Documente Academic

Documente Profesional

Documente Cultură

FDHDFGSGJHDFHDSHJD

Încărcat de

babylovelylovelyTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

FDHDFGSGJHDFHDSHJD

Încărcat de

babylovelylovelyDrepturi de autor:

Formate disponibile

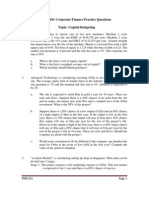

Corporate Finance

Tutorial 1 Questions

Corporate Finance

Tutorial 1: Time Value of Money and Project Appraisal

Questions

Exercises on Time Value of Money

1.

2.

A Japanese company is considering investing in Singapore. It intends to make a

bid to the Singapore government to participate in the development of a leisure

resort in Jurong West, the profits of which will be realised at the end of 5 years.

The resort is expected to produce S$5,000,000 in cash to the Japanese company at

that time. Other than the bid at the outset, no other cash flows will occur, as the

Singapore government will reimburse the Japanese company for all cost. If the

Japanese company requires an annual return of 20%, what is the maximum bid it

should make for the participation right if interest is compounded

(a)

annually?

(b)

semi-annually?

(c)

quarterly?

You are considering making an offer to buy some land for $25,000. Your offer

will be to pay $5,000 down and for the seller to carry a contract for the remaining

$20,000. You would like to pay off the contract over 6 years at an interest rate of

12% per year. For the first year you wish to pay interest only each month. For the

remaining 5 years, you are willing to pay off the contract in equal monthly

instalments. What will be your monthly payment for years 2 through 6 if the seller

agrees to your terms?

Impact Consultancy & Training Pte Ltd

Corporate Finance

3.

Tutorial 1 Questions

A financial manager has been presented with two proposals for automating an

assembly process. Plan X requires an immediate investment of $75,000 in assets

which will have a salvage value of $15,000 at the end of its 15 years lifespan. It

further requires an additional investment of $25,000 at the end of the third year.

Plan Y will require an initial investment of only $30,000 and two additional

modifications. The first modification will be done at the end of the fifth year at a

cost of $40,000 and the second at the end of the tenth year at cost of another

$40,000. It would have a salvage value of $30,000 at the end of its 15 years

lifespan.

The annual out-of-pocket operating disbursements for the two alternatives would

be as follows:

Year

13

4 15

Plan X

$7,500 per year

$9,000 per year

Year

15

6

7 15

Plan Y

$4,500 per year

$6,000 per year

$9,500 per year

The companys cost of capital is 10% p.a.

Which plan would you recommend the firm to adopt?

Exercises on Net Present Value

Assume an interest rate of 5% p.a. Compute the NPV of each of the following projects,

and state whether each project should be accepted or not.

1.

Project A has an immediate cost of $5,000, generates $1,000 for each of the next

six years and zero thereafter.

2.

Project B costs 1,000 immediately, generates cash flows of 600 in year 1, 300

in year 2 and 300 in year 3.

3.

Project C costs 10,000 and generates 6,000 in year 1. Over the following years,

the cash flows decline by 2,000 each year, until the cash flow reaches zero.

4.

Project D costs 1,500 immediately. In Year 1 and Year 2 it generates 1,000. In

Year 2 there is a further cost of 2,000. In Year 3, 4 and 5 the project generates

revenues of 1,500 per annum.

Impact Consultancy & Training Pte Ltd

Corporate Finance

Tutorial 1 Questions

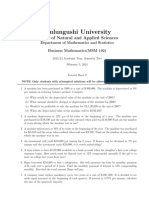

Sample Examination Questions on NPV

1.

The Toyundai Motor Company has the opportunity to invest in new production

line equipment, which would have a working lifetime of 10 years. The new

equipment would generate the following increases in Toyundais net cash flows.

In the first year of usage the new plant would decrease costs by $200,000. For the

following six years the cost saving would fall at a rate of five per cent per annum.

In the remaining years of the equipments lifetime, the annual cost saving would

be $140,000. Assuming that the cost of the equipment is $1,000,000 and that

Toyundais cost of capital is 10 per cent, calculate the NPV of the project. Should

Toyundai take on the investment?

(15%)

2.

Describe two methods of project evaluation other than NPV. Discuss the

weaknesses of these methods when compared to NPV.

(10%)

Impact Consultancy & Training Pte Ltd

Corporate Finance

Tutorial 1 Questions

Lee Ltd

Lee Ltd is considering changing its plant and has spent $7,000 on a work-study project

covering the proposed changes. The study revealed:

(1)

Existing plant has an expected life of 5 years at which date it would have a zero

scrap value. It could be sold for $40,000 in 2 years time.

