Documente Academic

Documente Profesional

Documente Cultură

History of Insurance in India

Încărcat de

Sharath HegdeDescriere originală:

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

History of Insurance in India

Încărcat de

Sharath HegdeDrepturi de autor:

Formate disponibile

History of insurance in India

Ref: IRDA/GEN/06/2007 Date: 12-07-2007

In India, insurance has a deep-rooted history. It finds mention in the writings of Manu ( Manusmrithi ), Yagnavalkya ( Dharmasastra ) and Kautilya ( Arthasastra ). The writings talk in terms of pooling of resources that could be re-distributed in times of calamities such as fire, floods, epidemics and famine. This was probably a pre-cursor to modern day insurance. Ancient Indian history has preserved the earliest traces of insurance in the form of marine trade loans and carriers contracts. Insurance in India has evolved over time heavily drawing from other countries, England in particular. 1818 saw the advent of life insurance business in India with the establishment of the Oriental Life Insurance Company in Calcutta. This Company however failed in 1834. In 1829, the Madras Equitable had begun transacting life insurance business in the Madras Presidency. 1870 saw the enactment of the British Insurance Act and in the last three decades of the nineteenth century, the Bombay Mutual (1871), Oriental (1874) and Empire of India (1897) were started in the Bombay Residency. This era, however, was dominated by foreign insurance offices which did good business in India, namely Albert Life Assurance, Royal Insurance, Liverpool and London Globe Insurance and the Indian offices were up for hard competition from the foreign companies. In 1914, the Government of India started publishing returns of Insurance Companies in India. The Indian Life Assurance Companies Act, 1912 was the first statutory measure to regulate life business. In 1928, the Indian Insurance Companies Act was enacted to enable the Government to collect statistical information about both life and non-life business transacted in India by Indian and foreign insurers including provident insurance societies. In 1938, with a view to protecting the interest of the Insurance public, the earlier legislation was consolidated and amended by the Insurance Act, 1938 with comprehensive provisions for effective control over the activities of insurers. The Insurance Amendment Act of 1950 abolished Principal Agencies. However, there were a large number of insurance companies and the level of competition was high. There were also allegations of unfair trade practices. The Government of India, therefore, decided to nationalize insurance business. An Ordinance was issued on 19 January, 1956 nationalising the Life Insurance sector and Life Insurance Corporation came into existence in the same year. The LIC absorbed 154 Indian, 16 non-Indian insurers as also 75 provident societies245 Indian and foreign insurers in all. The LIC had monopoly till the late 90s when the Insurance sector was reopened to the private sector. The history of general insurance dates back to the Industrial Revolution in the west and the consequent growth of sea-faring th trade and commerce in the 17 century. It came to India as a legacy of British occupation. General Insurance in India has its roots in the establishment of Triton Insurance Company Ltd., in the year 1850 in Calcutta by the British. In 1907, the Indian Mercantile Insurance Ltd, was set up. This was the first company to transact all classes of general insurance business. 1957 saw the formation of the General Insurance Council, a wing of the Insurance Associaton of India. The General Insurance Council framed a code of conduct for ensuring fair conduct and sound business practices. In 1968, the Insurance Act was amended to regulate investments and set minimum solvency margins. The Tariff Advisory Committee was also set up then. In 1972 with the passing of the General Insurance Business (Nationalisation) Act, general insurance business was nationalized st with effect from 1 January, 1973. 107 insurers were amalgamated and grouped into four companies, namely National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd and the United India Insurance Company Ltd. The General Insurance Corporation of India was incorporated as a company in 1971 and it commence business on January 1sst 1973. This millennium has seen insurance come a full circle in a journey extending to nearly 200 years. The process of re-opening of the sector had begun in the early 1990s and the last decade and more has seen it been opened up substantially. In 1993, the Government set up a committee under the chairmanship of RN Malhotra, former Governor of RBI, to propose recommendations for reforms in the insurance sector.The objective was to complement the reforms initiated in the financial sector. The committee submitted its report in 1994 wherein , among other things, it recommended that the private sector be permitted to enter the insurance industry. They stated that foreign companies be allowed to enter by floating Indian companies, preferably a joint venture with Indian partners. Following the recommendations of the Malhotra Committee report, in 1999, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry. The IRDA was incorporated as a statutory body in April, 2000. The key objectives of the IRDA include promotion of competition so as to enhance customer satisfaction through increased consumer choice and lower premiums, while ensuring the financial security of the insurance market. The IRDA opened up the market in August 2000 with the invitation for application for registrations. Foreign companies were allowed ownership of up to 26%. The Authority has the power to frame regulations under Section 114A of the Insurance Act, 1938 and has from 2000 onwards framed various regulations ranging from registration of companies for carrying on insurance business to protection of policyholders interests.

