Documente Academic

Documente Profesional

Documente Cultură

BKWeek 2012 01 30

Încărcat de

Mbok EmaDescriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

BKWeek 2012 01 30

Încărcat de

Mbok EmaDrepturi de autor:

Formate disponibile

BANKRUPTCY WEEK

Vol. 12, No. 5 A COMPANION RESOURCE TO WWW.BANKRUPTCYDATA.COM

January 30, 2012

INSIDE THIS ISSUE THE ALMANAC:

BANKRUPTCIES

Ener1 Chapter 11 Petition, Plan Filed Ener1 filed for Chapter 11 protection with the U.S. Bankruptcy Court in the Southern District of New York, case number 12-10299. The Company, which is a holding company for entities engaged in the research, development and production of rechargeable batteries and battery packs, is represented by Michael J. Venditto of Reed Smith. Concurrent with its petition, the Company also filed with the Court a Joint Prepackaged Plan of Reorganization and related Disclosure Statement. The Company explains that its plan has been unanimously accepted by all impaired creditors. See Feature on P. 3 for more information on Ener1, Inc. Evergreen Energy Chapter 7 Petition Filed Evergreen Energy and 9 affiliated Debtors filed for Chapter 7 protection with the U.S. Bankruptcy Court in the District of Delaware, lead case number 12-10289. The Company, which is engaged in the production of clean energy, is represented by Mark D. Collins of Richards, Layton & Finger. According to documents filed with the SEC, the Companys financial condition continued to deteriorate during 2010: We are continuing to evaluate restructuring and capital raising alternatives. Without an additional influx of capital, we will not be able to pursue our business plan and may not be able to remain a going concern. Waste2Energy Holdings Additional Chapter 11 Petitions Filed Three additional Debtors filed for Chapter 11 protection and filed motions seeking to consolidate under the November 2011 bankruptcy proceeding of parent company: Waste2Energy Holdings. According to documents filed with the Court, The filing of the Subsidiary Debtors chapter 11 petitions was necessitated to maximize the return of value for the Parent Debtor and the Subsidiary Debtors creditor-bodies and estates and to prevent the piecemeal dismantling of the technology processes which underlie the intrinsic value of the Parent Debtor and the Subsidiary Debtors.

2011 LEAGUE TABLES

P. 5 FirstFed Financial Plan Filed - P. 14 Nebraska Book Company Extenson Sought - P. 14 NewPage LTIP Approval Sought - P. 14 Washington Mutual Stipulations Approved - P. 16

CONTENTS

Financial Reports Case Status Retentions 2 6 8 10 11 12 18

Financing Claims Transfers From the Docket Public Filings

CONFIRMATIONS & EMERGENCES

Lee Enterprises Plan Confirmed The U.S. Bankruptcy Court approved Lee Enterprises Disclosure Statement and concurrently confirmed the Debtors Second Amended Chapter 11 Plan of Reorganization. Mary Junck, chairman and C.E.O, comments, Stockholders retain their interest in the company with only modest dilution. The refinancing, along with our ongoing strong cash flow, will keep Lee on solid financial footing as we continue reshaping our company and building on our unique strengths. The Company filed for Chapter 11 protection on December 12, 2011, listing $1.16 billion in pre-petition assets. (Confirmations & Emergences continued on P. 10)

For more information, consult www.BankruptcyData.com Copyright 2012 New Generation Research 225 Friend Street, Suite 801 Boston, MA 02114

Page 1

BANKRUPTCY WEEK January 30, 2012

FINANCIAL REPORTS

General Maritime M.O.R. Filed General Maritime filed with the U.S. Bankruptcy Court a monthly operating report for November 17, 2011 through November 30, 2011. For the period the Company reported a net loss of $19 million on $5.9 million in revenue. Great Atlantic & Pacific Tea Company M.O.R. Filed Great Atlantic & Pacific Tea Company filed with the U.S. Bankruptcy Court a monthly operating report for November 6, 2011 to December 3, 2011. For the period, the Company reported a net loss of $62 million. Imperial Capital Bancorp M.O.R. Filed Imperial Capital Bancorp filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported a net loss of $392,757 on zero revenue. Lee Enterprises M.O.R. Filed Lee Enterprises filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported net income of $3.1 million on $61 million in revenue. PFF Bancorp M.O.R. Filed PFF Bancorp filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported a net loss of $118,688 on zero revenue. PMI Group M.O.R. Filed PMI Group filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported a net loss of $4.5 million on zero revenue. TerreStar Corporation M.O.R. Filed TerreStar Corporation filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported a net loss of $1.2 million on $2 million in revenue. (Financial Reports continued on P. 17)

CALENDAR

January 30, 2012 Ahern Rentals, Inc. Chapter 11: December 22, 2011 The U.S. Trustee assigned to the Ahern Rentals case scheduled a January 30, 2012 341-Meeting of Creditors. Real Mex Restaurants, Inc. Chapter 11: October 4, 2011 The U.S. Bankruptcy Court scheduled a January 30, 2012 sale hearing in the Real Mex Restaurants case. January 31, 2012 MF Global Holdings Ltd. Chapter 11: October 31, 2011 The U.S. Bankruptcy Court scheduled a January 31, 2012 customer claims deadline in the MF Global Holdings case. February 1, 2012 Washington Mutual, Inc. Chapter 11: September 26, 2008 The U.S. Bankruptcy Court scheduled a February 1, 2012 hearing to consider Washington Mutuals official creditors committees motion to alter or amend the Courts opinion and order regarding subordination of the claim of Tranquility Master Fund. (Calendar continued on P. 20)

DOCUMENTS POSTED

The following documents were posted on BankruptcyData.com since publication of the last issue: Eastman Kodak Company Ener1, Inc. Evergreen Energy Inc. FirstFed Financial Corp. Official Committee of Unsecured Creditors Chapter 11 Petition/Largest Creditors Chapter 7 Petition Holdco Advisors Chapter 11 Plan of Reorganization & related DS and Prepackaged Plan of Reorganization & related DS www.BankruptcyData.com - Page 2

BANKRUPTCY WEEK January 30, 2012

FEATURE:

scale, lithium-ion automotive battery systems. Ener1 also conducts research and development activities on fuel cells and nano coating processes through other subsidiaries: NanoEner, Inc. is building prototype equipment that utilizes a proprietary vapor deposition and solidification process for depositing materials onto battery electrodes as part of the battery cell manufacturing process. EnerFuel, Inc. is working on developing a hydrogen fuel cell range extender for PEVs and has created a high temperature fuel cell stack. Through subsidiaries TVG Saehan Holdings and TVG SEI Holdings, Ener1 owns 94% of Ener1 Korea, Inc., a South Korean based manufacturer of flat or prismatic batteries used in EnerDels battery packs. Restructuring Initiatives In documenting the causes of its financial difficulties, Ener1 explains that the market for advanced rechargeable batteries is at a relatively early stage of development and that competition in this niche industry is intense. Ener1 writes, This competition ranges from development stage companies to major Fortune 500 domestic and international companies, many of which have significant financial, technical, marketing, sales, manufacturing, distribution, and other resources. Ener1s business plan has historically been premised on consumers adopting the use of electric vehiclesand a subsequent uptick in the demand for lithium-ion batteries. The Company explains that its anticipated rise in the popularity of electric vehicles did not materialize, which in turn harmed the Debtors business, operating results, financial condition and prospects. Ener1 also points to volatility in the debt and equity marketsadversely impacting the Companys ability to secure much-needed financing. The Company states that its prospects were further eroded as a result of the insolvency of Norway-based Think Holdings AS, and the resulting failure of EnerDel operating subsidiary: Think Global. Think Global, an electric car company located in Oslo, Norway manufactured cars under the TH!NK brand; however, Think Global stopped producing vehicles in March 2011. Think Holdings filed for bankruptcy protection in Norway three months later. (Feature continued on P. 4)

Address: Suite 25C 1540 Broadway New York, NY 10036 212 920-3500 Bankruptcy Case Summary Bankruptcy Date: 1/26/2012 Case Number: 12-10299 Action Type: 11 District: Southern District of New York Filing City: Manhattan, NY Judge: Martin Glenn Counsel for Debtor Reed Smith LLP Michael J. Venditto 599 Lexington Avenue New York, NY 10022 212 205-6081 Corporate History & Current Operations Holding company Ener1, Inc. was formed in 1985 and known as Boca Research Corp. until 2002. The Company is engaged in the pursuit of multiple alternative energy applications and storage solutions through its foreign and domestic subsidiaries and a joint venture. The Debtors subsidiarieswhich did not file for Chapter 11 protectiondesign, develop and manufacture high-performance, prismatic, rechargeable lithium-ion batteries and battery pack systems for utility grid, transportation and industrial applications. Although none of Ener1s subsidiaries are expected to be Debtors in the bankruptcy proceeding, the Company believes that these subsidiaries will benefit from the infusion of up to $81 million in new capital, which will be effected through consummation of the Companys Prepackaged Plan of Reorganization. Ener1 advises, If the Plan is confirmed, it is not contemplated that there will be a need for any of these subsidiaries to commence a bankruptcy case. Wholly-owned subsidiary EnerDel is one of the only U.S. manufacturers producing large-

