Documente Academic

Documente Profesional

Documente Cultură

Philhealth rf1 PDF

Încărcat de

Dimitri IrtimidTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Philhealth rf1 PDF

Încărcat de

Dimitri IrtimidDrepturi de autor:

Formate disponibile

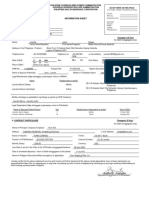

Republic of the Philippines

PHILIPPINE HEALTH INSURANCE CORPORATION

EMPLOYERS REMITTANCE REPORT

REVISED JAN 2008

FOR PHILHEALTH USE

Date Received:

PHILHEALTH NO.

Action Taken:

By:

EMPLOYER TIN

2

Signature Over Printed Name

3

COMPLETE EMPLOYER NAME

EMPLOYER TYPE

COMPLETE MAILING ADDRESS

TELEPHONE NO.

6

NAME OF EMPLOYEE/S

NO.

SURNAME

PRIVATE

REGULAR RF-1

GOVERNMENT

ADDITION TO PREVIOUS RF-1

HOUSEHOLD

DEDUCTION TO PREVIOUS RF-1

GIVEN NAME

PHILHEALTH NO.

MIDDLE NAME

REPORT TYPE

MONTHLY

SALARY

BRACKET

(MSB)

NHIP PREMIUM

CONTRIBUTION

PS

APPLICABLE PERIOD

200

10

MEMBER STATUS

S-Separated, NE-No Earnings,

NH-Newly Hired

ES

STATUS

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

11

APPLICABLE

PERIOD

ACKNOWLEDGEMENT RECEIPT (ME-5/POR/OR/PAR)

REMITTED AMOUNT

ACKNOWLEDGEMENT

RECEIPT NO.

TRANSACTION

DATE

12

NO. OF

EMPLOYEES

SUBTOTAL

(PS + ES)

(To be accomplished on every page)

GRAND TOTAL

CERTIFIED CORRECT

13

SIGNATURE OVER PRINTED NAME

OFFICIAL DESIGNATION

(PS + ES)

(To be accomplished on the last page)

PLEASE READ INSTRUCTIONS ( FOR EACH NUMBERED BOX) AT THE BACK BEFORE ACCOMPLISHING THIS FORM

DATE

14

PAGE

OF

PAGES

NHIP MONTHLY PREMIUM CONTRIBUTION SCHEDULE

INSTRUCTIONS

NOTE: Instructions for each numbered box are enumerated below

BOX 1

Write the complete Employer TIN and PHILHEALTH NO. in corresponding boxes. if without PEN, the employer shall be required to

attach duly accomplished ER1 form and any of the following documents, whichever is applicable to facilitate registration and PEN

issuance:

1. Business License Permit for single proprietorship;

2. SEC Registration for a partnership and Corporation;

3. License to Operate for all employers.

BOX 2

Write the COMPLETE Employer Name, Address and Telephone No. (DO NOT ABBREVIATE)

BOX 3

Check applicable box for the Employer Type.

BOX 4

Check the applicable box for the Report Type. For adjustment on remittance report on previous month, use a separate RF-1 form

and check the box corresponding to "Addition to Previous RF-1" or "Deduction to Previous RF-1" as the case maybe. Write

only the names of the employees with erroneous contributions and the difference between the correct amount and the amount that

was previously reported. If an underpayment results due to correction, please remit the amount due to PhilHealth. Use separate/

different sets of RF-1 form for each month when reporting previous payments or late payments made on previous month(s).

BOX 5

Always indicate the applicable month and year of premium contributions paid. The month and year coverage in the RF-1 should

correspond with the month and year coverage indicated in the ME-5 /OR/POR/PAR.

BOX 6

Print names of Employees in alphabetical order; write Family Name first; Given Name and Middle Name as they pronounced.

For instance, the names JULIAN SALVADOR DELA CRUZ , LILIA BERNARDO DELOS SANTOS. and MARIA LAGDAMEO DE

GUIA should be written as DELA CRUZ, JULIAN SALVADOR; DELOS SANTOS LILIA BERNARDO; and DE GUIA MARIA

LAGDAMEO; also, names with suffixes such as Jr., Sr., III, etc. should always be written after the family name. Do not skip lines

when listing down theIr names. Write "NOTHING FOLLOWS" on the line immediately following the last listed employee.

