Documente Academic

Documente Profesional

Documente Cultură

EDInet XML InvoiceRO 2.0

Încărcat de

Anonymous 0ed3QYB2Titlu original

Drepturi de autor

Formate disponibile

Partajați acest document

Partajați sau inserați document

Vi se pare util acest document?

Este necorespunzător acest conținut?

Raportați acest documentDrepturi de autor:

Formate disponibile

EDInet XML InvoiceRO 2.0

Încărcat de

Anonymous 0ed3QYB2Drepturi de autor:

Formate disponibile

EDInet Invoice XML [v.2.

0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

INVOICE MESSAGE

EDInet XML

Document version: 2.0

Copyright 2014 by Infinite Sp. z o.o. (www.infinite.pl) All rights reserved.

No dissemination or copying of this document or any part hereof is permitted unless expressly authorised by Infinite Sp. z o.o. in

writing.

1/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

1.

Dictionary / Dicionar

M mandatory, D dependent, N numeric, AN alpha numeric

2.

Units of measure / Uniti de msur

UNITS OF MEASURE

M3= mentru cub

M2= metru patrat

M= metru

BUC= bucata

COL= coli

SET= set

ROL= rola

L= litru

PAL= palet

PAC= pachet

3.

Details / Detalii

Data

YYYY-MM-DDTHH:MM:SS or(vagy) YYYY-MM-DD

Numbers

Decimal separator: point, is not used for grouping separator characters (eg 10,234.12 wrong, correct: 10234.12) /

Separator zecimal : punct, nu este folosit ca separator pentru caractere

grupate (10,234.12 gresit, corect : 10234.12)

4.

Shortcut / Abrevieri

GLN = Global Location Number:

GTIN = Global Trade Item Number:

EAN = International Article Numbering Association:

2/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

5.

Tipuri facturi (Invoice types)

Cinci tipuri de facturi au putut fi gestionate pe baza profilului de facturare electronica din Ungaria.

factura comerciala care ar putea fi partiala sau finala

factura proforma

factura preplata

factura storno, in care trebuie mentionata factura originala sau referitor la o linie cu articole trebuie sa fie o referinta la factura originala si valoarea totala trebuie sa

reflecte directia in care merg banii. Daca cel ce emite factura (de obicei furnizori) au datorii catre cei ce le este adresata (comercianti de obicei)atunci valoarea totala

este negativa. Daca comerciantii platesc emitentul unei facturi (de obicei furnizori) atunci valoarea finala trebuie sa fie un numar pozitiv. Acest lucru se refera si la

factura de corectie.

Corectarea unei facturi se poate efectua in mai multe feluri.

Factura incorecta trebuie sa fie creditata in intregime cu o factura storno, apoi o noua factura poate fi emisa

Articolele din factura storno trebuie sa fie identice cu cele din factura de referinta dar cu semn minus

Factura de corectare contine articolele incorecte cu semn negativ urmate imediat de articolele corecte fara semn

datele articolului original trebuie date cu semn negativ

datele articolului modificat trebuie date fara semn

Factura de corectare contine numai diferenta intre valoarea corecta si cea incorecta a unui articol

Five kinds of invoice could be managed on the basis of current e-invoicing profile for Romania.

Commercial invoice which could be partial or final invoice

Proforma invoice

Prepayment invoice

Storno invoice, in which there must be a reference to the original invoice or to a given line of its Correction invoice, in which there must be a reference to the original invoice

or to a given line of its Items on the invoice and the total value of it must reflect the direction to where money moves. If the issuer of an invoice (usually suppliers/manufacturers)

owes the invoicee (usually traders) then the total value is a negative number. If the invoicee (usually traders) pays the issuer of an invoice (usually suppliers) then the final value

must be a positive number in every case. This rule also refers to the correction invoice.

The correction of an invoice can be applied in several ways. The correction of an invoice could be done with an appropriately produced correction invoice whether the sender

realizes immediately or later that he started a wrongly filled invoice message.

