Documente Academic

Documente Profesional

Documente Cultură

R19 Release Highlights

Încărcat de

Khang Lương NgọcDrepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

R19 Release Highlights

Încărcat de

Khang Lương NgọcDrepturi de autor:

Formate disponibile

What's New in R19 AMR

©2019 Temenos Headquarters SA - All rights reserved.

Warning: This document is protected by copyright law and international treaties. Unauthorised reproduction of this document, or any portion of it, may result in severe

and criminal penalties, and will be prosecuted to the maximum extent possible under law.

Table of Contents

Release Information 6

Document Overview 7

Application Framework 8

Core 8

Archiving 10

Banking Framework 11

Beneficiary 11

Enterprise Customer Management 11

Financial Accounting 11

Delivery 11

Interest and Charges 12

ISO20022 XML Account Statement1 13

Nostro Reconciliation 13

Retail Sweeping 13

System Tables 14

LIMIT 14

ACCOUNTS 15

Transaction Restrictions 17

Collateral 18

Expected Receipts 19

Standing Order 19

Data Framework 19

Loan Loss Provisioning 20

Generic Accounting Interface 21

IBAN 21

Transaction Recycler 21

Business Intelligence 22

Data Warehousing 22

Risk 22

Channels 24

Internet Banking 24

What's New in R19 AMR - Page 2 of 94

User Administration 25

Corporate 27

Cash Management 27

Letters of Credit 29

Miscellaneous Deals 30

Syndicated Lending 30

Country / Regional Solutions 31

Argentina Model Bank 31

Australia Model Bank 32

Finland Model Bank 32

France Model Bank 33

Generic Regional Solutions 33

Hong Kong Model Bank 34

Hungary Model Bank 35

Lebanon Model Bank 35

Luxembourg Model Bank 36

Mexico Model Bank 36

Saudi Arabia Model Bank 37

Singapore Model Bank 37

Spain Model Bank 38

United Arab Emirates Model Bank 43

United Kingdom Model Bank 43

United States 44

Enterprise Frameworks 51

Data Framework 51

Design Studio 53

Integration Framework 53

Interaction Framework 56

UXP Browser 57

Islamic Banking 59

Corporate Mudaraba 59

What's New in R19 AMR - Page 3 of 94

Payments 60

Payments Hub 60

Cheque and Draft Issue Management 70

Direct Debit 71

Private Wealth 73

Securities Trading 73

Derivatives 75

Repos 76

Process Orchestration 77

Regulation and Compliance 78

Common Reporting Standards 78

Consent Management 78

Customer Data Protection 78

IFRS 78

Legal Entity Identifier 79

Payment Services Directive 80

Retail Banking 81

Arrangement Architecture - Core 81

Deposits 84

External Products 86

Retail Accounts 86

Retail Bundle 87

Retail Lending 88

Preferential Pricing 88

Safe Deposit Box 90

Treasury 91

Non-Deliverable Forward 91

Interest Rate Swaps 91

OC Clearing 91

Treasury Front Office 92

Dashboards 92

What's New in R19 AMR - Page 4 of 94

Order and Deal Capture Management 92

Position Management and Profitability 93

Treasury Foundation 94

Trade Blotter 94

What's New in R19 AMR - Page 5 of 94

Release Information

Version Release Date

1.0 R19 AMR 2019 - 04 - 25

What's New in R19 AMR - Page 6 of 94

Document Overview

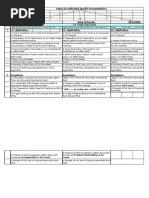

The Release Highlights list the new functionality that has been introduced into Temenos Core Banking product and

other Temenos products. It is broken down by Product Stream.

The enhancements listed in this document are also present in the R19 AMR documentation pack (available with Dis-

tribution Team). Readers can access the What's New in R19 AMR section of the documentation pack to read the

detailed release highlights. The image below shows the homepage of the documentation.

For documentation support, contact Knowledge Team

What's New in R19 AMR - Page 7 of 94

Application Framework

Core

Enterprise Deployment Pattern

Enhancement ID: 2473496, 2480798

Available from: Release 201807

This feature enables the T24PackageInstaller to get deployed via appserver thus removing the dependency of UD dir-

ectory.

User Role Information

Enhancement ID: 2511276

Available from: Release 201806

User role information is now available in the PROTOCOL table, which helps in identifying the roles used by the users for

the corresponding activities.

Alignment of Roles and Menus

Enhancement ID: 2529023

Available from: Release 201806

In T24, the role changing functionality is enhanced such that a role change automatically triggers a change in the menu

corresponding to the role.

Automating Services

Enhancement ID: 2340902

Available from: Release 201807

Validations of service operations can be performed using the Service Automation feature.

Selecting Sample Size

Enhancement ID: 2601389

Available from: Release 201807

The sample select feature can be used to select applications and fetch records based on sample size

using SPF.

Extracting data for Alert Generation of Expiring Customer Documents

Enhancement ID: 2515132

Available from: Release 201808

The system can now generate alert and post restrictions for expired documents.

Additional Features in Mass Changes Utility

Enhancement ID: 2567127, 2584299

What's New in R19 AMR - Page 8 of 94

Available from: Release 201808

The following features are now available in the Mass Change Utility:

l Selection

o Select across Books under the current Lead Company

o Selection based on Arrangement Branch/Region (ST.ORGANISATION.STRUCTURE)

o Special support for Joins created using Attributes from AA Account Details (Example Dormancy Status)

l Additional Business Operations to Change Tax, Update Account Static, Change Product, Change Charge, Define

Holiday Schedule and Change Branch (ST.BRANCH)

Alert Request

Enhancement ID: 2564941

Available from: Release 201809

Based on customer role, subscription to Alerts and event generation is now possible.

Improvements in Standard Selection

Enhancement ID: 2665928

Available from: Release 201810

Standard selection is now updated on rebuild, if the lenghts defined in the EB.OBJECT and EB.ALTERNATE.KEY applic-

ation are modified.

Handling Override and External Variable in OFS

Enhancement ID: 2565209

Available from: Release 201811

The following two functionalities can be used in OFS mode for request processing:

l Accept overrides and warnings,

l Setting any external variables for a session by sending them as a part of the request.

Pagination for Enquiries

Enhancement ID: 2782731

Available from: Release 201812

OFS request can now be processed by using the following parameters:

l Token number

l Page size

l Page number

l Total number of pages

Access Control for channel users

Enhancement ID: 2873763, 2873759

Available from: Release 201901

What's New in R19 AMR - Page 9 of 94

External requests can now be processed by setting up EB.EXTERNAL.USER id for each channel (internet banking) users

and restriction of access of data in various enquiries in T24.

GDPR support for LOCAL.REF.FIELDS

Enhancement ID: 2917535

Available from: Release 201902

The system is now enhanced to uniquely identify a local table entry that contains customer sensitive data and to specify

various customer personal data attributes for that field.

GDPR Support for EB.TABLE.DEFINITION and AA.CLASS.DEFINITION

Enhancement ID: 2917550

Available from: Release 201903

Specifying personal data information for fields present in the EB.TABLE.DEFINITION and AA.CLASS.DEFINITION

applications based on GDPR regulations is now possible.

T24 Traceability

Enhancement ID: 2964773

Available from: Release 201904

In T24, it is now possible to trace banking transactions from multiple third parties and inspect that trace log as an evid-

ent to identify whether the transaction has occurred as stated or tampered.

Archiving

‘Segmentation’ in Statement Archiving

Enhancement ID: 2444010

Available from: Release 201807

‘Segmentation’ is introduced in statement archiving, which is already a proven performance solution for SWIFT state-

ments in Temenos Core Banking. Segmentation is the process of multi-threading the job processing by splitting the

entries between available agents.

What's New in R19 AMR - Page 10 of 94

Banking Framework

Beneficiary

Additional Validations for Payee Instructions(BENEFICIARY)

Enhancement ID: 2329163

Available from: Release 201805

New validations have been added to Payees instructions to notify the customer about the impact of changing or can-

celling an existing Payee.

