Documente Academic

Documente Profesional

Documente Cultură

MSDI AlcalaDe

Încărcat de

kjpcs12Descriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

MSDI AlcalaDe

Încărcat de

kjpcs12Drepturi de autor:

Formate disponibile

MSDI – Alcala de Henares, Spain

Submitted By: Jaya Prakash Kommu, 2009PGP098

Problem Statement

Merk & Co., Inc was reviewing an investment proposal from MSDI, its facility in Spain. The value of this

investment has to be evaluated using discounted cash flow method. The problem which the company has to

solve is to decided among the following three options:

Discounted cash flow analysis should be performed in USD

Discounted cash flow analysis should be performed in pesetas

Discounted cash flow is independent of currency

Case Facts

Merck & Co., Inc

Large multinational producer of pharmaceuticals for human and animal health care

1987 Projected sales: ~ $5 billion

Year ended December 31, 1986

Reported earnings: $676 million

Reported sales: $4,129 million

Company’s extensive international operations are conducted primarily through subsidiaries grouped

within its MSDI division and the facilities include:

o Manufacturing facilities

o Research laboratories

o Experimental farms in 20 countries

o Sales and marketing subsidiaries in many more

In 1986: subsidiaries outside the US recorded sales approx half of Merck’s sales and pretax income of

slightly less than 40%

Operations at Alcala de Herares

Manufacturing facility, research laboratory and experimental farm owned by Merck

Primary production process – washing, filling, inspecting and sealing of ampoules of Lidocaine. The

process was semi-automated.

In 1987, the increase in capacity resulted in shortage of resources. The alternatives available are:

o An added shift of 10 workers

o Photo electric sensing machinery + 4 workers

Jaya Prakash Kommu

New cost saving proposal

Comparison between the new and old proposals

Semi-automated Fully automated

Workers required 10 4, under favorable conditions 3

Training 2 to 3 months Less that semi-automated approach

Rejection rate of ampules 11% 3%

Direct training and labor cost High Low

Capacity 4.8 million ampoules per yr 6 million ampoules per year

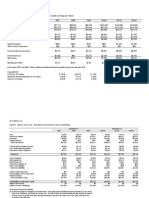

Analysis

Three possibilities

The following three cases are possible in the way Merck & Co., Inc deals with its cash flows from its

subsidiaries.

1. The cash flows which come in peseta are reinvested in the local currency (peseta). Therefore the

opportunity cost of capital(the rate at which cash flows are discounted) should be that of peseta

2. The cash flows which come in peseta are converted to USD as an when they are received.

3. The cash flows conversion to dollars does not follow a pattern.

Possible valuation approaches

For each of the three cases mentioned above the corresponding valuation approaches are as follows:

1. Use cash flows in peseta and discount them using peseta discount rate (opportunity cost at subsidiary).

NPV that is obtained is in peseta which is converted to USD using the spot rate.

2. Convert the cash flows from peseta into USD using future exchange rates. Calculate NPV using $

discount rate.

3. Estimate the rate at which peseta cash flows are converted to dollars. Get the corresponding $ amount

and discount it using $ discount rate.

If parity condition holds in two currencies, then all the three approaches will result in the save value. Therefore

the value of the investment is independent of the approach. However in the next five years peseta is predicted

to appreciate against dollar. The reason is because of the improvements in performance of Spanish economy

in the recent years. The GDP has doubled in the past 4 years (from 1984 to 1987).

Merck & Co., Inc can reinvest their cash flows in peseta because of the following reasons:

Spanish economy is developing, and it makes more sense for Merck & Co., Inc to reinvest their cash

flows in local currency.

Operations at Alcala de Henares is into research are development and not sales. Therefore the cash

realized might not be translated readily into dollars.

Therefore valuation approach 1 can be used for the purpose of evaluating the value of the investment.

