Documente Academic

Documente Profesional

Documente Cultură

Exercise 2 Current and Non Current Classification

Încărcat de

PATRICIA SANTOSDescriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Exercise 2 Current and Non Current Classification

Încărcat de

PATRICIA SANTOSDrepturi de autor:

Formate disponibile

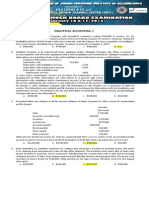

CA5106: CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS

EXERCISE 2: CLASSIFICATION OF LIABILITIES INTO CURRENT AND NON-

CURRENT IN THE STATEMENT OF FINANCIAL POSITION:

Answers will be provided later this week.

1. Based on our class discussion on the classification of liabilities into current

and non-current, determine the amount of the notes payable reported as

current and non-current at December 31, 2020.

Case 1

Taft, Inc. has P3 million of notes payable due June 15, 2021. At December

31, 2020, Taft signed an agreement to borrow up to P3 million to refinance

the notes payable on a long-term basis. The financing agreement called for

borrowings not to exceed 80% of the value of the collateral Taft was providing.

At the date of issue of the December 31, 2020 financial statements, the value

of the collateral was P3.6 million and was not expected to fall below this

amount.

Case 2

Taft, Inc. has P2 million of notes payable due June 15, 2021. At February 15,

2021, Taft signed an agreement to borrow up to P2 million to refinance the

notes payable on a long-term basis. The financing agreement called for

borrowings not to exceed 80% of the value of the collateral Taft was providing.

The value of the collateral was P2.4 million and was not expected to fall below

this amount. The financial statements are authorized for issuance on March

5, 2021.

Case 3

In October 2018, Wilson Corporation acquired land from Woodrow, Inc. by

paying P1,000,000 down and signing a note with a maturity value of P6

million due October 31, 2020.

Situation A. Under the terms of the financing agreement, Wilson has the

discretion to roll over the obligation for at least twelve months. In October

2020, management decides to exercise its discretion to extend the maturity

date of its obligation to December 31, 2021.

Situation B. Under the terms of the financing agreement, Wilson has the

discretion to roll over the obligation for at least twelve months. In October

2020 management decides to exercise its discretion to extend the maturity

date of its obligation to December 31, 2022.

Situation C. The existing loan agreement does not carry a provision to

refinance. In October 2020, Wilson was experiencing financial difficulty and

was unable to pay the maturing obligation. On February 1, 2021, Woodrow

has agreed not to demand payment for at least 12 months as a consequence

of the breach of payment on the principal of the loan. The financial

statements were authorized for issue on March 31, 2021.

Situation D. The existing loan agreement does not carry a provision to

refinance. In October 2020, Wilson was experiencing financial difficulty and

was unable to pay the maturing obligation. On December 31, 2020, Woodrow

signed an agreement to provide Wilson a grace period of 15 months from that

date, during which period, Woodrow will not demand immediate payment in

EMPLEO, P.M. 1|Page

CA5106: CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS

order to give Wilson the chance to rectify the breach. The financial

statements were authorized for issue on March 31, 2021.

2. Included in Harding Company’s liability account balances at December 31,

2020 were the following:

14% note payable issued, October 1, 2016, maturing September 30, 2021,

P2,500,000

16% note payable issued October 1, 2020 payable in six equal semi-annual

installments of P800,000 every April 1 and October 1, beginning April 1,

2021, P4,800,000

Harding’s December 31, 2020 financial statements were issued on March 31,

2021. On March 10, 2021, Harding consummated a non-cancelable

agreement with the lender to refinance the 14% P2,500,000 note on a long-

term basis, on readily determinable terms that have not yet been

implemented.

REQUIRED:

On the December 31, 2020 statement of financial position, what amount of the

notes payable should Harding classify as current liabilities? (Disregard any

amount of accrued interest as of December 31, 2020)

3. At December 31, 2020, Roosevelt Corporation owed notes payable of

P2,000,000 with a maturity of April 30, 2021. These notes did not arise from

transactions in the normal course of business. On February 1, 2021,

Roosevelt issued P4,000,000 of ten-year bonds with the intention of using

part of the bond proceeds to liquidate the P2,000,000 of notes payable.