Enterprise Customer Management

Customer Group Hierarchy - Corporate

Enhancement ID: 2247145 / 2462788

Available from: Release 201805/201807

Customer Group provides the capability of defining relationships between individuals and/or corporate parties. Based

on these relationships, users can retrieve relationships that fit their needs in order to create customer groups or cus-

tomer group hierarchies that they can use for different purposes. The customer groups for purpose of risk can be used

for limit allocation.

Financial Accounting

Future Dated Transactions

Enhancement ID: 2289672

Available from: Release 201805

'Future dated transactions (Future Booking Date)’ is an amendment to the system’s accounting process which allows

you to perform intercompany transactions between accounts which reside in different ledgers with the same pro-

cessing date.

Delivery

SWIFT - Stop Delivery Service

Enhancement ID: 2104155

Available from: Release 201806

Users can now stop SWIFT delivery services when the company is offline.

What's New in R19 AMR - Page 11 of 94

SWIFT 2018 Rulebook Changes

Enhancement ID: 2368487

Available from: Release 201808

This functionality describes how Temenos Core Banking accommodates the SWIFT 2018 Rulebook changes. It includes

the changes made by SWIFT, which are described in the new version of the 2018 MT Standards Release. It also

includes the changes to the BIC standard that will also come into effect from November 2018, the same as the new

SWIFT standards.

Additional fields in Delivery Address

Enhancement ID: 2563259

Available from: Release 201809

Additional fields are introduced in Delivery Address to automatically copy the additional address details into the main

Customer Delivery Address (PRINT.1). For all the other Delivery Addresses, the Address field is manually entered.

This functionality also allows you to Enable or Disable the hold feature for different carriers.

SWIFT Non-Standard Characters in Names and Addresses

Enhancement ID: 2702516

Available from: Release 201810

This functionality covers the development and non-standard use of SWIFT characters in fields like name and address

but prevents the use of invalid characters in SWIFT messages.

Archival of EB.QUERIES.ANSWERS

Enhancement ID: 2765358

Available from: Release 201901

It covers functionality such as Moving the records from EBQA records from Live to History and Archiving the records

which have moved to History.

SWIFT Customer Security Program - Local Authentication

Enhancement ID: 2448568

Available from: Release 201904

This functionality is intended to cover the Security of the data flows which are exchanged between T24

(Back-office application) and the connected SWIFT infrastructure components (SWIFT Alliance Access).

It describes how the Local Authentication (LAU) principle is used to ensure the integrity and authen-

tication of the files that are exchanged by T24 with the SWIFT infrastructure (on inward and on out-

ward message flows).

The functionality is also about securing the inward and outward messages using a pair of bilateral security keys (kept

in a secure keystore). The Temenos Core System and the SWIFT infrastructure (eg SWIFT Alliance Access) use these

keys at the same time (the same pair of keys).

Interest and Charges

What's New in R19 AMR - Page 12 of 94

Maximum Interest Rate

Enhancement ID: 2539309

Available from: Release 201806

The functionality is part of the existing tables such as ACCOUNT.DEBIT.INT & GROUP.DEBIT.INT, where both tables

have the ability to enter maximum interest rate for overdraft accounts, that is, for maximum debit interest to be applied

to the DR balance type.

Compounding of Banded Interest Rate

Enhancement ID: 2343476

Available from: Release 201806

The functionality is part of the existing tables such as ACCOUNT.DEBIT.INT & GROUP.DEBIT.INT, where both tables

have the ability to enter maximum interest rate for overdraft accounts, that is, for maximum debit interest to be applied

to the DR balance type.

ISO20022 XML Account Statement1

CAMT Changes

Enhancement ID: 2453753

Available from: Release 201806

Changes are made to enhance the performance while producing CAMT messages and provision to add the local tags

via APIs.

Nostro Reconciliation

Aging Analysis

Enhancement ID: 2411415

Available from: Release 201806

Three new enquiries are added to the Nostro Reconciliation application to display the aged analysis of the unreconciled

items. They display number of days an item (ledger entry or Swift statement entry) has been in an unmatched state.

The historical and current aged analysis can be extracted and viewed.

Retail Sweeping

Value dated Retail Sweeps

Enhancement ID: 2324013

Available from: Release 201806

‘Value dated Retail Sweeps’ is an amendment to the system’s functionality of performing sweeping transactions

between accounts taking into consideration the value dated balance of the accounts.

What's New in R19 AMR - Page 13 of 94

System Tables

Increase in Tax Code Length

Enhancement ID: 2215793

Available from: Release 201806

The Tax application @ID which is currently 2 numeric (Effective date) has been extended to 4 numeric (Effective date).

Periodic Rate Days

Enhancement ID: 2342569

Available from: Release 201806

PERIODIC.INTEREST and FORWARD.RATES tables have been enhanced to hold values in number of days which are

greater than 31. The Rest.Period field now allows an input of 3 digit periods in the number of days.

Account Proxy Identifier

Enhancement ID: 2702104

Available from: Release 201812

This functionality allows banks to store the local Account Proxy directory and support the registration or de-registration

process involving an external central Account Proxy Database.

Monitoring Customer Dormancy

Enhancement ID: 2377912

Available from: Release 201901

Customer Dormancy Monitor is a new functionality to monitor Dormancy at customer level.

Support External DDA in Account Proxy Identifier

Enhancement ID: 2920507

Available from: Release 201903

This functionality provides support to use the Account Proxy Directory for accounts which are maintained in an external

DDA system.

LIMIT

Customer Limits Overview

Enhancement ID: 2323395

Available from: Release 201807

The CUSTOMER.SCV.CHECK enquiry is improved to aggregate the limits of a customer marked as duplicate to be dis-

played under the main customer, to drilldown and view Limit details for all limits displayed in the enquiry, to drilldown

and view account and transaction details for the accounts linked to the limits displayed in the enquiry and to display

account information belonging to a customer who doesn’t necessarily have a Limit record attached to it.

What's New in R19 AMR - Page 14 of 94

Support for Customer Sub Group in Risk Exposure Overview

Enhancement ID: 2638398

Available from: Release 201811

The Risk Exposure overview screen is improved with two new links added in Customer-Group Risk exposure overview

to view the details of Customers in the group and their relationship with other customers and to also view the list of Cus-

tomer-Sub-Groups created for the given Group ID.

You can drill down to the Risk Exposure details for customers defined in the sub group from the above Sub-Group list

view.

An option is allowed to add or remove customer numbers in the Limit application. Consolidation keys for Validation type

of Limits are generated to report in the General Ledger with customer information from the first customer in the multi-

value set.

Protection Usage with Multiple Arrangements

Enhancement ID: 2783211

Available from: Release 201902

The purpose of this development is to enrich the Protection Limit functionality to support multiple Channel arrange-

ments having Protection Limits and tagged to the same External User.

Repaid Non-revolving Limits and Store Repayment

Enhancement ID: 2834305

Available from: Release 201903

“Repaid Non-revolving Limits and Store Repayment”, is an amendment to the existing LIMIT.PARAMETER and LIMIT

tables, as well as with the dynamic calculation performed by Risk and Exposure Overview enquiries to display Limit

amounts.

Joint Owned Loans

Enhancement ID: 2048052

Available from: Release 201904

Under “Joint Owned Loans”, multiple features are developed within the LIMIT and LIMIT.PARAMETER tables where

the LIMIT Property Class is improved to capture the new Limit key and the CUSTOMER Property Class is improved to

use the current field Limit Alloc % for all owners of an arrangement.

Update Approved and Advised Limits

Enhancement ID: 2293158

Available from: Release 201904

Under the “Update Approved and Advised Limits”, multiple features are developed within the LIMIT.REFERENCE and

LIMIT tables, as well as with the manner with which limits are processed within the system.

