Documente Academic

Documente Profesional

Documente Cultură

Multivariate Jump Diffusion Models For The Foreign Exchange Market

Încărcat de

Sui Kai WongDescriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Multivariate Jump Diffusion Models For The Foreign Exchange Market

Încărcat de

Sui Kai WongDrepturi de autor:

Formate disponibile

Jump Diffusion Models for the Foreign Exchange Market

Abstract

In this project, we look at the developments and limitations of some of the mainstream financial models and build a framework of assumptions to develop a univariate and a multivariate Jump Diffusion model to represent the returns of assets. We will implement a Double Exponential (DE) distribution to a Gaussian model in a mixture model to account for large jumps in asset returns. Finally, we will employ Markov chain Monte Carlo (MCMC) techniques to estimate the parameters for the jump diffusion models using data from the Foreign Exchange (FX) market.

Keywords: Geometric Brownian motion, Jump Diffusion, Mixture model, Multivariate Double Exponential, Markov chain Monte Carlo, Metropolis-Hastings within Gibb Sampler, Leptokurtosis, Foreign Exchange Market

Jump Diffusion Models for the Foreign Exchange Market

1. Introduction

1.1 Financial Models

Brownian motion is an observation made by botanist Robert Brown of the erratic movements of particles suspended in fluid. This observation was quantified and modelled as a continuous time stochastic process known as the geometric Brownian motion (GBM) in which the increment of the stochastic process is normal with respect to its current value1. It was French mathematician Louis Bachelier who first conceptualise the assumption that an asset price movement is a GBM in 1900. Many of todays financial theories, like the Modern Portfolio Theory (Markowitz 1952), the Capital Asset Pricing Model (Sharpe 1964) and the Black-Scholes-Merton Option Pricing model (1973), are based on this assumption2.

Figure 1.1.1: Illustration of the Brownian motion in 1- and 2-dimensions

Prior to Harry Markowitzs paper on portfolio selection in 1952, the conventional wisdom called for an investor to choose a portfolio that maximises the profit. Markowitz hypothesized that the one can maximise their profit while minimising their risk by selecting a well-diversified portfolio3. His meanvariance portfolio theory described the assets returns as jointly normally distributed random variables with the risk or volatility defined as the standard deviation. By selecting a portfolio of well-diversified

1 2

Sheldon M. Ross, 2007. Introduction to Probability Models. 7th ed. Elsevier/Academic Press Eugene F. Fama, 1965. Random Walks in Stock Market Prices. Financial Analyst Journals, Vol. 21, No. 5 page 55-59, Sep.-Oct.,1965 3 Harry Markowitz, 1952. Portfolio Selection, The Journal of Finance. Vol. 7, No. 1, page 77-91, Mar., 1952.

Jump Diffusion Models for the Foreign Exchange Market

securities, Markowitz aimed to reduce the total variance (and hence the risk) of the portfolio to the intrinsic systematic or market risk. This became known as the Market portfolio. The investors will then choose a weighted combination of this portfolio and a riskless asset (government bonds etc.) to maximise their profits according to their risk appetite.

Expanding on Markowitzs work, William Sharpe introduced the Capital Asset Pricing model (CAPM) in 1964. CAPM formulates the expected returns of an asset as the sum of the riskless rate of returns and a ratio of the market premium i.e. the additional expected returns of the Market portfolio above that of the riskless asset4. The ratio is represented by the coefficient Beta, which measures the elasticity of the assets return to the markets return. Beta is usually computed through historic data of the asset. As Sharpe was working upon the framework of Markowitzs portfolio theory, it inherited the same assumptions (and therefore, also its limitation)5. CAPM is use effectively to determine the price of individual security and its widespread use forms one of the cornerstone of asset pricing models today.

One of the most influential financial models today is the Black-Scholes-Merton Option Pricing model (B-S model). The model was conjured up by Fischer Black and Myron Scholes (1973), and Robert C. Merton (1973) on a separate paper and is primarily used in pricing European-style options. The option prices are equilibrated with the prices of the underlying asset so that there can be no arbitrage in the market and the fundamental assumption in the B-S model framework is that returns of the underlying assets is a GBM. The B-S model formalise the process of option pricing and its widespread acceptance saw the boom in options trading in the 1980s6.

S. Ross, R. Westerfield, J. Jaffe, B. Jordan, 2008, Modern Financial Management, 8th ed., McGraw-Hill Irwin, 2008 5 Harry Markowitz, 1999. The early history of portfolio theory: 1600-1960, Financial Analyst Journal , Vol.55, No.4,. Page 5-16, Jul.- Aug. 1999 6 Ajay Shah, 1997. Black, Merton and Scholes: Their Work and its Consequences. Economic and Political Weekly, Vol. 32, No.52, Page 3337-3342, Dec,. 1997

Jump Diffusion Models for the Foreign Exchange Market

1.2. Limitations of Financial Models

When modelling the financial markets, there are many justified assumptions made to the behaviour of returns (normally distributed and fixed correlation between assets) and investors (price takers, rational and risk-averse), the market efficiency (information symmetry, no arbitrage and frictionless transaction) and the legislation pertaining to the financial markets (tax free market and short selling laws). These assumptions are made when modelling market movements to simplify the reality and yet derive a robust formulation that represents the real world.

However, despite the elegance of these models, recent events in the financial market have forced us to re-evaluate some of these assumptions. In this report, we shall investigate the limitation of the Gaussian assumption made earlier. Over the bubble and bust cycle in the financial market, jumps of magnitude over 5 standard deviations () are observed more frequently that predicted under the Gaussian assumption (1 in 3 million event). Empirical data showed the FX market, by far the most volatile and liquid financial market, saw jumps of 7 in the DEM-GBP rates (a 10-12 event; Black Wednesday 1992), 9 in the USD-THB rates (Asian financial crisis 1997), and rebounds of 8 in the EUR-ISK (Icelandic financial crisis 2008). These huge deviations created the fat-tail phenomena, known as leptokurtosis7, in the distribution of the drifts. Probability of such events occurring are almost negligible under the Gaussian model but ignoring this statistic, as history has shown, is disastrous. The inability of the Gaussian model to accommodate these frequent large jumps in the financial markets opposes the idea that assets return is a GBM. Therefore a more accurate model will be required if we were to improve our predictions in the financial markets.

Peter Verhoeven and Michael McAleer, 2004. Fat tails and asymmetry in financial volatility models, Mathematics and Computers in Simulation, Vol.64 No.3-4 , Pages 351-361, Feb., 2004

Jump Diffusion Models for the Foreign Exchange Market

1.3. The Foreign Exchange Market

As mentioned earlier, the FX market is by far the largest financial market8. It boasted a $4 trillion daily turnover worldwide and is traded round the clock all year long. Currencies are traded in pairs, with a countrys currency exchanging for anothers. Therefore, a currency trade may be considered as a structure of long and short trades. Due to this long-short arrangement, the exchange rates across the worlds currencies are intricately linked. Large quantity of speculative trades in the FX market gives the market additional liquidity, which in turn ensures that all arbitrage opportunities are eliminated quickly after an exogenous shock. The fast changing and volatile nature of the FX market may hinder the effectiveness of a predictive model for currency exchange. As such, there are few financial models developed for the FX market. However, we are precisely looking to develop a model for an eccentric and interrelated class of asset. Therefore, we will use the market data from the FX market to evaluate our model.