The incorrect invoice could be entirely credited with a storno invoice, then a new flawless invoice could be issued

The items of a storno invoice must be identical to the reference original invoice with opposite sign

The correction invoice contains the incorrect items with negative sign immediately followed by the correct items without a sign.

the data of the original item must be given once with negative sign

the data of the modified item must be given once without a sign (positive)

The correction invoice contains only the difference between the correct and incorrect value of an item.

3/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

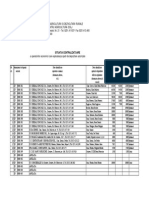

SEGMENT/ELEMENT (SEGMENT/ELEMENT)

M/D

FORMAT/

FORMAT

DESCRIPTION/ Descriere

Main element should contain: Version="1.0.1" xmlns:xsi= "http://www.w3.org/2001/XMLSchemainstance"

xsi:noNamespaceSchemaLocation=

"http://www.infinite.pl/pub/doc/fmt/xml/invoice/1.0/invoice.xsd

<Invoice>

<InvoiceHeader>

<InvoiceNumber>301929</InvoiceNumber>

AN (14)

<Date>2008-04-01</Date>

YYYY-MMDD

Invoice date / Data facturarii

<InvoiceDueDate>2008-05-21</InvoiceDueDate>

YYYY-MMDD

Due date /Termen de plata

<PaymentTermsQualifier>3</PaymentTermsQualifier>

N (1)

Payment terms type qualifier (3 = fixed date) / Calificativ termen de plata (3=data fixa)

<PaymentMethod>

M

N (2)

Payment code (42 -Bank Transfer, 10Cash, 31-Encashment) /Cod plata (42 -Transfer bancar, 10Cash, 31-Incasare)

<Code>42</Code>

<Description> tutals </Description>

</PaymentMethod>

<InvoiceCurrencyCoded>RON</InvoiceCurrencyCoded>

<InvoicePurposeCoded>O</InvoicePurposeCoded>

<DocumentRole>O</ DocumentRole >

<Comment>Comment</Comment>

<RefInvoiceNumber> </RefInvoiceNumber>

<RefInvoiceDate></RefInvoiceDate>

</InvoiceHeader>

<InvoiceParty>

<BuyerParty>

Invoice Header/Antet factura

Invoice number / Numar factura

AN (14)

Payment method description/Descriere metoda de plata

AN (3)

Currency code in accordance with ISO 4217 used in an order/ Cod valuta conf.ISO4217 folosit la o

comanda

N (1)

Invoice type (C-corrected, O-commercial)/

O Comerciala

C - corectata

N (1)

Document Role (O-original, A-STORNO)

O - original

A storno

AN (1000)

AN (14)

YYYY-MMDD

Seller comment (Purchasing information) /Comentariu vanzator

Number of original invoice (in case of Storno/Corrected) /Numar factura originala (in caz de

storno/corectura)

Date of original invoice (in case of Storno/Corrected) / Data factura originala (in caz de

storno/corectura)

Party to which merchandise is sold and/or a service is provided / Beneficiar marfa sau servicii

4/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

<ILN>5940475841003</ILN>

N (13)

<TaxID>RO2816464</TaxID>

AN (35)

Tax registration number / Numar inregistrare fiscala

<Name>DEDEMAN SEDIU</Name>

AN (175)

Buyer name / Nume cumparator

<Street> Str. Al. Tolstoi, nr. 8</Street>

AN (175)

Street / Strada

<HouseNumber></HouseNumber>

AN (9)

House number (can occure in Street) / Numar

<PostalCode></PostalCode>

AN (9)

Postal code /Cod postal

<City>Bacu, jud. Bacau</City>

AN (35)

City / Oras

<Country>RO</Country>

AN (3)

Country, coded ISO 3155 two alpha code /Tara, cod alfanumeric din doua cifre conf ISO 3155

</BuyerParty>

<InvoiceeParty>

GLN number / Numar GLN

Mandatory if not the same as BuyerParty - Party to whom an invoice is issued / Catre cine este

emisa factura

<ILN>5940475841003</ILN>

N (13)