ACCOUNTS

Float and Balances

Enhancement ID: 2364301

What's New in R19 AMR - Page 15 of 94

Available from: Release 201808

The concept of the Float (uncleared balance, sometimes called uncollected balance) refers to credit transactions posted

to a customer account, where funds credited are treated as cleared not instantly at the time of booking of the trans-

action but at a defined date in the future.

Statement Preferences

Enhancement ID: 2499867

Available from: Release 201808

This solution addresses the set of requirements such as ‘Statements Preferences’, ‘Standalone Statements’ and ‘Com-

bined Statements’.

Few additional fields and functionalities are introduced into the existing Core applications such as

ACCOUNT.STATEMENT, PRINT.STATEMENT and DE.CUSTOMER.PREFERENCES, which includes enabling the User to

input a set of off-cycle statements for the same frequency, the process of production from T24 of combined statements

and setting up default frequencies and printing features.

Funds Reservation in Balance Netting Pool

Enhancement ID: 2130265

Available from: Release 201809

Funds reservation in Balance Netting Pool’ is a development to introduce a manual and automatic fund reservation pro-

cess for members of the Balance Netting pool.

Non-Sufficient Funds (NSF) processing

Enhancement ID: 2617681

Available from: Release 201810

It covers functionalities such as Configurable Available Balance for NSF credit check, Pooling funds for credit checks,

Opt-In/Opt-Out of Limit facility for credit check, NSF Exception handling, Assessment of NSF item and Decision man-

agement and NSF Closing Evaluation process.

Secondary Limit on accounts for Direct Debit transactions

Enhancement ID: 2573368

Available from: Release 201811

‘Secondary Limit on accounts for certain Direct Debit transactions’ is an amendment to the AA

BALANCE.AVAILABILITY PROPERTY.CLASS.

This functionality provides the ability to configure the system to disregard the Intraday Limit when doing a credit check,

in case this is granted on the account.

Saving booked balance on the STMT.ENTRY

Enhancement ID: 2712985

Available from: Release 201812

The functionality is about saving booked balance on the STMT.ENTRY at the time the transaction is booked.

Processing Date in TXN.ENTRY.MB

Enhancement ID: 2796406

Available from: Release 201901

What's New in R19 AMR - Page 16 of 94

The functionality is about adding processing date to the core enquiry named TXN.ENTRY.MB.

Client Accounts without Interest and Charges

Enhancement ID: 2761438

Available from: Release 201901

The functionality is about making the Interest and charges module optional for Accounts.

Account Number Format

Enhancement ID: 2702238

Available from: Release 201901

The functionality is about offering a solution for the generation of scalable account ids.

Enhanced Transaction Search

Enhancement ID: 2898141

Available from: Release 201902

The functionality is about adding a new enquiry or API to retrieve the most recent number of entries.

Extend the Number of Decimals allowed for a Currency

Enhancement ID: 2819235

Available from: Release 201902

The functionality is about extending the number of decimals allowed for a currency.

Enhanced Transaction Search - Pagination and Others

Enhancement ID: 2933731

Available from: Release 201903

The functionality is about adding a new enquiry or API to retrieve the required number of entries or account movement

details available.

Transaction Restrictions

Transaction Stop Conditions

Enhancement ID: 2364382

Available from: Release 201808

A new module is introduced in the Temenos Core Banking System named ‘Transaction Restrictions’ (TZ). The Trans-

action Restrictions module allows the bank to define stop instructions for accounts that are evaluated when a debit book-

ing request initiated via Generic Accounting Interface (OFS Clearing) is processed on the account.

Block Creditors or Automatic debits from an account

Enhancement ID: 2634798

Available from: Release 201811

What's New in R19 AMR - Page 17 of 94

New features are added in the Transaction Restrictions module to allow the bank user or customer to blacklist or whitel-

ist specific Creditors to debit a customer account(s).

Moreover, the stop instructions allow the bank user or customer to restrict Direct Debit (DD) collections initiated under

a specific mandate reference and/or Creditor identifier to a maximum amount or an amount range.

Collateral

Preferential LTV for Diversified Portfolios

Enhancement ID: 2468312

Available from: Release 201808

Effecting the Preferential rate on diversified portfolios & applicability of a cross currency haircut when the collateral cur-

rency is different from the limit currency.

Concentration Checks for Client Portfolio

Enhancement ID: 2468312

Available from: Release 201809

This is an amendment to the existing Advanced Collateral (CX) functionality, which caters to the application of Con-

centration cap for Customer Collateral. Features such as Threshold or Qualifying Currency and Value, Collateral Lend-

ing Value (CLV) and Pre-trade check for Buying Power are added to this functionality.

Collateral Pledge Reduction

Enhancement ID: 2820983

Available from: Release 201901

This functionality is about the generation of an override in case of insufficient pledge for the utilized part of a variable

limit.

Advance Collateral - Cross Pledging

Enhancement ID: 2956072

Available from: Release 201904

This functionality is about applying Advance ratio to cross pledged assets which are now maintained at the Collateral

Right level instead of Customer level.

Collateral Link to New Limit Structure

Enhancement ID: 2960925

Available from: Release 201904

Functionalities under 'Collateral link to new Limit structure' are introduced within the COLLATERAL.RIGHT and LIMIT

tables to support attaching Collateral to Limits with new Limit key, as well as a new ACCOUNT.OVERDRAWN.CUST

table which holds overdrawn Accounts and exceeded Limits per Customer since now Limits can be multi-customer.

What's New in R19 AMR - Page 18 of 94

Expected Receipts

Pre-authorized Credits

Enhancement ID: 2366632

Available from: Release 201808

‘Pre-authorised credits’ is an amendment to the AC.EXPECTED.RECS application, where the system is improved to

increase the available balance of an account when an expected payment is entered in the system via the

AC.EXPECTED.RECS application.

Matching Payment Instructions and Cover Payments

Enhancement ID: 2645516

Available from: Release 201812

The functionality for automatic matching between payment instructions and cover payments describes how the cover

message such as MT202, MT202COV or MT910 received by the bank is matched against the payment message MT103

or MT202.

Matching of Advised Funds

Enhancement ID: 2645516

Available from: Release 201812

This functionality describes how the MT210 SWIFT message that is received through Delivery and uploaded directly in

the Expected Receipts module is matched against the MT103/MT202 SWIFT messages that are received through deliv-

ery and are processed by TPH (which sends them to the Expected Receipts module for matching)

Standing Order

Creation Of Beneficiary

Enhancement ID: 2366632

Available from: Release 201809

This functionality describes how Beneficiary and Standing Order applications from T24 capture the information related

to SEPA additional details.

It also includes adding additional SEPA fields in the Beneficiary and Standing Order application to fully support SEPA pay-

ments, and also update the mapping of the existing and new fields for the Beneficiary to Standing Order flow, and from

Standing Order to Payment Order flow.

Standing Order Execution Independent of COB

Enhancement ID: 2760724

Available from: Release 201903

This development introduces a new online service that processes standing order instructions outside the COB.

Data Framework

What's New in R19 AMR - Page 19 of 94

IF Reporting Balance

Enhancement ID: 2677928

Available from: Release 201810

When a business event occurs, the existing Customer Reporting Model publishes IF event records that carry data in

raw format. The raw data is then transformed into XML at runtime by the integration service.

The objective of this functionality is to optimise the size of the XML data that is dynamically sent for an Enterprise Ser-

vice Bus (ESB) to consume in case of high volume transactions.

Loan Loss Provisioning

Provision on Undrawn Limits for Overdraft

Enhancement ID: 2640024

Available from: Release 201811

It covers functionality such as Selection of Undrawn Limits for Overdrafts for standard provisioning, Classification of

Undrawn Limit for Overdrafts, Calculation of Provision on Undrawn Balance of the OD Limit and Posting of the Provision

on Undrawn Limits in Balance Sheet.

Provision on Bank Guarantee

Enhancement ID: 2639940

Available from: Release 201811

It covers functionality such as Selection of Bank guarantees issued for standard provisioning, Classifying the Bank guar-

antees, Calculation of Provision on Outstanding Balance of the Guarantee Issued and Posting of the Provision on Guar-

antee Issued in Balance Sheet.

