Documente Academic

Documente Profesional

Documente Cultură

Mult PDX Registration

Încărcat de

Isaac MillerDescriere originală:

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Mult PDX Registration

Încărcat de

Isaac MillerDrepturi de autor:

Formate disponibile

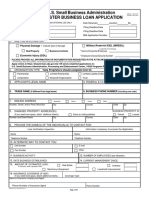

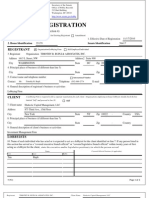

REGISTRATION FORM PLEASE RETURN THIS FORM TO:

City of Portland

CITY OF PORTLAND BUSINESS LICENSE Revenue Bureau, License & Tax Division

& MULTNOMAH COUNTY BUSINESS 111 SW Columbia St., Suite 600

Portland, OR 97201

INCOME TAX (503) 823-5157

Registration is required. You may register online at www.pdxbl.org

Most information provided on this form is subject to disclosure under Public Record Law. License & Tax Division

* Business activity conducted in the City of Portland Account Number:

* Business activity conducted in Multnomah County

* Business activity occurs outside Multnomah County / City of Portland

* Please check all that apply

Note: Single-member LLCs should not register or file in the LLC’s name. The business name, taxpayer ID #, entity type, etc. should match the federal/Oregon tax return on which the single-

member LLC’s income is directly reported. The name of the single-member LLC should be included on the “Doing Business As” line below.

BUSINESS NAME:

(Last Name, First Name if sole proprietorship or single-member LLC filing as a sole proprietorship)

CONTACT NAME: CONTACT PHONE:

DOING BUSINESS AS:

(If different from BUSINESS NAME above)

EMAIL ADDRESS: FAX NUMBER:

BUSINESS ENTITY TYPE: Sole *S.S. # __ __

Proprietorship

Partnership Corporation S-Corporation

LLC (multiple Limited Estate Trust *FEIN: __

member) Partnership

Non-Profit Corporation (under IRS Section 501) * This information is not subject to public disclosure.

BUSINESS FISCAL/TAX YEAR END (December for sole proprietorships and most single-member LLCs):

CITY OF PORTLAND BUSINESS START DATE: NUMBER OF OWNERS:

MULTNOMAH COUNTY BUSINESS START DATE:

PRIMARY BUSINESS LOCATION ADDRESS – (No PMB or P.O. Box Numbers – physical location only):

(List additional business location addresses on back)

BUSINESS ACTIVITY

DESCRIPTION:

BUSINESS PHONE: BUSINESS PROPERTY TYPE: Commercial Residential

MAILING ADDRESS – PMB or P. O. Box Numbers accepted (if different from primary business location address above):

This section for Office Use Only – Application continued on back

DATE RECEIVED: ENTRY DATE: NAICS:____________

Form REG - Rev. 3/19/2010

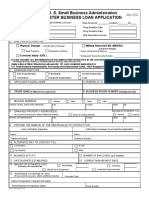

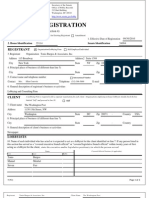

ADDITIONAL LOCATION ADDRESSES and/or ADDRESSES OF RENTAL PROPERTY OWNED (use add’l sheet if needed):

Business Name and Address Business Description Check All That Apply

This is an Add’l Bus Location

Rental Property Owned

If Rental Property is owned, is it:

Commercial or Residential.

Number of units:

This is an Add’l Bus Location

Rental Property Owned

If Rental Property is owned, is it:

Commercial or Residential.

Number of units:

This is an Add’l Bus Location

Rental Property Owned

If Rental Property is owned, is it:

Commercial or Residential.

Number of units:

OWNERS OF CORPORATION or PARTNERS - List corporate owners that hold more than 5% of the voting stock of the

corporation. List all partners, including limited partners if any and all LLC members. Use additional sheets if needed.

Owner Name and Address Social Security Number % of Stock

Business tax registration is required of all those doing business within Multnomah County and/or the City of Portland, Oregon.