BOX 7

Indicate the corresponding PhilHealth Identification No. (PIN) opposite the respective names of your employees. IF WITHOUT PIN,

The employer shall be required to attach the properly accomplished Registration Forms (M1a) including the supporting

document/s for declared dependent/s if any and ER2s to faciliate PIN issuance and registration.

BOX 8

Indicate your employees' respective Monthly Salary Bracket (MSB) corresponding to the Monthly Salary Range where the

employees monthly salary falls. Please refer to the Monthly Premium Contribution Schedule for your reference. Corresponding

MSB left unaccomplished shall mean that the employees compensation for the particular period shall belong to the highest

bracket.

BOX 9

Indicate the corresponding Personal Share (PS) and Employer Share (ES) on the boxes provided for each remittance. The total

premium contribution (PS + ES) for the month must fall within the prescribed bracket.

MSB

1

2

3

4

5

6``

7

8

9

10

11

12

13

14

15

Salary Base

(SB)

Monthly Salary

Range

P

4,999.99 and below

5,000.00 to 5,999.99

6,000.00 to 6,999.99

7,000.00 to 7,999.99

8,000.00 to 8,999.99

9,000.00 to 9,999.99

10,000.00 to 10,999.99

11,000.00 to 11,999.99

12,000.00 to 12,999.99

13,000.00 to 13,999.99

14,000.00 to 14,999.99

15,000.00 to 15,999.99

16,000.00 to 16,999.99

17,000.00 to 17,999.99

18,000.00 to 18,999.99

4,000.00

5,000.00

6,000.00

7,000.00

8,000.00

9,000.00

10,000.00

11,000.00

12,000.00

13,000.00

14,000.00

15,000.00

16,000.00

17,000.00

18,000.00

Total Monthly

Contribution

P

100.00

125.00

150.00

175.00

200.00

225.00

250.00

275.00

300.00

325.00

350.00

375.00

400.00

425.00

450.00

Personal Share

(PS)

Employer Share

(ES)

50.00

62.50

75.00

87.50

100.00

112.50

125.00

137.50

150.00

162.50

175.00

187.50

200.00

212.50

225.50

50.00

62.50

75.00

87.50

100.00

112.50

125.00

137.50

150.00

162.50

175.00

187.50

200.00

212.50

225.50

16

19,000.00 to 19,999.99

19,000.00

475.00

237.50

237.50

17

18

19

20,000.00 to 20,999.99

21,000.00 to 21,999.99

22,000.00 to 22,999.99

20,000.00

21,000.00

22,000.00

500.00

525.00

550.00

250.00

262.50

275.00

250.00

262.50

275.00

20

23,000.00 to 23,999.99

23,000.00

575.00

287.50

287.50

21

22

23

24

25

26

27

24,000.00 to 24,999.99

25,000.00 to 25,999.99

26,000.00 to 26,999.99

27,000.00 to 27,999.99

28,000.00 to 28,999.99

29,000.00 to 29,999.99

30,000.00 and up

24,000.00

25,000.00

26,000.00

27,000.00

28,000.00

29,000.00

30,000.00

600.00

625.00

650.00

675.00

700.00

725.00

750.00

300.00

312.50

325.00

337.50

350.00

362.50

375.00

300.00

312.50

325.00

337.50

350.00

362.50

375.00

COPY DISTRIBUTION

Form

RF-1

No. of Copies

2

ME-5

4th

1st

2nd

3rd

PHIC

PAYOR

PHIC

BANK

PAYOR

PHIC

BOX 10

In the "Member Status" column indicate the "S" if the employee is separated, "NE" if with no earnings and "NH" if employee is

newly hired.

BOX 11

Supply needed information on the "ACKNOWLEDGEMENT RECEIPTS (ME-5/POR/OR/PAR)" boxes. Indicate in the

corresponding box the acknowledgement receipts no. (i.e ME-5 Reconciliation No., found in the lower left portion of the ME-5

form for the month. Total Monthly Premium to be indicated opposite the applicable month coverage in the ME-5/POR/OR/PAR

should also tally with the amount reflected in the RF-1).

