Documente Academic

Documente Profesional

Documente Cultură

Omnitel Pronto Full Report On Omnitel Pronto Italia

Încărcat de

Snehal JoshiTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Omnitel Pronto Full Report On Omnitel Pronto Italia

Încărcat de

Snehal JoshiDrepturi de autor:

Formate disponibile

Omnitel Pronto Italia

The case study Omnitel Pronto Italia describes the companys situation soon after its launch of

its mobile telecommunication offerings in Italy in 1995. Omnitel had decided to focus on

improvements on the quality dimension in competing against the Italian monopoly (TIM).

However, the results were not very positive. Therefore, Omnitel conducted various marketing

research activities in order to create a new business strategy. Various needs of the individual

customer segments were identified. Omnitel now had to decide whether the new service plan,

LIBERO, was the right move to attack a new segment and improve on prior performance.

Citation:

Lal, Rajiv, Carin-Isabel Knoop, and Suma Raju. Omnitel Pronto Italia. Harvard Business

School Case 501-002, August 2000. (Revised September 2005.)

Case questions and answers:

1. What was Omnitels competitive advantage when the service was launched in December

1995?

2. Why did the launch not perform to expectations?

3. What are the economics of LIBERO?

4. Why is the churn rate so high for many European countries?

5. Do you expect the churn rate to increase or decrease with the launch or LIBERO?

6. What do you learn from consumer research? What do you learn from the results of the

conjoint analysis in Exhibits 5 to 8?

7. Will LIBERO lead to a price war? If yes, what could Omnitel do to avoid one?

8. If you were Fabrizio Bona, what changes would you make to LIBERO and why?

Omnitel Pronto Italia Case Study Analysis

Omnitel Beginnings

Omnitel was launched in late 1995 as Italys second mobile phone service provider at a time

when TIM, Omnitels sole competitor, generated 97% of the cellular market penetration.

Omnitels entrance to the Italian telecommunications market offered a new way to increase

competition and enhance awareness about cellular products among Italians.

When Omnitel finally launched, the company felt that its superior customer care would be its

competitive advantage. By having a polite operator answer the phone Omnitel gained an

advantage over TIMs operators who were known to be very impersonal. Furthermore Omnitels

service calls were answered rapidly and operators avoided transferring calls. Omnitel was

working to differentiate itself from TIM whose own customers stated, I have never heard a

polite word from TIMs customer service (6).

Omnitel also believed that this advantage would allow the company to maintain a low churn rate

of 10-15% per year. A high churn rate indicated customers were dissatisfied, and Omnitel was

obsessed about churn (5). By keeping their customers satisfied Omnitel would not have to face

losing customers or the costs that came with this.

By May of 1996 even with its superior customer service, the Omnitel launch had only signed

180,000 subscribers and held merely 4% of the market share. The market analysis showed that

although customers valued customer service, they did not choose a cell phone provider based on

this value. Good service was only seen as an appreciated added feature. Exhibit 6 indicates that

the Service and Included Service categories are ranked 7th and 8th in importance out of 8

possible values. Furthermore only 19% of personal users were service sensitive while 35% were

sensitive to charge and fixed costs. Exhibit 7 shows that Service is ranked 7 out of 7 possible

values behind values like brand, monthly charges, and peak and off-peak tariff charges

Diagnosis:

Telecom Italia Mobile (TIM) had a monopoly over the Italian Communications Market. It

generated 97%

of Italys 7.5% market penetration, also until Omnitels entrance into the market because of the

lack of thecompetition, TIM didnt incur the huge marketing costs. TIMs marketing strategy

was primarily directed towards the uppers echelons of Italian society. Omnitel entered the market

in Feb 1995 but they could start the commercialservices in December 1995 with network

coverage of 40% of the Italian territory. Ominitel thought of its superiorcustomer care as its

competitive advantage over TIM, however they could only acquire 1,80,000 subscribers by

May1996. Omnitel was looking for methods to differentiate itself from TIM but at the same time

avoiding a price war.