Risk Segmentation and Provision Parameters

Enhancement ID: 2639980

Available from: Release 201812

It covers functionality such as Classification of borrowers under different Risk segment, Parameterise Segment-wise

provision percentage for Risk Classification, Parameterise Cut-off factor, if applicable to arrive at the Base Balance for

calculating provision and Process provision considering the parameters for Risk segmentation and cut-off factor.

Priority for Collateral Allocation

Enhancement ID: 2639993

Available from: Release 201812

It covers functionality such as Prioritising the credit facility for collateral allocation on the basis of risk, Allocation of the

Collateral and Provision calculation to mitigate the risk with the collateral allocated to the contract.

Joint Holder Provisioning

Enhancement ID: 2640035

Available from: Release 201812

What's New in R19 AMR - Page 20 of 94

This functionality is aimed at classifying the risk for the accounts or contracts held jointly by customers, for provisioning

purpose.

Generic Accounting Interface

Manual OFS Clearing Reversals

Enhancement ID: 2635768

Available from: Release 201811

A new application named Generic Accounting Request is introduced to capture a manual request to reverse a Generic

Accounting interface (GAI) booking transaction. After the Generic Accounting Request is approved the system auto-

matically generates a Generic Accounting message (OFS Clearing message).

Moreover, the Generic Accounting Interface now provides an option to supply a contra transaction code as part of the

entry which takes precedence over the contra transaction code indicated in the processing rule (AC.ENTRY.PARAM)

Restrict Off Balance Sheet Balancing Entries in OFS

Enhancement ID: 2960947

Available from: Release 201904

This functionality is about restricting balancing entries posted for off balance sheet entries (for contingent accounts)

when requests are posted through generic accounting interface.

IBAN

IBAN Creation using an Alternate Account Number

Enhancement ID: 2660141

Available from: Release 201902

The functionality is about IBAN Creation based on country specific rules.

Transaction Recycler

Handling cut-off time in Transaction Recycler

Enhancement ID: 2796634

Available from: Release 201904

The Transaction Cycler module (also referred as recycler) is improved to consider a cut-off time when the retry

requests are processed either Online or in Close Of Business. The cut-off time can be set up in the system as a retry con-

dition for a specific type of request or is sent by the Business Application, which initiates the request.

What's New in R19 AMR - Page 21 of 94

Business Intelligence

Data Warehousing

Extracting CoB Transactions in Incremental Mode

Enhancement ID: 1992849

Available from: Release 201807

The existing Incremental Mode of extraction is now optimized to extract T24 CoB transactions for Funds.transfer and

AA.ARRANGEMENT.ACTIVITY.

Improved Online Extraction Mode

Enhancement ID: 1992850

Available from: Release 201810

Experience the near real-time transactions and improved online extraction mode.

Integration of DW Online with Insight Online

Enhancement ID: 2803457

Available from: Release 201901

Integration of DW Online with Insight Online offers data integrity and synchronisation between near real-time DW and

Analytics.

Risk

Vanilla Instruments Pricing

Enhancement ID: 1992849

Available from: Release 201809

This feature now allows you to price the bonds and Asset-Backed Securities using discounted cash-flow mechanism.

You can now re-evaluate FX Spot Deals with the latest price available in FX Rate and Equity Trade Deals with latest

price. Cashflows for Bond with option can be generated.

Statistical PD Modelling

Enhancement ID: 2462766

Available from: Release 201809

Now you can calculate Probability of Default (PD) using Historical data under Statistical Methods.

Interest Rate Risk

Enhancement ID: 2538956

Available from: Release 201811

What's New in R19 AMR - Page 22 of 94

Changes to Interest Rate Risk in Credit Risk Module for Trading Book Transactions.

Changes to Specific and General Risk Capital Charge under Interest Rate Risk for Trading Book Trans-

actions.

Change in CRM for Off-Balance Sheet Exposures

Enhancement ID: 923804

Available from: Release NA

During Credit Risk Mitigation, Credit Conversion Factor is also applied to collateral value in addition to the outstanding

exposure amount. Credit Risk Mitigation value in the reports includes Credit Conversion Factor as percentage being

applied to the collateral value.

Liquidity Risk System (ALM) - Basel III LCR

Enhancement ID: 2535214

Available from: Release 201812

Liquidity Risk System now conforms to the latest BASEL Liquidity Risk Management Guidelines.

Changes to Operational Risk Standardised Approach

Enhancement ID: 1601536

Available from: Release 201903

After the introduction Basel III guidelines, the operational risk standardised approach's Business Indicator component

and Internal loss component calculations are now independent of existing Basel II computation.

Changes to Standardised Simple Mitigation Method

Enhancement ID: 2936530

Available from: Release 201903

The existing reports that allow the Standardised Comprehensive Mitigation method now supports Standardised Simple

Mitigation method too.

Statistical LGD modelling

Enhancement ID: 2033508

Available from: NA

Internal Rating Based (IRB) approach involves assigning risk weights based on the internal rating of the borrowers.

The ratings exercise must fulfill certain criteria to the satisfaction of the regulator. There are two options available.

They are Foundation approach and Advanced Approach.

What's New in R19 AMR - Page 23 of 94

Channels

Internet Banking

PSD2 Transparency Information

Enhancement ID: 2341151

Available from: Release 201806

Internet Banking Retail now complies with the transparency of conditions and information requirements for payment

services, as stipulated by the new PSD2 directive of the European Union.

Travel Notifications

Enhancement ID: 2347353

Available from: Release 201806

Internet Banking Retail now manages the logged in user’s travel notifications. The user may now view and manage

their active travel notifications, being able to add new ones, edit or delete existing ones. The notifications capture data

like the country of travel, the period and the purpose of the travel.

Consent Management

Enhancement ID: 2169734

Available from: Release 201807

Internet Banking Retail and Mobile Banking were recently updated to allow the logged in user to manage the consent

types for the use of personal data. The user may now view and edit his/her personal data consent types and any asso-

ciated consent sub-type(s), as stated in the GDPR regulation.

Updated Payment Workflows

Enhancement ID: 2620132

Available from: Release 201808

Internet Banking Retail payment workflows were recently updated, along with adding new payees workflows.

Enhanced Loans Functionality

Enhancement ID: 2288272

Available from: Release 201811

Internet Banking Retail Loans accounts were recently enhanced with new features, contained within two new tabs

accessible at Loan Account page level.

Enhanced Deposits Functionality

Enhancement ID: 2623196, 2623196

Available from: Release 201812

Internet Banking Retail Deposit accounts were recently enhanced with new features, contained within two new tabs

accessible at Deposit page level.

What's New in R19 AMR - Page 24 of 94

Enhanced Loans Functionality

Enhancement ID: 2798930, 2798930

Available from: Release 201812

Internet Banking Retail Loans accounts were recently enhanced with a new feature to repay some of the loan, con-

tained within the Repay Loan tab accessible at Loan Account page level.

Updated Alerts Functionality

Enhancement ID: 2288334

Available from: Release 201812

Internet Banking Retail's Alerts functionality at account level was recently updated, enhancing the manageability of the

alerts. Specifically, after selecting an account and then clicking on the Alerts tab, you may view the alert groups, col-

lapsed.

Enhanced Cheques Functionality

Enhancement ID: 2293366

Available from: Release 201901

Retail Cheques functionality at account level was recently enhanced with new features, contained within the pre-exist-

ing nested tabs accessible at Accounts page level - Cheques tab.

Letter of Credit

Enhancement ID: 2664294

Available from: Release 201901

Letter of Credit is a bank service ensuring payment of the amount indicated in the letter of credit to the Seller as per the

Buyer's instructions against the shipment of goods, performance of other conditions stipulated in the letter of credit and

submittal of relevant documents.

User Administration

Online Arrangement Validations

Enhancement ID: 2584355

Available from: Release 201809

All the changes to a Master Arrangement are validated against the Product Conditions that the Arrangement is set up

against and they never augment the functionality beyond that. If any update exceeds the Product Conditions, then an

error is displayed and the user is prevented from proceeding further.