Exemptions include most non-profit agencies and businesses whose total gross receipts for all business everywhere are less than

$50,000 annually. Taxes are based upon net apportioned income and the minimum annual tax is $100 for each jurisdiction. Please

complete this registration form and return it to the address on the front of the form.

Annual Business License/Income Tax Filing Process:

1. You will have 3.5 months after the last day of your tax year to file your return, your extension request, or your exemption

request. PLEASE NOTE: Businesses that are exempt must file Form AER and provide verification.

* For example, if your business fiscal year goes from January 1 to December 31, then your tax return, extension request,

or exemption request must be filed by April 15th of the following year.

2. The tax will be determined by the income figures reported on the tax return. If you are exempt and verifying

documentation/tax pages have been provided, then no tax is due.

3. No payment is due with this form. Registration is required within 60 days of the start of business activity.

4. All required forms may be found at www.pdxbl.org

Notice of confidentiality: All tax returns and related financial information, including a Taxpayer ID #, filed with the City

of Portland are confidential. Except as provided by PCC 7.02.230, .240, and .250, it it unlawful to divulge or release any

information submitted or disclosed to the City.

The Business License tax is for revenue purposes, and is not regulatory. The payment of a license tax and the acceptance of such

a payment does not entitle a registered business to carry on a business not in compliance with all applicable requirements of state,

federal, municipal or other laws. The undersigned declares under penalty of making a false statement, that the information given

in this form is true.

Signature of Registrant or Authorized Representative Title Date

S-ar putea să vă placă și

- NC Business LicenseDocument4 paginiNC Business Licensepersonal1492100% (1)

- International Business or Company Tax Reg FormDocument4 paginiInternational Business or Company Tax Reg FormNithinÎncă nu există evaluări

- Zealot DiaryDocument13 paginiZealot DiaryMaria SamsonÎncă nu există evaluări

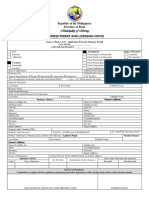

- Application Form For Business PermitDocument2 paginiApplication Form For Business PermitJoyce Leeann Manansala0% (1)

- Santa Clara Business Tax Certificate GuideDocument2 paginiSanta Clara Business Tax Certificate GuideTom Reynolds100% (1)

- BPLS Unified Form ApplicationDocument1 paginăBPLS Unified Form ApplicationEvan Fontamillas DeocadesÎncă nu există evaluări

- Application Form Bplo Latest LegalDocument1 paginăApplication Form Bplo Latest LegalEvan Fontamillas DeocadesÎncă nu există evaluări

- Federal Tax Registration FormDocument2 paginiFederal Tax Registration FormMuhammad Faisal KhanÎncă nu există evaluări

- Tarlac - San Filipe - Business Permit - NewDocument2 paginiTarlac - San Filipe - Business Permit - Newarjhay llaveÎncă nu există evaluări

- IRC Taxpayer Guide RegistrationDocument13 paginiIRC Taxpayer Guide RegistrationAwong Zoo KiipaÎncă nu există evaluări

- Original Copy Business Permit Application Form BPLOs PDFDocument2 paginiOriginal Copy Business Permit Application Form BPLOs PDFNicole Canarias100% (1)

- Formular 200 Anaf EngDocument14 paginiFormular 200 Anaf Enguzuneanu ralucaÎncă nu există evaluări

- Form 1945 - Application For Certificate of Tax Exemption For CooperativesDocument4 paginiForm 1945 - Application For Certificate of Tax Exemption For CooperativesDarryl Jay Medina100% (1)

- Interstate Power and Light Company and Wisconsin Power and Light Company Are Alliant Energy Companies Is Entered in The Owner Information SectionDocument4 paginiInterstate Power and Light Company and Wisconsin Power and Light Company Are Alliant Energy Companies Is Entered in The Owner Information SectionKhalid AwanÎncă nu există evaluări

- Apply - For - Dealership - Application Form PDFDocument15 paginiApply - For - Dealership - Application Form PDFabhishekÎncă nu există evaluări

- GST Registration Application FormDocument5 paginiGST Registration Application Formrajnikant kukretiÎncă nu există evaluări