1.4. Jump Diffusion

One possible improvement is to employ a jump diffusion (JD) model to represent the returns of assets (Merton (1976); Kou (2002)). Jump diffusion is a stochastic process that separates the diffusion (drifts) component from the spontaneous jumps. While the diffusions follow a GBM, which is a continuous time stochastic process, market data we obtain are usually discretised in time. Therefore, we will simplify the model by using a discrete time space for greater practicality and develop a probability distribution function (pdf) for the model. We will use a Gaussian distribution to represent the drifts while a Bernoulli model will separate the jumps and the drifts from occurring at the same time. In reality, the Bernoulli random variable will mimic the occurrence of a shock (both positive and negative) amidst the well-behaved drifts in the financial market. The Double Exponential (DE)

Bank of International Settlement, 2007. Foreign Exchange and Derivative market activity in 2007, Triennial Central Bank Survey,19 Dec.2007

Jump Diffusion Models for the Foreign Exchange Market

Distribution (also known as the Laplace distribution) will model the resultant jump9. The DE will give us the leptokurtosis feature for our model.

We will extend our investigation of the jump diffusion model to look at a multivariate model. Due to the complex intricate nature of the securities in the market, price movements are rarely only securityspecific. They usually have a corresponding effect on related assets. This was the motivation behind Markowitz mean-variance model in 1952. Furthermore, the recent proliferation of structured financial products, like exotic options, Mortgage backed securities and Collateral Debt Obligations, which are themselves composed of multiple securities, exemplify the need to developing a multivariate version of the jump diffusion model. The multivariate model will be useful in representing the movement of a portfolio of securities or the market in general in view of the jumps and may be instrumental in finding optimal portfolio allocations, identifying the market portfolio and pricing options. These applications are however not within the scope of this report but are worth further investigations.

In both our univariate JD (UVJD) and multivariate JD (MVJD) model, we did not separate the occurrence and the magnitude of the positive and negative jumps (as oppose to Ramezani and Zeng (1998)) as we seek not to complicate our model by introducing too many parameters and lose the degrees of freedom. Therefore, we will assume that the jumps are centralised at zero, and for the multiple assets in our MV model, with the common magnitude. The drifts in the MVJD are modelled as a multivariate Gaussian distribution with positive semi-definite variance-covariance matrix to demonstrate the correlated nature of the price movements. We assume that the jumps of the multiple assets occur at the same time (when our Bernoulli random variable is 1). From an economic standpoint, this assumption is a practical one as in a liquid market, within a feasible unit of discrete time, jumps occur simultaneously.

S.G. Kou, 2002, A Jump-Diffusion Model for Option Pricing, Management Science, Vol.48, No. 8 page1086-1101, Aug. 2002

Jump Diffusion Models for the Foreign Exchange Market

1.5. Markov chain Monte Carlo

For our analysis, we opted for the Bayesian approach to inference over the Frequentists technique of Maximum Likelihood Estimate (MLE)10. We chose this method as it allows us to incorporate our knowledge and the information we have about the data into the analysis by specifying a prior distribution. To compute the marginal posterior density, we used the standard Metropolis-Hasting within a Gibbs Sampling MCMC algorithm. The algorithm gives us flexibility in implementing a suitable proposal distribution for the Markov chain. We will obtain a series of values for each parameter estimate, which will allow us to analyse the range and the precision of the estimate. In addition, the derivation of the MLE for our mixture (JD) model, and especially the multivariate form, will be extremely complicated.

This report will first describe the structure of the UVJD and MVJD model and illustrate the derivation process for their probability density function. We will then adopt these two models for the four most liquid currency-pair in the FX market. Finally, we will analyse and conclude our findings and discuss the limitations of the models and possible avenues for further research.

10

Cyrus A. Ramezani and Yong Zeng, 1998. Maximum Likelihood Estimate of the double exponential jumpdiffusion process, Annals of Finance, Vol. 3, Issue 4, Page 487-507. Oct.2007

Jump Diffusion Models for the Foreign Exchange Market

2. Model Development

2.1 Univariate Jump Diffusion (UVJD) Model

In this section, we describe the construction of our model through a mixture of the Gaussian model and the DE model. We first consider the day-to-day returns of assets interest. , where denotes the price on day i. as the random variable of

If drifts in the returns are GBM i.e. the process is in diffusion, the returns should be normally distributed with mean and volatility .

In a case of a jump, we have modelled the returns as DE random variable (Ramezani and Zeng 1998; Kou 2002). The JD model has mean negative jumps, we will set . and volatility . As we do not separate the positive and

Jump Diffusion Models for the Foreign Exchange Market

Both the Normal and DE distributions are members of the Generalised Normal (GN) distribution family.

where

is the Gamma function

The Normal distribution has

while the DE distribution has

and

. The

family has kurtosis (peakiness) of

. Therefore, the Normal distribution (zero

kurtosis) has a smoother peak than the DE distribution (kurtosis of 3). Consequently, the DE distribution has a fatter tail than Normal.

Standard Gaussian model

DE model with mean 0 and variance 1

Figure 2.1: Difference between the Gaussian distribution and DE distribution with the same mean and variance

The occasion switch from the diffusion model to the jump model (when a jump occurs) give rise to the leptokurtic property we were looking for.

Jump Diffusion Models for the Foreign Exchange Market

The switch will be controlled by a Bernoulli random variable, function where

is an Indicator

Therefore we have the random variable , where , ,

Upon derivation (refer to Appendix A and B), we find that

has conditional posterior density

, where is the cumulative distribution function of a standard Normal.

The pdf is a complicated equation consisting of the special function

and 4 distinct parameters.

As such, finding the MLE is not feasible as the derivative process would be difficult and a point estimate provides little analytical value. On the other hand, the MCMC technique for parameter estimation offers a reasonable alternative as the simulation process generates a series of values, with which we can evaluate the robustness of our assumptions and the model, and to better understand the meaning of the parameters.

Jump Diffusion Models for the Foreign Exchange Market

The Metropolis-Hastings (MH) algorithm will be used within a Gibbs sampler. In the Gibbs sampler, we will simulate the parameters as random variables separately. This simplifies the process of evaluating the marginal density and the likelihood of a parameter through multiple integrations of the conditional density function. Instead, by looking at a specified parameter at each step, we compute the full conditional density and in turn, update the parameter.

We will adopt the MH algorithm for proposal acceptance in our model. The algorithm will be performed using the MATLAB package (refer to Appendix C and D for code)

For ith iteration Do Propose where is the parameter of interest and is the

hyperparameter(s) of the proposal density. Compute logarithm of the MH acceptance ratio

Generate If Return then else

Jump Diffusion Models for the Foreign Exchange Market

We decided on the following priori and proposal densities (at the ith iteration) that gives most stable set of results and the best mixing of proposals.

