Documente Academic

Documente Profesional

Documente Cultură

Optima Restore Brochure

Încărcat de

jsmanian79Descriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Optima Restore Brochure

Încărcat de

jsmanian79Drepturi de autor:

Formate disponibile

OptimaRESTORE, the new health plan from Apollo Munich, restores your entire insurance amount without a charge

if you exhaust it in the middle of the year. And in case you have a claim-free year it increases your insurance cover by 50% the rst year and doubles it the year after, at no extra charge

Lets Uncomplicate.

The Apollo Hospitals Group, Asias largest healthcare provider and Munich Health, world leaders in health insurance, come together to make quality healthcare easy and accessible. Simple language, clear policies, transparent procedures and innovative products, making health insurance the way it ought to be. We know healthcare. We know insurance.

Guan from China inates balloons using just his ears.

A factory worker from Malaysia sticks metal objects magnetically to his body.

UNBELIEVABLE.

A contortionist from America packs all of herself into a suitcase in just 5.43 seconds.

UNBELIEVABLE.

Twitter - Follow us @apollomunichins Join our Facebook fan page: http://www.facebook.com/ApolloMunichHealthInsurance Save Tax U/S 80D of IT Act. Toll Free Number: 1800-103-0555/ 1800-3010-2555. SMS: restore to 56767 333. Buy online: apollomunichinsurance.com

Reg. Office: Apollo Hospitals Complex, Jubilee Hills, Hyderabad-33. Corp. Office: 10th Floor, Building No. 10, Tower B, DLF City Phase II, Cyber City, Gurgaon-2.

Insurance is the subject matter of solicitation. For more details on risk factors, terms and conditions please read sales brochurecarefully before concluding a sale.

Creative visualization of real acts.

AMHI/MA/H/0002/0063/112010/P

unbelievable RESTORE BENEFIT

Apollo Munich introduces a first of its kind, unique Restore benefit that automatically reinstates the basic sum insured in case you exhaust it in a policy year. Sure it sounds too good to be true but here is how it works: If you use up your coverage in an individual policy and fall ill with another illness, we will restore the entire sum insured for you to use, at no extra charge. If someones illness in your family uses up the coverage in a floater policy and if any other family member falls ill later during the same insured period, we will restore the entire amount at no extra charge. So, if you have a Rs. 5 lakhs policy and exhaust the entire amount, we will restore Rs. 5 lakhs, which you can use for some other illnesses or for any other member covered under the family floater policy, if needed.

The coverage would be the accumulation of basic Sum Insured and accumulated Multiplier Benefit (if any).

unbelievable PORTABILITY

Optima RESTORE , offers you easy portability, so if you are insured under another Insurers health insurance policy you can transfer to Apollo Munich with all your accrued benefits after due allowances for waiting periods and enjoy all the unbelievable benefits of Optima RESTORE .

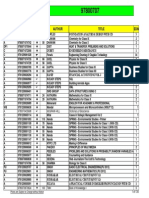

Restore Family

Basic Sum Insured per Policy per Policy Year (Rs. in Lakh) 3.00, 5.00, 10.00, 15.00 1) In-patient Treatment Pre-Hospitalization Post-Hospitalization Day Care Procedures Domiciliary Treatment Organ Donor Emergency Ambulance 2) Restore Benefit 3) Multiplier Benefit Covered Covered, up to 60 Days Covered, up to 180 Days Covered for 140 listed day care procedures Covered Covered Upto Rs.2,000 per Hospitalisation Equal to 100% of Basic Sum Insured Bonus of 50% of the Basic Sum Insured for every claim free year, maximum upto 100%. In case of claim, bonus will be reduced by 50% of the basic sum insured. However this reduction will not reduce the Sum Insured below the basic Sum Insured of the policy.

