Documente Academic

Documente Profesional

Documente Cultură

Steps To Discharging Debt Collections

Încărcat de

erickutnyDescriere originală:

Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Steps To Discharging Debt Collections

Încărcat de

erickutnyDrepturi de autor:

Formate disponibile

Debt Collections Violations This may sound confusing but actual it's fairly simple.

Debt elimination companies look to find your credit card companies in violation of both state and federal laws, rendering your agreement and debt owed as void. That is always very easy to do since the promissory note you signed was fraud from the beginning due to non disclosure of what was actually taking place when they offered you a loan and accepted your promissory note. This service is based on U.S. Supreme Court's decisions, Title 15 United State Code (USC) section 1692, the Fair Debt Collections Practices Act, section 1601, the Fair Credit Billing Act, the Uniform Commercial Code (UCC), section 203, and numerous Banking and Lending laws . There are many cases that have been decided on when it comes to the issues of "money," "credit," and "banking." The collection of interest on credit issued by a bank or a credit card company is in direct violation of all usury laws! The laws are very specific concerning the corporate authority of banks and credit institutions. THEY CANNOT LAWFULLY ISSUE CREDIT! When you tell them you discovered their fraud, THEY HAVE TO LISTEN AND RESPOND! It is your LEGAL RIGHT to have them certify that a lawful debt exists. They can NEVER DO THIS!!! Discharging The problem in the past with trying to discharge public debts with instruments that could not be processed through your bank on the corner, was that those discharge instruments did not route through the Federal Reserve. It is the bean counter for the national debt. That debt is first and primarily owed to the people who are the equitable titleholders of all the substance in this country. If you try to discharge a public debt with your discharge instrument, and you do not route it through the Federal Reserve, it appears you are receiving a benefit from the United States without exchanging it for something of value. This is not technically correct because you have a right to be reimbursed, whether or not you apply it toward the debt the United States owes you. You are the substance; it is the fiction. If you do route your discharge instrument through the Federal Reserve, where the national debt owed to you can be reduced by the amount of the instrument, you have made an exchange that fits nicely into their accrual bookkeeping system. Your PERSON s charge from the charging party within the United States commercial scheme is discharged, and the debt the United States owes to you is discharged by the same amount. That is a quid pro quo, and everyone is happy, EXCEPT those who are not interested in the money but just want to be in control from behind the scenes. To accomplish this quid pro quo exchange: 1. your claim to being one of the people must appear on a public register (the Secretary of State), 2. you must have an account with the banker for the United States (the Secretary of the Treasury), 3. you must have given notice of your reservation of routing numbers through the national debt accountant (the Federal Reserve), 4. you must refer to the insurance policy that covers your remedy (House Joint Resolution 192), 5. you must make your instrument negotiable so it can be used by the United States for a profit, 6. you must transmit your instrument back into the public through an agent (your registered debtor), 7. you must only use a noncash item for this exchange, 8. you must do a banker s acceptance of a charging instrument to attach to your noncash item, and 9. you must understand that you are not getting something for nothing

Reserving your routing numbers to use on your discharge instruments is not as difficult as was thought during the previous decade. Every person has opened bank accounts in the past that have been closed for one reason for another. On the bottom of the checks for those closed bank accounts is a routing number to the particular bank and a routing number to the particular account. Each check has a check number. When you put the check number together with the two routing numbers, you have a means of tracking each item that goes through the worldwide banking system. The routing numbers on the bottom of the checks from accounts your person has closed will never be reassigned. They are attached to your person s NAME forever and kept in the records of the Federal Reserve. Bank accounts that are still open and active are used for cash items. Checks written on these open bank accounts can be taken to the particular bank and CASHED. This is the type of instrument used in commercial transactions everyday. There is a fund attached to the check from which the debt evidenced by the check can be paid. Bank accounts that are no longer open and active cannot be used to process cash items. They can only be used to process noncash items. They require special handling. Title 12 of USC and CFR explain how and when receiving banks are to process noncash items. A closed bank account associated with your debtor s NAME, has routing numbers that can route your discharge instrument through the Federal Reserve to reduce the national debt to you and increase the balance of the bank account of the party that is charging your debtor. It is a WIN WIN situation. The charging party is instructed to mail the discharge instrument to the Secretary of Transportation. Title 46 has sufficient evidence to support the proposition that the Secretary is the trustee over some or all vessels mortgaged by the United States. If your debtor PERSON is presumed to be a vessel, it is regulated by the Secretary of Transportation through the Maritime Ministries Administration, that is the proper party to assist in processing your noncash item. The Secretary of Transportation can forward the item to the Secretary of the Treasury, who already has been notified to prepare for noncash activity in your treasury direct account on the Bill of Exchange. The Secretary of the Treasury is directly related to the Federal Reserve. Between the Treasury and the Federal Reserve, your noncash item can be directed to the proper parties to settle the account and get everyone into that quid pro quo position we want. The United States and its co-business partners are debtors to you. You are the creditor, not only over your debtor PERSON, but also over the United States, the legal titleholder over the registered things to which you are the equitable titleholder. You are the primary creditor, so if the United States has other creditors, like the international bankers, they cannot jump to the front of the line. Their claims are subordinated to your claims if your claims are registered and if you understand the law surrounding what you are doing. LEARN THE LAW FIRST, THEN JUMP OFF THE CLIFF!!!!!!!!! -------------------------------------------------------With additional documents and letters not covered here you can call upon the Secretary of the Treasury or the IRS to adjust the accounts and pay the bills, taxes and the like that you have accumulated over time and have the incurred debt paid off using the pre-paid account that is waiting for you to use. Treasury or the IRS will eliminate debt you incurred while slaving away to pay "your" taxes every year. .