Parameters Priors Proposals

Table 2.1.1 Table of Prior and Proposal distributions used for the parameters

Remarks: t1, t2, t3 and t4 are tuning parameters which we adjust to achieve better mixing. and and have independent proposal densities. have random walk proposal mechanism centered at previous iteration.

We noted the relationship between the standard deviation of the proposal densities and the rate of proposal acceptance11, which increases with a decreasing proposal variance. However, by increasing the variance, we are proposing small differences between the iterations, and therefore a convergence towards the most probably parameter value will be slower. We chose a tuning factor that stabilizes the proposals (i.e. converging series of iterations) that has good mixing (acceptance rate of > 0.23).

11

William J. Browne, David Draper, 2000, Implementation and performance issues in Bayesian and likelihood fitting of multilevel models, Computational Statistics, Vol.15, page 391-420, 2000

Jump Diffusion Models for the Foreign Exchange Market

2.1 Multivariate Jump Diffusion (MVJD) Model

For our multivariate version, we consider the returns of k assets as a random vector The diffusion drifts of

. and k x

follow a multivariate Normal distribution with k x 1 mean vector , where is positive semi-definite.

k variance-covariance matrix

The jumps of

follow the Multivariate Double Exponential (MDE) distribution. The Multivariate

Double Exponential distribution can be considered as a multivariate normal variance mixture model comprising of a Gaussian and an exponential variable12. The model has the form

, where and

is a positive definite constant matrix. has a determinant of 1.

We assume that while the jumps occur at the same time, the sizes of the jumps are comparable but independent. Therefore, we let to be the identity matrix.

The resultant conditional posterior density for the jumps is

12

T.Eltoft, T. Kim, T-W. Lee 2006, On the Multivariate Laplace Distribution, IEEE Signal Processing Letters, Vol. 13 No.5 May., 2006.

Jump Diffusion Models for the Foreign Exchange Market

As MCMC is itself a numerical approximation process, we can avoid evaluating the analytical form of the double integral by finding approximation for the equation. Suppose we generate a series of and from the distributions and respectively. By the strong

law of large numbers, we have

1 Ni N j

( y zk ) 1 (2 w )k / 2 e 2 wi j =1 i=1 i

Nj

Ni

( y zk )

1 ( y Z k )T ( y Z k ) 1 2W EW [EZ [ e ]] , (2W ) k / 2 N j , N i

which we will use to estimate the likelihood for the jump component. We can tolerate variance in the approximation if it is sufficiently small i.e. less than the variance of the likelihoods in the MCMC.

Figure 2.1.1 Illustration of the variance of the simulation and the size of simulated sample

We can see that the variance of the approximation decreases with the size of the simulated

and

. However, the approximation, when used in an MCMC process is very computationally intensive. This is due to the long chain of simulations and the generations of the the double summations at each iteration. and , and evaluations of

Jump Diffusion Models for the Foreign Exchange Market

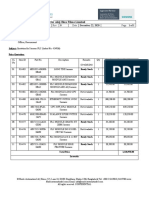

, Variance Computation time (s)

40 95.38 0.113

80 59.33 0.258

120 33.04 0.347

160 25.44 0.560

200 19.26 0.858

240 16.90 1.337

280 18.87 1.780

Table 2.1.1 Table of size of simulated sample, variance of estimation and computation time per iteration

Therefore we will use a suitable size estimate in the quickest time.

that gives us sufficiently precise likelihood

We use the same Bernoulli variable

to regulate the jumps. i.e.

The random vector in our MV JD model is

, where

The conditional density function has the form

which we will estimate via

for a sufficiently large N.

Jump Diffusion Models for the Foreign Exchange Market

Again, we have chosen the following priori and proposal densities (at the ith iteration) that promotes stability and mixing. As far as possible, we have also tried to use the same distributions in the MV model as our UV model.

Parameters Priors

Proposals

Table 2.1.2: Table of Prior and Proposal Distributions used for the parameters

Remarks: t1, t2, t3 and t4 are tuning parameters which we adjust to achieve better mixing. and and have independent proposal densities. have random walk proposal mechanism centered at previous iteration.

The Wishart distribution13 is as both the prior and proposal distribution for distribution is a generalization of the , where mean .

. The Wishart

distribution to a multiple dimension vector space. denotes the degree of freedom has

is a p x p positive definite matrix and

13

William J. Browne, 2006, MCMC algorithms for constrained variance matrices, Computational Statistics & Data Analysis Vol. 50. pages 1655-1677, 2006

Jump Diffusion Models for the Foreign Exchange Market

3 Data Analysis

3.1 Preliminary Analysis

We used the day-to-day returns of the Sterling pounds (GBP) to Euros (EUR) currency pair (GBPEUR) from 1st January 2008 to 31th December 2009 as our data for the (UVJD) model.

Figure 3.1.1: Day-to-day time series plot of the GBP-EUR currency pair

Figure 3.1.2: Day-to-day time series plot of the returns of t

The returns of the GBPEUR have mean -0.0002753 and volatility (

) 0.0051. Currency pairs are

normally traded in high precision due to the large volume of trade, hence, a small change in the exchange rate will relate to a large profit or loss. We can observe that returns of GBPEUR are with + 3% of the rate. Out of the 730 days, we have 39 days with returns > 2 . and 2 days of returns of > 5

Jump Diffusion Models for the Foreign Exchange Market

We will use the MH within a Gibbs sampling algorithm to estimate the parameters. The fitted model will then be used for inference. We start by undertaking some preliminary analysis of the likelihood function so that we can propose appropriate priori values to start the Markov chain.

As the model is a mixture of two separate models (with possibly two distinct peak), we need to find out that the likelihood is unimodal in the parameter space. If there is more than one maximum likelihood value, then the likelihood function in the Markov chain may converge to any of the peaks, giving rise to inconsistent results.

=0.005 Figure 3.1.3: Surface plot of the Log-likelihood against the

=0.0002 and for a fixed .

We can see that given the same (fixed at 0), when we set and are both large. On the other hand, when we set is small but is large.

=0.005, the likelihood is higher when

=0.0002, the likelihood is higher when

Due to the high precision of the returns, tuning the MCMC becomes a very delicate process. While the scale of the tuning for the proposal densities parameters , and can be scaled lies within

correspondingly (i.e. smaller proposal variances, proportionate to the proposal mean),

Jump Diffusion Models for the Foreign Exchange Market

the range [0,1]. Since the value of

would affect how the rest of the parameters are updated, we s.

must be careful in using a reasonable priori and tuning factor to propose

3.2 UVJD Analysis

With the suitable configuration for the tuning, we ran the MCMC algorithm for 10000 iterations.

Figure 3.2.1: Plot of the log-likelihood against the iterations (1000 and 10000).

We observed that there are two large jumps in the chain before the chain arrives at a stable state. We will remove the first 1000 iterations (burn-in) for our analysis.