Terms of Renewal: Life-long renewal

Life-long Renewal: We offer life-long renewal regardless of your health status or previous claims made under your policy, unless the Insured Person or any one acting on behalf of an Insured Person acts in a dishonest or fraudulent manner or if there is any misrepresentation under or in relation to this policy or it poses a moral hazard. Waiting Period: The waiting periods mentioned in the policy wording will get reduced by 1 year on every continuous renewal of your policy. Renewal premium are subject to change with prior approval from IRDA. Any change in benefits or premium (other than due to change in Age) will be done with the approval of the Insurance Regulatory and Development Authority and will be intimated atleast 3 months in advance. In the likelihood of this policy being withdrawn in future, intimation will be sent to insured person about the same 3 months prior to expiry of the policy. Insured Person will have the option to migrate to similar indemnity health insurance policy available with us at the time of renewal with all the accrued continuity benefits such as Multiplier Benefit, waiver of waiting period etc. provided the policy has been maintained without a break as per portability guidelines issued by IRDA. Sum Insured Enhancement: Sum Insured can be enhanced only at the time of renewal subject to no claim having been lodged/paid under the Policy. If the insured increases the Sum Insured one grid up, no fresh medicals shall be required. In case where the Sum Insured increase is more than one grid up, the case shall be subject to medicals. In case of increase in the Sum Insured, waiting period will apply afresh for the amount by which the Sum Insured has been enhanced. However, the quantum of increase shall be at the discretion of the company. Any Insured Person in the policy has the option to migrate to similar indemnity health insurance policy available with us at the time of renewal subject to underwriting with all the accrued continuity benefits such as Multiplier Benefit, waiver of waiting period etc. provided the policy has been maintained without a break as per portability guidelines issued by IRDA.

Remember

Maximum Age: The maximum entry age is 65 years. There is no maximum cover ceasing age in this Policy. Minimum Age: The minimum entry age is 91 days. Children between 91 days and 5 years can be insured provided both parents are getting insured under this Policy. The cover will be valid for 1 or 2 year(s) as opted. An additional 7.5% discount is offered on the premium if you choose a 2 year Policy. An individual and/or his family members namely spouse, dependent children and dependent parents are eligible for buying this cover on an individual or floater basis.

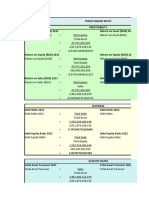

unbelievable MULTIPLIER BENEFIT

The amazing restore benefit also comes with a never before renewal incentive. If youve had a claim free year, we will increase your basic sum insured by 50% as a no claim bonus. If you dont claim even in the second year, well double your basic sum insured as a no claim bonus i.e. 100% of the basic Sum Insured. So, if you have a 5 lakh policy and dont claim in the first year, we will increase your cover to 7.5 lakh for the second year and 10 lakh in the third year (if you dont claim in the second year), while you only pay a premium for a 5 lakh policy.

Restore Individual

Basic Sum Insured per Insured Person per Policy Year (Rs. in Lakh) 3.00, 5.00, 10.00, 15.00 1) In-patient Treatment Covered Covered, up to 60 Days Covered, up to 180 Days Covered for 140 listed day care procedures Covered Covered Upto Rs.2,000 per Hospitalisation Equal to 100% of Basic Sum Insured Bonus of 50% of the Basic Sum Insured for every claim free year, maximum upto 100%. In case of claim, bonus will be reduced by 50% of the basic sum insured. However this reduction will not reduce the Sum Insured below the basic Sum Insured of the policy.

A man from a little town in Morocco snacks on anything. Even nails.

unbelievable OTHERS

What makes OptimaRESTORE really a game changing health plan is that the goodies dont just stop with the unique Restore and Multiplier benefits. OptimaRESTORE is packed with a bunch of fantastic features that truly uncomplicate healthcare and make it a plan that genuinely cares for you. Lifelong renewal: Renew your cover lifelong and stay covered forever. No sublimit on room rent: With this health plan you can get the room you like and the treatment you deserve without a hassle. Cashless transactions: OptimaRESTORE enables you to get treated on a cashless basis across 4000 hospitals in over 800 cities. No geography based sub-limits: No matter where you buy your policy you can get treated in any city or hospital you like in the country with no additional copays or sublimits. No claim based loading: We will never load your renewal premium because you claimed or fell ill after taking our policy. Quick turnaround time: You dont have to worry about pre-authorization, 90% of pre-authorization is done within 2 hours. Quick claim payment: When it comes to claim settlement, were one of the fastest in the industry to honour every genuine claim. Certified associates: When you deal with us you can be assured that all our field partners and sales executives are well trained. Easy upgrade: This health plan also comes with an easy upgrade option. You can upgrade your cover to the next slab at the time of your policy renewal. Tax benefits: You can avail tax benefits for the premium amount under Section 80 D of the Income Tax Act. (Tax benefits are subject to changes in tax laws.)

Major Exclusions

Any treatment within first 30 days of cover except any accidental injury. Any Pre-existing diseases/conditions will be covered after a waiting period of 3 years. 2 years exclusion for specific diseases like cataract, hernia, hysterectomy, joint replacement etc. Expenses arising from HIV or AIDS and related diseases.

Tax Benet:

The premium amount paid under this policy qualifies for deduction under Section 80D of the Income Tax Act, subject to applicable tax laws.

