Documente Academic

Documente Profesional

Documente Cultură

Ion Onl Y: Copy For HM Revenue & Customs

Încărcat de

M Muneeb SaeedTitlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Ion Onl Y: Copy For HM Revenue & Customs

Încărcat de

M Muneeb SaeedDrepturi de autor:

Formate disponibile

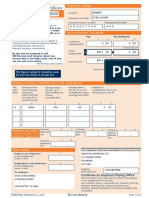

P45 Part 1

Details of employee leaving work

Copy for HM Revenue & Customs

File your employee's P45 online at www.hmrc.gov.uk Use capital letters when completing this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Enter 'Y' if Student Loan deduction is due to be made

/

6 Tax Code at leaving date

2 Employee's National Insurance number

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title – enter MR, MRS, MISS, MS or other title Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax Code is cumulative. Make no entry

if week 1 or month 1 applies, go straight to box 8.

y

nl

Week number Month number

First or given name(s)

o Total pay to date

ion £ •

4 Leaving date DD MM YYYY

at Total tax to date

o rm £ •

i n f

8

r

This employment pay and tax. Leave blank if the Tax Code 12 Employee’s private address

Fo

is cumulative and the amounts are the same as box 7.

Total pay in this employment

£ •

Total tax in this employment

Postcode

£ •

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on

this form are correct.

Employer name and address

10 Gender. Enter ‘X’ in the appropriate box

Male Female

11 Date of birth DD MM YYYY

Postcode

Date DD MM YYYY

14 When an employee dies. If the employee has died

enter 'D' in the box and send all four parts of this

form to your HMRC office immediately.

Instructions for the employer

• Complete this form following the 'What to do when an employee leaves' instructions in the Employer Helpbook E13 Day-to-day

payroll. Make sure the details are clear on all four parts of this form and that your name and address is shown on Parts 1 and 1A.

• Send Part 1 to your HM Revenue & Customs office immediately.

• Hand Parts 1A, 2 and 3 to your employee when they leave.

P45(Manual) Part 1 HMRC 04/08

P45 Part 1A

Details of employee leaving work

Copy for employee

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

/

6 Tax Code at leaving date

2 Employee's National Insurance number

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title – enter MR, MRS, MISS, MS or other title

Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax Code is cumulative. If there is an ‘X’

at box 6 there will be no entries here.

First or given name(s)

n ly Week number Month number

o Total pay to date

ion £ •

4 Leaving date DD MM YYYY

at Total tax to date

o rm £ •

i n f

8

r

This employment pay and tax. If no entry here, the amounts 12 Employee’s private address

are those shown at box 7.

Fo

Total pay in this employment

£ •

Total tax in this employment

Postcode

£ •

9 Works number/Payroll number and Department or branch

(if any) 13 I certify that the details entered in items 1 to 11 on

this form are correct.

Employer name and address

10 Gender. Enter ‘X’ in the appropriate box

Male Female

11 Date of birth DD MM YYYY

Postcode

Date DD MM YYYY

To the employee Tax credits

The P45 is in three parts. Please keep this part (Part 1A) safe. Tax credits are flexible. They adapt to changes in your life, such

Copies are not available. You might need the information in as leaving a job. If you need to let us know about a change in

Part 1A to fill in a Tax Return if you are sent one. your income, phone 0845 300 3900.

Please read the notes in Part 2 that accompany Part 1A. To the new employer

The notes give some important information about what you If your new employee gives you this Part 1A, please return

should do next and what you should do with Parts 2 and 3 of it to them. Deal with Parts 2 and 3 as normal.

this form.