- Shared Services Division: Purchasing DepartmentDocument2 paginiShared Services Division: Purchasing DepartmentNyl Gabriel BandalanÎncă nu există evaluări

- For Resident Companies Registering For Tax in Ireland: General Details Part ADocument8 paginiFor Resident Companies Registering For Tax in Ireland: General Details Part ANaitik singalÎncă nu există evaluări

- Philippines Business Permit ApplicationDocument3 paginiPhilippines Business Permit ApplicationMr. Kitty CatÎncă nu există evaluări

- Request For A Business Number and Certain Program AccountsDocument13 paginiRequest For A Business Number and Certain Program AccountsDattadharmawardhaneÎncă nu există evaluări

- Unified 2024 NewDocument2 paginiUnified 2024 NewabmbookkeepingofficeÎncă nu există evaluări

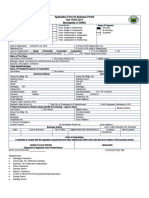

- SBA Disaster Loan Application GuideDocument6 paginiSBA Disaster Loan Application GuideJustin MichaelÎncă nu există evaluări

- Serv Da All Loanapp 2 0 0 3Document5 paginiServ Da All Loanapp 2 0 0 3alexÎncă nu există evaluări

- Unifiedform DavaoDocument2 paginiUnifiedform DavaoTristan Lindsey Kaamiño Ares100% (1)

- Business Permit Application Form PDFDocument1 paginăBusiness Permit Application Form PDFKimberly ParalejasÎncă nu există evaluări

- Revolt Dealership Application Form 17 Dec 2020Document8 paginiRevolt Dealership Application Form 17 Dec 2020abhishekÎncă nu există evaluări

- Taxpayer Registration Form OrganisationDocument4 paginiTaxpayer Registration Form OrganisationMagdalene AmewodzoÎncă nu există evaluări

- Business Application Form 2020 Revised 2022 1Document2 paginiBusiness Application Form 2020 Revised 2022 1Jan Cyrelle AbrazadoÎncă nu există evaluări

- Due Diligence Questionnaire (DDQDocument8 paginiDue Diligence Questionnaire (DDQIrelena RomeroÎncă nu există evaluări

- Unified Application Form For New Business Permit (Online) : Male Male Female FemaleDocument2 paginiUnified Application Form For New Business Permit (Online) : Male Male Female Femaleflashpower fuelÎncă nu există evaluări

- Registration by Kyle Michel Law Firm To Lobby For Southern Carolina Regional Development Alliance (300332368)Document2 paginiRegistration by Kyle Michel Law Firm To Lobby For Southern Carolina Regional Development Alliance (300332368)Sunlight FoundationÎncă nu există evaluări

- Completed Loan ApplicationDocument9 paginiCompleted Loan ApplicationNoriely Altagracia Paulino RivasÎncă nu există evaluări

- Bplo Unified Form PDFDocument2 paginiBplo Unified Form PDFTristan Lindsey Kaamiño AresÎncă nu există evaluări

- 64-8 Form (Másolat)Document2 pagini64-8 Form (Másolat)Molnar FerencneÎncă nu există evaluări

- SampleForms 201 - Corporation Act 201Document74 paginiSampleForms 201 - Corporation Act 201vietanhpsÎncă nu există evaluări

- Application For Registration: Republic of The Philippines BIR Form NoDocument6 paginiApplication For Registration: Republic of The Philippines BIR Form Nomarlon anzanoÎncă nu există evaluări

- Business Account Services ApplicationDocument9 paginiBusiness Account Services ApplicationZaccheus JulesÎncă nu există evaluări

- MCSBG@co - Monterey.ca - Us: County of Monterey Workforce Development Board EmailDocument2 paginiMCSBG@co - Monterey.ca - Us: County of Monterey Workforce Development Board EmailIliana RamosÎncă nu există evaluări

- A1-A2 - Business Customer InfoDocument2 paginiA1-A2 - Business Customer InfoSteve LimÎncă nu există evaluări

- FBN App StatementDocument2 paginiFBN App StatementBecca FriasÎncă nu există evaluări