(2)

At present the plant produces 2,000 units per annum, each yielding a contribution

of $10.

(3)

New plant would take five years to build and would cost $200,000 payable in 5

equal annual installments. This would produce 4,000 units per annum after the

existing plant's closure and still contribute $10 per unit. The life of the plant

would be 20 years, at the end of which time it would have a zero scrap value.

(4)

Fastbuild plc. has offered to construct the plant in 2 years but at a cost of

$280,000 payable in two annual instalments. Performance would not be affected

by the speed of construction.

Assume that

i)

Cost of capital is 7%

ii)

If the plant were not replaced, the company could invest at the cost of the capital.

iii)

That manufacture of the product according to the company's strategic plans will

cease at the end of either the existing or the new plant's life.

iv)

All receipts and payments take place on the last day of each year.

Required:

a)

A report indicating whether construction of the new plant is worthwhile, and if so,

over 2 or 5 years.

(12 marks)

b)

Discuss whether you think the assumptions on which your calculations are based

are reasonable and whether there are any other factors which might affect the

decision.

(9 marks)

c)

Assuming a 10% error in each of the predictions identify the most sensitive

variable influencing your decision in a) with your evidence.

(4 marks)

Impact Consultancy & Training Pte Ltd

Corporate Finance

Tutorial 1 Questions

FE 2007 Zone B Question B6 (Part a)

Describe the NPV-rule, the internal rate of return criterion, and the payback rule

for investment. What are the relative advantages and disadvantages of these

rules?

(8 marks)

Impact Consultancy & Training Pte Ltd

Corporate Finance

Tutorial 1 Questions

FE2009 Zone B Question A3(a)

Cranberry Plc is considering to purchase a new machine. It has

identified two possible models which have the following initial costs and

expected cash savings per year:

C0

Model A - 200,000

Model B - 200,000

C1

90,000

190,000

C2

70,000

55,000

C3

110,000

Model A has a useful life of 3 years while model B can last for 2 years. Neither of

these models have any residual value at the end of their useful economic lives.

Cranberry plc has been discounting similar investments at 10% per annum. It

intends to replace the chosen model each time when it reaches the end of its

useful life. If the above cash flows to these two models will be unchanged in the

foreseeable future, which model should the company choose to make economic

sense? Explain clearly the reasoning behind and any reservation for your

calculations.

(10 marks)

Impact Consultancy & Training Pte Ltd

Corporate Finance

Tutorial 1 Questions

FE2010 Zone B Question A3

Solar Products Plc has just developed a new product to be called RTC3. The

total development cost amounts to 480,000. The company is now considering

whether to put it into production. The following information is available.

Production of RTC3 will require the purchase of new machinery at a cost of

1,200,000 payable immediately. This machinery is specific to the production

of RTC3 and will be obsolete and valueless when that production ceases. The

machinery has a production life of 4 years and a normal production capacity of

30,000 units per annum. The production capacity can be increased to 40,000

units per year for a one-off modification cost of 50,000. This modification

expense is payable at the beginning of the year in which the company wants to

increase the production capacity. Once the modification is made, the

production capacity will stay at 40,000 per year. If the demand exceeds

capacity, the company will only be able to sell the products up to the

maximum capacity at the price stated below.

The companys policy is to depreciate this type of machinery using the

straight-line method.

Production costs per unit of RTC3 are estimated as follows:

Materials

Labour

Overheads

8

6

20

Overheads include the allocated depreciation charge on the new machinery,

otherwise they are all related to the production of RTC3.

The selling price of RTC3 will be 60 per unit. Demand is expected to fluctuate

in accordance with the market condition. A market survey, which was

commissioned prior to the production, has the following findings:

Market

condition

Good

Average

Bad

Probability

%

30

50

20

Year 1

units

30,000

25,000

18,000

Year 2

units

32,000

26,000

17,000

Year 3

units

35,000

27,000

15,000

Year 4

units

40,000

28,000

15,000

The cost of the market survey has not been paid and it amounts to 5,000. The

realisation of the market condition in each year is independent from each

other.

Impact Consultancy & Training Pte Ltd

Corporate Finance

Tutorial 1 Questions

The companys effective tax rate is 30% and the capital allowances are at 25%

of the written down value of the machinery at the beginning of each year. Any

unrelieved capital allowance will be given in full in the year of disposal. Tax

is payable in the same year to which it is related. To keep things simple

assume the net cash flow per year is treated as the taxable profit before capital

allowance.

