Documente Academic

Documente Profesional

Documente Cultură

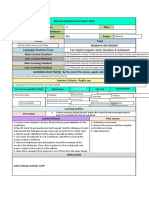

Exit Strategies

Încărcat de

msimionescu680 evaluări0% au considerat acest document util (0 voturi)

198 vizualizări9 paginiAn exit strategy details the methods for withdrawing from a working relationship with a supplier. Strategy usually details timescales for key actions and the party responsible for such actions. Contract escape clauses are particularly relevant with respect to outsourcing and subcontracting.

Descriere originală:

Drepturi de autor

© © All Rights Reserved

Formate disponibile

PDF, TXT sau citiți online pe Scribd

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentAn exit strategy details the methods for withdrawing from a working relationship with a supplier. Strategy usually details timescales for key actions and the party responsible for such actions. Contract escape clauses are particularly relevant with respect to outsourcing and subcontracting.

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca PDF, TXT sau citiți online pe Scribd

0 evaluări0% au considerat acest document util (0 voturi)

198 vizualizări9 paginiExit Strategies

Încărcat de

msimionescu68An exit strategy details the methods for withdrawing from a working relationship with a supplier. Strategy usually details timescales for key actions and the party responsible for such actions. Contract escape clauses are particularly relevant with respect to outsourcing and subcontracting.

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca PDF, TXT sau citiți online pe Scribd

Sunteți pe pagina 1din 9

Exit Strategies

Buyers and suppliers need to have a clearly defined exit strategy

agreed during the pre-contract stage to avoid difficulties should the

relationship turn sour (Barton, 2012).

Concept Overview

Definition

An exit strategy details the methods for withdrawing from a working relationship with a supplier (Elango, 2008; Kam

et al., 2011). The term is also widely used to refer to the process of business owners exiting or selling a business or

business unit, and in the financial markets with the trading of stocks and shares. Here we refer to exit strategies

specifically in relation to the ending of contracting relationships between buyers and suppliers.

Description

There are many reasons why contracts come to an end, including non-performance by one or both parties, a

significant change in the requirements of either party, or that the contract has run its course (Burnes and

Anastasiadis, 2003; Elango, 2008). In almost all cases, having a well-developed exit strategy is critical. The strategy

is usually developed as the means by which to withdraw from a working relationship with a supplier. It can

incorporate the process of returning assets, transferring back key employees and the conditions under which a

relationship can terminate, for example, the failure to meet service level agreements, changes in circumstances, and

ethical breaches (Elango, 2008; Kam et al., 2011). The strategy usually details timescales for key actions and the

party responsible for such actions (Elango, 2008, Kam et al., 2011).

Exit strategies and contract escape clauses are particularly relevant with respect to outsourcing and subcontracting.

Outsourcing typically involves restructuring an enterprise around core competencies and external relationships, and

demonstrates a long-term strategic commitment - this differs to subcontracting which can be a short-term tactical

approach (Elango, 2008; Lysons and Farrington, 2006). There may be a significant transfer of assets and people to

the outsource supplier and it is therefore important to establish a contract that entitles the company to re-purchase

relevant assets and have key staff transfer back to it at the conclusion of the contract however the contract's end is

brought about. The exit strategy, documented in the contract, is a way of ensuring that the supplier is responsible for

guaranteeing that appropriate information, staff and other assets are transferred (CIPS: Business Process Re-

engineering & Business Process Outsourcing). This transfer process might mean returning assets back in-house or

cooperating in transitioning them to a new supplier under an agreed timescale set-out in the exit strategy (Burnes

and Anastasiadis, 2003). In discussing exit strategies, there is a tendency to see them as predominantly for the

benefit of the buyer. However, there are equally crucial reasons for why exit strategies and escape clauses benefit

suppliers.

Business Evidence

Strengths

An exit strategy can generally reduce the likelihood of legal complications further down the line in the event of a

problem with a chosen outsourcing provider (Burnes and Anastasiadis, 2003).

By enforcing an exit strategy, companies have some degree of control over legal costs that would otherwise

arise if problems occurred without implementing an exit strategy (Burnes and Anastasiadis, 2003; Kam et al.,

2011).

Implementing an exit strategy encourages suppliers to act in a professional way and to cooperate (CIPS

Australia: Wheres the Exit?)

Weaknesses

Exit strategies must be discussed at the early stages of the relationship and treated sensitively: too much

emphasis on the exit strategy or handling discussions unprofessionally could signal a red flag to the supplier

concerning future commitment and cooperation, thus also negatively impacting agreed service levels (Power et

al., 2004).