- EDF-InstructionsDocument1 paginăEDF-InstructionsRaiza Mei AndresÎncă nu există evaluări

- Application Form For Business Permit Tax Year 2017 Municipality of GAMUDocument1 paginăApplication Form For Business Permit Tax Year 2017 Municipality of GAMUGamu DILGÎncă nu există evaluări

- LEPCGX Document 2016 03 17 TIN1 Non Individual TIN ApplicationDocument3 paginiLEPCGX Document 2016 03 17 TIN1 Non Individual TIN ApplicationLiberation FoundationÎncă nu există evaluări

- Registration by TIMOTHY R. RUPLI & ASSOCIATES, INC. To Lobby For Dialectic Capital Management, LLCDocument2 paginiRegistration by TIMOTHY R. RUPLI & ASSOCIATES, INC. To Lobby For Dialectic Capital Management, LLCSunlight FoundationÎncă nu există evaluări

- Business Permit ApplicationDocument2 paginiBusiness Permit Applicationjohnsspliff anime X gamerÎncă nu există evaluări

- Application Form For Business Permit: Amendment: AmendmentDocument2 paginiApplication Form For Business Permit: Amendment: AmendmentJdavidÎncă nu există evaluări

- Application For Registration: (To Be Filled Up by BIR) DLNDocument2 paginiApplication For Registration: (To Be Filled Up by BIR) DLNRhu BurauenÎncă nu există evaluări

- Unified FormDocument1 paginăUnified FormRobert V. AbrasaldoÎncă nu există evaluări

- SST 01Document1 paginăSST 01OSAMAÎncă nu există evaluări

- Philippines Business Permit ApplicationDocument6 paginiPhilippines Business Permit ApplicationKaren Grace DumangcasÎncă nu există evaluări

- Taguig City Business Permit Application Form 2019Document1 paginăTaguig City Business Permit Application Form 2019Binkee VillaramaÎncă nu există evaluări

- Bplo Unified Business Application Form Final20201216 - 05939Document1 paginăBplo Unified Business Application Form Final20201216 - 05939Elmer ZabalaÎncă nu există evaluări

- f13005 1 PDFDocument4 paginif13005 1 PDFtran longÎncă nu există evaluări

- Registration by Tonio Burgos & Associates, Inc. To Lobby For The Washington Post (300320435)Document2 paginiRegistration by Tonio Burgos & Associates, Inc. To Lobby For The Washington Post (300320435)Sunlight FoundationÎncă nu există evaluări

- Business Permit App FormDocument1 paginăBusiness Permit App FormcheansiaÎncă nu există evaluări

- ST 3Document5 paginiST 3sandyolkowskiÎncă nu există evaluări

- Arf - 2018Document6 paginiArf - 2018Vipin GargÎncă nu există evaluări

- Application For Dealer RegistrationDocument3 paginiApplication For Dealer RegistrationAlexander DaltonÎncă nu există evaluări

- 2020 Guide to Small Business Tax PlanningDe la Everand2020 Guide to Small Business Tax PlanningÎncă nu există evaluări

- People Vs ValdezDocument2 paginiPeople Vs ValdezEvangelyn EgusquizaÎncă nu există evaluări

- Arrieta vs. LlosaDocument5 paginiArrieta vs. LlosaJoni PurayÎncă nu există evaluări

- Cancellation of Bail Sec 497Document6 paginiCancellation of Bail Sec 497Azad SamiÎncă nu există evaluări

- DouglasDocument52 paginiDouglasChicago MaroonÎncă nu există evaluări

- Setting Up a Legal Business Credit ProfileDocument7 paginiSetting Up a Legal Business Credit ProfileMaryUmbrello-Dressler83% (12)

- Contoh Surat Perjanjian VendorDocument3 paginiContoh Surat Perjanjian VendorKhalid RidwanÎncă nu există evaluări

- Draft 2 Research On Child Sexual Exploitation in Sierra LeoneDocument35 paginiDraft 2 Research On Child Sexual Exploitation in Sierra LeoneGrace Bella-KamaraÎncă nu există evaluări

- Human Rights and Duties - IndiaDocument43 paginiHuman Rights and Duties - IndiaLolÎncă nu există evaluări