Roosevelt’s 2020 financial statements were issued on March 29, 2021.

REQUIRED:

How much of the P2,000,000 notes payable should be classified as non-current

liabilities in Roosevelt’s statement of financial position at December 31, 2020?

EMPLEO, P.M. 2|Page

CA5106: CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS

ANSWER SHEET

NAME:

Answers:

1. Case 1. ___________________________

Case 2. ___________________________

Case 3.

Situation A. ___________________________

Situation B. ___________________________

Situation C. ___________________________

Situation D. ___________________________

2. ____________________________________

3. ____________________________________

EMPLEO, P.M. 3|Page

S-ar putea să vă placă și

- Module 11 Current Liabilities Provisions and ContingenciesDocument14 paginiModule 11 Current Liabilities Provisions and ContingenciesZyril RamosÎncă nu există evaluări

- EXERCISES - Current LiabilitiesDocument6 paginiEXERCISES - Current LiabilitiesClaudette ClementeÎncă nu există evaluări

- Quiz - Intangible Assets With QuestionsDocument3 paginiQuiz - Intangible Assets With Questionsjanus lopezÎncă nu există evaluări

- PSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Document12 paginiPSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Abdulmajed Unda MimbantasÎncă nu există evaluări

- Quiz 1Document11 paginiQuiz 1VIRGIL KIT AUGUSTIN ABANILLAÎncă nu există evaluări

- Prelim Exam Aud AnswersDocument5 paginiPrelim Exam Aud Answerslois martinÎncă nu există evaluări

- EarningsperShare Finacc5Document3 paginiEarningsperShare Finacc5Miladanica Barcelona BarracaÎncă nu există evaluări

- Last QuizDocument5 paginiLast QuizMariah MacasÎncă nu există evaluări

- This Study Resource Was: Njpia Region 3 CouncilDocument7 paginiThis Study Resource Was: Njpia Region 3 CouncilPeachy Rose TorenaÎncă nu există evaluări

- P 1Document4 paginiP 1Kenneth Bryan Tegerero TegioÎncă nu există evaluări

- Comprehensive Review-Acctg 1n21Document27 paginiComprehensive Review-Acctg 1n21Angelica GaliciaÎncă nu există evaluări

- Discussion Problems: FAR.2928-Notes Payable OCTOBER 2020Document3 paginiDiscussion Problems: FAR.2928-Notes Payable OCTOBER 2020John Nathan KinglyÎncă nu există evaluări

- LiabilitiesDocument11 paginiLiabilitiesJayson Manalo GañaÎncă nu există evaluări

- ch3 Not EditedDocument14 paginich3 Not EditedDM MontefalcoÎncă nu există evaluări

- Assignment Leverage and Capital StructureDocument6 paginiAssignment Leverage and Capital StructureCristopherson PerezÎncă nu există evaluări

- Intacc 3Document102 paginiIntacc 3sofiaÎncă nu există evaluări

- Audipra Substantive Test of Liabilities ILLUSTRATION 1 (Classification of Liabilities)Document5 paginiAudipra Substantive Test of Liabilities ILLUSTRATION 1 (Classification of Liabilities)Girl lang0% (1)

- Easy 1. Which Is The Correct Accounting For A Finance Lease in The AccountsDocument4 paginiEasy 1. Which Is The Correct Accounting For A Finance Lease in The AccountsQueen ValleÎncă nu există evaluări

- Compound Financial Instrument LmsDocument28 paginiCompound Financial Instrument LmsRosethel Grace Gallardo100% (1)

- Intacc Review Questions Micha 1Document3 paginiIntacc Review Questions Micha 1Christian ContadorÎncă nu există evaluări

- National Federation of Junior Philippine Institute of Accountants Financial AccountingDocument8 paginiNational Federation of Junior Philippine Institute of Accountants Financial AccountingWeaFernandezÎncă nu există evaluări

- Nfjpia Region III Constitution & By-Laws - Final VersionDocument20 paginiNfjpia Region III Constitution & By-Laws - Final VersionAdrianneHarveÎncă nu există evaluări