Jaya Prakash Kommu

S-ar putea să vă placă și

- Case 2: MSDI - Alcala de Henares, Spain For All Three Questions, Assume The FollowingsDocument2 paginiCase 2: MSDI - Alcala de Henares, Spain For All Three Questions, Assume The FollowingsSammy Dalie Soto BernaolaÎncă nu există evaluări

- Msdi - Alcala de Henares, SpainDocument4 paginiMsdi - Alcala de Henares, SpainDurgesh Nandini Mohanty100% (1)

- MSDI Excel SheetDocument4 paginiMSDI Excel SheetSurya AduryÎncă nu există evaluări

- Msdi Alcala de Henares, SpainDocument24 paginiMsdi Alcala de Henares, SpainVineet NairÎncă nu există evaluări

- MSDI SolnDocument4 paginiMSDI Solnhenuan0408100% (1)

- Lyons Document Storage Corporation Bond AccountingDocument6 paginiLyons Document Storage Corporation Bond AccountingRatnesh Dubey100% (1)

- Msdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleDocument24 paginiMsdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleShashank Shekhar100% (1)

- Glaxo ItaliaDocument11 paginiGlaxo ItaliaLizeth RamirezÎncă nu există evaluări

- Lockheed Tristar ProjectDocument1 paginăLockheed Tristar ProjectDurgaprasad VelamalaÎncă nu există evaluări

- MFIN Case Write-UpDocument7 paginiMFIN Case Write-UpUMMUSNUR OZCANÎncă nu există evaluări

- Cases Qs MBA 6003Document5 paginiCases Qs MBA 6003Faria CHÎncă nu există evaluări

- Merrill Lynch CaseDocument2 paginiMerrill Lynch CaseHailey Judkins100% (2)

- Harris SeafoodsDocument2 paginiHarris SeafoodsNadia Iqbal100% (1)

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 paginiCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashÎncă nu există evaluări

- Flash Memory AnalysisDocument25 paginiFlash Memory AnalysisaamirÎncă nu există evaluări

- Toy World - ExhibitsDocument9 paginiToy World - Exhibitsakhilkrishnan007Încă nu există evaluări

- Flash Memory, Inc.Document2 paginiFlash Memory, Inc.Stella Zukhbaia0% (5)

- CM FinanceforUndergradsDocument5 paginiCM FinanceforUndergradsChaucer19Încă nu există evaluări

- OceanCarriers KenDocument24 paginiOceanCarriers KensaaaruuuÎncă nu există evaluări

- Mercury Athletic Footwear Case (Work Sheet)Document16 paginiMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaÎncă nu există evaluări

- Sampa SolnDocument13 paginiSampa SolnAnirudh KowthaÎncă nu există evaluări

- The Super Project: Mark Smukler, Griffin Meyer & Estefania GarciaDocument8 paginiThe Super Project: Mark Smukler, Griffin Meyer & Estefania GarciaMark SmuklerÎncă nu există evaluări

- List of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationDocument2 paginiList of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationArnold TampubolonÎncă nu există evaluări

- Case Bidding For Antamina: This Study Resource Was Shared ViaDocument6 paginiCase Bidding For Antamina: This Study Resource Was Shared ViaRishavLakraÎncă nu există evaluări

- Case 3 - Ocean Carriers Case PreparationDocument1 paginăCase 3 - Ocean Carriers Case PreparationinsanomonkeyÎncă nu există evaluări

- New Earth Mining: Ashutosh DashDocument16 paginiNew Earth Mining: Ashutosh DashSaurabh ChhabraÎncă nu există evaluări

- Flash Memory IncDocument3 paginiFlash Memory IncAhsan IqbalÎncă nu există evaluări

- Flash Memory IncDocument7 paginiFlash Memory IncAbhinandan SinghÎncă nu există evaluări

- Ocean Carriers - Case (Final)Document18 paginiOcean Carriers - Case (Final)Namit LalÎncă nu există evaluări

- Coursehero 40252829Document2 paginiCoursehero 40252829Janice JingÎncă nu există evaluări

- Sampa VideoDocument24 paginiSampa VideoHenny ZahranyÎncă nu există evaluări

- Sampa Video Case Analysis-Submission by Abhishek Ojha (ePGP-04B-003), Saurabh Singh (ePGP-04B-102) and Toban Varghese (ePGP-04B-116)Document11 paginiSampa Video Case Analysis-Submission by Abhishek Ojha (ePGP-04B-003), Saurabh Singh (ePGP-04B-102) and Toban Varghese (ePGP-04B-116)sks6184280Încă nu există evaluări

