Documente Academic

Documente Profesional

Documente Cultură

Fama&MacBeth Presentation

Încărcat de

Antonio J FernósDescriere originală:

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

Fama&MacBeth Presentation

Încărcat de

Antonio J FernósDrepturi de autor:

Formate disponibile

Risk, Return, and Equilibrium: Empirical Test by Eugene Fama

and James MacBeth

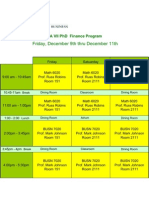

Antonio Ferns and Miguel Ruiz LA VII PhD Finance Program February 24, 2012 BUSN 8510 Prof. Yufeng Han

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Methodology

Test relationship between average return and risk

Testing for two parameter model

Cannot reject H0 : pricing of common stocks reflects the attempts of riskaverse investors to hold portfolios that are efficient in terms of expected value and dispersion returns Fair game properties of the coefficients Residuals of the risk-return regressions are consistent with an efficient capital market (i.e.: market where prices of securities fully reflect available information)

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Literature Review:

Tobin (1958): Liquidity Preference as Behavior toward Risk

Markowitz (1959): Portfolio Selection: Efficient Diversification of Investments

Fama (1965): Portfolio Analysis in a Stable Pareto State Cass and Stiglitz (1970): The Structure of Investor Preferences and Asset Returns, and Separability in Portfolio Allocation: A Contribution to the Pure Theory of Mutual Funds

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Literature Review

Tobin (1958)

Believed the theory of liquidity preference was essentially a Keynesian explanation. Under certain conditions the investors portfolio allocation decision could be considered as a 2-stage process: - Investor first decides in what proportions to purchase the available risky assets - Then decides how to divide his total investment between risky and safe assets This 2-stage process is called separation and is a special case of a more general property of the investors portfolio allocation A set of m linear combinations with weights adding to one (1) of the available assets

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Literature Review

Markowitz (1959)

Separation An investor selects a portfolio at time t -1 that produces a stochastic return at t. The model assumes investors are risk averse and, when choosing among portfolios, they care only about the mean and variance of their one-period investment return. As a result, investors choose mean variance-efficient portfolios, in the sense that the portfolios: - minimize the variance of portfolio return, given expected return, and - maximize expected return, given variance. Thus, the Markowitz approach is often called a mean-variance model.

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Literature Review

Fama (1965)

Using earlier work from Sharpe developed portfolio analysis model for a stable Paretian market Empirical probability distributions of returns of securities conform better to Paretian distributions with infinite variances than the normal distribution Established the conditions under which diversification is a meaningful economic activity, even though probability distributions of returns on individual securities have finite variances

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Literature Review

Cass & Stiglitz (1970)

Separation process properties derives four (4) sources: 1. Keynesian macro-economic models conventionally assume that such a separation property obtains 2. When such a separation property does obtain, achieving a pure exchange Pareto optimum may not require a full complement of Arrow-Debreu securities. And, of course, there are good reasons (i.e.: transaction costs) for believing Arrow-Debreu markets will not exist 3. Many of the results in modern portfolio theory depend crucially on the existence of a safe and just one risky asset or, equivalently, a single mutual fund composed of risky assets 4. The separation property represents a particular extension of an aggregation property which has long interested economists

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Theoretical Background/Assumptions

Capital markets are perfect in the sense that investors are prices takers and there are neither transaction sense or transaction costs Distributions of percentage returns are assumed normal Investors are risk averse Optimal portfolio for any investor must be efficient in the sense that no other portfolio with the same or higher expected return has lower dispersion on returns The difference between the expected return on the asset and the expected return on the portfolio is proportional to the difference between the risk of the asset and the risk of the portfolio

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Hypothesis

A stochastic two-parameter model for expected returns

With testable implications:

C1: Linearity C2: No systemic effects on non beta risk. C3: Positive expected return-risk tradeoff/Capital market efficiency - Sharpe Lintner Hypothesis

