Documente Academic

Documente Profesional

Documente Cultură

2015 Fall Erm Syllabus

Încărcat de

gman4dx266Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

2015 Fall Erm Syllabus

Încărcat de

gman4dx266Drepturi de autor:

Formate disponibile

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

Important Exam Information:

Reading Extensions

At registration, candidates must select from one of six reading

extensions. The readings for each extension appear at the end of this

document. The study note package includes all extensions. Seventy-five

percent of the exam points will come from the core readings and will be

common for all candidates. The remaining twenty-five percent will be

based on the case study and/or the readings for the selected extension.

These questions may also draw on material from the core reading.

Exam Registration

Candidates may register online or with an application.

Order Study Notes

Study notes are part of the required syllabus and are not

available electronically but may be purchased through the

online store.

Courseware

This document will guide candidates through the syllabus material and

reinforce learning that is expected from each topic. It is not intended to

duplicate or replace the study material, but rather to enhance it.

Courseware is required reading and is in the Study Note package as

ERM-52-15.

Introductory Study Note

The Introductory Study Note has a complete listing of all study notes

as well as errata and other important information.

Case Study

This case study will also be provided with the examination. Candidates

will not be allowed to bring their copy of the case study into the

examination room. There is a single case study. However, within the

case study are instructions as to which parts relate to which reading

extension.

Past Exams

Past Exams from 2012 - present are available on the SOA website.

Updates

Candidates should be sure to check the Updates page on the exam

home page periodically for additional corrections or notices.

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

The five topics that follow are the core learning objectives and readings for this examination. All

candidates are responsible for this material.

1. Topic: Risk Categories and Identification

Learning Objectives

The candidate will understand the types of risks faced by an entity and be able to identify and analyze these

risks.

Learning Outcomes

The candidate will be able to:

a)

Explain risk concepts and be able to apply risk definitions to different entities.

b) Explain risk taxonomy and its application to different frameworks.

c)

Identify and assess the potential impact of risks faced by an entity, including but not limited to market

risk, currency risk, credit risk, counterparty risk, spread risk, liquidity risk, interest rate risk, equity risk,

hazard/insurance risk, inflationary risk, environmental risk, pricing risk, product risk, legal risk,

operational risk, project risk and strategic risk.

Resources

Financial Enterprise Risk Management, Sweeting

o

Ch. 7 Definitions of Risk

Ch. 8 Risk Identification

Value-at- Risk: The New Benchmark for Managing Financial Risk, Jorion, 3rd Edition

o

Ch. 13 Liquidity Risk

ERM-107-12: Strategic Risk Management Practice, Andersen and Schroder, 2010, Ch. 7: Strategic Risk

Analyses

ERM-117-14: AAA Practice Note: Insurance Enterprise Risk Management Practices (pp. 4- 26)

ERM-702-12: IAA Note on ERM for Capital and Solvency Purposes in the Insurance Industry, pp. 938

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

2. Topic: Risk Modeling and Aggregation of Risks

Learning Objectives

The candidate will understand the concepts of risk modeling and be able to evaluate and understand the

importance of risk models.

Learning Outcomes

The candidate will be able to:

a)

Demonstrate how each of the financial and non-financial risks faced by an entity can be amenable to

quantitative analysis including an explanation of the advantages and disadvantages of various

techniques such as Value at Risk (VaR), stochastic analysis, and scenario analysis.

b) Evaluate how risks are correlated, and give examples of risks that are positively correlated and risks

that are negatively correlated.

c)

Analyze and evaluate risk aggregation techniques, including use of correlation, integrated risk

distributions and copulas.

d) Apply and analyze scenario and stress testing in the risk measurement process.

e)

Evaluate the theory and applications of extreme value theory in the measuring and modeling of risk.

f)

Analyze the importance of tails of distributions, tail correlations, and low frequency / high severity

events.

g)

Analyze and evaluate model and parameter risk.

h) Construct approaches to modeling various risks and evaluate how an entity makes decisions about

techniques to model, measure and aggregate risks including but not limited to stochastic processes.

Resources

Financial Enterprise Risk Management, Sweeting

o

Ch. 12 Extreme Value Theory

Ch. 14 Quantifying Particular Risks

Ch. 15.5 Unquantifiable Risks

Value-at- Risk: The New Benchmark for Managing Financial Risk, Jorion, 3rd Edition

o

Ch. 5 Computing VaR, Sections 5.1-5.3 including appendices

Ch. 7 Portfolio Risk: Analytical Methods

Ch. 9 Forecasting Risk Correlations (only Section 9.3 Modelling Correlations, pp. 232-236)

Ch. 12 Monte Carlo Methods

ERM-101-12: Measurement and Modeling of Dependencies in Economic Capital, Ch. 4-5