Problem Identification

The problem was twofold, that of building Omnitels market share while avoiding a price war

with TIM, and

differentiating brand Omnitel from brand TIM.

5 C Analysis

Company Background:

Omnitel was able to obtain GSM license after liberalization and paid Lit.750 bn in Dec

94 to become Italys second GSM operator and launched its commercial service in Dec.

95.

They started with a network coverage of 40% of Italian territory.

Market share was 4% of the total Italian telecom market.

Initially they offered plans similar to TIM but prime focus was on its high-quality

customer service, which

led to happy customers and low churn rates.

Financial strength of Omnitel was not as strong as their competitor i.e TIL, hence they

avoided getting into aprice war situation.

Competitor Analysis:

The major competitor was Telecom Italia Mobile (TIM) formed in July 1995 after divested from

TelecomItalia and was listed separately on Italian stock exchange.

The customer base was over 4 million by the end of first quarter of 1986 and had strong roots in

ItalianCellular market.

They offered two types of tariffs:

o

Euro Family

o

Euro Professional

They enjoyed monopoly over Italian telecommunication market until Omnitels

recent entrance; themarketing costs had been lower than its European counterparts.

The distribution channel of TIM was very strong as it had 1,500 exclusive dealers, 20 TIM-

owned shopsand 150 Telecom Italia stores, but after the entrance of Omnitel they became more

aggressive.

Its marketing strategy was to cater primarily to the high end segment of the Italian society

touting cellularphone as a status symbol.

Customer Analysis

The Italian customer market was different from other markets as the people were willing to pay

handsomelyas they like to show off as they liked show off.

It was noticed that the customers were not interested in paying activation fees, instead they want

to pay onlywhen they use the phone.

The customers wanted a different set of tariffs for local calls, long distance calls and

international calls andthey did not mind paying more.

Collaborator Analysis

The shops that sold consumer electronics goods and telecommunication goods and services sold

Omnitels

handsets which were 2000 in number.

They paid a commission of Lit 40,000 for each account they activated and Omnitel didnt make

any profit on

the handsets sold.

Context Analysis:

In 1993, the European Commission declared that by January 1998, all member states would have

to opentheir markets and guarantee competition in telephony markets but under pressure from

business interests,the EC liberalized the cellular telephony by January 1994, subjected to

interpretation by the countryinvolved.

Cellular penetration rates were relatively modest.

Value for Money of the service continued to increase because of reduced costs and improved

quality.

All cellular operators in Europe had adopted the GSM digital standard.

Many European countries began to have multiple players resulting in increased marketing.

Competitive Advantage

Focus on Customer service

Polite Operator

Minimum waiting time

One stop calling

trained operator

LIBERO

No monthly fee

No increase in commission to distribution channels

Increase in demand

Creating and promoting the brand image

Spending of Lit. 40 bn for advertisement

Customer Analysis

The Italian customer market was different from other markets as the people were willing to pay

handsomelyas they like to show off as they liked show off.

It was noticed that the customers were not interested in paying activation fees, instead they want

to pay onlywhen they use the phone.

The customers wanted a different set of tariffs for local calls, long distance calls and

international calls andthey did not mind paying more.

Collaborator Analysis

The shops that sold consumer electronics goods and telecommunication goods and services sold

Omnitels

handsets which were 2000 in number.

They paid a commission of Lit 40,000 for each account they activated and Omnitel didnt make

any profit on

the handsets sold.

Context Analysis:

In 1993, the European Commission declared that by January 1998, all member states would have

to opentheir markets and guarantee competition in telephony markets but under pressure from

business interests,the EC liberalized the cellular telephony by January 1994, subjected to

interpretation by the countryinvolved.

Cellular penetration rates were relatively modest.

Value for Money of the service continued to increase because of reduced costs and improved

quality.