Acceptance rate

Mean 2.96x103

Variance 343.74 3.29x10-9 3.54x10-7 1.01x10-7 0.0112

Mean (after burn in) 2.96x103 -1.79x10-5 9.27x10-5 3.9x10-3 0.8714

Variance (after burn in) 3.2329 2.03x10-10 2.86x10-10 2.58x10-8 2.52x10-4

0.3112 0.7249 0.2273 0.2539

-1.81x10-5 2.08x10-4 3.9x10-3 0.8527

Table 3.2.1 Table of results (acceptance rate, mean and variance) of the MCMC

Jump Diffusion Models for the Foreign Exchange Market

Figure 3.2.2: Fitting the histogram of data with the UVJD (red) and Gaussian (green) posterior density function

A peculiar observation was that mean (

) from the MCMC process is 0.8527. In other words, there is

a shock in the FX market for GBPEUR 85% of the trading days. Intuitively, this meant that the DE distribution is controlling the drifts more often than the Normal distribution giving rise to the leptokurtic effect. This implies that jumps are recognized as the usual trading pattern for GBPEUR.

As the DE distribution has a greater effect for our model, its is small. If the

is smaller that what it would be if the

is small, when an occasional jump occurs, the size of the jump will have to be

sufficiently big in order to give the leptokurtic characteristic. Conversely, when jumps occur frequently, the size of each jump (and hence, ) will need to be small so there would not be excessive leptokurtosis.

Jump Diffusion Models for the Foreign Exchange Market

The prior distribution we used for

was centered at a small value at as we expected jumps to occur

sporadically. However, the MCMC converges within the first 500 iterations to a stable state.

Figure 3.2.3 Plot of the jumps of the MCMC for

3.3. MVJD Analysis

For our multivariate model, we included the Euro to US Dollars (USD), GBP to USD and USD to Japanese Yen (JPY) currency pairs. Together, they made up the four most traded currency pairs in the FX market.

Figure 3.3.1 Time series plot for EURUSD, GBPUSD and USDJPY rates

Jump Diffusion Models for the Foreign Exchange Market

Figure 3.3.2 Time series plot for EURUSD, GBPUSD and USDJPY returns

The returns of the multiple FX rates have mean (-0.18, -2.62, -2.89, -2.47)T and variance-covariance

matrix

From the plots of the return, we can see that some jumps of the exchange rates do occur simultaneously across the markets. These shocks affect the different rates in different ways.

Due to the computationally intensive process of likelihood estimation for each iteration, we ran the model for 3000 iterations. We have obtained from the univariate model about the mean of the currency pairs and used it for our prior and proposal densities.

Jump Diffusion Models for the Foreign Exchange Market

Figure 3.3.3: Plot of log-likelihood against the first 1000 iterations

Acceptance rate

Mean (after burn in) 9.4345 x 103

Variance (after burn in) 5.4923 x 106

0.9997

(1.11 1.20 -0.18 0.99 0.14

2.88

2.35 x10-3

6.80)T 0.14 0.31 0.53 1.78

(4.76 13.9 0.39 11.0 13.6

4.17

5.22 x10-3

6.54)T 1.36 0.91 4.89 28.2

0.4430

-0.18 0.99 1.24 1.02 1.02 2.11 0.31 0.53 x10-2 0.0036 0.0188

0.39 11.0 18.0 14.8 14.8 52.3 0.91 4.89 x 10-8 1.9216e-06 0.0036

0.5433 0.7807

Table 3.3.1 Table of results (acceptance rate, mean and variance) from the MCMC Notice that the for the multivariate model has = 0.0188, which relates to approximate one jump

in every 53 days. This is very different from our univariate model. In our multivariate model, the definition of a jump is stricter. Jumps in returns must occur at the same time for multiple returns. Suppose the returns for USDJPY recorded a large drift at time t but the other currency pairs do not display corresponding jumps at time t, then the large drift would not be considered as a jump. This filtered out many of the supposed jumps from our univariate model and the actual jumps are results of exogenous shocks that affect the returns market wide. As a result of the small , the is larger.

Jump Diffusion Models for the Foreign Exchange Market

4 Conclusion

While JD models are useful in describing movements in the financial markets, there are some limitations and considerations when using it. In both our models, we have modelled the JD process using to four parameters compared to the two parameters used in the Gaussian model. In order to relax our assumptions and accommodate more information, we need to introduce additional parameters. However, these parameters used in the process will reduce the effectiveness. Most model comparison analyses do penalize additional parameters14, as the reduction in deviance may not compensate the loss of degree of freedom. While the model may be a better fit, the reduced number of effective parameters makes it less appealing.

In addition, the process of piecewise tuning of the each parameters is extremely time consuming, especially on a precise scale such as that of currency pairs returns. For the

proposals, we have

adopted the Wishart proposal mechanism. The tuning process requires us to increase the degrees of freedom and at the same time, dividing the random variable by the same factor (recall that . However, during the MCMC, most standard computers are unable to evaluate the proposal density the large degree of freedom. Therefore, there is a lower bound to which we can tune the variance. Due to the small values of the asset returns, it requires a proposal mechanism with a much smaller variance in order to promote mixing. We are unable to do this for the multivariate Gaussian model for model comparison.

One interesting feature of the DE distribution within the mixture model is that it may not be unimodal. With a varying

14

value, either the DE model or the Gaussian model would dominate the other,

Andrew Gelman, John B. Carlin, Hal Stern, 2004, Baysian Data Analysis, 2nd ed. Boca Raton, 2004

Jump Diffusion Models for the Foreign Exchange Market

leading the MCMC to converge to a different set of parameters. As such, we need some prior knowledge about the data before we can choose a prior and proposal models.

The derivation of the JD model is not a simple process, and in particular, the multivariate version of the model is very complicated. The approximation process of our MVJD model is computationally intensive as it involves the estimation of a double integrand via two summation loops. Such time consuming process makes this model not feasible for the fast moving FX market.

The some of assumptions we have made may not hold in the FX market. For example, we did not separate positive and the negative jumps. We hypothesize that the impact that the exogenous shocks have each currency pair are conditionally independent on the others, hence we set to be the identity matrix. This however, may not be true as the we know that the currency pairs are intricately linked to each other and the fact that the jumps occurs at the same time meant that some jumps by a particular currency pair will have corresponding effect on the others.

The FX market displayed some unique features. The overtly volatile nature makes jumps in the markets more common than drifts. This volume of liquidity may be the cause of the volatility. On the other hands, shocks that move the entire market, although present, are less frequent.

In order to improve on our model, some further research will be needed. A possible extension will be to derive the analytical form for the multivariate posterior density. This will eliminate reduce the time taken, and the error due to the numerical approximation process. We can also consider the full model by relaxing the assumptions made to and .