The instrument that was used was given by the government (company) as the collateral to secure the debt they had with the bankers. You can redeem and regain control of that instrument by filing a UCC-1 financing statement with the Secretary of State in your state and listing your birth certificate as your property or collateral.

S-ar putea să vă placă și

- Instructions For Discharging Public Debt With Private ChecksDocument4 paginiInstructions For Discharging Public Debt With Private Checkssspikes93% (168)

- Proof Debt Is PrepaidDocument9 paginiProof Debt Is Prepaidfabrignani@yahoo.com92% (25)

- Promissory Note RedemptionDocument5 paginiPromissory Note Redemptionsalim bey98% (46)

- Zero Balance FreedomDocument23 paginiZero Balance FreedomALI MORGAN92% (37)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionDe la EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionÎncă nu există evaluări

- I GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRDe la EverandI GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRÎncă nu există evaluări

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersDe la EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersEvaluare: 3 din 5 stele3/5 (1)

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsDe la EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsEvaluare: 5 din 5 stele5/5 (12)

- Discharge Debts For Free!! (Info Letter)Document3 paginiDischarge Debts For Free!! (Info Letter)Shanae94% (158)

- 1040v Discharge Debt GuideDocument2 pagini1040v Discharge Debt GuideKNOWLEDGE SOURCE94% (86)

- Zero Your AccountDocument8 paginiZero Your Accountamenelbey97% (160)

- Discharging Debt As Secured Party Creditor You Need To KnowDocument3 paginiDischarging Debt As Secured Party Creditor You Need To KnowMin Hotep Tzaddik Bey78% (54)

- Discharge The DebtDocument14 paginiDischarge The Debtedwin97% (146)

- STEPS in Redemption ProcessDocument5 paginiSTEPS in Redemption ProcessEmpressInI98% (46)

- Discharging Debt Via HJR 192Document7 paginiDischarging Debt Via HJR 192Horton Glenn88% (17)

- Discharge of Public Debts 2Document39 paginiDischarge of Public Debts 2CK in DC100% (16)

- My AFV SuccessDocument10 paginiMy AFV SuccessRachel Rey90% (52)

- Bill of Exchange (Careful... )Document12 paginiBill of Exchange (Careful... )Jayanth Kumar93% (61)

- All Debts Are PrepaidDocument7 paginiAll Debts Are PrepaidLashawn El Bey96% (24)

- Letter To Pay Bill NewDocument1 paginăLetter To Pay Bill Newapi-1973110994% (86)

- Treasury Direct Account TDADocument10 paginiTreasury Direct Account TDAVincent J. Cataldi91% (81)

- How To Endorse A CheckDocument30 paginiHow To Endorse A Checkfreedompool11391597% (77)

- Tender InstructionsDocument4 paginiTender InstructionsHerbert Stout100% (73)

- Discharge The Debt PDFDocument14 paginiDischarge The Debt PDFmaurice100% (20)

- Using Your ExemptionDocument41 paginiUsing Your ExemptionNikki Cofield100% (10)

- Audio Title: Beneficiary: Jack Smith Audio Download For February 23, 2009Document54 paginiAudio Title: Beneficiary: Jack Smith Audio Download For February 23, 2009marisolchavez88% (32)