<NameDEDEMAN SEDIU</Name>

AN (175)

Invoicee name /Numele celui ce primeste factura

<Street> Str. Al. Tolstoi, nr. 8</Street>

AN (175)

Street /Strada

<HouseNumber>61</HouseNumber>

AN (9)

House number (can occure in Street) /Numar

<PostalCode>2061</PostalCode>

AN (9)

Postal code /Cod postal

<City>Bacu, jud. Bacau</City>

AN (35)

City / Oras

<Country>RO</Country>

AN (3)

Country, coded ISO 3155 two alpha code / Tara, cod alfanumeric din doua cifre conf ISO 3155

</InvoiceeParty>

<ShipToParty>

GLN number / Numar GLN

Party to which goods should be delivered /Beneficiar

<ILN>5940475841065</ILN>

N (13)

<Name> DEDEMAN BISTRITA 71</Name>

AN (175)

Delivery point name / Punct de livrare

<Street> Str. Sigmirului, Nr. 20</Street>

AN (175)

Street / Strada

<HouseNumber></HouseNumber>

AN (9)

House number (can occure in Street) / Numar

<PostalCode></PostalCode>

AN (9)

Postal code / Cod postal

<City> Bistrita, jud. Bistrita-Nasaud </City>

AN (35)

City / Oras

<Country>RO</Country>

AN (3)

Country, coded ISO 3155 two alpha code/ Tara, cod alfanumeric din doua cifre conf ISO 3155

</ShipToParty>

<SellerParty>

GLN number / Numar GLN

Party which provides goods//Furnizor

5/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

<ILN>5940000000909</ILN>

N (13

<BuyerSellerID>20257</BuyerSellerID>

AN (14)

Buyer's seller id /ID vanzator pentru cumparator

<TaxID>RO12345678</TaxID>

AN (35)

Tax registration number /Numar de inregistrare fiscala

<BankAccount> 99999999-22222222-33333333 </BankAccount>

n8-n8-n8

Bank account number / Numar cont bancar

<BankAccountOwner> </BankAccountOwner>

AN (175)

Bank account owner / Detinator cont

<BankName>Raiffeisen Romania</BankName>

AN (175)

Bank Name / Numele bancii

<Name> Test supplier </Name>

AN (175)

Seller name / Nume vanzator

<Street> Zsolnay Vilmos </Street>

AN (175)

Street / Strada

<HouseNumber>12</HouseNumber>

AN (9)

House number, can occur in Street / Numar

<PostalCode>1147</PostalCode>

AN (9)

Postal code /Cod postal

<City> BUCARESTI</City>

AN (35)

City / Oras

<Country>RO</Country>

AN (3)

Country, coded ISO 3155 two alpha code / Tara, cod alfanumeric din doua cifre conf ISO 3155

</SellerParty>

<ShipFromParty>

GLN number / Numar GLN

Ship from Party / Expediat de catre

<ILN>594000000090</ILN>

N (13)

<Name DHL LOGISTICS </Name>

AN (175)

Ship from name / Expediat de catre nume

<Street Alkotmny utca </Street>

AN (175)

Street / Strada

<HouseNumber>23</HouseNumber>

AN (9)

House number (can occure in Street) / Numar

<PostalCode>3455</PostalCode>

AN (9)

Postal code /Cod postal

<City BUCARESTI </City>

AN (35)

City /Oras

<Country>RO</Country>

AN (3)

Country, coded ISO 3155 two alpha code/ Tara, cod alfanumeric din doua cifre conf ISO 3155

</ShipFromParty>

GLN number / Numar GLN

</InvoiceParty>

<InvoiceDetail>

<Item>

<ItemNum>1</ItemNum>

AN (1000)

Numar articol

<EAN>5990000000001</EAN>

GTIN-8

GTIN-13

GTIN-14

GTIN number of the ordered article / Cod GTIN

6/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

<BuyerItemID>123444</BuyerItemID>

AN (14)

Buyer's article number / Numar articol cumparator

<SellerItemID>6665</SellerItemID>

AN (14)