ERM-103-12: Basel Committee - Developments in Modelling Risk Aggregation, pp. 72 -89

ERM-104-12: Study Note on Parameter Risk, Venter and Sahasrabuddhe

ERM-106-12: Economic Capital-Practical Considerations, Milliman

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

.ERM-117-14: AAA Practice Note: Insurance Enterprise Risk Management Practices (pp. 4- 26)

ERM-118-14: Model Validation Principles Applied to Risk and Capital Models in the Insurance Industry

ERM-119-14: Aggregation of Risks and Allocation of Capital (Sections 4-7)

ERM-120-14: IAA Note on Stress Testing and Scenario Analysis (pp. 1-6 and 14-17)

ERM-124-15: Counterparty Credit Risk: The New Challenge for Global Financial Markets, Ch.2, Defining

Counterparty Credit Risk

ERM-125-15: Loss Models Further Topics, Klugman, Panjer and Wilmot, Ch. 10 Copula models

ERM-602-12: Investment Management for Insurers, Babbel and Fabozzi, Ch. 11, The Four Faces of an

Interest Model

Risk Appetite: Linkage with Strategic Planning Report

Modeling Tail Behavior with Extreme Value Theory, Risk Management, Sept 2009

SOA Monograph- A New Approach to Managing Operational Risk, Ch. 8

Summary of Variance of the CTE Estimator, Risk Management, Aug 2008

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

3. Topic: Risk Measures

Learning Objectives

The candidate will understand how the risks faced by an entity can be quantified and the use of metrics to

measure risk.

Learning Outcomes

The candidate will be able to:

a)

Apply and construct risk metrics to quantify major types of risk exposure such as market risk,

credit risk, liquidity risk, operational risk, regulatory risk, etc., and tolerances in the context of an

integrated risk management process.

b) Analyze and evaluate the properties of risk measures (e.g., Delta, volatility, duration, VaR, TVaR,

etc.) and their limitations.

c)

Analyze quantitative financial market data and insurance data (including asset prices, credit

spreads and defaults, interest rates, incidence, causes and losses) using modern statistical

methods. Construct measures from the data and contrast the methods with respect to scope,

coverage and application.

d) Analyze risks that are not easily quantifiable, such as operational and liquidity risks.

Resources

Financial Enterprise Risk Management, Sweeting

o

Ch. 9 Some Useful Statistics (Background only)

Ch. 15.5 Unquantifiable Risks

Value-at-Risk: The New Benchmark for Managing Financial Risk, Jorion, 3rd Edition

o

Ch. 5 Computing VaR, Sections 5.1-5.3 including

Ch. 7 Portfolio Risk: Analytical Methods

Ch. 9 Forecasting Risk and Correlations

Ch. 12 Monte Carlo Methods

Ch. 13 Liquidity Risk

Ch. 18 Credit Risk Management (excluding Appendices)

ERM-102-12: Value-at-Risk: Evolution, Deficiencies, and Alternatives

ERM-105-12: Coherent Measures of Risk An Exposition for the Lay Actuary, Meyers, Glenn

ERM-702-12: IAA Note on ERM for Capital and Solvency Purposes in the Insurance Industry, pp. 938

Summary of Variance of the CTE Estimator, Risk Management, Aug 2008

ASOP 23: Data Quality, pp. 1-8

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

4. Topic: Risk Management Tools and Techniques

Learning Objectives

The candidate will understand the approaches for managing risks and how an entity makes decisions about

appropriate techniques.

Learning Outcomes

The candidate will be able to:

a)

Demonstrate and analyze applicability of risk optimization techniques and the impact of an ERM

strategy on an organizations value. Analyze the risk and return trade-offs that result from changes in

the organizations risk profile.

b) Demonstrate means for transferring risk to a third party, and estimate the costs and benefits of doing

so.

c)

Demonstrate means for reducing risk without transferring it.

d) Demonstrate how derivatives, synthetic securities, and financial contracting may be used to reduce risk

or to assign it to the party most able to bear it.

e)

Develop an appropriate choice of a risk mitigation strategy for a given situation (e.g., reinsurance,

derivatives, financial contracting), which balances benefits with inherent costs, including exposure to

credit risk, basis risk, moral hazard and other risks.

f)

Analyze the practicalities of market risk hedging, including dynamic hedging.

g)

Demonstrate the use of tools and techniques for analyzing and managing credit and counterparty risk.

h) Analyze funding and portfolio management strategies to control equity and interest rate risk, including

key rate risks. Contrast the various risk measures and be able to apply these risk measures to various

entities. Explain the concepts of immunization including modern refinements and practical limitations.

i)

Analyze the application of Asset Liability Management and Liability Driven Investment principles to

Investment Policy and Asset Allocation.

j)

Demonstrate risk management strategies for other key risks (for example, operational, strategic, legal,

and insurance risks).

k)

Apply best practices in risk measurement, modeling and management of various financial and nonfinancial risks faced by an entity.

