Documente Academic

Documente Profesional

Documente Cultură

Investment Decision Making

Încărcat de

Dhruv0 evaluări0% au considerat acest document util (0 voturi)

25 vizualizări16 paginiPpt on investment

Titlu original

9179027

Drepturi de autor

© © All Rights Reserved

Formate disponibile

PPT, PDF, TXT sau citiți online pe Scribd

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentPpt on investment

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca PPT, PDF, TXT sau citiți online pe Scribd

0 evaluări0% au considerat acest document util (0 voturi)

25 vizualizări16 paginiInvestment Decision Making

Încărcat de

DhruvPpt on investment

Drepturi de autor:

© All Rights Reserved

Formate disponibile

Descărcați ca PPT, PDF, TXT sau citiți online pe Scribd

Sunteți pe pagina 1din 16

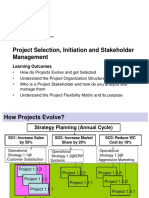

Chapter 4

Investment decision making

Learning objectives

• explain the key phases and associated information

flows in an investment management process

• explain the purpose of a feasibility study and how it

relates to a business case

• prepare and analyse a feasibility study

• prepare and analyse a business case for a proposed

project

• discuss a variety of approaches for project prioritisation

• use a range of techniques to help make investment

decisions

• A project is an investment like any other

• The main phases

• of an investment management process are:

– Selection of the portfolio

– Control of ongoing projects

– Evaluation of completed or cancelled projects

Feasibility study

• The purpose is to:

– determine if a business opportunity is possible,

practical and viable

– provide a structured method:

• to focus on problems

• identify objectives

• evaluate alternatives along with associated benefits and

costs

• aid in the selection of the best solution

– improve confidence that the recommended action

is the most viable solution to the problem

– assure the sponsor that projects requiring

significant resources can, should and will be done.

Business case development

• The purpose of a business case is to:

– obtain management commitment and

approval for investment, through a clearly

presented rationale

– provide a framework for informed decision

making in planning and managing the

project and its subsequent benefits

realisation.

Business case perspectives

There are five main perspectives of a business case to

consider in its preparation (OGC, 2003):

1. Strategic fit

2. Options appraisal

3. Achievability

4. Commercial aspects

5. Affordability

The amount of detail needed in a business case depends

to a large extent on the total cost of the project.

Progressive development of a

business case

• For large-scale investments, the business case

can be developed in progressive stages

• For example, a three-stage process might

generate the following components (OGC, 2003):

– Preliminary business case

– Outline business case

– Full business case

Capital budgeting

• A set of techniques used systematically to

evaluate, compare and select projects

• Decisions often have an impact for many

years and as such reduce an organisation’s

flexibility – an important opportunity cost

Project Appraisals

• The purpose is to assist an organisation in

deciding whether a project concept is worth

turning into reality

• The following concepts are important when

conducting a project appraisal:

– Financial vs economic appraisal

– Externalities and their valuation

– Cash flows and sunk costs

– Cash flow analysis

Cash flow analysis

• To establish the value of a project, a

financial evaluation is carried out

• Preliminary information required will

include:

– the evaluation period

– project risk

– an organisation’s cost of capital

– the cost of doing the project

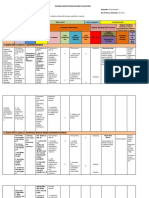

Prioritisation techniques

• Many methods are available for prioritising

projects, most of which fall into one of the

following categories (Martino, 1995):

– financial analysis

– decision tree analysis

– scoring and ranking

– portfolio optimisation

– simulation

– real options

– cognitive modelling

– cluster analysis

The prioritisation techniques used should

reflect the following considerations:

1. The degree of business risk involved.

2. The organisation’s internal and external

environment.

3. The corporate governance regime (for

example balance of shareholder versus

stakeholder focus).

4. Cost of prioritisation activities compared to

expected project returns.

