Documente Academic

Documente Profesional

Documente Cultură

Bdo Application Form

Încărcat de

Anonymous pnCfNWeCUZDrepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Bdo Application Form

Încărcat de

Anonymous pnCfNWeCUZDrepturi de autor:

Formate disponibile

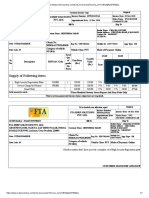

HOME LOAN APPLICATION FORM

(FOR INDIVIDUAL / SOLE PROPRIETORSHIP)

*Failure to provide sufficient and accurate information in this Application Form may result to BDO's inappropriate determination of the financial requirements of the Borrower.

(mm/dd/yyyy)

Borrower Type

For BDO Use Only: Program/Promotion: Date:

Principal Co-Borrower

REFERRAL INFORMATION

Unit / Branch Developer Broker / Referrer

Account Officer Others

BORROWER’S INFORMATION

*Name (First, Middle, Last) *Date of Birth (mm/dd/yyyy) *Place of Birth

*Gender Male *Civil Status Single Married Separated No. of Dependents *Citizenship Filipino

Female Annulled / Divorced Widow/er Foreigner, ACR No.

*TIN *SSS / GSIS No. *Mobile. No. Prepaid

Postpaid

Residence Phone No. (Area Code, Number) Office Phone No. (Area Code, Number) Fax No. (Area Code, Number) *Email Address

*Mother’s Maiden Name (First, Middle, Last) *Father’s Name (First, Middle, Last)

*Present Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Length of Stay (Year/s | Month/s)

Home Ownership Owned Rented Mortgaged Used free Living with Relatives

*Permanent Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Length of Stay (Year/s | Month/s)

Previous Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Length of Stay (Year/s | Month/s)

Are you related to a BDO employee?

If Yes, indicate full name (First, Middle, Last) and relationship

SPOUSE’S INFORMATION

*Name (First, Middle, Last) Date of Birth (mm/dd/yyyy) Place of Birth

Citizenship Filipino TIN SSS / GSIS No.

Foreigner, ACR No.

Office Phone No. Mobile No. Prepaid Email Address

Postpaid

LOAN INFORMATION

Loan Amount Term Fixing Period

Loan Purpose

Purchase of Vacant Lot Purchase of Condominium Refinancing / Take-out from

Purchase of House & Lot Construction of House Reimbursement of Acquisition Cost

Purchase of Townhouse Renovation / House Improvement Equity Loan, please specify

COLLATERAL INFORMATION

Property Address Present Registered Owner

TCT / CCT No. Contact Person Contact No.

EMPLOYMENT / BUSINESS INFORMATION

Borrower Spouse

*Employment Type Employed Self-Employed (w/ Business) OFW / Immigrant Employed Self-Employed (w/ Business) OFW / Immigrant

Private Self-Employed (Professional) Others Private Self-Employed (Professional) Others

Government Government

NGO NGO

*Business Type Single Proprietorship Partnership Corporation Single Proprietorship Partnership Corporation

*Employer / Business Name and Address (No. / Street / Barangay / Municipality or City / Province / Country)

*Phone / Fax No.

*Email Address

*Nature of Business

Years of Employment / Business

Position / Title

LOAN ADMINISTRATOR (if OFW or IMMIGRANT)

Name (First, Middle, Last) Date of Birth (mm/dd/yyyy) Citizenship Filipino

Foreigner, ACR No.

Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Relationship to Borrower Contact No.

Name of Spouse (First, Middle, Last) Date of Birth (mm/dd/yyyy) Contact No.

(*) Mandatory Field/s Version: Feb 2018

INCOME DETAILS

Borrower Spouse

Gross Monthly Income

Other Monthly Income

(Please specify)

Total Monthly Income

Combined Gross

Monthly Income

Rentals Loans and Credit Cards Other Expenses

Monthly Expenses

FINANCIAL INFORMATION / BANK RELATIONSHIP

Deposits Bank Branch Type of Account Account No. Date Opened (mm/yyyy) Outstanding Balance

Loans Bank Type of Loan Original Loan Amount Date Granted (mm/yyyy) Maturity Date (mm/yyyy) Monthly Payment

TRADE REFERENCES

Major Company Name Contact Person / Position Contact No.