Supplier's article number / Numar articol furnizor

<CustomTariffNumber>2202100000</CustomTariffNumber>

AN (14)

Custom tarrif number /Numar tarif vamal

AN (2)

Item description code / Cod descriere articol

(RC returnable asset / bun returnabil, CU commercial unit /unitate comerciala)

N (15.2)

Number of consumer units in commercial unit /numar unitati in unitate comerciala

<ProductIdentifierExt>CU</ProductIdentifierExt>

<PacketContentQuantity>45.00</PacketContentQuantity>

<PackageType>CT</PackageType>

<QuantityValue>2.00</QuantityValue>

<QuantityValueWithdrawn>-2.00</QuantityValueWithdrawn>

AN (3)

Package type: CT-carton/BX-box , RC returnable asset

Tip ambalaj: CT-cutie carton RC- bun returnabil

N (15.2)

Invoiced quantity / cantitate facturata

N (15.2)

Only in case of corrected invoice/Numai in cazul corectiei de facturi

AN (1)

VAT type coded:

24 % - Merchandise purchases from RO - D1

9% - Merchandise purchases from RO - W7

24% - Merchandise purchases from RO with delayed payment of VAT I8

9% - Merchandise purchases from RO with delayed payment of VAT I9

0% - Merchandise purchases from RO P3

0% - Merchandise purchases from EU D3

0% - Merchandise purchases from NON EU V0

Only in case of corrected invoice/Numai in cazul corectiei de facturi

<TaxCategoryCoded>D1</TaxCategoryCoded>

<TaxCategoryCodedWas>D1</TaxCategoryCodedWas>

AN (1)

N (4)

VAT rate / Procent TVA

<TaxPercent>20.00</TaxPercent>

<TaxPercentWas>20</TaxPercentWas>

N (4)

Only in case of corrected invoice/Numai in cazul corectiei de facturi

N (18)

VAT amount / Valoare TVA

<TaxAmountWithdrawn>-14610.40</TaxAmountWithdrawn>

N (18)

Only in case of corrected invoice /Numai in cazul corectiei de facturi

<MonetaryGrossValue>87662.40</MonetaryGrossValue>

N (18)

Gross amount of item ( MonetaryNetValue + TaxAmount) Total valoare

<MonetaryGrossValueWithdrawn>87662.40</MonetaryGrossValueWithdrawn>

<MonetaryNetValue>73052.00</MonetaryNetValue>

N (18)

Net amount of item

<MonetaryNetValueWithdrawn>73052.00</MonetaryNetValueWithdrawn>

N (18)

Only in case of corrected /Numai in cazul corectiei de facturi

<MonetaryAmountPayable>73052.00</ MonetaryAmountPayable >

N (18)

Line item total /Total articole

(QuantityValue *UnitPriceValue- UnitDiscount)

Cantitate *Pret unitar - Discount unitar

<MonetaryAmountPayableWithdrawn>-73052.00</

MonetaryAmountPayableWithdrawn>

<UnitOfMeasure>BUC</UnitOfMeasure>

<TaxAmount>14610.40</TaxAmount>

N (18)

N (18)

AN (3)

Only in case of corrected /Numai in cazul corectiei de facturi

Only in case of corrected /Numai in cazul corectiei de facturi

Units of measure for QuantityValue /Unitati de masura pentru Cantitate Valoare

7/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

<UnitOfMeasureXCBL>DB</UnitOfMeasureXCBL>

AN (3)

Units of measure XCBL for QuantityValue / Unitati de masura XCBL pentru Cantitate Valoare

<PackUnitOfMeasure>BUC</PackUnitOfMeasure>

AN (3)

Units of measure for PacketContentQuantity /Unitati de masura pentru PachetContinutCantitate

<UnitPriceValue>36526.00</UnitPriceValue>

N (18)

Net-net price /pret net

<UnitPriceValueWas>36526.00</UnitPriceValueWas>

N (18)

Only in case of corrected /Numai in cazul corectiei

N (18)

