Lavender Citrus fruits Japan Citrus Floral Mint Russia Ocean/ Marine/Sea/ Aquamarine Anti-tobacco Citrus fruits South Africa Lavender Citrus Rose USA Clean linen/Fresh laundry Vanilla Citrus fruits

45

Competitive Environment

Household Care: Global Air Care Euromonitor International

Most Popular Fragrances Worldwide

The right fragrance can provide a product with a real competitive advantage, playing a key part in psychologically

reinforcing the product to consumers, which makes it a powerful differentiator, essential in building brand loyalty. With consumer preferences constantly changing, will lavender vanilla become the next best selling fragrance?

Fragrance

Lavender in the Top 3 Fragrances Vanilla in the Top 3 Fragrances Lavender & Vanilla in the Top 3 Fragrances Not Illustrated

46

Competitive Environment

Household Care: Global Air Care Euromonitor International

Green Is a Natural for Air Care

Environment vs economy

There is a desire to enhance the home environment but

Mainstream or niche trend?

Environment-friendly products are becoming

not at all costs. Green issues are a general trend in household care and are now being more readily adopted by consumers as they realise green products can perform and do not necessarily attract a premium.

The global economic crisis has created shorter-term

increasingly mainstream in developed markets such as North America and Western Europe.

Launches by major manufacturers are required to shift

concerns over pricing but in essence green is a longerterm influence that will shape the market and NPD. There are clear trends in Western European nations such as Germany that the development of green products will be essential to the market's continued growth.

green products from niche to mainstream. With their larger budgets and resources these products can in themselves boost awareness and rates of adoption.

Although larger players can obtain first-mover

advantage by adopting a green stance there are conflicts between traditional air care and the environment.

Eco-friendly opportunity in natural

The best opportunities for air care to capitalise on

Personal environment improvements

While there are opportunities to offer products which are

environmental awareness maybe to pursue the use of 'natural' fragrances. Especially if these scents come from natural ingredients rather than being chemicallyderived.

The growth in clean and outdoor scents is already

sensitive to the environment there are concerns about how any chemicals used may affect the personal environment.

Fragrance was declared Allergen of the Year in 2007

by the American Dermatitis Society.

To address this issue, Ambi-Pur now offers its

making an impact.

Candles may benefit from the desire to be green as they

are generally less harmful and more eco-friendly than sprays/aerosols and electric devices. They are also available in many natural scents.

hypoallergenic Puresse aroma in most of its air care formats.

47

Competitive Environment

Household Care: Global Air Care Euromonitor International

Air Hygiene

The introduction of hygiene into the air care market

is a significant innovation.

This trend was evident first in beauty products such

as hand washes but has been spreading to household care through washing-up liquids and surface cleaners but now also into air care.

The trend appears to be strongest in Japan where

perhaps concern over germs and the spread of disease is high. Air hygiene has also become a growth niche category and Japan has seen growth in products such as Kobayashi's air hygiene spray Bacterito.

Launched in 2007, Bacterito is a spray that

produces a negatively-electrified mist to destroy household germs, and also contains deodorising agents.

The trend has seen manufacturers adding

antibacterial functionality to existing brands. In Japan, Lion-Shoji Corp has added an antibacterial agent to its popular Pet Keirei Shu Shutto Shoshu & Jokin, a natural ingredient-based pet spray for removing animal odour from furniture, soft furnishings and other household items.

Other household products include Thornton &

Air hygiene is not limited to the home with the availability of

Henkel's Loctite hygiene spray a germ-free environment can be achieved on-the-move with this car air-conditioning spray.

Advanced Formulations' NO-GERMS brand now has an

Ross' Zoflora range of antibacterial household sprays, a brand that has expanded from disinfection agents into air care.

Antibacterial Air Sanitizing Spray for personal space. The NO-GERMS brand is now rapidly expanding sales in the EU, the Middle East, Asia and Australasia

Health threats, such as the 2009 swine flu scare,

could significantly boost demand for such products.

48

Competitive Environment

Household Care: Global Air Care

Euromonitor International

NPD Looks to Lifestyle as an Opportunity

Air care has moved from a functional necessity to a must-have luxury which can improve in-home ambience visually

as well as through fragrance. The desire to improve the home environment rather than just cover bad smells provides an opportunity to add value and with that add a premium to prices.

Although economic constraints may be making value more pertinent it has also been responsible for more

consumers staying in and looking to enhance the home environment.

Developments are not confined to fragrances but also include alternative methods of delivery allowing in part a multi-

sensory experience. For manufacturers, an appetite for premium products offers a wealth of opportunities for new product development not only in fragrance but in method of delivery, presentation and functionality.

A limited number of single user-activated fragrances has been replaced by a spectrum of options reaching up to

multi-fragranced, self-activating devices.

For those entertaining at home they want the home to Where the economy is forcing consumers to stay at

be smelling its best and in particular to be able to neutralise odours such as cooking smells.

