Documente Academic

Documente Profesional

Documente Cultură

The Basic Financial Statements

Încărcat de

Park ChimmyTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

The Basic Financial Statements

Încărcat de

Park ChimmyDrepturi de autor:

Formate disponibile

THE BASIC FINANCIAL STATEMENTS

Financial Statements are the formal reports prepared by accountants. These statements show the

financial effects of transactions and other events that grouped into broad classes according to their

economic characteristics. These broad classes are called elements of financial statements.

Financial Statements are the following:

1. Statement of Financial Position – also known as the Balance Sheet shows the financial

condition of the business entity at any given time. This statement conveys information about the

business entity’s liquidity, solvency, stability, capital structure, and financial flexibility. The

accounting elements of the financial position are ASSETS, LIABILITIES, AND EQUITY.

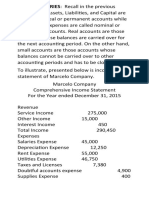

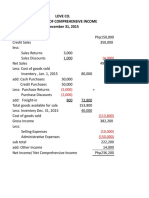

2. Statement of Comprehensive Income – is also known as the Income Statement. This accounting

report shows the operating performance of the business entity for a given period. The

accounting elements of this report are REVENUES AND EXPENSES.

3. Statement of Changes in Equity – shows the movements in the various elements of the owner’s

equity or capital for a certain period. The following are the basic components of this statement:

a. Owner’s investments to the business.

b. Profit or loss for the period.

c. Owner’s personal withdrawals, and

d. Prior period adjustments.

4. Cash Flow Statement – The financial report explains the changes of cash and cash equivalents

during an accounting period.

A cash equivalent is a short-term, highly liquid investment that is easily convertible to cash.

The components of a cash flow statement are classified into the following activities:

a. Operating – the inflows and outflows of cash from the normal operating activities of the

business.

b. Investing – the inflow and outflow of cash from the sale or purchase of assets other than

inventory.

c. Financing – the inflows and outflows of cash from the owners and creditors of the enterprise.

The components of the cash flow statement merely explain the sources and uses of cash. CASH is

one of the components of the current assets in the Statement of Financial Position.

5. Notes to the Financial Statements – The parenthetical disclosures and notes to the financial

statements are considered part of the basic financial statements to achieve proper

understanding of the financial reports.

ELEMENTS of FINANCIAL STATEMENTS (FS)

1. Assets – These are resources owned or controlled by an entity resulting from past events and

from them, future economic benefits are expected to flow to the entity.

2. Liabilities – These are existing obligations of the entity arising from past events; their

settlements are expected to result in an outflow of assets from the entity.

3. Equity – The residual interest in the assets of the entity after deducting all its liabilities.

Note: The above elements are directly used to the measurement of financial position.

4. Revenues – These are increases in assets or decreases in liabilities arising from business

operation during an accounting period that result to increase in owners’ equity. These increases

in assets are not contributions of owners and creditors.

5. Expenses – These are decreases in assets or increases in liabilities arising from the business

operations during an accounting period that result to the decrease in owner’s equity. These

decreases in assets are not withdrawals or owners or payments of existing liabilities.

Note: The above elements are used to measure operating performance or also called as Income

Statement accounts.

S-ar putea să vă placă și

- Financial Statements Based On Philippine Accounting StandardsDocument3 paginiFinancial Statements Based On Philippine Accounting StandardsDashiell Robert Parr100% (1)

- Welfare and Justice For All - Economic LifeDocument10 paginiWelfare and Justice For All - Economic LifeLeeÎncă nu există evaluări

- Fabm Module4Document50 paginiFabm Module4Paulo VisitacionÎncă nu există evaluări

- Account Titles and Its ElementsDocument3 paginiAccount Titles and Its ElementsJeb PampliegaÎncă nu există evaluări

- Statement of Cash Flows Quiz Set ADocument5 paginiStatement of Cash Flows Quiz Set AImelda lee0% (1)

- Basic Acctg 4th SatDocument11 paginiBasic Acctg 4th SatJerome Eziekel Posada PanaliganÎncă nu există evaluări

- Financial Statement ExamDocument2 paginiFinancial Statement ExamTam TamÎncă nu există evaluări