User Administration as a Business Component

Enhancement ID: 2569248, 2594359, 2594359 and 2644743

Available from: Release 201810

User Administration as a Business Component, newly introduced controls for external users and other improvements.

Purging unused external user Customer through COB Job

Enhancement ID: 2731491

Available from: Release 201902

What's New in R19 AMR - Page 25 of 94

The Indirect External User of an Internet Banking solution, a record in the EXTERNAL.USER table, is linked in Core

Banking to a CUSTOMER record of type External User. This type of ”Customers” of the Bank do not own any financial

products, otherwise they would have the CUSTOMER record of type Active.

External User Type Handling

Enhancement ID: 2731526

Available from: Release 201902

External Users can access the Internet Banking solutions determined by the Arrangements they are linked to.

Extensions to Sub-Arrangements

Enhancement ID: NA

Available from: NA

Online Arrangements are subject to change and in that case, any Roles (Sub-Arrangements) and External Users linked

must be re-evaluated according to the impact those changes have on them. In order to grasp all the changes and cor-

relate the effects with the impacted solutions, the following aspects are detailed:

l Updating the Master Arrangements and the subsequent Sub-Arrangements;

l Tracking updates for each External User linked to an Online Arrangement;

l Rebuilding EXT variables in cache files to reflect updates in Permissions.

TC Licensing - User and Role Licensing for Master Arrangements

Enhancement ID: NA

Available from: NA

Banks need to be able to track the licenses sold to their Customers and control the number of External Users and Roles

created for Online Arrangements, by both Bank Users and External Administrators. A new property class is imple-

mented in order to provide these functionalities. This is a non mandatory property class for the Online Services Product

Line and it stores the maximum numbers of Users that can be linked to Online Arrangements and maximum number or

Roles that can be linked to a Master Arrangement.

External User Licensing

Enhancement ID: NA

Available from: NA

The number of allocated External Users licenses from the Online Services Arrangements must be directly compared to

the maximum number of available licenses stored in Core Banking to prevent unauthorised creation of External Users

beyond the licenses granted by Temenos to the Bank.

What's New in R19 AMR - Page 26 of 94

Corporate

Cash Management

Arrangement Level Inheritance

Enhancement ID: 2368167

Available from: Release 201806

Transaction Accounts in a Balance Netting Cash Pool Hierarchy can now get their Interest, Charge and Payment sched-

ule conditions defaulted from another Account placed higher up within the hierarchy.

Automation of Balance Netting Pool Administration

Enhancement ID: 2234578, 2141429, 2575480

Available from: Release 201809

System now supports the automation of administrative tasks related to the Balance Netting (BN) Pool Administration

through the lifecycle viz., opening, maintenance and closure of the Pool.

l Opening a Pool structure takes the User through a purpose built workflow starting from creating a Draft Struc-

ture, moving it to Preliminary and then taking it Live.

l Maintenance of the Pool structure includes Pool level events such as, addition/removal (external restructuring)

or changing parent (internal restructuring) of the accounts in the Pool – This is allowed both in the Preliminary

and in the Live status.

l Closure events in the Pool structure could be that of an individual account or a substructure or Currency position

or that of the whole Pool itself.

l Several validations and orchestrations are in place to guide the user.

Rescheduling Failed Closure Process in BN

Enhancement ID: 2692781

Available from: Release 201811

System automatically reschedules the closure event, which has failed during the SOD process to the next working day.

Changing Pricing Plan in Bundles

Enhancement ID: 2706316

Available from: Release 201812

It is now possible to update a Pricing Plan for BN Pool at any lifecycle stage if the Pricing Rule as Manual.

Fund Reservation during External Restructuring in BN Pool

Enhancement ID: 2692786

Available from: Release 201812

It is now possible to consider locked funds when adding a Standalone account to the Pool and remove a TR account

from the Pool. Automatic cascading funds reservation to the Parent Accounts in the Pool hierarchy is possible when

funds are locked in the TR account.

What's New in R19 AMR - Page 27 of 94

Enquiries in Balance Netting for Bank User Interface

Enhancement ID: 2576017

Available from: Release 201812

New enquiries are added to Balance Netting feature for easing Bank User Interface.

Future STO and Sweeps in BN Pool

Enhancement ID: 2692789

Available from: Release 201812

It is now possible to setup Standing Orders and Sweeps in the BN Pool that is in Preliminary stage. The Standing Orders

and Sweeps go live after the Pool and the specific Account in Pool goes live.

Corporate Cash Pooling

Enhancement ID: 2420544

Available from: Release 201812

Corporate Cash Pooling and Sweeping” is functionality to the existing AC.CASH.POOL

AC.CP.GROUP.PARAM and AC.SWEEP.TYPE applications.

The applications are modified to support various functionalities such as:

l Setting a Priority Order for sweep transfers

l Setting Minimum amount to transfer to be taken into consideration by the system

l Setting criteria for calculating the amount to be swept in Increments

l Possibility to choose new balance types to use

l Setting a Maximum Amount for the Concentration account

l The possibility of setting up a different Partial Transfer criteria

l Possibility to Suspend the entire Cash Pool or a Sub-Group

l Possibility to set an External Corporate sweep

l Possibility to transfer the Float to the ultimate parent of the Cash Pool

Disable Cover Control at Transaction Level

Enhancement ID: 2689261

Available from: Release 201902

“Using CT’s balance as sweeping criteria and to disable Cover Control at TR level” is an amendment to the existing

AC.SWEEP.TYPE application, as well as an improvement of the Cover Control functionality, based on transaction codes.

Sweep Options for a Non-banking Day

Enhancement ID: 2689236

Available from: Release 201902

“Sweeps options for a non-banking day” is an amendment to the existing AC.CASH.POOL and STANDING.ORDER

applications to perform sweeps and standing order transactions on the same day in case the accounts involved in the

transfer reside in different T24 companies, and there is a non-working day when the transactions are scheduled.

What's New in R19 AMR - Page 28 of 94

Sweeping with Same Booking and Value Date

Enhancement ID: 2542522

Available from: Release 201902

‘Sweeps with Split Per Value Date’ is an enhancement in the existing functionality of the corporate bal-

ance sweeping.

This enhancement brings new functionalities, such as:

l To set the sweep intra-day run time, based on the server or company time

l To define sweep cut-off time for all accounts of T24 companies (which are part of the same

sweeping group) and apply it for all intra-day sweep executions

l New enquiry for intra-day sweep executions

Sweeps with Split Per Value Date

Enhancement ID: 2542481

Available from: Release 201902

‘Sweeps with Split per Value Date’ is an enhancement to the existing AC.CASH.POOL and

AC.SWEEP.TYPE applications.

The applications are modified to support various functionalities such as:

l To choose new balance type to use

l To set whether the sweep needs to transfer booked balance split per value date or booked bal-

ance in one tranche

Integrity Checks in BN Pool

Enhancement ID: 2692769

Available from: Release 201902

Integrity checks can be performed in BN Pool to identify the validations' errors that appears when the

event is performed in live.

Running Multiple Intraday Value Date Based Sweeps

Enhancement ID: 2689294

Available from: Release 201903

‘Running multiple intraday value dated based sweeps’ is a development to the existing corporate

sweeping functionality. The system allows the sweeping transactions to be performed multiple times

per day and at the end of day. Based on both the booked dated balance and value dated balance, the

system triggers transaction based on sweeping account’s balance.

Letters of Credit

SWIFT Release 2018

Enhancement ID: 1834784, 2369671, 2369710, 2369713, 2369717, 2369719, 2369721, 2369731, 2494146

What's New in R19 AMR - Page 29 of 94

Available from: Release 201806

A significant overhaul of the Category 7(Trade Finance) interbank MTs is addressed and the messages are upgraded to

increase automation, reduce enquiries and address the existing gaps.