P45(Manual) Part 1A HMRC 04/08

P45 Part 2

Details of employee leaving work

Copy for new employer

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

/

6 Tax Code at leaving date

2 Employee's National Insurance number

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title - enter MR, MRS, MISS, MS or other title Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax Code is cumulative. If there is an ‘X’

at box 6, there will be no entries here.

y

nl

Week number Month number

First or given name(s)

o Total pay to date

ion £ •

4 Leaving date DD MM YYYY

at Total tax to date

o rm £ •

i n f

r

Fo

To the employee

This form is important to you. Take good care of it and Claiming Jobseeker's Allowance or

keep it safe. Copies are not available. Please keep Employment and Support Allowance (ESA)

Parts 2 and 3 of the form together and do not alter them Take this form to your Jobcentre Plus office. They will pay you

in any way. any tax refund you may be entitled to when your claim ends,

or at 5 April if this is earlier.

Going to a new job

Give Parts 2 and 3 of this form to your new employer, Not working and not claiming Jobseeker's Allowance or

or you will have tax deducted using the emergency Employment and Support Allowance (ESA)

code and may pay too much tax. If you do not want If you have paid tax and wish to claim a refund ask for

your new employer to know the details on this form, form P50 Claiming Tax back when you have stopped

send it to your HM Revenue & Customs (HMRC) office working from any HMRC office or Enquiry Centre.

immediately with a letter saying so and giving the

Help

name and address of your new employer. HMRC can

If you need further help you can contact any HMRC office

make special arrangements, but you may pay too

or Enquiry Centre. You can find us in The Phone Book under

much tax for a while as a result of this.

HM Revenue & Customs or go to www.hmrc.gov.uk

Going abroad

If you are going abroad or returning to a country To the new employer

outside the UK ask for form P85 Leaving the United Kingdom Check this form and complete boxes 8 to 18 in Part 3

from any HMRC office or Enquiry Centre. and prepare a form P11 Deductions Working Sheet.

Becoming self-employed Follow the instructions in the Employer Helpbook E13

You must register with HMRC within three months of Day-to-day payroll, for how to prepare a P11 Deductions

becoming self-employed or you could incur a penalty. Working Sheet. Send Part 3 of this form to your HMRC office

To register as newly self-employed see The Phone Book immediately. Keep Part 2.

under HM Revenue & Customs or go to www.hmrc.gov.uk

to get a copy of the booklet SE1 Are you thinking of working

for yourself?

P45(Manual) Part 2 HMRC 04/08

P45 Part 3

New employee details

For completion by new employer

File your employee's P45 online at www.hmrc.gov.uk Use capital letters when completing this form

1 Employer PAYE reference 5 Student Loan deductions

Office number Reference number

Student Loan deductions to continue

/

6 Tax Code at leaving date

2 Employee's National Insurance number

If week 1 or month 1 applies, enter 'X' in the box below.

3 Title – enter MR, MRS, MISS, MS or other title

Week 1/Month 1

7 Last entries on P11 Deductions Working Sheet.

Surname or family name Complete only if Tax Code is cumulative. If there is an ‘X’

at box 6, there will be no entries here.

First or given name(s)

n lyWeek number Month number

o Total pay to date

ion £ •

4 Leaving date DD MM YYYY

at Total tax to date

o rm £ •

To the new employer i n f

Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

r

8 New employer PAYE reference

Fo

Office number Reference number

15 Employee's private address

/

9 Date new employment started DD MM YYYY

Postcode

10 Works number/Payroll number and Department or branch

(if any)

16 Gender. Enter ‘X’ in the appropriate box

Male Female

17 Date of birth DD MM YYYY

11 Enter 'P' here if employee will not be paid by you

between the date employment began and the

next 5 April.

Declaration

12 Enter Tax Code in use if different to the Tax Code at box 6

18 I have prepared a P11 Deductions Working Sheet

in accordance with the details above.

Employer name and address

If week 1 or month 1 applies, enter 'X' in the box below.

Week 1/Month 1

13 If the tax figure you are entering on P11 Deductions

Working Sheet differs from box 7 (see the E13 Employer

Helpbook Day-to-day payroll) please enter the

figure here.