- Module 1.3 - Peformance Incentives and DisincentivesDocument10 paginiModule 1.3 - Peformance Incentives and DisincentivesAnabelle McKenlyÎncă nu există evaluări

- Post Quiz Chapter 10Document1 paginăPost Quiz Chapter 10joanna supresenciaÎncă nu există evaluări

- ReflectionDocument1 paginăReflectionLindbergh SyÎncă nu există evaluări

- Handouts Acctg 1 - MerchandisingDocument13 paginiHandouts Acctg 1 - MerchandisingJoannah Marie OliverosÎncă nu există evaluări

- Journalizing Merchandising TransactionsDocument3 paginiJournalizing Merchandising TransactionsMarian Augelio PolancoÎncă nu există evaluări

- Chapter 3 Statement of Changes in EquityDocument21 paginiChapter 3 Statement of Changes in EquityRonald De La RamaÎncă nu există evaluări

- LORENZOPABLOMARKETINGPLAN2021Document13 paginiLORENZOPABLOMARKETINGPLAN2021France Delos SantosÎncă nu există evaluări

- Merchandise Inventory PDFDocument14 paginiMerchandise Inventory PDFLutfi MualifÎncă nu există evaluări

- CONCEPTUAL FRAMEWORK - Presentation and Disclosure Concepts of CapitalDocument4 paginiCONCEPTUAL FRAMEWORK - Presentation and Disclosure Concepts of CapitalAllaine ElfaÎncă nu există evaluări

- Statement of Financial PositionDocument7 paginiStatement of Financial PositionJay KwonÎncă nu există evaluări

- Reversing EntriesDocument10 paginiReversing EntriesKarina Charmaine LimÎncă nu există evaluări

- Dental Clinic AnswerDocument16 paginiDental Clinic AnswerMaria Licuanan100% (1)

- FAR Chapter 1 Problem 2Document1 paginăFAR Chapter 1 Problem 2jelou ubagÎncă nu există evaluări

- Simple and Compound EntryDocument4 paginiSimple and Compound EntryJezeil DimasÎncă nu există evaluări

- Notes To Financial StatementsDocument11 paginiNotes To Financial StatementsDonielle RobertsÎncă nu există evaluări

- Stevenson 14e Ch01writingDocument2 paginiStevenson 14e Ch01writingelvis oheneba manuÎncă nu există evaluări

- Typical Account Titles UsedDocument3 paginiTypical Account Titles Usedwenna janeÎncă nu există evaluări

- RESEARCHDocument5 paginiRESEARCHvarun v sÎncă nu există evaluări

- Financial Statements AnalysisDocument35 paginiFinancial Statements AnalysisKiarra Nicel De TorresÎncă nu există evaluări

- General Journal CholoDocument9 paginiGeneral Journal CholokrylÎncă nu există evaluări

- Definition - What Are Financial Statements?Document2 paginiDefinition - What Are Financial Statements?Manuel BautistaÎncă nu există evaluări

- Fabm23statement of Changes in EquityDocument3 paginiFabm23statement of Changes in EquityRenz AbadÎncă nu există evaluări

- University of San Jose - Recoletos: Vision, Mission and Core ValuesDocument17 paginiUniversity of San Jose - Recoletos: Vision, Mission and Core ValuesReyniere AloÎncă nu există evaluări

- Closing EntriesDocument10 paginiClosing EntriesFranco DexterÎncă nu există evaluări

- Module II - Analyzing Business TransactionsDocument4 paginiModule II - Analyzing Business TransactionsIj IlardeÎncă nu există evaluări

- Balance Sheet Bella EnterprisesDocument2 paginiBalance Sheet Bella EnterprisesmarivicÎncă nu există evaluări

- ABM 3 Quarterly ExamDocument2 paginiABM 3 Quarterly ExamLenyBarrogaÎncă nu există evaluări

- Chapter 1 - EthicsDocument7 paginiChapter 1 - EthicsEzekylah AlbaÎncă nu există evaluări

- Statement of Cash Flows - Lecture NotesDocument6 paginiStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)

- This Study Resource Was Shared ViaDocument8 paginiThis Study Resource Was Shared Viadave iganoÎncă nu există evaluări