The after-tax cost of capital for the company is 15%.

(a)

Calculate the after-tax net present value of this project.

(b)

Explain why net present value is a more preferable technique for capital

budgeting than other methods.

(8 marks)

Impact Consultancy & Training Pte Ltd

(17 marks)

S-ar putea să vă placă și

- Required:: Project A Would CostDocument10 paginiRequired:: Project A Would CostSad CharlieÎncă nu există evaluări

- Assignment For CB TechniquesDocument2 paginiAssignment For CB TechniquesRahul TirmaleÎncă nu există evaluări

- Time Value and Capital BudgetingDocument9 paginiTime Value and Capital BudgetingaskdgasÎncă nu există evaluări

- Tutorial Problems - Capital BudgetingDocument6 paginiTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- 05 Exercises On Capital BudgetingDocument4 pagini05 Exercises On Capital BudgetingAnshuman AggarwalÎncă nu există evaluări

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pagini3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanÎncă nu există evaluări

- Ex.C.BudgetDocument3 paginiEx.C.BudgetGeethika NayanaprabhaÎncă nu există evaluări

- Corporate Valuation NumericalsDocument47 paginiCorporate Valuation Numericalspasler9929Încă nu există evaluări

- Ps Capital Budgeting PDFDocument7 paginiPs Capital Budgeting PDFcloud9glider2022Încă nu există evaluări

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocument3 paginiFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohÎncă nu există evaluări

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 paginiCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiÎncă nu există evaluări

- Activity - Capital Investment AnalysisDocument5 paginiActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTEÎncă nu există evaluări

- NPV & Capital Budgeting QuestionsDocument8 paginiNPV & Capital Budgeting QuestionsAnastasiaÎncă nu există evaluări

- Bài Tập Buổi 4 (Updated)Document4 paginiBài Tập Buổi 4 (Updated)Minh NguyenÎncă nu există evaluări

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 paginiFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaÎncă nu există evaluări

- AFM Capital Budgeting AssignmentDocument5 paginiAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 paginiFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezÎncă nu există evaluări

- Fin3n Cap Budgeting Quiz 1Document1 paginăFin3n Cap Budgeting Quiz 1Kirsten Marie EximÎncă nu există evaluări

- F9FM SQB Qs - d07Document40 paginiF9FM SQB Qs - d07Erclan50% (2)

- MN20501 Lecture 9 Review ExerciseDocument3 paginiMN20501 Lecture 9 Review Exercisesamvrab1919Încă nu există evaluări

- SFM Practice QuestionsDocument13 paginiSFM Practice QuestionsAmmar Ahsan0% (1)

- HW Week 5 Fin/571Document5 paginiHW Week 5 Fin/571trelvisd0% (1)

- S 12Document15 paginiS 12AbhishekKumar0% (3)

- Engineering Economics and Finacial Management (HUM 3051)Document5 paginiEngineering Economics and Finacial Management (HUM 3051)uday KiranÎncă nu există evaluări

- Tutorial Capital BudgetingDocument4 paginiTutorial Capital Budgetingmi luÎncă nu există evaluări

- Questions - Investment AppraisalDocument2 paginiQuestions - Investment Appraisalpercy mapetere100% (1)

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 paginiCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavÎncă nu există evaluări

- F 9Document32 paginiF 9billyryan1100% (2)

- NPV Practice CompleteDocument5 paginiNPV Practice CompleteShakeel AslamÎncă nu există evaluări

- Question of Capital BudgetingDocument7 paginiQuestion of Capital Budgeting29_ramesh170100% (2)

- Investment Decisions Problems 2Document5 paginiInvestment Decisions Problems 2MussaÎncă nu există evaluări

- Business Finance Sample Examination PaperDocument4 paginiBusiness Finance Sample Examination PaperYeshey ChodenÎncă nu există evaluări

- Project Financial Appraisal - NumericalsDocument5 paginiProject Financial Appraisal - NumericalsAbhishek KarekarÎncă nu există evaluări

- Investment Appraisal-Fm AccaDocument11 paginiInvestment Appraisal-Fm AccaCorrinaÎncă nu există evaluări

- Economics Tutorial-Sheet-2Document3 paginiEconomics Tutorial-Sheet-2Saburo SahibÎncă nu există evaluări

- Practice-4Document21 paginiPractice-4Akash KumarÎncă nu există evaluări

- Workshop Lecture 9 QsDocument4 paginiWorkshop Lecture 9 QsabhirejanilÎncă nu există evaluări