Gross list price /Lista preturi brute

(UnitPriceValue + TaxPercent* UnitPriceValue)/Valoare pret unitar+TVA*Valoare pret unitar

Only in case of correction/Numai in caz corectie

<UnitPriceValueGross>43831.20</UnitPriceValueGross>

<UnitPriceValueGrossWas>43831.20</UnitPriceValueGrossWas>

N (18)

<Name> Orange juice 0.5 l </Name>

AN (35)

<Order>

<BuyerOrderNumber>123</BuyerOrderNumber>

AN(35)

<BuyerOrderDate>2009-02-05T00:00:00</BuyerOrderDate>

YYYY-MMDD

Thh:mm:ss

</Order>

<DeliveryDetail>

<DeliveryDate>2009-02-09T12:00:00</DeliveryDate>

YYYY-MMDD

Thh:mm:ss

<DeliveryDocumentNumber>WZ523</DeliveryDocumentNumber>

AN(35)

</DeliveryDetail>

</Item>

</InvoiceDetail>

<InvoiceSummary>

Product description / Descriere produs

Invoice Summary/Sumar facturi

<NumberOfLines>3</NumberOfLines>

N (1000)

<NetValue>1800424.00</NetValue>

N (18)

Number of lines/Numar de linii

Total line items amount (MonetaryNetValue) /Total suma articole pe linie

<NetValueDiff>-40424.00</NetValueDiff>

N (18)

Only in case of corrected /Numai in caz corectie

<TaxValue>274104.00</TaxValue>

N (18)

Message total duty/tax/fee amount / Mesaj total taxa

N (18)

<TaxValueDiff>-4104.00</TaxValueDiff>

<TaxableValue>1800424.00</TaxableValue>

Only in case of corrected /Numai in caz corectie

8/9

EDInet Invoice XML [v.2.0]

www.infinite-b2b.com

www.edinet.ro, www.edinet-solutions.com

<TaxableValueDiff>-1800424.00</TaxableValueDiff>

< GrossValue >2074528.00</ GrossValue >

< GrossValueDiff >2074528.00</GrossValueDiff >

D

M

N (18)

Invoice amount / Valoare factura

N (18)

Only in case of corrected /numai in caz corectie

<TaxSummary>

N (18)

Tax Sumary/Sumar taxe

<Tax>

M

AN (1)

Tax type coded / Cod taxa

24 % - Merchandise purchases from RO - D1

9% - Merchandise purchases from RO - W7

24% - Merchandise purchases from RO with delayed payment of VAT I8

9% - Merchandise purchases from RO with delayed payment of VAT I9

0% - Merchandise purchases from RO P3

0% - Merchandise purchases from EU D3

0% - Merchandise purchases from NON EU V0

<TaxCategoryCoded>D1</TaxCategoryCoded>

<TaxPercent>20.00</TaxPercent>

AN (4)

Tax rate / Procent taxa

<TaxNettoAmount>1370520.00</TaxNettoAmount>

N (18)

Tax rate net amount /Suma neta taxa

<TaxNettoAmountDiff>-370520.00</TaxNettoAmountDiff>

N (18)

Only in case of corrected /Numai in caz corectie

N (18)

Tax rate tax amount /Procent taxa

<TaxAmountDiff>-74104.00</TaxAmountDiff>

N (18)

Only in case of corrected /Numai in caz corectie

< TaxGrossAmount >1644624.00</ TaxGrossAmount >

N (18)

Tax rate gross amount /Suma bruta taxa

< TaxGrossAmountDiff >-144624.00</ TaxGrossAmount Diff>

N (18)

Only in case of corrected/numai in caz de corectie

<TaxableAmount>1370520.00</TaxableAmount>

<TaxableAmountDiff>-1370520.00</TaxableAmountDiff>

<TaxAmount>274104.00</TaxAmount>

<Tax>

</TaxSummary>

</InvoiceSummary>

</Invoice>

9/9

S-ar putea să vă placă și

- Managementul ProiectelorDocument11 paginiManagementul ProiectelorMarineata AlinÎncă nu există evaluări