Jump Diffusion Models for the Foreign Exchange Market

References Bank of International Settlement, 2007. Foreign Exchange and Derivative market activity in 2007, Triennial Central Bank Survey,19 Dec.2007 Browne, W. J., 2006, MCMC algorithms for constrained variance matrices, Comuptational Statistics & Data Analysis, Vol. 50. pages 1655-1677, 2006 Browne, W.J., Draper, D., 2000, Implementation and performance issues in Bayesian and likelihood fitting of multilevel models, Computational Statistics, Vol.15, page 391-420, 2000 Eltoft, T., Kim, T, Lee, T-W, 2006, On the Multivariate Laplace Distribution, IEEE Signal Processing Letters, Vol. 13 No.5 May., 2006. Fama, E. F., 1965. Random Walks in Stock Market Prices. Financial Analyst Journals, Vol. 21, No. 5, page 55-59, Sep.-Oct.,1965. Gelman, A., Carlin, J. B., Stern, H., 2004, Baysian Data Analysis, 2nd ed. Boca Raton, 2004 Kou, S.G., 2002, A Jump-Diffusion Model for Option Pricing, Management Science, Vol.48, No. 8 page1086-1101, Aug. 2002 Markowitz, H., 1952. Portfolio Selection, The Journal of Finance. Vol. 7, No. 1, page 77-91, Mar., 1952. Markowitz, H., 1999. The early history of portfolio theory: 1600-1960, Financial Analyst Journal , Vol.55, No.4,. Page 5-16, Jul.- Aug. 1999 Ramezani, C.A., Zeng Y., 1998. Maximum Likelihood Estimate of the double exponential jumpdiffusion process, Annals of Finance, Vol. 3, Issue 4, Page 487-507. Oct.2007 Ross, S. M., 2007. Introduction to Probability Models. 7th ed. Elsevier/Academic Press. Ross, S., Westerfield, R., Jaffe, J., Jordan, B., 2008, Modern Financial Management, 8th ed., McGraw-Hill Irwin, 2008 Shah, A., 1997. Black, Merton and Scholes: Their Work and its Consequences. Economic and Political Weekly, Vol. 32, No.52, Page 3337-3342, Dec,. 1997 Verhoeven, P., McAleer, M., 2004. Fat tails and asymmetry in financial volatility models, Mathematics and Computers in Simulation, Vol.64 No.3-4 , Pages 351-361, Feb., 2004

Jump Diffusion Models for the Foreign Exchange Market

Appendix A Derivation of the UVJD posterior function

Let

denotes price of asset at time t , , where , , ,

We have

We want Now, Consider ,

(1)

(1)

(2)

Jump Diffusion Models for the Foreign Exchange Market

Consider

Similarly,

Observe that

, where

, where

For

(2)

Jump Diffusion Models for the Foreign Exchange Market

Appendix B Derivation of the MVJD posterior density and estimate Let For , where , where denotes return of asset i at time t. , ,

Now,

Now,

where

are generated values of random variables W and Z respectively.

Jump Diffusion Models for the Foreign Exchange Market

Appendix C MCMC algorithm for UVJD model

function [lliks,mus,sigmas,etas,lambdas] = jdmcmc(m0,s0,e0,a,b,t1,t2,t3,t4,Y,N) lliks = zeros(1,N); mus = zeros(1,N); sigmas = zeros(1,N); etas = zeros(1,N); lambdas = zeros(1,N); mup = zeros(1,N); sp = zeros(1,N); ep = zeros(1,N); lap = betarnd(a,b,1,N); mus(1) = normrnd(m0,s0,1,N); sigmas(1) = gamrnd(t1,s0/t2); etas(1) = gamrnd(t2,e0/t3); lambdas(1) = lap(1); lliks(1) = sum(log(jdlik(lambdas(1),sigmas(1),mus(1),etas(1),Y))); for(i = 2:N) mup(i) = normrnd(m0,s0*t1); llc = sum(log(jdlik(lambdas(i-1),sigmas(i-1),mus(i-1),etas(i-1),Y))); llp = sum(log(jdlik(lambdas(i-1),sigmas(i-1),mup(i),etas(i-1),Y))); lpp = log(normpdf(mup(i),m0,s0)); lpc = log(normpdf(mus(i-1),m0,s0)); ar = (log(rand) <= llp-llc+lpp-lpc); % Metropolis acceptance ratio mus(i) = mus(i-1)*(1-ar)+mup(i)*ar; sp(i) = chi2rnd(t2*sigmas(i-1))/t2; llc = sum(log(jdlik(lambdas(i-1),sigmas(i-1),mus(i),etas(i-1),Y))); llp = sum(log(jdlik(lambdas(i-1),sp(i),mus(i),etas(i-1),Y))); lpp = log(exppdf(sp(i),s0)); lpc = log(exppdf(sigmas(i-1),s0)); lprop = log(chi2pdf(t1*sp(i),t2*sigmas(i-1))); lproc = log(chi2pdf(t1*sigmas(i-1),t2*sp(i))); ar = (log(rand) <= llp-llc+lpp-lpc+lproc-lprop); % Metropolis acceptance ratio sigmas(i) = sigmas(i-1)*(1-ar)+sp(i)*ar; llc = sum(log(jdlik(lambdas(i-1),sigmas(i),mus(i),etas(i-1),Y))); llp = sum(log(jdlik(lambdas(i-1),sigmas(i),mus(i),ep(i),Y))); lpp = log(exppdf(ep(i),e0)); lpc = log(exppdf(etas(i-1),e0));

Jump Diffusion Models for the Foreign Exchange Market

lprop = log(gampdf(ep(i),t2,e0/t3)); lproc = log(gampdf(etas(i-1),t2,e0/t3)); ar = (log(rand) <= llp-llc+lpp-lpc+lproc-lprop); % Metropolis acceptance ratio etas(i) = ep(i)*ar+etas(i-1)*(1-ar); llc = sum(log(jdlik(lambdas(i-1),sigmas(i),mus(i),etas(i),Y))); d = t4*(1-lambdas(i-1))/lambdas(i-1); lap(i) = betarnd(t4,d); lpp = log(betapdf(lap(i),a,b)); lpc = log(betapdf(lambdas(i-1),a,b)); lprop = log(betapdf(lap(i),c,d)); d = t4*(1-lap(i))/lap(i); lproc = log(betapdf(lambdas(i-1),t4,d)); llp = sum(log(jdlik(lap(i),sigmas(i),mus(i),etas(i),Y))); lambdas(i) = lambdas(i-1)*(1-ar)+lap(i)*ar; lliks(i) = sum(log(jdlik2(lambdas(i),sigmas(i),mus(i),etas(i),Y))); end