Link to POA – Export Drawings and Import drawings

Enhancement ID: 1448490, 1841362

Available from: Release 201811

External Payment for drawings booked under Import / Export Letter of Credit is linked and routed through centralized

payment module (PAYMENT.ORDER).

TCIB - LC Issuance Revamp

Enhancement ID: 1927769

Available from: Release 201901

Corporate customers who are TCIB enabled are currently able to place LC Issuance requests online,

view status of the transactions and provide instructions for further action to the bank.

Miscellaneous Deals

SWIFT Release 2018

Enhancement ID: 2369731, 2494146

Available from: Release 201806

A significant overhaul of the Category 7(Trade Finance) interbank MTs is addressed and the messages are upgraded to

increase automation, reduce enquiries and address the existing gaps.

Integration of POA with MD

Enhancement ID: 2277467

Available from: Release 201812

This functionality is for the integration of POA with the MD module. A payment order is an alternate mechanism for

executing a payment in MD. When the payment order is opted as the payment method, the payment is sent/received

through the POA in the MD application.

Syndicated Lending

Syndicated Loan module - Modification to Accounting entries & Transaction code

(Narrative)

Enhancement ID: 2540747

Available from: Release 201901

The objective of this functionality arises as a resolution to an issue raised by the Client indicating incon-

sistent Accounting entries & Transaction narratives’ for similar events in the life cycle of a Facility /

Commitment / Loan between LD and SL modules.

What's New in R19 AMR - Page 30 of 94

Country / Regional Solutions

Argentina Model Bank

CBU code for Accounts

Enhancement ID: 2826753

Available from: Release 201903

The CBU Code functionality allows the creation of current, special and saving account with a banking standard for the

account number. It is a public code used in Argentina by banks for the identification of their customer’s accounts. While

each bank identifies accounts with internal numbers, the CBU identifies an account uniquely throughout the Argentine

financial system since Central Bank of the Argentine Republic (BCRA) regulated its use.

Creation of beneficiaries with CBU Code and/or Alias name

Enhancement ID: 2866273

Available from: Release 201903

According to Argentina regulation, you can create beneficiaries with CBU code and/or Alias name.

Validating Cheque Authenticity

Enhancement ID: 2866270

Available from: Release 201903

You can now validate local cheques based on the Central Bank of Argentina (CBRA) regulation.

Special Savings Account for Authorized Minors

Enhancement ID: 2866308

Available from: Release 201903

Savings Account for Authorized Minors is a product that is offered to customers in Argentina due to

country’s regulation. A guardian is the account owner, and a minor is a joint owner that is able to use

the account.

Dormancy Process

Enhancement ID: 2912664

Available from: Release 201903

In Argentina model bank, it is now possible for the banks to manage the inactivity process of both sav-

ings and current accounts of customers.

Capture Additional Customer Information

Enhancement ID: 2817700

Available from: Release 201904

This feature explains the regulation carried out by Argentina, where banks need to capture additional

customer information during on-boarding process.

What's New in R19 AMR - Page 31 of 94

Alias CBU for Saving and Current Accounts

Enhancement ID: 2826777

Available from: Release 201904

In Argentina Model Bank, you can now have a CBU Alias in order to identify the originator of each

transfer received.

Balance Check between Accounts

Enhancement ID: 2826777

Available from: Release 201904

You can now define sweeps between accounts to move balances during insufficient balance in primary

account. The sweeps are done based on a defined hierarchy of accounts.

Australia Model Bank

Annual Investment Income Report

Enhancement ID: 2699435

Available from: Release 201812

You can now generate an Annual Investment income report (AIIR) as required to be furnished by the investment bod-

ies in Australia to the taxation authorities.

Customer and Party

Enhancement ID: 2658175

Available from: Release 201901

You can now capture the KYC verifying details, Australian Business Number (ABN), Australian Company Number

(ACN), and Tax File Number (TFN) of Australian customers.

Withholding Tax

Enhancement ID: 2658232

Available from: Release 201904

You can now apply WHT on the interest credited or paid to the customer as per the guidelines provided by ATO in Aus-

tralia.

Finland Model Bank

Initial Periodic Interest Reset

Enhancement ID: 2378023

Available from: Release 201805

In Finland Model Bank, the country layer provides the following functionality:

What's New in R19 AMR - Page 32 of 94

l The periodic interest rate reset is based on the market conventions such as EURIBOR, STIBOR etc.

l These rates are uploaded in T24, based on certain key dates for loans and deposits such as system date,

arrangement creation rate and the disbursal date.

l The rates have 2-day spot value (T+2).

Penalty Interest Calculation

Enhancement ID: 2466910

Available from: Release 201809

You can now define the product conditions and logic in a loan for switching to a highest interest rate, for the penalty

interest, in the event of a default, in repayment of a lending arrangement.

Prevention of Loan Disbursements during a restricted time

Enhancement ID: 2573125

Available from: Release 201811

You can now restrict loan disbursement in Finland Model Bank during a restricted time.

France Model Bank

NPAI Flag

Enhancement ID: 2667212

Available from: Release 201901

The mail provider can provide the list of customers to the bank, where it could not deliver mail due to NPAI (N’Habite

Plus à l’Adresse Indiquée – No longer lives at this address) scenario. The bank after receiving this file updates the NPAI

flag at the Customer level.

Generic Regional Solutions

Loans, Deposits and Payment Dues

Enhancement ID: 2553478

Available from: Release 201808

You can now use the core TAX functionality of T24 to support GST (Goods and Service Tax).

Swift Alliance Interface

Enhancement ID: 2484554

Available from: Release 201809

The SWIFT Alliance interface helps you to communicate between financial institutions for financial transactions. It also

acts as an Interface in T24 and other external interfaces to exchange secured information.

ATM Framework

Enhancement ID: 2783269

Available from: Release 201812

What's New in R19 AMR - Page 33 of 94

ATM Framework provides a structure to define ISO message fields, provide information for mapping the ISO message

fields to T24, define the way the ATM Transactions updates T24, the ISO response code to be sent back to the Switch,

etc,.

The Structure of the ISO Message sent from the Switch and the way ATM Transactions updates are done in T24 can be

customised using the framework.

You can now also pass multiple transactions in a single OFS message for processing in T24, triggered by a single ATM

transaction. This is done by indicating, it is a bulk message (indicated by the keyword BULK) in the OFS message.

GST Enquiry

Enhancement ID: 2524747

Available from: Release 201809

You can now use an online enquiry to check GST transactions.

Bloomberg Pricing Interface

Enhancement ID: 2678498

Available from: Release 201804

You can now have an Interface between T24 and the Bloomberg financial institutions to carry out financial transactions

from Bloomberg to T24.

Hong Kong Model Bank

DD Mandate

Enhancement ID: 2416903

Available from: Release 201806

In Hong Kong Model Bank, a user can create the mandates manually, and further through the request from channels

like HKICL.

DD Processing

Enhancement ID: 2238984

Available from: Release 201806

When claims are received for DD mandates, various validations are performed for the debit account including posting

restriction, dormancy, and insufficient funds. Based on the validations, the transactions are either rejected or tagged as

a HOLD item for user action at the later point time.

Ad-Hoc Holiday

Enhancement ID: 2152678

Available from: Release 201806

In Hong Kong Model Bank, banks can mark the holidays on ad-hoc basis in their core banking systems, which results in

extension of transaction credits to the customer accounts, and thereby an adverse impact on transactions are avoided.

CNY Remittance

Enhancement ID: 2152665

Available from: Release 201806

What's New in R19 AMR - Page 34 of 94

Hong Kong Model Bank now complies with CNY Remittance regulatory requirements.

Bulk Processing

Enhancement ID: 1996088

Available from: Release 201806

Hong Kong Model Bank now supports bulk processing feature that includes collections / Auto-Debits or payments /

Auto-Credit.

Privileged and Step-up deposit

Enhancement ID: 2352472

Available from: Release 201808

In Hong Kong Model Bank, Privileged and Step-up deposits can be offered on campaign basis to the customers of the

bank.