Pre-Hospitalization Post-Hospitalization Day Care Procedures Domiciliary Treatment Organ Donor Emergency Ambulance 2) Restore Benefit 3) Multiplier Benefit

Discounts:

Family Discount of 10% if 2 or more family members are covered under Optima Restore Individual Sum Insured Plan.

UNBELIEVABLE.

Abuse of intoxicant or hallucinogenic substance like drugs and alcohol. Pregnancy, dental treatment, external aids and appliances. Hospitalization due to war or an act of war or due to nuclear, chemical or biological weapon and radiation of any kind. Non-allopathic treatment, congenital diseases, mental disorder, cosmetic surgery or weight control treatments.

For complete exclusions please refer to the policy document.

UNBELIEVABLE.

An additional 7.5% discount is offered on the premium if you choose a 2 year policy

Disclaimer: This is only a summary of the product features. The actual benefits available are as described in the policy, and will be subject to the policy terms, conditions and exclusions. Please seek the advice of our insurance advisor if you require any further information or clarification. Statutory warning: Section 41 of Insurance Act 1938 (Prohibition of Rebates) 1) No person shall allow or offer to allow either directly or indirectly as an inducement to any person to take out or continue an insurance in respect of any kind of risk relating to life or property in India any rebate of the whole or part of the commission payable or any rebate of premium shown on the policy nor shall any person taking out or renewing or continuing a policy accept any rebate except such rebate as may be allowed in accordance with the prospectus or tables of the insurers. 2) Any person making default in complying with the provisions of this section shall be punishable with fine, which may extend to five hundred rupees.

Sixty-four year old farmer, has not slept since 1973.

S-ar putea să vă placă și

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (895)

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (73)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- BA 323 Study GuideDocument7 paginiBA 323 Study GuideTj UlianÎncă nu există evaluări

- Section 2 - Clutch AssemblyDocument29 paginiSection 2 - Clutch Assemblyjsmanian79Încă nu există evaluări

- Simple, Compound Interest and Annuity Problems For Special ClassDocument2 paginiSimple, Compound Interest and Annuity Problems For Special ClassPaolo PerezÎncă nu există evaluări

- Hotel ProjectDocument38 paginiHotel ProjectMelat MakonnenÎncă nu există evaluări

- Activity Questions 6.1 Suggested SolutionsDocument6 paginiActivity Questions 6.1 Suggested SolutionsSuziÎncă nu există evaluări

- An Analytical Study On Strategic Management of PaytmDocument16 paginiAn Analytical Study On Strategic Management of PaytmYashi Khoobchandani100% (1)

- DeVilliers Present OFW10 17Document22 paginiDeVilliers Present OFW10 17jsmanian79Încă nu există evaluări

- CFD NotesDocument155 paginiCFD NotesAjit ChandranÎncă nu există evaluări

- An Intro To Computational Fluid DynamicsDocument21 paginiAn Intro To Computational Fluid DynamicsRorldanÎncă nu există evaluări

- Inspiron 15 5547 Laptop Owner's Manual en UsDocument89 paginiInspiron 15 5547 Laptop Owner's Manual en Usjsmanian79Încă nu există evaluări

- Td1ug PDFDocument288 paginiTd1ug PDFjsmanian79Încă nu există evaluări

- Supporting Documents For I 129 Form (Step 3)Document1 paginăSupporting Documents For I 129 Form (Step 3)jsmanian79Încă nu există evaluări

- Speed Secret-XP - VistaDocument24 paginiSpeed Secret-XP - Vistaராஜா MVSÎncă nu există evaluări

- C3000 UM 21aug2014Document103 paginiC3000 UM 21aug2014jsmanian79Încă nu există evaluări

- India Price ListDocument134 paginiIndia Price Listjsmanian79Încă nu există evaluări

- 10 Unwealthy HabitsDocument28 pagini10 Unwealthy HabitsMafruhin Joko NugrohoÎncă nu există evaluări

- Daily Thanthi - Tamil Year JothidamDocument35 paginiDaily Thanthi - Tamil Year Jothidamjsmanian79Încă nu există evaluări

- DASA 2013 BrochureDocument25 paginiDASA 2013 Brochurejsmanian79Încă nu există evaluări

- A4a5 1Document3 paginiA4a5 1jsmanian79Încă nu există evaluări

- Lb03a.pdoptimization in Automotive Powertrain Subsystems FDocument6 paginiLb03a.pdoptimization in Automotive Powertrain Subsystems Fjsmanian79Încă nu există evaluări

- Huawei E355 On Ubuntu 12Document6 paginiHuawei E355 On Ubuntu 12jsmanian79Încă nu există evaluări

- Linux Driver 4.19.19.00 Tool User GuideDocument19 paginiLinux Driver 4.19.19.00 Tool User Guidejsmanian79Încă nu există evaluări