Resources

Financial Enterprise Risk Management, Sweeting

o

Ch. 16 Responses to Risk

Value-at- Risk: The New Benchmark for Managing Financial Risk, Jorion, 3rd Edition

o

Ch. 7 Portfolio Risk: Analytical Methods

Ch. 18 Credit Risk Management (excluding Appendices)

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

ERM-107-12: Strategic Risk Management Practice, Andersen and Schroder, 2010, Ch. 7: Strategic Risk

Analyses

ERM-110-12: Derivatives: Practice and Principles, Recommendations 9-24 & Section III

ERM-111-12: Key Rate Durations: Measures of Interest Rate Risks

ERM-112-12: Revisiting the Role of Insurance Company ALM within a Risk Management Framework

ERM-114-13: Introduction to Reinsurance, Rudolpho Wehrhahn (excluding all Annexes)

ERM-115-13: Creating an Understanding of Special Purpose Vehicles, PWC

ERM-117-14: AAA Practice Note: Insurance Enterprise Risk Management Practices (pp. 4-26)

ERM-122-14: Chapter 1 of Captives and the Management of Risk, Kate Westover

ERM-124-15: Counterparty Credit Risk: The New Challenge for Global Financial Markets, Ch.2, Defining

Counterparty Credit Risk

ERM-702-12: IAA Note on ERM for Capital and Solvency Purposes in the Insurance Industry, pp. 9-38

SOA 2012 Annual Meeting Session 53 Assumption Setting Best Practices, Towers Watson (Steiner

slides only)

SOA Monograph- A New Approach to Managing Operational Risk, Ch. 8

Risk Appetite: Linkage with Strategic Planning Report

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

5. Topic: Capital Management

Learning Objectives

The candidate will understand the concept of economic capital, risk measures in capital assessment and

techniques to allocate the cost of risks within business units.

Learning Outcomes

The candidate will be able to:

a)

Describe the concepts of measures of value and capital requirements (for example, EVA, embedded

value, economic capital, regulatory measures, and accounting measures) and demonstrate their uses in

the risk management and corporate decision-making processes.

b) Define the basic elements and explain the uses of economic capital. Explain the challenges and limits

of economic capital calculations and explain how economic capital may differ from external

requirements of rating agencies and regulators.

c)

Apply risk measures and demonstrate how to use them in capital assessment. Contrast regulatory,

accounting, statutory and economic capital.

d) Propose techniques for allocating /appropriating the cost of risks/capital/hedge strategy to business

units in order to gauge performance (risk adjusted performance measures).

e)

Demonstrate the ability to develop a capital model for a representative financial firm.

Resources

ERM-101-12: Measurement and Modelling of Dependencies in Economic Capital, Ch 3

ERM-106-12: Economic Capital Practical Considerations, Milliman

ERM-112-12: Revisiting the Role of Insurance Company ALM within a Risk Management Framework

ERM-119-14: Aggregation of risks and Allocation of capital (Sections 4-7)

ERM-123-14: S&P Enterprise Risk Management Criteria (Paragraphs 1-71, 86-88)

ERM-126-15: ORSA An International Requirement, Sections 3.1 and 4.1

ERM-501-12: Risk Based CapitalGeneral Overview

Risk Appetite: Linkage with Strategic Planning Report

SOA 2012 Annual Meeting Session 53 Assumption Setting Best Practices, Towers Watson (Steiner

slides only)

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

READING EXTENSIONS

The following are the resources for the six extensions. They apply risk management across the set of

learning objectives for this examination. Candidates are responsible only for the readings in the

extension for which they registered.

RETIREMENT BENEFITS

ERM-301-12: Pension Investing and Corporate Risk Management

ERM-304-12: Mind the Gap: Using Derivatives Overlays to Hedge Pension Duration

ERM-307-12: Pensions Risk in an ERM Context

ERM-309-13: Risk Assessment Framework for Federal Regulated Private Pension Plans, OSFI

ERM-311-13: Russell Investments: Strategies for Hedging Interest Rate Risk in a Cash Balance Plan

ERM-314-13: Financial Economics and Actuarial Practice

ERM-315-14: LDI in a Risk Factor Framework

ERM-316-14: How Corporate Pension Plans Impact Stock Prices

ERM-317-14: Allocating Shareholder Capital to Pension Plans

ERM-318-14: Longevity Hedging 101: A Framework for Longevity Basis Risk Analysis and Hedge