www.BankruptcyData.com - Page 3

BANKRUPTCY WEEK January 30, 2012

FEATURE CONTINUED

Ener1 explains that Think Global was a major customer of its operating subsidiaries. In addition to the obvious loss of business caused by this bankruptcy, the filing also resulted in the write-off of the Ener1s investment in Think Holdings. As a result of the Think Holdings failure, Ener1 announced in August 2011 the need to restate its financial statements for the period included in an amended annual report on Form 10-K/A for the year ended December 31, 2010, as well as an amended Form 10-Q/A for the quarter ended March 31, 2011to reflect the impairments of its investment in Think Holdings. Just one month later, Ener1 announced key leadership changes: board member Thomas J. Snyder replaced Charles Gassenheimer as chairman by assuming the role of non-executive chairman. Chris Cowger, who had been serving as president of Ener1, took over as chief executive officer from Gassenheimer, who announced he would be leaving the Company. In addition, Ener1s board of directors was expanded from nine to 10 board seats, with Cowger to fill the new board seat. In October 2011, Ener1 was notified by NASDAQ that the Company did not comply with its filing requirements for continued listing as a result of its failure to file a quarterly report for the period ended June 30, 2011 on a timely basisas well as its failure to submit a plan to NASDAQ to regain compliance. NASDAQ suspended trading of Ener1s common stock and, in December 2011, removed the securities from listing. According to Ener1, the Company experienced a significant liquidity crunch in Fall 2011. This situation left it unable to service existing debt obligations and properly fund the operations of its subsidiaries. Capital markets and traditional lending sources were not available due to the Companys lack of current financial statements. Ener1 states that it pursued strategic alternatives, including the possibility of selling assets and attracting capital from strategic investors, but ultimately determined that a restructuring was inevitable. As a result, Ener1 initiated a restructuring process that focused on cost reduction, management changes, development of a long-range business plan and the engagement of turnaround professionals. As part of this restructuring process, Ener1 initiated negotiations with the holders of the Senior Notes, Bzinfin and ITOCHU regarding restructuring its debt obligations and obtaining additional financing. In November 2011, Ener1 announced another executive change: Alex Sorokin joined the Company as interim chief executive officer to lead the Companys continuing efforts to improve its performance and shift its business toward heavy-duty transportation and electric grid energy storage applications. Nicholas Brunero, who had served as Ener1s general counsel since 2008, accepted the additional role of interim president; and Dale E. Parker, joined Ener1 as interim chief financial officer. Both Cowger, who most recently served as chief executive officer; and Jeffrey Seidel who served as chief financial officer, resigned from Ener1. Snyder commented, Alex and Dale bring a strong combination of operational and financial expertise with companies that are undergoing change. Together with Nick Brunero, who has been a part of nearly every facet of our business over the last three-and-a-half years, they will sharpen our focus on how we leverage Ener1s energy storage expertise, while implementing a sustainable structure to support our go-forward business strategy. Ener1s release explains that Sorokin was selected for the role because of his nearly thirty years of experience successfully leading companies through periods of transition and transformation. After several months of discussions and negotiations, the Company and its plan support parties entered into a Plan Support Agreement on January 26, 2012. The Plan Support Agreement provides that Bzinfin provide a D.I.P. facility for general working capital and operational expenses. According to the Company, its Pre-packaged Planwhich was filed concurrently with its Chapter 11 petition, is the product of substantial negotiations between the Company and its longterm debt holders. (Feature continued on P. 16)

www.BankruptcyData.com - Page 4

BANKRUPTCY WEEK January 30, 2012

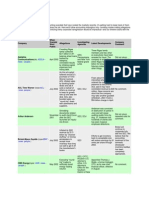

THE ALMANAC: 2011 LEAGUE TABLES

Listed below are league tables for publicly-traded company bankruptcies with over $100 million or more in pre-petition assets that filed for Chapter 11 in 2011 with two or more retentions. Please note that the data below is current as of January 27, 2012. # of Retentions 6 5 4 4 4 3 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 # of Retentions 7 5 5 5 4 2 2 # of Retentions 13 11 9

Counsel Retentions Pachulski Stang Ziehl & Jones LLP Young Conaway Stargatt & Taylor, LLP Greenberg Traurig, LLP Lowenstein Sandler PC Skadden, Arps, Slate, Meagher & Flom LLP Akin Gump Strauss Hauer & Feld LLP Curtis, Mallet-Prevost, Colt & Mosle LLP Dewey & LeBoeuf LLP Gordon Silver Jager Smith P.C. Jones Day Kasowitz, Benson, Torres & Friedman LLP Kirkland & Ellis LLP Kramer Levin Naftalis & Frankel LLP Morris, Nichols, Arsht & Tunnell LLP Morrison & Foerster LLP Paul Hastings LLP Pepper Hamilton LLP Richards, Layton & Finger, P.A. Sidley Austin LLP Troutman Sanders LLP

Accountant/Auditor and/or Tax Advisor Retentions PricewaterhouseCoopers LLP Ernst & Young LLP Deloitte Tax LLP Deloitte & Touche LLP KPMG LLP Grant Thornton LLP BDO USA, LLP

Claims Agent Retentions Garden City Group, Inc. Kurtzman Carson Consultants LLC EPIQ Bankruptcy Solutions, LLC

(The Almanac continued on P. 7)

www.BankruptcyData.com - Page 5

BANKRUPTCY WEEK January 30, 2012

CASE STATUS

The chart below indicates the status, the filing of a Plan and/or an extension or termination of each Debtors exclusivity or, alternatively, the filing of a new publicly-traded bankruptcy, of all currently active public U.S. Bankruptcy Court proceedings listing total pre-petition assets of $100 million or more. Company 155 East Tropicana, LLC 3dfx Interactive, Inc. Ahern Rentals, Inc. Ambac Financial Group, Inc. AmericanWest Bancorporation Ames Department Stores, Inc. (2001) AMR Corporation Arlington Hospitality, Inc. Ascendia Brands, Inc. BankUnited Financial Corporation Blockbuster Inc. Buffets Restaurants Holdings, Inc. (2012) CDC Corporation Delta Petroleum Corporation Dynegy Holdings, LLC Eastman Kodak Company Ener1, Inc. Evergreen Solar, Inc. Filene's Basement, LLC (Syms Corp.) (2011) FirstFed Financial Corp. General Maritime Corporation Great Atlantic & Pacific Tea Company, Inc. Harrington West Financial Group, Inc. Hartmarx Corporation Imperial Capital Bancorp, Inc. Indianapolis Downs, LLC Lee Enterprises, Incorporated Lehman Brothers Holdings Inc. Majestic Capital, Ltd. MF Global Holdings Ltd. Nebraska Book Company, Inc. NewPage Corporation Nortel Networks, Inc. Omega Navigation Enterprises, Inc. PFF Bancorp, Inc. PMI Group, Inc., The Point Blank Solutions, Inc. Radnor Holdings Corporation Real Mex Restaurants, Inc. Sharper Image Corporation ShengdaTech, Inc. Southeast Banking Corp. Bankruptcy Date 08/01/11 10/15/02 12/22/11 11/08/10 10/28/10 08/20/01 11/29/11 08/31/05 08/05/08 05/21/09 09/23/10 01/18/12 10/04/11 12/15/11 11/07/11 01/19/12 01/26/12 08/15/11 11/02/11 01/06/10 11/17/11 12/12/10 09/10/10 01/23/09 12/18/09 04/07/11 12/12/11 09/15/08 04/29/11 10/31/11 06/27/11 09/07/11 01/14/09 07/08/11 12/05/08 11/23/11 04/14/10 08/21/06 10/04/11 02/19/08 08/19/11 09/20/91 Case Status Plan Filed Plan Filed Within 120 Days of Filing DS Approved / Am. Plan Filed / Excl. Ext. DS Approved / Plan Filed Plan Filed / Exclusivity Extension Within 120 Days of Filing Plan Filed Unknown Exclusivity DS Approved / Amended Plan Filed Exclusivity Extension Prepackaged Plan Filed Within 120 Days of Filing Within 120 Days of Filing Amended Plan Filed Within 120 Days of Filing New Filing! Prepackaged Plan Filed Exclusivity Extension Within 120 Days of Filing Competing Plan Filed Within 120 Days of Filing DS Approved / Rev. Plan Filed / Excl. Ext. DS Approved / Plan Supp. Filed Exclusivity Expired Amended Plan & DS Filed Exclusivity Extension Confirmed -- Awaiting Emergence Confirmed -- Awaiting Emergence Plan Filed Within 120 Days of Filing DS Appr. / Am. Plan Filed / Excl. Ext. Req. Exclusivity Extension DS Filed Exclusivity Extension Unknown Exclusivity Within 120 Days of Filing Amended Plan Filed / Exclusivity Extension DS Approved / Plan Supplement Filed Exclusivity Extension Exclusivity Expired Exclusivity Extension Confirmed -- Awaiting Emergence (Case Status continued on P. 7)

www.BankruptcyData.com - Page 6

BANKRUPTCY WEEK January 30, 2012

CASE STATUS CONTINUED

Company Team Financial, Inc. TerreStar Corporation (2011) TerreStar Networks Inc. (2010) Thornburg Mortgage, Inc. TOUSA, Inc. Trailer Bridge, Inc. Tribune Company Trident Microsystems, Inc. Tweeter Home Entertainment Group, Inc. Velocity Express Corporation W.R. Grace & Co. Washington Mutual, Inc. Westpoint Stevens, Inc. (2003) William Lyon Homes WorldSpace, Inc. Bankruptcy Date 04/05/09 02/16/11 10/19/10 05/01/09 01/29/08 11/16/11 12/08/08 01/04/12 06/11/07 09/24/09 04/02/01 09/26/08 06/01/03 12/19/11 10/17/08 Case Status No Exclusivity Filed DS Approved / Am. Plan Filed / Excl. Ext. DS Approved / Rev. Plan Filed / Excl. Ext. Exclusivity Expired Plan Filed Plan Filed DS Approved / Amended Plan Filed Within 120 Days of Filing Unknown Exclusivity No Exclusivity Filed Confirmed -- Awaiting Emergence DS App. / Am. Plan Filed / Plan Supp. Filed Plan Filed Prepackaged Plan Filed Exclusivity Expired

THE ALMANAC: 2011 LEAGUE TABLES CONTINUED

Financial Advisor Retentions Alvarez & Marsal, LLC FTI Consulting, Inc Blackstone Group, The Deloitte Financial Advisory Services LLP AlixPartners LLP BDO USA, LLP Duff & Phelps, LLC Mesirow Financial Consulting, LLC Zolfo Cooper # of Retentions 8 7 4 3 2 2 2 2 2