- Realizarea Primei Retele de Calculatoare Din Romania - Prof. Dr. Ing Marius GuranDocument14 paginiRealizarea Primei Retele de Calculatoare Din Romania - Prof. Dr. Ing Marius GuransiriusdarkstarÎncă nu există evaluări

- Curs SecDocument98 paginiCurs SecEugen MatcinÎncă nu există evaluări

- d406 Mfixe Asset Accountid Saf TDocument14 paginid406 Mfixe Asset Accountid Saf ThomecontÎncă nu există evaluări

- CF ECHO, Manual de InstalareDocument26 paginiCF ECHO, Manual de InstalareAnonymous DytNol3Încă nu există evaluări

- Pasii ViziteiDocument1 paginăPasii ViziteiLaic MihaelaÎncă nu există evaluări

- BAZELE PROGRAMĂRII Visual Basic For ApplicationDocument119 paginiBAZELE PROGRAMĂRII Visual Basic For ApplicationtazicÎncă nu există evaluări

- Notificare Autoritate de Supraveghere - MODEL 20 PDFDocument4 paginiNotificare Autoritate de Supraveghere - MODEL 20 PDFmrsaproÎncă nu există evaluări

- Tasin Gemil - Hanatul Tătar Din Crimeea IIIDocument5 paginiTasin Gemil - Hanatul Tătar Din Crimeea IIIekurtasanÎncă nu există evaluări

- AutoDocument84 paginiAutoionpatrascuÎncă nu există evaluări

- Istorii Adevarate Povestea Opincii Romanesti Arborate Pe Parlamentul Din Budapesta in 1919 Cer Si Pamant RomanescDocument10 paginiIstorii Adevarate Povestea Opincii Romanesti Arborate Pe Parlamentul Din Budapesta in 1919 Cer Si Pamant RomanescSava CezarÎncă nu există evaluări

- Spioni in SutanaDocument4 paginiSpioni in SutanapascusalÎncă nu există evaluări

- Cobra Manual Iin Limba RomanaDocument2 paginiCobra Manual Iin Limba RomanaViorel Vulpe100% (1)

- Hotarare Guvern 01365 Din 2002 Pentru Aprobarea Listei Informatiilor SecreteDocument20 paginiHotarare Guvern 01365 Din 2002 Pentru Aprobarea Listei Informatiilor SecreteSPR DiamantulÎncă nu există evaluări

- Mic Manual de Campanie ElectoralaDocument15 paginiMic Manual de Campanie ElectoralaGeorgiana SabinaÎncă nu există evaluări

- Model UNCSV Contract Cooperativa Si Membri 19.01.2022Document3 paginiModel UNCSV Contract Cooperativa Si Membri 19.01.2022Andrei Aparaschivei100% (1)

- Reţeaua Lui Mondialu - A Spălat - 130 de Milioane de Euro. - Şefu' României - Din Dobreni Vindea 300 de Tone de Fier Pe Zi - ExclusDocument11 paginiReţeaua Lui Mondialu - A Spălat - 130 de Milioane de Euro. - Şefu' României - Din Dobreni Vindea 300 de Tone de Fier Pe Zi - ExcluscfcshakerÎncă nu există evaluări

- Ion Creangă, Într-O Fotografie Inedită Descoperită La Muzeul Literaturii Române IașiDocument3 paginiIon Creangă, Într-O Fotografie Inedită Descoperită La Muzeul Literaturii Române IașiZv Al100% (1)

- Eu Si Gheorghiu Dej PDFDocument2 paginiEu Si Gheorghiu Dej PDFLaurenÎncă nu există evaluări

- Motivare Dosarul ZambaccianDocument214 paginiMotivare Dosarul ZambaccianBiro AttilaÎncă nu există evaluări

- Instalarea Si Configurarea Unui Server DNS Pe Windows Server 2003Document12 paginiInstalarea Si Configurarea Unui Server DNS Pe Windows Server 2003vitalik099100% (1)