S-ar putea să vă placă și

- Project Feasibility Study1Document54 paginiProject Feasibility Study1shuvo134Încă nu există evaluări

- Project Formulation: What Is Project Formulation? Stages of Project Formulation Project ReportDocument15 paginiProject Formulation: What Is Project Formulation? Stages of Project Formulation Project Reportynkamat60% (5)

- Project ManagementDocument98 paginiProject Managementmelkamu endaleÎncă nu există evaluări

- Project PlanningDocument13 paginiProject PlanningMirara SimonÎncă nu există evaluări

- Chapter 2Document43 paginiChapter 2S Varun SubramanyamÎncă nu există evaluări

- Project Appraisal-1: Overview: Chapter 1Document35 paginiProject Appraisal-1: Overview: Chapter 1a11235Încă nu există evaluări

- Chap 7 Feasibility StudyDocument25 paginiChap 7 Feasibility Studymeenac_4100% (1)

- Chapter Two: The Project CycleDocument24 paginiChapter Two: The Project CycleTemesgenÎncă nu există evaluări

- EDIMDocument10 paginiEDIMSanskruti PathakÎncă nu există evaluări

- Lesson 2.2 Business PlanningDocument10 paginiLesson 2.2 Business PlanningBÎncă nu există evaluări

- Analysis and Design: of E-Commerce SystemsDocument31 paginiAnalysis and Design: of E-Commerce SystemshamedskyÎncă nu există evaluări

- Edp Module 3Document55 paginiEdp Module 3Seena AnishÎncă nu există evaluări

- SKBBBDocument42 paginiSKBBBKazuyano DoniÎncă nu există evaluări

- Module - 1: Planning & Analysis Overview: PhasesDocument43 paginiModule - 1: Planning & Analysis Overview: Phaseslakshmipriya_mcÎncă nu există evaluări

- Tefr & DPR - PM - Module - IIIDocument21 paginiTefr & DPR - PM - Module - IIIAtish NairÎncă nu există evaluări

- Chapter 2 - Project Life Cycle-2Document37 paginiChapter 2 - Project Life Cycle-2Yabe Mohammed100% (1)

- Project Integration ManagementDocument54 paginiProject Integration ManagementSabahat KhanÎncă nu există evaluări

- Module-6:: Project Preparation & Appraisal Definition:-Project Is The Whole Complex ofDocument17 paginiModule-6:: Project Preparation & Appraisal Definition:-Project Is The Whole Complex ofMehul_Singh_7900Încă nu există evaluări

- Systems Analysis and Design: Chapter Two: Identification, Selection, and Planning PhaseDocument13 paginiSystems Analysis and Design: Chapter Two: Identification, Selection, and Planning PhaseSuraphel BirhaneÎncă nu există evaluări

- Chapter ThreeDocument17 paginiChapter ThreeKumera Dinkisa ToleraÎncă nu există evaluări

- PPT3-IT Project Integration Management-R0Document51 paginiPPT3-IT Project Integration Management-R0Eris RisoÎncă nu există evaluări

- Chapter-2 - PROJECT DESIGN AND DEVELOPMENTDocument32 paginiChapter-2 - PROJECT DESIGN AND DEVELOPMENTnuhaminÎncă nu există evaluări

- Project MGMTDocument102 paginiProject MGMTNikhil KhobragadeÎncă nu există evaluări

- Week 5 - Feasibility StudyDocument21 paginiWeek 5 - Feasibility StudyEskinderÎncă nu există evaluări

- Simran KaurDocument8 paginiSimran KaurgarvitÎncă nu există evaluări

- Template PPT - R1 - W1-EngDocument29 paginiTemplate PPT - R1 - W1-EngViccy IntanÎncă nu există evaluări

- Capital Budgeting: Meaning Process Project AppraisalDocument15 paginiCapital Budgeting: Meaning Process Project Appraisalhanu11Încă nu există evaluări

- Feasibility Studies and Business PlansDocument21 paginiFeasibility Studies and Business PlansSanya MohindraÎncă nu există evaluări

- 1 Project CH 2Document21 pagini1 Project CH 2Nolawi BirhanuÎncă nu există evaluări