DEADLINE OF SUBMISSION OF FORMS

BOX 12

Add all contribution in the Personal Share (PS) column and Employer Share (ES) column, for each month and reflect the sum in

the "Subtotal" box for each page. Consequently, add all subtotals/page totals and reflect sum in the "Grand Total" box in the

last sheet of the accomplished RF-1 to indicate total amount of contributions paid for the applicable month.

BOX 13

Affix signature and print complete name, designation and date of certification of authorized officer certifying the report.

Submit Original Copy of this duly accomplished form with the corresponding copies of the validated ME-5/ OR/POR/

PAR to the Collection Section of the respective NCR-Service Offices for payors within the NCR or to Service Offices

(SOs)/PhilHealth Regional Offices (PROs) for payors outside NCR. The Duplicate copy of this form shall be the

Payors Copy. Deadline of payment contributions shall be on the 10th day after the applicable month. Employers who

fail to comply with the above requirements shall be subjected to the penalties provided under Article X, R.A.7875

BOX 14

Always indicate page number and total number of pages at each of the form.

Every 15th day after the applicable month

THIS FORM MAY BE REPRODUCED

S-ar putea să vă placă și

- PhilHealth Revised Employer Remittance Report-RF-1Document2 paginiPhilHealth Revised Employer Remittance Report-RF-1Grace GayonÎncă nu există evaluări

- rf1 - PhilhealthDocument6 paginirf1 - PhilhealthAngelica Radoc SansanÎncă nu există evaluări

- Philhealth RF1-Employer RemittanceDocument2 paginiPhilhealth RF1-Employer RemittanceAimee F100% (3)

- PhilHealth Revised Employer Remittance Report-RF-1 PDFDocument2 paginiPhilHealth Revised Employer Remittance Report-RF-1 PDFYvan Jackson Marquez NacionalesÎncă nu există evaluări

- Philhealth rf-1Document2 paginiPhilhealth rf-1Suzette SubicoÎncă nu există evaluări

- PHILHEALTH FormDocument2 paginiPHILHEALTH Formketty04Încă nu există evaluări

- SSS R3 Contribution Collection List in Excel FormatDocument2 paginiSSS R3 Contribution Collection List in Excel FormatJohn Cando57% (14)

- FPF060 Member'sContributionRemittance V01Document3 paginiFPF060 Member'sContributionRemittance V01christine_balanagÎncă nu există evaluări

- Pag IbigDocument3 paginiPag IbigSharon Rillo Ofalda100% (1)

- SSS R3 Contribution Collection List in Excel FormatDocument2 paginiSSS R3 Contribution Collection List in Excel FormatJaniene Secuya100% (2)

- SSS R3 Contribution Collection List in Excel FormatDocument2 paginiSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- SLF017 ShortTermLoanRemittanceForm V01Document2 paginiSLF017 ShortTermLoanRemittanceForm V01Ray Nan100% (8)

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 paginiPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielÎncă nu există evaluări

- HDMF Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Document2 paginiHDMF Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)denisemanalo72% (18)

- Sss r3 PDFDocument2 paginiSss r3 PDFbn_dcks9105Încă nu există evaluări

- R3 Form Download Contribution Collection ListDocument2 paginiR3 Form Download Contribution Collection ListRvn Nvr33% (3)

- SSS R5 - AdmiralDocument6 paginiSSS R5 - AdmiralKaye LadsÎncă nu există evaluări

- Contributions Payment Form-SSSDocument6 paginiContributions Payment Form-SSSrhev63% (8)

- SSS RS - 5Document1 paginăSSS RS - 5Anid AzertsedÎncă nu există evaluări

- R 1aDocument2 paginiR 1aJaniene SecuyaÎncă nu există evaluări

- Inos Sss Contribution FormDocument6 paginiInos Sss Contribution FormYeye TanÎncă nu există evaluări

- R 1a Social Security SystemDocument2 paginiR 1a Social Security SystemCaroline TurlaÎncă nu există evaluări

- PFF053 Member'SContributionRemittanceForm V03Document12 paginiPFF053 Member'SContributionRemittanceForm V03CA RosarioÎncă nu există evaluări

- ML 1Document1 paginăML 1Angelique Marie Adriano100% (1)

- SSSForm Member Loan Payment ReturnDocument5 paginiSSSForm Member Loan Payment ReturnRMR Group of CompaniesÎncă nu există evaluări