All cellular operators in Europe had adopted the GSM digital standard.

Many European countries began to have multiple players resulting in increased marketing.

Competitive Advantage

Focus on Customer service

Polite Operator

Minimum waiting time

One stop calling

trained operator

LIBERO

No monthly fee

No increase in commission to distribution channels

Increase in demand

Creating and promoting the brand image

Spending of Lit. 40 bn for advertisement

Evaluation of Alternatives

Alternative 1

is risky because it is most likely to trigger an immediate price war with TIM. Also, if after the

launchof LIBERO, TIM slashes its rates, it is highly probable that subscribers will switch to

TIM. This is based on thefindings of the conjoint analysis (exhibit 6) which revealed a low brand

loyalty of 25% as compared to cost sensitivityof 35% among the customers. Since LIBERO does

not involve any monthly fee, Omnitel might suffer very heavylosses.

Alternative 2

on the other hand is safer as compared to alternative 1. However, it has nothing new to attract

theexisting TIM subscriber base to itself. As has been stated in the case, this strategy has worked

successfully in othercountries, it might work in this case as well, although the extent to which it

is successful might be less.

Alternative 3

appears to be the best solution for Omnitel. It will appeal to the potential subscribers

psychologically,as they will no longer have to pay a fixed monthly fee. They will pay only for

the time blocks in which they are using

the operators services. The costs will easily be covered through careful selection of the time

block rental value and

call charges.

ref: http://www.scribd.com/doc/51085275/Case-Analysis-OMNITEL-PRONTO-ITALIA

S-ar putea să vă placă și

- Omnitel Pronto Italia Case AnalysisDocument8 paginiOmnitel Pronto Italia Case AnalysisSnehal JoshiÎncă nu există evaluări

- Omnitel Pronto Italia CaseDocument10 paginiOmnitel Pronto Italia CaseAnurag GuptaÎncă nu există evaluări

- Omnitel Case Team 5Document14 paginiOmnitel Case Team 5atefzouari100% (3)

- Omnitel Case AnalysisDocument2 paginiOmnitel Case Analysisstarzgazer100% (1)

- Omnitel Pronto ItaliaDocument16 paginiOmnitel Pronto ItaliaAshwin LawandeÎncă nu există evaluări

- Omnitel Pronto ItaliaDocument12 paginiOmnitel Pronto ItaliaKaranpal Singh JulkaÎncă nu există evaluări

- Case Analysis: OMNITEL PRONTO ITALIADocument5 paginiCase Analysis: OMNITEL PRONTO ITALIAmahtaabk100% (5)

- Omnitel Pronto Italia - Mumbai BorivaliDocument11 paginiOmnitel Pronto Italia - Mumbai BorivaliMedha Tawde SalviÎncă nu există evaluări

- Omnitel Pronto Report V2Document15 paginiOmnitel Pronto Report V2evergreenankitÎncă nu există evaluări

- WESCO Distribution, IncDocument9 paginiWESCO Distribution, IncDeepankar MukherjeeÎncă nu există evaluări

- Hubspot: Inbound Marketing and Web 2.0Document4 paginiHubspot: Inbound Marketing and Web 2.0Demendra BhagatÎncă nu există evaluări

- Omnitel Pronto Italia - Sec B - Group 15Document5 paginiOmnitel Pronto Italia - Sec B - Group 15Rohit GarhwalÎncă nu există evaluări

- Innovation at NyproDocument12 paginiInnovation at NyproMadan Kumar100% (1)

- Sales: SKF Bearings Series - Case Analysis-C6Document2 paginiSales: SKF Bearings Series - Case Analysis-C6Manik BajajÎncă nu există evaluări

- Dendrite InternationalDocument9 paginiDendrite InternationalSaurabh Srivastava0% (1)

- Icici CaseDocument2 paginiIcici CaseDebi PrasannaÎncă nu există evaluări

- Toyota Motor Manufacturing USA., inDocument5 paginiToyota Motor Manufacturing USA., inmudasserÎncă nu există evaluări