Jump Diffusion Models for the Foreign Exchange Market

Appendix D MCMC Algorithm for MVJD model

function [lliks,mus,sigmas,etas,lambdas] = jdmcmcMV(M0,S0,e0,a,b,t1,t2,t3,t4,Y,N,J) K = size(Y,2); lliks = zeros(1,N); mus = zeros(N,K); sigmas = zeros(K,K,N); etas = ones(1,N); lambdas = 0.1.*ones(1,N); % Independent proposals at the beginning mup = mvnrnd(repmat(M0,N,1),S0.*t1); ep = gamrnd(t3,e0/t3,1,N); % RW proposals start with series of zeros Sp = zeros(K,K,N); lap = zeros(1,N); mus(1,:) = mup(1,:); sigmas(:,:,1) = wishrnd(S0,t2)./t1; % 1st RW proposal lambdas(1) = betarnd(a,b,1,n); % 1st RW proposal etas(1) = ep(1); lliks(1) = mvjdlik(Y,mus(1,:),etas(1),squeeze(sigmas(:,:,1)),lambdas(1),J); for i = 2:N % for each iteration, chain moves from mu -> sigma -> eta -> lambda llc = mvjdlik(Y,mus(i-1,:),etas(i-1),squeeze(sigmas(:,:,i1)),lambdas(i-1),J); llp = mvjdlik(Y,mus(i,:),etas(i-1),squeeze(sigmas(:,:,i-1)),lambdas(i1),J); lprp = log(mvnpdf(mus(i,:),M0,S0)); lprc = log(mvnpdf(mus(i-1,:),M0,S0)); ar = (log(rand) <= llp-llc+lprp-lprc); ratio mus(i,:) = mus(i-1,:).*(1-ar)+mup(i,:).*ar; Sp(:,:,i)= wishrnd(sigmas(:,:,i-1),t2)./t2; llc = mvjdlik(Y,mus(i,:),etas(i-1),squeeze(sigmas(:,:,i-1)),lambdas(i1),J); llp = mvjdlik(Y,mus(i,:),etas(i-1),squeeze(Sp(:,:,i)),lambdas(i-1),J); lprop = logwishpdf(t1.*Sp(:,:,i),sigmas(:,:,i-1),t2); lproc = logwishpdf(t1.*sigmas(:,:,i-1),Sp(:,:,i),t2); lprp = logwishpdf(K.*squeeze(Sp(:,:,i)),S0,K); lprc = logwishpdf(K.*squeeze(sigmas(:,:,i-1)),S0,K); ar = (log(rand) <= llp-llc+lproc-lprop+lprp-lprc); %ar = MH acceptance

Jump Diffusion Models for the Foreign Exchange Market

sigmas(:,:,i) = sigmas(:,:,i-1).*(1-ar)+Sp(:,:,i).*ar; llc = mvjdlik(Y,mus(i,:),etas(i-1),squeeze(sigmas(:,:,i)),lambdas(i1),J); llp = mvjdlik(Y,mus(i,:),ep(i),squeeze(sigmas(:,:,i)),lambdas(i-1),J); lprp = log(exppdf(ep(i),e0)); lprc = log(exppdf(etas(i-1),e0)); lprop = log(gampdf(ep(i),t3,e0/t3)); lproc = log(gampdf(etas(i-1),t3,e0/t3)); ar = (log(rand) <= llp-llc+lprp-lprc+lproc-lprop); etas(i) = ep(i)*ar+etas(i-1)*(1-ar); lap(i) = betarnd(c,c*(1-lambdas(i-1))/lambdas(i-1)); llp = mvjdlik(Y,mus(i,:),etas(i),squeeze(sigmas(:,:,i)),lap(i),J); llc = mvjdlik(Y,mus(i,:),etas(i),squeeze(sigmas(:,:,i)),lambdas(i1),J); lprp = log(betapdf(lap(i),a,b)); lprc = log(betapdf(lambdas(i-1),a,b)); lprop = log(betapdf(lap(i),t4,t4*(1-lambdas(i-1))/lambdas(i-1))); lproc = log(betapdf(lambdas(i-1),t4,t4*(1-lap(i))/lap(i))); ar = (log(rand) <= llp-llc+lprp-lprc-lprop+lproc); lambdas(i) = lambdas(i-1)*(1-ar)+lap(i)*ar; lliks(i) = mvjdlik(Y,mus(i,:),etas(i),squeeze(sigmas(:,:,i)),lambdas(i),J); end

S-ar putea să vă placă și

- Global Shocks: An Investment Guide for Turbulent MarketsDe la EverandGlobal Shocks: An Investment Guide for Turbulent MarketsÎncă nu există evaluări

- SSRN Id4339128 PDFDocument36 paginiSSRN Id4339128 PDFZvi OrenÎncă nu există evaluări

- Admin, 1-19 A Framework For The Active Management of A Global Currency FDocument20 paginiAdmin, 1-19 A Framework For The Active Management of A Global Currency FFabiane MelloÎncă nu există evaluări

- The Capital Asset Pricing ModelDocument5 paginiThe Capital Asset Pricing Modeljames Nartey AgboÎncă nu există evaluări

- American Finance AssociationDocument26 paginiAmerican Finance AssociationSanjita ParabÎncă nu există evaluări

- The Carry Trade and FundamentalsDocument36 paginiThe Carry Trade and FundamentalsJean-Jacques RousseauÎncă nu există evaluări

- The European Journal of FinanceDocument21 paginiThe European Journal of FinanceMushtaq AliÎncă nu există evaluări

- Market Microstructure Term PaperDocument20 paginiMarket Microstructure Term PaperMburu SÎncă nu există evaluări

- Financial TheoryDocument21 paginiFinancial Theoryমুসফেকআহমেদনাহিদ0% (1)

- Disposition Effect and Multi-Asset Market DynamicsDocument21 paginiDisposition Effect and Multi-Asset Market DynamicsWihelmina DeaÎncă nu există evaluări

- Do Market Timing Hedge Funds Time The Market?: Yong Chen, Bing LiangDocument48 paginiDo Market Timing Hedge Funds Time The Market?: Yong Chen, Bing Liangvetir39Încă nu există evaluări

- Growth or Glamour? Fundamentals and Systematic Risk in Stock ReturnsDocument56 paginiGrowth or Glamour? Fundamentals and Systematic Risk in Stock ReturnsjamilkhannÎncă nu există evaluări

- Testing The Performance of Asset Pricing Models During The Covid-19 Crisis Evidence From European Stock MarketsDocument40 paginiTesting The Performance of Asset Pricing Models During The Covid-19 Crisis Evidence From European Stock MarketsZurab OshkhneliÎncă nu există evaluări

- Jorion 1995Document23 paginiJorion 1995econdocsÎncă nu există evaluări

- Predicting Volatility in The Foreign Exchange MarketDocument23 paginiPredicting Volatility in The Foreign Exchange MarketThu HuyềnÎncă nu există evaluări

- Literature Review Stock Market VolatilityDocument8 paginiLiterature Review Stock Market Volatilitybaduidcnd100% (1)

- VIX Futures Prices PredictabilityDocument37 paginiVIX Futures Prices PredictabilityElmar ReichmannÎncă nu există evaluări

- AndersenDocument45 paginiAndersenntlresearchgroupÎncă nu există evaluări

- Desantis 1997Document32 paginiDesantis 1997renanrboÎncă nu există evaluări

- Samy - Stochastic Volatility and Option Pricing in The BrazilianDocument41 paginiSamy - Stochastic Volatility and Option Pricing in The Brazilianajdcavalcante78Încă nu există evaluări