Postcode

£ •

14 New employee's job title or job description

Date DD MM YYYY

P45(Manual) Part 3 HMRC 04/08

S-ar putea să vă placă și

- Copy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnDocument3 paginiCopy For Employee: Complete Only If Tax Code Is Cumulative. If There Is AnZavache DanaÎncă nu există evaluări

- P45 Part 1A Details of Employee Leaving WorkDocument3 paginiP45 Part 1A Details of Employee Leaving WorkCaleb PriceÎncă nu există evaluări

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 paginip45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoÎncă nu există evaluări

- Ca 3916Document5 paginiCa 3916GenovevaShtereva100% (1)

- P45 68148Document4 paginiP45 68148Эдварт АнтонÎncă nu există evaluări

- 5184 P45 (Online) PDFDocument3 pagini5184 P45 (Online) PDFAlejandroe AuditoreÎncă nu există evaluări

- Print VAT Registration - GOV - UkDocument11 paginiPrint VAT Registration - GOV - Uksiva kumarÎncă nu există evaluări

- P 85Document5 paginiP 85Fernando Mochales GutiérrezÎncă nu există evaluări

- Starter Checklist: Instructions For EmployersDocument2 paginiStarter Checklist: Instructions For EmployersTareqÎncă nu există evaluări

- View Completed FormsDocument9 paginiView Completed FormsAla CocpÎncă nu există evaluări

- Y3 and Personal Data Form 2Document5 paginiY3 and Personal Data Form 2Shakil AhmedÎncă nu există evaluări

- Opt-Out FormDocument3 paginiOpt-Out FormAggregate DataÎncă nu există evaluări

- Cost Accounting Past PapersDocument66 paginiCost Accounting Past Paperssalamankhana100% (2)

- 2009 Form 6744Document192 pagini2009 Form 6744Vita Volunteers WebmasterÎncă nu există evaluări

- P45 Part 1A Details of Employee Leaving WorkDocument6 paginiP45 Part 1A Details of Employee Leaving WorkCatalin FandaracÎncă nu există evaluări

- Inspired Sisters LTD Online) AUDocument3 paginiInspired Sisters LTD Online) AUthankksÎncă nu există evaluări

- P45 Part 1A Details of Employee Leaving WorkDocument3 paginiP45 Part 1A Details of Employee Leaving WorkDan NolanÎncă nu există evaluări

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 paginiCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonÎncă nu există evaluări

- Staff - p45Document4 paginiStaff - p45velorutionÎncă nu există evaluări

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 paginăFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanÎncă nu există evaluări

- Tax Return 2018-19Document18 paginiTax Return 2018-19Kasam AÎncă nu există evaluări

- View Tax Return PDFDocument14 paginiView Tax Return PDFEmil AndriesÎncă nu există evaluări

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 paginiCopy For Employee: P45 Part 1A Details of Employee Leaving WorkDenis VitalieviciÎncă nu există evaluări

- Avis 2018 Revenus 2017Document15 paginiAvis 2018 Revenus 2017Arnaud CalisteÎncă nu există evaluări

- PrintP45 PDFDocument3 paginiPrintP45 PDFIstoc AngelaÎncă nu există evaluări

- 2021 FullDocument14 pagini2021 FullDamian MikaÎncă nu există evaluări

- UK Legal Entity: Assets TransferredDocument3 paginiUK Legal Entity: Assets Transferredshu1706Încă nu există evaluări

- Federal Tax Return FormDocument8 paginiFederal Tax Return FormKING ZeusÎncă nu există evaluări

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 paginiP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuÎncă nu există evaluări

- P45 (ONLINE) Duc Trong Duong 2Document3 paginiP45 (ONLINE) Duc Trong Duong 2Duc Trong DuongÎncă nu există evaluări

- 64-8 Form (Másolat)Document2 pagini64-8 Form (Másolat)Molnar FerencneÎncă nu există evaluări

- HMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDocument3 paginiHMRC NRL1e Non Resident Landlord Application For An Individual 83G 62UW SOFDavid Gatt100% (1)