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Conclusion

Results support the important testable implications of the two-parameter model

Market portfolio efficiency hypothesis at least cannot be rejected: NYSE common stocks reflect the attempts of risk averse investor to hold efficient portfolios On average, there seems to be a positive tradeoff between return and risk, with risk measured from the portfolio viewpoint There are stochastic non-linearities form period to periods, nonlinearity (C1) cannot be rejected Hypothesis on two-parameter model being no measure of risk, in addition to portfolio risk, systematically affects average returns, cannot be rejected fair game properties of the coefficients and residual of the risk-return regressions are consistent with an efficient capital market

10

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

Appendix

11

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

12

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

13

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

14

Risk, Return, and Equilibrium: Empirical Test The Journal of Political Economy, Vol. 81, No. 3. (May - Jun., 1973) by Eugene Fama and James MacBeth

15

S-ar putea să vă placă și

- Financial Risk Management Formula SheetDocument46 paginiFinancial Risk Management Formula SheetSaptarshi Bhose100% (1)

- CAPM Is CRAP, Or, The Dead Parrot Lives!Document10 paginiCAPM Is CRAP, Or, The Dead Parrot Lives!Andres GoldbaumÎncă nu există evaluări

- Statistical Inference in Financial and Insurance Mathematics with RDe la EverandStatistical Inference in Financial and Insurance Mathematics with RÎncă nu există evaluări

- Financial TheoriesDocument6 paginiFinancial TheoriesalishbakhalidÎncă nu există evaluări

- Literature ReviewDocument7 paginiLiterature ReviewadjoeadÎncă nu există evaluări

- Capital Asset Pricing ModelDocument25 paginiCapital Asset Pricing ModelCesar Monterroso100% (1)

- Review of LiteratureDocument8 paginiReview of LiteratureChandruÎncă nu există evaluări

- Ec371 Topic 3Document13 paginiEc371 Topic 3Mohamed HussienÎncă nu există evaluări

- AJMSE Vol23 No7 Dec2021-23Document8 paginiAJMSE Vol23 No7 Dec2021-23lkwintelÎncă nu există evaluări

- 17-Revisiting Market Efficiency - The Stock Market As A Complex Adaptive SystemDocument9 pagini17-Revisiting Market Efficiency - The Stock Market As A Complex Adaptive SystemSjasmnÎncă nu există evaluări

- Market Microstructure Term PaperDocument20 paginiMarket Microstructure Term PaperMburu SÎncă nu există evaluări

- Testing The Performance of Asset Pricing Models During The Covid-19 Crisis Evidence From European Stock MarketsDocument40 paginiTesting The Performance of Asset Pricing Models During The Covid-19 Crisis Evidence From European Stock MarketsZurab OshkhneliÎncă nu există evaluări

- Presentation PPT (Finance)Document21 paginiPresentation PPT (Finance)Muhammad Ahmed HaroonÎncă nu există evaluări

- Lukas Mazal ThesisDocument33 paginiLukas Mazal ThesisAkshay RawatÎncă nu există evaluări

- Banz On Small Firm Effect 1981 JFEDocument16 paginiBanz On Small Firm Effect 1981 JFEGelu AgutaÎncă nu există evaluări

- 345 DanielDocument39 pagini345 Danielsajidobry_847601844Încă nu există evaluări

- Sharpe1964 (Editable Acrobat)Document19 paginiSharpe1964 (Editable Acrobat)julioacev0781Încă nu există evaluări

- Technical Analysis-: Dow TheoryDocument8 paginiTechnical Analysis-: Dow TheoryVaibhav DubeyÎncă nu există evaluări

- Efficient Market HypothesisDocument10 paginiEfficient Market HypothesisafjkjchhghgfbfÎncă nu există evaluări

- Neer 291 BDocument24 paginiNeer 291 BmerryÎncă nu există evaluări

- (Smith Suchanek Williams, Econometrica 1988) Bubbles, Crashes and Endogenous Expectations in Experimental Asset MarketsDocument34 pagini(Smith Suchanek Williams, Econometrica 1988) Bubbles, Crashes and Endogenous Expectations in Experimental Asset MarketsSaad TateÎncă nu există evaluări