Customers

Major Company Name Contact Person / Position Contact No.

Suppliers

UNDERTAKING

1. The Borrower hereby certifies that the provided information are true and correct and shall form part of the loan documents and the signatures indicated herein are genuine. The Borrower’s or his authorized

representative’s provision of any information which is not true or updated may cause BDO Unibank, Inc. (BDO) to automatically reject the Borrower's loan application or cancel its approval.

2. The Borrower authorizes BDO to obtain relevant information as it may require concerning this application from other institutions/persons. All information obtained by or provided to BDO pursuant to this application

shall be BDO's property whether or not the loan is granted.

3. The Borrower agrees that this loan application shall be subject to Applicable Laws1 (including BSP circulars, rules, and regulations), and policies of BDO and undertake to comply with/submit all the loan

requirements.

4. The Borrower hereby waives confidentiality of client information including without limitation, the provisions of Republic Act Nos. 9510 (Credit Information System Act), 1405 (The Law on Secrecy of Bank Deposits),

6426 (Foreign Currency Deposit Act), and Section 55.1.b of Republic Act No. 8791 (General Banking Law) and any law relating to the secrecy of bank deposits. The Borrower authorizes BDO to: (a) pursuant to BSP

Circular No. 472 Series of 2005 as implemented by BIR Revenue Regulation RR-4 2005, conduct random verification with the Bureau of Internal Revenue in order to establish authenticity of the ITR, accompanying

financial statements and such other documents/information/data submitted by the Borrower, and/or (b) obtain or disclose such information regarding the Borrower or the loan/credit facilities applied for hereunder

to any party as BDO may deem necessary or as may be required or allowed by Applicable Laws. The Borrower also authorizes BDO to request information regarding the status of any court case to which the

Borrower is a party.

5. The Borrower authorizes BDO to conduct, through its representative accredited appraisers, an appraisal of any or all of the collateral to be used for this loan. The Borrower also agrees that the appraisal report will

be forwarded directly to BDO for its sole use only.

6. Any payment of bank fees (appraisal fee, mortgage registration expenses, insurance premium, DST, notarial fee, handling fee, cancellation fee, and other amounts as may be required upon loan application and/or

for the release of loan proceeds) should only be through a BDO branch, otherwise, payments shall not be honored or recognized.

7. In case of disapproval, the Borrower understands that BDO is under no obligation to disclose the reason/s for such disapproval.

8. The Borrower further certifies that the proceeds of the loan, if this application is approved, will be used solely for the purpose stated in this application.

9. The Borrower hereby authorizes BDO, its parent, subsidiaries, affiliates, and their respective representatives and agents (“BDO Group”) to send notices, offers and announcements to the Borrower as BDO or any

member of the BDO Group may deem proper, including without limitation, information regarding the status of the Borrower's loan application, details concerning the Borrower’s approved/availed loan, and product

offers via email, as well as broadcast messaging service, multi-media messaging service, and/or short messaging service as these terms are defined in the regulations of the National Telecommunications Commission

(NTC). The Borrower agrees to hold BDO free and harmless against any loss, injury or damage that the Borrower may suffer in relation to any notification/announcement sent by BDO to the Borrower in the format

stated herein. It is agreed and understood that unless and until BDO is in receipt of a written notice from the Borrower not to be sent such messages, the Borrower's authority as given herein shall be deemed

continuing, valid and effective.

DATA PRIVACY CONSENT

In compliance with the requirements of the Data Privacy Act (“DPA”), the Borrower authorizes the general use and sharing of information obtained in the course of any transaction/s (which may include any

transaction, business or other form of commercial relationship) with any member of the BDO Group or from third parties. The data, which include personal information or sensitive personal information2 may be

collected, processed, stored, updated, or disclosed by BDO or continually be collected, stored, processed and/or shared for five (5) years from the conclusion of the Borrower’s transaction with any member of the

BDO Group or until the expiration of the retention limits set by applicable law, whichever comes later, (i) for legitimate purposes3, (ii) to implement transactions which the Borrower requests, allows, or authorizes,

(iii) to offer and provide new or related products and services of the BDO Group or third parties, and (iv) to comply with the BDO Group’s internal policies and its reporting obligations4 to Governmental Authorities5

under Applicable Laws.