There are no hard and fast rules for discussing the exit strategy. Timing is an important issue in international

outsourcing where business negotiations in some cultures depend strongly on effective relationship

management, such as in China concerning the cultural phenomenon of saving face (Kam et al., 2011).

Because the non-performance aspect of an exit strategy is tied to key performance indicators (KPIs), the KPIs

themselves may leave either the supplier or the buyer less than satisfied. The exit strategy therefore might not

be viewed as ideal by one of the parties but nonetheless sufficient for the working relationship to commence

and the required products or services purchased (Burnes and Anastasiadis, 2003).

Case Evidence

IBM failed to help energy company NiSource Inc. achieve projected cost savings of US$530m, causing the

latter to amend a 10-year US$1.6bln contract after two and a half years. NiSource's exit strategy enabled the

company to reconfigure elements of the contract and backsource some of the processes in-house (Nevers,

2008).

Cable and Wireless signed a 10-year contract in 1998 worth 1.8bln covering IT infrastructure outsourcing.

However, the deal ended less than half way through when C&W sought legal action against IBM for alleged

overcharging (McLaughlin and Peppard, 2006).

US financial services firm Wachovia outsourced some functions to Hewitt Associates in a US$450m agreement

but then later backsourced some processes in-house, creating a 'blend of in-house and outsourced solutions'

(Workforce Management, 2008b).

Business Application

Implementation Information

Fundamentally, the exit strategy should contain concrete details on the timescales for key actions and the party

responsible for these actions. Neither the buyer nor the supplier can predict the future, but an exit strategy is a

logically sound way to reduce the risks encountered when a relationship ends (Burnes and Anastasiadis, 2003;

Elango, 2008; Power et al., 2004). The non-performance aspect of an exit strategy should be based on established

KPI that are central to the contract and remit of the project.

Implementation Steps

1.

Hold discussions prior to meeting with suppliers about the nature of the relationship and what the KPIs

should be.

2.

Discuss assets to be held by the supplier that will need to be transferred: staff members; information

on any contracts with third parties; data to be held by the supplier; and intellectual property issues.

3.

Ensure that all parties are satisfied before proceeding to formally draft the exit strategy and before

signing any agreement.

CIPS Australia: Wheres the Exit?

Success Factors

The practical implementation of an exit strategy is, to a large extent, dependent upon maintaining a working

relationship with the outgoing supplier (CIPS Australia: Wheres the Exit?).

It is imperative to avoid terminating a contract in a way that damages the financial integrity of a small supplier

(or a supplier of any size for that matter). Ultimately, a reasonable notice period defined within the exit strategy

"will assist the supplier to either, seek new work to fill the gap, or restructure" (CIPS Australia: Wheres the

Exit?).

For outsourcing activities, penalties for non-performance are common and emphasise the importance of

meeting the specified performance requirements (Lysons and Farrington, 2006).

It is important to include a general clause in the contract to the effect that, the supplier is required to provide all

such assistance as may be necessary to ensure a seamless handover to a new supplier (CIPS Australia:

Wheres the Exit?).

Measures

Consider KPI turnaround time or schedule of performance can be suitable for outsourcing relationships, for

example, specify a performance time for services (Lysons and Farrington, 2006).

Consider KPI downtime: how will the exit strategy come into play when measuring the downtime of equipment

or when the supplier is unavailable for a specified period of time? (Lysons and Farrington, 2006).

Conduct cost comparisons: at regular intervals between the current supplier and potential other suppliers

(Lysons and Farrington, 2006).

Professional Tools

Video

Rights to terminate an English law contract for breach

cipsintelligence.cips.org/video/o-86U4LH9Nk

File Downloads

CIPS Source Downloads

CIPS: Wheres the Exit?

cipsintelligence.cips.org/opencontent/wheres-the-exit

CIPS & PACG: Business process re-engineering & business process outsourcing

cipsintelligence.cips.org/opencontent/business-process-re-engineering-business-process-outsourcing

CIPS: Contract Management

cipsintelligence.cips.org/opencontent/cips-purchasing-and-supply-management.-contract-management