- 1604-CFDocument8 pagini1604-CFmamasita25Încă nu există evaluări

- Pag-IBIG Data FormDocument2 paginiPag-IBIG Data Formnelia_villarete3070Încă nu există evaluări

- SSS Form Salary LoanDocument4 paginiSSS Form Salary LoanMikoy Lacson100% (4)

- R1a Fillin Rev-1Document2 paginiR1a Fillin Rev-1Christian Talento0% (2)

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDocument4 pagini941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanÎncă nu există evaluări

- 1604 CFDocument6 pagini1604 CFromarcambriÎncă nu există evaluări

- Pag Ibig 1Document2 paginiPag Ibig 1Fervi Louie Jalop Bongco0% (1)

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 paginiACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyÎncă nu există evaluări

- Bureau of Internal Revenue Form 1604e 2016Document2 paginiBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesÎncă nu există evaluări

- PHILFAST R-5 - Fill PDFDocument2 paginiPHILFAST R-5 - Fill PDFChristopher SantiagoÎncă nu există evaluări

- 3003568.australia Super Standard Choice 2.p7Document3 pagini3003568.australia Super Standard Choice 2.p7gogin565Încă nu există evaluări

- F Ss'Philippine Health Insurance Corporation) (@ "1" : Philhealth CircularDocument3 paginiF Ss'Philippine Health Insurance Corporation) (@ "1" : Philhealth CircularJo Anne LayugÎncă nu există evaluări

- 1 - DD Form 2656 (JUN 2008)Document4 pagini1 - DD Form 2656 (JUN 2008)Catalina PachecoÎncă nu există evaluări

- Pagibig - FormDocument2 paginiPagibig - FormTiffany Malata100% (3)

- PF Forms FormatsDocument10 paginiPF Forms FormatsSnehal ChauhanÎncă nu există evaluări

- (B) Superannuation Standard Choice Form - ShortDocument2 pagini(B) Superannuation Standard Choice Form - ShortAnonymous FsIAZZ9llxÎncă nu există evaluări

- Employer Specail Wage Report Social-Security-Form-SSA-131Document2 paginiEmployer Specail Wage Report Social-Security-Form-SSA-131DellComputer99Încă nu există evaluări

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 paginiAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneÎncă nu există evaluări

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 paginiEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelÎncă nu există evaluări

- 1040 Exam Prep: Module II - Basic Tax ConceptsDe la Everand1040 Exam Prep: Module II - Basic Tax ConceptsEvaluare: 1.5 din 5 stele1.5/5 (2)

- Thrift Savings Plan Investor's Handbook for Federal EmployeesDe la EverandThrift Savings Plan Investor's Handbook for Federal EmployeesÎncă nu există evaluări

- High-Q Financial Basics. Skills & Knowlwdge for Today's manDe la EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manÎncă nu există evaluări

- 1040 Exam Prep: Module I: The Form 1040 FormulaDe la Everand1040 Exam Prep: Module I: The Form 1040 FormulaEvaluare: 1 din 5 stele1/5 (3)

- Progressive Consumption Taxation: The X Tax RevisitedDe la EverandProgressive Consumption Taxation: The X Tax RevisitedÎncă nu există evaluări

- Summary of Richard A. Lambert's Financial Literacy for ManagersDe la EverandSummary of Richard A. Lambert's Financial Literacy for ManagersÎncă nu există evaluări

- Besorah NEBI'IMDocument444 paginiBesorah NEBI'IMDimitri IrtimidÎncă nu există evaluări

- Besorah TORAHDocument234 paginiBesorah TORAHMico LeiÎncă nu există evaluări

- Besorah MessianicDocument299 paginiBesorah MessianicDimitri IrtimidÎncă nu există evaluări

- Besorah KETHUBIMDocument288 paginiBesorah KETHUBIMDimitri IrtimidÎncă nu există evaluări

- New Heart English Bible Messianic EditionDocument884 paginiNew Heart English Bible Messianic EditionDimitri IrtimidÎncă nu există evaluări

- Bibles OnlinesDocument3 paginiBibles OnlinesDimitri IrtimidÎncă nu există evaluări

- Bibles OnlinesDocument3 paginiBibles OnlinesDimitri IrtimidÎncă nu există evaluări