The Borrower allows members of the BDO Group to process, collect, use, store, or disclose information (including without limitation, the Borrower’s credit data in connection with any credit availment with BDO) to

other members, to Governmental Authorities, to all credit information bureaus, including without limitation the Credit Information Corporation defined in R.A. No. 9510, and to any third party (local or overseas) who

acquires or will acquire the rights and obligations of any member of the BDO Group; who is in negotiations with any member of the BDO Group in connection with the possible sale, acquisition or restructuring of

any member of the BDO Group; who processes information, transactions, services, or accounts, on behalf of the BDO Group (including but not limited to courier agencies; telecommunication information technology

companies; payment, payroll, collection, training, and storage agencies; entities providing customer support, and other similar entities); or who requires the information for market research, product and business

analysis, audit and administrative purposes, offering of products and services, or for marketing or advertising activities undertaken by the BDO Group.

1 Refers to mean any statute, law, constitution, regulation, rule, ordinance, order, decree, directive, guideline, policy, requirement or governmental restriction or any similar form of decision of, or determination of

any of the foregoing by, any national, regional or local government or political subdivision, commission, authority, tribunal, agency or entity of the Republic of the Philippines or a foreign country, as may be

applicable.

2 Name, address, gender, age, marital status, contact details, birthday, SSS/GSIS, TIN, education, employment or financial or medical information, spouse details, preferences, behavior, and other information

classified as “personal data,” “personal information,” or “sensitive personal information” under the DPA, and those of the Borrower’s authorized representatives, as well as accounts, transactions, and

communications.

3 Including but not limited to credit and risk management, know your customer checks, prevention and detection of fraud or crime, system or product development and planning, cross-selling, direct marketing,

profiling, complaints management, insurance, audit and administrative purposes, and relationship management.

4 Means obligations of the BDO Group to comply with (a) Applicable Law, and internal policies or procedures, or (b) any demand and/or request from Government Authorities for purposes of reporting, regulatory

trade reporting, disclosure or other obligations under Applicable Law.

5 Refers to the government of the Republic of the Philippines or a foreign country, as may be applicable, or any political subdivision thereof, and any entity exercising executive, legislative, judicial, regulatory or

administrative functions of or pertaining to the government.

Signature of Borrower Date Signature of Spouse/Co-Borrower/Co-Maker Date

over Printed Name over Printed Name

Credit Card

By signing in this section, the Borrower agrees that this shall serve as the Borrower's application for issuance of BDO Credit Card/s. The Borrower undertakes to submit documents as may be deemed necessary by BDO.

The Borrower authorizes BDO to conduct whatever credit investigation and verification with government agencies or third parties to ascertain credit standing, financial capability of the Borrower, and establish the

authenticity of the information declared and/or documents submitted. The Borrower further waives applicable confidentiality rules and laws. The Borrower understands that the issuance of a BDO Credit Card shall be

subject to credit evaluation and discretion of BDO.

Further, the Borrower agrees that in case of issuance of two or more BDO Credit Cards, BDO may give a separate Credit Card Limit for each of the Card issued or a consolidated Shared Credit Card Limit for existing and

future BDO Credit Cards, expressed in Philippine Pesos. The Borrower understands that Shared Credit Card Limit is the Credit Limit assigned to a Cardholder across all issued BDO Credit Cards. Any request for increase

in Credit Limit may be accommodated by BDO, subject to compliance with BDO’s requirements.

Signature of Borrower over Printed Name Date

S-ar putea să vă placă și

- UTI Mutual Fund 19-20Document2 paginiUTI Mutual Fund 19-20Kiran DandileÎncă nu există evaluări

- Uribapplicationform 39694878 PDFDocument3 paginiUribapplicationform 39694878 PDFsheelkumar belekarÎncă nu există evaluări

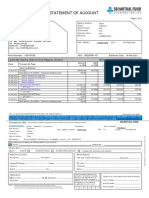

- Statement of Account: 678170259 16-Jul-2019 588.84 PDocument2 paginiStatement of Account: 678170259 16-Jul-2019 588.84 PIvy PantalunanÎncă nu există evaluări

- 2020 02 01 0030300175734 PDFDocument1 pagină2020 02 01 0030300175734 PDFShavina Say Miguel ArnaizÎncă nu există evaluări