- Dominion Motors & Controls, LTDDocument6 paginiDominion Motors & Controls, LTDdileepÎncă nu există evaluări

- LoctiteDocument19 paginiLoctiteAbhi_The_RockstarÎncă nu există evaluări

- Case Analysis: Commercialization The Kunst 1600 Dry Piston Vacuum PumpDocument14 paginiCase Analysis: Commercialization The Kunst 1600 Dry Piston Vacuum PumpJyotsna GautamÎncă nu există evaluări

- Mekanism Case StudyDocument8 paginiMekanism Case StudyIshanÎncă nu există evaluări

- Wesco Distribution IncDocument2 paginiWesco Distribution IncJiswanath MondalÎncă nu există evaluări

- Clique PensDocument4 paginiClique PensGarima SinghÎncă nu există evaluări

- Respuestas Amore PacificDocument7 paginiRespuestas Amore Pacificlaura rÎncă nu există evaluări

- B2B - Group 3 - Jackson Case StudyDocument5 paginiB2B - Group 3 - Jackson Case Studyriya agrawallaÎncă nu există evaluări

- Computron IncDocument7 paginiComputron IncJD_04100% (1)

- Case Analysis - Managing Innovation at Nypro - Group EDocument8 paginiCase Analysis - Managing Innovation at Nypro - Group Enamita_jain1608100% (4)

- Dominion Motors & Controls, LTDDocument8 paginiDominion Motors & Controls, LTDIshan AgrawalÎncă nu există evaluări

- Group H - Apple Privacy Vs SafetyDocument6 paginiGroup H - Apple Privacy Vs SafetyHello AwesomeÎncă nu există evaluări

- Ge Healthcare India (B)Document6 paginiGe Healthcare India (B)Rahul SethiÎncă nu există evaluări

- Kunst 3500 DRY PISTON Vacuum Pump: Presented by Group 3ADocument7 paginiKunst 3500 DRY PISTON Vacuum Pump: Presented by Group 3ARohanMohapatraÎncă nu există evaluări

- Group 6 - IMC Assignment Lipton BriskDocument6 paginiGroup 6 - IMC Assignment Lipton BriskSpandanNandaÎncă nu există evaluări

- Hubspot: Inbound Marketing and Web 2.0: Market Research For A New Product IntroductionDocument4 paginiHubspot: Inbound Marketing and Web 2.0: Market Research For A New Product IntroductionAnimesh ChakrabortyÎncă nu există evaluări

- Xiameter - Debasish SahooDocument2 paginiXiameter - Debasish SahooDebasish SahooÎncă nu există evaluări

- Verklar Austria CaseDocument15 paginiVerklar Austria Caseydchou_690% (2)

- Case Analysis Aniket Bothare MBM PVTDocument4 paginiCase Analysis Aniket Bothare MBM PVTAniket BothareÎncă nu există evaluări

- MM Goodyear-Aquatred Case SubmissionDocument4 paginiMM Goodyear-Aquatred Case Submissionnilay100% (1)

- LRDocument14 paginiLRasaÎncă nu există evaluări

- Dell Computers: Field Service For Corporate Clients (A) : Group Number: 7Document4 paginiDell Computers: Field Service For Corporate Clients (A) : Group Number: 7someone specialÎncă nu există evaluări

- Giovanni Case SlidesDocument20 paginiGiovanni Case SlidesManishaÎncă nu există evaluări

- Brighter Smile For The MassesDocument1 paginăBrighter Smile For The MassesRohanÎncă nu există evaluări

- Nypro Case StudyDocument8 paginiNypro Case StudyTalhaÎncă nu există evaluări

- Goodyear - Group 3Document4 paginiGoodyear - Group 3Prateek Vijaivargia0% (1)

- EkohealthDocument3 paginiEkohealthSARATH RAM P PGP 2019-21 BatchÎncă nu există evaluări