- CF1Document1 paginăCF1Kim ViñasÎncă nu există evaluări

- AO No.2012-0012-ADocument6 paginiAO No.2012-0012-Akmand_lustregÎncă nu există evaluări

- Page 1Document14 paginiPage 1JohnÎncă nu există evaluări

- 2 Valid Ids With Correct Name and Date of BirthDocument1 pagină2 Valid Ids With Correct Name and Date of BirthNathaniel OducadoÎncă nu există evaluări

- Pre-Employment Forms 2023Document20 paginiPre-Employment Forms 2023HR JeanÎncă nu există evaluări

- Final LGU Scorecard Indicators 2012-2016 As of April 19Document22 paginiFinal LGU Scorecard Indicators 2012-2016 As of April 19Arianne A Zamora100% (19)

- List of First Class Municipalities in The Philippines: Revised VersionDocument8 paginiList of First Class Municipalities in The Philippines: Revised Versionjade123_129Încă nu există evaluări

- Adult Mswd-ToolDocument3 paginiAdult Mswd-Toolclaverialc10Încă nu există evaluări

- Accomplishment Report JUNE 2012Document2 paginiAccomplishment Report JUNE 2012Martin Federic PalcoÎncă nu există evaluări

- PhilhxDocument2 paginiPhilhxHannah YtacÎncă nu există evaluări

- Republic Act No. 9994 - Expanded Senior Citizens ActDocument29 paginiRepublic Act No. 9994 - Expanded Senior Citizens ActJumen Gamaru TamayoÎncă nu există evaluări

- Madaron Security Agency: Cost Distribution Per MonthDocument3 paginiMadaron Security Agency: Cost Distribution Per MonthYvette Marie Yaneza NicolasÎncă nu există evaluări

- Q1 Las Health10 Module1 WK1 - 2Document10 paginiQ1 Las Health10 Module1 WK1 - 2bonzai guillenaÎncă nu există evaluări

- Insulin Access ProgramDocument3 paginiInsulin Access ProgramErnest Jerome Malamion100% (1)

- Healthcare Engineering CompilationDocument149 paginiHealthcare Engineering CompilationrobbyÎncă nu există evaluări

- State of The City Address 2014 of Mayor Belen FernandezDocument49 paginiState of The City Address 2014 of Mayor Belen FernandezbalondagupanÎncă nu există evaluări

- IRR Foster Care Act of 2012Document25 paginiIRR Foster Care Act of 2012BabangÎncă nu există evaluări

- Kasambahay BillDocument9 paginiKasambahay BillRICKY ALEGARBESÎncă nu există evaluări

- Reaction On The The Philippine Health Agenda 2016Document5 paginiReaction On The The Philippine Health Agenda 2016Jesselle Iquin100% (3)

- LS5 Module 5Document29 paginiLS5 Module 5Don't be shy, Do it100% (2)

- Doh Noh 2017-2022Document170 paginiDoh Noh 2017-2022Alvin Cloyd Dakis, MHSS, RN, CGDP100% (3)

- Philhealth ArrearsDocument29 paginiPhilhealth ArrearsGILBERT L. MALIMATAÎncă nu există evaluări

- CHHHHHHHHHHNDocument17 paginiCHHHHHHHHHHNAira Shane MargesÎncă nu există evaluări

- Info SheetDocument1 paginăInfo SheetJazel LlamasÎncă nu există evaluări

- Essay HisDocument3 paginiEssay HisGeeyan Marlchest B NavarroÎncă nu există evaluări

- EPRS For PhilhealthDocument2 paginiEPRS For PhilhealthBuddy Chua67% (6)

- Philhist ActivitiesDocument12 paginiPhilhist ActivitiesLovely Mae GalosÎncă nu există evaluări

- HMO Dependents Enrolment Form and Salary Deduction Authorization Form 20...Document1 paginăHMO Dependents Enrolment Form and Salary Deduction Authorization Form 20...GemarieRoblesDelosReyesÎncă nu există evaluări

- Doh2011 2013isspDocument191 paginiDoh2011 2013isspJay Pee CruzÎncă nu există evaluări

- REPUBLIC ACT NO. 11291 (Magna Carta of The Poor)Document7 paginiREPUBLIC ACT NO. 11291 (Magna Carta of The Poor)Yappi NaniÎncă nu există evaluări