- Econ 138: Financial and Behavioral Economics: The Efficient Markets Hypothesis February 1, 2017Document28 paginiEcon 138: Financial and Behavioral Economics: The Efficient Markets Hypothesis February 1, 2017econdocsÎncă nu există evaluări

- Capm - Theory of Market Equilibrium Under Conditions of Risk - Sharpe WDocument19 paginiCapm - Theory of Market Equilibrium Under Conditions of Risk - Sharpe WWilliam Santiago Núñez LópezÎncă nu există evaluări

- Behavioral Finance: Learning From Market Anomalies and Psychological FactorsDocument58 paginiBehavioral Finance: Learning From Market Anomalies and Psychological FactorsAlejandra SalinasÎncă nu există evaluări

- Game Theory To Optimize Stock PortfolioDocument7 paginiGame Theory To Optimize Stock Portfolioashuking2020Încă nu există evaluări

- MANDIMIKA Et Al-2012-South African Journal of EconomicsDocument22 paginiMANDIMIKA Et Al-2012-South African Journal of EconomicsRym CharefÎncă nu există evaluări

- Foundations of Portfolio Theory: Harrym - MarkowitzDocument9 paginiFoundations of Portfolio Theory: Harrym - Markowitzsachinsaxena1986Încă nu există evaluări

- 2008 Financial Market Anomalies - New Palgrave Dictionary of Economics (Keim)Document14 pagini2008 Financial Market Anomalies - New Palgrave Dictionary of Economics (Keim)jude55Încă nu există evaluări

- Asset Allocation Models Using The Markowitz Approach: Revised January 1998Document13 paginiAsset Allocation Models Using The Markowitz Approach: Revised January 1998Yogendra SinghÎncă nu există evaluări

- Explaining Stock ReturnsDocument14 paginiExplaining Stock ReturnsGhazzzzanfarÎncă nu există evaluări

- American Eco R2014-104-6p1467 - Asset - Pricing - Nobel - Lecture - FamaDocument19 paginiAmerican Eco R2014-104-6p1467 - Asset - Pricing - Nobel - Lecture - Famafarida styaningrumÎncă nu există evaluări

- Equity Premium-Its Still A Puzzle-KocherlakotaDocument30 paginiEquity Premium-Its Still A Puzzle-KocherlakotaNigelT.LeeÎncă nu există evaluări

- Asset Pricing FullDocument26 paginiAsset Pricing FullBhupendra RaiÎncă nu există evaluări

- The Capital Asset Pricing Model (CAPM)Document17 paginiThe Capital Asset Pricing Model (CAPM)RezvanmoghisehÎncă nu există evaluări

- CC CC: CCCC CDocument1 paginăCC CC: CCCC CCristopher Andres AgustinÎncă nu există evaluări

- Asian Economic Journal7Document26 paginiAsian Economic Journal7sekar_smrÎncă nu există evaluări

- YarosDocument3 paginiYarossfsdhg,kÎncă nu există evaluări

- Lit ReveiwDocument29 paginiLit ReveiwSarikaÎncă nu există evaluări

- JEL Classification Keywords: BstractDocument35 paginiJEL Classification Keywords: BstractsexscansexÎncă nu există evaluări

- Efficient Market HypothesisDocument8 paginiEfficient Market HypothesisGaara165100% (1)

- Theory of Portfolio Investment: A Review of Literature: Worapot Ongkrutaraksa, PH.DDocument8 paginiTheory of Portfolio Investment: A Review of Literature: Worapot Ongkrutaraksa, PH.Dvouzvouz7127Încă nu există evaluări

- CapmDocument3 paginiCapmTalha SiddiquiÎncă nu există evaluări

- Hot Hands in Mutual FundsDocument11 paginiHot Hands in Mutual FundsLuis Jara CidÎncă nu există evaluări