Investment Banker Retentions Rothschild, Inc. Moelis & Company Lazard Freres & Co., LLC Jefferies & Co. Perella Weinberg Partners LP

# of Retentions 5 4 3 2 2

www.BankruptcyData.com - Page 7

BANKRUPTCY WEEK January 30, 2012

RECENT PROFESSIONAL RETENTIONS

Bankruptcy Weeks retention data sponsored by

Ahern Rentals, Inc. Chapter 11: December 22, 2011 (1/26/2012) Ahern Rentals official committee of unsecured creditors filed with the U.S. Bankruptcy Court motions to retain FTI Consul-ting (Contact: Matthew Pakkala) as financial advisor at the following hourly rates: administrative/ paraprofessional at $115 to 230, consultant/senior consultant at 280 to 530, director/managing director at 560 to 745 and senior managing director at 780 to 895 and Covington & Burling (Contact: Michael St. Patrick Baxter) as counsel at the following hourly rates: paralegal at $200 to 360, associate at 330 to 445, special counsel at 730 and of counsel at 855. Buffets Restaurants Holdings, Inc. Chapter 11: January 18, 2012 (1/27/2012) Buffets Restaurants Holdings filed with the U.S. Bankruptcy Court motions to retain Paul, Weiss, Rifkind, Wharton & Garrison (Contact: Jeffrey Safterstein) as attorney at the following hourly rates: partner at $830 to 1,120, counsel at 760 to 795, associate at 375 to 760 and legal assistant at 85 to 250; Young Conaway Stargatt & Taylor (Contact: Pauline K. Morgan) as attorney at hourly rates ranging from $230 to 700; Moelis & Company (Contact: Robert J. Flachs) as financial advisor and capital markets advisor for a monthly fee of $150,000 and a $3 million restructuring fee; Huntley, Mullaney, Spargo & Sullivan (Contact: William Sullivan) as special real estate consultant for a monthly fee of $10,000 and PricewaterhouseCoopers (Contact: Chad Berge) as tax consultant at the following hourly rates: partner at $735, director at 595, manager at 495, senior associate at 395 and associate at 285.

CDC Corporation Chapter 11: October 4, 2011 (1/27/2012) The U.S. Bankruptcy Court approved CDCs official committee of equity security holders motion to retain Morgan Joseph TriArtisan as financial advisor. Delta Petroleum Corporation Chapter 11: December 15, 2011 (1/24/2012) Delta Petroleum filed with the U.S. Bankruptcy Court a motion to retain Hyperams (Contact: Thomas E. Pabst) as auctioneer for a commission of 10% of gross sales proceeds, a sale expense allowances for reimbursement of direct sale related expenses associated with Tranche One of $17,000 and a buyers premium not to exceed 15% and KPMG (Contact: Robert C. Dennis) as service provider for audit, tax compliance and tax consulting matters at the following hourly rates: partner at $375 to 500, senior manager at 325 to 350, manager at 275 to 300, senior associate at 200 to 225 and associate at 100 to 150. Dynegy Holdings, LLC Chapter 11: November 7, 2011 (1/23/2012) The examiner appointed to the Dynegy Holdings case filed with the U.S. Bankruptcy Court motions to retain Quinn Emanuel Urquhart & Sullivan (Contact: Susheel Kirpalani) as counsel for a discount of 10% on the rates of professionals and paraprofessionals who incur time on the engagement and Zolfo Cooper (Contact: Scott W. Winn) as financial advisor at the following hourly rates: managing director at $775 to 825, professional staff at 230 to 695 and support personnel at 55 to 295.

(Retentions continued on P. 9)

www.BankruptcyData.com - Page 8

BANKRUPTCY WEEK January 30, 2012

RECENT PROFESSIONAL RETENTIONS CONTINUED

Ener1, Inc. Chapter 11: January 26, 2012 (1/26/2012) Ener1filed with the U.S. Bankruptcy Court motions to retain Reed Smith (Contact: Edward J. Estrada) as counsel at hourly rates ranging from $180 to 715; Houlihan Lokey Capital (Contact: Saul E. Burian) as financial advisor and investment banker for a monthly fee of $150,000 and a restructuring fee of $1 million and Garden City Group (Contact: Emily Gottlieb) as notice agent. Filene's Basement, LLC (Syms Corp.) Chapter 11: November 2, 2011 (1/24/2012) The U.S. Bankruptcy Court approved Filenes Basements motions to retain Skadden Arps, Slate, Meagher & Flom as bankruptcy counsel; Young Conaway Stargatt & Taylor as conflicts counsel and Alvarez & Marsal North America to provide each of the Debtors with a president and chief operating officer, a chief financial officer and certain additional personnel and designating Jeff Feinberg as each of the Debtors president and chief operating officer and Gary Binkoski as each of the Debtors chief financial officer. MF Global Holdings Ltd. Chapter 11: October 31, 2011 (1/23/2012) MF Global Holdings and the Chapter 11 trustee assigned to the case filed with the U.S. Bankruptcy Court motions to retain Kasowitz, Benson, Torres & Friedman (Contact: David S. Rosner) as conflict counsel and special investigative counsel at hourly rates ranging from $135 to 1,100; Skadden, Arps, Slate, Meagher & Flom (Contact: J. Gregory Milmoe) as bankruptcy counsel at hourly rates ranging from $195 to 1,095 and FTI Consulting (Contact: Michael Eisenband) as financial advisor for a monthly fixed fee of $1.5 million for November and December 2011, $1millon for January and February 2012, $750,000 for March and April 2012 and $500,000 thereafter. The trustee filed motions to retain Pepper Hamilton (Contact: David B. Stratton) as special counsel at hourly rates ranging from $215 to 850, Freeh Sporkin & Sullivan (Contact: Louis J. Freeh) as investigative counsel at hourly rates ranging from $275 to 750; Freeh Group International Solutions

(Contact: Louis J. Freeh) as advisor at hourly rates ranging from $250 to 600 and Morrison & Foerster (Contact: Brett H. Miller) as bankruptcy counsel at hourly rates ranging from $380 to 975. PMI Group, Inc., The Chapter 11: November 23, 2011 (1/20/2012) PMI Groups official committee of unsecured creditors filed with the U.S. Bankruptcy Court motions to retain Morrison & Foerster (Contact: Anthony Princi) as counsel at the following hourly rates: partner at $695 to 1,125, of counsel at 550 to 950, associate at 320 to 685 and paraprofessional at 185 to 360 and Womble Carlyle Sandridge & Rice (Contact: Francis Monaco Jr.) as co-counsel at the following hourly rates: attorney at $210 to 700 and paraprofessional at 110 to 225. Point Blank Solutions, Inc. Chapter 11: April 14, 2010 (1/24/2012) Point Blank Solutions filed with the U.S. Bankruptcy Court a supplemental motion to retain Venable (Contact: Nancy R. Grunberg) as special government contracting, litigation and government investigation counsel to clarify and expand the scope of work. Venable will be employed at the following hourly rates: partner and counsel at $420 to 685, associate at 280 to 475, paraprofessionals and staff at 190 to 295 Real Mex Restaurants, Inc. Chapter 11: October 4, 2011 (1/23/2012) The U.S. Bankruptcy Court approved Real Mex Restaurants official committee of unsecured creditors motion to retain Duff & Phelps Securities as financial advisor. (Retentions continued on P. 10)

www.BankruptcyData.com - Page 9

BANKRUPTCY WEEK January 30, 2012

RECENT PROFESSIONAL RETENTIONS CONTINUED

Trailer Bridge, Inc. Chapter 11: November 16, 2011 (1/23/2012) Trailer Bridges official committee of unsecured creditors filed with the U.S. Bankruptcy Court a motion to retain Glass-Ratner Advisory & Capital Group (Contact: James W. Fox) as financial advisor at hourly rates ranging from $95 to 495. William Lyon Homes Chapter 11: December 19, 2011 (1/20/2012) William Lyon Homes filed with the U.S. Bankruptcy Court a motion to retain Jackson DeMarco Tidus Peckenpaugh (Contact: Ruth Muskovi) as special counsel at the following hourly rates: partner at $400 to 525, associate at 275 to 405 and legal assistant /paralegal at 125 to 190.

RECENT FINANCING TRANSACTIONS

Ener1, Inc. Chapter 11: January 26, 2012 (1/26/2012) Ener1 filed with the U.S. Bankruptcy Court a motion for approval to obtain $20 million in debtor-in-possession financing from Bzinfin. The funding will be used for general working capital and to fund a loan to wholly owned subsidiary EnerDel, and the loan would bear interest annually at LIBOR plus 7%. Great Atlantic & Pacific Tea Company, Inc. Chapter 11: December 12, 2010 (1/27/2012) The U.S. Bankruptcy Court approved Great Atlantic & Pacific Teas motion to obtain $750 million in exit financing from JPMorgan, JPMorgan Chase Bank and CS Securities. Tribune Company Chapter 11: December 8, 2008 (1/25/2012) Tribune Company filed with the U.S. Bankruptcy Court a motion for authorization to amend the letter of credit facility with Barclays, which will extend the termination date to earliest of April 10, 2013 or the effective date of a Chapter 11 plan. The Court scheduled a February 15, 2012 hearing to consider the motion.

DEBTOR-IN-POSSESSION FINANCING DETAILS

Company Ener1, Inc. Loan Amt. $20 million Loan Type D.I.P. Credit Facility Interest Rate LIBOR + 7% Banks Bzinfin S.A.