This is an opportunity for premium and luxury products

home then air care can make them feel better or almost virtually take them where they want to go.

Through fragrance, air care is able to deliver luxury and

and has led to products which are odour-specific. Odour-specific fragrance

Cooking Toilet Pet Tobacco

escapism. Mood-enhancing fragrance

Emotive Escapism Luxury/pampering

49

Household Care: Global Air Care Euromonitor International

Introduction Global Snapshot Regional Analysis Category Analysis Competitive Environment Future Outlook

50

Future Outlook

Household Care: Global Air Care Euromonitor International

Future of Mixed Fortunes

One of the most dynamic regions is forecast to continue to be Eastern Europe. Although the pace of growth here will

slow after 2010 it will still increase at a faster rate than any other region widening the gap between it and Latin America.

The gap will narrow between the leading countries as North America grows faster than Western Europe. Here the

effects of the recession will still be felt, particularly in key countries such as the UK, with environmental concerns restricting the market in countries such as Germany. By 2013, market sizes will be comparable. Product development in North America will help sales to grow more strongly.

The ongoing effects of the economic slowdown will allow private label to continue to strengthen in Western Europe

which will keep unit prices low hampering value growth.

Air Care by Region Forecast % CAGR 2008-2013

3,000 Australasia US$ million Western Europe Asia Pacific North America 500 Middle East and Africa Latin America Eastern Europe -2 0 2 4 6 0 2,500 2,000 1,500 1,000

Air Care Forecast Market Size by Region 2008-2013

2008

2009

2010

2011

2012

2013

Western Europe Asia Pacific Latin America Australasia

North America Eastern Europe Middle East and Africa 51

Future Outlook

Household Care: Global Air Care Euromonitor International

Fastest-growing Countries

In absolute terms growth, North America will add most to the global air care market. Although it is only anticipated

to have a CAGR of 2% between 2008 and 2013, it will still add US$289 million to the market.

Fastest growth is occurring in the less developed regions of Latin America, Eastern Europe and Asia Pacific with

Thailand not only growing fast but making the largest contribution in absolute terms to the growth in Asia Pacific.

In Eastern Europe, Poland continues to be an engine of growth and will make the second largest contribution to

growth in the market overall.

The BRIC countries continue to promise strong growth as rising incomes fuel increases in car ownership (important

for car air fresheners) and continued interest in home enhancement. India and China are expected to post CAGRs of 9% and 5%, respectively, with Brazil at 4%, and Russia at 6% between 2008-2013.

As nations develop, distribution necessarily improves, helping air care products reach beyond urban centres,

bringing new consumers into the market, as has been the case in a number of nations in the Middle East and Africa.

Air Care Forecast CAGR 2008-13 by Top 10 Fastest Growing Countries

80.0 2008-13 CAGR % 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 Pakistan Peru Czech Republic India Indonesia Poland Venezuela Thailand Ukraine Russia 52 2008-13 %

Future Outlook

Household Care: Global Air Care Euromonitor International

Western Europe Looking Flat

Between 2008 and 2013 the CAGR for the Western

Europe region overall is less than 1% which will see the market only grow by US$78 million.

Continued economic difficulties will see the market

Western Europe Forecast Growth by Country 2008-2013

5

in Western Europe's leading nations going into decline as consumers avoid what they see to be unnecessary expenditure.

The air care markets in Germany, France and the

% year-on-year growth

UK are all forecast to show a reduction in absolute growth over the period, together shrinking by some US$16 million.

In addition to economic pressures the market in

Germany is expected to contract year-on-year throughout the forecast period as consumers become increasingly concerned about the environmental impact of air care products.

The recession in Spain has been much more serious

than expected causing the market to decline sharply in 2009. To counter the effects, strong promotional activity is expected to aid a return to growth.

Italy has proved to be the exception to the rule in the

-1

region where the market is less mature than elsewhere. Here, innovation and premium products have kept interest and unit prices strong. New concepts such as 'intelligent' air fresheners and hypoallergenic products will help continue to drive growth going forward.

-2

-3 2008-09 France Germany 2009-102010-112011-122012-13 Italy Spain United Kingdom 53

Future Outlook

Household Care: Global Air Care Euromonitor International

More of the Same to Come?

The domination of sprays/aerosols is set to continue and product innovation in this sector is likely to see the format

further strengthen its position.

Although electric air care has suffered in North America there are still further growth opportunities in both

Western and Eastern Europe which will sustain the category.

Where air care is most readily perceived as a home enhancement product, e.g. North America, there will be new

opportunities for candles with added odour-eliminating and mood-enhancing properties.

Global Air Care: % CAGR 2008-2013

3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 US$ million

Forecast Absolute Value Growth 2008-2013

450 400 350 300 250 200 150 100 50 0

54

Future Outlook

Household Care: Global Air Care Euromonitor International

Product Trends

Health and hygiene

The natural extension from trying to

Eco Europe

There is an increasing trend in

More decorative

Having gone beyond the mere