- Microprocesoarele Si Tehnologiile Utilizate in Producerea AcestoraDocument17 paginiMicroprocesoarele Si Tehnologiile Utilizate in Producerea AcestoraCristina RaduÎncă nu există evaluări

- Madalin Hodor-Despre Aur, Legionari, ComunismDocument13 paginiMadalin Hodor-Despre Aur, Legionari, ComunismChircu100% (1)

- Contract de Mandat Director General Vesfrid Ionut 2Document11 paginiContract de Mandat Director General Vesfrid Ionut 2Bobeica Madalina Maria100% (1)

- Diploma ThesisDocument151 paginiDiploma ThesisandpuÎncă nu există evaluări

- Avere Ionita Alexandru CatalinDocument4 paginiAvere Ionita Alexandru CatalinAnonymous c3IPK8100% (1)

- Curs - UTILIZARE CALCULATOR - Nivel IncepatorDocument88 paginiCurs - UTILIZARE CALCULATOR - Nivel Incepatordya_ganeaÎncă nu există evaluări

- Centrale Termice Pe Gaz Protherm Panther Carte TehnicaDocument47 paginiCentrale Termice Pe Gaz Protherm Panther Carte TehnicaLupu Bogdan0% (1)

- Cerere Discount SuplimentarDocument2 paginiCerere Discount SuplimentarGina DogărescuÎncă nu există evaluări

- Ghidul Romanului in UkDocument10 paginiGhidul Romanului in Uk431794100% (1)

- Conexiunile Unei Retele PPPoE (2003)Document23 paginiConexiunile Unei Retele PPPoE (2003)antoci_stelianaÎncă nu există evaluări

- Manual Inteligent v1.12Document484 paginiManual Inteligent v1.12Alexutzu Alex100% (1)

- Cartea de Uraniu FinalDocument122 paginiCartea de Uraniu Finaltibi cÎncă nu există evaluări

- George Friedman Si RomaniaDocument8 paginiGeorge Friedman Si RomaniaMika RainmanÎncă nu există evaluări

- Insula SerpilorDocument11 paginiInsula SerpilorVasile PopescuÎncă nu există evaluări

- Informatica PDFDocument50 paginiInformatica PDFAnastasia PSÎncă nu există evaluări

- Anexa 13.1.3.d. - Grila Conformităţii Şi Calităţii SF (HG Nr. 907 - 2016)Document6 paginiAnexa 13.1.3.d. - Grila Conformităţii Şi Calităţii SF (HG Nr. 907 - 2016)Razvan CiucaÎncă nu există evaluări

- Intrarea 57837Document1 paginăIntrarea 57837ratatuÎncă nu există evaluări

- Experti Tehnici ValceaDocument1 paginăExperti Tehnici ValceaimkobraÎncă nu există evaluări

- Eugen BarbuDocument4 paginiEugen BarbuSchiop Cristian0% (1)

- Crearea Unui Site WebDocument2 paginiCrearea Unui Site WebburloiuÎncă nu există evaluări

- Dolj SilozuriDocument6 paginiDolj SilozuriZamfir CatalinÎncă nu există evaluări

- Memoria RAMDocument14 paginiMemoria RAMspidi3103Încă nu există evaluări

- Buletin - 2017 - 12 - 6 - 2017 - 22994 - 22994 - 2017 - Sentinta FalimentDocument18 paginiBuletin - 2017 - 12 - 6 - 2017 - 22994 - 22994 - 2017 - Sentinta FalimentFractal InsolvencyÎncă nu există evaluări

- Proiect Arhitectura Sem IDocument43 paginiProiect Arhitectura Sem IVeronica NegutÎncă nu există evaluări

- Chişinău File de JurnalDocument531 paginiChişinău File de JurnalIvanMunteanuÎncă nu există evaluări

- CF AFM RablaClasic v1Document8 paginiCF AFM RablaClasic v1Stoian MariusÎncă nu există evaluări