CONFIRMATIONS & EMERGENCES CONTINUED

Green Builders Plan Confirmed The U.S. Bankruptcy Court confirmed Green Builders First Chapter 11 Plan of Reorganization, dated December 8, 2011. This real estate development and home building company filed for Chapter 11 protection on August 12, 2011, listing $31 million in pre-petition assets.

www.BankruptcyData.com - Page 10

BANKRUPTCY WEEK January 30, 2012

RECENT CLAIM TRANSFERS

The chart below indicates claim transfers for the last week. Only those transfers of more than $1 million include the additional information of purchasing party. Contact BankruptcyData.com for further information regarding the availability of claim number and claim amount details on these larger claim transfers. Transfer Date 01/25/12 01/27/12 01/25/12 01/20/12 01/24/12 01/24/12 01/26/12 01/25/12 01/11/12 01/11/12 01/17/12 01/23/12 01/23/12 01/23/12 01/24/12 01/25/12 01/25/12 01/26/12 01/26/12 01/26/12 01/26/12 01/26/12 01/26/12 01/26/12 01/26/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12 01/27/12

Company Delta Petroleum Corporation Dynegy Holdings, LLC Filene's Basement, LLC

Great Atlantic & Pacific Tea Co., Inc. Lehman Brothers Holdings Inc.

Transfer to Liquidity Solutions, Inc. Liquidity Solutions, Inc. Debt Acquisition Company of America V Claims Recovery Group LLC (*) CRT Capital Group LLC (*) Sonar Credit Partners II, LLC (*) TRC Master Fund LLC Full Value Special Situations Fund L.P. Banca Popolare Di Spoleto S.p.A. Illiquidx Ltd. (*) CF Claims (*) Banca di Credito Cooperativo di Alba Banca Popolare Di Spoleto S.p.A. Credit Suisse AG (*) Stichting The Value Foundation (*) Credit Suisse Securities (USA) LLC Illiquidx Ltd. Bank Coop AG, Basel Credit Suisse International (*) Elliott Associates, L.P. JPMorgan Chase Bank, N.A. (*) Liquidity Solutions, Inc. (*) PBC Financing (*) The Royal Bank of Scotland York Global Finance BDH, LLC (*) Candlewood Special Sit. Master Fund (*) Goldman Sachs Lending Partners LLC (*) Illiquidx Ltd. JPMorgan Chase Bank, N.A. MAP 98 Segregated Portfolio (*) Oceana Master Fund (*) Ore Hill Hub Fund Ltd. Pentwater Equity Opp. Master Fund PMT Credit Opportunities Fund PWCM Master Fund Ltd UBS AG, Zurich Branch Wilshire Institutional Master Fund II (*)

Transfer from

Kutxa Credito Emiliano

HSBC Private Bank Olympic Finance PBC Financing Fondazione Enasarco Banque DeGroof Paulson Credit Goldman Sachs

ICCREA Banca Deutsche Bank AG Deutsche Bank AG The Royal Bank Deutsche Bank AG The Royal Bank Deutsche Bank AG

(Claim Transfers continued on P. 12)

www.BankruptcyData.com - Page 11

BANKRUPTCY WEEK January 30, 2012

RECENT CLAIM TRANSFERS CONTINUED

Company NewPage Corporation Transfer Date 01/23/12 01/24/12 01/26/12 01/24/12 01/25/12 01/25/12 01/23/12 01/23/12 01/23/12 01/25/12 01/26/12 01/26/12 Transfer to Sierra Liquidity Fund, LLC (*) Sierra Liquidity Fund, LLC (*) Fair Harbor Capital, LLC Longacre Institutional Opportunity Fund Liquidity Solutions, Inc. Marblegate Special Opp. Master Fund Sonar Credit Partners II, LLC (*) Corre Opportunities Fund, L.P. Longacre Opportunity Fund, L.P. Sonar Credit Partners II, LLC (*) Avenue TC Fund Sonar Credit Partners II, LLC (*) Transfer from

Nortel Networks, Inc.

Real Mex Restaurants, Inc. Tribune Company

(*) Indicates multiple claims transferred on the same date

FROM THE DOCKET

See Docket Index on final pages for detailed reference information for all cases mentioned in this issue.

155 East Tropicana Sale Procedures Approved The U.S. Bankruptcy Court approved 155 East Tropicanas motion for approval of procedures related to the sale of substantially all of the Debtors assets and scheduled a February 17, 2012 sale hearing. The deadline for qualifying bids is set for February 10, 2012. Ahern Rentals Objections Filed Kubota Tractor filed with the U.S. Bankruptcy Court an objection to Ahern Rentals financing motion and financing motion supplement. Kubota also filed with the Court notice of its unwillingness to finance sales of Kubota Equipment to Debtor under the restrictions of the Financing Motion and the Financing Motion Supplement. The Companys official committee of unsecured creditors also objected to the Companys motion for post-petition financing and a stipulation between the Debtor and its majority term lenders regarding the use of term lenders cash collateral. Ahern Rentals Stipulation Filed Ahern Rentals filed with the U.S. Bankruptcy Court a stipulation related to the Debtors use of the first lien lenders, including the term lenders cash collateral and the Debtors entry into the post-petition financing, pursuant to the debtor-in-possession loan and security agreement among the Debtor, the lending institutions party thereto, Bank of America as administrative agent for itself and the D.I.P. lenders and as a Decision Agent thereunder, Wells Fargo Bank as collateral agent for the D.I.P. lenders and Merrill Lynch, Pierce Fenner & Smith Incorporated as lead arranger. AMR Objection Filed AMR filed with the U.S. Bankruptcy Court an objection to the motion filed by Mr. Vern Englert, a claim shareholder of AMR, requesting dismissal of the A.M.R. Bankruptcy petition. According to AMR, Mr. Englert has not established cause for dismissal of the chapter 11 cases. Mr. Englerts dissatisfaction, as claimed, may be understandable, but it is not a basis for dismissal of the chapter 11 cases. The chapter 11 cases were commenced in conformity with applicable law and principles. (From the Docket [AMR case update] continued on P. 13)

www.BankruptcyData.com - Page 12

BANKRUPTCY WEEK January 30, 2012

FROM THE DOCKET CONTINUED

AMR Committee Sought AMR Retirees Pension Protection Corp., a non-profit corporation that was formed by non-union retirees of AMR Corporation that currently receive pensions and retiree benefits, filed with the U.S. Bankruptcy Court a motion for the appointment of an official committee of retired employees in the AMR case. The motion asserts, Although the Debtor has not yet made any formal application to this Court to terminate or modify retiree benefits in these cases, the Debtors filings leave little doubt that such efforts will be undertaken in these cases. Accordingly, it is respectfully submitted that the formation of a Retiree Committee is appropriate now so that Retirees are properly in a position to protect their interests and are not forced to scramble to catch up if the Debtors file a motion to modify or terminate retiree benefits. CDC Objection Filed CDCs official committee of equity security holders filed with the U.S. Bankruptcy Court an objection to the Debtors motion for approval of a retention bonus plan and executive service agreements for certain key employees. According to the objection, The Committee believes that the proposed trigger for the bonus payments is not appropriate because it provides no incentive to conclude this bankruptcy case according to a process supported by the Committee. While the Evolution claim may have been the initial cause of the Debtors bankruptcy case, it has become apparent in the course of this case that there is in all probability substantial equity in the Debtor. Accordingly, from the perspective of the Committee, simply satisfying Evolution by a certain date should not be the primary goal of the Debtor or the Key Employees. Delta Petroleum Sale Approval Sought Delta Petroleum filed with the U.S. Bankruptcy Court a motion to approve sale procedures to be utilized in connection with the sale of certain de minimis assets. The Court scheduled a February 14, 2012 hearing on the matter. Delta Petroleum Committee Statement Docketed The U.S. Trustee assigned to the Delta Petroleum case filed with the U.S. Bankruptcy Court a statement that an unsecured creditors committee has not been appointed due to a lack of response for service on the committee. Eastman Kodak Committee Appointed The U.S. Trustee assigned to the Eastman Kodak case appointed an official committee of unsecured creditors. Filenes Basement Hearing Continuance Sought Syms official committee of equity security holders filed with the U.S. Bankruptcy Court a motion for an order continuing the hearing and related deadlines with respect to the Debtors motion for appointment of an examiner to investigate possible estate causes of action. According to the objection, The Equity Committee opposes the motion because despite whatever benefit it may be intended to provide, the Equity Committee believes that the Debtors proposed self-examination will waste limited estate resources and delay and distract parties from negotiating and soliciting one or more chapter 11 plans and a swift emergence from bankruptcy. Filenes Basement Objection Filed Syms filed with the U.S. Bankruptcy Court an objection to the official committee of equity security holders motion for an order continuing the hearing and related deadlines with respect to the motion for appointment of an examiner to investigate possible estate causes of action. Syms asserts, The Motion to Continue is a tactic to (i) block timely adjudication of the Examiner Motion, (ii) avoid independent examination of allegations against management made by the Equity Committee and its members, (iii) prevent a prompt and cost-effective investigation and (iv) block any plan-based resolution of the issues raised by Equity Committee allegations. (From the Docket continued on P. 14)