- ACCT1A&B Reviewer Disadvantages: ABRAHAM, Daisy JaneDocument33 paginiACCT1A&B Reviewer Disadvantages: ABRAHAM, Daisy JaneGabriel L. CaringalÎncă nu există evaluări

- E-PORTFOLIO in LTS 1-B (Module 1&2)Document16 paginiE-PORTFOLIO in LTS 1-B (Module 1&2)Joan Cristine DacuyanÎncă nu există evaluări

- Chapter 3 - The Accounting EquationDocument10 paginiChapter 3 - The Accounting Equationgeyb away100% (1)

- 01 Activity 2Document4 pagini01 Activity 2Laisan SantosÎncă nu există evaluări

- TransactionDocument1 paginăTransactionMARVIN ROSEL0% (1)

- Periodic and Perpetual Inventory SystemDocument19 paginiPeriodic and Perpetual Inventory SystemMichelle RotairoÎncă nu există evaluări

- Chapter 6: Business Transcations & Their Analysis (FAR By: Millan)Document9 paginiChapter 6: Business Transcations & Their Analysis (FAR By: Millan)Ella Montefalco50% (2)

- Bam 040 ReviewerDocument7 paginiBam 040 ReviewerAndrea Vila VelascoÎncă nu există evaluări

- Analyzing Business TransactionsDocument13 paginiAnalyzing Business TransactionsEricJohnRoxasÎncă nu există evaluări

- Oral CommunicationDocument2 paginiOral CommunicationHshs NglÎncă nu există evaluări

- Module 1 ACCTG 1 A & B Partnership & Corporation (2021)Document24 paginiModule 1 ACCTG 1 A & B Partnership & Corporation (2021)Mary Lynn Dela PeñaÎncă nu există evaluări

- Accounting Fundamentals: The Accounting Equation and The Double-Entry SystemDocument70 paginiAccounting Fundamentals: The Accounting Equation and The Double-Entry SystemAllana Mier100% (1)

- (GEMATMW) InvestagramsDocument3 pagini(GEMATMW) InvestagramsCourtney TulioÎncă nu există evaluări

- AdjustingDocument7 paginiAdjustingRochelle BuensucesoÎncă nu există evaluări

- PurchasesDocument18 paginiPurchasesChibi ChichiwÎncă nu există evaluări

- Accounting Process of A Services BusinessDocument9 paginiAccounting Process of A Services BusinessFiverr RallÎncă nu există evaluări

- Template For Synthesis TallyDocument5 paginiTemplate For Synthesis TallyFloesine De JesusÎncă nu există evaluări

- Module 0 Review Accounting 1 PDFDocument40 paginiModule 0 Review Accounting 1 PDFJmaseÎncă nu există evaluări

- SCALP Handout 040Document2 paginiSCALP Handout 040Cher NaÎncă nu există evaluări

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesDocument19 paginiSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesareumÎncă nu există evaluări

- Adjusting EntriesDocument27 paginiAdjusting EntrieskaiginÎncă nu există evaluări

- Closing EntriesDocument14 paginiClosing EntriesAlbert Moreno100% (1)

- CLOSING ENTRIES: Recall in The PreviousDocument4 paginiCLOSING ENTRIES: Recall in The PreviousPark ChimmyÎncă nu există evaluări

- Chapter 2Document2 paginiChapter 2Park ChimmyÎncă nu există evaluări

- 3 RDDocument2 pagini3 RDPark ChimmyÎncă nu există evaluări

- Sample Income StatementDocument1 paginăSample Income StatementPark ChimmyÎncă nu există evaluări

- Business PlanDocument27 paginiBusiness PlanCJ Paz-ArevaloÎncă nu există evaluări

- AnswersDocument15 paginiAnswersSahar KhanÎncă nu există evaluări

- Balance Sheet: StandaloneDocument3 paginiBalance Sheet: Standalonealok pratap singhÎncă nu există evaluări

- Financial Decision Making and The Law of One Price: NPV PV PVDocument4 paginiFinancial Decision Making and The Law of One Price: NPV PV PV김진영Încă nu există evaluări

- Cost of CapitalDocument45 paginiCost of CapitalTaliya ShaikhÎncă nu există evaluări