- Case StudyDocument10 paginiCase StudyEvelyn VillafrancaÎncă nu există evaluări

- Case Analysis - Compania de Telefonos de ChileDocument4 paginiCase Analysis - Compania de Telefonos de ChileSubrata BasakÎncă nu există evaluări

- Polar SportsDocument7 paginiPolar SportsShah HussainÎncă nu există evaluări

- MM 5009 Financial Management Yeats Valves and Control Inc.: Group 10Document11 paginiMM 5009 Financial Management Yeats Valves and Control Inc.: Group 10ppÎncă nu există evaluări

- Lex Service PLC - Cost of Capital1Document4 paginiLex Service PLC - Cost of Capital1Ravi VatsaÎncă nu există evaluări

- Flash Memory ExcelDocument4 paginiFlash Memory ExcelHarshita SethiyaÎncă nu există evaluări

- Session 19 - Dividend Policy at Linear TechDocument2 paginiSession 19 - Dividend Policy at Linear TechRichBrook7Încă nu există evaluări

- Case Analysis I American Chemical CorporationDocument13 paginiCase Analysis I American Chemical CorporationamuakaÎncă nu există evaluări

- Ocean Carriers Executive SummaryDocument2 paginiOcean Carriers Executive SummaryAniket KaushikÎncă nu există evaluări

- Tottenham Case SolutionDocument14 paginiTottenham Case SolutionVivek SinghÎncă nu există evaluări

- Flash MemoryDocument9 paginiFlash MemoryJeffery KaoÎncă nu există evaluări

- Lockheed Case SolutionDocument3 paginiLockheed Case SolutionKashish SrivastavaÎncă nu există evaluări

- Student SpreadsheetDocument14 paginiStudent SpreadsheetPriyanka Agarwal0% (1)

- Polar SportDocument4 paginiPolar SportKinnary Kinnu0% (2)

- Ocean Carriers - Case SolutionDocument1 paginăOcean Carriers - Case SolutionGerman IzurietaÎncă nu există evaluări

- Victoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XDocument4 paginiVictoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XPaco ColínÎncă nu există evaluări

- Group 3-Case 1Document3 paginiGroup 3-Case 1Yuki Chen100% (1)

- Sterling Student ManikDocument23 paginiSterling Student ManikManik BajajÎncă nu există evaluări

- Calaveras Vineyards ExhibitsDocument9 paginiCalaveras Vineyards ExhibitsAbhishek Mani TripathiÎncă nu există evaluări

- Harvard Publishing Case Study - Darden Business Publishing - University of Virginia - Calaveras VineyardDocument2 paginiHarvard Publishing Case Study - Darden Business Publishing - University of Virginia - Calaveras Vineyardalka murarkaÎncă nu există evaluări

- Seagate NewDocument22 paginiSeagate NewKaran VasheeÎncă nu există evaluări

- Ocean Carriers Case StudyDocument7 paginiOcean Carriers Case StudyaidaÎncă nu există evaluări

- Flash Memory AnalysisDocument25 paginiFlash Memory AnalysisTheicon420Încă nu există evaluări

- Case Background: Case - TSE International CompanyDocument9 paginiCase Background: Case - TSE International CompanyAvinash AgrawalÎncă nu există evaluări

- HAMPTON MACHINE TOOL Case - PresentationDocument7 paginiHAMPTON MACHINE TOOL Case - PresentationChaitanya90% (10)

- Applichem: Case Analysis Presented To Indian Institute of Management, BangaloreDocument15 paginiApplichem: Case Analysis Presented To Indian Institute of Management, BangaloreNitin BandgarÎncă nu există evaluări

- Portfolio Optimization and Monte Carlo SimulationDocument96 paginiPortfolio Optimization and Monte Carlo Simulationmaha rehmanÎncă nu există evaluări

- SPJ2021 SolsDocument13 paginiSPJ2021 Solsmohamad nassrallahÎncă nu există evaluări