www.BankruptcyData.com - Page 13

BANKRUPTCY WEEK January 30, 2012

FROM THE DOCKET CONTINUED

FirstFed Financial Plan Filed FirstFed Financial creditor Holdco Advisors filed with the U.S. Bankruptcy Court a Chapter 11 Plan of Reorganization and related Disclosure Statement. According to the Disclosure Statement, The Plan provides for the reorganization of the Debtor and for Holders of certain Allowed Claims to receive equity in the Reorganized Debtor, with the option for each Holder of General Unsecured Claims to receive instead a cash out right of payment and/or a security that results in cash from certain of the Debtors assets, including Cash held by the Debtor as of the Effective Date. In order to effectuate the Distributions, the Plan provides that all of the assets of the Debtors Estate (including Causes of Action not expressly released under the Plan) shall vest in the Reorganized Debtor and then, where applicable, be distributed pursuant to the Plan. The Court scheduled a March 14, 2012 hearing to consider the Disclosure Statement. Great Atlantic & Pacific Tea Company Exhibits Filed Great Atlantic & Pacific Tea Company filed with the U.S. Bankruptcy Court the following Exhibits for the Plan Supplement for the Debtors Joint Plan of Reorganization: Executory Contract and Unexpired Lease Assumption. Great Atlantic & Pacific Tea Company Objections Filed Numerous parties filed with the U.S. Bankruptcy Court objections to Great Atlantic & Pacific Tea Companys Joint Plan of Reorganization, including Food Employers Labor Relations Association and United Food and Commercial Workers Pension Fund, UFCW Local 1776 and Participating Employers Health and Welfare Fund and the United Food and Commercial Workers Union and Participating Employers Tri-State Health and Welfare Fund and UFCW Local 1262 and Employers Pension Fund. Great Atlantic & Pacific Company Extension Approved The U.S. Bankruptcy Court approved Great Atlantic & Pacific Tea Companys motion to extend the exclusive period during which the Company can file a Chapter 11 plan and solicit acceptances thereof through and including June 12, 2012 and August 12, 2012, respectively. Great Atlantic & Pacific Tea Company Sale Approved The U.S. Bankruptcy Court approved Great Atlantic & Pacific Tea Companys motion for an order authorizing the Debtors to apply the Court-approved going-out-of-business procedures to conduct sales. Great Atlantic & Pacific Tea Company Agreement Approved The U.S. Bankruptcy Court approved Great Atlantic & Pacific Tea Companys motion for authority to enter into modifications to a collective bargaining agreement with 1199SEIU United Healthcare Workers East. Nebraska Book Company Extension Sought Nebraska Book Company filed with the U.S. Bankruptcy Court a motion to extend the exclusive period during which the Company can file a Chapter 11 plan and solicit acceptances thereof through and including April 23, 2012 and June 21, 2012, respectively. The Court scheduled a February 22, 2012 hearing on the matter. NewPage LTIP Approval Sought NewPage filed with the U.S. Bankruptcy Court a motion for an order approving a long-term incentive plan (LTIP), the second of two performance incentive plans comprising the Debtors executive incentive program for certain insider participants. The LTIP provides for performance-based incentive payments to 15 executives based upon their achievements, as measured by four objective goals, and provides for a targeted aggregate payout of approximately $8.6 million based on achievement of the goals. The Court scheduled a February 7, 2012 hearing to consider the motion. (From the Docket continued on P. 15)

www.BankruptcyData.com - Page 14

BANKRUPTCY WEEK January 30, 2012

FROM THE DOCKET CONTINUED

PMI Group Objection Filed The U.S. Trustee assigned to the PMI Group case filed with the U.S. Bankruptcy Court an objection to the Debtors motion for approval of (i) assumption of employment contracts, (ii) approval of incentive payments for the employees and (iii) approval of severance payments. According to the Trustee, The Motion is a motion to assume an executory contract entered into prior to the filing of the Petition. A motion to assume is not governed by Section 363. A motion to assume is governed by Section 365 of the Bankruptcy Code. The assumption of an executory contract may not be used to circumvent other provisions of the Bankruptcy Code. This motion attempts to circumvent the provisions of Section 503(c) in this manner. Second, the proposed Incentive Payments are tied solely to the occurrence of events and are of the sort typically rejected by the Courts. Third, the proposed Severance Payments do not comply with the formula contained in Section 503(c)(2) and must be rejected. The Court scheduled a February 7, 2012 hearing on the matter. Trailer Bridge Objections Filed Trailer Bridges official committee of unsecured creditors filed with the U.S. Bankruptcy Court an objection to the Debtors motion to schedule a combined hearing to consider the Disclosure Statement and Chapter 11 Plan. The Committee asserts, The Debtors request for a combined hearing on the Disclosure Statement and Plan, along with the other relief requested in the Solicitation Motion, is an effort to avoid judicial scrutiny of the incomplete and misleading information contained in the Disclosure Statement to allow the Debtor to obtain acceptance of a non-confirmable Chapter 11 plan. The committee also filed an objection to the Debtors motion for approval of a performance-based key employee incentive plan. The Committee objects to the bonuses under the KEIP proposed to be paid to the Co-CEOs of the Debtor. The Committee submits that the proposed bonuses are not warranted under the facts of this Case, where general unsecured creditors are not being paid in full. Additionally, there can be no dispute that the Co-CEOs are insiders of the Debtor as defined in Section 101(31)(B) of the Bankruptcy Code. Given its short duration but significant distributions to the Co-CEOs, the KEIP is more in the form of a retention plan than an incentive plan. Trident Microsystems Objection Filed Trident Microsystems official committee of unsecured creditors filed with the U.S. Bankruptcy Court an objection to the Debtors motion for approval of performance-based incentives for key employees (KEIP). According to the committee, the objection to the KEIP was filed because it is actually a pay-to-stay retention plan prohibited by section 503(c)(3) of the Bankruptcy Code, it does not contain objective milestones, and it would cost the estate up to $4 million with no demonstrated benefit. The committee also filed an objection to the Debtors motion for an order approving procedures in connection with the sale of certain of the Debtors assets related to their set top box business. The committee asserts, The Committee has no issue with the notion that the Debtors should sell their settop-box business (the STB Business) in exchange for the highest and best bid. However, the Committee cannot support an expedited sale of the STB Business pursuant to the Interim Bidding Procedures in their current form. Inasmuch as there is no secured creditor in these cases, the unsecured creditors - the parties that stand to lose the most from a flawed sale process - should be involved in all aspects of the sale including the marketing process, bid selection, and negotiation. W.R. Grace Term Extension Sought W.R. Grace filed with the U.S. Bankruptcy Court a motion for an order extending the term of the credit agreement with Advanced Refining Technologies to extend its term to February 28, 2013. The Court scheduled a February 27, 2012 hearing to consider the motion. (From the Docket continued on P. 16)

www.BankruptcyData.com - Page 15

BANKRUPTCY WEEK January 30, 2012

FROM THE DOCKET CONTINUED

Washington Mutual Certification Approval Sought Boilermakers National Annuity Trust, Doral Bank Puerto Rico, Policemens Annuity and Benefit Fund of the City of Chicago (the MBS plaintiffs) filed with the U.S. Bankruptcy Court a motion, pursuant to Fed. R. Civ. P. 23 and Fed R. Bankr. P. 7023 and 9014(c), for an order certifying the class for purposes of the class claim. The motion explains, The Class Claim, in the amount of at least $273 Million, is for damages against WMI,...for damages related to the purchases of mortgage-backed securities by the MBS Plaintiffs and the Class....Certification of the Class for purposes of the Class Claim is not only proper but warranted by virtue of, at the very least, the fact that the Class has already been certified by the District Court. The Court scheduled a February 16, 2012 hearing to consider the motion. Washington Mutual Plan Supplement, Exhibit Filed Washington Mutual filed with the U.S. Bankruptcy Court a Supplement in support of its Seventh Amended Joint Plan. The Supplement contains the following documents: Exhibit A: Form of Liquidating Trust Agreement, Exhibit B; Form of Amended and Restated By-laws for Reorganized WMI, Exhibit C: Form of Amended and Restated Articles of Incorporation of Reorganized WMI; Exhibit D: Schedule of Executory Contracts and Unexpired Leases to Be Assumed or Assumed and Assigned; Exhibit E: Initial Directors of the Reorganized Debtors; Exhibit F: Form of Senior First Lien Notes Indenture; Exhibit G: Form of Senior Second Lien Notes Indenture; Exhibit H: Form of Pledge and Security Agreement (relating to Runoff Notes); Exhibit I: Form of Pledge and Security Agreement (relating to Credit Facility) and Exhibit J: Form of Intercreditor Agreement. The Company also filed with the Court an Amended Exhibit E: Form of Senior First Lien Notes Indenture. Washington Mutual Stipulations Approved The U.S. Bankruptcy Court approved Washington Mutuals motion for an order approving the stipulation and agreement among the Debtors and JPMorgan Chase Bank with respect to the allowance of the JPMC claims solely for the purpose of voting on the Debtors Seventh Amended Chapter 11 Plan and, separately, among the Debtors and the Federal Deposit Insurance Corporation with respect to the allowance of Claim Number 2140 solely for the purpose of voting on the Plan.

FEATURE CONTINUED

Prepackaged Plan According to documents filed with the Court, the purpose of the Chapter 11 restructuring is to deleverage Ener1s balance sheet. This deleveraging will be implemented via a reduction in the amount of funded debt from around $90 million to approximately $46 million, with current debt holders receiving newly-issued debt and newlyissued common equity of the Reorganized Company. In addition, Bzinfin, S.A., one of the Debtors existing debt and stockholders has committed to provide a post-petition financing facility in the aggregate principal amount of up to $20 million as well as an exit equity commitment. As of the Prepackaged Plans effective date, Ener1s capital structure will consist of the following: i. ii. Approximately $39.65 million in New Notes. New Preferred Stock which will be issued to Bzinfin under the Plan, with a liquidation preference in the amount of the D.I.P. loan outstanding on such date and any amounts funded under the exit funding on such date; provided, however, that Bzinfin shall receive additional shares of New Preferred Stock as it advances funds post-effective date under the Equity Commitment Agreement. New Common Stock which will be issued on the effective date to holders of Senior Note Claims, holders of Convertible Note Claims and holders of Line of Credit Claims. (Feature continued on P. 17)

iii.

www.BankruptcyData.com - Page 16

BANKRUPTCY WEEK January 30, 2012

FEATURE CONTINUED

On the Plans effective date, Ener1s Senior Notes will be canceled, and holders of the Senior Note Claims will receive New Notes which will be issued by the Reorganized Debtor. The Company has agreed to secure all of its obligations under the New Notes Loan Agreement by granting the agent, liens on substantially all of the Reorganized Debtors assets for the benefit of the lenders. Certain of the Companys subsidiaries will guarantee the Reorganized Debtors obligations under the New Notes Loan Agreement and will grant the agent liens on certain of the guarantors assets. Under the current Plan, all authorized or issued interests in Ener1 will be canceled and extinguished and the holders of the interest will not retain any rights thereunder. In addition, the Reorganized Debtor will issue New Common Stock and New Preferred Stock. Specifically, the Company will have the authority to issue (i) shares of common stock, par value $0.01 per share and (ii) shares of preferred stock, par value $0.01 per share. Ener1 warns: If the Plan is not confirmed, the Debtor believes it may be forced to liquidate under Chapter 7 of the Bankruptcy Code. In such event, the Debtor believes that Creditors would realize a less favorable distribution of value, or, in certain cases, none at all, for their Claims. Last Friday, the Court scheduled a February 27, 2012 combined hearing to consider both the Disclosure Statement and Prepackaged Plan of Reorganization. Interested parties must file objections to the documents on or before February 22, 2012.