Effectiveness

ERM-319-14: The Tax Consequences of Long-Run Pension Policy

ERM-320-14: Retirement Risk Metrics for Evaluating Target Date Funds

ERM-321-14: LDI Evolution: Implementing Dynamic Asset Allocation Strategies that Respond to Changes

in Funded Status

ERM-322-14: Enterprise Risk Management: Theory and Practice

ERM-323-14: Level 1 LDI: Selecting an Appropriate Benchmark

ERM-324-14: Level 2 LDI: Three Key Implementation Considerations

ERM-325-14: The Credit Rating Impact of Pension De-Risking

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

INDIVIDUAL LIFE AND ANNUITIES

ERM-123-14: S&P Enterprise Risk Management Criteria (Paragraphs 72-73)

ERM-308-12: Integrated Risk Management, Doherty - Ch. 7: Why is Risk Costly for Firms

ERM-401-12: Mapping of Life Insurance Risks

ERM-402-12: Countering the Biggest Risk of All

ERM-405-14: Secondary Guarantee Universal Life - Practical Considerations, excluding sections 1, 2, and 7

ERM-406-14: Income Annuities Improve Portfolio Outcomes in Retirement (Executive Summary and

Sections I, II and IV only)

ERM-407-14: Equity Indexed Annuities: Downside Protection, But at What Cost?

ERM-408-14: The Captive Triangle: Where Life Insurers Reserve and Capital Requirements Disappear

(pp. 1-11)

ERM-409-14: A Brief Primer on Financial Reinsurance

ERM-410-14: Coinsurance and its Variants

How Fair Value Measurement Changes Risk Management Behavior in the Insurance Industry

A Comparative Analysis of US, Canadian and Solvency II Capital Adequacy Requirements in Life Insurance

10

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

GROUP AND HEALTH

Group Insurance, 6th Edition

o

Ch. 22, Risk Based Capital Formulas

Ch. 47, Enterprise Risk Management for Health Insurers

ERM-123-14: S&P Enterprise Risk Management Criteria (Paragraphs 72-73, 82-85)

ERM-502-12: Healthcare Reform's Minimum Medical Loss Ratios

ERM-503-12: Hedging with Derivatives in Traditional Insurance Products

ERM-509-13: PPACA MLR Regulations

ERM-511-13: PPACA 3Rs Programme Description

ERM-512-13: Economics and Financing, Getzen, Sections 5.4 & 5.5

ERM-513-13: Extending the Insurance ERM Criteria to the Health Insurance Sector

ERM-515-14: Health Insurance Market Reforms: Rate Restrictions

ERM-516-14: AAA Financial Reporting Implications Under the Affordable Care Act

ERM-517-15: The Cost of Waiting, Nov/Dec 2014 Contingencies

Enterprise Risk Management, Health Watch, January 2006, Health Section SOA

Risk & Mitigation for Health Insurance Companies

A Health Insurance Insolvency Case Study, Health Section News, No 38, 2000 , pp.1 & 20-25

11

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

INVESTMENT

Value-at- Risk: The New Benchmark for Managing Financial Risk, Jorion, 3rd Edition

o

Ch. 8, Multivariate Models

Ch. 11, VAR Mapping

Ch. 17, VAR and Risk Budgeting in Investment Management, excluding Sections 17.3 and 17.4

ERM-304-12: Mind the Gap: Using Derivative Overlays to Hedge Pension Duration

ERM-315-14: LDI in a Risk Factor Framework

ERM-318-14: Longevity Hedging 101: A Framework for Longevity Basis Risk Analysis and Hedge

Effectiveness

ERM-603-12: The Handbook of Fixed Income Securities, Fabozzi, 7th Edition, Ch. 47: Bond Immunization:

An Asset Liability Optimization Strategy

ERM-604-12: Impact of Skewness and Fat Tails on Asset Allocation Decision

ERM-605-12: Modern Investment Management, Litterman, Ch. 10: Strategic Asset Allocation in the

Presence of Uncertain Liabilities

ERM-606-12: Fixed Income Securities, Tuckman, 2nd Edition, Ch. 7: Key Rate and Bucket Exposures

ERM-609-15: A Constant Volatility Framework for Managing Tail Risk

12

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

GENERAL INSURANCE

ERM-123-14: S&P Enterprise Risk Management Criteria (Paragraphs 74-81)

ERM-705-12: P&C RAROC: A Catalyst for the Improved Capital Management in the Property and Casualty

Insurance Industry

ERM-706-13: Solvency II Reserving Risk and Risk Margins

ERM-707-13: Catastrophe Reinsurance Pricing

ERM-708-13: Natural Catastrophe Loss Modeling

ERM-709-14: Managing Interest Rate Risk: ALM, Franchise Value, and Strategy

ERM-710-14: Allocation of Capital in the Insurance Industry

Were Going to Need a Bigger Boat, CAS, Part 1 pp. 15-16, Aug 2010 (Ingram and Underwood)

Riding the Waves of the Cycle, CAS, Part 2, pp. 2627, Nov 2010 (Ingram and Underwood)