Further Reading

Web Resources

Exit strategies are critical when outsourcing problem functions

kburl.me/v24mw

Bringing a function back in-house

kburl.me/uq1lf

The issue of backsourcing

kburl.me/fpyvc

Case study highlighting the importance of an exit strategy

kburl.me/v3oi3

Making an exit: a clearly defined exit strategy

kburl.me/ygzcx

Print Resources

Offshoring opportunities: strategies and tactics

http://www.amazon.co.uk/dp/0471716731?tag=knowled0f-21

Well-referenced text on global outsourcing

http://www.amazon.co.uk/dp/0230235506?tag=knowled0f-21

Implications of outsourcing and offshoring

http://www.amazon.co.uk/dp/159140875X?tag=knowled0f-21

Basic reading on outsourcing and exit strategies

http://www.amazon.co.uk/dp/0749444304?tag=knowled0f-21

E-business strategy contains information on exit strategies

http://www.amazon.co.uk/dp/1599040042?tag=knowled0f-21

References

Barton, P. (2012) Making an Exit. Supply Management, Vol. 12(3), p.18.

Bullen, C.V., LeFave, R. and Selig, G.J. (2010) Implementing Strategic Sourcing. Van Haren Publishing,

Netherlands.

Burnes, B. and Anastasiadis, A. (2003) Outsourcing: A Public-private Sector Comparison. Supply Chain

Management: An International Journal, Vol. 8(4), pp. 355-66.

CIO (2005) Outsourcing - and Backsourcing - at JPMorgan Chase. [Online] Available at:

www.cio.com/article/10524/Outsourcing_and_Backsourcing_at_JPMorgan_Chase [Accessed: 8 February

2012].

CIPS Australia: Wheres the Exit?

CIPS: Business Process Re-engineering & Business Process Outsourcing.

Elango, B. (2008) Using Outsourcing for Strategic Competitiveness in Small and Medium-sized Firms.

Competitiveness Review: An International Business Journal, Vol. 18(4), pp. 322-32.

HR World (2008) TrendWatcher: Backsourcing - Bringing HR Processes Back In-House. [Online] Available at:

www.hrworld.com/features/trendwatcher-backsourcing-072508/ [Accessed: 8 February 2012].

Kam, B.A., Chen, L. and Wilding, R. (2011) Managing Production Outsourcing Risks in China's Apparel

Industry: A Case Study of Two Apparel Retailers. Supply Chain Management: An International Journal, Vol.

16(6), pp. 428-45.

Lysons, K. and Farrington, B. (2006) Purchasing and Supply Chain Management. Pearson Education, Essex,

UK.

McLaughlin, D. and Peppard, J. (2006) IT Backsourcing: From 'Make or Buy' to 'Bringing it Back In-house'.

Proceedings of the Fourteenth European Conference on Information Systems, Dublin.

Nevers, K. (2008) NiSource Admits Outsourcing Jobs to IBM was a Failure. [Online] Available at:

chestertontribune.com/Business/138 nisource_admits_outsourcing_jobs.htm [Accessed: 8 February 2012].

Power, M., Bonifazi, C. and Desouza, K.C. (2004) The Ten Outsourcing Traps to Avoid. Journal of Business

Strategy, Vol. 25(2), pp. 37-42.

Supply Management (2005) Outsourcing a 'Problem' Function. [Online] Available at:

www.supplymanagement.com/resources/q-and-a/2005/outsourcing-a-problem-function/locale=en.? [Accessed:

8 February 2012].

Workforce Management (2008a) Starbucks Terminates HRO Contract With Convergys. [Online] Available at:

old.workforce.com/section/news/article/starbucks-terminates-hro-contract-convergys.php [Accessed: 8

February 2012].

Workforce Management (2008b) Wachovia Takes HR Process Back From Hewitt. [Online] Available at:

www.workforce.com/article/20080227/NEWS01/302279996 [Accessed: 8 February 2012].

S-ar putea să vă placă și

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018De la EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Încă nu există evaluări

- Anti Hacking Security: Fight Data BreachDe la EverandAnti Hacking Security: Fight Data BreachÎncă nu există evaluări

- Cyber Incident Response Plan A Complete Guide - 2020 EditionDe la EverandCyber Incident Response Plan A Complete Guide - 2020 EditionÎncă nu există evaluări

- Information Technology Security Audit A Complete Guide - 2021 EditionDe la EverandInformation Technology Security Audit A Complete Guide - 2021 EditionÎncă nu există evaluări

- Patch Management A Complete Guide - 2021 EditionDe la EverandPatch Management A Complete Guide - 2021 EditionÎncă nu există evaluări