- Case Analysis - Wright Line, Inc. (A)Document8 paginiCase Analysis - Wright Line, Inc. (A)ayush singlaÎncă nu există evaluări

- Reshaping The IT Governance in Octo Telematics To Gain IT-business AlignmentDocument17 paginiReshaping The IT Governance in Octo Telematics To Gain IT-business AlignmentPriyanka AzadÎncă nu există evaluări

- Dominion Motor CaseDocument3 paginiDominion Motor Caseabhijeet pandeÎncă nu există evaluări

- Clique Pens Case AnalysisDocument8 paginiClique Pens Case AnalysisShweta Verma100% (1)

- CiscoDocument6 paginiCiscoNatalia Kogan0% (2)

- Sales Soft Case StudyDocument7 paginiSales Soft Case StudyNaina Agrawal100% (1)

- Assignment B2B MarketingDocument5 paginiAssignment B2B MarketingNitam BaroÎncă nu există evaluări

- Uniglobe Case StudyDocument7 paginiUniglobe Case StudyHarish G RautÎncă nu există evaluări

- Isme MM - Airtel Data AmbitionsDocument6 paginiIsme MM - Airtel Data AmbitionsAkhilesh desaiÎncă nu există evaluări

- GCP - Group 8Document9 paginiGCP - Group 8Anosh DoodhmalÎncă nu există evaluări

- Dell Computers: Field Service For Corporate Clients: Group - 8Document6 paginiDell Computers: Field Service For Corporate Clients: Group - 8satyander malwalÎncă nu există evaluări

- Ahmed Gabri: Marketing Management - Omnitel Pronto Italia CaseDocument3 paginiAhmed Gabri: Marketing Management - Omnitel Pronto Italia CaseAhmed GabriÎncă nu există evaluări

- Mnitel Pronto Italia: Syndicate A4Document10 paginiMnitel Pronto Italia: Syndicate A4Vibhuti BatraÎncă nu există evaluări

- Omnitel Pronto ItaliaDocument17 paginiOmnitel Pronto ItaliaKaspito Gabriel HutagalungÎncă nu există evaluări

- Analysis of Singapore TelecomDocument4 paginiAnalysis of Singapore TelecomAlvin Cardoza DE VillaÎncă nu există evaluări

- Telecommunication Sector in France: HistoryDocument7 paginiTelecommunication Sector in France: HistoryDEVHEREÎncă nu există evaluări

- Porters Five Forces Model Automobile IndustryDocument16 paginiPorters Five Forces Model Automobile IndustrySnehal Joshi100% (2)

- Monopolistic CompetitionDocument9 paginiMonopolistic CompetitionSnehal JoshiÎncă nu există evaluări

- CM Questionnaire For Mapping ComptenciesDocument3 paginiCM Questionnaire For Mapping ComptenciesSnehal Joshi100% (1)

- Miles Laboratories Inc. Case StudyDocument4 paginiMiles Laboratories Inc. Case StudySnehal JoshiÎncă nu există evaluări

- Non Marketable Financial AssetsDocument3 paginiNon Marketable Financial AssetsSnehal JoshiÎncă nu există evaluări

- Project Report On TranspirationDocument5 paginiProject Report On TranspirationSnehal JoshiÎncă nu există evaluări

- Monopolistic CompetitionDocument9 paginiMonopolistic CompetitionSnehal JoshiÎncă nu există evaluări

- Market Structure PPT Group 8Document27 paginiMarket Structure PPT Group 8Snehal JoshiÎncă nu există evaluări

- Group 8 Et Summary From 27th July To 02 AugustDocument4 paginiGroup 8 Et Summary From 27th July To 02 AugustSnehal JoshiÎncă nu există evaluări

- Market Structure PPT Group 8Document27 paginiMarket Structure PPT Group 8Snehal JoshiÎncă nu există evaluări