- ViewSoa PDFDocument6 paginiViewSoa PDFIan DelesÎncă nu există evaluări

- Loan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Document12 paginiLoan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Omprakash KatreÎncă nu există evaluări

- Soa 0030300056258Document1 paginăSoa 0030300056258orlando bataraoÎncă nu există evaluări

- Cart Information - Reference Number: CMU0VWJYI9QDocument2 paginiCart Information - Reference Number: CMU0VWJYI9QShashank Raj OnkarÎncă nu există evaluări

- StatementDocument1 paginăStatementVishakha RawatÎncă nu există evaluări

- PDFDocument4 paginiPDFRomel VerdugoÎncă nu există evaluări

- Account Summary: Credit Card NumberDocument6 paginiAccount Summary: Credit Card Numberanilvishaka7621Încă nu există evaluări

- Smart Aug 2018Document6 paginiSmart Aug 2018Ash MangueraÎncă nu există evaluări

- Sample Credit Card Statement FiqDocument1 paginăSample Credit Card Statement FiqAditya KulkarniÎncă nu există evaluări

- Stay Connected FormDocument3 paginiStay Connected Formkumarneeraj0% (1)

- Project DescriptionDocument4 paginiProject DescriptionVenu GopalÎncă nu există evaluări

- TYBFM Sem 6 Mutual Fund ManagementDocument53 paginiTYBFM Sem 6 Mutual Fund ManagementHitesh BaneÎncă nu există evaluări

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document2 paginiHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971sumit keshriÎncă nu există evaluări

- R A 7836Document4 paginiR A 7836Les Camacho SorianoÎncă nu există evaluări

- Statement of Account: 44 Centro St. Domigpe CMPD Lawang Bato Valenzuela Metro ManilaDocument1 paginăStatement of Account: 44 Centro St. Domigpe CMPD Lawang Bato Valenzuela Metro ManilaXyrick John AspirasÎncă nu există evaluări

- PYKRP16676330000010193 NewDocument2 paginiPYKRP16676330000010193 NewGagan SwainÎncă nu există evaluări

- Statement of Account: 863 M. DELA FUENTE SAMPALOC Barangay 452 Sampaloc East Metro ManilaDocument1 paginăStatement of Account: 863 M. DELA FUENTE SAMPALOC Barangay 452 Sampaloc East Metro ManilaJayson IbardalozaÎncă nu există evaluări

- DBS Bank LTD Ground Floor Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-6638 8888 DBSS0IN0811 400641002Document6 paginiDBS Bank LTD Ground Floor Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-6638 8888 DBSS0IN0811 400641002Sham AinapuÎncă nu există evaluări

- Í - ) (Fè Dabuet Patriaââââââââ R Çcâ#55Eî Mrs. Patria Rueda DabuetDocument3 paginiÍ - ) (Fè Dabuet Patriaââââââââ R Çcâ#55Eî Mrs. Patria Rueda DabuetPatria RuedaÎncă nu există evaluări

- Statement of Account: 673916953 16-Jul-2019 748.00 PDocument2 paginiStatement of Account: 673916953 16-Jul-2019 748.00 PAldrin Admana AsuncionÎncă nu există evaluări

- Sample Bank StatementDocument9 paginiSample Bank Statementemma adeoyeÎncă nu există evaluări

- Product Name Validity Price: Samajho LearningDocument1 paginăProduct Name Validity Price: Samajho LearningMohammad JaveedÎncă nu există evaluări

- Invoice: Page 1 of 2Document2 paginiInvoice: Page 1 of 2AbhinavÎncă nu există evaluări

- Acctstmt LDocument3 paginiAcctstmt LIshwaryaÎncă nu există evaluări

- Application Form For MSB Licence - Eng - 22032013Document8 paginiApplication Form For MSB Licence - Eng - 22032013Shahrizan NoorÎncă nu există evaluări

- .BD & . Domain InvoiceDocument3 pagini.BD & . Domain InvoiceBWEB SOLUTIONSÎncă nu există evaluări

- AadmDocument6 paginiAadmSandhya ParabÎncă nu există evaluări

- I-20, Certificate of Eligibility For Nonimmigrant Student Status - SantacolomaDocument3 paginiI-20, Certificate of Eligibility For Nonimmigrant Student Status - SantacolomaYesenia SilvestreÎncă nu există evaluări