- Information risk management Complete Self-Assessment GuideDe la EverandInformation risk management Complete Self-Assessment GuideEvaluare: 3 din 5 stele3/5 (1)

- Infrastructure And Operations Automation A Complete Guide - 2020 EditionDe la EverandInfrastructure And Operations Automation A Complete Guide - 2020 EditionÎncă nu există evaluări

- Point Of Zero Trust A Complete Guide - 2019 EditionDe la EverandPoint Of Zero Trust A Complete Guide - 2019 EditionÎncă nu există evaluări

- Business Impact Analysis A Complete Guide - 2020 EditionDe la EverandBusiness Impact Analysis A Complete Guide - 2020 EditionÎncă nu există evaluări

- Business Continuity Planning BCP A Complete Guide - 2019 EditionDe la EverandBusiness Continuity Planning BCP A Complete Guide - 2019 EditionÎncă nu există evaluări

- Third Party Vendors A Complete Guide - 2020 EditionDe la EverandThird Party Vendors A Complete Guide - 2020 EditionÎncă nu există evaluări

- Insider Threat Program The Ultimate Step-By-Step GuideDe la EverandInsider Threat Program The Ultimate Step-By-Step GuideÎncă nu există evaluări

- Privileged Account Management A Complete Guide - 2020 EditionDe la EverandPrivileged Account Management A Complete Guide - 2020 EditionÎncă nu există evaluări

- Information Security Strategic PlanDocument1 paginăInformation Security Strategic PlanVince VulpesÎncă nu există evaluări

- Architects Guide To Business ContinuityDocument62 paginiArchitects Guide To Business ContinuityEvaristo CarriegoÎncă nu există evaluări

- Deloitte Uk Audit Transparency Report 2017Document76 paginiDeloitte Uk Audit Transparency Report 2017Chris LittleÎncă nu există evaluări

- WBCSD Risk Publication 2016 PDFDocument52 paginiWBCSD Risk Publication 2016 PDFNugroho Dwi PÎncă nu există evaluări

- Planning Phase Exit Review ChecklistDocument1 paginăPlanning Phase Exit Review ChecklistjfelipemoralesÎncă nu există evaluări

- Measuring Risk and Risk GovernanceDocument24 paginiMeasuring Risk and Risk GovernanceDizzyDudeÎncă nu există evaluări

- Create CIRTDocument282 paginiCreate CIRTSyeda Ashifa Ashrafi PapiaÎncă nu există evaluări

- MIS589 - Group 5 - ProjectDocument13 paginiMIS589 - Group 5 - ProjectAndré Bassi0% (1)

- National Cyber Security Policy 2021 WWW - Csstimes.pkDocument23 paginiNational Cyber Security Policy 2021 WWW - Csstimes.pkSabrina GhilzaiÎncă nu există evaluări

- The 'Security' ParadoxDocument15 paginiThe 'Security' Paradoxanna9412Încă nu există evaluări

- Cyber RiskDocument112 paginiCyber Riskverdict7usÎncă nu există evaluări

- Digital Forensics AssignmentDocument35 paginiDigital Forensics AssignmentvijayÎncă nu există evaluări

- Implementing A Security Awareness Training Program Would Be An Example of Which Type of ControlDocument14 paginiImplementing A Security Awareness Training Program Would Be An Example of Which Type of ControlSohaib KhanÎncă nu există evaluări

- Enhancing Decision MakingDocument28 paginiEnhancing Decision MakingHayel Ababneh100% (1)

- Professional Cloud Security Manager - Mock ExamDocument22 paginiProfessional Cloud Security Manager - Mock ExamCSK100% (1)

- 2018 IDG Security Priorities SurveyDocument9 pagini2018 IDG Security Priorities SurveyIDG_WorldÎncă nu există evaluări

- Information Technology Risk Frameworks and AuditsDocument43 paginiInformation Technology Risk Frameworks and AuditsMaxwell ChigangaidzeÎncă nu există evaluări

- Content Management System Elite GroupDocument4 paginiContent Management System Elite Groupbharatgupta35Încă nu există evaluări

- Business Case For An ISMS Whitepaper PDFDocument54 paginiBusiness Case For An ISMS Whitepaper PDFJeya Shree Arunjunai RajÎncă nu există evaluări

- Gartner MQ Data Centre Outsourcing & Infrastructure Utility Services - EuropeDocument38 paginiGartner MQ Data Centre Outsourcing & Infrastructure Utility Services - EuroperossloveladyÎncă nu există evaluări