FINANCIAL REPORTS CONTINUED

TerreStar Networks M.O.R. Filed TerreStar Networks filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported a net loss of $40.7 million on $140,137 in revenue. Tribune Company M.O.R. Filed Tribune Company filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported a net loss of $2.1 million on $9.4 million in revenue. Washington Mutual M.O.R. Filed Washington Mutual filed with the U.S. Bankruptcy Court a monthly operating report for December 2011. For the period, the Company reported a net loss of $42.2 million on negative revenues of $1 million. During the month, the Company paid $11.1 million in professional fees.

CONFIRMATION & EMERGENCE DATES

The U.S. Bankrutpcy Court confirmed a Plan of Reorganization and/or Liquidation for the following publicly-traded company since the prior reporting period: Company Green Builders, Inc. Lee Enterprises, Incorporated Confirmation Date 01/26/12 01/23/12 Effective Date N/A N/A

www.BankruptcyData.com - Page 17

BANKRUPTCY WEEK January 30, 2012

PUBLIC FILINGS

ENER1, INC.

Business: Rechargeable Batteries Address: Suite 25C 1540 Broadway New York, NY 10036 212 920-3500 SIC Codes: 3690 Auditor: PricewaterhouseCoopers LLP Employees: 769 Assets: $396,544,000 EIN: 59-2479377

Bankruptcy Case Summary Bankruptcy Date: 1/26/2012 Case Number: 12-10299 Action Type: 11 District: New York - Southern Filing City: Manhattan, NY Judge: Martin Glenn

Counsel for Debtor Reed Smith LLP Michael J. Venditto 599 Lexington Avenue New York, NY 10022 212 205-6081

Company Officers Charles Gassenheimer, Previous C.E.O. & Chair Alex Sorikin, Interim C.E.O. Jeffrey Seidel, C.F.O. Company Description Ener1, Inc. designs, develops and manufactures high-performance, prismatic, rechargeable, lithium-ion batteries and battery pack systems for energy storage. The Company also conducts research and development activities on fuel cells and nano-coating processes. Its fuel cell business develops and markets fuel cells and fuel cell systems and its nanotechnology business develops and markets nanotechnology related manufacturing processes and materials. Company Securities Common Stock / Post-Petition (Ticker/CUSIP: HEVVQ); Traded: OTC Common Stock / Pre-Petition (Ticker/CUSIP: HEV); Traded: NASDAQ; 164,866,277 shares outstanding as of 2/28/2011; $.01 par value. Security Ownership Boris Zingarevich, 55.1%; Ener1 Group, Inc., 50.1%; Bzinfin, S.A., 9.8%; Green Ventures Group, 7.3%; Michael Zoi, 7.3%; Anchorage Capital Master Offshore, Ltd., 5.5% (Public Filings continued on P. 19)

www.BankruptcyData.com - Page 18

BANKRUPTCY WEEK January 30, 2012

PUBLIC FILINGS CONTINUED

EVERGREEN ENERGY INC.

Business: Provides Clean Energy Solutions Address: Suite 1300 1225 17th Street Denver, CO 80202 303 293-2992 SIC Codes: 1221 Auditor: Hein & Associates LLP Employees: 23 Assets: $29,558,000 EIN: 84-1079971

Bankruptcy Case Summary Bankruptcy Date: 1/23/2012 Case Number: 12-10289 Action Type: 7 District: District of Delaware Filing City: Wilmington, DE Judge: Kevin J Carey Company Officers Thomas H. Stoner, C.E.O. Dianna L, Kubik, C.F.O.

Counsel for Debtor Richards, Layton & Finger, P.A. Mark D. Collins One Rodney Square 920 North King Street Wilmington, DE 19801 302 651-7700

Company Description Evergreen Energy labels itself a business intelligence and environmental solutions company, focused on the development of accurate and reliable technologies. Its products manage costs and operational issues while providing technologies for efficient and cost-effective clean coal solutions. Company Securities Common Stock (Ticker/CUSIP: EVEI); Traded: OTC:BB; 25,701,845 shares outstanding as of 3/7/2011; $.001 par value. Security Ownership Edgehill Partners; Edgehill Multi-Strategy Fund, Ltd, 5.56%; ECK & Partners Holdings Limited; Stanhill Asset Management Inc.; Stanhill Special Situations Fund; Stanhill Capital Partners (BVI) Limited, 5.29%; Ilyas T. Khan, 5.29%; Thomas H. Stoner, Jr., 2.39%; Diana L. Kubik, 1.01%

www.BankruptcyData.com - Page 19

BANKRUPTCY WEEK January 30, 2012

BUSINESS BANKRUPTCY FILINGS

Listed below is a random sampling of nationwide business bankruptcy filings compiled by our research staff during the week of January 23, 2012. An updated list with recent filings from all geographic divisions is always available at BankruptcyData.com.

CALENDAR CONTINUED

February 1, 2012 (Contd). Evergreen Solar, Inc. Chapter 11: August 15, 2011 The U.S. Bankruptcy Court scheduled a February 1, 2012 hearing to consider converting or dismissing the Evergreen Solar case.

Arizona Tribute Aviation LLC Debtor, P.O. Box 26136, Scottsdale, AZ, 85255 Date: 1/24/2012 Chapter: 11 Case #: 12-01311 California - Central Sweet Petroleum Corporation, 89 E Hwy 246, Buellton, CA, 93427 Date: 1/25/2012 Chapter: 11 Case #: 12-10300 District of Columbia BHI International Inc., P.O. Box 1470, Washington, DC, 20013 Date: 1/24/2012 Chapter: 11 Case #: 12-00039

February 3, 2012 William Lyon Homes Chapter 11: December 19, 2011 The U.S. Bankruptcy Court established February 3, 2012 as the final date by which interested parties must file objections to William Lyon Homes Plan.

Florida - Southern Martin County Marine Corp., PO Box 1713, Palm City, FL, 34991 Date: 1/24/2012 Chapter: 11 Case #: 12-11819 Illinois - Northern Midwest Environmental Services Group Inc., 343 W. Erie Ste. 220, Chicago, IL, 60654 Date: 1/25/2012 Chapter: 11 Case #: 12-02569 New Jersey Roar Investments LLC, 1064 Clinton Avenue, Irvington, NJ, 07111 Date: 1/24/2012 Chapter: 11 Case #: 12-11608 Pennsylvania - Eastern Advanced Life Support Ambulance Inc., 3020 Darnell Road, Philadelphia, PA, 19154 Date: 1/24/2012 Chapter: 11 Case #: 12-10597 Texas - Southern Webb Container Corporation, 201 Roberts Street, Houston, TX, 77003 Date: 1/25/2012 Chapter: 11 Case #: 12-30524

Bankruptcy Week is published weekly by New Generation Research, Inc. Ste. 801, 225 Friend St., Boston, MA 02114, 800 468-3810

Publisher: George Putnam, III

Senior Editor: Brandy Chetsas Data Editor: Kerry Mastroianni

Bankruptcy Week subscribers also receive a subscription to www.BankruptcyData.com. Other publications from New Generation Research, Inc. include The Distressed Company Alerta weekly publication identifying companies experiencing financial distress; The Bankruptcy Yearbook and Almanacan annual compendium of bankruptcy information and The Turnaround Lettera monthly investment newsletter. For more information on these publications, e-mail us at customersupport@BankruptcyData.com or call us at 800 468-3810.

www.BankruptcyData.com - Page 20

BankruptcyWeek Index

Company 155 East Tropicana, LLC 3dfx Interactive, Inc. Ahern Rentals, Inc. Ambac Financial Group, Inc. AmericanWest Bancorporation Ames Department Stores, Inc. (2001) AMR Corporation Arlington Hospitality, Inc. Ascendia Brands, Inc. BankUnited Financial Corporation Barzel Industries Inc. Blockbuster Inc. Buffets Restaurants Holdings, Inc. (2012) CDC Corporation Delta Petroleum Corporation Dynegy Holdings, LLC Eastman Kodak Company Ener1, Inc. Evergreen Solar, Inc. Filene's Basement, LLC (Syms Corp.) (2011) FirstFed Financial Corp. General Maritime Corporation Great Atlantic & Pacific Tea Company, Inc. Harrington West Financial Group, Inc. Hartmarx Corporation Imperial Capital Bancorp, Inc. Indianapolis Downs, LLC Lee Enterprises, Incorporated Lehman Brothers Holdings Inc. Majestic Capital, Ltd. MF Global Holdings Ltd. Nebraska Book Company, Inc. NewPage Corporation Nortel Networks, Inc. Omega Navigation Enterprises, Inc. PFF Bancorp, Inc. PMI Group, Inc., The Point Blank Solutions, Inc. Radnor Holdings Corporation Real Mex Restaurants, Inc. Sharper Image Corporation ShengdaTech, Inc. Southeast Banking Corp. SulphCo, Inc. Team Financial, Inc. TerreStar Corporation (2011) TerreStar Networks Inc. (2010) Thornburg Mortgage, Inc. TOUSA, Inc. Trailer Bridge, Inc. Tribune Company Trident Microsystems, Inc. Tweeter Home Entertainment Group, Inc. Velocity Express Corporation W.R. Grace & Co. Washington Mutual, Inc. Westpoint Stevens, Inc. (2003) William Lyon Homes WorldSpace, Inc.