- Module 5 Note Payable and Debt RestructureDocument15 paginiModule 5 Note Payable and Debt Restructuremmh100% (1)

- Variable Costing Practice ProblemsDocument48 paginiVariable Costing Practice ProblemsURBANO CREATIONS PRINTING & GRAPHICSÎncă nu există evaluări

- Quiz On Debt InvestmentDocument2 paginiQuiz On Debt InvestmentYa NaÎncă nu există evaluări

- IA 3 ReviewDocument34 paginiIA 3 ReviewHell LuciÎncă nu există evaluări

- Unit VIII Accounting For Long Term Construction ContractsDocument8 paginiUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveÎncă nu există evaluări

- ACC5116 - Module 1Document6 paginiACC5116 - Module 1Carl Dhaniel Garcia SalenÎncă nu există evaluări

- Financial Assets at Fair Value (Investments) Basic ConceptsDocument2 paginiFinancial Assets at Fair Value (Investments) Basic ConceptsMonica Monica0% (1)

- Conceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaDocument2 paginiConceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaJm SevallaÎncă nu există evaluări

- ACCTG 013 - Module 6Document33 paginiACCTG 013 - Module 6Andrea Lyn Salonga CacayÎncă nu există evaluări

- Bonds ReviewerDocument7 paginiBonds ReviewerDM MontefalcoÎncă nu există evaluări

- Module 1A - PFRS For Small Entities Discussion ProblemsDocument7 paginiModule 1A - PFRS For Small Entities Discussion ProblemsLee SuarezÎncă nu există evaluări

- MAS.05 Drill Variable and Absorption CostingDocument5 paginiMAS.05 Drill Variable and Absorption Costingace ender zeroÎncă nu există evaluări

- Chapter 9 - Narrative ReportDocument29 paginiChapter 9 - Narrative ReportShelly Mae SiguaÎncă nu există evaluări

- Chapter 9 Part 1 Input VatDocument25 paginiChapter 9 Part 1 Input VatChristian PelimcoÎncă nu există evaluări

- Quennie V.Centino Accounting For Governance and Non-Profit Organizations TTH 5:00PM - 6:30PM Bsma - 3 Assessment: Week 1 - Module 1 Multiple ChoiceDocument3 paginiQuennie V.Centino Accounting For Governance and Non-Profit Organizations TTH 5:00PM - 6:30PM Bsma - 3 Assessment: Week 1 - Module 1 Multiple Choicequennie vilchezÎncă nu există evaluări

- Chapter 10Document4 paginiChapter 10ashibhallauÎncă nu există evaluări

- Chapter 11 - RR: ConsignmentDocument17 paginiChapter 11 - RR: ConsignmentJane DizonÎncă nu există evaluări

- 12 Capital Budgeting v2Document4 pagini12 Capital Budgeting v2Celine GalvezÎncă nu există evaluări

- 17 Property Plant and Equipment - Discussion PDFDocument204 pagini17 Property Plant and Equipment - Discussion PDFJay Aubrey PinedaÎncă nu există evaluări

- HW On INVESTMENT PROPERTY - 1Document2 paginiHW On INVESTMENT PROPERTY - 1Charles TuazonÎncă nu există evaluări

- Capitalizable Make-Ready Costs Related To A New Machine Do Not IncludeDocument1 paginăCapitalizable Make-Ready Costs Related To A New Machine Do Not Includejahnhannalei marticioÎncă nu există evaluări

- Cost AccountingDocument6 paginiCost Accountingulquira grimamajowÎncă nu există evaluări

- FAR Cash and Cash EquivalentsDocument2 paginiFAR Cash and Cash EquivalentsXander AquinoÎncă nu există evaluări

- Classwork - Valuations 011621 PDFDocument2 paginiClasswork - Valuations 011621 PDFJasmine Acta0% (2)

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pagini02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoÎncă nu există evaluări

- Warranty Liability: Start of DiscussionDocument2 paginiWarranty Liability: Start of DiscussionclarizaÎncă nu există evaluări

- The University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16Document5 paginiThe University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16ana rosemarie enaoÎncă nu există evaluări