- Engineering EconomyDocument16 paginiEngineering EconomyHazel Marie Ignacio PeraltaÎncă nu există evaluări

- Capital Budgeting ProblemsDocument4 paginiCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 paginiCorporate Finance I: Home Assignment 2 Due by January 30RahulÎncă nu există evaluări

- Engineering Economy Problem1Document11 paginiEngineering Economy Problem1frankRACEÎncă nu există evaluări

- Capital BudgetingDocument6 paginiCapital Budgetingkaf_scitÎncă nu există evaluări

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 paginiUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaÎncă nu există evaluări

- Tutorial QuestionsDocument19 paginiTutorial QuestionsTan Ngoc TranÎncă nu există evaluări

- Assigment 6 - Managerial Finance Capital BudgetingDocument5 paginiAssigment 6 - Managerial Finance Capital BudgetingNasir ShaheenÎncă nu există evaluări

- Bf208 Assignment 1Document3 paginiBf208 Assignment 1Emmanuel NeshiriÎncă nu există evaluări

- PracticeQuestions-Qbank-Part I-FM-IIDocument7 paginiPracticeQuestions-Qbank-Part I-FM-IISonakshi BhatiaÎncă nu există evaluări

- CapbudgetingproblemsDocument3 paginiCapbudgetingproblemsVishal PaithankarÎncă nu există evaluări

- Tutorial Sheet 2Document2 paginiTutorial Sheet 2siamesamuel229Încă nu există evaluări

- Section A - QuestionsDocument27 paginiSection A - Questionsnek_akhtar87250% (1)

- Skkc3343 Assignment 1-2019Document2 paginiSkkc3343 Assignment 1-2019Yi Wen Yap100% (1)

- Time Value of Money SumsDocument13 paginiTime Value of Money SumsrahulÎncă nu există evaluări

- Investment Appraisal Review QuestionsDocument5 paginiInvestment Appraisal Review QuestionsGadafi FuadÎncă nu există evaluări

- Cap BudgDocument5 paginiCap BudgShahrukhÎncă nu există evaluări

- CF - PWS - 5Document3 paginiCF - PWS - 5cyclo tronÎncă nu există evaluări

- Group Assignment Fm2 A112Document15 paginiGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Ie342 SS4Document8 paginiIe342 SS4slnyzclrÎncă nu există evaluări

- Question One Acca 2014 June QN 1Document4 paginiQuestion One Acca 2014 June QN 1Joseph Timasi ChachaÎncă nu există evaluări

- Heriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial QuestionsDocument7 paginiHeriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial QuestionsAmy FitzpatrickÎncă nu există evaluări

- Singapore Standard On AuditingDocument7 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument19 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- This Paper Is Not To Be Removed From The Examination HallsDocument3 paginiThis Paper Is Not To Be Removed From The Examination HallsbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument19 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument14 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument18 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument28 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On Auditing: Conforming AmendmentsDocument9 paginiSingapore Standard On Auditing: Conforming AmendmentsbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument14 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument29 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument16 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument14 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Regulatory Framework - Seminar SolutionsDocument3 paginiRegulatory Framework - Seminar SolutionsbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument12 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- FGDFGDFDFSDFMHJFDKHDFDocument10 paginiFGDFGDFDFSDFMHJFDKHDFbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument10 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument11 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument21 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- Singapore Standard On AuditingDocument20 paginiSingapore Standard On AuditingbabylovelylovelyÎncă nu există evaluări

- HFHGFHGHDGSFDHDGGFGDocument31 paginiHFHGFHGHDGSFDHDGGFGbabylovelylovelyÎncă nu există evaluări

- HFHGFHGHDGSFDHDGGFGDocument31 paginiHFHGFHGHDGSFDHDGGFGbabylovelylovelyÎncă nu există evaluări

- HFHGFHGHDGSFDHDGGFGDocument17 paginiHFHGFHGHDGSFDHDGGFGbabylovelylovelyÎncă nu există evaluări

- Consequences of Accounting Harmonization: IFRS Adoption and Cross-Border ContagionDocument48 paginiConsequences of Accounting Harmonization: IFRS Adoption and Cross-Border ContagionbabylovelylovelyÎncă nu există evaluări

- Oligopoly: Characteristics Revenue CurvesDocument1 paginăOligopoly: Characteristics Revenue CurvesbabylovelylovelyÎncă nu există evaluări