Bankruptcy Date 08/01/11 10/15/02 12/22/11 11/08/10 10/28/10 08/20/01 11/29/11 08/31/05 08/05/08 05/21/09 09/15/09 09/23/10 01/18/12 10/04/11 12/15/11 11/07/11 01/19/12 01/26/12 08/15/11 11/02/11 01/06/10 11/17/11 12/12/10 09/10/10 01/23/09 12/18/09 04/07/11 12/12/11 09/15/08 04/29/11 10/31/11 06/27/11 09/07/11 01/14/09 07/08/11 12/05/08 11/23/11 04/14/10 08/21/06 10/04/11 02/19/08 08/19/11 09/20/91 09/16/11 04/05/09 02/16/11 10/19/10 05/01/09 01/29/08 11/16/11 12/08/08 01/04/12 06/11/07 09/24/09 04/02/01 09/26/08 06/01/03 12/19/11 10/17/08

Case Number 11-22216 02-55795 / 11-41900 11-53860 10-15973 10-06097 01-42217 11-15463 05-34885 08-11787 09-19940 09-13204 10-14997 12-10237 11-79079 11-14006 11-38111 12-10202 12-10299 11-12590 11-13511 10-12927 11-15285 10-24549 10-14677 09-02046 09-19431 11-11046 11-13918 08-13555 11-36225 11-15059 11-12005 11-12804 09-10138 11-35926 08-13127 11-13730 10-11255 06-10894 11-13122 08-10322 11-52649 91-14561 11-37949 09-10925 11-10612 10-15446 09-17787 08-10928 11-08348 08-13141 12-10069 07-10787 09-13294 01-01139 08-12229 03-13532 11-14019 08-12412

Filing District Nevada California - Northern Nevada New York - Southern Washington - Eastern New York - Southern New York - Southern Illinois - Northern Delaware Florida - Southern Delaware New York - Southern Delaware Georgia - Northern Delaware New York - Southern New York - Southern New York - Southern Delaware Delaware California - Central New York - Southern New York - Southern California - Central Illinois - Northern California - Southern Delaware Delaware New York - Southern New York - Southern New York - Southern Delaware Delaware Delaware Texas - Southern Delaware Delaware Delaware Delaware Delaware Delaware Nevada Florida - Southern Texas - Southern Kansas New York - Southern New York - Southern Maryland Florida - Southern Florida - Middle Delaware Delaware Delaware Delaware Delaware Delaware New York - Southern Delaware Delaware

Judge Bruce A. Markell James R. Grube Bruce T. Beesley Shelley C. Chapman Patricia C. Williams Robert E. Gerber Sean H. Lane A. Benjamin Goldgar Brendan Linehan Shannon Laurel M. Isicoff Christopher S. Sontchi Burton R. Lifland Mary F. Walrath Paul M. Bonapfel Kevin J. Carey Cecelia G. Morris Allan L. Gropper Martin Glenn Mary F. Walrath Kevin J. Carey Ernest M. Robles Allan L. Gropper Robert D. Drain Robin Riblet Bruce W. Black Louise DeCarl Adler Brendan Linehan Shannon Kevin Gross James M. Peck Cecelia G. Morris Martin Glenn Peter J. Walsh Kevin Gross Kevin Gross Karen K. Brown Kevin J. Carey Brendan Linehan Shannon Peter J. Walsh Peter J. Walsh Peter J. Walsh Kevin Gross Bruce T. Beesley Paul G. Hyman, Jr. Jeff Bohm Robert E. Nugent Sean H. Lane Sean H. Lane Duncan W. Keir John K. Olsen Jerry A. Funk Kevin J. Carey Christopher S. Sontchi Peter J. Walsh Mary F. Walrath Ronald L. Buckwalter Mary F. Walrath Stuart M. Bernstein Christopher S. Sontchi Peter J. Walsh

Attorney Gordon Silver, Ltd. Murray & Murray Gordon Silver Dewey & LeBoeuf LLP Foster Pepper PLLC Weil, Gotshal & Manges LLP Weil, Gotshal & Manges LLP Jenner & Block LLP Young Conaway Stargatt & Taylor, LLP Shutts & Bowen LLP Cole, Schotz, Meisel, Forman & Leonard, P.A. Weil, Gotshal & Manges LLP Young Conaway Stargatt & Taylor, LLP Lamberth, Cifelli, Stokes, Ellis & Nason, P.A. Morris, Nichols, Arsht & Tunnell LLP Sidley Austin LLP Sullivan & Cromwell LLP Reed Smith LLP Pachulski Stang Ziehl & Jones LLP Skadden, Arps, Slate, Meagher & Flom LLP Landau Gottfried & Berger LLP Kramer, Levin, Naftalis & Frankel LLP Kirkland & Ellis LLP Landau Gottfried & Berger LLP Skadden, Arps, Slate, Meagher & Flom LLP Stutman, Treister & Glatt Greenberg Traurig, LLP Sidley Austin LLP Weil, Gotshal & Manges LLP Murphy & King Professional Corporation Skadden, Arps, Slate, Meagher & Flom LLP Pachulski Stang Ziehl & Jones LLP Pachulski Stang Ziehl & Jones LLP Morris, Nichols, Arsht & Tunnell LLP Bracewell & Giuliani LLP Richards, Layton & Finger, P.A. Young Conaway Stargatt & Taylor, LLP Pachulski Stang Ziehl & Jones LLP Skadden, Arps, Slate, Meagher & Flom LLP Pachulski Stang Ziehl & Jones LLP Womble Carlyle Sandridge & Rice, PLLC Greenberg Traurig, LLP Herbert Stettin, Esq. Hoover Slovacek LLP Redmond & Nazar, L.L.P. Akin Gump Strauss Hauer & Feld LLP Akin Gump Strauss Hauer & Feld LLP Venable LLP Berger Singerman, P.A. Foley & Lardner LLP Sidley Austin LLP DLA Piper US LLP Skadden, Arps, Slate, Meagher & Flom LLP Richards, Layton & Finger, P.A. Pachulski Stang Ziehl & Jones LLP Richards, Layton & Finger, P.A. Weil, Gotshal & Manges LLP Pachulski Stang Ziehl & Jones LLP Pachulski Stang Ziehl & Jones LLP

www.BankruptcyData.com

S-ar putea să vă placă și

- Beard Corp Rest Review 201112Document31 paginiBeard Corp Rest Review 201112bankrupt0Încă nu există evaluări

- Beard Group Corporate Restructuring Review For November 2011Document32 paginiBeard Group Corporate Restructuring Review For November 2011bankrupt0Încă nu există evaluări

- Corporate Restructuring Review For April 2011Document25 paginiCorporate Restructuring Review For April 2011bankrupt0Încă nu există evaluări

- Coffin v. Atlantic Power Corp., 2015 ONSC 3686Document43 paginiCoffin v. Atlantic Power Corp., 2015 ONSC 3686Drew HasselbackÎncă nu există evaluări

- Affidavit of ResCap C.F.O.Document101 paginiAffidavit of ResCap C.F.O.DealBook100% (1)

- Toys R Us Debtors Motion For Entry of OrdersDocument124 paginiToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiÎncă nu există evaluări

- ToysRUs March 2018Document124 paginiToysRUs March 2018Ben SchultzÎncă nu există evaluări

- C0120 6Document9 paginiC0120 6Chapter 11 DocketsÎncă nu există evaluări

- In The United States Bankruptcy Court For The District of DelawareDocument4 paginiIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsÎncă nu există evaluări

- 10000004161Document16 pagini10000004161Chapter 11 DocketsÎncă nu există evaluări

- Le Pain Quotidien DeclarationDocument15 paginiLe Pain Quotidien DeclarationKhristopher J. BrooksÎncă nu există evaluări

- A.&P. Affidavit in Support of Its Bankruptcy FilingDocument92 paginiA.&P. Affidavit in Support of Its Bankruptcy FilingDealBook100% (1)

- News Release - Ener1 Restructuring - 012612 - FINALDocument3 paginiNews Release - Ener1 Restructuring - 012612 - FINALpandorasboxofrocksÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New York For PublicationDocument16 paginiUnited States Bankruptcy Court Southern District of New York For Publicationanna338Încă nu există evaluări

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument538 paginiIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsÎncă nu există evaluări

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument14 paginiAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New YorkDocument11 paginiUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Central District of California (Santa Ana Division)Document15 paginiUnited States Bankruptcy Court Central District of California (Santa Ana Division)Chapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Central District of California (Santa Ana Division)Document15 paginiUnited States Bankruptcy Court Central District of California (Santa Ana Division)Chapter 11 DocketsÎncă nu există evaluări

- Prepared by Simpson DsouzaDocument32 paginiPrepared by Simpson DsouzaSimpson_DsouzaÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New YorkDocument11 paginiUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsÎncă nu există evaluări

- United States Trustees Complaint Objecting Discharge To Charles R Lance's Chapter 7 Bankruptcy DischargeDocument20 paginiUnited States Trustees Complaint Objecting Discharge To Charles R Lance's Chapter 7 Bankruptcy DischargeDGWBCSÎncă nu există evaluări

- "Whistle Blower": Enron The ScandalDocument5 pagini"Whistle Blower": Enron The ScandalRonessa CauguiranÎncă nu există evaluări

- The Debtors Are Electroglas, Inc. ("Electroglas") and Electroglas International, Inc. ("Electroglas International")Document135 paginiThe Debtors Are Electroglas, Inc. ("Electroglas") and Electroglas International, Inc. ("Electroglas International")Chapter 11 DocketsÎncă nu există evaluări

- Enron PresentationDocument12 paginiEnron PresentationmuffindangÎncă nu există evaluări

- Audit of Accounts, Processes, and Assertions: SectionDocument6 paginiAudit of Accounts, Processes, and Assertions: SectionCryptic LollÎncă nu există evaluări

- Investing in the Renewable Power Market: How to Profit from Energy TransformationDe la EverandInvesting in the Renewable Power Market: How to Profit from Energy TransformationÎncă nu există evaluări

