Documente Academic

Documente Profesional

Documente Cultură

2.3 The General Banking Law of 2000 PDF

Încărcat de

Zhanika Marie CarbonellTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

2.3 The General Banking Law of 2000 PDF

Încărcat de

Zhanika Marie CarbonellDrepturi de autor:

Formate disponibile

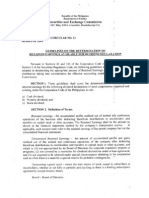

REPUBLIC ACT NO.

8791

May 23, 2000

AN ACT PROVIDING FOR THE REGULATION OF THE ORGANIZATION AND OPERATIONS OF BANKS, QUASI-BANKS, TRUST ENTITIES AND FOR OTHER PURPOSES Section 40. Requirement for Grant Of Loans or 0ther Credit Accommodations. Before granting a loan or other credit accommodation, a bank must ascertain that the debtor is capable of fulfilling his commitments to the bank. Toward this end, a bank may demand from its credit applicants a statement of their assets and liabilities and of their income and expenditures and such information as may be prescribed by law or by rules and regulations of the Monetary Board to enable the bank to properly evaluate the credit application which includes the corresponding financial statements submitted for taxation purposes to the Bureau of Internal Revenue. Should such statements prove to be false or incorrect in any material detail, the bank may terminate any loan or other credit accommodation granted on the basis of said statements and shall have the right to demand immediate repayment or liquidation of the obligation. In formulating rules and regulations under this Section, the Monetary Board shall recognize the peculiar characteristics of micro financing, such as cash flow-based lending to the basic sectors that are not covered by traditional collateral. (76a) Section 41. Unsecured Loans or Other Credit Accommodations. - The Monetary Board is hereby authorized to issue such regulations as it may deem necessary with respect to unsecured loans or other credit accommodations that may be granted by banks. (n) Section 42. Other Security Requirements for Bank Credits. - The Monetary Board may, by regulation, prescribe further security requirements to which the various types of bank credits shall be subject, and, in accordance with the authority granted to it in Section 106 of the New Central Bank Act, the Board may by regulation, reduce the maximum ratios established in Sections 36 and 37 of this Act, or, in special cases, increase the maximum ratios established therein. (78) Section 43. Authority to Prescribe Terms and Conditions of Loans and Other Credit Accommodations. - The Monetary Board, may, similarly in accordance with the authority granted to it in Section 106 of the New Central Bank Act, and taking into account the requirements of the economy for the effective utilization of long-term funds, prescribe the maturities, as well as related terms and conditions for various types of bank loans and other credit accommodations. Any change by the Board in the maximum maturities, as well as related terms and conditions for various types of bank loans and other credit accommodations. Any change by the Board in the maximum maturities shall apply only to loans and other credit accommodations made after the date of such action. The Monetary Board shall regulate the interest imposed on micro finance borrowers by lending investors

and similar lenders such as, but not limited to, the unconscionable rates of interest collected on salary loans and similar credit accommodations. (78a) Section 44. Amortization on Loans and Other Credit Accommodations. - The amortization schedule of bank loans and other credit accommodations shall be adapted to the nature of the operations to be financed. In case of loans and other credit accommodations with maturities of more than five (5) years, provisions must be made for periodic amortization payments, but such payments must be made at least annually: Provided, however, That when the borrowed funds are to be used for purposes which do not initially produce revenues adequate for regular amortization payments therefrom, the bank may permit the initial amortization payment to be deferred until such time as said revenues are sufficient for such purpose, but in no case shall the initial amortization date be later than five (5) years from the date on which the loan or other credit accommodation is granted. (79a) In case of loans and other credit accommodations to micro finance sectors, the schedule of loan amortization shall take into consideration the projected cash flow of the borrower and adopt this into the terms and conditions formulated by banks. (n)

S-ar putea să vă placă și

- Revised Mins. of Bright VisionDocument1 paginăRevised Mins. of Bright VisionZhanika Marie CarbonellÎncă nu există evaluări

- Revised Option Money AgreementDocument3 paginiRevised Option Money AgreementZhanika Marie Carbonell100% (1)

- Memo REIT 29 May 18Document6 paginiMemo REIT 29 May 18Zhanika Marie CarbonellÎncă nu există evaluări