- LicenseDocument6 paginiLicenseRazvannusÎncă nu există evaluări

- November 2020 - PaySlipDocument1 paginăNovember 2020 - PaySlipShikhar GuptaÎncă nu există evaluări

- Inbound Paper SA1 Form With Instruction - SignedDocument3 paginiInbound Paper SA1 Form With Instruction - SignedKushal SharmaÎncă nu există evaluări

- KYC For JP Fuel (KPS)Document6 paginiKYC For JP Fuel (KPS)LorraineÎncă nu există evaluări

- Ep60 2016-17 PDFDocument1 paginăEp60 2016-17 PDFAnonymous ZoN0SOKzVÎncă nu există evaluări

- ПЭЙСЛИП OutputDocument1 paginăПЭЙСЛИП Output13KARATÎncă nu există evaluări

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 paginăPrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaÎncă nu există evaluări

- R43 2019 PDFDocument4 paginiR43 2019 PDFDavid Mark AldridgeÎncă nu există evaluări

- Royal Air Force Interest Form - Officer: Customer Id: 14911956 Request Id: 20273155Document14 paginiRoyal Air Force Interest Form - Officer: Customer Id: 14911956 Request Id: 20273155Jay SayÎncă nu există evaluări

- P60single 2Document1 paginăP60single 2Claira JervisÎncă nu există evaluări

- Contact Information: Mirosanu I Do Not Have A Middle Name / Initial ToniDocument9 paginiContact Information: Mirosanu I Do Not Have A Middle Name / Initial ToniToni MirosanuÎncă nu există evaluări

- View Completed FormsDocument10 paginiView Completed FormsRui FariaÎncă nu există evaluări

- What Is Aadhaar KYC Know e KYC For Aadhaar CardDocument3 paginiWhat Is Aadhaar KYC Know e KYC For Aadhaar CardHARSHÎncă nu există evaluări

- P 50Document2 paginiP 50Emily DeerÎncă nu există evaluări

- Book1 PsDocument2 paginiBook1 PsVincent IgnacioÎncă nu există evaluări

- Leaving The UK - Getting Your Tax Right: About This FormDocument4 paginiLeaving The UK - Getting Your Tax Right: About This Form_Cristi_Încă nu există evaluări

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 paginiClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshÎncă nu există evaluări

- Tax Return 2016Document18 paginiTax Return 2016kezia dugdale0% (1)

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 paginăNoa-Iit Ob2620150425142233zb4 PDFKanza KhanÎncă nu există evaluări

- Arupr6491f 2019 PDFDocument4 paginiArupr6491f 2019 PDFVeda PrakashÎncă nu există evaluări

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 paginăTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresÎncă nu există evaluări

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 paginăAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaÎncă nu există evaluări

- Private and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duDocument1 paginăPrivate and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duElaine HicksÎncă nu există evaluări

- 620 Iova M SA100 11-12Document16 pagini620 Iova M SA100 11-12Natalia Ciocirlan100% (1)

- Agent Appointment FormDocument2 paginiAgent Appointment FormSatyen ChikhliaÎncă nu există evaluări

- Noa-Iit Ob212020062419132485y PDFDocument1 paginăNoa-Iit Ob212020062419132485y PDFilamahizhÎncă nu există evaluări

- Payslip For Tax Week - 26, Tax Year - 2022-2023Document1 paginăPayslip For Tax Week - 26, Tax Year - 2022-2023Paul NarineÎncă nu există evaluări

- P45 - HM R&CDocument3 paginiP45 - HM R&Cdmitrykrylov34Încă nu există evaluări

- P45 Part 1A Details of Employee Leaving WorkDocument3 paginiP45 Part 1A Details of Employee Leaving WorkPapa JP JohnÎncă nu există evaluări

- Non Sterile Shipping Agreement1Document2 paginiNon Sterile Shipping Agreement1M Muneeb SaeedÎncă nu există evaluări