Hungary Model Bank

Processing and Validating Payment Orders

Enhancement ID: 2628219

Available from: Release 201810

In Hungary model bank, you can validate the received payment message to check whether the received BBAN is cor-

rect, BIC is valid or IBAN present in the payment message.

Validating Transactions using GVT

Enhancement ID: 2806311

Available from: Release 201812

You can now validate payer and payee’s account number based on GIRO CDV and GVT validation.

Alias account identifiers service

Enhancement ID: 2536710

Available from: Release 201812

Alias identifiers are identifiers that the customer may link with the payment account numbers, so that they can be used

instead of account numbers while generation of Instant payment order.

Lebanon Model Bank

Guarantee

Enhancement ID: 2580868, 2579152

Available from: Release 201902

You can now set a restriction to the number of renewals allowed for the guarantee, i.e. the maximum number of times

the expiry date can be extended.

Stamps and Taxes

Enhancement ID: 2580777

What's New in R19 AMR - Page 35 of 94

Available from: Release 201904

The Bank can now collect tax settlement for various type of taxes, transfer the same to the head office account, and

capture stamps purchase and stamps usage related transactions.

Honorary

Enhancement ID: 2580777

Available from: Release 201904

You can now calculate honorary amount for the Lawyer online and capture the Summon details send to the customer or

guarantor.

Luxembourg Model Bank

Local Withholding Tax Movement

Enhancement ID: 2453559

Available from: Release 201812

In Luxembourg Model Bank, when the credit interest rate becomes less than 0.75 percent, banks proposes to exclude

the income on those days during the calculation of With Holding Tax for residents on credit interest income.

VAT Reporting

Enhancement ID: 2688916, 2698918, 2698922

Available from: Release 201901

In Luxembourg Model Bank, banks can charge the appropriate VAT tax based on the Customer set up and cor-

responding charge details.

Early Repayment Fee

Enhancement ID: 1996582

Available from: Release 201902

When the customer decides to pre close his loan earlier than the term agreed the bank charges an early repayment

fee. This is calculated based on specific formula.

Certificate of Interest Paid

Enhancement ID: 2675214

Available from: Release 201904

This feature helps you to generate a certificate of interest paid by customer for loans and overdrafts, and a certificate

of interest received by customer for deposits and accounts.

Mexico Model Bank

Account Compliance CLABE

Enhancement ID: 2667212

Available from: Release 201901

What's New in R19 AMR - Page 36 of 94

You can now create current and saving accounts with a banking standard for numbering bank accounts in Mexico. This

ensures that interbank funds transfers, payroll deposits or automatic service charges are made in the correct accounts.

Customer Compliance – Legal ID

Enhancement ID: 2752782

Available from: Release 201904

You can use this feature to capture the legal ID of the customer.

Saudi Arabia Model Bank

SIMAH

Enhancement ID: 2960759

Available from: Release 201903

This feature covers the reporting structure of customer’s credit information to credit bureaus.

Watheeq Services

Enhancement ID: 2690691

Available from: Release 201904

The functionality focuses on extending the Watheeq services to connect a financial institution with the statutory organ-

izations.

Singapore Model Bank

Securities Orders funded through MF and CPF

Enhancement ID: 2104896

Available from: Release 201806

MF/CPF- Securities Orders Funded through CPF makes it possible to select CPF-OA (CPF Ordinary Account) and CPF-SA

(CPF Special Account).

Signature Portfolio Valuations

Enhancement ID: 2104896

Available from: Release 201806

A new framework named Signature Portfolio is introduced which can accept the valuation amount for a particular pos-

ition, that is, a combination of Portfolio and Instrument.

Sweeping TAXGST

Enhancement ID: 2709580

Available from: Release 201810

The sweep feature enables you to sweep the input and output GST tax into GST currency account and provides an auto-

matic resweeping feature when reversed transactions are required.

Refund TAXGST

Enhancement ID: 2709525

What's New in R19 AMR - Page 37 of 94

Available from: Release 201810

You can now refund commissions and taxes for transactions that are collected from customers.

Spain Model Bank

NIE-DNI-CIF Validation

Enhancement ID: 2481470

Available from: Release 201805

The legal ID is a mandatory field during the customer creation process. The validation is performed through the check

digit algorithm for each legal ID.

Payroll Account

Enhancement ID: 2468754

Available from: Release 201805

In Spain Model Bank, the Payroll Account feature allows the banks to define the predefined credit amounts, which if

present in an account, it switches the vanilla current account to a payroll account. In absence of these predefined cred-

its, the account is switched back to a current account.

Customer Search

Enhancement ID: 2493399

Available from: Release 201805

In Spain Model Bank, this feature facilitates the additional search criteria that is now added for easy search option for

the bank users.

Customer Additional Fields

Enhancement ID: 2473592

Available from: Release 201805

In Spain Model Bank, this feature captures additional details of customer during customer creation process.

Restriction of Customer Status Change

Enhancement ID: 2472150

Available from: Release 201806

In Spain Model Bank, this feature restricts the mixture of residents and non-residents holding a Joint account/deposit.

Payment Cheque Validation

Enhancement ID: 2496030

Available from: Release 201806

In Spain Model Bank, this feature supports the validation of the control digit in MICR.

Non-Emancipated Minors

Enhancement ID: 2495996

Available from: Release 201806

What's New in R19 AMR - Page 38 of 94

In Spain Model Bank, this feature checks and validates the legal ID provided by the minor customers while opening the

account.

Validating the Joint Holder

Enhancement ID: 2565602

Available from: Release 201807

When a joint account / deposit is opened or amended, this validation feature allows you to validate the residential

status of the beneficial owners of the arrangement.

Changing Young Account to Open Savings Account

Enhancement ID: 2544431

Available from: Release 201807

In Spain Model Bank, you can open the Young Account for minors under the age of 18 and can change the account to

Open Savings Account as the minor reaches the age of 18.

Capturing the Non-Customer Information

Enhancement ID: 2495983

Available from: Release 201807

In Spain Model Bank, you can capture the non-customer information during cash transactions and the system can dis-

play the cash transactions performed by non-customer, through an enquiry, by date.

Rounding of Interest Rates

Enhancement ID: 2576365

Available from: Release 201808

In Spain Model Bank, all banks and financial institutions can round off the interest rates values during events affecting

the interest rates.

Account Verification

Enhancement ID: 2496013

Available from: Release 201808

In Spain Model Bank, this feature reduces the documentation effort and background verification process of a new

onboarding customer.

Teller Report

Enhancement ID: 2671349

Available from: Release 201808

You can now send a report containing the details of all cash transactions (incoming and outgoing) along with denom-

ination information to the Central Bank of Spain for a specified period.

Validating Spanish Names and Address

Enhancement ID: 2481470

Available from: Release 201808

What's New in R19 AMR - Page 39 of 94

In Spain Model Bank, you can now use the CUSTOMER application to capture and maintain certain customer related

information.

Additional Collateral Fields

Enhancement ID: 2495981

Available from: Release 201808

It is now possible to store additional collateral details of a customer for lending.

Product Limits

Enhancement ID: 2608650

Available from: Release 201809

You can now parameterize limits based on count, amount or both for the various products. These limits can be defined

at a Company level, Channel level and Campaign level.

Spanish Fiscal ID

Enhancement ID: 2496008

Available from: Release 201809

The Spanish Fiscal ID from incoming DD mandate message can be validated against the values stored in customer

records in T24. On successful validation, system processes the payment.

Confirmed Cheques

Enhancement ID: 2493776

Available from: Release 201811

In Spain Model Bank, you can now request the bank to add confirmation for the cheque amount. It also allows you to

cancel, stop and inward clearing of a confirmed cheque.

Customer Payment for Social Security Taxes

Enhancement ID: 2539246

Available from: Release 201811

Tax payments could be classified as Autoliquidation, Liquidation and state taxes and each of these taxes are uniquely

identified by way of the associated tax model codes. Banks can collect taxes from customers by way of cash deposits

or through account transfer and remit these funds to the tax authorities. Banks are further obliged to transmit these

details at a pre-defined frequency with the tax authorities.