- Cyber Security Framework V1.01Document42 paginiCyber Security Framework V1.01santanujoshiÎncă nu există evaluări

- Quantitative Risk Management For Homeland SecurityDocument46 paginiQuantitative Risk Management For Homeland SecuritytomtuducÎncă nu există evaluări

- Papper 5 PDFDocument16 paginiPapper 5 PDFSebastian GuerraÎncă nu există evaluări

- The Business Case For A Next Generation SIEMDocument11 paginiThe Business Case For A Next Generation SIEMGheorghica AndreeaÎncă nu există evaluări

- Gift Giving and CorruptionDocument12 paginiGift Giving and CorruptionJesús F. HernándezÎncă nu există evaluări

- Testing Your Business Continuity Plan A Guide For Headteachers and GovernorsDocument4 paginiTesting Your Business Continuity Plan A Guide For Headteachers and GovernorsJoyce Anne MoratoÎncă nu există evaluări

- Ver001 Trustwave MSS SLA PDFDocument4 paginiVer001 Trustwave MSS SLA PDFRaúl Menjura MachadoÎncă nu există evaluări

- DCSS enDocument36 paginiDCSS enashvar9Încă nu există evaluări

- CIS RAM v2.1 IG2 Workbook Guide 2022 08Document53 paginiCIS RAM v2.1 IG2 Workbook Guide 2022 08Lukas PedrottaÎncă nu există evaluări

- Incident Response Play BookDocument21 paginiIncident Response Play BookUmoora MinhajiÎncă nu există evaluări

- Business Services Partnership: Clark CountyDocument17 paginiBusiness Services Partnership: Clark CountyBusiness Services PartnershipÎncă nu există evaluări

- Ransomware in High-Risk EnvironmentsDocument38 paginiRansomware in High-Risk Environmentsalvin_munsamyÎncă nu există evaluări

- It GovernanceDocument12 paginiIt GovernanceVaibhav SachdevÎncă nu există evaluări

- Database Security - Concepts, Approaches: IEEE Transactions On Dependable and Secure Computing February 2005Document23 paginiDatabase Security - Concepts, Approaches: IEEE Transactions On Dependable and Secure Computing February 2005Sky SantanaÎncă nu există evaluări

- Ministry of Defence (SAR) FormDocument3 paginiMinistry of Defence (SAR) FormChris EmmÎncă nu există evaluări

- 5 Outsourcing Models What Are TheyDocument3 pagini5 Outsourcing Models What Are Theyyatara20Încă nu există evaluări

- Capability Maturity ModelDocument12 paginiCapability Maturity ModelAnonymous QEcQfTeHlÎncă nu există evaluări

- SECOMDocument24 paginiSECOMBalkar Bonney SiviaÎncă nu există evaluări

- 2014-03-03 - NCC Group - Whitepaper - Cyber Battle Ship v1-0Document10 pagini2014-03-03 - NCC Group - Whitepaper - Cyber Battle Ship v1-0Cerys WatkinsÎncă nu există evaluări

- Metric Based Security AssessmentDocument1 paginăMetric Based Security Assessmentsresearcher7Încă nu există evaluări

- 8th Annual IT Audit Benchmarking Survey ISACA Protiviti Mis - Eng - 0320Document82 pagini8th Annual IT Audit Benchmarking Survey ISACA Protiviti Mis - Eng - 0320Ahmed AÎncă nu există evaluări

- Business Continuity Plan TemplateDocument30 paginiBusiness Continuity Plan TemplatesilvmÎncă nu există evaluări

- 007 Organizational Coaching Best PracticesDocument4 pagini007 Organizational Coaching Best PracticesMichelle ChaudhuriÎncă nu există evaluări

- Buying Print v3060208 PDFDocument12 paginiBuying Print v3060208 PDFJavier Martinez CañalÎncă nu există evaluări

- Negotiation PoPDocument4 paginiNegotiation PoPmsimionescu68Încă nu există evaluări

- Marketing Services ProcurementDocument9 paginiMarketing Services Procurementmsimionescu68Încă nu există evaluări

- LOCOG Invitation To Tender For The Provision of Goods and ServciesDocument9 paginiLOCOG Invitation To Tender For The Provision of Goods and Servciesmsimionescu68Încă nu există evaluări

- Buyer-Seller Improvement TeamsDocument9 paginiBuyer-Seller Improvement Teamsmsimionescu68Încă nu există evaluări