- Feasibility 1Document26 paginiFeasibility 156-2k18 Muhammad AbdullahÎncă nu există evaluări

- Project Identification and Feasility - MulamaDocument34 paginiProject Identification and Feasility - MulamaCalvin MÎncă nu există evaluări

- MG 623 Lecture No. 5 - Project Scope Management 2015Document62 paginiMG 623 Lecture No. 5 - Project Scope Management 2015Albert MwauziÎncă nu există evaluări

- Project CH - 2Document40 paginiProject CH - 2tamirat tadese100% (1)

- GIT: Living in The IT Era: Lect Ure 04Document37 paginiGIT: Living in The IT Era: Lect Ure 04Shazney SapalitÎncă nu există evaluări

- MPPL 5 Project Integration ManagementDocument41 paginiMPPL 5 Project Integration ManagementFirman AuliaÎncă nu există evaluări

- Ch12 Project AuditingDocument41 paginiCh12 Project AuditingM Ilham Ghifari100% (2)

- Project Management FrameworkDocument47 paginiProject Management FrameworkNamig Pashayev100% (1)

- Managing The Project Selection ProcessDocument17 paginiManaging The Project Selection ProcessKochappen Ipe KumarÎncă nu există evaluări

- PM CreationsDocument20 paginiPM CreationsTesfaye KebedeÎncă nu există evaluări

- LN07 Formulating Technological Innovation Strategy.v1.1 PDFDocument37 paginiLN07 Formulating Technological Innovation Strategy.v1.1 PDFSumaya Akter Ruhi 2022610642Încă nu există evaluări

- What Is A Feasibility StudyDocument5 paginiWhat Is A Feasibility Studyarunt_19Încă nu există evaluări

- PPA Subjective QuestionsDocument3 paginiPPA Subjective Questionsgoldemanu0% (1)

- Week 2 - Project Management ProcessesDocument62 paginiWeek 2 - Project Management ProcessesHuynh Thuy VyÎncă nu există evaluări

- Chương 4 Investment 1Document52 paginiChương 4 Investment 1Minh NghiêmÎncă nu există evaluări

- Chapter Four Project IdentificationDocument45 paginiChapter Four Project IdentificationAlas StudioÎncă nu există evaluări

- Managing The Project Selection ProcessDocument17 paginiManaging The Project Selection Processapi-3798606100% (2)

- UU-Project Chapter 3Document74 paginiUU-Project Chapter 3Kiya Tesfaye100% (1)

- Lesson 1 Business EnvironmentDocument11 paginiLesson 1 Business EnvironmentHimanshu TalwarÎncă nu există evaluări

- Project Integration Management: Dhanusha Somawardhana BSC (Hons) It (Sliit), Mba (Uow)Document55 paginiProject Integration Management: Dhanusha Somawardhana BSC (Hons) It (Sliit), Mba (Uow)BJ roxÎncă nu există evaluări

- Business Plan ContentDocument5 paginiBusiness Plan ContentRhislee PabrigaÎncă nu există evaluări

- Ict Life CycleDocument2 paginiIct Life CycleravinslÎncă nu există evaluări

- Unit 8 - Capital BudgetingDocument25 paginiUnit 8 - Capital BudgetingParul SrivastavÎncă nu există evaluări

- PMBOK Chapter 4 - ScopeDocument52 paginiPMBOK Chapter 4 - ScopelatehoursÎncă nu există evaluări

- Feasibility StudyDocument10 paginiFeasibility StudyAiswarya RajeevÎncă nu există evaluări

- Managing Project-2nd SessionDocument15 paginiManaging Project-2nd SessionAsma ShoaibÎncă nu există evaluări

- Rajiv Dua Bsc. (Eng), PMP: Managing Cost Overruns and Project ManagementDocument193 paginiRajiv Dua Bsc. (Eng), PMP: Managing Cost Overruns and Project Managementfhsn84Încă nu există evaluări