- HLL Question & AnswersDocument16 paginiHLL Question & AnswersSnehal Joshi75% (4)

- Wockhardt LTD Divergence Between PreceptsDocument11 paginiWockhardt LTD Divergence Between PreceptsSnehal Joshi100% (2)

- Haldiram's Case AnalysisDocument4 paginiHaldiram's Case AnalysisSnehal JoshiÎncă nu există evaluări

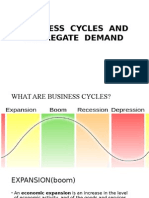

- Business Cycles and Aggregate DemandDocument40 paginiBusiness Cycles and Aggregate DemandSnehal Joshi100% (1)

- Market Structure PPT Group 8Document27 paginiMarket Structure PPT Group 8Snehal JoshiÎncă nu există evaluări

- HLL Question & AnswersDocument16 paginiHLL Question & AnswersSnehal Joshi75% (4)

- More Pay For EngineersDocument1 paginăMore Pay For EngineersSnehal JoshiÎncă nu există evaluări

- Case Solution Bangaram IslandsDocument1 paginăCase Solution Bangaram IslandsSnehal Joshi100% (1)

- Callawaygolfcompanycgc-110330093402 - Callaway Golf Company Case Analysisphpapp02Document22 paginiCallawaygolfcompanycgc-110330093402 - Callaway Golf Company Case Analysisphpapp02Snehal JoshiÎncă nu există evaluări

- Demand and Supply Detailed Study MaterialDocument1 paginăDemand and Supply Detailed Study MaterialSnehal JoshiÎncă nu există evaluări

- Omnitel Pronto Full Report On Omnitel Pronto ItaliaDocument8 paginiOmnitel Pronto Full Report On Omnitel Pronto ItaliaSnehal JoshiÎncă nu există evaluări

- The Copyright ToolkitThe Copyright Toolkit - Docx The Copyright Toolkit - Docx The Copyright Toolkit - Docx The Copyright ToolkitDocument3 paginiThe Copyright ToolkitThe Copyright Toolkit - Docx The Copyright Toolkit - Docx The Copyright Toolkit - Docx The Copyright ToolkitSnehal JoshiÎncă nu există evaluări

- HaldiramDocument5 paginiHaldiramSnehal JoshiÎncă nu există evaluări

- Case 4 Mis Case 4 Mis Case 4 MisDocument1 paginăCase 4 Mis Case 4 Mis Case 4 MisSnehal JoshiÎncă nu există evaluări

- GK QuestionsDocument12 paginiGK QuestionsSnehal JoshiÎncă nu există evaluări

- Total Quality Management TQMDocument25 paginiTotal Quality Management TQMHaitham NegmÎncă nu există evaluări

- Sonia Vaze ReportDocument51 paginiSonia Vaze ReportSnehal JoshiÎncă nu există evaluări

- Consumer Behaviour Questionnaire On Buying Behaviour Towards Branded ClothsDocument1 paginăConsumer Behaviour Questionnaire On Buying Behaviour Towards Branded ClothsSnehal JoshiÎncă nu există evaluări

- WEBINAR-LAPENKOP@2021 - Ustadz Mursalin Maggangka, P.HDDocument33 paginiWEBINAR-LAPENKOP@2021 - Ustadz Mursalin Maggangka, P.HDcooperative inovatorsÎncă nu există evaluări

- IFRS 5 Non-Current Assets Held For Sale and Discontinued OperationsDocument12 paginiIFRS 5 Non-Current Assets Held For Sale and Discontinued Operationsanon_419651076Încă nu există evaluări

- Diagnostic Service: Factors Factor Weight Rating Factor ScoreDocument2 paginiDiagnostic Service: Factors Factor Weight Rating Factor ScoreAlayou TeferaÎncă nu există evaluări

- SM ProjectDocument31 paginiSM ProjectHrushikeish ShindeÎncă nu există evaluări

- NPA of Indian BanksDocument27 paginiNPA of Indian BanksShristi GuptaÎncă nu există evaluări

