Documente Academic

Documente Profesional

Documente Cultură

Income Deemed To Accrue or Arise in India

Încărcat de

Dhirendra SinghTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Income Deemed To Accrue or Arise in India

Încărcat de

Dhirendra SinghDrepturi de autor:

Formate disponibile

Page 1

C

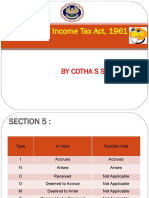

Income Deemed to Accrue or Arise in India [Section 9]

(For CMA Inter Group 1)

[Issued on July 15, 2013]

1. Income from a business connection in India.

A business connection involves a relation between a business carried on and some activity in India

which contributes to the earning of profits.

Some examples of non-resident having business connection in India are

(a) Branch or agent or

(b) Subsidiary in India or

(c) Factory in India

A new Explanation has been added to section 9(1) which clarifies that

Business connection shall include following activities carried out by non-resident, through a person

acting on his behalf:-

(i) Concluding contracts on behalf of non-resident.

(ii) Maintaining stock of goods and delivering them on behalf of non-resident.

(iii) Securing orders in India

Apportionment of profit:-

If all business operations are not carried out in India, the income of the business deemed to accrue or

arise in India shall be only such part of income as is reasonably attributable to the operations carried

out in India. [Explanation 1 to section 9(1)]

The apportionment of profits should be on a rational basis and should not be arbitrary.

For example if in India only negotiation was done in relation to trading while the contract was

performed entirely outside India, it was held that only 10% of profits shall be deemed to accrue or arise

in India.

However in case of Non-resident the following operations confined to India shall not be treated as

business connection in India:

(i) Purchase of goods in India for the purpose of exports.

(ii) collection of news and views for transmission outside India by Non-resident who is engaged in the

business of running news agency or of publishing newspapers, magazines or journals.

(iii) Shooting of cinematography films in India if

(a) An individual- he is not a citizen of India

(b) Firm - no partner is citizen or resident of India

(c) Company - no shareholder is citizen or resident of India.

2. Income from any property, assets or source of income situated in India.

3. Income from the transfer of any capital assets situated in India.

4. Any income from salary if it is payable for services rendered in India.

5. Salary payable by the Govt. to an Indian citizen for services rendered outside India.

However, all allowances and perquisites received by Citizen of India rendering services outside

India, who is a govt. employee are fully exempt

6. Dividend paid by an Indian company outside India.

7. Interest payable by:

(i) Govt.

(ii) Resident in India

Except where interest is payable in respect of money borrowed and used for the purpose of

Page 2

C

business or profession or earning any income from any source outside India or

(iii) A non-resident if interest is payable for money borrowed and used for a business or

profession in India

8. Royalty payable by:

(i) Govt.

(ii) A person who is a resident in India except where it is payable in respect of any right/

information/ property used for the purposes of a business or profession carried on outside India

or earning any income from any source outside India or

(iii) A person who is a non-resident provided royalty is payable in respect of any right/

information/ property used for the purpose of the business or profession carried on in India.

However it shall not apply to

lump sum royalty paid by a resident for transfer of computer software supplied by a non-resident

manufacturer along with a computer under a scheme approved by govt.

Royalty means: -

(i) Transfer of rights in respect of a

patent, invention, model, design, process or

trade mark or

copyright, literary, artistic or scientific work including films or video tapes.

(ii) use of

any patent, invention, model , design or process etc.

(iii) giving anti information

concerning the working of a patent, invention, model, design or process etc.

(iv) rendering any services

in connection with the above activities.

(H) A person who is a resident in India,

9. Fees for Technical Services:

(i) Govt.

(ii) A person who is resident in India

Except where services are utilized for a business or profession carried on outside India or

earning any income from any source outside India or

(iii) A non-resident provided fee is payable in respect of services for a business carried in India.

Fees for technical services means any consideration for the rendering of any managerial, technical or

consultancy services.