- MR - Augustin Mathew: Page 1 of 1 M-6163060Document1 paginăMR - Augustin Mathew: Page 1 of 1 M-6163060AUGUSTINMATHEWÎncă nu există evaluări

- Date Transaction Description Amount (In RS.)Document1 paginăDate Transaction Description Amount (In RS.)shashi singhÎncă nu există evaluări

- Globe Postpaid Oct 2020 PDFDocument3 paginiGlobe Postpaid Oct 2020 PDFJasper GicaÎncă nu există evaluări

- Receipt PDFDocument1 paginăReceipt PDFlingamkumarÎncă nu există evaluări

- Account Statement PDFDocument12 paginiAccount Statement PDFअतुल पिंपळकरÎncă nu există evaluări

- Smart Privilege: Key HighlightsDocument1 paginăSmart Privilege: Key HighlightsYogesh MeenaÎncă nu există evaluări

- Motor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceDocument2 paginiMotor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceAbhisek KumarÎncă nu există evaluări

- Valued Customer:: Leaving VerifyDocument1 paginăValued Customer:: Leaving VerifyJomar GarciaÎncă nu există evaluări

- Aircel Nov BillDocument14 paginiAircel Nov BillPavnesh SharmaaÎncă nu există evaluări

- GSTR1 08axvpp9576c1zl 062018 PDFDocument5 paginiGSTR1 08axvpp9576c1zl 062018 PDFkrishan chaturvediÎncă nu există evaluări

- InvoiceDocument1 paginăInvoiceNabeel ShaikhÎncă nu există evaluări

- L&TDocument6 paginiL&Tshweta pundirÎncă nu există evaluări

- SDCTS0008257510 PDFDocument4 paginiSDCTS0008257510 PDFPrashanth GugulothÎncă nu există evaluări

- FD Certificate PDFDocument1 paginăFD Certificate PDFDilip DineshÎncă nu există evaluări

- Soa-163960-1592823-February 2011Document1 paginăSoa-163960-1592823-February 2011Murali KrishnaÎncă nu există evaluări

- PolycyDocument10 paginiPolycyShivamDave100% (1)

- Folio No. 9075 4601 351: Account SummaryDocument2 paginiFolio No. 9075 4601 351: Account SummaryspeedenquiryÎncă nu există evaluări

- 1 1 PDFDocument6 pagini1 1 PDFKarthik Clinical LabÎncă nu există evaluări

- Patanjali YogDocument1 paginăPatanjali Yoggaurav_potnisÎncă nu există evaluări

- Kredily - Salary Slip - ExcelDocument3 paginiKredily - Salary Slip - ExcelAashi ChaudharyÎncă nu există evaluări

- Lucky ScootyDocument1 paginăLucky ScootyPramodKumarÎncă nu există evaluări

- Loan Account Statement For 4080cdia297899: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 paginiLoan Account Statement For 4080cdia297899: Component Due (RS.) Receipt (RS.) Overdue (RS.)mulaparthi RaviÎncă nu există evaluări

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 paginiMobile Services: Your Account Summary This Month'S ChargesAlankar GuptaÎncă nu există evaluări

- October 2021Document1 paginăOctober 2021Zaynn17Încă nu există evaluări

- Bank Statement - Oct 2021 To Jan 2022 - ReynaldoDocument4 paginiBank Statement - Oct 2021 To Jan 2022 - ReynaldoErwin Dela CruzÎncă nu există evaluări

- Umesh BillDocument1 paginăUmesh Billlokesh naikÎncă nu există evaluări

- AL Form Individual RevisedDocument3 paginiAL Form Individual RevisedMicaela ImperialÎncă nu există evaluări

- Carmelita Barlongan Vs Banco de Oro DigestDocument3 paginiCarmelita Barlongan Vs Banco de Oro DigestjetotheloÎncă nu există evaluări

- Traders' Takedown: Stories For The DayDocument9 paginiTraders' Takedown: Stories For The DayLeslie MirandaÎncă nu există evaluări

- DocumentDocument4 paginiDocumentLee AlbareceÎncă nu există evaluări

- Monde Nissin Corporation Final Prospectus Clean PDFDocument521 paginiMonde Nissin Corporation Final Prospectus Clean PDFChristian John Rojo100% (1)