- 2021-11-17 Summons & Complaint - REDACTED FinalDocument17 pagini2021-11-17 Summons & Complaint - REDACTED FinalDaily Caller News FoundationÎncă nu există evaluări

- Land Use ChargeDocument25 paginiLand Use ChargeOmoniyiOmoniyiÎncă nu există evaluări

- Chua-Burce vs. Ca: G.R. No. 109595. April 27, 2000Document17 paginiChua-Burce vs. Ca: G.R. No. 109595. April 27, 2000ALain Rascid G. HarunÎncă nu există evaluări

- 1 UQ Assessment Form 2Document4 pagini1 UQ Assessment Form 26.Poorvi sarnaikÎncă nu există evaluări

- The Notwithstanding Clause: Sword of Damocles or Paper Tiger?Document6 paginiThe Notwithstanding Clause: Sword of Damocles or Paper Tiger?Rafael BezerraÎncă nu există evaluări

- Letter To NF For Inclusion RTPDocument4 paginiLetter To NF For Inclusion RTPM J da PrinceÎncă nu există evaluări

- Heirs of Dr. Mario S. Intac and Angelina Mendoza Intac vs. CA PDFDocument18 paginiHeirs of Dr. Mario S. Intac and Angelina Mendoza Intac vs. CA PDFGodly Ann Tuttle CamitanÎncă nu există evaluări

- Protection of Trans Rights (Newsletter)Document3 paginiProtection of Trans Rights (Newsletter)Aishwarya PandeyÎncă nu există evaluări

- 41 (A) ArrestDocument16 pagini41 (A) ArrestT Jayant JaisooryaÎncă nu există evaluări

- The Role of A Lawyer in SocietyDocument16 paginiThe Role of A Lawyer in SocietyDAWA JAMES GASSIMÎncă nu există evaluări

- PHELPS DUNBAR WELL CONTROL COVERAGESDocument3 paginiPHELPS DUNBAR WELL CONTROL COVERAGESgimgagÎncă nu există evaluări

- 402-Judgment Minor Rape CaseDocument12 pagini402-Judgment Minor Rape CaseLive LawÎncă nu există evaluări

- Frank Krische A/K/A Joseph Boyd v. Harold J. Smith, Superintendent, Attica Correctional Facility, 662 F.2d 177, 2d Cir. (1981)Document6 paginiFrank Krische A/K/A Joseph Boyd v. Harold J. Smith, Superintendent, Attica Correctional Facility, 662 F.2d 177, 2d Cir. (1981)Scribd Government DocsÎncă nu există evaluări

- Reversed Civrev Bqa 2016 1989Document225 paginiReversed Civrev Bqa 2016 1989doraemoan100% (1)

- Marikay Abuzuaiter E-Mail FilesDocument33 paginiMarikay Abuzuaiter E-Mail FilesYESWeeklyÎncă nu există evaluări

- Source: UST Golden Notes On Taxation Law 2017Document5 paginiSource: UST Golden Notes On Taxation Law 2017Mau Dela CruzÎncă nu există evaluări

- General Provisions on Damages and Penalties in Estafa CasesDocument19 paginiGeneral Provisions on Damages and Penalties in Estafa CasesElica DiazÎncă nu există evaluări

- CathleenDocument8 paginiCathleenJeanLotusÎncă nu există evaluări

- Curious Case of Agnes Raguinan, Teacher: AsiseeitDocument7 paginiCurious Case of Agnes Raguinan, Teacher: AsiseeitJason JavierÎncă nu există evaluări

- M.C. Mehta v. State of Tamil NaduDocument16 paginiM.C. Mehta v. State of Tamil NaduVishal Tyagi100% (1)

- Revenue Allocation Act SummaryDocument9 paginiRevenue Allocation Act SummaryOyebisi OpeyemiÎncă nu există evaluări

- Filipinas Broadcasting Network Vs AMEC-BCCM Case DigestDocument6 paginiFilipinas Broadcasting Network Vs AMEC-BCCM Case DigestAlyssa Mae Ogao-ogaoÎncă nu există evaluări