- 2O Multiple Choice Questions About PAS 1Document4 pagini2O Multiple Choice Questions About PAS 1jahnhannalei marticioÎncă nu există evaluări

- ASR3 Materials - Auditing Equity and Debt InvestmentsDocument4 paginiASR3 Materials - Auditing Equity and Debt InvestmentsHannah Jane ToribioÎncă nu există evaluări

- Theories: Basic ConceptsDocument20 paginiTheories: Basic ConceptsJude VeanÎncă nu există evaluări

- 02 Conceptual Framework - RevisedDocument13 pagini02 Conceptual Framework - RevisedRazel MhinÎncă nu există evaluări

- Compre FAR19Document16 paginiCompre FAR19Gwen Cabarse PansoyÎncă nu există evaluări

- Mama Mo Lily I AbilitiesDocument39 paginiMama Mo Lily I AbilitiesjdÎncă nu există evaluări

- Liability Chap1 4Document5 paginiLiability Chap1 4prey kunÎncă nu există evaluări

- Satisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsDocument12 paginiSatisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsJohn FloresÎncă nu există evaluări

- Week 1 OutputDocument4 paginiWeek 1 OutputFria Mae Aycardo AbellanoÎncă nu există evaluări

- Acccob2 Quiz1 Set A With AnswersDocument5 paginiAcccob2 Quiz1 Set A With AnswersshirardadivisoÎncă nu există evaluări

- 6991 Note PayableDocument2 pagini6991 Note PayableFREE MOVIESÎncă nu există evaluări

- Google Drive: (CITATION Bet13 /L 1033) (CITATION Sot12 /L 1033)Document2 paginiGoogle Drive: (CITATION Bet13 /L 1033) (CITATION Sot12 /L 1033)PATRICIA SANTOSÎncă nu există evaluări

- (CITATION Cod16 /L 1033) (CITATION H3V19 /L 1033)Document4 pagini(CITATION Cod16 /L 1033) (CITATION H3V19 /L 1033)PATRICIA SANTOSÎncă nu există evaluări

- Standards and Criteria For Success: The Learner's Presentation Will Be Assessed Using A RubricDocument2 paginiStandards and Criteria For Success: The Learner's Presentation Will Be Assessed Using A RubricPATRICIA SANTOSÎncă nu există evaluări

- A. Plan and RationaleDocument8 paginiA. Plan and RationalePATRICIA SANTOSÎncă nu există evaluări

- Answers To True or False, Relating To SFP, With ExplanationsDocument3 paginiAnswers To True or False, Relating To SFP, With ExplanationsPATRICIA SANTOS100% (1)

- Ca5106: Conceptual Framework and Accounting StandardsDocument1 paginăCa5106: Conceptual Framework and Accounting StandardsPATRICIA SANTOSÎncă nu există evaluări

- Answers To True or False, Relating To SFP, With ExplanationsDocument3 paginiAnswers To True or False, Relating To SFP, With ExplanationsPATRICIA SANTOS100% (1)

- Handouts For Chapters 1 & 2Document8 paginiHandouts For Chapters 1 & 2PATRICIA SANTOSÎncă nu există evaluări

- Reviewer From Idk WhereDocument10 paginiReviewer From Idk WherePATRICIA SANTOSÎncă nu există evaluări

- Cfas AnswersDocument5 paginiCfas AnswersPATRICIA SANTOSÎncă nu există evaluări

- Abc 2020Document9 paginiAbc 2020PATRICIA SANTOSÎncă nu există evaluări

- The Accounting and Business Environment: After Reading This Chapter, The Learners Should Be Able ToDocument14 paginiThe Accounting and Business Environment: After Reading This Chapter, The Learners Should Be Able ToPATRICIA SANTOSÎncă nu există evaluări

- Article 1179: Section 1: Pure & Conditional ObligationsDocument67 paginiArticle 1179: Section 1: Pure & Conditional ObligationsMaria LopezÎncă nu există evaluări

- Ruben Fleurantin V., 3rd Cir. (2011)Document6 paginiRuben Fleurantin V., 3rd Cir. (2011)Scribd Government DocsÎncă nu există evaluări