- Pilipinas Shell Petroleum Corporation: SHLPHDocument17 paginiPilipinas Shell Petroleum Corporation: SHLPHIsis Normagne PascualÎncă nu există evaluări

- Artificial Flowers Import Business PlanDocument34 paginiArtificial Flowers Import Business PlanZUZANI MATHIYAÎncă nu există evaluări

- State Bank of IndiaDocument60 paginiState Bank of IndiaJohnsonÎncă nu există evaluări

- L5M4 New PaperDocument9 paginiL5M4 New PaperibraokelloÎncă nu există evaluări

- Fashion Retail Merchandising Retail Visit ReportDocument6 paginiFashion Retail Merchandising Retail Visit Reportchins1289Încă nu există evaluări

- Chapter 03 - AnswerDocument10 paginiChapter 03 - AnswerGeomari D. BigalbalÎncă nu există evaluări

- LSP404Document2 paginiLSP404Qian WangÎncă nu există evaluări

- T-IEET001 - Business-Model-Canvas - Ta-Ay, Jay L. - MEE31Document1 paginăT-IEET001 - Business-Model-Canvas - Ta-Ay, Jay L. - MEE31JayÎncă nu există evaluări

- WBCSD TIP Sustainability Driven SDG Tire Sector RoadmapDocument49 paginiWBCSD TIP Sustainability Driven SDG Tire Sector RoadmapComunicarSe-ArchivoÎncă nu există evaluări

- Premium & Warranty LiabilitiesDocument16 paginiPremium & Warranty LiabilitiesKring Zel0% (1)

- Effect of Liquidity and Bank Size On The Profitability of Commercial Banks in BangladeshDocument4 paginiEffect of Liquidity and Bank Size On The Profitability of Commercial Banks in BangladeshdelowerÎncă nu există evaluări

- Balanced Scorecard Pre Read AAIDocument16 paginiBalanced Scorecard Pre Read AAIIndresh Singh Saluja100% (1)

- Current AssetsDocument3 paginiCurrent AssetsFelicity CabreraÎncă nu există evaluări

- Learning Elt Future PDFDocument66 paginiLearning Elt Future PDFrafanrin9783Încă nu există evaluări

- Percent Per Day Binary Options CalculatorDocument4 paginiPercent Per Day Binary Options CalculatorJohn BoydÎncă nu există evaluări

- The Comparison Between LG and Samsung in Satisfaction and AwarenessDocument37 paginiThe Comparison Between LG and Samsung in Satisfaction and AwarenessChandan SrivastavaÎncă nu există evaluări

- CPM PertDocument17 paginiCPM Pert39SEAShashi KhatriÎncă nu există evaluări

- Micro Analysis of CERA SenetaryDocument98 paginiMicro Analysis of CERA SenetaryDhimant0% (1)

- What Is Water Scarcity LISTODocument6 paginiWhat Is Water Scarcity LISTOAdrián Lume HuayllaniÎncă nu există evaluări

- WJEC Economics AS Unit 2 QP S19Document7 paginiWJEC Economics AS Unit 2 QP S19angeleschang99Încă nu există evaluări

- Chapter 1 Capital MarketsDocument7 paginiChapter 1 Capital MarketsNovel LampitocÎncă nu există evaluări

- The Complete Guide To Financial PlanningDocument160 paginiThe Complete Guide To Financial PlanningVikas Acharya100% (2)

- Chapter 7 - Compound Financial Instrument (FAR6)Document5 paginiChapter 7 - Compound Financial Instrument (FAR6)Honeylet SigesmundoÎncă nu există evaluări

- The Political Economy of Gross Domestic Product Accounting and The Philippine Case BulatlatDocument14 paginiThe Political Economy of Gross Domestic Product Accounting and The Philippine Case BulatlatStephen VillanteÎncă nu există evaluări