Evolution of Risk Management by Robert Wolf Part 2: The Birth, Death and Resurrection of Dynamic

Financial Analysis

ERM for Strategic Management - Status Report, Venter

Human Dynamics of Insurance Cycles and Implications for Insurers

Regulatory Capital Standards for Property and Casualty Insurers under US, Canadian and Proposed

Solvency II (Standard) Formulas

Research paper on Quantification of Variability in P&C Liabilities, CIA

13

ERM Enterprise Risk Management Exam

Fall 2015/Spring 2016

GENERAL CORPORATE ERM

ERM-103-12: Basel Committee Developments in Modelling Risk Aggregation, Sections 3-8

ERM-123-14: S&P Enterprise Risk Management Criteria (Paragraphs 72-85)

ERM-402-12: Countering the Biggest Risk of All

ERM-806-14: IAIS Global Systemically Important Insurers: Initial Assessment Methodology (pp. 6-9)

ERM-807-14: FSB Principles for An Effective Risk Appetite Framework

ERM-808-14: Federal Sentencing Guidelines, Chapter 8, Section 2.1

ERM-809-14: Increasing the Intensity and Effectiveness of SupervisionFSB Guidance on Supervisory

Interaction with Financial Institutions on Risk Culture

ERM-811-15: Agency Theory and Asymmetric Information

ERM-812-15: Valuation for Mergers and Acquisitions, Ch. 1

ERM-813-15:Financial Structure, Capital Structure (Capitalization), and Leverage Explained

ERM-814-15: Cognitive Bias and their Implications on the Financial Market

ERM for Strategic Management - Status Report, Venter

Incentive Compensation/Risk Management Integration Incentive Alignment and Risk Mitigation Beal

SOA Monograph A New Approach for Managing Operational Risk, Sections 5-7

Regulatory Risk and North American Insurance Organizations, Sections 6.1-6.14 and 7

14

S-ar putea să vă placă și

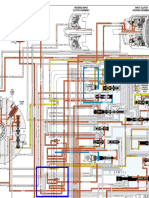

- 700r4 DiagramDocument1 pagină700r4 Diagramgman4dx266100% (1)

- Implementing Enterprise Risk Management: From Methods to ApplicationsDe la EverandImplementing Enterprise Risk Management: From Methods to ApplicationsÎncă nu există evaluări

- Problem 11.3Document1 paginăProblem 11.3SamerÎncă nu există evaluări

- 5-Niif-9-Instrumentos-Financieros Libro Rojo PDFDocument88 pagini5-Niif-9-Instrumentos-Financieros Libro Rojo PDFmlarrotasÎncă nu există evaluări

- Multi-Asset Risk Modeling: Techniques for a Global Economy in an Electronic and Algorithmic Trading EraDe la EverandMulti-Asset Risk Modeling: Techniques for a Global Economy in an Electronic and Algorithmic Trading EraEvaluare: 4.5 din 5 stele4.5/5 (2)

- Practical Project Risk Management: The ATOM MethodologyDe la EverandPractical Project Risk Management: The ATOM MethodologyÎncă nu există evaluări

- Hanson CaseDocument11 paginiHanson Casegharelu10Încă nu există evaluări

- ERM - Enterprise Risk Management Exam: Fall 2023 and Spring 2024Document12 paginiERM - Enterprise Risk Management Exam: Fall 2023 and Spring 2024SahilÎncă nu există evaluări

- ST9 Enterprise Risk Management PDFDocument6 paginiST9 Enterprise Risk Management PDFVignesh SrinivasanÎncă nu există evaluări

- FRM2023 Study GuideDocument30 paginiFRM2023 Study GuideAkhilesh kumar verma50% (2)

- Synopsis of End-Term ProjectDocument5 paginiSynopsis of End-Term ProjectAmit BatraÎncă nu există evaluări

- Tips For Passing The Risk Management ProfessionalDocument3 paginiTips For Passing The Risk Management ProfessionalMuhammadKhan100% (2)

- The Practice of Lending: A Guide to Credit Analysis and Credit RiskDe la EverandThe Practice of Lending: A Guide to Credit Analysis and Credit RiskÎncă nu există evaluări

- FRM Assignment 2Document18 paginiFRM Assignment 2SheiryÎncă nu există evaluări

- 1 Risks-07-00029-V2Document22 pagini1 Risks-07-00029-V2Shweta TewariÎncă nu există evaluări

- Model RiskDocument40 paginiModel RiskAlexandru NechiforÎncă nu există evaluări

- Enterprise Risk Menterprise-Risk-Management-PaperDocument12 paginiEnterprise Risk Menterprise-Risk-Management-Papertome44Încă nu există evaluări

- FRM Exam Preparation Handbook 2012 PDFDocument15 paginiFRM Exam Preparation Handbook 2012 PDFDennis LoÎncă nu există evaluări