- Villareal vs. RamirezDocument15 paginiVillareal vs. RamirezchrisÎncă nu există evaluări

- HSC Accounts Model Question Paper For Board ExamDocument7 paginiHSC Accounts Model Question Paper For Board ExamAMIN BUHARI ABDUL KHADER100% (2)

- Group 2 - Forfaiting & Factoring-MBA (IB) - 2018-21Document12 paginiGroup 2 - Forfaiting & Factoring-MBA (IB) - 2018-21Kaushik HazarikaÎncă nu există evaluări

- Income Tax Payment Challan: PSID #: 34336315Document1 paginăIncome Tax Payment Challan: PSID #: 34336315kashif shahzadÎncă nu există evaluări

- Chap 001Document21 paginiChap 001Ch Rajkamal100% (1)

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocument2 paginiEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777Încă nu există evaluări

- Trump Taj Mahal Prospectus - 1988Document89 paginiTrump Taj Mahal Prospectus - 1988davidsirotaÎncă nu există evaluări

- VP0316Document24 paginiVP0316Anonymous 9eadjPSJNgÎncă nu există evaluări

- Exercitii Limbaje de SpecialitateDocument39 paginiExercitii Limbaje de SpecialitateAsteka IoanaÎncă nu există evaluări

- The Employees Provident Fund and Miscellaneous Act 1952Document28 paginiThe Employees Provident Fund and Miscellaneous Act 1952Rh SamsserÎncă nu există evaluări

- InsolvencyDocument6 paginiInsolvencyNur Aqilah Abd RahimÎncă nu există evaluări

- Rubio V CADocument5 paginiRubio V CAthebluesharpieÎncă nu există evaluări

- Ch05 Mini CaseDocument8 paginiCh05 Mini CaseSehar Salman AdilÎncă nu există evaluări

- KingsBench001 (Final)Document11 paginiKingsBench001 (Final)psholtzÎncă nu există evaluări

- Student Loan Forgiveness For Frontline Health WorkersDocument20 paginiStudent Loan Forgiveness For Frontline Health WorkersKyle SpinnerÎncă nu există evaluări

- SOP Visma Reconciliations in VB Vs 1.1Document52 paginiSOP Visma Reconciliations in VB Vs 1.1Zven BlackÎncă nu există evaluări

- TheLabourPartyManifesto 2010Document78 paginiTheLabourPartyManifesto 2010Katey Sarah Alice RoweÎncă nu există evaluări

- Conditional SentenceDocument2 paginiConditional Sentencealya putri alizahÎncă nu există evaluări

- ACCA Pilot Paper Int PPQDocument19 paginiACCA Pilot Paper Int PPQqaisar1982Încă nu există evaluări

- Hukumchand Insurance Company LimitedDocument2 paginiHukumchand Insurance Company LimitedBrena GalaÎncă nu există evaluări

- Bir Form 1701 Summary Alphalist of Withholding Taxes (Sawt) For The Month of December, 2016Document5 paginiBir Form 1701 Summary Alphalist of Withholding Taxes (Sawt) For The Month of December, 2016Renz Christopher TangcaÎncă nu există evaluări

- Republic Act No 1156 BLAWDocument3 paginiRepublic Act No 1156 BLAWDe Nev OelÎncă nu există evaluări

- Executive Sales /account Maneger EnterpriseDocument2 paginiExecutive Sales /account Maneger Enterpriseapi-78510219Încă nu există evaluări

- Shell Mex House 80 The Strand, Pearson PLC, Was S. Pearson and Son Plc.Document6 paginiShell Mex House 80 The Strand, Pearson PLC, Was S. Pearson and Son Plc.John Adam St Gang: Crown ControlÎncă nu există evaluări

- Survey of The Somali Food Industry PDFDocument177 paginiSurvey of The Somali Food Industry PDFMickael Gedion67% (3)

- Simple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBDocument26 paginiSimple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBSrini VasuluÎncă nu există evaluări

- Contract Obligation: ContractsDocument11 paginiContract Obligation: ContractsWindel Lingahan AbelongÎncă nu există evaluări

- CHAPTER 7 Final PDFDocument108 paginiCHAPTER 7 Final PDFabbasÎncă nu există evaluări

- Formaatbeschrijving MT103 SWIFT FIN PDFDocument9 paginiFormaatbeschrijving MT103 SWIFT FIN PDFAnonymous 9NgJRDVHMMÎncă nu există evaluări

- H02 Post TestDocument7 paginiH02 Post TestCharles100% (1)