- 2019 10-08 OTHERS - Top 100 Stockholders 2019-Q3Document5 pagini2019 10-08 OTHERS - Top 100 Stockholders 2019-Q3Kenneth ShiÎncă nu există evaluări

- RCBC Capital Corporation vs. Banco de Oro Unibank, Inc PDFDocument46 paginiRCBC Capital Corporation vs. Banco de Oro Unibank, Inc PDFDianne May CruzÎncă nu există evaluări

- San Sebastian College College of Law Income Taxation Final ExamDocument4 paginiSan Sebastian College College of Law Income Taxation Final ExamMark CastañedaÎncă nu există evaluări

- BDO Secretary CertificateDocument2 paginiBDO Secretary CertificateDeliaÎncă nu există evaluări

- Quick Note: Ayala CorporationDocument5 paginiQuick Note: Ayala CorporationVJ QatarÎncă nu există evaluări

- Your Electric BillDocument2 paginiYour Electric BillMark Anthony B. IsraelÎncă nu există evaluări

- Success StoryDocument19 paginiSuccess StoryCrissa BernarteÎncă nu există evaluări

- Asep Membership Application Form Rev201309 FinalDocument9 paginiAsep Membership Application Form Rev201309 FinalBT JumaaniÎncă nu există evaluări

- ALI 05-25 R23 ALI-Bonds-due-2025-Amended-Offer-Supplement-04212021Document320 paginiALI 05-25 R23 ALI-Bonds-due-2025-Amended-Offer-Supplement-04212021Ram CervantesÎncă nu există evaluări

- 2018 ILS Journal Vol1No2 PDFDocument174 pagini2018 ILS Journal Vol1No2 PDFjonathan quibanÎncă nu există evaluări

- List of Blue Chip Companies in The Philippine Stock ExchangeDocument1 paginăList of Blue Chip Companies in The Philippine Stock ExchangeSj EclipseÎncă nu există evaluări

- Finals (Cases)Document9 paginiFinals (Cases)ASGarcia24Încă nu există evaluări

- Banco de Oro (Bdo) : Corporate ProfileDocument1 paginăBanco de Oro (Bdo) : Corporate ProfileGwen CaldonaÎncă nu există evaluări

- AL Form Individual Revised MAY - Fillable BdoDocument2 paginiAL Form Individual Revised MAY - Fillable BdoAnonymous BjaA0IiY100% (1)

- Litecrete Corporation Company Profile PDFDocument15 paginiLitecrete Corporation Company Profile PDFCarlos ValdesÎncă nu există evaluări

- Í R"Yhè Ocampo Orlandoâââââââ G Çi (, 3 Î Mr. Orlando Ginson OcampoDocument3 paginiÍ R"Yhè Ocampo Orlandoâââââââ G Çi (, 3 Î Mr. Orlando Ginson OcampoMorisse ManaloÎncă nu există evaluări

- Unioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerDocument7 paginiUnioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerEdgar LayÎncă nu există evaluări

- Your Electric BillDocument2 paginiYour Electric BillTor YulsÎncă nu există evaluări

- Global Finance With Electronic Banking PaperDocument10 paginiGlobal Finance With Electronic Banking PaperJennica Cruzado100% (1)

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Document8 paginiThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaÎncă nu există evaluări

- The Fuller Method Learn To Grow Your Money Exponentially 7Document33 paginiThe Fuller Method Learn To Grow Your Money Exponentially 7Khazel Joi Cassanova Bautista100% (1)

- Critique Paper Bdo - Far3Document10 paginiCritique Paper Bdo - Far3John Jet TanÎncă nu există evaluări

- How To Buy or Sell Stocks in Col Financial After Trading HoursDocument33 paginiHow To Buy or Sell Stocks in Col Financial After Trading HoursJonas B. San Luis100% (1)

- GR 221153 2017Document24 paginiGR 221153 2017Anonymous KgPX1oCfrÎncă nu există evaluări

- How To Fill-Up BDO Withdrawal Slip - Banking 30766Document4 paginiHow To Fill-Up BDO Withdrawal Slip - Banking 30766kabbun enterprisesÎncă nu există evaluări