- Negotiations in ProcurementDocument9 paginiNegotiations in Procurementmsimionescu68Încă nu există evaluări

- Chapter 8 Supplier Quality ManagementDocument71 paginiChapter 8 Supplier Quality ManagementAnh NguyenÎncă nu există evaluări

- Bruxism Hypnosis Script No. 2Document12 paginiBruxism Hypnosis Script No. 2Eva Jacinto100% (2)

- Architect Magazine 2023 0506Document152 paginiArchitect Magazine 2023 0506fohonixÎncă nu există evaluări

- Solaris Hardening Guide v1Document56 paginiSolaris Hardening Guide v1GusGualdÎncă nu există evaluări

- Jane AustenDocument2 paginiJane Austendfaghdfo;ghdgÎncă nu există evaluări

- Molly On The Shore by Percy Grainger Unit StudyDocument5 paginiMolly On The Shore by Percy Grainger Unit Studyapi-659613441Încă nu există evaluări

- 130004-1991-Maceda v. Energy Regulatory BoardDocument14 pagini130004-1991-Maceda v. Energy Regulatory BoardChristian VillarÎncă nu există evaluări

- 3RD Last RPHDocument5 pagini3RD Last RPHAdil Mohamad KadriÎncă nu există evaluări

- How To Format Your Business ProposalDocument2 paginiHow To Format Your Business Proposalwilly sergeÎncă nu există evaluări

- Franieboy Ponce, BSIT-1, - DAY 2 ACTIVITYDocument2 paginiFranieboy Ponce, BSIT-1, - DAY 2 ACTIVITYFrancisco PonceÎncă nu există evaluări

- MoMA Learning Design OverviewDocument28 paginiMoMA Learning Design OverviewPenka VasilevaÎncă nu există evaluări

- Using JAXB For XML With Java - DZone JavaDocument20 paginiUsing JAXB For XML With Java - DZone JavajaehooÎncă nu există evaluări

- Chronology of Events:: Account: North Davao Mining Corp (NDMC)Document2 paginiChronology of Events:: Account: North Davao Mining Corp (NDMC)John Robert BautistaÎncă nu există evaluări

- Legend of September 2019 MagazineDocument40 paginiLegend of September 2019 MagazineAswathi ThatchinamoorthiÎncă nu există evaluări

- 11 PJBUMI Digital Data Specialist DR NOOR AZLIZADocument7 pagini11 PJBUMI Digital Data Specialist DR NOOR AZLIZAApexs GroupÎncă nu există evaluări

- Makalah Soal Soal UtbkDocument15 paginiMakalah Soal Soal UtbkAndidwiyuniarti100% (1)

- The Neuromarketing ConceptDocument7 paginiThe Neuromarketing ConceptParnika SinghalÎncă nu există evaluări

- Correlation SecretDocument23 paginiCorrelation SecretDavid100% (1)

- Principles of Cooking MethodsDocument8 paginiPrinciples of Cooking MethodsAizelle Guerrero Santiago100% (1)

- RMC No. 23-2007-Government Payments WithholdingDocument7 paginiRMC No. 23-2007-Government Payments WithholdingWizardche_13Încă nu există evaluări

- Bed BathDocument6 paginiBed BathKristil ChavezÎncă nu există evaluări

- Multiple ChoiceDocument3 paginiMultiple ChoiceEfrelyn CasumpangÎncă nu există evaluări

- History of Architecture VI: Unit 1Document20 paginiHistory of Architecture VI: Unit 1Srehari100% (1)

- Citibank Vs Hon ChuaDocument12 paginiCitibank Vs Hon ChuaJA BedrioÎncă nu există evaluări

- Lozada Vs MendozaDocument4 paginiLozada Vs MendozaHarold EstacioÎncă nu există evaluări

- Basic Elements of Rural DevelopmentDocument7 paginiBasic Elements of Rural DevelopmentShivam KumarÎncă nu există evaluări

- Floating PonttonDocument9 paginiFloating PonttonToniÎncă nu există evaluări

- Lae 3333 2 Week Lesson PlanDocument37 paginiLae 3333 2 Week Lesson Planapi-242598382Încă nu există evaluări

- Chapter 3 - StudentDocument38 paginiChapter 3 - StudentANIS NATASHA BT ABDULÎncă nu există evaluări

- The Relationship Between Law and MoralityDocument12 paginiThe Relationship Between Law and MoralityAnthony JosephÎncă nu există evaluări