- Chapter 5: Efficient Markets: Theory and Empirical Evidence: Aim of The ChapterDocument12 paginiChapter 5: Efficient Markets: Theory and Empirical Evidence: Aim of The ChapterAshikÎncă nu există evaluări

- Net Net USDocument70 paginiNet Net USFloris OliemansÎncă nu există evaluări

- Banz Small Firm EffectsDocument16 paginiBanz Small Firm EffectsRdpthÎncă nu există evaluări

- Presentation CAPMDocument31 paginiPresentation CAPMSaami AwanÎncă nu există evaluări

- Portfolio & Investment Analysis Efficient-Market HypothesisDocument137 paginiPortfolio & Investment Analysis Efficient-Market HypothesisVicky GoweÎncă nu există evaluări

- Tseng - Behavioral Finance, Bounded Rationality, Traditional FinanceDocument12 paginiTseng - Behavioral Finance, Bounded Rationality, Traditional FinanceMohsin YounisÎncă nu există evaluări

- 463-Article Text-463-1-10-20160308Document10 pagini463-Article Text-463-1-10-20160308Luciene MariaÎncă nu există evaluări

- A Capital Asset Pricing Model WithDocument17 paginiA Capital Asset Pricing Model Withgutoinfo2009Încă nu există evaluări

- Boucher NiceDocument27 paginiBoucher Niceelielo0604Încă nu există evaluări

- Reading 1 - Burghardt2011 - Chapter - RelatedTheoreticalAndEmpiricalDocument25 paginiReading 1 - Burghardt2011 - Chapter - RelatedTheoreticalAndEmpiricalMeiliaÎncă nu există evaluări

- Capital Ideas Revisited - Part 2 - Thoughts On Beating A Mostly-Efficient Stock MarketDocument11 paginiCapital Ideas Revisited - Part 2 - Thoughts On Beating A Mostly-Efficient Stock Marketpjs15Încă nu există evaluări

- 4 Equilbrium in Capital MarketsDocument18 pagini4 Equilbrium in Capital MarketsESTHERÎncă nu există evaluări

- Downes 1973Document19 paginiDownes 1973Ranho JaelaniÎncă nu există evaluări

- Dissertation ProposalDocument7 paginiDissertation ProposalAnshul RathiÎncă nu există evaluări

- Capital Asset Pricing Model: Make smart investment decisions to build a strong portfolioDe la EverandCapital Asset Pricing Model: Make smart investment decisions to build a strong portfolioEvaluare: 4.5 din 5 stele4.5/5 (3)

- Microeconomic Theory Old and New: A Student's GuideDe la EverandMicroeconomic Theory Old and New: A Student's GuideEvaluare: 4 din 5 stele4/5 (1)

- Portfolio Mastery: Navigating the Financial Art and ScienceDe la EverandPortfolio Mastery: Navigating the Financial Art and ScienceÎncă nu există evaluări

- Portfolio Optimization with Different Information FlowDe la EverandPortfolio Optimization with Different Information FlowÎncă nu există evaluări

- Roles and Responsibilities: The Financing Team in An Initial Municipal Bond OfferingDocument4 paginiRoles and Responsibilities: The Financing Team in An Initial Municipal Bond OfferingAntonio J FernósÎncă nu există evaluări

- Dealing With The Tax Issues: Discount and Premium BondsDocument4 paginiDealing With The Tax Issues: Discount and Premium BondsAntonio J FernósÎncă nu există evaluări

- S&P Perspectives On The State of The Municipal Market: Where We Have Been and Where We Are HeadingDocument52 paginiS&P Perspectives On The State of The Municipal Market: Where We Have Been and Where We Are HeadingAntonio J FernósÎncă nu există evaluări

- BBrandeis13-22 BrownDocument29 paginiBBrandeis13-22 BrownAntonio J FernósÎncă nu există evaluări

- Fall December 9th Finance CalendarDocument1 paginăFall December 9th Finance CalendarAntonio J FernósÎncă nu există evaluări

- Mastering The MacdDocument4 paginiMastering The Macdsaran21Încă nu există evaluări