Informa Extract and Upload

Enhancement ID: 2545446

Available from: Release 201810

You can use Informa, a database that contains customer information like commercial, financial and other business

information which helps you to overcome manual effort in collecting all information from customers directly.

INEM

Enhancement ID: 2544582

Available from: Release 201811

What's New in R19 AMR - Page 40 of 94

Social benefits can now be provided to eligible citizens of Spain through a special institution knowns as INEM. It sends

credit request to bank once in every month.

IMSERSO Special Institutions

Enhancement ID: 2519064

Available from: Release 201811

This feature relates to IMSERSO-Special Institutions to initiate bulk customer credit transfer initiation message in pro-

prietary format to T24 with one or more customer credit transfer instructions. The Bank receives payment trans-

mission flows from IMSERSO-Special Institutions and the same needs to be processed by T24/TPH as per payment

instructions as credit transfers to the corresponding customers.

Forwarding Direct Debits Mandate

Enhancement ID: 2609030

Available from: Release 201812

You can now set up a forward account for direct debit (DD) mandates in the event that the mandate holder approaches

a bank with such a request.

Social Insurance Payments

Enhancement ID: 2593883

Available from: Release 201901

T24 has a provision which banks in Spain can use to collect social insurance payments on behalf of the insurance entity

TGSS (General Treasury of Social Security).

Non Resident Payments

Enhancement ID: 2544473

Available from: Release 201902

This feature relates to the Spain National Electronic Clearing System (SNCE) managed by Iberpay has

the scheme of SNCE_03 to accommodate payment transfer for Non Residents.

The Bank receives non-resident payments instructions in Spanish specific format SNCE03, wherein the

same needs to be processed by T24/TPH as per payment instructions as credit transfers and process

claims from the corresponding customers.

SNCE04 Cheques and Drafts

Enhancement ID: 2542954

Available from: Release 201902

In Spain, the clearing of cheques is carried out using a proprietary message format called SNCE04.

This development pertains to the receipt of standard SNCE04 format files into T24, and the generation

of outward SNCE04 file formats.

Sepa Iberpay Instant payments

Enhancement ID: 2976573

Available from: Release 201904

What's New in R19 AMR - Page 41 of 94

The directories for SEPA are available in T24. The framework for uploading the directories is available and the same

are configured and used for loading the Iberpay directory as well.

Miscellaneous Payments

Enhancement ID: 2539418

Available from: Release 201902

In Spain model bank, you can interchange payment instructions that are not covered under standard SNCE message

types.

Creating 20 Digit Security Number

Enhancement ID: 2764797

Available from: Release 201902

This feature allows you to create 20 digit alternate portfolio id using specific business validations and then you can use

this unique id as a search criterion in various enquiries.

Open Bank Provisioning

Enhancement ID: 2950740

Available from: Release 201903

You can now have a holistic view of Asset Classification and Provisioning covering both Funded and Non Funded Credit

across Loans, Overdraft, and Bank Guarantees for both Single Account and Joint Account.

Cartera Payments

Enhancement ID: 2496043

Available from: Release 201903

This feature relates to the Spain National Electronic Clearing System (SNCE) managed by Iberpay. You can use this fea-

ture to accommodate payment transfer for commercial transactions settled by the use of promissory notes, bills of

exchange, domicile payments and other such instruments.

Accounting Bulk

Enhancement ID: 2608655

Available from: Release 201903

The purpose of the development is to provide an enquiry with all the details such as Bulk Id, total

amount, status of the transaction, individual payments, transaction amount, status, issuer and des-

tination accounts.

Account Statements in NORMA 43 Format

Enhancement ID: 2833766

Available from: Release 201904

This feature helps you to provide account statements to customers in NORMA 43 format.

DD Account Forward Notification

Enhancement ID: 2780323

Available from: Release 201904

What's New in R19 AMR - Page 42 of 94

This feature helps to change the customer’s account number, which is given in the direct debit man-

date through Cuaderno 72.

Additional transaction Id for Funds

Enhancement ID: 2764835

Available from: Release 201904

You now have a field in the SEC.OPEN.ORDER application where you can store the Transaction Id

provided by All Funds Bank (AFB) for every Fund transaction that happens in the SEC.OPEN.ORDER

application.

United Arab Emirates Model Bank

Direct Debit System

Enhancement ID:

Available from: Release 201807

This feature provides an alternative method of effecting recurring payment transactions for utility services such as tele-

phone bills, electricity bills, insurance premiums, card payments and loan/finance repayments, which would reduce the

need for issuing and handling paper instruments.

Wages Processing System

Enhancement ID:

Available from: Release 201807

This feature provides a safe, secure, efficient and robust mechanism to streamline the timely payment of wages to

employees by their employers.

Image Cheque Clearing System

Enhancement ID: 2245161

Available from: Release 201809

Image Cheque Clearing System (ICCS) reduces the dependence of the payment infrastructure on the physical move-

ment of paper, and therefore facilitates shorter clearing and settlement cycles.

Payments Transaction Indicator

Enhancement ID: 2245418

Available from: Release 201810

You can now use an indicator to process payments transaction either through RTGS or SWIFT.

United Kingdom Model Bank

ISA Electronic Transfer

Enhancement ID: 2173103

Available from: Release 201812

What's New in R19 AMR - Page 43 of 94

You can now print advices for the various status movements of the ISA Electronic Transfer and the arriving at the

Actual Transfer amount from one bank to another.

Extracting T24 AA mortgage into MSO

Enhancement ID: 2590586

Available from: Release 201902

You can now extract T24 AA Mortgage products into MSO system.

Faster Payments Redirect Files

Enhancement ID: 25583349

Available from: Release 201903

Faster Payments Redirect Files details the processing of FP Redirect files by T24

Mortgage Creation and Disbursement

Enhancement ID: 2925630

Available from: Release 201904

You can now create Mortgage loan arrangement for customers based on the request received from

MSO. Based on this request you can also create Collateral/ Collateral Right/ Collateral origination

details, Beneficiary, Direct debit mandate and disbursements to the beneficiary through payment

order.

BBSI Reporting

Enhancement ID: 2667247

Available from: Release 201904

The Bank Building Society Interest (BBSI) reporting feature helps to report the interest paid or credited

to customers.

Vocalink Direct Debit Originator (DDO) Directory Import

Enhancement ID: 2676594

Available from: Release 201904

You can now receive Direct Debit Originator details from vocalink system and upload the details into

T24.

United States

Account Inquiry

Enhancement ID: 2343143

Available from: Release 201807

The bank requires the ability to view all maintenance changes performed on an account record, and search monetary

and maintenance activities using predefined selection criteria. The Account Inquiry enhancement meets these require-

ments plus has additional filtering options used to display specific types of changes or amendments.

What's New in R19 AMR - Page 44 of 94

Large Bank Failure

Enhancement ID: 2260554

Available from: Release 201807

FDIC Large Bank Failure functionality provides the user the ability to perform tasks in accordance with the FDIC Large

Bank Failure requirements and regulations, including:

l Provisional holds on a subset of deposit accounts.

l Extract files

l Receive processing files from the FDIC in order to comply with the Large-Bank Insurance Determination

Modernization rule (the Rule).

Federal Reserve Accounts Sweeps

Enhancement ID: 2309199

Available from: Release 201808

Federal Reserve Account Sweeps (Reserve Reclassification) is a new enhancement on top of existing functionality in

USMB, which provides the bank the ability to:

l Define the rules and parameters regarding the Federal Account Sweeps.

l Determine the Target Balance for the transaction sub-account.

l Perform daily sweeps between the transaction sub-account and non-transaction sub-account.

l Count the transfers from the non-transaction account and reset the counter on monthly basis.

l Provide reports from the Federal Account Sweep process.

Bonus Payout

Enhancement ID: 2301857

Available from: Release 201806

The bank offers products that pay bonuses on accounts that satisfy specific behavior during specific periods. This solu-