- Debt Elimination Discharge Set Off, Law, TruthDocument5 paginiDebt Elimination Discharge Set Off, Law, TruthLandiBrown100% (7)

- Sucessful Mortgage DischargeDocument48 paginiSucessful Mortgage DischargeAkil Bey83% (30)

- A Simple Letter That Voids Any Debt.Document1 paginăA Simple Letter That Voids Any Debt.GezaLive100% (4)

- Sample Discharge of Mortgage To LendersDocument2 paginiSample Discharge of Mortgage To LendersZIONCREDITGROUP100% (12)

- How To Be Debt Free in 100 DaysDocument123 paginiHow To Be Debt Free in 100 DaysJo Jo96% (48)

- The Commercial Process of CreditorsDocument12 paginiThe Commercial Process of CreditorsJulie Hatcher-Julie Munoz Jackson97% (33)

- Debt Elimination Is Based On Understanding How YouDocument20 paginiDebt Elimination Is Based On Understanding How YouHorton Glenn100% (13)

- New Accepted For Value ProcessDocument2 paginiNew Accepted For Value ProcessBryant Georgen95% (40)

- 5 - Acceptance For Value Wording For Birth CertificateDocument1 pagină5 - Acceptance For Value Wording For Birth Certificateapi-374440893% (88)

- Affidavit of Discharge and Tender of Payment AcknowledgementDocument5 paginiAffidavit of Discharge and Tender of Payment Acknowledgementsalim bey96% (27)

- Request Banks To Follow UCC PROOF OF CLAIMDocument4 paginiRequest Banks To Follow UCC PROOF OF CLAIMZIONCREDITGROUP100% (19)

- PRIVATE CHECK v1 - For Discharge and PurchaseDocument10 paginiPRIVATE CHECK v1 - For Discharge and PurchaseAlberto98% (65)

- Living in The PrivateDocument31 paginiLiving in The Privatepanamahunt2292% (26)

- Accessing Your Postal Treasury AccountsDocument1 paginăAccessing Your Postal Treasury AccountsTiffany Whyask96% (57)

- BondedPromissoryNoteExample PackageToPayOffPublicDebtDocument7 paginiBondedPromissoryNoteExample PackageToPayOffPublicDebtLucy Maysonet94% (35)

- UCC IRS Private BankingDocument52 paginiUCC IRS Private BankingKonan Snowden98% (208)

- Accepted For Value Part 2. Does It WorkDocument5 paginiAccepted For Value Part 2. Does It WorkLews Matin79% (19)

- Promissory Note NotesDocument14 paginiPromissory Note NotesFreeman Lawyer89% (28)

- Acceptance&discharge-State Home Mortgage, Atlanta, GaDocument13 paginiAcceptance&discharge-State Home Mortgage, Atlanta, GaTiyemerenaset Ma'at El82% (17)

- 7 - Wording For Accepting Future Offers of ContractDocument1 pagină7 - Wording For Accepting Future Offers of Contractapi-3744408100% (42)

- The Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationDe la EverandThe Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationEvaluare: 5 din 5 stele5/5 (1)

- Debt Cleanse: How To Settle Your Unaffordable Debts for Pennies on the Dollar (And Not Pay Some At All)De la EverandDebt Cleanse: How To Settle Your Unaffordable Debts for Pennies on the Dollar (And Not Pay Some At All)Evaluare: 3 din 5 stele3/5 (1)

- The Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeDe la EverandThe Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeEvaluare: 4.5 din 5 stele4.5/5 (9)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills, and MoreDe la EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills, and MoreÎncă nu există evaluări

- How to Make Your Credit Card Rights Work for You: Save MoneyDe la EverandHow to Make Your Credit Card Rights Work for You: Save MoneyÎncă nu există evaluări

- Get Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionDe la EverandGet Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionEvaluare: 5 din 5 stele5/5 (1)

- Department of Agrarian Reform Adjudication Board (Darab) : PetitionDocument3 paginiDepartment of Agrarian Reform Adjudication Board (Darab) : PetitionDe Dios JVÎncă nu există evaluări

- SI 2023-005 Base Minerals Export Control (Unbeneficiated Base Mineral Ores) Order, 2023Document2 paginiSI 2023-005 Base Minerals Export Control (Unbeneficiated Base Mineral Ores) Order, 2023tapiwaÎncă nu există evaluări

- Agriculture Water Usage Poster ProjectDocument1 paginăAgriculture Water Usage Poster Projectapi-339004071Încă nu există evaluări