- International Finance Model Question PaperDocument2 paginiInternational Finance Model Question PaperHema LathaÎncă nu există evaluări

- CM Fact Book 2021 SifmaDocument92 paginiCM Fact Book 2021 SifmaSachin DegavekarÎncă nu există evaluări

- In Gold We Trust 2015Document140 paginiIn Gold We Trust 2015Gold Silver Worlds100% (1)

- Chapter 2 HWDocument4 paginiChapter 2 HWFarah Nader GoodaÎncă nu există evaluări

- Forex RegistrationDocument15 paginiForex RegistrationHedge Fund Lawyer100% (2)

- Fundamentals of Capital MarketDocument37 paginiFundamentals of Capital MarketBharat TailorÎncă nu există evaluări

- FIN 301 B Porter Rachna Soln.Document3 paginiFIN 301 B Porter Rachna Soln.Seema KiranÎncă nu există evaluări

- SGX SICOM RSS 3 Rubber Approved Packer ListDocument2 paginiSGX SICOM RSS 3 Rubber Approved Packer ListJulian AngÎncă nu există evaluări

- CT National Report 2Q10Document16 paginiCT National Report 2Q10amy_schenkÎncă nu există evaluări

- TreasuryDocument31 paginiTreasuryrasiga6735100% (1)

- Jakarta Market Report 2010 - ColliersDocument29 paginiJakarta Market Report 2010 - Colliersendrohierarki100% (1)

- QuestionnaireDocument4 paginiQuestionnaireZain AliÎncă nu există evaluări

- Jeevan Chhaya - Right Policy For A Person Who Wants To Provide Funds For Daughter's Marriage. This Plan Is Open Even To Bachelors.Document12 paginiJeevan Chhaya - Right Policy For A Person Who Wants To Provide Funds For Daughter's Marriage. This Plan Is Open Even To Bachelors.K.N. BabujeeÎncă nu există evaluări

- Finc3014 Major Assignment FinalDocument17 paginiFinc3014 Major Assignment FinalLliam Clayton-JohnsonÎncă nu există evaluări

- Introduction To Financial DerivativesDocument80 paginiIntroduction To Financial Derivativessnehakopade0% (1)

- Vodafone Case StudyDocument2 paginiVodafone Case Studyrdd2008Încă nu există evaluări

- Market Insight Credit Strategies End CycleDocument4 paginiMarket Insight Credit Strategies End CycledhyakshaÎncă nu există evaluări

- ProspectusDocument490 paginiProspectusAlbert AsiÎncă nu există evaluări

- Chicago SyllabusDocument10 paginiChicago SyllabusOingo BoingoÎncă nu există evaluări

- Front Office CashDocument4 paginiFront Office CashpranithÎncă nu există evaluări

- Andrew Aziz (PDFDrive)Document153 paginiAndrew Aziz (PDFDrive)arun100% (2)

- Future Generali ProjectDocument24 paginiFuture Generali ProjectSandeepa Biswas100% (4)

- SIP Report GeldwicksDocument41 paginiSIP Report GeldwicksRishibha SinglaÎncă nu există evaluări

- Proffesional Option TraderDocument15 paginiProffesional Option TraderNehang PandyaÎncă nu există evaluări

- PORTFOLIO MANAGEMENT SERVICES - AN INVESTMENT OPTION Sharekhan 2Document73 paginiPORTFOLIO MANAGEMENT SERVICES - AN INVESTMENT OPTION Sharekhan 2niceprachi0% (1)

- How To Trade Synthetic Indices. Simple Invest FXDocument14 paginiHow To Trade Synthetic Indices. Simple Invest FXuuguludavid77Încă nu există evaluări

- Benjamin Graham and The Birth of Value InvestingDocument85 paginiBenjamin Graham and The Birth of Value Investingrsepassi100% (1)

- A Mapping Study of Venture Capital Provision To SMEs in England-2005Document98 paginiA Mapping Study of Venture Capital Provision To SMEs in England-2005dmaproiectÎncă nu există evaluări