- CWE Clerks III AdvtDocument31 paginiCWE Clerks III Advtmahendernayal0070% (1)

- Optima Restore ProspectusDocument7 paginiOptima Restore Prospectusjsmanian79Încă nu există evaluări

- LectureSlides10 OpenfoamDocument13 paginiLectureSlides10 OpenfoamŞükrü Ayhan BaydırÎncă nu există evaluări

- Section PL7-1 LanguageDocument27 paginiSection PL7-1 LanguageTalyson AlexandreÎncă nu există evaluări

- Implement at Ing Third Order Compressible Flow Solver For Hexahedral Meshes in OpenFoamDocument6 paginiImplement at Ing Third Order Compressible Flow Solver For Hexahedral Meshes in OpenFoamjsmanian79Încă nu există evaluări

- ICPAK Speech - Critical National Strategies Towards Embracing Change & Transformation During & Post-PandemicDocument12 paginiICPAK Speech - Critical National Strategies Towards Embracing Change & Transformation During & Post-PandemicOmarih K. HiramÎncă nu există evaluări

- Republic Vs CaguioaDocument6 paginiRepublic Vs CaguioaKim Lorenzo CalatravaÎncă nu există evaluări

- SWAT Guide PREVIEWDocument38 paginiSWAT Guide PREVIEWChetan DeoÎncă nu există evaluări

- 48168321-2013-International Hotel Corp. v. Joaquin Jr.Document16 pagini48168321-2013-International Hotel Corp. v. Joaquin Jr.Christine Ang CaminadeÎncă nu există evaluări

- ZEROPAY WhitepaperDocument15 paginiZEROPAY WhitepaperIlham NurrohimÎncă nu există evaluări

- Multi-Level Trading-Recovery Trading: ND RDDocument11 paginiMulti-Level Trading-Recovery Trading: ND RDAkram BoushabaÎncă nu există evaluări

- Proyeksi INAF - Kelompok 3Document43 paginiProyeksi INAF - Kelompok 3Fairly 288Încă nu există evaluări

- Company Law SummerisedDocument15 paginiCompany Law SummerisedOkori PaulÎncă nu există evaluări

- Bus. & Entrep. Module 4aDocument3 paginiBus. & Entrep. Module 4aamie abriamÎncă nu există evaluări

- RecFin AnswerKeySolutionsDocument3 paginiRecFin AnswerKeySolutionsHannah Jane UmbayÎncă nu există evaluări

- 7th NFC Award 2010Document4 pagini7th NFC Award 2010humayun313Încă nu există evaluări

- Public Private Partnership Booklet - enDocument28 paginiPublic Private Partnership Booklet - enJoeÎncă nu există evaluări

- Deed of Absolute Sale of A Portion of LandDocument2 paginiDeed of Absolute Sale of A Portion of LandmkabÎncă nu există evaluări

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 paginiChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 paginăAlphaex Capital Candlestick Pattern Cheat Sheet InfographTW INGOÎncă nu există evaluări

- Management Letter Mattsenkumar Services PVT LTD 2021-22Document12 paginiManagement Letter Mattsenkumar Services PVT LTD 2021-22Sudhir Kumar DashÎncă nu există evaluări

- PNB Vs CA - DigestDocument2 paginiPNB Vs CA - DigestGladys Viranda100% (1)

- Research Papers On Bank Loans in IndiaDocument7 paginiResearch Papers On Bank Loans in Indiaofahxdcnd100% (1)

- Tata Motors ReportDocument5 paginiTata Motors ReportrastehertaÎncă nu există evaluări

- Application For Bank FacilitiesDocument4 paginiApplication For Bank FacilitiesChetan DigarseÎncă nu există evaluări

- AXA Rosenberg Equity Alpha Trust September Interim 2017Document257 paginiAXA Rosenberg Equity Alpha Trust September Interim 2017Saluka KulathungaÎncă nu există evaluări

- VAT Guidance For Retailers: 375,000 / 12 MonthsDocument1 paginăVAT Guidance For Retailers: 375,000 / 12 MonthsMuhammad Suhaib FaryadÎncă nu există evaluări

- Ias 38 - TSVHDocument37 paginiIas 38 - TSVHHồ Đan ThụcÎncă nu există evaluări

- Essentials of Budgetary ControlDocument13 paginiEssentials of Budgetary ControlShashiprakash SainiÎncă nu există evaluări

- Brooks Financial mgmt14 PPT ch11Document60 paginiBrooks Financial mgmt14 PPT ch11Jake AbatayoÎncă nu există evaluări