- Property DigestDocument9 paginiProperty DigestJoy OrenaÎncă nu există evaluări

- Introduction To MAX InternationalDocument48 paginiIntroduction To MAX InternationalDanieldoeÎncă nu există evaluări

- Soal PAS-UAS Bahasa Inggris Kelas 11 SMADocument10 paginiSoal PAS-UAS Bahasa Inggris Kelas 11 SMAAlexander TristanÎncă nu există evaluări

- Bbit/Bptm: Busbar Insulating Tubing (5-35 KV)Document1 paginăBbit/Bptm: Busbar Insulating Tubing (5-35 KV)Stephen BridgesÎncă nu există evaluări

- Workflows in RUP PDFDocument9 paginiWorkflows in RUP PDFDurval NetoÎncă nu există evaluări

- Boat, Time Speed and DistanceDocument5 paginiBoat, Time Speed and DistanceAnmol AswalÎncă nu există evaluări

- MyFlixer - Watch Movies and Series Online Free in Full HD On MyFlixerDocument1 paginăMyFlixer - Watch Movies and Series Online Free in Full HD On MyFlixerGeanina OlteanuÎncă nu există evaluări

- BEVERAGE SERVICE INDUSTRY Lesson 1Document18 paginiBEVERAGE SERVICE INDUSTRY Lesson 1milyn maramagÎncă nu există evaluări

- Euroleague Basketball: Change Pays Off ForDocument36 paginiEuroleague Basketball: Change Pays Off ForNikos TagalnikÎncă nu există evaluări

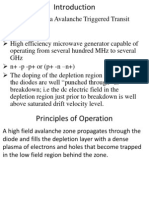

- Trapatt ModeDocument30 paginiTrapatt Modebchaitanya_555100% (1)

- Cbi LNG Storage US Rev8 LoresDocument4 paginiCbi LNG Storage US Rev8 LoresVilas AndhaleÎncă nu există evaluări

- JD Data Analyst CapgeminiDocument2 paginiJD Data Analyst CapgeminiShivansh KansalÎncă nu există evaluări

- Activity 2.1 Test Your Food Safety IQDocument3 paginiActivity 2.1 Test Your Food Safety IQAustin PriceÎncă nu există evaluări

- Rubric AutocadDocument2 paginiRubric Autocadros maria100% (6)

- JSSG-2010-7 - Crash Systems Handbook PDFDocument155 paginiJSSG-2010-7 - Crash Systems Handbook PDFdaymonÎncă nu există evaluări

- FEW Tapping Drill Sizes PDFDocument1 paginăFEW Tapping Drill Sizes PDFrefaeÎncă nu există evaluări

- UTAR Convocation Checklist For Graduands Attending Convocation (March 2019) - 1Document5 paginiUTAR Convocation Checklist For Graduands Attending Convocation (March 2019) - 1JoyleeeeeÎncă nu există evaluări

- Thesun 2009-07-09 Page05 Ex-Pka Director Sues Nine For rm11mDocument1 paginăThesun 2009-07-09 Page05 Ex-Pka Director Sues Nine For rm11mImpulsive collectorÎncă nu există evaluări

- F110 Payment Run - CheckDocument29 paginiF110 Payment Run - Checktawfikmohamed213Încă nu există evaluări

- 4-Sided Planer & Moulder Operation Manual: For Spares and Service ContactDocument48 pagini4-Sided Planer & Moulder Operation Manual: For Spares and Service ContactAlfred TsuiÎncă nu există evaluări

- Prime Time FeaturesDocument15 paginiPrime Time FeaturesPruthwish PatelÎncă nu există evaluări

- Community Support For IYCF As of 22 SeptDocument57 paginiCommunity Support For IYCF As of 22 SeptMJ ArcillaÎncă nu există evaluări

- RBA Catalog Maltby GBR Aug 16 2023 NL NLDocument131 paginiRBA Catalog Maltby GBR Aug 16 2023 NL NLKelvin FaneyteÎncă nu există evaluări

- COURT CLERK NoticeDocument10 paginiCOURT CLERK NoticeED Curtis100% (3)

- Cbjessco 13Document3 paginiCbjessco 13Fawaz ZaheerÎncă nu există evaluări

- Krishna Yadav Cell#+91-9540308010: BjectiveDocument6 paginiKrishna Yadav Cell#+91-9540308010: BjectiveIssac JohnÎncă nu există evaluări

- GT Reading Test 5, 2Document2 paginiGT Reading Test 5, 2Muzammel Hossian MatinÎncă nu există evaluări