- University of Wah Wah Engineering College Assignment # 03Document5 paginiUniversity of Wah Wah Engineering College Assignment # 03HAMZA KHANÎncă nu există evaluări

- Study Guide-FRM24Document30 paginiStudy Guide-FRM24motiquotes4Încă nu există evaluări

- 1554207916unit 6 Risk Assessment, Evaluation and ManagementDocument20 pagini1554207916unit 6 Risk Assessment, Evaluation and ManagementWongÎncă nu există evaluări

- CH 1 Foundations of Risk ManagementDocument162 paginiCH 1 Foundations of Risk ManagementMohd RizzuÎncă nu există evaluări

- The Possibility of Evolution From Non-Strategic RiDocument7 paginiThe Possibility of Evolution From Non-Strategic RiIsabella Velasquez RodriguezÎncă nu există evaluări

- Research Paper On Risk Management PDFDocument5 paginiResearch Paper On Risk Management PDFc9hpjcb3100% (1)

- CP1 - Syllabus - Final ProofDocument9 paginiCP1 - Syllabus - Final ProofMoon MoonÎncă nu există evaluări

- Value at Risk: Implementing A Risk Measurement Standard: Financial Institutions CenterDocument34 paginiValue at Risk: Implementing A Risk Measurement Standard: Financial Institutions CenterhamnaashrafÎncă nu există evaluări

- FIN 562 Class 1 Slides Winter.2017Document56 paginiFIN 562 Class 1 Slides Winter.2017Kethana SamineniÎncă nu există evaluări

- FRM - Syllabus PDFDocument64 paginiFRM - Syllabus PDFAnonymous x5odvnNVÎncă nu există evaluări

- Chap 5Document33 paginiChap 5vishalsingh9669Încă nu există evaluări

- Research Paper Risk ManagementDocument4 paginiResearch Paper Risk Managementafmcbmoag100% (1)

- Bankruptcy Risk ThesisDocument4 paginiBankruptcy Risk Thesisjessicasimmssterlingheights100% (2)

- Fin Opmgt 579 Erm Aut20Document12 paginiFin Opmgt 579 Erm Aut20Carl Joshua RioÎncă nu există evaluări

- Research Paper Financial Risk ManagementDocument8 paginiResearch Paper Financial Risk Managementwpuzxcbkf100% (1)

- A Risk Management StandardDocument17 paginiA Risk Management StandardRishabh JainÎncă nu există evaluări

- Dissertation Risk AssessmentDocument8 paginiDissertation Risk AssessmentHelpWritingPapersUK100% (1)

- Research ProposalDocument23 paginiResearch Proposalnidamah100% (2)

- Project Risk Management HanbookDocument8 paginiProject Risk Management HanbookSamuel MarioghaeÎncă nu există evaluări

- Business Risk CalculationDocument5 paginiBusiness Risk CalculationKaylle Mae OcioÎncă nu există evaluări

- Rsk4801 Janfeb 2015 SolutionsDocument8 paginiRsk4801 Janfeb 2015 SolutionsNobeso2Încă nu există evaluări

- Eindhoven University of Technology: Soetekouw, R.C.MDocument79 paginiEindhoven University of Technology: Soetekouw, R.C.MLuay SamhouriÎncă nu există evaluări

- Hermela Risk AssignmentDocument9 paginiHermela Risk AssignmentHermela tedlaÎncă nu există evaluări

- Thesis Risk Management PDFDocument5 paginiThesis Risk Management PDFafkneafpz100% (2)

- Model Risk TieringDocument32 paginiModel Risk TieringGabiÎncă nu există evaluări

- Risk ManagementDocument14 paginiRisk ManagementMateta Elie100% (2)

- 2017 FRM Study GuideDocument24 pagini2017 FRM Study GuideDuc AnhÎncă nu există evaluări

- MIE1622H OutlineDocument3 paginiMIE1622H OutlineGavrochÎncă nu există evaluări

- Enterprise Risk Management Coping With Model RiskDocument12 paginiEnterprise Risk Management Coping With Model RiskLjiljana SorakÎncă nu există evaluări

- FRM Part 1 Exam StructureDocument16 paginiFRM Part 1 Exam StructurestefanhenryÎncă nu există evaluări

- FM 49Document2 paginiFM 49Ashutosh RanjanÎncă nu există evaluări

- Project Risk Management PHD ThesisDocument4 paginiProject Risk Management PHD Thesisfjdqvrcy100% (2)

- Risk Rank Filter Training GuideDocument9 paginiRisk Rank Filter Training GuideravellababuÎncă nu există evaluări

- Fixed Income in ExcelDocument1 paginăFixed Income in ExcelCRMD JodhpurÎncă nu există evaluări