- Explaining Stock ReturnsDocument14 paginiExplaining Stock ReturnsGhazzzzanfarÎncă nu există evaluări

- Sharpe1964 (Editable Acrobat)Document19 paginiSharpe1964 (Editable Acrobat)julioacev0781Încă nu există evaluări

- Models: Comparative Study Between An Islamic and A Conventional Index (SP Sharia VS SP 500)Document5 paginiModels: Comparative Study Between An Islamic and A Conventional Index (SP Sharia VS SP 500)Tanzeel Mustafa RanaÎncă nu există evaluări

- Financial TheoriesDocument6 paginiFinancial TheoriesalishbakhalidÎncă nu există evaluări

- Capital Asset Prices Model (Sharpe)Document23 paginiCapital Asset Prices Model (Sharpe)David PereiraÎncă nu există evaluări

- Fractal Markets Hypothesis and The Global Financial Crisis: Scaling, Investment Horizons and LiquidityDocument12 paginiFractal Markets Hypothesis and The Global Financial Crisis: Scaling, Investment Horizons and Liquiditygauri kanodiaÎncă nu există evaluări

- VIX ManipulationDocument58 paginiVIX ManipulationZerohedge100% (2)

- Volatility Surfaces: Theory, Rules of Thumb, and Empirical EvidenceDocument39 paginiVolatility Surfaces: Theory, Rules of Thumb, and Empirical EvidenceBlein KidaneÎncă nu există evaluări

- An Investigation of Heston and SVJ Model During Financial CrisesDocument30 paginiAn Investigation of Heston and SVJ Model During Financial CrisesSally YuÎncă nu există evaluări

- Ciadmin,+Journal+Manager,+8662 34326 1 CEDocument12 paginiCiadmin,+Journal+Manager,+8662 34326 1 CERajeev AttriÎncă nu există evaluări

- Systematic Liquidity: Gur Huberman and Dominika HalkaDocument18 paginiSystematic Liquidity: Gur Huberman and Dominika HalkaabhinavatripathiÎncă nu există evaluări

- Review On Efficiency and Anomalies in Stock MarketDocument49 paginiReview On Efficiency and Anomalies in Stock MarketB4 Arya BobihuÎncă nu există evaluări

- Real Return Bonds and SunspotsDocument20 paginiReal Return Bonds and Sunspotsvidovdan9852Încă nu există evaluări

- Dynamic Asset Allocation For Varied Financial Markets Under Regime Switching FrameworkDocument9 paginiDynamic Asset Allocation For Varied Financial Markets Under Regime Switching FrameworkFarhan SarwarÎncă nu există evaluări

- Review - "FX Markets' Reactions To COVID-19 - Are They Different - "Document5 paginiReview - "FX Markets' Reactions To COVID-19 - Are They Different - "Ecopreneur, Advitya 22'Încă nu există evaluări

- Hsu JmpaperDocument50 paginiHsu JmpaperKok Jin GanÎncă nu există evaluări

- Artigo Rubinstein Implied Binomial TreesDocument43 paginiArtigo Rubinstein Implied Binomial TreesAndrew Drummond-MurrayÎncă nu există evaluări

- Dealing With Multi-Currency Inventory Risk in FX Cash MarketsDocument11 paginiDealing With Multi-Currency Inventory Risk in FX Cash Marketsg.nikishinÎncă nu există evaluări

- Roisin DonnellyDocument9 paginiRoisin DonnellyShana Bervin HabeebÎncă nu există evaluări

- 024 Article A006 enDocument38 pagini024 Article A006 enHugoPrieto2Încă nu există evaluări

- Stochastic Volatiity Models 2005 PDFDocument35 paginiStochastic Volatiity Models 2005 PDFFrancisco López-HerreraÎncă nu există evaluări

- Week 5 Essay AssignmentDocument3 paginiWeek 5 Essay AssignmentAlice Stephanie TaÎncă nu există evaluări

- Guenster Et Al. Riding BubblesDocument48 paginiGuenster Et Al. Riding BubblesecrcauÎncă nu există evaluări

- Soa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives AssignmentDocument10 paginiSoa University: Name: Gyanabrata Mohapatra Subject: Financial Derivetives Assignment87 gunjandasÎncă nu există evaluări

- Informational Integration and FX Trading: Martin D.D. Evans, Richard K. LyonsDocument25 paginiInformational Integration and FX Trading: Martin D.D. Evans, Richard K. LyonsPratik ChhedaÎncă nu există evaluări

- Exploring The Volatility of Stock Markets: Indian ExperienceDocument15 paginiExploring The Volatility of Stock Markets: Indian ExperienceShubham GuptaÎncă nu există evaluări

- Regime-Switching Factor Investing With Hidden Markov ModelsDocument15 paginiRegime-Switching Factor Investing With Hidden Markov ModelsHao OuYangÎncă nu există evaluări

- Chen 2009Document13 paginiChen 2009Sufi KhanÎncă nu există evaluări

- Bates Crash Risk MarketDocument48 paginiBates Crash Risk Markettmp01@jesperlund.comÎncă nu există evaluări

- Working Paper Series: Derivatives On Volatility: Some Simple Solutions Based On ObservablesDocument21 paginiWorking Paper Series: Derivatives On Volatility: Some Simple Solutions Based On ObservablesHarol ZuletaÎncă nu există evaluări

- YarosDocument3 paginiYarossfsdhg,kÎncă nu există evaluări

- Fernandez2006 PDFDocument17 paginiFernandez2006 PDFCristhianRosadioAranibarÎncă nu există evaluări

- Economics 2013 3Document22 paginiEconomics 2013 3Sachin SahooÎncă nu există evaluări

- Does Risk Seeking Drive Stock Prices? A Stochastic Dominance Analysis of Aggregate Investor Preferences and BeliefsDocument30 paginiDoes Risk Seeking Drive Stock Prices? A Stochastic Dominance Analysis of Aggregate Investor Preferences and BeliefscastjamÎncă nu există evaluări

- A Capital Asset Pricing Model WithDocument17 paginiA Capital Asset Pricing Model Withgutoinfo2009Încă nu există evaluări

- Asset Pricing FullDocument26 paginiAsset Pricing FullBhupendra RaiÎncă nu există evaluări

- Efficient Market HypothesisDocument11 paginiEfficient Market HypothesisDoktormin106Încă nu există evaluări

- FullDocument32 paginiFullnexxus hcÎncă nu există evaluări

- Genser - Explaining Volatility Smiles of Equity Options With Capital Structure ModelsDocument49 paginiGenser - Explaining Volatility Smiles of Equity Options With Capital Structure ModelsOmer LandauÎncă nu există evaluări

- Implied Realized Vol Cross SectionDocument30 paginiImplied Realized Vol Cross Sectionpurumi77Încă nu există evaluări

- Amity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorDocument23 paginiAmity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorMayank TayalÎncă nu există evaluări