- Herbalife NPC Cover LetterDocument1 paginăHerbalife NPC Cover LetterZhanika Marie CarbonellÎncă nu există evaluări

- SEC Licensing & PSE ListingDocument3 paginiSEC Licensing & PSE ListingZhanika Marie CarbonellÎncă nu există evaluări

- Subscription Agreement MSTIDocument2 paginiSubscription Agreement MSTIZhanika Marie CarbonellÎncă nu există evaluări

- Demand Letter 5 May 2018Document1 paginăDemand Letter 5 May 2018Zhanika Marie CarbonellÎncă nu există evaluări

- Letter of Appeal Corporate Name NovaDocument3 paginiLetter of Appeal Corporate Name NovaZhanika Marie Carbonell89% (19)

- Sec Memo 11, s2008Document5 paginiSec Memo 11, s2008aian josephÎncă nu există evaluări

- Memo To: Kbs From: Zoc Subject: LGU Transfer Taxes - Baras Properties Date: 15 March 2018Document2 paginiMemo To: Kbs From: Zoc Subject: LGU Transfer Taxes - Baras Properties Date: 15 March 2018Zhanika Marie CarbonellÎncă nu există evaluări

- HIPI - Privacy PolicyDocument5 paginiHIPI - Privacy PolicyZhanika Marie CarbonellÎncă nu există evaluări

- Affidavit of DiscrepancyDocument1 paginăAffidavit of DiscrepancyZhanika Marie CarbonellÎncă nu există evaluări

- Practice Court ScriptDocument20 paginiPractice Court ScriptZhanika Marie CarbonellÎncă nu există evaluări

- 5.6 Vorys QuestionnaireDocument2 pagini5.6 Vorys QuestionnaireZhanika Marie CarbonellÎncă nu există evaluări

- Sample Written WorkDocument4 paginiSample Written WorkZhanika Marie CarbonellÎncă nu există evaluări

- 2009 Bar Exam TopicsDocument5 pagini2009 Bar Exam TopicsZhanika Marie CarbonellÎncă nu există evaluări

- Contract To Sell ResDocument2 paginiContract To Sell ResZhanika Marie CarbonellÎncă nu există evaluări

- Jurisdiction and Admissibility FAQS ICCDocument8 paginiJurisdiction and Admissibility FAQS ICCZhanika Marie CarbonellÎncă nu există evaluări

- Certification of Non Forum Shopping - Small Money ClaimsDocument1 paginăCertification of Non Forum Shopping - Small Money Claimsrupertville12Încă nu există evaluări

- Ceremony SeatDocument2 paginiCeremony SeatZhanika Marie CarbonellÎncă nu există evaluări

- Rights#sthash - PX3cifvy - Dpuf: Republic Act 8293Document1 paginăRights#sthash - PX3cifvy - Dpuf: Republic Act 8293Zhanika Marie CarbonellÎncă nu există evaluări

- RRL ImootDocument9 paginiRRL ImootZhanika Marie CarbonellÎncă nu există evaluări

- RecommendationDocument1 paginăRecommendationZhanika Marie CarbonellÎncă nu există evaluări

- Regina Iustitiae Solicitation Letter For Anniv - TERI EditDocument5 paginiRegina Iustitiae Solicitation Letter For Anniv - TERI EditZhanika Marie CarbonellÎncă nu există evaluări

- Christmas RaffleDocument1 paginăChristmas RaffleZhanika Marie CarbonellÎncă nu există evaluări

- Labor ReviewerDocument83 paginiLabor ReviewerChristian Francis Valdez DumaguingÎncă nu există evaluări

- Utulo v. Vda de GarciaDocument1 paginăUtulo v. Vda de GarciaZhanika Marie CarbonellÎncă nu există evaluări

- Guingona V CaragueDocument19 paginiGuingona V CaragueZhanika Marie CarbonellÎncă nu există evaluări

- Vinuya V RomuloDocument42 paginiVinuya V RomuloZhanika Marie CarbonellÎncă nu există evaluări

- Cover LettersDocument14 paginiCover LettersZhanika Marie CarbonellÎncă nu există evaluări

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (120)

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)