th

In December, 2000, the subsidiaries of the General Insurance Corporation of India were restructured as independent companies and at the same time GIC was converted into a national re-insurer. Parliament passed a bill de-linking the four subsidiaries from GIC in July, 2002. Today there are 24 general insurance companies including the ECGC and Agriculture Insurance Corporation of India and 23 life insurance companies operating in the country. The insurance sector is a colossal one and is growing at a speedy rate of 15-20%. Together with banking services, insurance services add about 7% to the countrys GDP. A well-developed and evolved insurance sector is a boon for economic development as it provides long- term funds for infrastructure development at the same time strengthening the risk taking ability of the country.

list of insurance co in india

Apart from Life Insurance Corporation, the public sector life insurer, there are 22 other private sector life insurers, most of them joint ventures between Indian groups and global insurance giants. Life Insurer in Public Sector 1. Life Insurance Corporation of India Life Insurers in Private Sector 1. SBI Life Insurance 2. Metlife India Life Insurance 3. ICICI Prudential Life Insurance 4. Bajaj Allianz Life 5. Max New York Life Insurance 6. Sahara Life Insurance 7. Tata AIG Life 8. HDFC Standard Life 9. Birla Sunlife 10. Kotak Life Insurance 11. Aviva Life Insurance 12. Reliance Life Insurance Company Limited - Formerly known as AMP Sanmar LIC 13. ING Vysya Life Insurance 14. Shriram Life Insurance 15. Bharti AXA Life Insurance Co Ltd 16. Future Generali Life Insurance Co Ltd 17. IDBI Fortis Life Insurance 18. AEGON Religare Life Insurance 19. DLF Pramerica Life Insurance 20. CANARA HSBC Oriental Bank of Commerce LIFE INSURANCE 21. India First Life insurance company limited 22. Star Union Dia-ichi Life Insurance Co. Ltd

The Life Insurance Corporation (LIC) of India founded in 1956 is the largest life insurance company in India owned solely by the Government of India. Headquartered in Mumbai, which is considered the financial capital of India, LIC presently has 7 Zonal Offices and 100 Divisional Offices situated all around the country. In addition to an even distribution of 2048 branches located in different towns and cities of India, LIC also has a network of around one million agents who solicit life insurance policies to the public. History of LIC of India The first 150 years of the British Rule in India were characterized by turbulent economic conditions. The first war of independence in 1857, the World Wars 1 and 2 (1914-1918 and 1939-45) and India's national struggle for freedom in between had adverse effect on the economy. In addition to this the period of world wide economic crisis in between the two World Wars termed as the period of Great Depression led to the high rate of bankruptcies and liquidation of most Life Insurance Companies in India that existed during that time. These occurrences led to loss of faith in insurance of the people of India. The Life Insurance Companies Act and Provident Fund Act both passed in 1912 provided regulatory mechanisms to the Life Insurance Industry in India for the first time. After undergoing several other such reforms in the following decades and nearly a decade after India achieved independence, the Parliament of India passed the Life Insurance of India Act on 19 th June, 1956 following which the Life Insurance Corporation (LIC) of India on 1 st September of the same year. The Company began its operations with 5 Zonal Offices , 33 Divisional Offices and 212 Branch Offices . Present Status of LIC of India Existing as a towering insurance company for over 50 years, LIC has acquired almost monopoly power in the solicitation and sale of life insurance policies in India. In addition to the summary regarding the present stature provided at the beginning, LIC has extended its activities in 12 countries other than India with the objective of catering to the insurance needs of Non Resident Indians. The enforcement of New Economic Reforms in 1991 coupled with the formation of Insurance Regulatory and Development Authority Act (IRDA) of 2000 (which started issuing licenses to private life insurers ) has diluted the monopolistic attitude commanded by LIC. The only insurance company belonging to the public sector now has to compete with several other corporate entities of its kind which often are heavyweight Indian as well as Multinational Life Insurance Brands in themselves. The other subsidiary companies under LIC are:

Life Insurance Corporation (LIC) of India International - A joint venture offshore company promoted by LIC which commenced its operations in July, 1989 with the objective of offering policies denominated in US $ to NRIs residing in the Gulf. LIC Nepal - Formed in 2001 in joint venture with Vishal Group of Industries, Nepal. LIC Lanka - Formed in 2003 in joint venture with Bartleet Group of Companies, Sri Lanka LIC Housing Finance - Established in 19 th June,1989 in Dubai with the objective of providing long term finance for construction of houses or apartments. LIC Housing Finance Limited Care Homes - A wholly owned subsidiary of LIC Housing Finance which builds "Assisted Community Living Centers" for senior citizens.

With its ever-expanding operations, LIC has set an example for other Public Sector Undertakings of India to follow.