- Unit 2: Air Intake and Exhaust SystemsDocument10 paginiUnit 2: Air Intake and Exhaust SystemsMahmmod Al-QawasmehÎncă nu există evaluări

- FIR FliterDocument10 paginiFIR FliterasfsfsafsafasÎncă nu există evaluări

- LC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Document2 paginiLC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Mahadi Hassan ShemulÎncă nu există evaluări

- Does Adding Salt To Water Makes It Boil FasterDocument1 paginăDoes Adding Salt To Water Makes It Boil Fasterfelixcouture2007Încă nu există evaluări

- 2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - LibroDocument82 pagini2010 - Howaldt y Schwarz - Social Innovation-Concepts, Research Fields and International - Librovallejo13Încă nu există evaluări

- Sony x300 ManualDocument8 paginiSony x300 ManualMarcosCanforaÎncă nu există evaluări

- CE162P MODULE 2 LECTURE 4 Analysis & Design of Mat FoundationDocument32 paginiCE162P MODULE 2 LECTURE 4 Analysis & Design of Mat FoundationPROSPEROUS LUCKILYÎncă nu există evaluări

- Governance Operating Model: Structure Oversight Responsibilities Talent and Culture Infrastructu REDocument6 paginiGovernance Operating Model: Structure Oversight Responsibilities Talent and Culture Infrastructu REBob SolísÎncă nu există evaluări

- Control ValvesDocument95 paginiControl ValvesHardik Acharya100% (1)

- School Based Management Contextualized Self Assessment and Validation Tool Region 3Document29 paginiSchool Based Management Contextualized Self Assessment and Validation Tool Region 3Felisa AndamonÎncă nu există evaluări

- str-w6754 Ds enDocument8 paginistr-w6754 Ds enAdah BumbonÎncă nu există evaluări

- ChatGPT & EducationDocument47 paginiChatGPT & EducationAn Lê Trường86% (7)

- Calculating Free Energies Using Adaptive Biasing Force MethodDocument14 paginiCalculating Free Energies Using Adaptive Biasing Force MethodAmin SagarÎncă nu există evaluări

- CE EVALUATION EXAM No. 4 - MGT, Fluid Properties, Hydrostatic Force (Answer Key)Document6 paginiCE EVALUATION EXAM No. 4 - MGT, Fluid Properties, Hydrostatic Force (Answer Key)Angelice Alliah De la CruzÎncă nu există evaluări

- solidworks ขั้นพื้นฐานDocument74 paginisolidworks ขั้นพื้นฐานChonTicha'Încă nu există evaluări

- MPI Unit 4Document155 paginiMPI Unit 4Dishant RathiÎncă nu există evaluări

- Press Statement - Book Launching Shariah Forensic 27 Oct 2023Document4 paginiPress Statement - Book Launching Shariah Forensic 27 Oct 2023aÎncă nu există evaluări

- WWW Ranker Com List Best-Isekai-Manga-Recommendations Ranker-AnimeDocument8 paginiWWW Ranker Com List Best-Isekai-Manga-Recommendations Ranker-AnimeDestiny EasonÎncă nu există evaluări

- Cap1 - Engineering in TimeDocument12 paginiCap1 - Engineering in TimeHair Lopez100% (1)

- Poster-Shading PaperDocument1 paginăPoster-Shading PaperOsama AljenabiÎncă nu există evaluări

- RH-A Catalog PDFDocument1 paginăRH-A Catalog PDFAchmad KÎncă nu există evaluări

- Radio Ac DecayDocument34 paginiRadio Ac DecayQassem MohaidatÎncă nu există evaluări

- Installing Surge Protective Devices With NEC Article 240 and Feeder Tap RuleDocument2 paginiInstalling Surge Protective Devices With NEC Article 240 and Feeder Tap RuleJonathan Valverde RojasÎncă nu există evaluări

- 147 Amity Avenue Nampa, ID 81937 (999) 999-9999 William at Email - ComDocument4 pagini147 Amity Avenue Nampa, ID 81937 (999) 999-9999 William at Email - ComjeyesbelmenÎncă nu există evaluări

- G.Devendiran: Career ObjectiveDocument2 paginiG.Devendiran: Career ObjectiveSadha SivamÎncă nu există evaluări

- Importance of Porosity - Permeability Relationship in Sandstone Petrophysical PropertiesDocument61 paginiImportance of Porosity - Permeability Relationship in Sandstone Petrophysical PropertiesjrtnÎncă nu există evaluări

- Accessoryd-2020-07-31-185359.ips 2Document20 paginiAccessoryd-2020-07-31-185359.ips 2Richard GarciaÎncă nu există evaluări

- File RecordsDocument161 paginiFile RecordsAtharva Thite100% (2)

- Aristotle - OCR - AS Revision NotesDocument3 paginiAristotle - OCR - AS Revision NotesAmelia Dovelle0% (1)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesDe la EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesEvaluare: 4.5 din 5 stele4.5/5 (8)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyDe la EverandChip War: The Quest to Dominate the World's Most Critical TechnologyEvaluare: 4.5 din 5 stele4.5/5 (227)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumDe la EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumEvaluare: 3 din 5 stele3/5 (12)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationDe la EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationEvaluare: 4 din 5 stele4/5 (11)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaDe la EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaÎncă nu există evaluări

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDe la EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingEvaluare: 4.5 din 5 stele4.5/5 (97)

- Economics 101: How the World WorksDe la EverandEconomics 101: How the World WorksEvaluare: 4.5 din 5 stele4.5/5 (34)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsDe la EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsEvaluare: 4.5 din 5 stele4.5/5 (94)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistDe la EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistEvaluare: 4.5 din 5 stele4.5/5 (37)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationDe la EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationEvaluare: 4.5 din 5 stele4.5/5 (46)

- The Meth Lunches: Food and Longing in an American CityDe la EverandThe Meth Lunches: Food and Longing in an American CityEvaluare: 5 din 5 stele5/5 (5)

- The New Elite: Inside the Minds of the Truly WealthyDe la EverandThe New Elite: Inside the Minds of the Truly WealthyEvaluare: 4 din 5 stele4/5 (10)

- Look Again: The Power of Noticing What Was Always ThereDe la EverandLook Again: The Power of Noticing What Was Always ThereEvaluare: 5 din 5 stele5/5 (3)

- Deaths of Despair and the Future of CapitalismDe la EverandDeaths of Despair and the Future of CapitalismEvaluare: 4.5 din 5 stele4.5/5 (30)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetDe la EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetÎncă nu există evaluări

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailDe la EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailEvaluare: 4.5 din 5 stele4.5/5 (237)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentDe la EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentEvaluare: 4.5 din 5 stele4.5/5 (92)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDe la EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassÎncă nu există evaluări

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldDe la EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldEvaluare: 4 din 5 stele4/5 (17)

- This Changes Everything: Capitalism vs. The ClimateDe la EverandThis Changes Everything: Capitalism vs. The ClimateEvaluare: 4 din 5 stele4/5 (349)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyDe la EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyEvaluare: 4.5 din 5 stele4.5/5 (263)