S-ar putea să vă placă și

- Section 9 of Income Tax Act 1961Document55 paginiSection 9 of Income Tax Act 1961Bharath SimhaReddyNaiduÎncă nu există evaluări

- Income deemed to accrue or arise in India under section 9Document13 paginiIncome deemed to accrue or arise in India under section 9Vicky DÎncă nu există evaluări

- ch-11 Taxation of NRIsDocument25 paginich-11 Taxation of NRIsdean.socÎncă nu există evaluări

- Tax NotesDocument11 paginiTax NotesVishal DeshwalÎncă nu există evaluări

- Sec 9Document39 paginiSec 9Akanksha BohraÎncă nu există evaluări

- Corporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)Document10 paginiCorporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)imamÎncă nu există evaluări

- 31 FAQ's On Registration of Foreign Company in IndiaDocument13 pagini31 FAQ's On Registration of Foreign Company in IndiaShiva LikhdhariÎncă nu există evaluări

- 01 Section 9Document54 pagini01 Section 9ABHIJEETÎncă nu există evaluări

- Income Tax ActDocument50 paginiIncome Tax ActMahesh NaikÎncă nu există evaluări

- 9Document4 pagini9SPARSH KAPOORÎncă nu există evaluări

- Income Deemed To Accrue or Arise in India-Sec 9Document16 paginiIncome Deemed To Accrue or Arise in India-Sec 9drive8124Încă nu există evaluări

- Income Deemed To Arise in IndiaDocument7 paginiIncome Deemed To Arise in IndiaDebaÎncă nu există evaluări

- TaxationDocument13 paginiTaxationneshh16Încă nu există evaluări

- Income deemed to accrue or arise in India through business connection or significant economic presenceDocument17 paginiIncome deemed to accrue or arise in India through business connection or significant economic presenceVicky DÎncă nu există evaluări

- Income Deemed To Be Accrue or Arise inDocument41 paginiIncome Deemed To Be Accrue or Arise inPJ 123Încă nu există evaluări

- Taxation Residential Status and Income Deemed Received or AccruedDocument9 paginiTaxation Residential Status and Income Deemed Received or AccruedVineet RajÎncă nu există evaluări

- Income Deemed To Accrue or Arise in IndiaDocument12 paginiIncome Deemed To Accrue or Arise in IndiaSuryaÎncă nu există evaluări

- Direct Tax Code SummaryDocument6 paginiDirect Tax Code SummaryShalini MahawarÎncă nu există evaluări

- Foreign Direct Investments 1218215823748473 9Document33 paginiForeign Direct Investments 1218215823748473 9roopendrawardlawÎncă nu există evaluări

- Taxation of Non-Residents With Special Reference To Chapter Xii and Xii ADocument16 paginiTaxation of Non-Residents With Special Reference To Chapter Xii and Xii APJ 123Încă nu există evaluări

- Foreign Direct Investments: by Prof. Augustin AmaladasDocument33 paginiForeign Direct Investments: by Prof. Augustin AmaladasPooja MehraÎncă nu există evaluări

- 40 - Section 9 of The Indian Income Tax ActDocument18 pagini40 - Section 9 of The Indian Income Tax ActDhirendra SinghÎncă nu există evaluări

- PGBP Book NotesDocument41 paginiPGBP Book NoteskrishnaÎncă nu există evaluări

- Entry Strategies For Foreign InvestorsDocument6 paginiEntry Strategies For Foreign Investorsconsurd1978Încă nu există evaluări

- Incidence of TaxDocument53 paginiIncidence of TaxAnurag SindhalÎncă nu există evaluări

- Basis of Charge and Scope of TotalDocument24 paginiBasis of Charge and Scope of TotalSujithÎncă nu există evaluări

- Hand Out Vodafone International Holdings BDocument11 paginiHand Out Vodafone International Holdings Bprernachopra88Încă nu există evaluări

- Week 4-7Document9 paginiWeek 4-7Vijayant DalalÎncă nu există evaluări

- RW FemaDocument3 paginiRW FemaRavi GuptaÎncă nu există evaluări

- Critical analysis of Vodafone vs. Union of IndiaDocument33 paginiCritical analysis of Vodafone vs. Union of IndiaNalini chandrakarÎncă nu există evaluări

- Section 9Document7 paginiSection 9Achulendra Ji PushkarÎncă nu există evaluări

- TDS On Commission To Non ResidentDocument6 paginiTDS On Commission To Non ResidentAdityaÎncă nu există evaluări

- FAQ On FDIDocument14 paginiFAQ On FDIParas ShahÎncă nu există evaluări

- Income Tax ActDocument12 paginiIncome Tax ActSomnath GuptaÎncă nu există evaluări

- Cloud hosting services not royalty under India-US tax treatyDocument10 paginiCloud hosting services not royalty under India-US tax treatyPJ 123Încă nu există evaluări

- Branch OfficeDocument32 paginiBranch OfficeVedang GupteÎncă nu există evaluări

- Mba Semester 3 Mfo012-Taxation Management Assignment Set - 2Document7 paginiMba Semester 3 Mfo012-Taxation Management Assignment Set - 2nirmal2501Încă nu există evaluări

- Rajesh VodafoneDocument9 paginiRajesh VodafoneMahanth SwaroopÎncă nu există evaluări