- Ifrs at A Glance: IAS 32 Financial InstrumentsDocument4 paginiIfrs at A Glance: IAS 32 Financial InstrumentsCindy YinÎncă nu există evaluări

- Statement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionDocument43 paginiStatement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasÎncă nu există evaluări

- BM1805 Marginal Costing and Absorption CostingDocument4 paginiBM1805 Marginal Costing and Absorption CostingMaria Anndrea MendozaÎncă nu există evaluări

- Asm2 Slide BriefDocument26 paginiAsm2 Slide Briefhoattkbh01255Încă nu există evaluări

- DFA MemoDocument3 paginiDFA MemoNick SchererÎncă nu există evaluări

- Exercises Responsibility Accounting AnswersDocument6 paginiExercises Responsibility Accounting AnswersAlexis Jaina Tinaan100% (1)

- ABC Slides Final (SP 23)Document11 paginiABC Slides Final (SP 23)Syed Shayan Haider RizviÎncă nu există evaluări

- AUD-90 PW (Part 2 of 2)Document7 paginiAUD-90 PW (Part 2 of 2)Elaine Joyce GarciaÎncă nu există evaluări

- International Financial Mgnt-TCHE425 For 2023-2025 - For 6 GroupsDocument17 paginiInternational Financial Mgnt-TCHE425 For 2023-2025 - For 6 GroupsSơn HoàngÎncă nu există evaluări

- Pressco Inc. Case StudyDocument18 paginiPressco Inc. Case StudyIrakli SaliaÎncă nu există evaluări

- Chapter 11 Investments - Additional ConceptsDocument15 paginiChapter 11 Investments - Additional ConceptsAna Leah Delfin100% (1)

- Case 01 Buffett 2015 F1769TNXDocument10 paginiCase 01 Buffett 2015 F1769TNXVaney Iori0% (1)

- Chap 11Document5 paginiChap 11키지아Încă nu există evaluări

- Suryaa Hotel Bal SheetDocument3 paginiSuryaa Hotel Bal Sheetarjun chauhan100% (1)

- Guide To Understand An Offer Document: (WWW - Sebi.gov - In)Document5 paginiGuide To Understand An Offer Document: (WWW - Sebi.gov - In)Geetika KhandelwalÎncă nu există evaluări

- Dr. Arshid Shah-1st March 2024 3 - Afternoon SessionDocument12 paginiDr. Arshid Shah-1st March 2024 3 - Afternoon Sessionromola613Încă nu există evaluări

- Sanchit Sinha - 119240 - Assignsubmission - File - Polar - Sports - ASG2a - Spreadsheet - Study - Group - 1 - DEMDocument16 paginiSanchit Sinha - 119240 - Assignsubmission - File - Polar - Sports - ASG2a - Spreadsheet - Study - Group - 1 - DEMAman KumarÎncă nu există evaluări

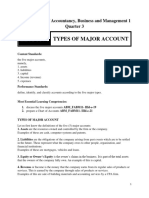

- LAS 4 Types of Major AccountDocument7 paginiLAS 4 Types of Major AccountFelicity BondocÎncă nu există evaluări

- Chapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceDocument19 paginiChapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceHenry RizqyÎncă nu există evaluări

- #Test Bank - Adv Acctg 2 - PDocument10 pagini#Test Bank - Adv Acctg 2 - PFaye EnrileÎncă nu există evaluări

- Tying Free Cash Flows To Market Valuation - Robert Howell - Financial ExecutiveDocument4 paginiTying Free Cash Flows To Market Valuation - Robert Howell - Financial Executivetatsrus1Încă nu există evaluări

- Indirect Method of Cash Flows Statement DirectionsDocument5 paginiIndirect Method of Cash Flows Statement DirectionsMary94% (18)

- Test Bank For Financial Accounting Canadian 5th Edition by Harrison ISBN 0132979276 9780132979276Document36 paginiTest Bank For Financial Accounting Canadian 5th Edition by Harrison ISBN 0132979276 9780132979276LarryWellsfcyz100% (28)

- Chapter 1 Notes Far210Document23 paginiChapter 1 Notes Far210Muzzammil Azfar Merzuki100% (1)

- Analisis Laporan KeuanganDocument3 paginiAnalisis Laporan KeuanganRiska AÎncă nu există evaluări