- Mortgage Concurrent Resolution 11-3-11Document6 paginiMortgage Concurrent Resolution 11-3-11Foreclosure FraudÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New YorkDocument11 paginiUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsÎncă nu există evaluări

- '/'-:,..:-LTT - ,-!L - /. - : United States Bankruptcy Court Southern District of New YorkDocument11 pagini'/'-:,..:-LTT - ,-!L - /. - : United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsÎncă nu există evaluări

- NRE ASE O BK Hapter Elta Roduce Ointly Dministered EbtorDocument38 paginiNRE ASE O BK Hapter Elta Roduce Ointly Dministered EbtorChapter 11 DocketsÎncă nu există evaluări

- Reasons Behind Enron's DownfallDocument16 paginiReasons Behind Enron's DownfallYash RajÎncă nu există evaluări

- Declaration of Adam Kraber in Support of Chapter 11 Petitions and First Day Motions (Doc 19)Document38 paginiDeclaration of Adam Kraber in Support of Chapter 11 Petitions and First Day Motions (Doc 19)Ann Dwyer100% (1)

- Corporate Governance: BankruptcyDocument37 paginiCorporate Governance: Bankruptcybhadoria9Încă nu există evaluări

- Corporate Rehabilitation of Bayan TelecommunicationsDocument12 paginiCorporate Rehabilitation of Bayan TelecommunicationsYvon BaguioÎncă nu există evaluări

- Declaration of Joseph Santangelo in Support of Chapter 11 Petitions and First Day PleadingsDocument144 paginiDeclaration of Joseph Santangelo in Support of Chapter 11 Petitions and First Day Pleadingsvawag91861Încă nu există evaluări

- Forensic Accounting Case Sec - Accounting and Auditing EnforcementDocument6 paginiForensic Accounting Case Sec - Accounting and Auditing EnforcementRosaliaWahdiniÎncă nu există evaluări

- Suzanne Etcheverry - OPIC Managing Risk in Clean Energy ProjectsDocument16 paginiSuzanne Etcheverry - OPIC Managing Risk in Clean Energy ProjectsAsia Clean Energy ForumÎncă nu există evaluări

- Filed: United States Court of Appeals Tenth CircuitDocument33 paginiFiled: United States Court of Appeals Tenth CircuitScribd Government DocsÎncă nu există evaluări

- 158-5 Second Amended Complaint Dated 3 3115Document78 pagini158-5 Second Amended Complaint Dated 3 3115larry-612445Încă nu există evaluări

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument11 paginiIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsÎncă nu există evaluări

- United States Court of Appeals, Eleventh CircuitDocument9 paginiUnited States Court of Appeals, Eleventh CircuitScribd Government DocsÎncă nu există evaluări

- Enronfinaloct13 100304021640 Phpapp02Document26 paginiEnronfinaloct13 100304021640 Phpapp02WASEEMZAHOORÎncă nu există evaluări

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument26 paginiAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsÎncă nu există evaluări

- In The United States Bankruptcy Court For The District of DelawareDocument3 paginiIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsÎncă nu există evaluări

- United States Bankruptcy Court Southern District of New YorkDocument19 paginiUnited States Bankruptcy Court Southern District of New YorkmwoehrÎncă nu există evaluări

- Declaration of Irit Eluz Pursuant To Local Bankruptcy Rule 1007-2 and in Support of The Debtor'S Chapter 11 Petition and First-Day MotionsDocument23 paginiDeclaration of Irit Eluz Pursuant To Local Bankruptcy Rule 1007-2 and in Support of The Debtor'S Chapter 11 Petition and First-Day MotionsChapter 11 DocketsÎncă nu există evaluări

- 10000005744Document26 pagini10000005744Chapter 11 DocketsÎncă nu există evaluări

- The Corporate Scandal SheetDocument4 paginiThe Corporate Scandal SheetAngelo LincoÎncă nu există evaluări

- 2018.10.24 (2115) Decl. of J. Slavek ISO of CVX's Mtn. To Hold Donziger in ContemptDocument22 pagini2018.10.24 (2115) Decl. of J. Slavek ISO of CVX's Mtn. To Hold Donziger in ContemptMichaelKraussÎncă nu există evaluări

- Enron CollapseDocument14 paginiEnron CollapseYandri HariandaÎncă nu există evaluări

- In The United States Bankruptcy Court For The District of DelawareDocument4 paginiIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsÎncă nu există evaluări

- Radio Shack CH 11 Part 2Document20 paginiRadio Shack CH 11 Part 2Robert WilonskyÎncă nu există evaluări

- Teamsters GE LawsuitDocument31 paginiTeamsters GE LawsuitDan ShepardÎncă nu există evaluări

- Robert J. Meyer v. William Britton Greene, 11th Cir. (2013)Document25 paginiRobert J. Meyer v. William Britton Greene, 11th Cir. (2013)Scribd Government DocsÎncă nu există evaluări

- Penn Virginia Corporation KLP CH 11 Schedules Andor StatDocument101 paginiPenn Virginia Corporation KLP CH 11 Schedules Andor Statsrikanth ogguÎncă nu există evaluări

- Rep 0306071313Document127 paginiRep 0306071313CRNÎncă nu există evaluări

- Enron Scandal - Wikipedia, The Free EncyclopediaDocument31 paginiEnron Scandal - Wikipedia, The Free Encyclopediazhyldyz_88Încă nu există evaluări

- OCC Application for Bank MergerDocument256 paginiOCC Application for Bank Mergerbob doleÎncă nu există evaluări

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyDe la EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyÎncă nu există evaluări

- WEEK 3 Jobs in Accounting PDFDocument2 paginiWEEK 3 Jobs in Accounting PDFdaniÎncă nu există evaluări

- Case Study of Satyam ScamDocument34 paginiCase Study of Satyam Scamshubhendra8967% (15)

- Bank statement summary and transactions for Giselle RosarioDocument3 paginiBank statement summary and transactions for Giselle RosarioCamiloÎncă nu există evaluări

- ROAROENPMDocument24 paginiROAROENPMPudding FcÎncă nu există evaluări

- Workshop 7. My Favorite CharacterDocument7 paginiWorkshop 7. My Favorite CharacterLAURA IVONNE REAY COTRINA0% (2)

- Factors Influencing Consumers' Intention to Use Mobile Money in NigeriaDocument159 paginiFactors Influencing Consumers' Intention to Use Mobile Money in NigeriaNk NoviaÎncă nu există evaluări

- Emerging Trends in Financial ServicesDocument2 paginiEmerging Trends in Financial ServicesAlok Ranjan100% (1)

- Christopher P. Mittleman's LetterDocument5 paginiChristopher P. Mittleman's LetterDealBook100% (2)

- Struktur OrganisasiDocument1 paginăStruktur OrganisasiRoudaÎncă nu există evaluări

- Gaisano Cagayan, Inc Vs Insurance Company of North America DigestDocument2 paginiGaisano Cagayan, Inc Vs Insurance Company of North America DigestAbilene Joy Dela Cruz100% (1)

- Unit 5 - Debit & Credit CardsDocument5 paginiUnit 5 - Debit & Credit CardsLighters KietÎncă nu există evaluări

- ECC Citizen Charter-17 1 RequirementsDocument8 paginiECC Citizen Charter-17 1 RequirementsMonique MangubatÎncă nu există evaluări

- 300 Saw Pa Accounting ManualDocument52 pagini300 Saw Pa Accounting ManualKaren Robinson WilliamsÎncă nu există evaluări

- Parabolic SARDocument2 paginiParabolic SARprivatelogic100% (2)

- Top NCD Picks and Analysis for May 2014Document1 paginăTop NCD Picks and Analysis for May 2014shobhaÎncă nu există evaluări

- New Sources of Leverage Loans: Making Use of FHA Loans in A NMTC TransactionDocument4 paginiNew Sources of Leverage Loans: Making Use of FHA Loans in A NMTC TransactionReznick Group NMTC PracticeÎncă nu există evaluări

- Hang Seng Index: FeaturesDocument2 paginiHang Seng Index: FeaturesHaroon GorayaÎncă nu există evaluări

- Lousianna Tax InstructionDocument17 paginiLousianna Tax Instructionchuckhsu1248Încă nu există evaluări

- Vanguard Acct Xfer Forms 06 PDFDocument62 paginiVanguard Acct Xfer Forms 06 PDFwlamillerÎncă nu există evaluări

- Barings - A Case Study For Risk ManagementDocument5 paginiBarings - A Case Study For Risk ManagementGyanendra Mishra100% (1)

- Request For ESCO Contract II PDFDocument22 paginiRequest For ESCO Contract II PDFjoechengshÎncă nu există evaluări

- Surrender Discharge Voucher of LIC Form No. 5074Document5 paginiSurrender Discharge Voucher of LIC Form No. 5074Arindam Samanta100% (3)

- Transportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)Document2 paginiTransportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)jobelle barcellanoÎncă nu există evaluări

- FMI - Benefits of Financial IntermediariesDocument11 paginiFMI - Benefits of Financial IntermediariesGaurav Pote100% (2)

- Merchant BankingDocument23 paginiMerchant Bankingmukeshdilse100% (1)

- New Government Accounting SystemDocument65 paginiNew Government Accounting SystemRuel Villanueva100% (1)

- Providing safe drinking water across Srikakulam districtDocument14 paginiProviding safe drinking water across Srikakulam districtSatyendraYadavÎncă nu există evaluări

- Insurance Law Syllabus OverviewDocument8 paginiInsurance Law Syllabus OverviewKarl Marxcuz ReyesÎncă nu există evaluări

- Presentation On Kotak Life InsuranceDocument15 paginiPresentation On Kotak Life Insurancehitesh38560% (1)

- Kape-Hc-217042-03-06-2022 Butyl ReclaimDocument1 paginăKape-Hc-217042-03-06-2022 Butyl Reclaim0911khanÎncă nu există evaluări