- FTS Course PPT - 07112020Document55 paginiFTS Course PPT - 07112020sanket.tatedÎncă nu există evaluări

- Sia - Itax-2018-19Document17 paginiSia - Itax-2018-19Abhay Pethani.Încă nu există evaluări

- Automatic Route FDI GuideDocument3 paginiAutomatic Route FDI GuideAbhishek ChoudharyÎncă nu există evaluări

- Direct Taxation Paper: Key HighlightsDocument18 paginiDirect Taxation Paper: Key HighlightsGopalÎncă nu există evaluări

- Tax Management and Practice RTPDocument122 paginiTax Management and Practice RTPNitin CÎncă nu există evaluări

- BFM CH 21 PDFDocument27 paginiBFM CH 21 PDFKiran KotlapatiÎncă nu există evaluări

- Ishikawajma-Harima Heavy Industries Ltd. Director of Income-TaxDocument6 paginiIshikawajma-Harima Heavy Industries Ltd. Director of Income-TaxpriyaÎncă nu există evaluări

- Application For Renewal of Unit Under Software Technology Park (STP) Scheme For 100% Export of Computer SoftwareDocument16 paginiApplication For Renewal of Unit Under Software Technology Park (STP) Scheme For 100% Export of Computer Softwareశ్రీనివాసకిరణ్కుమార్చతుర్వేదులÎncă nu există evaluări

- Unit IV Taxation NotesDocument38 paginiUnit IV Taxation NotesVivek GautamÎncă nu există evaluări

- Foreign Investment in IndiaDocument10 paginiForeign Investment in Indiaramashankar10Încă nu există evaluări

- Singapore company's offshore distribution commission not taxable in IndiaDocument13 paginiSingapore company's offshore distribution commission not taxable in IndiaABCÎncă nu există evaluări

- Manufacturing Setup ProceduresDocument1 paginăManufacturing Setup ProceduresRajiv GuptaÎncă nu există evaluări

- ASA Assoc-Cross-Border-Merger-Acquisition 13 PDFDocument9 paginiASA Assoc-Cross-Border-Merger-Acquisition 13 PDFsaif700Încă nu există evaluări

- Practice Problems On Incidence of TaxDocument3 paginiPractice Problems On Incidence of TaxPratik DesaiÎncă nu există evaluări

- Doing Business in IndiaDocument54 paginiDoing Business in IndiaWilliam HenryÎncă nu există evaluări

- Inter-Law-July 2020-Amendment-ClassDocument15 paginiInter-Law-July 2020-Amendment-ClassDhruvi JainÎncă nu există evaluări

- Foreign Investment in IndiaDocument6 paginiForeign Investment in IndiaShraddha BendkhaleÎncă nu există evaluări

- FDI in India GuideDocument3 paginiFDI in India Guideabc defÎncă nu există evaluări

- Doing Business IndiaDocument70 paginiDoing Business IndiaKinshuk UdayakumarÎncă nu există evaluări

- How To Start An Industry in PuducherryDocument5 paginiHow To Start An Industry in PuducherryKathir RkoÎncă nu există evaluări

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItDe la EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItÎncă nu există evaluări

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDe la EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisÎncă nu există evaluări

- To Become An Accounting TechnicianDocument4 paginiTo Become An Accounting TechnicianultimatewinnnnerÎncă nu există evaluări

- GST First White PaperDocument5 paginiGST First White PaperDhirendra SinghÎncă nu există evaluări

- ButerflyDocument1 paginăButerflyDhirendra SinghÎncă nu există evaluări

- Income Tax Judgements 2009Document10 paginiIncome Tax Judgements 2009Dhirendra SinghÎncă nu există evaluări

- Great LessonsDocument2 paginiGreat LessonsDhirendra SinghÎncă nu există evaluări

- Accounting TermsDocument30 paginiAccounting TermsDhirendra SinghÎncă nu există evaluări

- 40 - Section 9 of The Indian Income Tax ActDocument18 pagini40 - Section 9 of The Indian Income Tax ActDhirendra SinghÎncă nu există evaluări

- Individaul Residential Status ProblemsDocument1 paginăIndividaul Residential Status ProblemsDhirendra SinghÎncă nu există evaluări

- 51 - Tax Free IncomesDocument4 pagini51 - Tax Free IncomesDhirendra SinghÎncă nu există evaluări

- Amalgamation of CompaniesDocument3 paginiAmalgamation of CompaniessandeepÎncă nu există evaluări