- Risk Management ProcessDocument11 paginiRisk Management ProcessDebby Taylan-HidalgoÎncă nu există evaluări

- Ahmed El Antary - PMP Part 11 - Risk 5th Ed - GeneralDocument33 paginiAhmed El Antary - PMP Part 11 - Risk 5th Ed - GeneralAhmed Adel AbdellatifÎncă nu există evaluări

- 360 Degree Risk ManagementDocument7 pagini360 Degree Risk Managementmaconny20Încă nu există evaluări

- FRM 2018 Lobs PDFDocument52 paginiFRM 2018 Lobs PDFAnonymous gtP37gHOÎncă nu există evaluări

- 2009.2010 ConstructionDocument2 pagini2009.2010 ConstructionSyazwan MohdÎncă nu există evaluări

- CISA Exam-Testing Concept-Knowledge of Risk AssessmentDe la EverandCISA Exam-Testing Concept-Knowledge of Risk AssessmentEvaluare: 2.5 din 5 stele2.5/5 (4)

- Mastering Financial Risk Management : Strategies for SuccessDe la EverandMastering Financial Risk Management : Strategies for SuccessÎncă nu există evaluări

- Engineering Economics & Accountancy :Managerial EconomicsDe la EverandEngineering Economics & Accountancy :Managerial EconomicsÎncă nu există evaluări

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part I - Finance TheoryDe la EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part I - Finance TheoryÎncă nu există evaluări

- FX Stiff Debug Log FileDocument8 paginiFX Stiff Debug Log Filegman4dx266Încă nu există evaluări

- Library Data DCMI 22february2012 Regform PDFDocument1 paginăLibrary Data DCMI 22february2012 Regform PDFgman4dx266Încă nu există evaluări

- Actuator Feed Limit: Pressure Control Solenoid ValveDocument1 paginăActuator Feed Limit: Pressure Control Solenoid Valvegman4dx266Încă nu există evaluări

- 77918S-09K-IN Sonnax Transmission InfoDocument1 pagină77918S-09K-IN Sonnax Transmission Infogman4dx266Încă nu există evaluări

- SmartProbe (R) Air Data SystemsDocument4 paginiSmartProbe (R) Air Data Systemsgman4dx266Încă nu există evaluări

- Air Data Computers: TechnologyDocument4 paginiAir Data Computers: TechnologyখালিদহাসানÎncă nu există evaluări

- Air DataDocument12 paginiAir Datagman4dx266Încă nu există evaluări

- Library Data DCMI 22february2012 Regform PDFDocument1 paginăLibrary Data DCMI 22february2012 Regform PDFgman4dx266Încă nu există evaluări

- TDA8560QDocument17 paginiTDA8560QJo BuÎncă nu există evaluări

- AD8307Document25 paginiAD8307shubhamformeÎncă nu există evaluări

- TriacDocument6 paginiTriacgman4dx266Încă nu există evaluări

- Section 1: Application Information: Business ConfidentialDocument12 paginiSection 1: Application Information: Business ConfidentialJyotiÎncă nu există evaluări

- Mult Comp: Features & Mechanical DataDocument2 paginiMult Comp: Features & Mechanical Datagman4dx266Încă nu există evaluări

- Max220 Max249 PDFDocument39 paginiMax220 Max249 PDFRahmad MisinÎncă nu există evaluări

- Syllabus Checklist: College of Arts & SciencesDocument3 paginiSyllabus Checklist: College of Arts & Sciencesgman4dx266Încă nu există evaluări

- Syllabus PDFDocument9 paginiSyllabus PDFevsgoud_goudÎncă nu există evaluări

- CPH533Document12 paginiCPH533gman4dx266Încă nu există evaluări

- IDocument3 paginiIgman4dx266Încă nu există evaluări

- 101 H Syll sp13Document10 pagini101 H Syll sp13gman4dx266Încă nu există evaluări

- Course Web Page: HTTP://WWW - Chem.umb - Edu/chemistry/orgchemDocument5 paginiCourse Web Page: HTTP://WWW - Chem.umb - Edu/chemistry/orgchemgman4dx266Încă nu există evaluări

- MA 15300 Fall 2015 Syllabus: Math - Purdue.edu/ma153 Loncapa - Purdue.eduDocument4 paginiMA 15300 Fall 2015 Syllabus: Math - Purdue.edu/ma153 Loncapa - Purdue.edugman4dx266Încă nu există evaluări

- IGCSE 128444-2015-SyllabusDocument38 paginiIGCSE 128444-2015-SyllabusChrysanthe GlikiÎncă nu există evaluări