- Marketing Strategies of Ford MotorsDocument72 paginiMarketing Strategies of Ford MotorsAmit Nayyar100% (1)

- Drivers and Risks of OutsourcingDocument5 paginiDrivers and Risks of OutsourcinglpelessÎncă nu există evaluări

- Chapter 3 Quiz KeyDocument2 paginiChapter 3 Quiz KeyAmna MalikÎncă nu există evaluări

- 1 SGD To Idr - Google SearchDocument2 pagini1 SGD To Idr - Google SearchBachtiar M TaUfikÎncă nu există evaluări

- Iberostar Grand Hotel Bavaro Inv #25468Document2 paginiIberostar Grand Hotel Bavaro Inv #25468David ArteagaÎncă nu există evaluări

- 7 D 6341 D 9Document6 pagini7 D 6341 D 9Saul IpanaqueÎncă nu există evaluări

- Basics of Financial ManagementDocument48 paginiBasics of Financial ManagementAntónio João Lacerda Vieira100% (1)

- Discovery JT FoxxDocument10 paginiDiscovery JT Foxxrifishman1Încă nu există evaluări

- Bath and Shower in India PDFDocument8 paginiBath and Shower in India PDFVishal SinghÎncă nu există evaluări

- VW Annual ReportDocument340 paginiVW Annual Reportdraco1907Încă nu există evaluări

- Philippine Stock ExchangeDocument4 paginiPhilippine Stock ExchangeSheila LisondraÎncă nu există evaluări

- CHA Press ReleaseDocument1 paginăCHA Press ReleaseJoshua BostÎncă nu există evaluări

- Internship Report Draft Saeed Ahamad-B1304048Document64 paginiInternship Report Draft Saeed Ahamad-B1304048saeed ahamadÎncă nu există evaluări

- Fi32rk14 LRDocument44 paginiFi32rk14 LRAvnik 'nickz' NayeeÎncă nu există evaluări

- First 10 Cases - CommrevDocument179 paginiFirst 10 Cases - CommrevStephen JacoboÎncă nu există evaluări

- Watch Tower Charter Corporate Entities and AmendmentsDocument116 paginiWatch Tower Charter Corporate Entities and AmendmentsSo AZ Cop Watch100% (1)

- Air India PresentationDocument16 paginiAir India PresentationIsha SinghÎncă nu există evaluări

- Corporate Social Responsibility CSRDocument25 paginiCorporate Social Responsibility CSRIoana-Loredana Ţugulea100% (1)

- Parle - G Industrial Visit of BIRENDERDocument11 paginiParle - G Industrial Visit of BIRENDERbirender_kumarÎncă nu există evaluări

- Leadership ProfileDocument3 paginiLeadership ProfileManjunathSulgadleÎncă nu există evaluări

- BAE Analysis1Document2 paginiBAE Analysis1kwathom186% (7)

- Makerere University: Business SchoolDocument5 paginiMakerere University: Business Schoolkitderoger_391648570Încă nu există evaluări

- PhiladelphiaBusinessJournal Sept. 8, 2017Document28 paginiPhiladelphiaBusinessJournal Sept. 8, 2017Craig EyÎncă nu există evaluări

- Form For Buy Auction CarDocument1 paginăForm For Buy Auction CarLen Ko ChoiÎncă nu există evaluări

- Production Operation Management General Motor Halol ChevroletDocument27 paginiProduction Operation Management General Motor Halol ChevroletApoorv JainÎncă nu există evaluări

- On IBCDocument60 paginiOn IBCShital Darak MandhanaÎncă nu există evaluări

- Local BankDocument2 paginiLocal BankSuresh ShÎncă nu există evaluări

- The Most Popular Professional Software For All Engineering FieldsDocument4 paginiThe Most Popular Professional Software For All Engineering Fieldsthakur_raghabÎncă nu există evaluări

- Distressed Debt InvestingDocument5 paginiDistressed Debt Investingjt322Încă nu există evaluări

- Ramon C. Lee and Antonio Lacdao v. The Hon. Court of AppealsDocument1 paginăRamon C. Lee and Antonio Lacdao v. The Hon. Court of AppealsTeff QuibodÎncă nu există evaluări