- BCP BB Claim - August 2022Document2 paginiBCP BB Claim - August 2022Nayyar AlamÎncă nu există evaluări

- Alexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002Document45 paginiAlexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002andresabelr100% (1)

- Demand Function and Regression ModelDocument14 paginiDemand Function and Regression ModelShahrul NizamÎncă nu există evaluări

- ,types of StrategiesDocument32 pagini,types of StrategiesmrunmaikrishnaÎncă nu există evaluări

- Cash Flow Management of Banijya BankDocument19 paginiCash Flow Management of Banijya BankPrashant McFc Adhikary0% (1)

- CAF-BCK-Additional Questions PDFDocument24 paginiCAF-BCK-Additional Questions PDFadnan sheikÎncă nu există evaluări

- Accounting For Trust and ControlDocument19 paginiAccounting For Trust and ControlJuan David Arias SuárezÎncă nu există evaluări

- People As Infrastructure in Johanesburg - AbdouMaliq SimoneDocument24 paginiPeople As Infrastructure in Johanesburg - AbdouMaliq SimoneFredrik Edmund FirthÎncă nu există evaluări

- 4 SourceanalysisDocument2 pagini4 Sourceanalysisapi-328118134Încă nu există evaluări

- FAM 1,2 UnitsDocument23 paginiFAM 1,2 Units2111CS010082 - KASINENI BHANU GAYATHRIÎncă nu există evaluări

- 817-Kenya Rural Roads Authority OAG-Report OCR by RoGGKenya 2018-Dec3Document120 pagini817-Kenya Rural Roads Authority OAG-Report OCR by RoGGKenya 2018-Dec3MatthewÎncă nu există evaluări

- The Importance of Work EthicsDocument5 paginiThe Importance of Work Ethicsalimoya13Încă nu există evaluări

- 54R-07 - AACE InternationalDocument17 pagini54R-07 - AACE InternationalFirasAlnaimiÎncă nu există evaluări

- Case Study Measuring ROI in Interactive SkillsDocument18 paginiCase Study Measuring ROI in Interactive SkillsAbhay KumarÎncă nu există evaluări

- Ee Roadinfra Tend 01Document3 paginiEe Roadinfra Tend 01Prasanna VswamyÎncă nu există evaluări

- How To Start Investing in Philippine Stock MarketDocument53 paginiHow To Start Investing in Philippine Stock MarketAlbert Aromin100% (1)

- Clearance Form HR-CLR-V001 (Revised)Document2 paginiClearance Form HR-CLR-V001 (Revised)Beauty Vanity PHÎncă nu există evaluări

- 3 McKinseyDocument16 pagini3 McKinseymadalina.tanaseÎncă nu există evaluări

- 2008 IOMA Derivatives Market Survey - For WCDocument83 pagini2008 IOMA Derivatives Market Survey - For WCrush2arthiÎncă nu există evaluări

- General Provisions Fiscal Year 2022: Official Gazette J 3, 2022Document23 paginiGeneral Provisions Fiscal Year 2022: Official Gazette J 3, 2022Ju DebÎncă nu există evaluări

- Reaction Paper On MarxDocument4 paginiReaction Paper On MarxRia LegaspiÎncă nu există evaluări

- Cap2 Sfma Summer Paper 2013 - FinalDocument6 paginiCap2 Sfma Summer Paper 2013 - FinalXiaojie LiuÎncă nu există evaluări

- Take Home Midterms Mix 30Document6 paginiTake Home Midterms Mix 30rizzelÎncă nu există evaluări

- College Admission Essay Format ExampleDocument5 paginiCollege Admission Essay Format Examplefz68tmb4100% (2)

- Homework Solution 7Document64 paginiHomework Solution 7Shalini VeluÎncă nu există evaluări

- CP CmbokDocument78 paginiCP CmbokSreejith Unnimon91% (11)

- Marketing Plan Group 5Document29 paginiMarketing Plan Group 5Neri La Luna100% (1)

- IO Model Vs Resource Based Model - Two Approaches To StrategyDocument14 paginiIO Model Vs Resource Based Model - Two Approaches To StrategyM ManjunathÎncă nu există evaluări

- Clariant Corporation CaseDocument16 paginiClariant Corporation Casehunnygoyal0% (1)