- Programare Structurata Structuri de Control VBA PDFDocument101 paginiProgramare Structurata Structuri de Control VBA PDFBogdana RacealaÎncă nu există evaluări

- Crearea Unui Un Site Pe Calculatorul PropriuDocument4 paginiCrearea Unui Un Site Pe Calculatorul PropriuCorbeanu DanielÎncă nu există evaluări

- Nicolae CeaușescuDocument13 paginiNicolae CeaușescuBianca PădurariuÎncă nu există evaluări

- Informatii ClasificateDocument107 paginiInformatii ClasificatenicabscribdÎncă nu există evaluări

- Virusi de CalculatorDocument24 paginiVirusi de Calculatorsirena_geta100% (2)

- Elemente de Informatica GeneralaDocument197 paginiElemente de Informatica GeneralaMihaela Constantina Vatavu100% (1)

- Manual Utilizare Aplicatia Topograph 8.0Document192 paginiManual Utilizare Aplicatia Topograph 8.0Sorin IsmailciucÎncă nu există evaluări

- Initiere CalculatorDocument100 paginiInitiere CalculatorJanneDoeeÎncă nu există evaluări

- Analiza de Film Nikita Mikhalkov - OblomovDocument6 paginiAnaliza de Film Nikita Mikhalkov - Oblomovrochester21Încă nu există evaluări

- Baze de Date AvansateDocument270 paginiBaze de Date AvansateMihail AndronicÎncă nu există evaluări

- Instructiuni de Transport Depozitare Si Instalare Conducte Din Fonta DuctilaDocument19 paginiInstructiuni de Transport Depozitare Si Instalare Conducte Din Fonta DuctilaMady Toma100% (1)

- Costel Vasilescu - Decembrie '89. Revoluție Sau... Diversiune?!Document155 paginiCostel Vasilescu - Decembrie '89. Revoluție Sau... Diversiune?!Aurică IvașcuÎncă nu există evaluări

- Compendiu Schita FLDocument346 paginiCompendiu Schita FLSiv Bibi0% (1)

- Curs NR 17 Infectiile Tractului Urinar FinalDocument56 paginiCurs NR 17 Infectiile Tractului Urinar FinalAnonymous 0ed3QYB2Încă nu există evaluări

- CURS 26 Hemofilia A, Boala Von WillebrandDocument30 paginiCURS 26 Hemofilia A, Boala Von WillebrandAnonymous 0ed3QYB2Încă nu există evaluări

- Accidentele Vasculare CerebraleDocument4 paginiAccidentele Vasculare CerebraleAnonymous 0ed3QYB2Încă nu există evaluări

- Insulinoterapia in Diabetul de Tip 2Document45 paginiInsulinoterapia in Diabetul de Tip 2Anonymous 0ed3QYB2100% (1)

- Curs Malnutritia Si RahitismulDocument78 paginiCurs Malnutritia Si RahitismulAnonymous 0ed3QYB2Încă nu există evaluări

- Diabet Zaharat Tip 2 Ghid TerapeuticDocument32 paginiDiabet Zaharat Tip 2 Ghid TerapeuticDiana Alina BeiÎncă nu există evaluări

- ImaDocument58 paginiImaAnonymous 0ed3QYB2Încă nu există evaluări

- Subiecte Rezolvate RadiologieDocument51 paginiSubiecte Rezolvate RadiologieHutuleac Mihaela100% (6)

- Catalog MIJLOACE FIXE Si Durata Normala de AmortizareDocument28 paginiCatalog MIJLOACE FIXE Si Durata Normala de AmortizareAnonymous 4MLEo9TVQ100% (2)

- 02 - Asepsia Si AntisepsiaDocument36 pagini02 - Asepsia Si AntisepsiaAnonymous 0ed3QYB2Încă nu există evaluări

- TrypanosomaDocument17 paginiTrypanosomaAnonymous 0ed3QYB2Încă nu există evaluări

- NematodeDocument38 paginiNematodeAnamaria RusuÎncă nu există evaluări

- Renal CursDocument28 paginiRenal CursMihaela IoluÎncă nu există evaluări