S-ar putea să vă placă și

- Shale Gas in India: Look Before You Leap: Policy BriefDocument8 paginiShale Gas in India: Look Before You Leap: Policy BriefSharath HegdeÎncă nu există evaluări

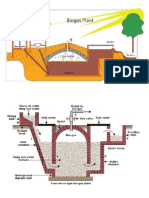

- Gobar GasDocument2 paginiGobar GasSharath HegdeÎncă nu există evaluări

- Hero Honda Motorcycle ProjectDocument93 paginiHero Honda Motorcycle ProjectSharath HegdeÎncă nu există evaluări

- Renewable and Nonrenewable Resources NotesDocument34 paginiRenewable and Nonrenewable Resources NotesSharath HegdeÎncă nu există evaluări

- Forestry PathologyDocument67 paginiForestry PathologySharath HegdeÎncă nu există evaluări

- Thisis of Forestry Part1Document1 paginăThisis of Forestry Part1Sharath HegdeÎncă nu există evaluări

- Ecological Consideration For Choice of SpeciesDocument3 paginiEcological Consideration For Choice of SpeciesSharath HegdeÎncă nu există evaluări

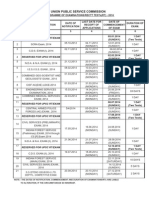

- In Person: Postal Address For Communication (In Block Letters)Document5 paginiIn Person: Postal Address For Communication (In Block Letters)Sharath HegdeÎncă nu există evaluări

- Ecological Consideration For Choice of SpeciesDocument10 paginiEcological Consideration For Choice of SpeciesSharath HegdeÎncă nu există evaluări

- Forestry PathologyDocument67 paginiForestry PathologySharath HegdeÎncă nu există evaluări

- Approved Annual Programme 2015Document1 paginăApproved Annual Programme 2015Sharath HegdeÎncă nu există evaluări

- Problems of PerceptionDocument3 paginiProblems of PerceptionSharath HegdeÎncă nu există evaluări

- GHJKDocument6 paginiGHJKSharath HegdeÎncă nu există evaluări

- Forest Types of IndiaDocument3 paginiForest Types of IndiaSharath HegdeÎncă nu există evaluări

- Dyan Chand Hocky PlayerDocument1 paginăDyan Chand Hocky PlayerSharath HegdeÎncă nu există evaluări

- Kannada Prabaha Kushi ReviewDocument1 paginăKannada Prabaha Kushi ReviewSharath HegdeÎncă nu există evaluări

- IFS GK ForestryDocument4 paginiIFS GK ForestrySharath HegdeÎncă nu există evaluări

- Forest Types of IndiaDocument3 paginiForest Types of IndiaSharath HegdeÎncă nu există evaluări

- Administrative Reforms CommissionDocument102 paginiAdministrative Reforms CommissionRahulRajRanaÎncă nu există evaluări

- Shale Gas in India: Look Before You Leap: Policy BriefDocument8 paginiShale Gas in India: Look Before You Leap: Policy BriefSharath HegdeÎncă nu există evaluări

- Story Writing SkillDocument7 paginiStory Writing SkillSharath HegdeÎncă nu există evaluări

- History of Insurance in IndiaDocument3 paginiHistory of Insurance in IndiaSharath HegdeÎncă nu există evaluări

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe la EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeEvaluare: 4 din 5 stele4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDe la EverandShoe Dog: A Memoir by the Creator of NikeEvaluare: 4.5 din 5 stele4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)De la EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Evaluare: 4 din 5 stele4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe la EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceEvaluare: 4 din 5 stele4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe la EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersEvaluare: 4.5 din 5 stele4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe la EverandThe Little Book of Hygge: Danish Secrets to Happy LivingEvaluare: 3.5 din 5 stele3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDe la EverandGrit: The Power of Passion and PerseveranceEvaluare: 4 din 5 stele4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDe la EverandThe Emperor of All Maladies: A Biography of CancerEvaluare: 4.5 din 5 stele4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe la EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaEvaluare: 4.5 din 5 stele4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe la EverandNever Split the Difference: Negotiating As If Your Life Depended On ItEvaluare: 4.5 din 5 stele4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe la EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryEvaluare: 3.5 din 5 stele3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDe la EverandOn Fire: The (Burning) Case for a Green New DealEvaluare: 4 din 5 stele4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe la EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureEvaluare: 4.5 din 5 stele4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDe la EverandTeam of Rivals: The Political Genius of Abraham LincolnEvaluare: 4.5 din 5 stele4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe la EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyEvaluare: 3.5 din 5 stele3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDe la EverandThe Unwinding: An Inner History of the New AmericaEvaluare: 4 din 5 stele4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe la EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreEvaluare: 4 din 5 stele4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De la EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Evaluare: 4.5 din 5 stele4.5/5 (120)

- Her Body and Other Parties: StoriesDe la EverandHer Body and Other Parties: StoriesEvaluare: 4 din 5 stele4/5 (821)