- Example LatexDocument10 paginiExample Latexdesfe344Încă nu există evaluări

- SyllabusDocument12 paginiSyllabuscromlach7973Încă nu există evaluări

- Instructors:: EDUC 561 Introduction To Higher Education Fall 2014 Fridays 1-4pm Room SEB 2229Document12 paginiInstructors:: EDUC 561 Introduction To Higher Education Fall 2014 Fridays 1-4pm Room SEB 2229gman4dx266Încă nu există evaluări

- Phy2054 Syllabus - Physics 2 Fall 2015: There Are Three Phy2054 Websites That You Will Need To UseDocument5 paginiPhy2054 Syllabus - Physics 2 Fall 2015: There Are Three Phy2054 Websites That You Will Need To Usegman4dx266Încă nu există evaluări

- Online Course Syllabus: STATS 8: Introduction To Biological StatisticsDocument6 paginiOnline Course Syllabus: STATS 8: Introduction To Biological Statisticsgman4dx266Încă nu există evaluări

- To DO SaturdayDocument1 paginăTo DO Saturdaygman4dx266Încă nu există evaluări

- Advanced Financial Accounting and Corporate Reporting - Semester-5Document9 paginiAdvanced Financial Accounting and Corporate Reporting - Semester-5furqan haider shahÎncă nu există evaluări

- Depreciation ExerciseDocument11 paginiDepreciation Exerciserikita_17100% (2)

- Loan, Pledge, Mortgage & FRIA MCQs AcadYr 18-19 2nd SemDocument10 paginiLoan, Pledge, Mortgage & FRIA MCQs AcadYr 18-19 2nd SemMariela LiganadÎncă nu există evaluări

- BMAN23000A Exam Paper ACTUALDocument6 paginiBMAN23000A Exam Paper ACTUALMunkbileg MunkhtsengelÎncă nu există evaluări

- Tech Mahindra: Financial Analysis To Determine Investment Decision by Group C10Document9 paginiTech Mahindra: Financial Analysis To Determine Investment Decision by Group C10Sucharita SahaÎncă nu există evaluări

- CRMDocument20 paginiCRMAnkush GuptaÎncă nu există evaluări

- Maf 630 Chapter 1Document3 paginiMaf 630 Chapter 1Pablo EkskobaÎncă nu există evaluări

- CH 6Document6 paginiCH 6rgkusumbaÎncă nu există evaluări

- Questions - Business Valuation, Capital Structure and Risk ManagementDocument5 paginiQuestions - Business Valuation, Capital Structure and Risk Managementpercy mapetereÎncă nu există evaluări

- Sip PDFDocument81 paginiSip PDFMayuri TetwarÎncă nu există evaluări

- Explorer Case Prices by 3D Flight Cases LTDDocument1 paginăExplorer Case Prices by 3D Flight Cases LTD3D_FlightcaseÎncă nu există evaluări

- Chapter 2 MONEY MARKETDocument14 paginiChapter 2 MONEY MARKETNur Dina AbsbÎncă nu există evaluări

- Penilaian Saham: Ari Fahimatussyam PN, S.E., M.AkDocument23 paginiPenilaian Saham: Ari Fahimatussyam PN, S.E., M.AkAynie AynieÎncă nu există evaluări

- PT Option Trader PerformanceDocument45 paginiPT Option Trader PerformanceAdigoppula NarsaiahÎncă nu există evaluări

- Speech 985Document44 paginiSpeech 985TBP_Think_TankÎncă nu există evaluări

- Government Securities MarketDocument35 paginiGovernment Securities MarketPriyanka DargadÎncă nu există evaluări

- Harmonic Trader IntroDocument2 paginiHarmonic Trader IntroBiantoroKunartoÎncă nu există evaluări

- Q4fy12 Earningsslides Final PDFDocument38 paginiQ4fy12 Earningsslides Final PDFmahony0Încă nu există evaluări

- EFCh 01 PPEd 2Document28 paginiEFCh 01 PPEd 2Naheed AkhtarÎncă nu există evaluări

- Case 45 Jetblue ValuationDocument12 paginiCase 45 Jetblue Valuationshawnybiha100% (1)

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 paginiFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderÎncă nu există evaluări

- Interest-Bearing Notes ReceivableDocument2 paginiInterest-Bearing Notes Receivablewarsidi100% (1)

- Spotless ProspectusDocument232 paginiSpotless Prospectusaovchar14Încă nu există evaluări

- Jade Group: Company ProfileDocument18 paginiJade Group: Company Profilesajd1Încă nu există evaluări

- Monopoly Tropical Tycoon DVD Game InstructionsDocument8 paginiMonopoly Tropical Tycoon DVD Game InstructionsSteveMateÎncă nu există evaluări

- The Commodity Investor S 102885050Document33 paginiThe Commodity Investor S 102885050Parin Chawda100% (1)

- Midterm Exam in Capital Market 1Document4 paginiMidterm Exam in Capital Market 1Joel PangisbanÎncă nu există evaluări