- Capital IqDocument32 paginiCapital IqEkta1989Încă nu există evaluări

- 0130323713Document42 pagini0130323713Rakib AhmedÎncă nu există evaluări

- Shareholders Dispute Over Family BusinessDocument10 paginiShareholders Dispute Over Family Businesskrys_elleÎncă nu există evaluări

- Book ListDocument10 paginiBook Listdj1284Încă nu există evaluări

- Interim Order in The Matter of Nixcil Pharmaceuticals Specialities Ltd.Document17 paginiInterim Order in The Matter of Nixcil Pharmaceuticals Specialities Ltd.Shyam SunderÎncă nu există evaluări

- Case StudyDocument4 paginiCase Studyglaide lojeroÎncă nu există evaluări

- Tata Sons Hits Back, Mistry's Mail Leak UnpardonableDocument3 paginiTata Sons Hits Back, Mistry's Mail Leak UnpardonableDynamic LevelsÎncă nu există evaluări

- Femsa Narrative ReportDocument65 paginiFemsa Narrative ReportLadyAnne David SebastianÎncă nu există evaluări

- Finance 33Document16 paginiFinance 33iris100% (1)

- CH 6 - Cost of Capital PDFDocument49 paginiCH 6 - Cost of Capital PDFJanta RajaÎncă nu există evaluări

- Victor Fasciani (Last) Interview With Manual of IdeasDocument6 paginiVictor Fasciani (Last) Interview With Manual of IdeasVitaliyKatsenelsonÎncă nu există evaluări

- Investment Theory and AnalysisDocument8 paginiInvestment Theory and AnalysisJinky Bago AcapuyanÎncă nu există evaluări

- 2nd QUARTELY VECC - English Lesson (Second Quarterly Exam) G7-G12 (2017-2018)Document16 pagini2nd QUARTELY VECC - English Lesson (Second Quarterly Exam) G7-G12 (2017-2018)Lucille Gacutan AramburoÎncă nu există evaluări

- Analyze Key Project StakeholdersDocument7 paginiAnalyze Key Project StakeholdersFarihaÎncă nu există evaluări

- Corporations OutlineDocument44 paginiCorporations Outlinecflash94100% (1)

- BBBL2043 Corporate Law Tutorials 6 & 7Document4 paginiBBBL2043 Corporate Law Tutorials 6 & 7YUNG WEI WONGÎncă nu există evaluări

- Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument9 paginiMar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseYASH KOTHARIÎncă nu există evaluări

- Financial Management: "Any Fool Can Lend Money, But It Takes A Lot of Skill To Get It Back"Document11 paginiFinancial Management: "Any Fool Can Lend Money, But It Takes A Lot of Skill To Get It Back"N ArunsankarÎncă nu există evaluări

- CFA Portfolio Management SlidesDocument182 paginiCFA Portfolio Management SlidesNguyệtt Hươngg100% (2)

- NISM SERIES X-A Site Model PaperDocument4 paginiNISM SERIES X-A Site Model Paperssk1972100% (2)

- Value Based Management: Paul A. Sharman, President Focused Management Information IncDocument24 paginiValue Based Management: Paul A. Sharman, President Focused Management Information IncJosemon VargheseÎncă nu există evaluări

- Lessons From Enron: Mark GoyderDocument11 paginiLessons From Enron: Mark GoyderPam IntruzoÎncă nu există evaluări

- Mead Vs McCullough (1911)Document2 paginiMead Vs McCullough (1911)Miguel GabionzaÎncă nu există evaluări

- PE, PB and The Present Value of Future DividendsDocument10 paginiPE, PB and The Present Value of Future Dividendsyassine_bnppÎncă nu există evaluări

- SBI Mutual Fund StudyDocument8 paginiSBI Mutual Fund StudyVijay KumarÎncă nu există evaluări

- A Guide Towards Becoming An and Investor.: Independent IntelligentDocument12 paginiA Guide Towards Becoming An and Investor.: Independent IntelligentVadim RsdÎncă nu există evaluări

- 1.cash Basis 2.accrual Basis: Golden Rules of AccountingDocument4 pagini1.cash Basis 2.accrual Basis: Golden Rules of AccountingabinashÎncă nu există evaluări

- Lau Cheung Chang - An Analysis of Why Public Listed Companies Go Private in Malaysia - MBA ThesisDocument82 paginiLau Cheung Chang - An Analysis of Why Public Listed Companies Go Private in Malaysia - MBA ThesisVanesa LidyaÎncă nu există evaluări

- Golden Parachutes - ExecutiveEmployment ContractsDocument33 paginiGolden Parachutes - ExecutiveEmployment ContractsarevalotovarÎncă nu există evaluări