- Managerial Judgement and Strategic Investment DecisionsDe la EverandManagerial Judgement and Strategic Investment DecisionsEvaluare: 4 din 5 stele4/5 (2)

- Fake PDFDocument2 paginiFake PDFJessicaÎncă nu există evaluări

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingDocument75 paginiInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspÎncă nu există evaluări

- Hotel Reservation SystemDocument36 paginiHotel Reservation SystemSowmi DaaluÎncă nu există evaluări

- D - MMDA vs. Concerned Residents of Manila BayDocument13 paginiD - MMDA vs. Concerned Residents of Manila BayMia VinuyaÎncă nu există evaluări

- Dike Calculation Sheet eDocument2 paginiDike Calculation Sheet eSaravanan Ganesan100% (1)

- What Is Retrofit in Solution Manager 7.2Document17 paginiWhat Is Retrofit in Solution Manager 7.2PILLINAGARAJUÎncă nu există evaluări

- P 1 0000 06 (2000) - EngDocument34 paginiP 1 0000 06 (2000) - EngTomas CruzÎncă nu există evaluări

- IEC Blank ProformaDocument10 paginiIEC Blank ProformaVanshika JainÎncă nu există evaluări

- Ingles Avanzado 1 Trabajo FinalDocument4 paginiIngles Avanzado 1 Trabajo FinalFrancis GarciaÎncă nu există evaluări

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDocument2 paginiEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaÎncă nu există evaluări

- TSB 120Document7 paginiTSB 120patelpiyushbÎncă nu există evaluări

- ADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementDocument33 paginiADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementNURATIKAH BINTI ZAINOL100% (1)

- Amare Yalew: Work Authorization: Green Card HolderDocument3 paginiAmare Yalew: Work Authorization: Green Card HolderrecruiterkkÎncă nu există evaluări

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDocument2 paginiAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfÎncă nu există evaluări

- Convention On The Rights of Persons With Disabilities: United NationsDocument13 paginiConvention On The Rights of Persons With Disabilities: United NationssofiabloemÎncă nu există evaluări

- Unit Process 009Document15 paginiUnit Process 009Talha ImtiazÎncă nu există evaluări

- Process States in Operating SystemDocument4 paginiProcess States in Operating SystemKushal Roy ChowdhuryÎncă nu există evaluări

- SM Land Vs BCDADocument68 paginiSM Land Vs BCDAelobeniaÎncă nu există evaluări

- Fidp ResearchDocument3 paginiFidp ResearchIn SanityÎncă nu există evaluări

- Reverse Engineering in Rapid PrototypeDocument15 paginiReverse Engineering in Rapid PrototypeChaubey Ajay67% (3)

- Working Capital ManagementDocument39 paginiWorking Capital ManagementRebelliousRascalÎncă nu există evaluări

- CHAPTER 3 Social Responsibility and EthicsDocument54 paginiCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- Micron Interview Questions Summary # Question 1 Parsing The HTML WebpagesDocument2 paginiMicron Interview Questions Summary # Question 1 Parsing The HTML WebpagesKartik SharmaÎncă nu există evaluări

- Check Fraud Running Rampant in 2023 Insights ArticleDocument4 paginiCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchÎncă nu există evaluări

- Web Technology PDFDocument3 paginiWeb Technology PDFRahul Sachdeva100% (1)

- 18PGHR11 - MDI - Aditya JainDocument4 pagini18PGHR11 - MDI - Aditya JainSamanway BhowmikÎncă nu există evaluări

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocument2 paginiSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloÎncă nu există evaluări

- 1934 PARIS AIRSHOW REPORT - Part1 PDFDocument11 pagini1934 PARIS AIRSHOW REPORT - Part1 PDFstarsalingsoul8000Încă nu există evaluări

- Amerisolar AS 7M144 HC Module Specification - CompressedDocument2 paginiAmerisolar AS 7M144 HC Module Specification - CompressedMarcus AlbaniÎncă nu există evaluări

- Arduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash GuptaDocument3 paginiArduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash Guptaabhishek kumarÎncă nu există evaluări