- LSBUapp FormDocument8 paginiLSBUapp FormM Muneeb SaeedÎncă nu există evaluări

- Merrill Regional Report MENA - 2014Document6 paginiMerrill Regional Report MENA - 2014M Muneeb SaeedÎncă nu există evaluări

- CHQDocument1 paginăCHQM Muneeb SaeedÎncă nu există evaluări

- UntitledDocument1 paginăUntitledM Muneeb SaeedÎncă nu există evaluări

- Education: Oxford English DictionaryDocument6 paginiEducation: Oxford English DictionaryM Muneeb SaeedÎncă nu există evaluări

- Acca TDMDocument2 paginiAcca TDMM Muneeb SaeedÎncă nu există evaluări

- UntitledDocument1 paginăUntitledM Muneeb SaeedÎncă nu există evaluări

- MEM Membership Bro Update FNL2Document12 paginiMEM Membership Bro Update FNL2M Muneeb SaeedÎncă nu există evaluări

- CIA HandbookDocument42 paginiCIA HandbookMuhammad UsmanÎncă nu există evaluări

- Ftsps FormDocument1 paginăFtsps FormM Muneeb SaeedÎncă nu există evaluări

- F9 Practice Question Sassone PLC INVESTMENT APPRAISALDocument3 paginiF9 Practice Question Sassone PLC INVESTMENT APPRAISALM Muneeb Saeed0% (1)

- Tax Aware Investment ManagementDocument320 paginiTax Aware Investment ManagementM Muneeb Saeed100% (1)

- CERT Certification Bro FNL Lo CXDocument8 paginiCERT Certification Bro FNL Lo CXM Muneeb Saeed100% (1)

- Pakistan Government Revokes The Decision of Age Increase For Importing CarsDocument1 paginăPakistan Government Revokes The Decision of Age Increase For Importing CarsM Muneeb SaeedÎncă nu există evaluări

- Common Mistakes in Selling CarsDocument3 paginiCommon Mistakes in Selling CarsM Muneeb SaeedÎncă nu există evaluări

- Companies Ordinance 1984Document419 paginiCompanies Ordinance 1984M Muneeb SaeedÎncă nu există evaluări

- F8 Syllabus 2011Document14 paginiF8 Syllabus 2011Rajeshwar NagaisarÎncă nu există evaluări

- Acca Approved EmployersDocument2 paginiAcca Approved EmployersAsim Khalil100% (1)

- Nokia CodesDocument5 paginiNokia Codesapi-26953169Încă nu există evaluări

- Objective: Sr. # Degree Subjects Institution Board Year Marks DivisionDocument2 paginiObjective: Sr. # Degree Subjects Institution Board Year Marks DivisionM Muneeb SaeedÎncă nu există evaluări

- British Council Report Pakistan: The Next GenerationDocument45 paginiBritish Council Report Pakistan: The Next GenerationM Muneeb SaeedÎncă nu există evaluări

- How To Check Your MobileDocument3 paginiHow To Check Your MobileM Muneeb SaeedÎncă nu există evaluări

- Learn How To Make A WebsitesDocument19 paginiLearn How To Make A WebsitesM Muneeb SaeedÎncă nu există evaluări

- Tips & Tricks of 7610Document5 paginiTips & Tricks of 7610ali khan100% (7)

- Please Choose One of The Topics Below:: History Categories of ComputersDocument32 paginiPlease Choose One of The Topics Below:: History Categories of ComputersM Muneeb SaeedÎncă nu există evaluări

- Nokia Cellphone Cheat CodesDocument5 paginiNokia Cellphone Cheat CodesbumblyjoeÎncă nu există evaluări

- Learn How To Speak Spanish EasilyDocument42 paginiLearn How To Speak Spanish Easilycinthya007Încă nu există evaluări

- Computer Architecture EbookDocument240 paginiComputer Architecture Ebookapi-19818136Încă nu există evaluări

- Joselle Midterm-ExamDocument4 paginiJoselle Midterm-ExamDiana Rose DalitÎncă nu există evaluări

- Fidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Document2 paginiFidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dominic angelesÎncă nu există evaluări

- Accounting For Labor 3Document13 paginiAccounting For Labor 3Charles Reginald K. HwangÎncă nu există evaluări

- E-Filling of ReturnDocument6 paginiE-Filling of ReturnNeelanjan MitraÎncă nu există evaluări

- 05 Current Taxation s19 FinalDocument29 pagini05 Current Taxation s19 FinalTsekeÎncă nu există evaluări

- Advances and Deposits - RMC No 89-12Document8 paginiAdvances and Deposits - RMC No 89-12美流Încă nu există evaluări

- Payment SlipDocument1 paginăPayment Slipchepkoechmourine100Încă nu există evaluări

- Question of Payment of TaxDocument7 paginiQuestion of Payment of Tax7013 Arpit DubeyÎncă nu există evaluări

- Tax 2 Notes Midterms LamosteDocument6 paginiTax 2 Notes Midterms LamosteRoji Belizar HernandezÎncă nu există evaluări

- BIR Form 1604cfDocument3 paginiBIR Form 1604cfMaryjean PoquizÎncă nu există evaluări

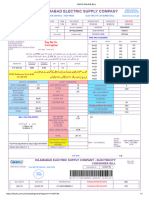

- Faisalabad Electric Supply Company: Say No To CorruptionDocument2 paginiFaisalabad Electric Supply Company: Say No To CorruptionSamar Ali AbbasÎncă nu există evaluări

- PT Prudential Life Assurance Payslip February 2021: ConfidentialDocument1 paginăPT Prudential Life Assurance Payslip February 2021: ConfidentialVenysunny KusnadiÎncă nu există evaluări

- Provident FundDocument5 paginiProvident FundG MadhuriÎncă nu există evaluări

- REVISED SURVEY FORM AND SOP MSME GDocument6 paginiREVISED SURVEY FORM AND SOP MSME GAzzia Morante LopezÎncă nu există evaluări

- Tax NotesDocument10 paginiTax Notescmv mendozaÎncă nu există evaluări

- Ey GSTHST 2022Document2 paginiEy GSTHST 2022Vijay BeniwalÎncă nu există evaluări

- House Bill 2526Document17 paginiHouse Bill 2526Kristofer PlonaÎncă nu există evaluări

- CHAPTER 1 TaxationDocument14 paginiCHAPTER 1 TaxationCharmaine Deirdre Dave100% (1)

- PWC NotesDocument2 paginiPWC NotesDave Mar IdnayÎncă nu există evaluări

- Fee Remission DocumentDocument4 paginiFee Remission DocumentAadhishwar ReddyÎncă nu există evaluări

- Markazu UloomDocument1 paginăMarkazu UloomYoonus VallatÎncă nu există evaluări

- 2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2Document3 pagini2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2nicole tolayba100% (1)

- Bhavnagar E-Way BillDocument2 paginiBhavnagar E-Way BillChiranjeevi ChipurupalliÎncă nu există evaluări

- Iesco Online Bill23Document1 paginăIesco Online Bill23aamir ShahzadÎncă nu există evaluări

- Module-1 - Introduction & Basic Tax ComputationDocument24 paginiModule-1 - Introduction & Basic Tax Computationshaswat sharmaÎncă nu există evaluări

- GST/HST Credit: Including Related Provincial and Territorial Credits and BenefitsDocument14 paginiGST/HST Credit: Including Related Provincial and Territorial Credits and BenefitsSarah AliÎncă nu există evaluări

- E-Filing of Returns (Income Tax Online Filing)Document23 paginiE-Filing of Returns (Income Tax Online Filing)Prashant Jadhav0% (1)

- G.R. No. 153793 August 29, 2006Document2 paginiG.R. No. 153793 August 29, 2006Armel PalerÎncă nu există evaluări

- Revised Commerce Indirect TaxexDocument4 paginiRevised Commerce Indirect Taxexlipsa PriyadarshiniÎncă nu există evaluări