- CP 2 IbcDocument3 paginiCP 2 IbcManvesh VatsÎncă nu există evaluări

- (PDF) Rem DigestsDocument5 pagini(PDF) Rem DigestsDinarSantosÎncă nu există evaluări

- Union Bank Vs SantibanezDocument2 paginiUnion Bank Vs SantibanezParis ValenciaÎncă nu există evaluări

- Chapter 4 Lecture NotesDocument30 paginiChapter 4 Lecture NotesStacy SMÎncă nu există evaluări

- Settlement Difference Is Recognized As Gain or LossDocument2 paginiSettlement Difference Is Recognized As Gain or LossKimmy ShawwyÎncă nu există evaluări

- HDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Document5 paginiHDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519Încă nu există evaluări

- Project Report - DseDocument33 paginiProject Report - DseHarsha Vardhan ReddyÎncă nu există evaluări

- Deloitte Model Aptitude Paper - XIDocument4 paginiDeloitte Model Aptitude Paper - XIAnonymous ZVbwfcÎncă nu există evaluări

- Industry Analysis Project Report - Banking IndustryDocument32 paginiIndustry Analysis Project Report - Banking IndustryANUSHKA100% (2)

- Commercial Application Form - A-4Document12 paginiCommercial Application Form - A-4sishir mandalÎncă nu există evaluări

- XLRI Jamshedpur: Ram Kumar KakaniDocument20 paginiXLRI Jamshedpur: Ram Kumar KakaniGautam DÎncă nu există evaluări

- 6.4. Comprehensive Problems - Final Tax 1Document10 pagini6.4. Comprehensive Problems - Final Tax 1Elle VernezÎncă nu există evaluări

- Fabm Analysis and Interpretation of Financial Statements 1Document4 paginiFabm Analysis and Interpretation of Financial Statements 1Mylen Noel Elgincolin Manlapaz0% (1)

- First Benchmark PublishingDocument17 paginiFirst Benchmark PublishingChan Mark AyapanaÎncă nu există evaluări

- Tax Is A Compulsory Contribution To State RevenueDocument12 paginiTax Is A Compulsory Contribution To State RevenueIryna HoncharukÎncă nu există evaluări

- Facts:: REYNALDO V. UMALI v. JESUS P. ESTANISLAO, GR No. 104037, 1992-05-29Document2 paginiFacts:: REYNALDO V. UMALI v. JESUS P. ESTANISLAO, GR No. 104037, 1992-05-29ron dominic dagumÎncă nu există evaluări

- Audit of Local Bodies PDFDocument4 paginiAudit of Local Bodies PDFSriram BastolaÎncă nu există evaluări

- Practical Accounting 1 With AnswersDocument10 paginiPractical Accounting 1 With Answerslibraolrack50% (8)

- Research Proposal: Effects of Working Capital Management On Sme ProfitabilityDocument3 paginiResearch Proposal: Effects of Working Capital Management On Sme Profitabilitykashifshaikh760% (1)

- Chapter 3 Ethiopian Payroll SystemDocument10 paginiChapter 3 Ethiopian Payroll SystemWonde Biru89% (46)

- Project On Icic BankDocument69 paginiProject On Icic BankDavinder Singh BanssÎncă nu există evaluări

- Contra AccountsDocument6 paginiContra AccountsRaviSankarÎncă nu există evaluări

- Intermediate Accounting Solutions Chapter 3Document27 paginiIntermediate Accounting Solutions Chapter 3jharris1063% (8)

- Advance Fuels CorporationDocument11 paginiAdvance Fuels CorporationQuyen Huynh100% (1)

- (LAW) BLS LLB Sem-1: Economics NotesDocument25 pagini(LAW) BLS LLB Sem-1: Economics Notesvivekvijaypawar81% (16)

- Oblicon - BPI Vs CA, REYESDocument1 paginăOblicon - BPI Vs CA, REYESChikoy AnonuevoÎncă nu există evaluări

- Finance II - CHP 13 MCQDocument2 paginiFinance II - CHP 13 MCQjudyÎncă nu există evaluări

- Engineering EconomyDocument23 paginiEngineering EconomyHajji Bañoc100% (1)